Featured

Taking a closer look at legal insider trading

When multiple insiders purchase simultaneously or within a few weeks, it’s good to pay attention.

There are lots of ways to look for interesting stock ideas. I have found that insider buying is one of the best indicators of future stock performance.

It operates under a very simple principle. Insiders know more about their business than you do. When they think it’s a good time to buy, it usually is. In fact, it is so simple; I’m surprised that investors do not follow insiders more closely.

Insiders sell shares for all sorts of reasons. Often, it has nothing to do with fundamentals.

Insiders are granted stock options all the time. It is part of pay. When these vest, they get sold. Sometimes an insider wants to enjoy the fruits of his labors and sells to buy a house or boat or send his kids to college. There are lots of reasons for stock sales. There is only one reason that insiders buy stock—they think it is going up and they want more exposure.

I have seen lots of studies on insider stock trading and these academics usually miss the mark. They think about it all wrong. If you analyze every insider transactions, the upside bias is marginal. If you segregate the transactions and think about them intelligently, you can find patterns that have value.

Insiders’ movement

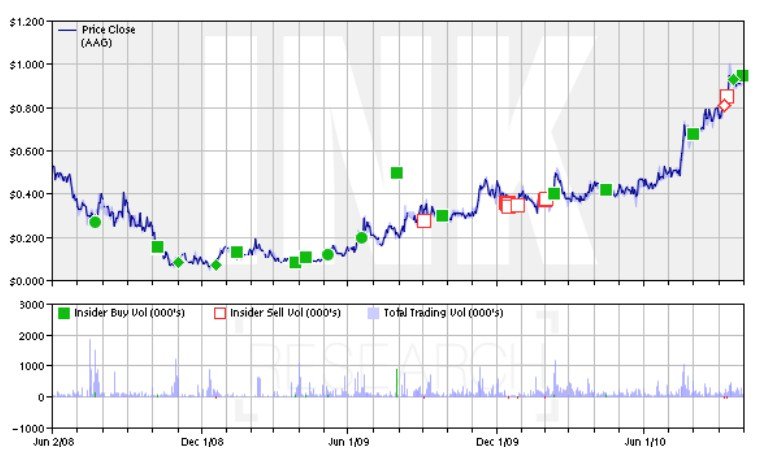

To start with, insiders are fallible—they are human after all. Sometimes, they simply make mistakes. If multiple insiders buy at the same time, it is unlikely that they are all wrong. More likely, they all see the same thing at the same time. When I see one insider buy, I find that interesting. When I see multiple buys in a few week period, I always look closer—there is probably something I need to learn about. Watch for clusters of buying.

If a board member buys a few thousand dollars worth, does it really matter? Sure, it is a vote of confidence. What I really focus on is what management thinks. No matter what, the CEO or CFO will know a lot more about the fundamentals than a board member. The management will also know a lot more about the industry and what is going on in the cycle.

Occasionally, you find directors who are the ones really calling the shots. It helps to know the corporate politics of a situation, but 95 percent of the time, the board is hostage to the management team. It is that management team that you need to watch in terms of insider transactions.

Small transactions

Do small transactions matter? At smaller companies, executives are not paid well. Sometimes, a $10,000 transaction may seem small, but it is quite meaningful to that person. I think of transaction size in terms of take-home salary.

If an executive is making $90,000 a year, his take-home salary is maybe $65,000 after taxes. After living expenses and mortgage payments, a $10,000 purchase may be all of his disposable income for the year. That means a whole lot more than when a wealthy CEO buys $50,000 worth of stock.

I am a nosy fellow. I have no problem with calling the executive up and feeling out his financial situation. These smaller transactions may actually be quite significant in terms of how confident the guy is. I always think of transaction size in terms of take-home pay. Small transactions may actually be very big.

Intuitive insiders

Insiders have an intuitive feel for if their shares are cheap or expensive. They watch acquisition multiples in their industry and they know how peers are valued. If their stock starts to plummet, they sometimes step up and buy on the way down.

These transactions often mess up the academic studies. Insiders tend to be too early in buying and they tend to underestimate perceived problems in their industry. When you see insiders buying on new lows, it’s bullish in a longer-term sense. Unfortunately, it often has little relevance in predicting stock performance in the next few quarters. Every time I have bought when insiders bought new lows, I have been too early. This is valuable for figuring out if a company is cheap—it isn’t a predictor of near-term movement.

It is VERY bullish when insiders pay up. When you see insiders buying shares after a big move, it means that they think it’s still a good bargain. Even more likely, they’ve been waiting patiently for the shares to pull back. Finally out of desperation, they’ve thrown in the towel because they want more exposure. Usually, it’s because they expect big news in the near future. Often, as that news approaches, they enter blackout periods where they cannot buy any more shares. When you see guys buy a stock right before a blackout window—you can almost assume that they are trying to jump the gun on the big news.

The key is to put these factors together in analyzing a situation. You want to see clusters of insider transactions. You want to see a large value to disposable income transactions. Finally, you want to see purchases at new highs and you want to see the key employees making those purchases. I never ignore insider sales, but I just don’t give them the same attention as I do towards insider buying.

© Harris Kupperman (Data provided by InkResearch.com)

Following insider trading

I follow the insider trading like a hawk. Each week, I scroll through the list of transactions. The first dozen or so are meaningless as they’re from big companies. I want to scroll through the little stocks that I’ve never heard of. $5,000 here and $10,000 there start to add up fast if you have multiple buyers reloading at the same company. That’s what I’m looking for.

Then I try to figure out what they see that the market is missing. Sometimes, I can figure it out. Sometimes I call them up and ask them about it. If they’re still buying, they may be cagey or they may want to tell me about how their shares are cheap and the business just got a whole lot better in the past month.

Usually, it’s something that only an insider would understand. Maybe it’s a large competitor who’s going bankrupt, or a sizable contract win or a new product that’s doing well. You cannot figure these things out from the financials—it is forward-looking. Ignore valuation scanners. Watch what the insiders are doing. I do not know why anyone would bother with following anything else.

Put it this way—if it appears cheap and insiders aren’t buying, something is probably wrong with the business—you just haven’t figured it out yet. Watch the insiders—they’re the best indicator that I know of.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto5 days ago

Crypto5 days agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Biotech2 weeks ago

Biotech2 weeks agoVytrus Biotech Marks Historic 2024 with Sustainability Milestones and 35% Revenue Growth

-

Biotech2 days ago

Biotech2 days agoSpain Invests €126.9M in Groundbreaking EU Health Innovation Project Med4Cure

-

Crypto1 week ago

Crypto1 week agoRipple Launches EVM Sidechain to Boost XRP in DeFi

You must be logged in to post a comment Login