Featured

Cocoa futures mixed as Ghana loses 50,000 tons due to disease

Ghana expects to lose more cocoa crop while sugar futures closed lower.

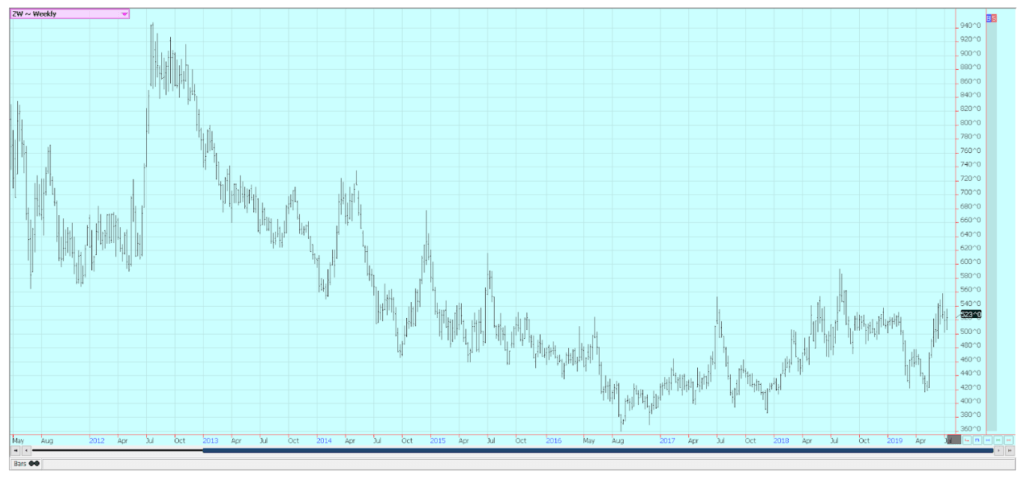

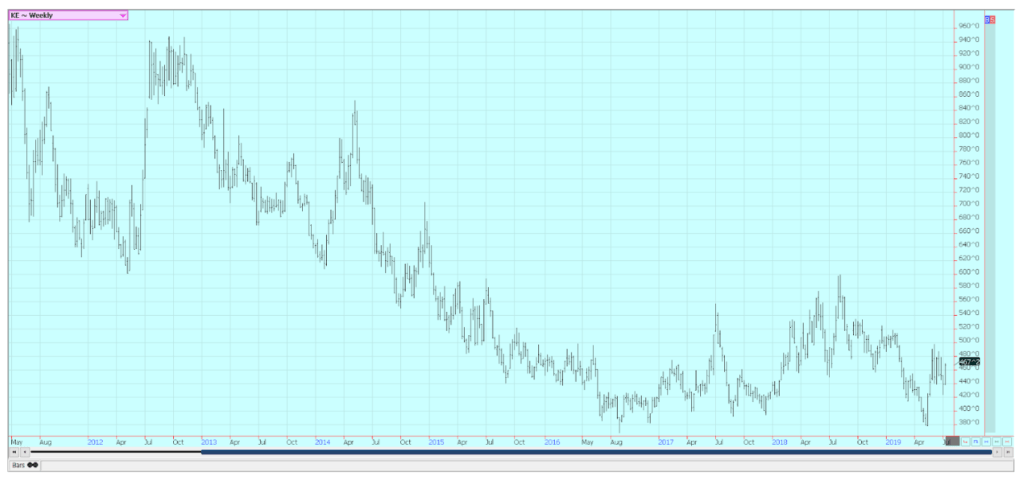

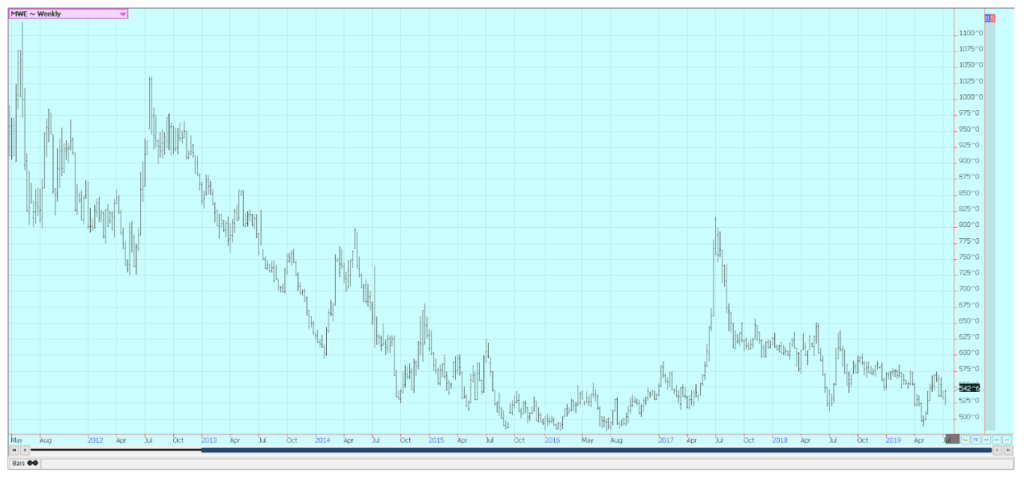

Wheat

Wheat markets were higher, with the USDA supply and demand updates the big reason for the late-week rally. HRW and HRS led SRW to the upside last week. USDA showed better production potential for US Wheat in its monthly harvest updates and All Wheat production is now estimated at 1.921 billion bushels. Winter Wheat production was estimated at 1.291 billion bushels while Spring Wheat production was estimated at 572 million bushels. Winter Wheat production was a bit above the average trade guess and Spring Wheat production was a big below the average trade guess. But the surprise for the market was not in the US estimates. Instead, it was found in the world estimates. USDA reduced production potential for Europe, Ukraine, Russia, and Australia in the reports.

Russian production was down over 3.5 million tons and the combined production loss was estimated at well over 9.0 million tons. These losses allowed USDAS to raise export estimates for US Wheat by 50 million bushels and cut ending stocks by the same amount. HRW saw the most buying as the world production losses were mostly in hard wheat-growing areas. Wheat futures might have trouble sustaining the rally for the short term ad the US Winter Wheat harvest is still very active. The market has a chance to see stronger prices once the harvest pressure has passed due to the reduced world production volumes and the chance for the US to sell more into the international market.

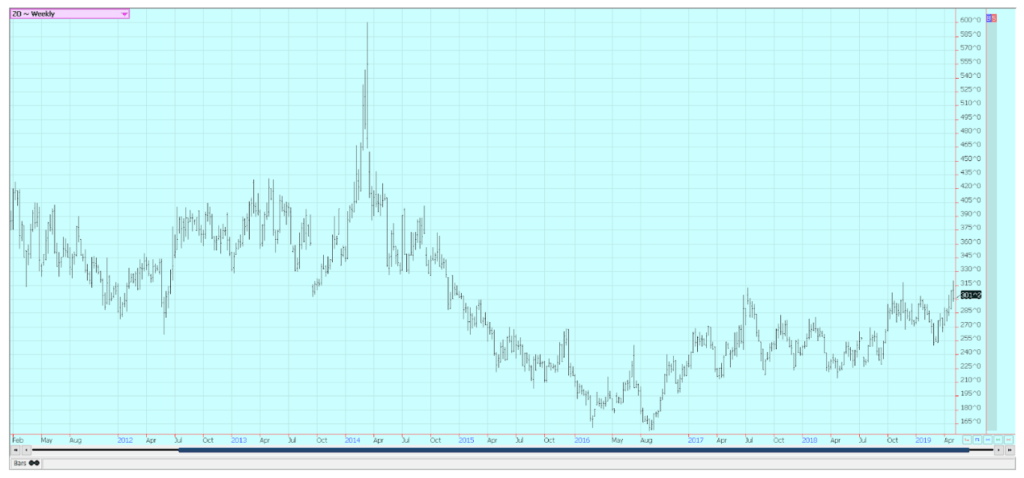

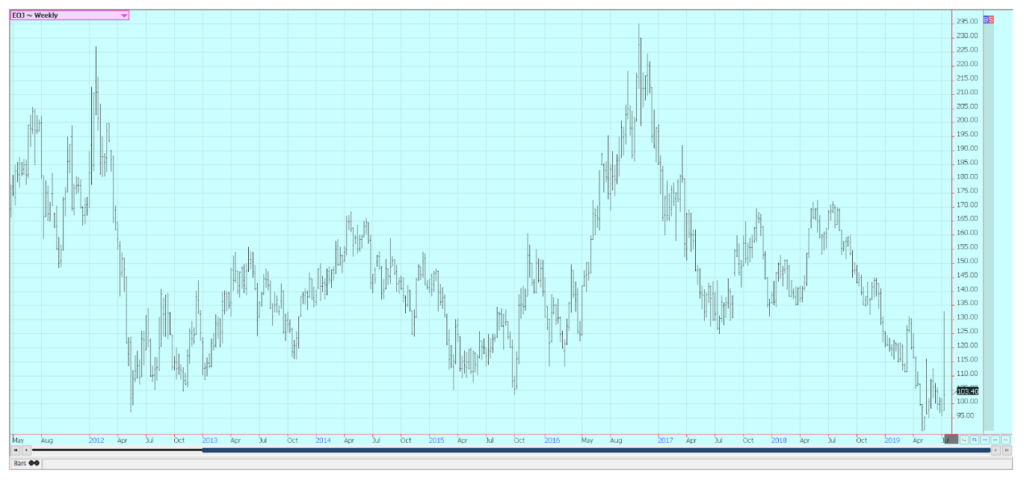

Weekly Chicago Soft Red Winter Wheat Futures ©Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures ©Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures ©Jack Scoville

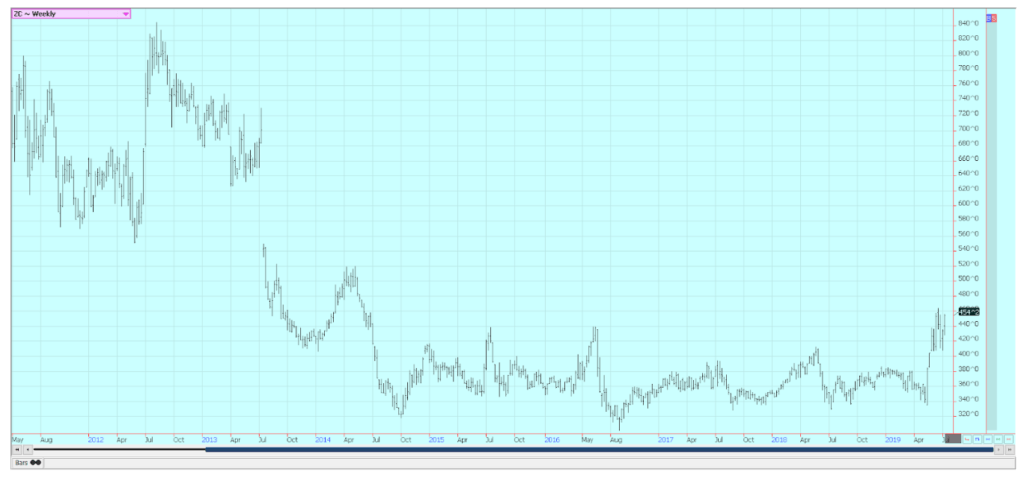

Corn

Corn closed sharply higher and Oats closed lower last week. The move came in spite of the USDA supply and demand estimates that were released late last week. USDA increased planted area in line with the June 30 acreage survey results but did not cut yield estimates. It had already cut the estimates by 10 bushels an acre a month ago and decided that was enough for now. The result was for production and ending stocks to higher than trade expectations. Futures initially moved lower on the new updates, but quickly rallied as no one really thinks the production will be that high. The crop is very late this year as much of the Corn was planted one to two months behind normal dates. It is mostly very short and at least some of it might not be mature before normal first freeze dates.

The crop was planted into mostly very wet soils and the soils have compacted due to the rain and the equipment used to plant and fertilize the crop. The root structure is not as strong as it might normally be and there have been reports of stress from leaves rolling in parts of Illinois and Indiana. There will most likely be other reports of the stress in other states soon. The weather forecast for the rest of July is for warmer and drier than normal conditions and that is exactly what the Corn crop does not need. It needs cooler and wetter. The outlook for higher prices remains intact as long as the weather forecasts do not change and a move to or above $5.00 a bushel remains a very good possibility.

Weekly Corn Futures ©Jack Scoville

Weekly Oats Futures ©Jack Scoville

Soybeans and Soybean Meal

Soybeans and products closed higher last week in response to the USDA monthly supply and demand updates and the weather. USDA reduced the planted area in line with the survey results released in the June 30 reports and also cut expected yields by one bushel per acre. The result was less production than expected by the trade. USDS also cut domestic and export demand, but ending stocks were still just below 800 million bushels instead of a little above that level that the trade had expected. It was a bullish report, but one not generally believed by the trade. Traders think that Soybeans planted area can be increased due to the late planting of corn. The market found new buying interest on Friday on forecasts for warmer and drier than normal growing conditions in the Midwest for the rest of July. Like Corn, the Soybeans were mostly planted very late and are very small. Hot and dry weather now will inhibit growth potential as the crops are not all that well established. It is now a weather market and the forecasts for this month and into August will be key for longer-term price direction. USDA showed that South America will have plenty of Soybeans to offer and this fact will inhibit the upside potential for [prices of Soybeans. The weekly charts show that the market is on the cusp of turning trends up, so price action in the short term might be key for Soybeans prices for the next few months.

Weekly Chicago Soybeans Futures ©Jack Scoville

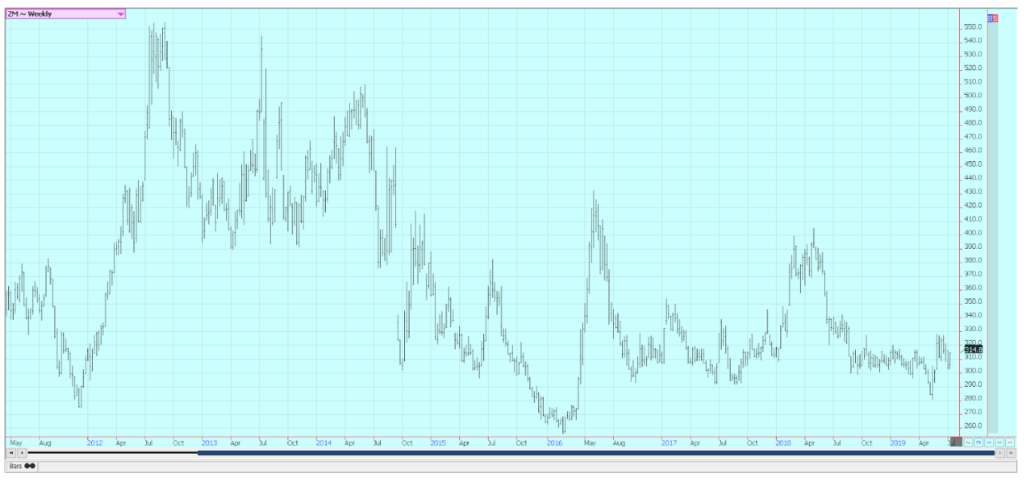

Weekly Chicago Soybean Meal Futures ©Jack Scoville

Rice

Rice was higher last week as the USDA monthly supply and demand updates and the weather both provided bullish inputs to price. The USDA reports showed increased planted and harvested area but reduced yield potential. Many in the trade doubt the planted area estimate as the weather was adverse during the Spring. It was simply too wet for many producers to plant in a timely way, and there are thoughts that at least some producers planted some of their areas to Soybeans or feed grains. USDA also showed increased domestic demand for the current crop Rice, a move that took at least some in the trade by surprise. It said there were indications through lower than expected stocks levels that the domestic demand was much stronger than expected. The new crop data showed good production potential, but strong demand for long-grain so USDA raised its average farm price by $1.00 per hundredweight.

The opposite happened in the medium and short-grain category and the average farm price was lower depending on location. World estimates showed that plenty of Rice is available. Weather is still important to watch as the hurricane came into Louisiana and became a tropical storm. The system threatens to bring flooding rains to Louisiana, Mississippi, and Arkansas and at least some of the crops in these areas can be damaged or lost. The Indian monsoon showed above-normal rains for central and western parts of the country, but Rice areas in the south of the country continued to get below normal rains. Indian Rice production might be stressed now and production might be less this year due to the weaker monsoon rains.

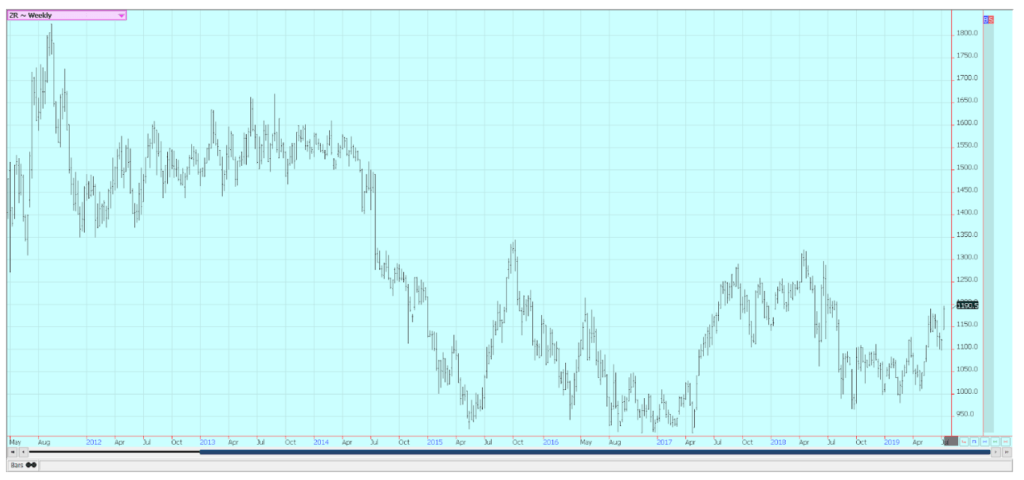

Weekly Chicago Rice Futures ©Jack Scoville

Palm Oil and Vegetable Oils

World vegetable oils markets remain generally weak on ideas of ample supplies and less demand. Palm Oil has seen less demand and production has been relatively strong. The market hopes for better demand but this demand has not really shown up yet as the private sources reported that month on month export demand was slightly lower than last month. The market also talks about big supplies and supplies appear good for the projected demand. Canola was a little higher for the week after holding support. The charts show the market is in range trading as rains were seen in the Prairies and more was in the forecast.

A drought had been developing in the Canadian Prairies. It has been very dry there and the crops in the region really need a drink. They are starting to get that drink now. There were chances for some precipitation over the weekend. There are hopes that Chinese demand can return as well. Soybean Oil was firm due to the rally in Crude Oil amid renewed and increased tensions with Iran. The move higher in Crude Oil and products implies more demand for biofuels. Chicago Soybeans futures are also rallying on the potential for less production. Trends are up in Soybeans and trends could turn up in Soybean Oil in sympathy.

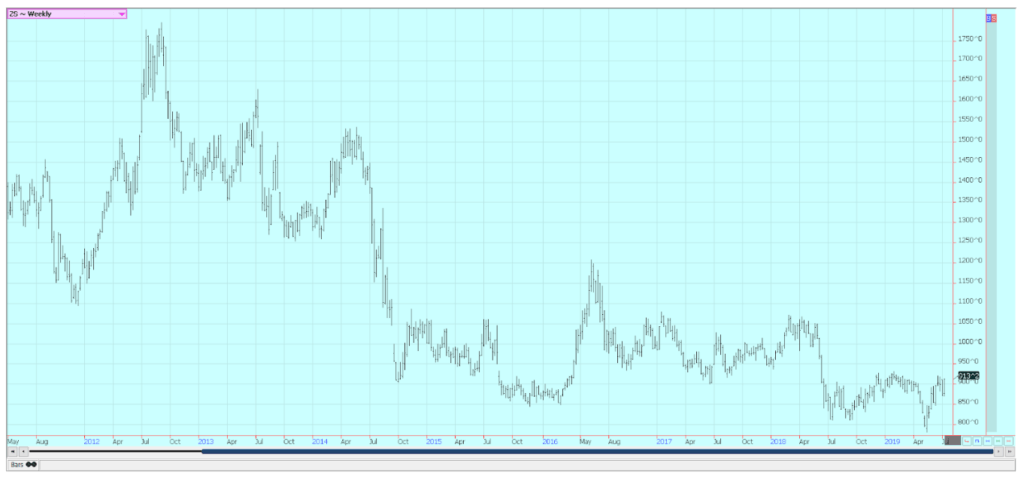

Weekly Malaysian Palm Oil Futures ©Jack Scoville

Weekly Chicago Soybean Oil Futures ©Jack Scoville

Weekly Canola Futures ©Jack Scoville

Cotton

Cotton was lower for the week on weak demand. The weekly export sales report was poor once again and there are no real prospects in sight for improvement soon. USDA showed less export demand in its monthly supply and demand updates and also showed a slight decrease in domestic demand. These current crop changes were passed through to the new crop data and ending stocks were higher than expected. Trends remain down on the daily and weekly charts. The weather has been bad, especially in the Texas Panhandle, where there are concerns that it has been too wet and cool for the crop to be developed well. That should be changing now as it has been warmer and drier in the last couple of weeks.

The Delta has also been wet and some rains have been seen in the Southeast over the last few weeks. The topical system now moving through the Delta could bring some very damaging precipitation. Cotton is already experiencing lost business potential with China and Turkey and could get hurt if Vietnam is targeted for tariffs later on. Also pressuring the market are forecasts for big production around the world. USDA sees no shortage of Cotton anywhere in the coming year. However, the Indian monsoon is off to a slow start and production potential could be hurt there and in Pakistan. Monsoon rains have started to move into central and northern parts of the country but these rains are arriving a couple of weeks late.

Weekly US Cotton Futures ©Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ was higher last week on the roll from July to September, but the weather in Florida remained tranquil. There are no tropical systems likely to hit the state this week. Futures appear poised to move back to or below 90.00 seen earlier in the year. Speculators have been buying in anticipation of the hurricane season, but there are no storms on the horizon this early in the season. They are selling some of these positions now and producers have also been looking to sell as the orange crop in Florida looks to be big. The hurricane season started on June 1, but so far the state has seen only an increase in showers and storms that have been beneficial for crops.

Trends are sideways to down on the daily charts and weekly charts as the market looks at a big orange crop and weak demand for FCOJ. USDA kept its production estimates above 70 million boxes in the reports last Friday. Inventories in Florida are still 15% above a year ago. Fruit for the next crop is developing and are as big as golf balls. Crop conditions are called good. Irrigation is being used a few times a week to help protect crop condition. Mostly good conditions are reported in Brazil as the harvest there is active.

Weekly FCOJ Futures ©Jack Scoville

Coffee

Futures failed to hold the rally and closed a little lower in New York. Even so, it has been a nice recovery in prices and one that should probably hold. Brazil continues to keep a strong export pace and shipped about 2.8 million bags in June. The Brazil harvest is moving along at a slow pace and producers are trying to store the crop due to the current low prices. Reports indicate that the yields are not really strong and that the quality of the crop is poor due to extreme weather seen early in the growing season. Reports from the recent freeze suggest little additional damage to crops, but some leaves were burned and some trees will be in shock for a while.

Vietnam is also reporting lower yields for the current crop as the weather was not good for flowering earlier in the year. There have been some hot and dry spells that have hurt yield and quality for these crops as well, but showers are reported in the Central Highlands now and ideas are that conditions and production potential have improved. Buyers are now more actively pursuing other origins, especially for certified or higher-end coffees. Roasters were scaled-down buyers on the extended down move and now have more than ample supplies in-house or on the way. Brazil had a big production year for the current crop, but the next crop should be less as it is the off-year for production.

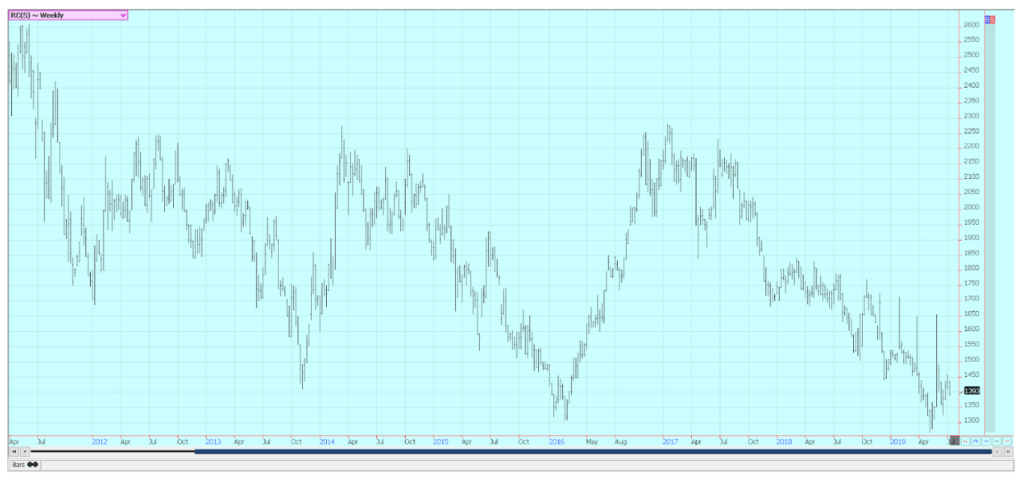

Weekly New York Arabica Coffee Futures ©Jack Scoville

Weekly London Robusta Coffee Futures ©Jack Scoville

Sugar

Futures closed lower, with London the leader on the way down. New York was lower, but held the recent trading range and seems to have no particular place to go. Reports from India indicate that the country still has a large surplus of White Sugar that probably must be exported. India has always been willing to dump agricultural goods such as Rice and Sugar at below cost prices, so the market began to anticipate improved sales from mills and exporters there. There are concerns that the Indian monsoon will not be strong this year and that Sugarcane production could be hurt. It is hot and dry there so far, but there are signs that the monsoon has started to develop as rains have now been at or above normal for a couple of weeks in Sugar areas.

Processing of Sugarcane in Brazil is faster now after a very slow start as the is now harvest in full swing. Mills are refining mostly for ethanol right now. The fundamentals still suggest big supplies, and the weather in Brazil and India has improved to support some of the big production ideas. Demand seems to be average and routine. Very good conditions are reported in Thailand. Demand for Sugar has been average, and demand for ethanol is reported to be increasing.

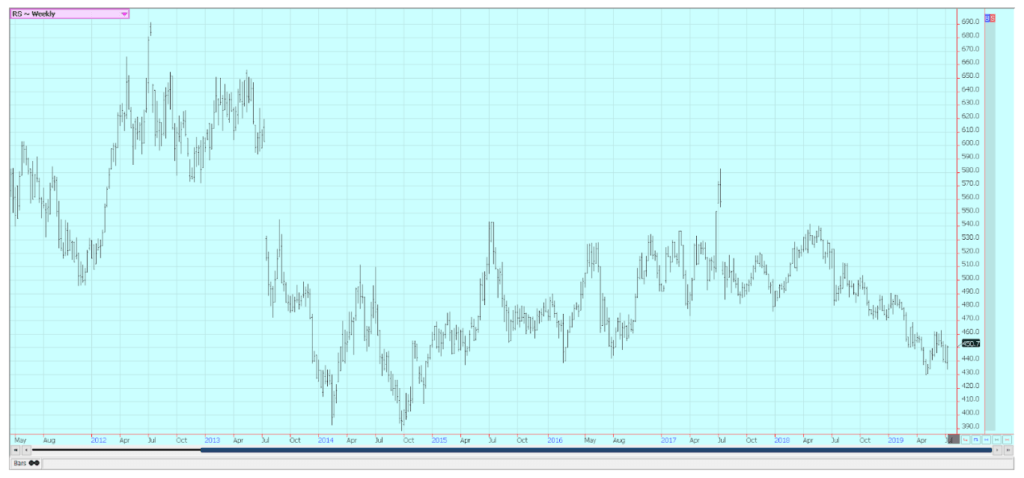

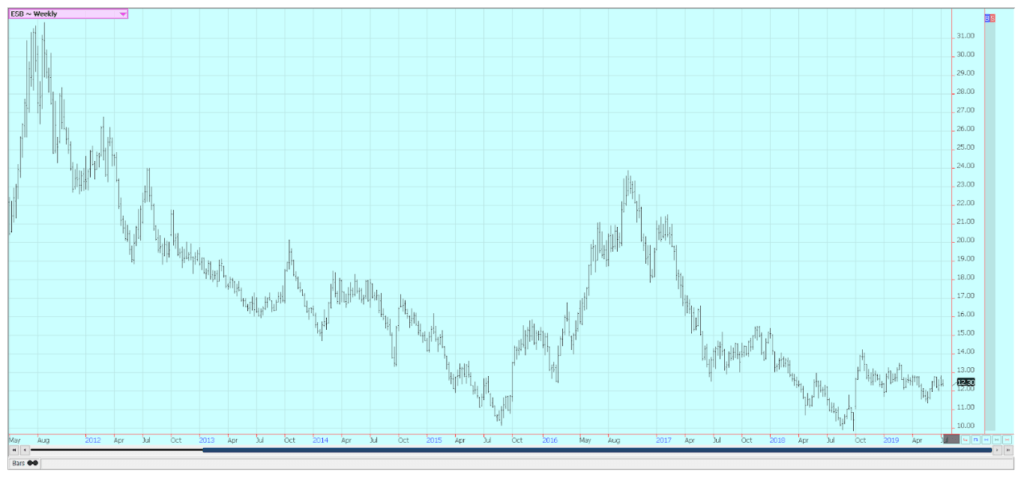

Weekly New York World Raw Sugar Futures ©Jack Scoville

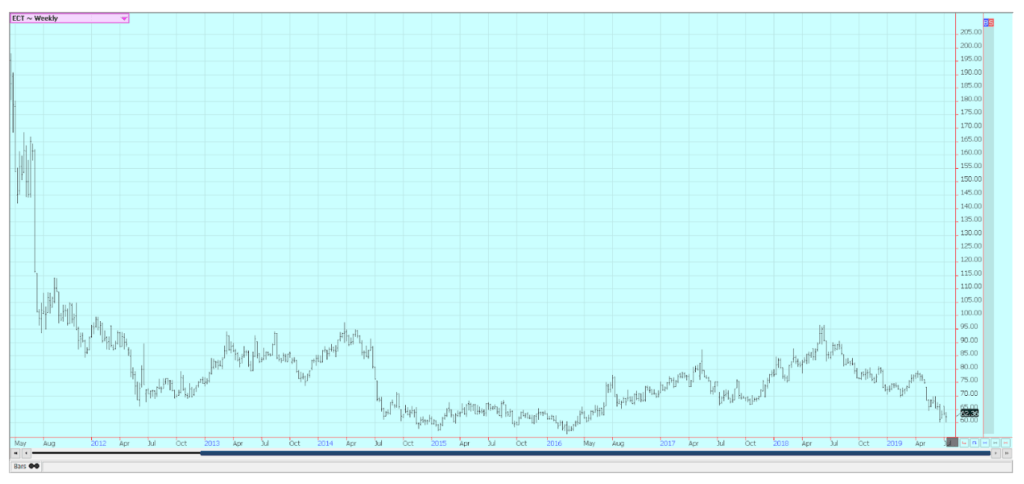

Weekly London White Sugar Futures ©Jack Scoville

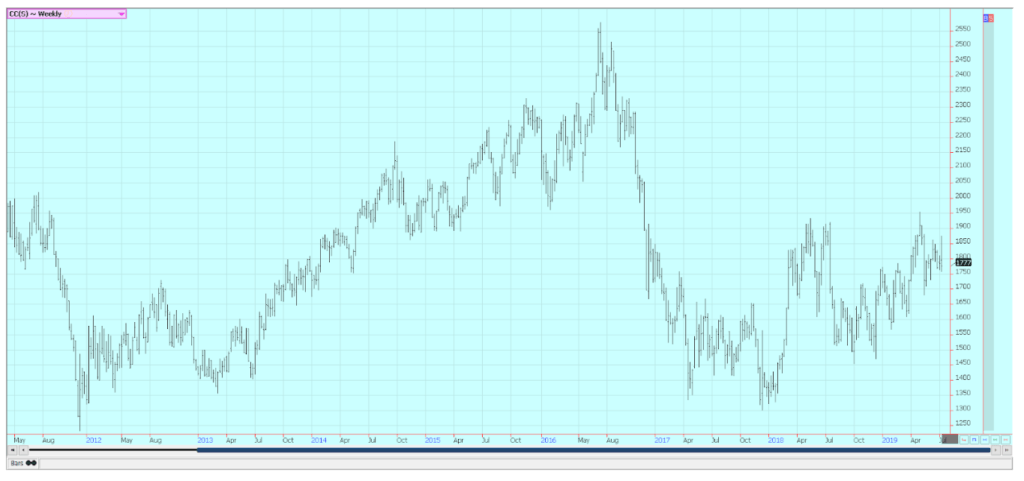

Cocoa

Futures closed mixed, with New York a little higher and London a little lower. Futures closed higher, but well off the highs for the week as the early week rally failed to hold. New York has now given back all of the early week rally and London is not far behind. The charts show that the majority of the Monday rally has been given up and that futures could test the support near the breakout point today. Some producer selling may have hit the market as well as prices tested the highs made in June. The uneven weather in West Africa is still a feature. Ghana says it has lost 50,000 tons of Cocoa from its main crop due to disease and expects to lose more from the mid-crop and maybe the nest main crop.

The weather in Ivory Coast has been drier than normal for the last couple of weeks and there is some talk that production of the next main crop could be hurt. Some showers are returning to West Africa now to help relieve stress on trees. Ivory Coast arrivals are now 2.115 million tons., from 1.904 million tons last year. Ivory Coast arrivals were 2.061 million tons through the end of June, from 1.869 million last year. Ghana said that producers could get 70% of the minimum in the new pricing program it is putting together with Ivory Coast.

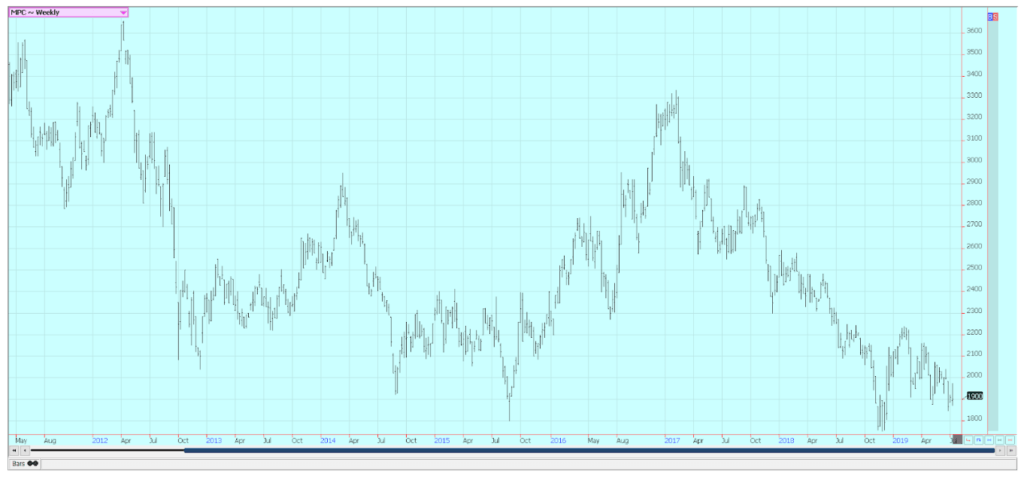

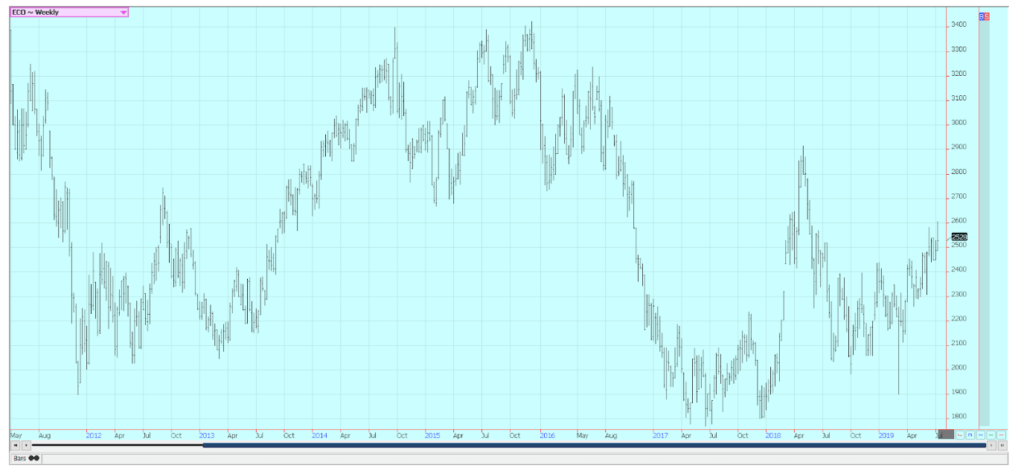

Weekly New York Cocoa Futures ©Jack Scoville

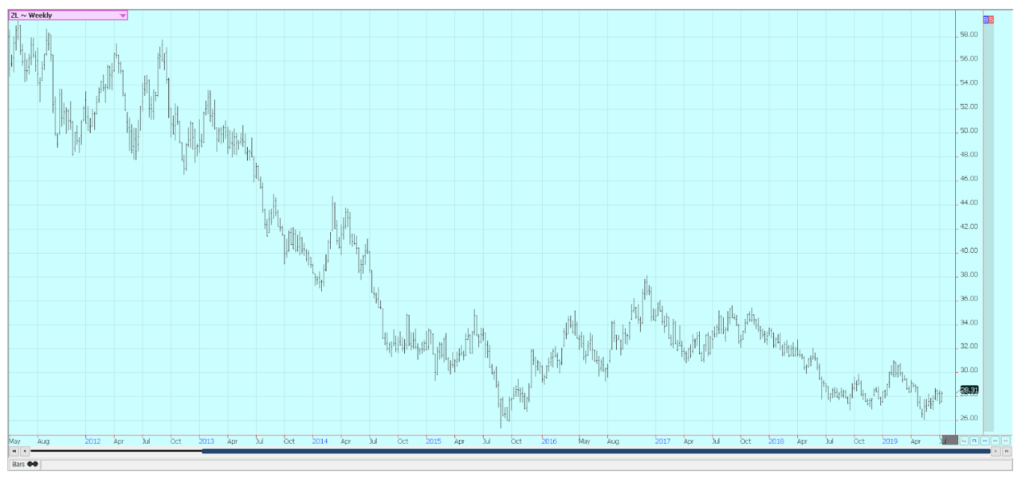

Weekly London Cocoa Futures ©Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing5 days ago

Impact Investing5 days agoOceanEye: EU Launches €50 Million Initiative to Strengthen Global Ocean Monitoring

-

Cannabis2 weeks ago

Cannabis2 weeks agoColombia Moves to Finalize Medicinal Cannabis Regulations by March

-

Markets10 hours ago

Markets10 hours agoOil Shock Risks: How Conflict with Iran Could Impact Markets

-

Markets1 week ago

Markets1 week agoMiddle East Escalation Sparks Market Uncertainty as Oil and Gold Poised to Rise