Business

Corn, coffee futures remain high; wheat markets low due to soft prices

Corn is preparing for the next round of USDA estimates while coffee production remains positive in Brazil and Vietnam.

Wheat

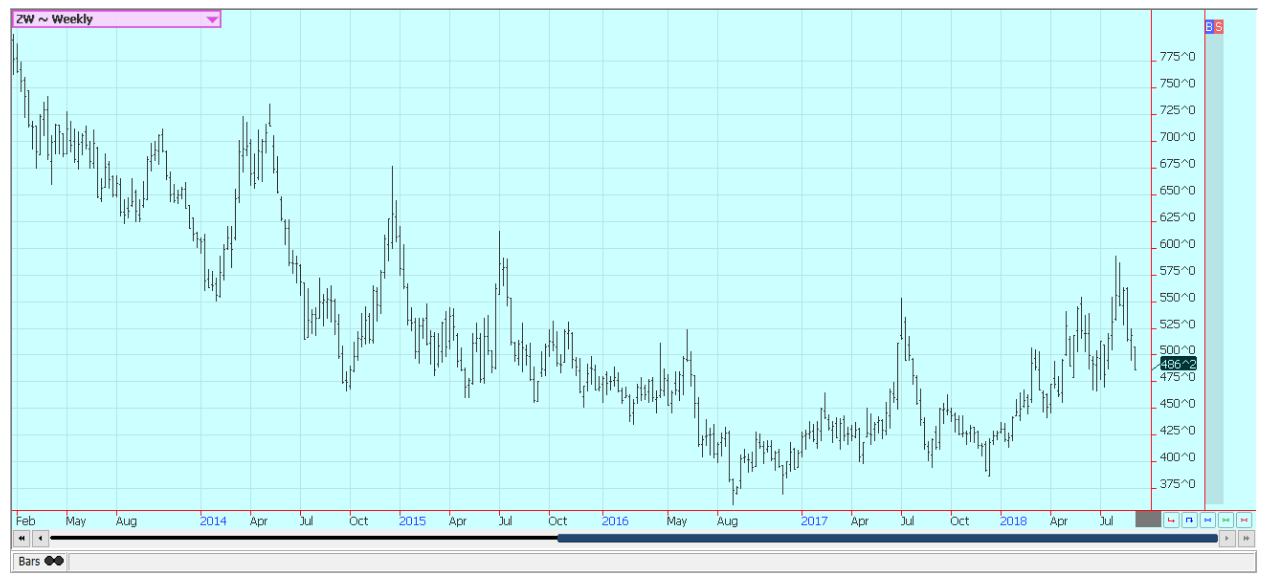

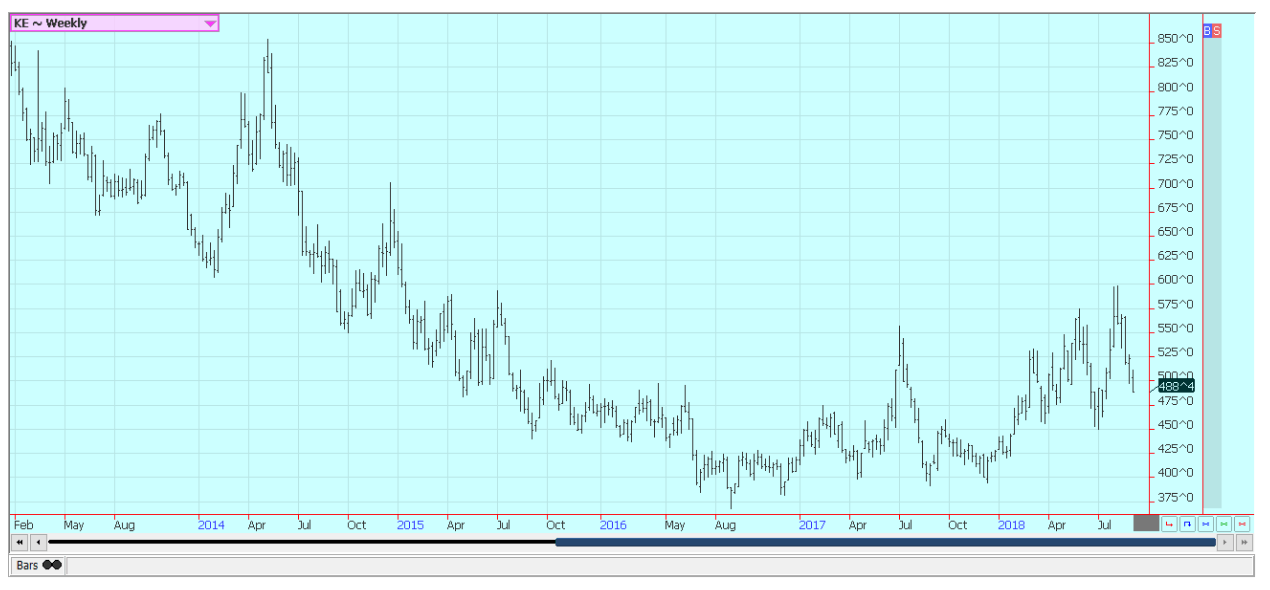

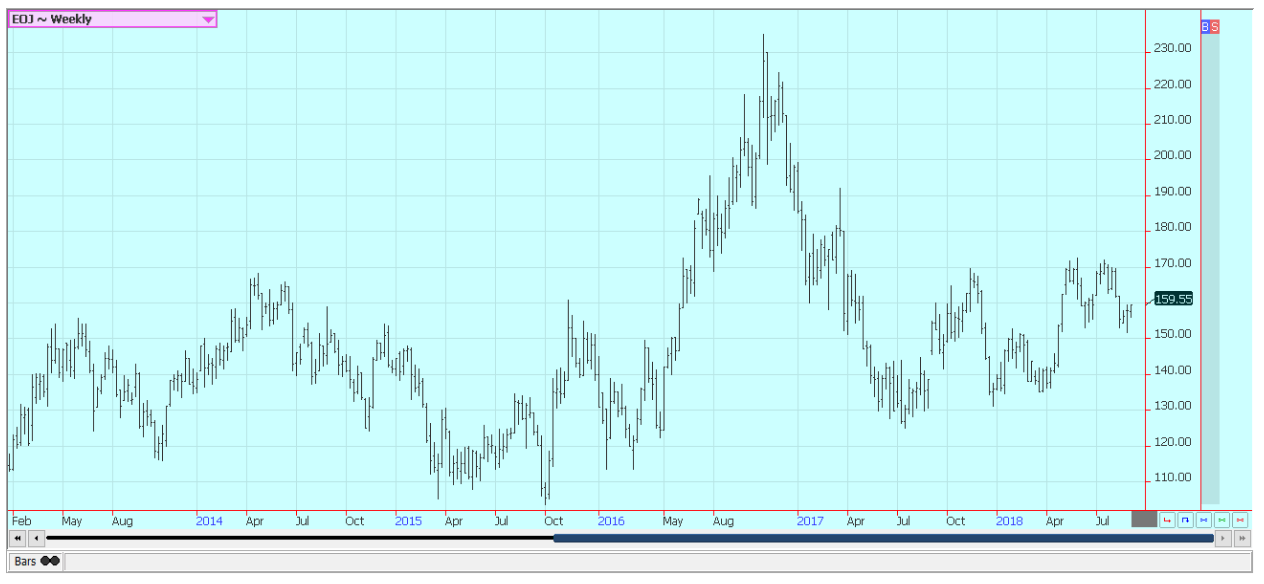

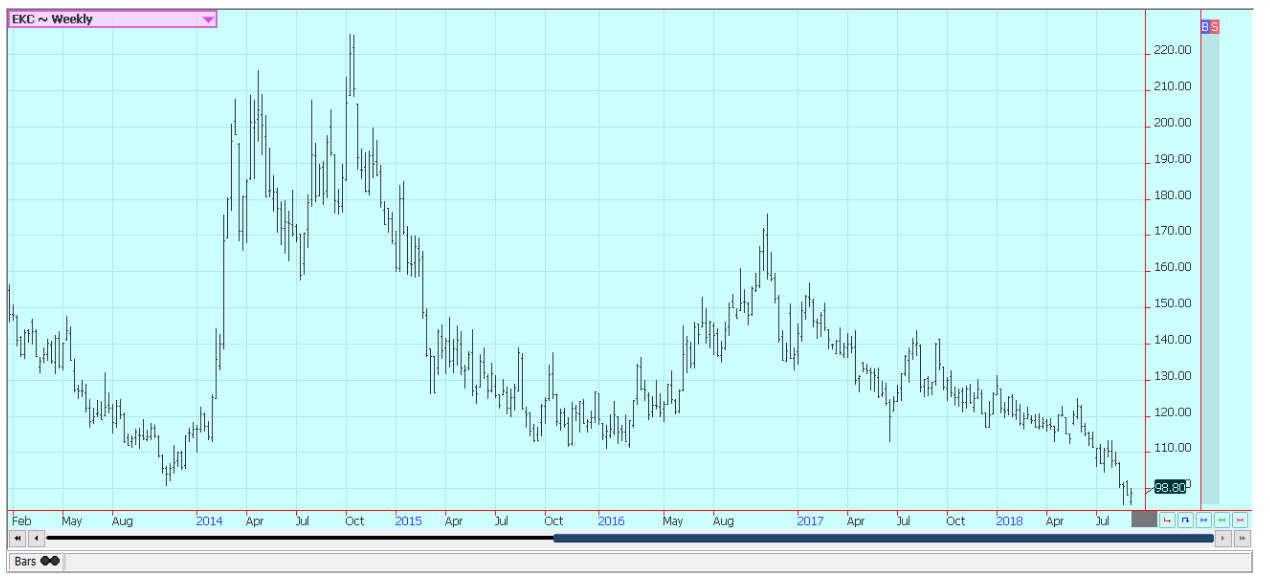

Wheat markets were lower last week on reports of softer prices in Europe and Russia. The market keeps its focus primarily on Russia and the prices it sells wheat into the world market, and especially to Egypt. Egypt was able to pay more than $3.00 per ton less for its purchase last week than it had paid the previous week. In fact, Russian wheat exports have been very strong so far this year at over 23 million tons, compared with less than 13 million tons for the same period last year. That news was enough to keep wheat futures in the U.S. under pressure.

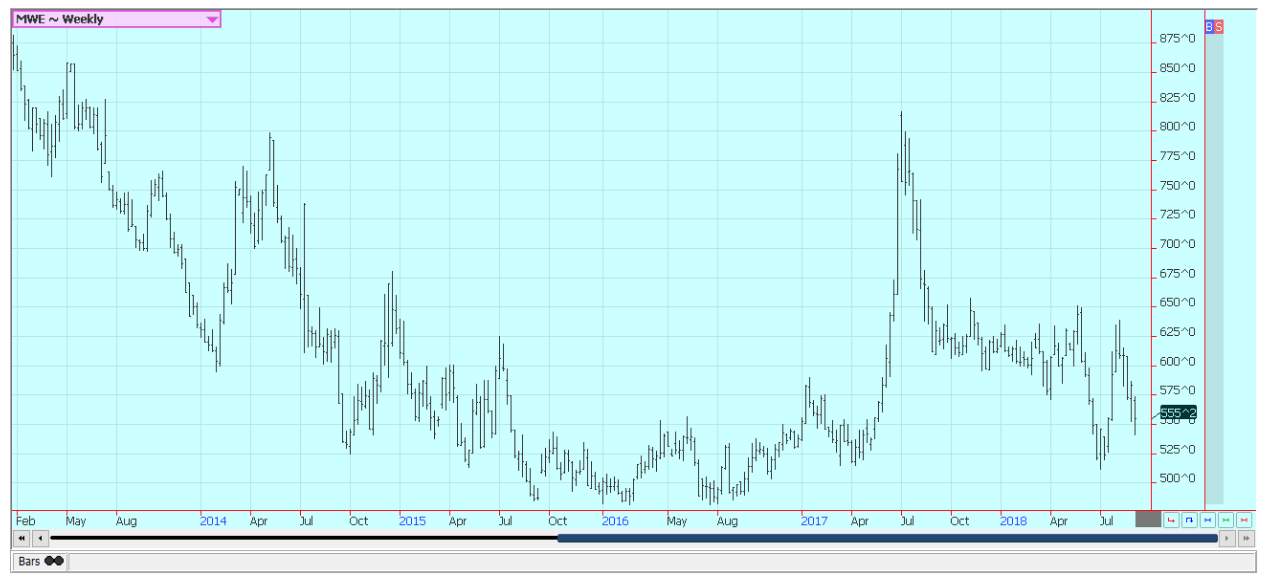

Traders look at the world supply and demand statistics and wonder how prices got so cheap after hot and dry weather greatly stressed crops in Europe and Russia and continues to stress crops in Australia. The data, as presented by USDA, shows a very tight ending stocks scenario moving forward, and these projections are expected to be little changed or perhaps show an even tighter stocks scenario when USDA updates its projections on Wednesday. USDA will also update its supply and demand projections for the domestic U.S. market.

Export sales so far have been consistent, but not real strong and USDA might cut its export demand by a small amount. USDA will not release new production estimates as it will wait for the small grains report at the end of the month to offer updates. The weather in the U.S. is improved for planting the next Winter Wheat crop as much of the Great Plains has seen rains in the last couple of weeks. The Canadian Spring Wheat harvest is moving forward, and the trade expects a smaller crop this year due to stressful growing conditions during the Summer.

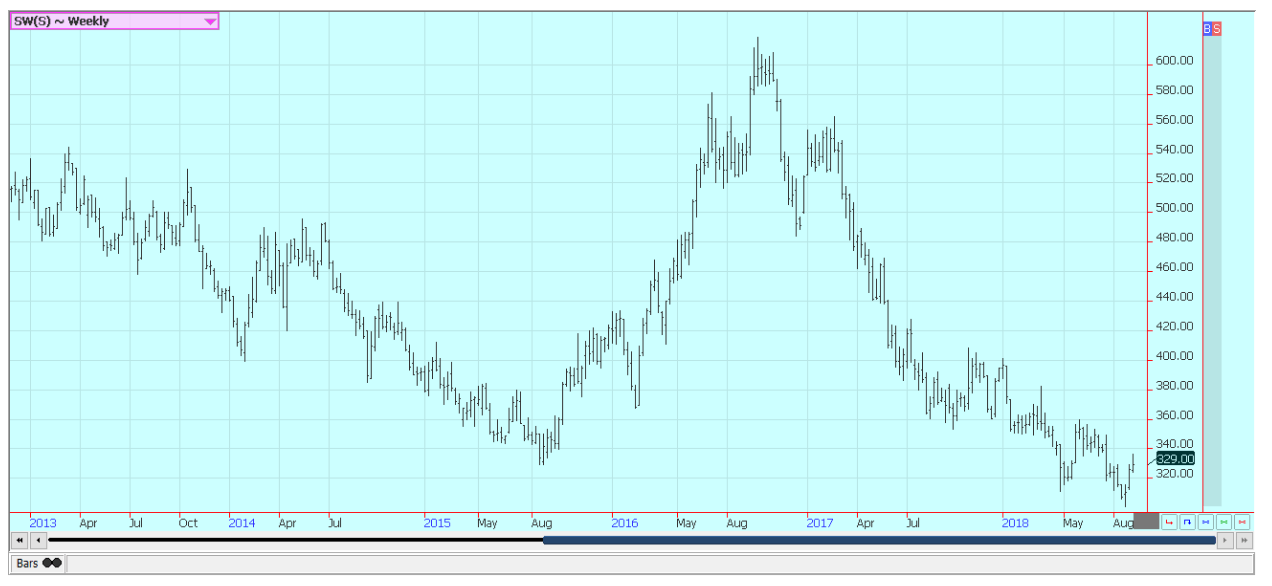

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

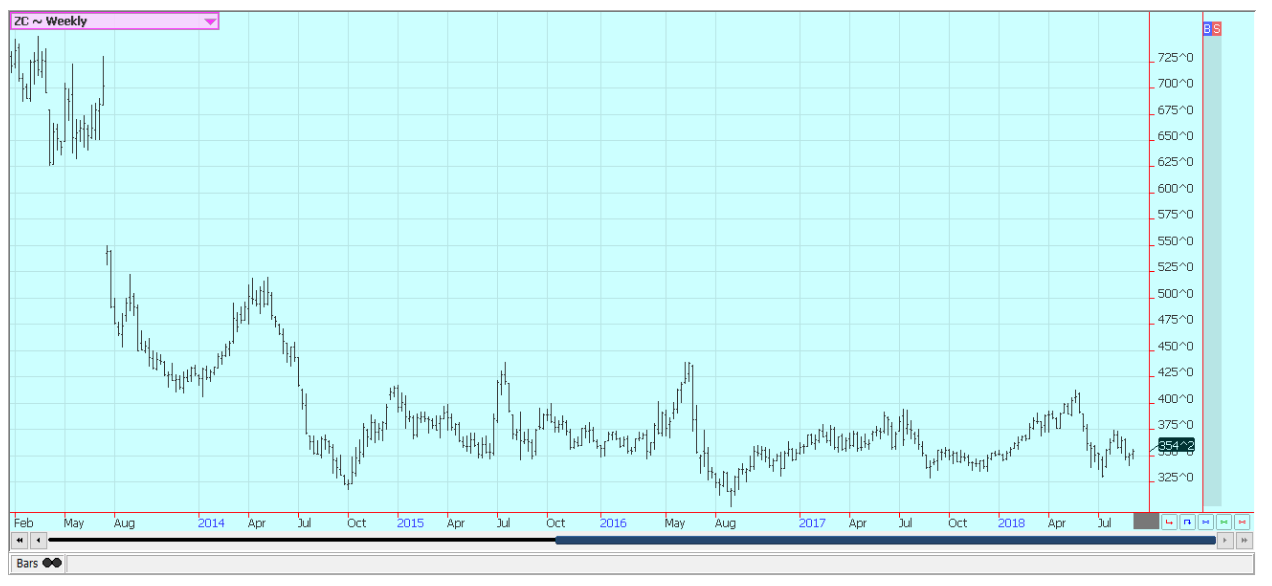

Corn was higher for the week after trading in a narrow range. The market is getting ready for the harvest and the next round of USDA production estimates that will be released on Wednesday. USDA is expected to cut its yield estimate slightly and to find production near 14.5 billion bushels. It is possible that yields and production will get a little smaller in future reports.

The harvest has been active in parts of the Delta, and yield reports have been disappointing and below farmer expectations. The Midwest could feature variable, but somewhat disappointing yields once the harvest gets active there in the next few weeks. Rainfall patterns have been very tropical this year, and have featured excessive rains in some areas and dry weather in others. It has been a warm summer as average temperatures have generally been a few degrees above long-term averages. The warm temperatures have kept plants active and have pushed maturity forward by up to two weeks or so. This usually means less yield at harvest and is the opposite of last year, when cool weather allowed the corn to mature slowly and add test weight and yield to the plants.

U.S. corn export sales remain very strong and were over 1.0 million tons again last week. Mexico has remained in the market and remains the largest buyer of U.S. corn in the world market. It bought about one-third of the export sales last week.

Prospects for corn and wheat demand in the export market have improved due to bad weather in places like Europe and South America. The South American drought has been documented and the lack of an offer is being felt in world cash markets now. Europe and Russia have seen some weather extremes and feed grain production has been affected as much as wheat production. The lone exception appears to be Ukraine, which saw some timely rains this summer to help feed grains but came too late to help wheat.

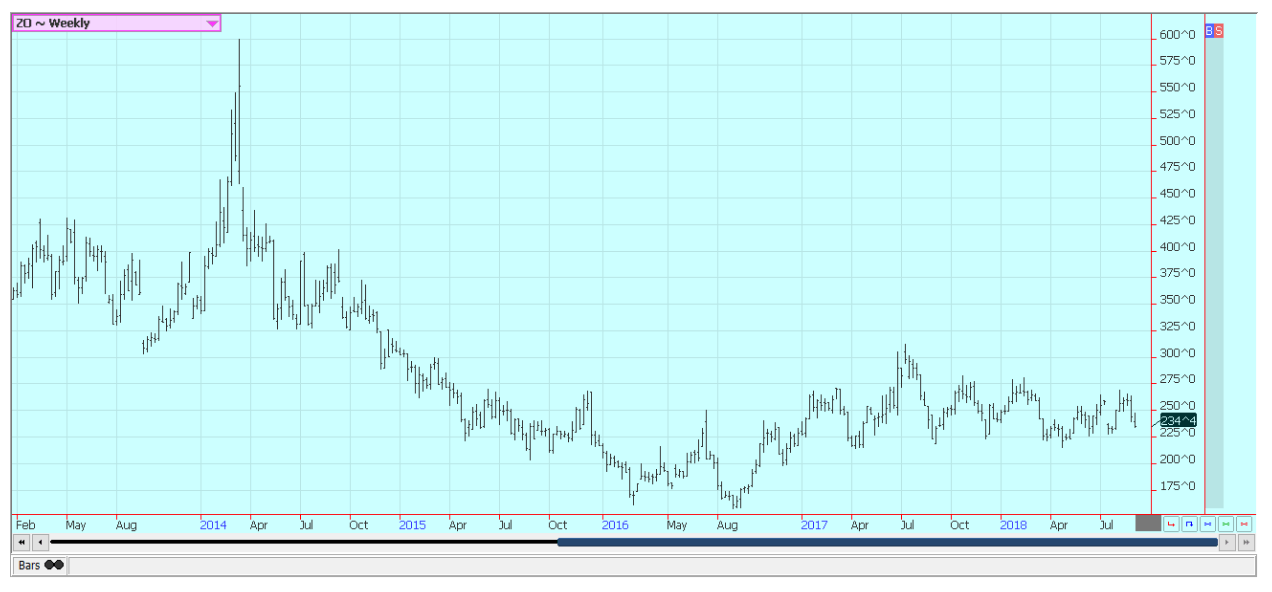

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans were near unchanged last week while soybean meal was higher and held support on the weekly charts. Trends in both markets are down as traders prepare for the USDA reports that will be released on Wednesday. The market expects strong yields near 52.5 bushels per acre and production of more than 4.5 billion bushels.

The strong production potential comes after big rains were seen in much of the U.S. in August. Ideas are that the rains will help cement the big yield potential for the crops. The big production estimates are coming at a time when the trade and tariff war with the Chinese continues to ramp up. President Trump announced that new tariffs are coming in the very near future and that the new tariffs could total about $200 million. He said he is prepared to bring another round of punitive tariffs against the Chinese that would cover another $267 billion in the near future. The Chinese show no signs of giving in, and compromise from the U.S. point of view seems unacceptable. The big loser in all of this is the U.S. farmer, who is getting far less for his soybeans than any other producer in the world.

USDA has announced supports, but the supports will cover only a part of the losses. And China will most likely look for as many other sources for soybeans in the short term and long term as possible, even though they will still need to buy some soybeans here. They will buy as little as possible here while the ramp up efforts in places like Africa to develop agriculture to feed their people. The U.S. farmer is the big loser in the Trump trade wars, and could be a loser in the battles for both the short and the long-term as supplies should be very high and prices will remain very low.

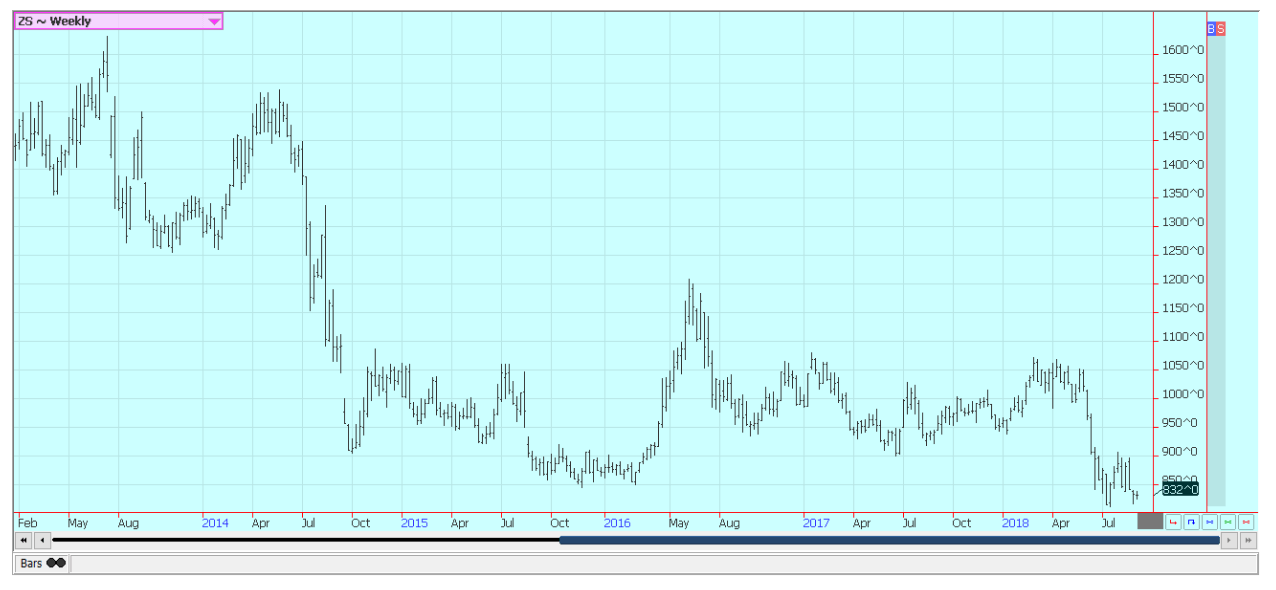

Weekly Chicago Soybeans Futures © Jack Scoville

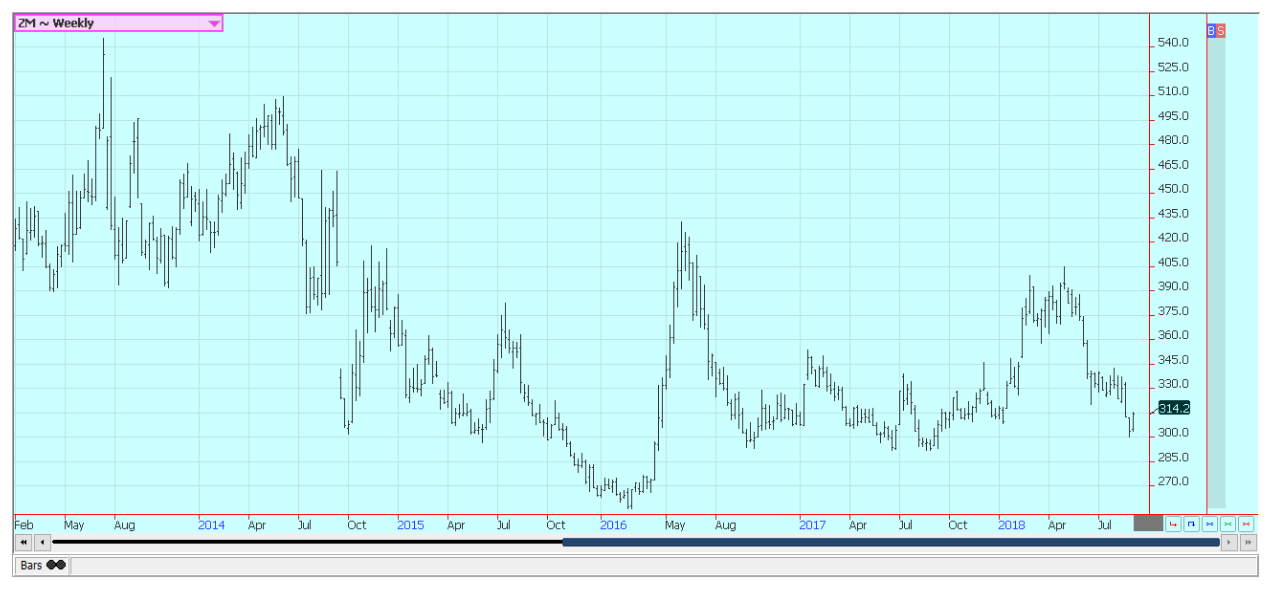

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

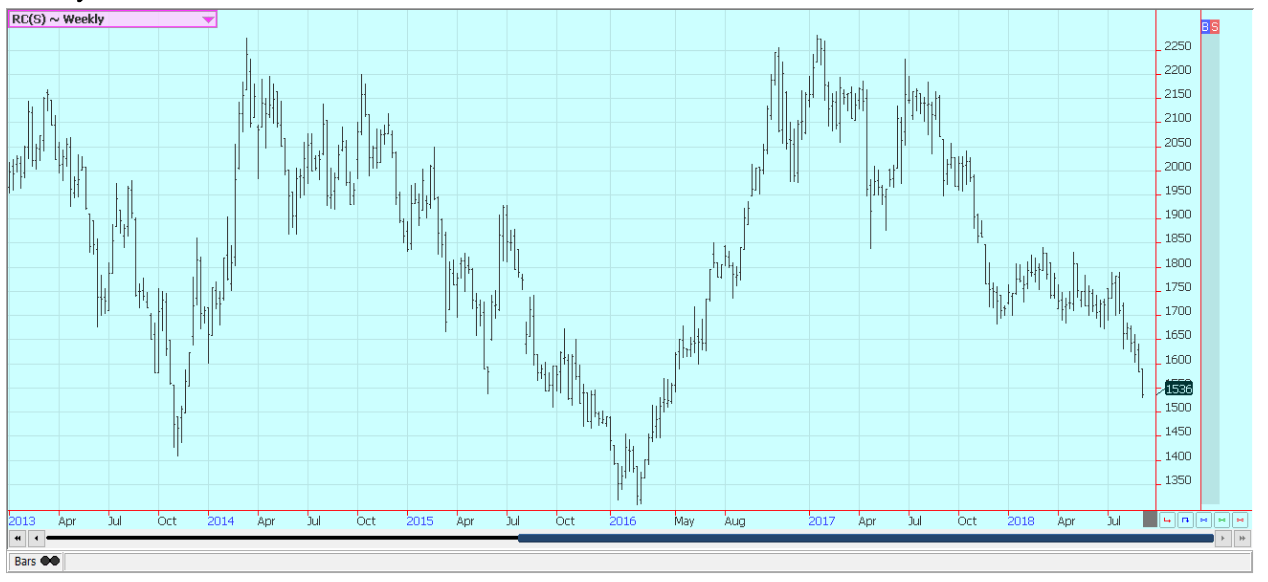

Rice was little changed as the harvest picked up speed. Good to excellent yields have been reported in Texas and Louisiana so far, and the harvest is about done in these areas. Cash prices are stable in the interior and have held well considering the weakness in futures. However, lower prices were reported last week in Texas as the main buyer has left the market for now. Ideas are that they have bought enough rice to cover commitments at this time.

Other storage facilities in the state are full, so farmers will have to store whatever is still left. Milling yields have been acceptable or mostly very good. The harvest is much more active this week in Mississippi and will soon spread north. Ideas are that the northern Delta will harvest in earnest starting in early September. Big rains were seen in Arkansas last week, but the rains should not have been enough to do more than delay harvest activities by a few days. The quality should remain strong overall. Producers in Arkansas are reporting that rice fields have a lot of grass, and this could rob some yield potential. World prices have been stable in the last week.

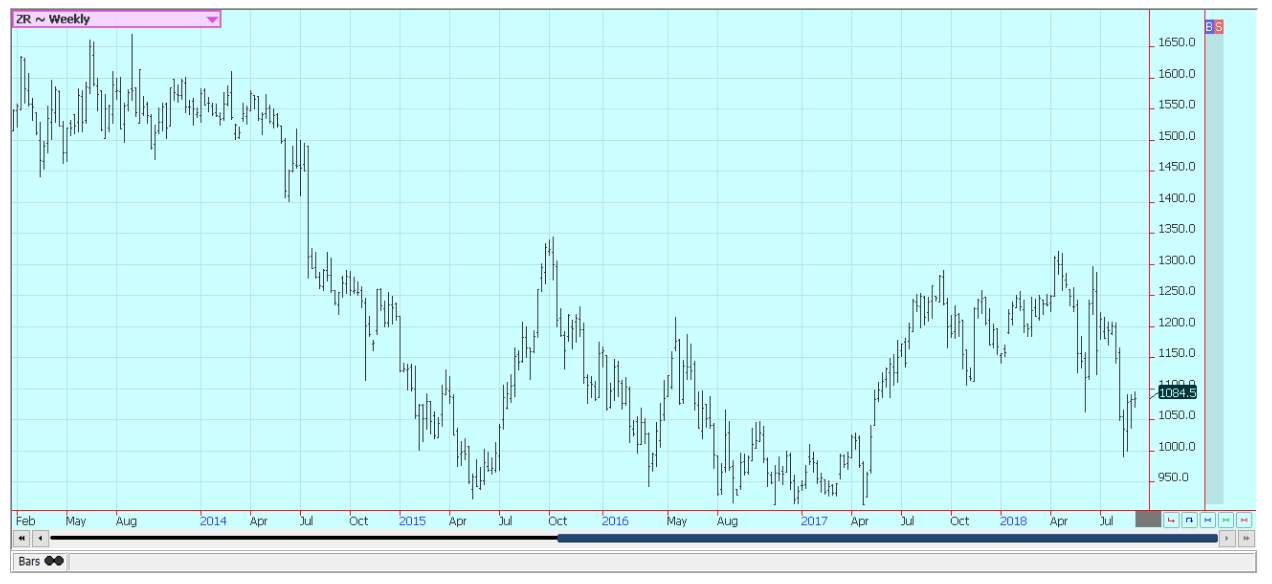

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils prices were mixed last week. Palm oil was a little high on the week as traders reacted to the strong export estimates for August from the private sources. Both sources reported exports of well over 1.0 million tons on the week and an improvement over July. However, futures faded late in the week as the market started to look for supply and demand estimates from MPOB. Ideas are that production can outstrip demand and month-on-month ending stocks levels can increase.

There is still plenty of supply, and the charts remain in a sideways trading range. Soybean oil was locked in a sideways trend all week and closed lower on some price weakness that developed on Friday. Trends are sideways in the market, but prices could work lower if soybeans stay weaker.

Demand for biofuels has been strong, but export sales were nonexistent last week. Canola was lower as the harvest is getting started. Early reports indicate variable and somewhat disappointing yields. Weather in the prairies remains important and some production losses have been expected. Some areas were hot and dry. This is particularly true in Saskatchewan. Temperatures are starting to turn cooler as the seasons change.

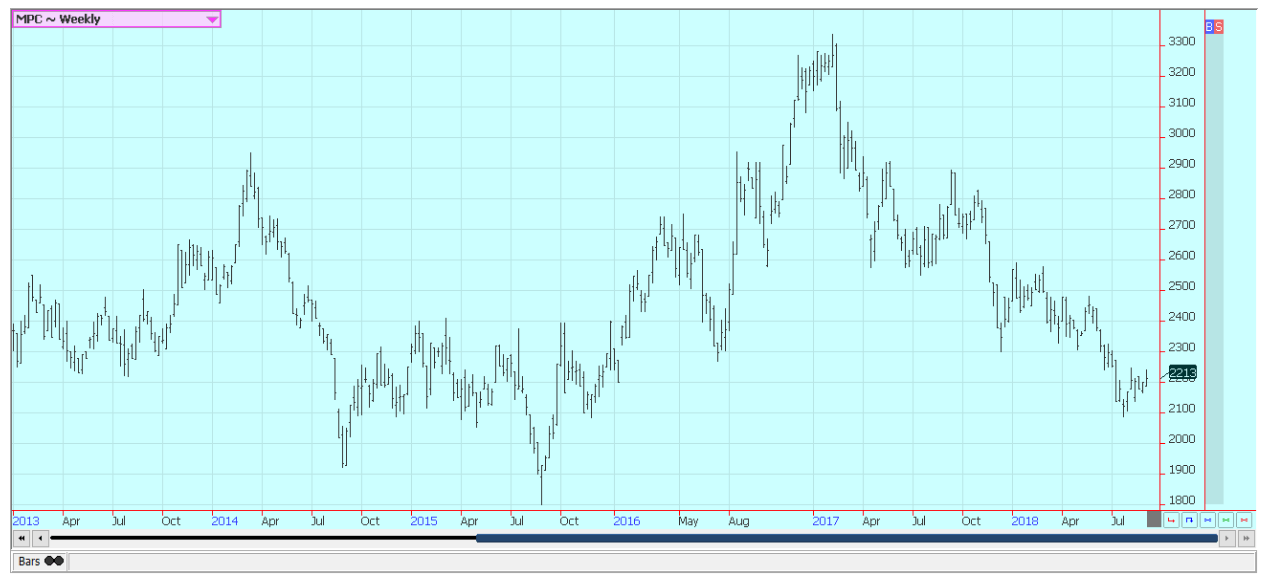

Weekly Malaysian Palm Oil Futures © Jack Scoville

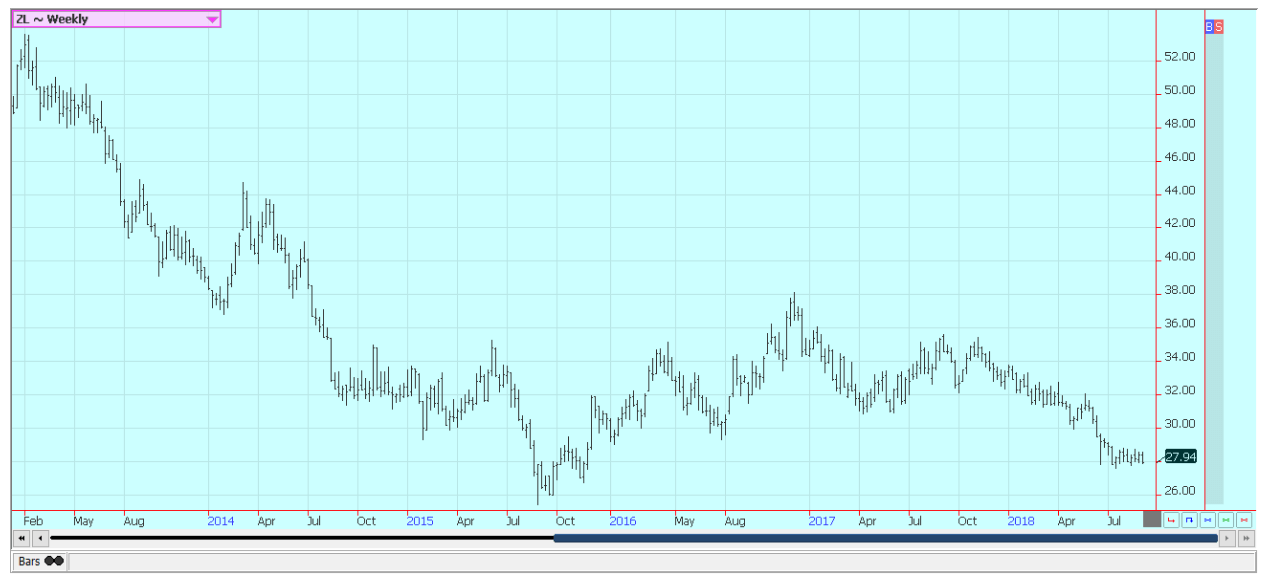

Weekly Chicago Soybean Oil Futures © Jack Scoville

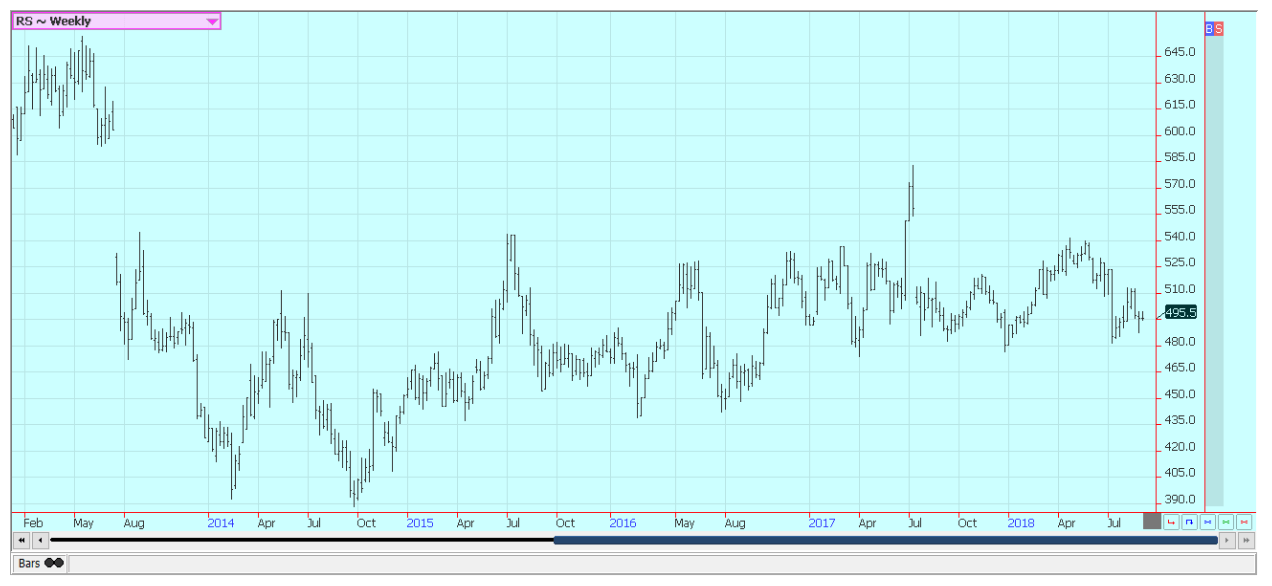

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was a little lower for the week in choppy trading. U.S. production ideas are lower after the extreme weather seen in Texas this year, and many analysts now expect total U.S. production below 19 million bales.

U.S. weather remains good in the Delta and Southeast, and has improved slightly in West Texas on north into Kansas with improved precipitation. Even so, the crop is generally in poor condition in much of Texas, and there are real questions on just how good the yield can be in the state this year.

The harvest has been active in far southern parts of the state. Crop scout reports indicate that the yield potential should be generally poor. Eastern Texas crops are in good condition and about ready for harvest. Bolls are opening in the Delta and Southeast.

The trade is monitoring the weekly Cotton Classings report for clues on yields and also quality. The reports are showing that just over half of the arrivals were tenderable. Classings data has been improving as the harvest starts to expand. Rains from the Indian monsoon have been below normal, but generally good enough to support crops. The trade there remains optimistic that a good crop is coming and that they will not need to import very much cotton this year. China has been active in India buying and will buy as much as possible there to make up for production losses inside of China. Conditions have also improved in Pakistan as rains have been reported.

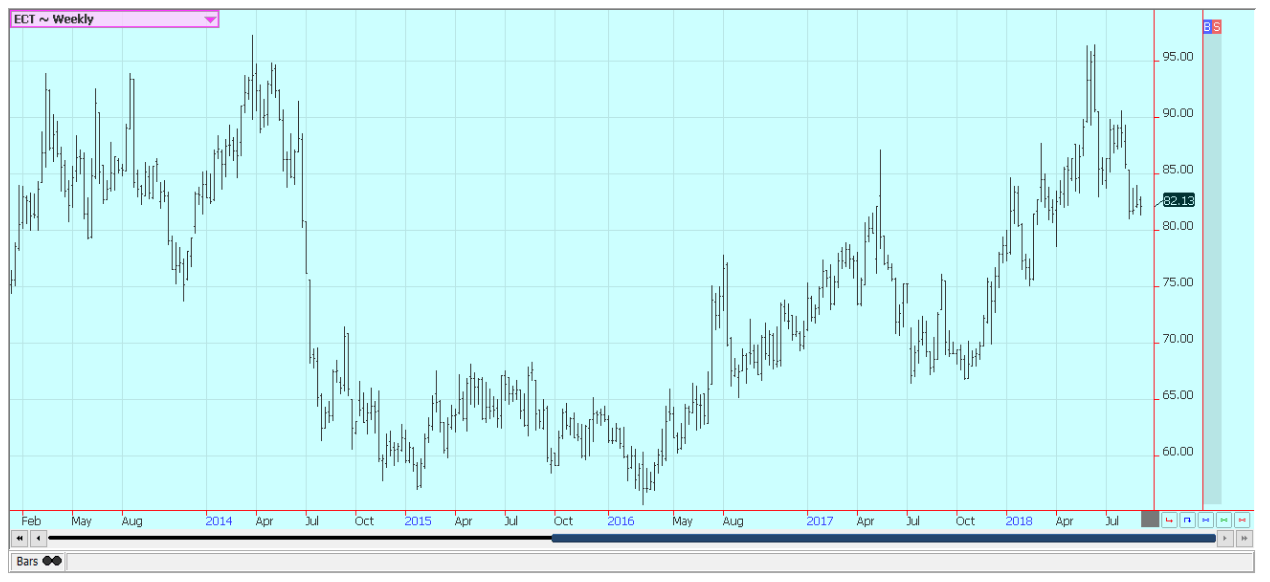

Weekly U.S. Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was firm last week in range trading as the hurricane season started to get much busier. The summer has been a quiet one in the Atlantic, but all that changed last week as one storm brushed Florida and another appeared headed to the middle of the North Atlantic Ocean. There are other systems developing that could impact Florida in the next week or so.

Chart trends are mixed as the market has found some support from speculators due to the increase in storm activity. Overall growing conditions in Florida are good to very good, and there is no storm development in the Atlantic at this time. The state is getting frequent periods of showers. Florida producers are seeing good-sized fruit, and work in groves maintenance is active. Irrigation is being used when needed, and producers expect a good crop. A good crop now will likely mean increasing inventories of frozen concentrate. Weaker demand has caused FCOJ inventories in Florida to increase on a year to year basis.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were higher last week and held the lows on the weekly charts set a couple of weeks ago. London charts show down trends on the weekly charts. Ideas of strong production in Brazil and Vietnam are keeping futures under selling pressure. Speculators have been looking at the weakness of the Brazilian Real against the U.S. Dollar and have been selling coffee on ideas of increased offers in Brazil.

Vietnam is getting close to its next harvest, and ideas are that producers there need to sell more of the previous crop to create new storage space. Producers in both countries are not selling, although some talk of some big sales in Brazil. But, the market is generally quiet there due to the after-effects of the truckers strike. The strike resulted in sharp increases in freight costs and shut off-farm selling interest. Arabica trees in Brazil were starting to show stress due to the lack of rain over the last few months. It will be dry again for the rest of the week.

The months leading up to the winter were also dry, and that early dryness is affecting trees now. It is very possible that some production could be lost for the next crop due to the very dry overall conditions. Estimates for production this year range as high as 60 million bags. Most of Central America is reporting good rains, so the overall losses could be minimal. Production in Vietnam is estimated at above 30 million bags and a new record. Growing conditions are called good.

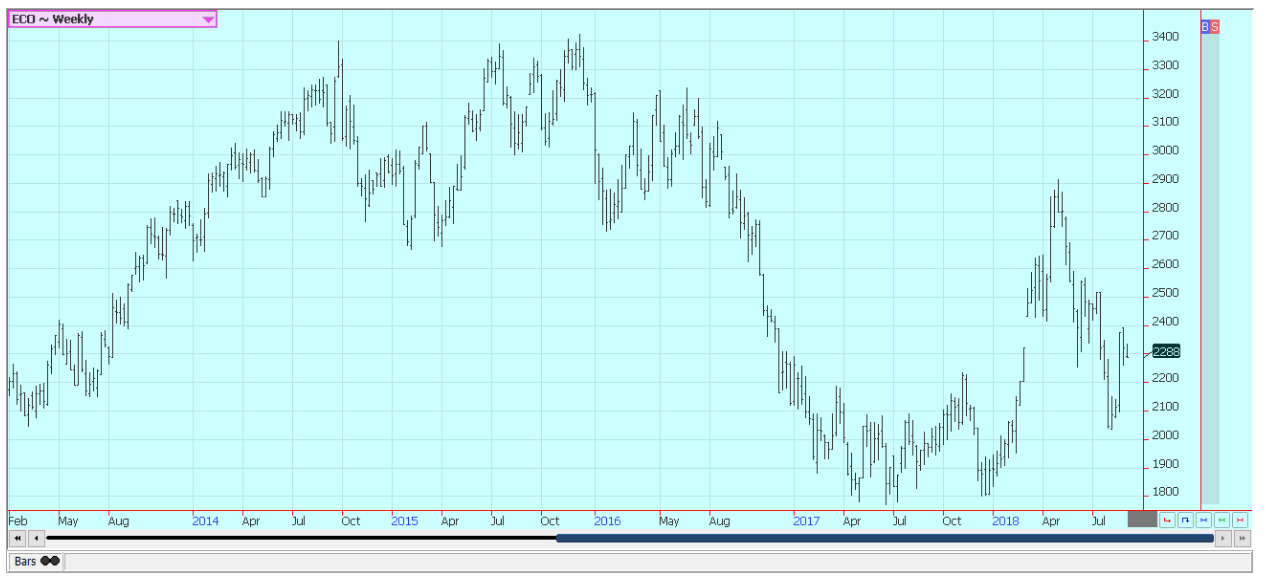

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

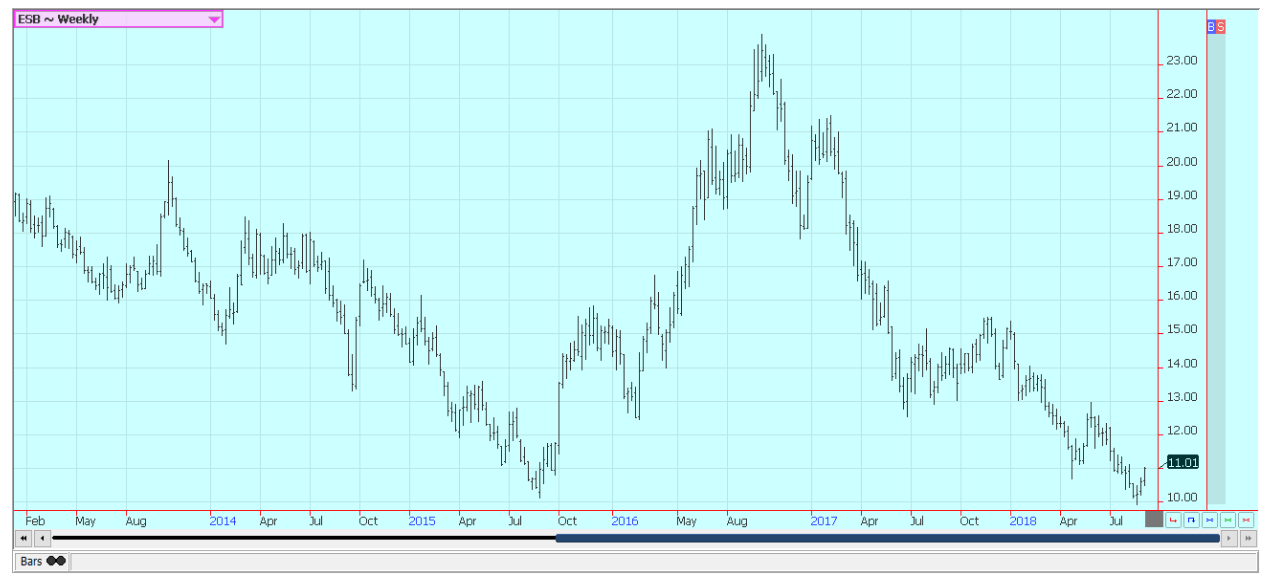

New York and London were higher last week. New York price action overall is stronger as futures moved to test resistance areas on the charts. The resistance so far has held, but speculators are short and might need to cover more as October New York futures will go off the board at the end of this month. Ideas of big world production are bearish and have been the reason for the selling. Just about everyone is looking for a significant production well above any demand potential.

Dry conditions continue in Brazil, the EU, and Russia, but conditions are mostly good in Ukraine. Very good conditions are reported in Thailand and India. Brazil producers are worried about cane production even with the rapid early harvest, and the market is now starting to talk about less production there this year. The dry weather in much of Europe and in southern Russia near the Black Sea has hurt sugarbeets production potential in these areas. Recent rains in parts of Ukraine have continued to improve production prospects there.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures closed lower for the week. The market has harvested the crop once and now needs to create some selling room for the actual harvest. The market appears to have made a pre-harvest low and now is seeing some speculative short covering. Prices have also firmed in West Africa this past week. The outlook for strong production in the coming year has been enough to keep the prices weak.

The main crop harvest is in its earliest stages in some parts of West Africa but will not really get going for at least another few weeks. Main crop production ideas for Ivory Coast are high. Ghana and Nigeria are expecting very good crops this year as well, although Nigerian estimates have started to drop a little bit on the volume of rains that have hit the country in recent weeks. Conditions also appear good in East Africa and Asia.

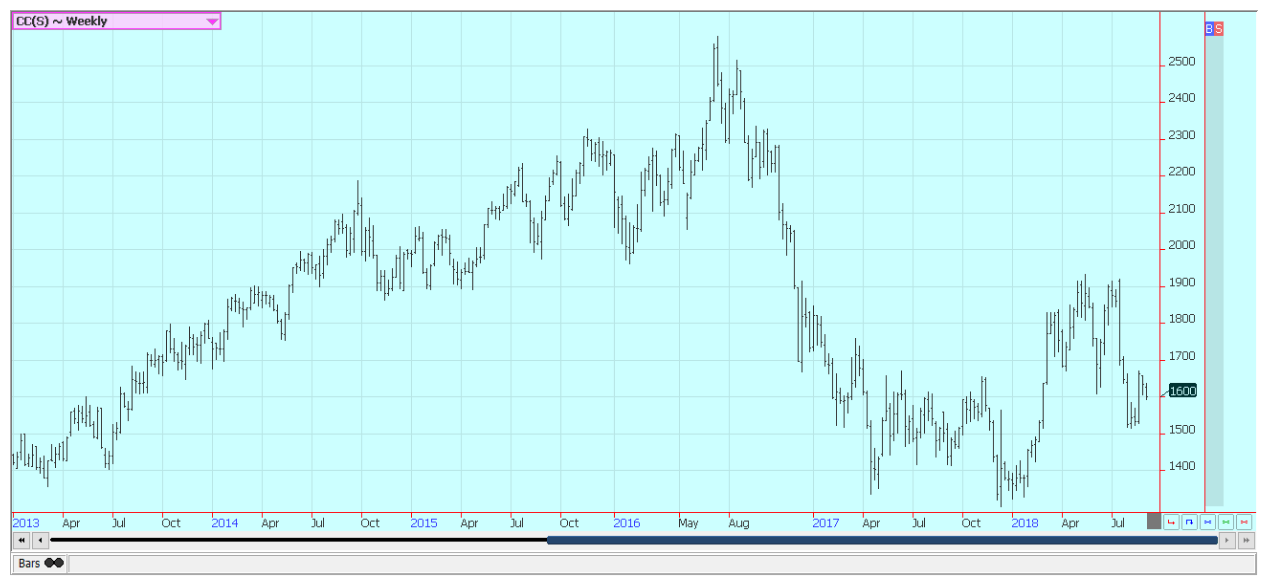

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoGlobal Gender Gap Progress Slows Amid Persistent Inequality and Emerging Risks

-

Biotech5 days ago

Biotech5 days agoVytrus Biotech Marks Historic 2024 with Sustainability Milestones and 35% Revenue Growth

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoColombia Approves Terrenta’s Crowdfunding Platform for Real Estate Financing

-

Africa7 days ago

Africa7 days agoCôte d’Ivoire Unveils Ambitious Plan to Triple Oil Output and Double Gas Production by 2030

You must be logged in to post a comment Login