Markets

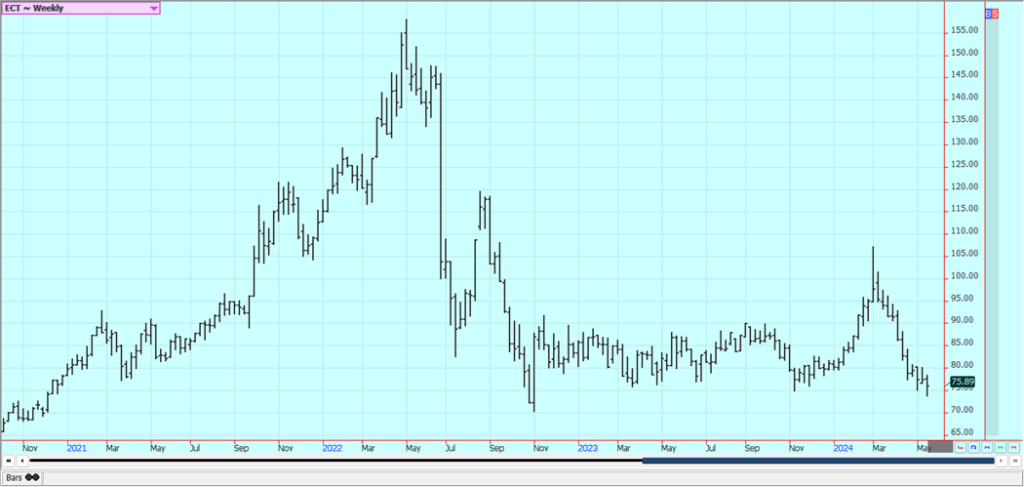

Both Cocoa Markets Were Lower Again Last Week

Cocoa markets declined last week, trading sideways but indicating potential for further drops. Despite mixed trends, production concerns in West Africa and strong demand from traditional and new buyers support futures. Extreme weather may reduce West African production, leading to tight supplies and a projected deficit. The mid-crop harvest may provide additional market supplies.

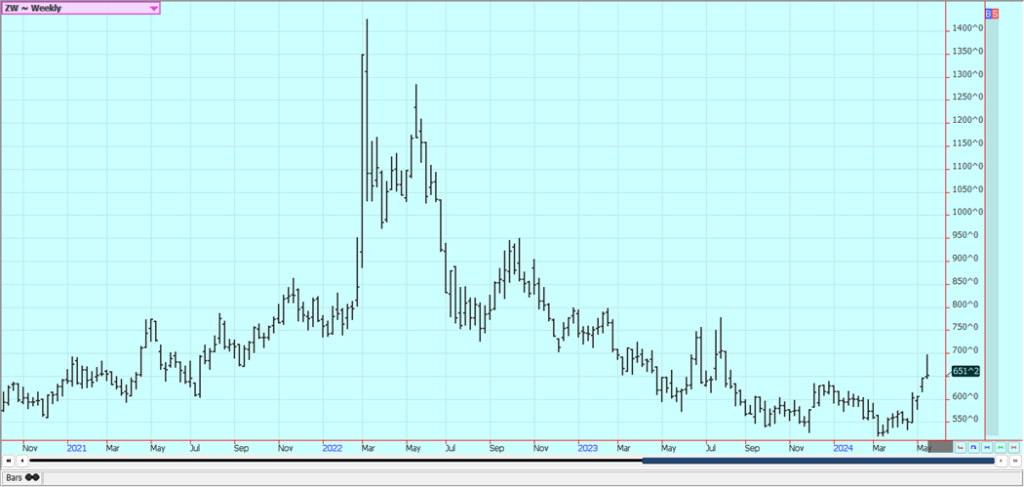

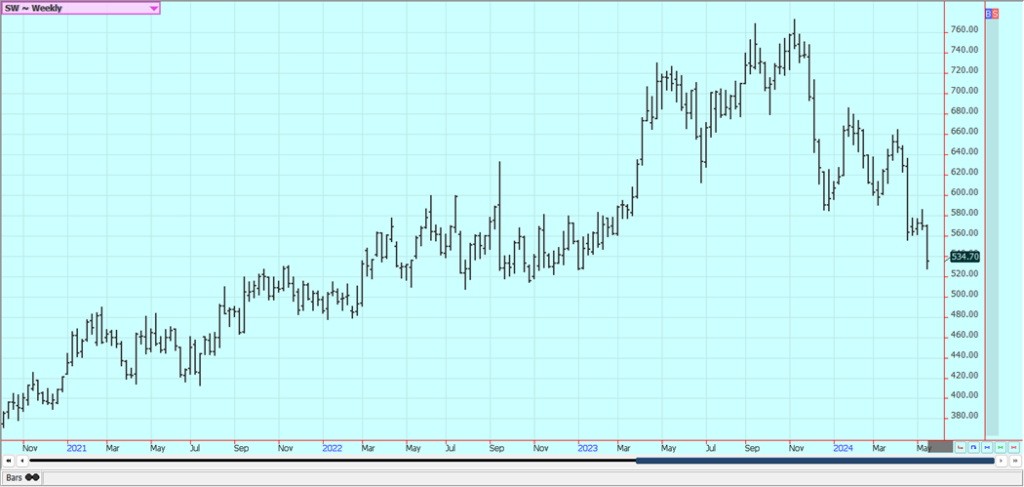

Wheat: Wheat was a little higher last week in Chicago and Minneapolis, but lower in Kansas City after more reports of frosts and freezing temperatures in Russian growing areas. Reports indicate that Russia will still have plenty of Wheat for export in the coming year. USDA issued its latest reports Friday and included a field survey of Winter Wheat production. Winter Wheat production was estimated at 1.288 billion bushels which was a little below the average trade estimate.

Ending stocks for Wheat were also below the trade estimate at 766 million bushels. The Kansas Wheat Tour has been this week and has found the best crop in five years with yields over 43 bushels per acre. The weather is still a key, with extreme dryness reported in Russia and parts of the US and too wet conditions reported in Europe.

The weekly export sales report showed improved sales. Big world supplies and low world prices are still around. Export sales remain weak on competition from Russia, Ukraine, and the EU as those countries look to export a lot of Wheat in the coming period. Black Sea offers are still plentiful, but Russia has been bombing Ukraine again and shipments might be hurt from that origin.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

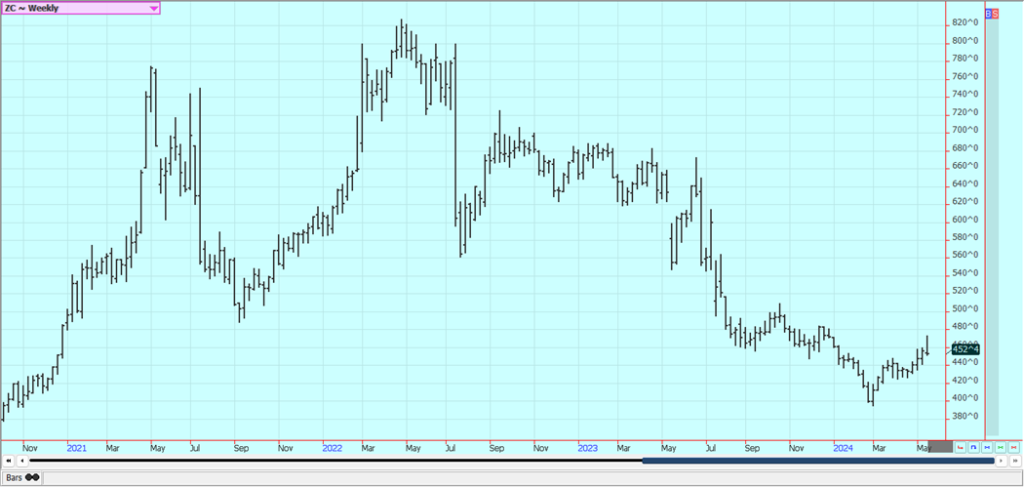

Corn: Corn and Oats closed lower last week. The USDA reports are helping to support futures as are ideas of better demand. USDA estimated high production at 14.860 billion bushels, but ending stocks were a little below trade expectations at 2.102 billion bushels. USDQ anticipates better demand for US Corn with the cheaper prices seen now. USDA made no real changes to South American production estimates.

The Argentine crop has been hit by stunting disease that robs yields and the Brazil Winter crop is suffering from hot and dry weather. Demand has been the driving force behind the rally but now South American weather is the driving force. Increased demand was noted in most domestic categories along with rising basis levels, and export demand has been strong. Ethanol demand has turned less due to weaker petroleum prices seen lately. There is very dry weather for the Winter crops in central and northern Brazil

Weekly Corn Futures

Weekly Oats Futures

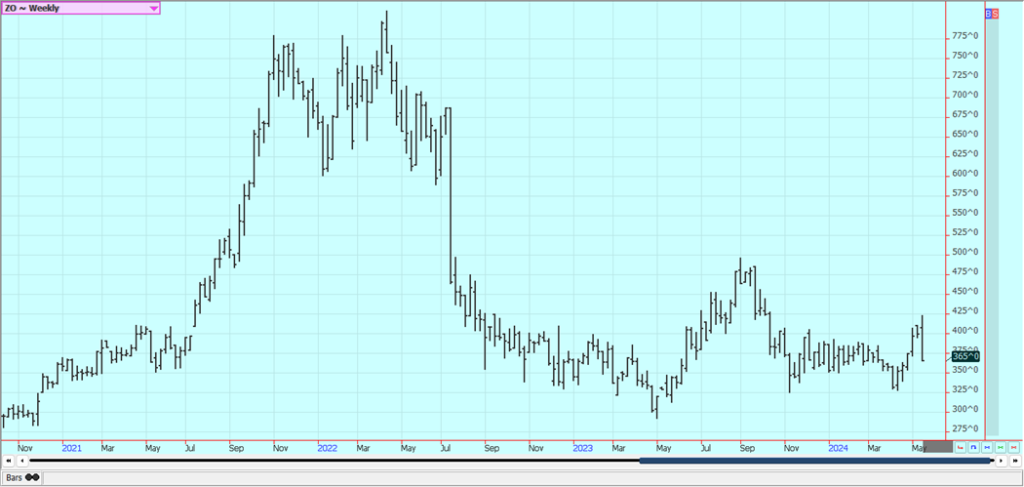

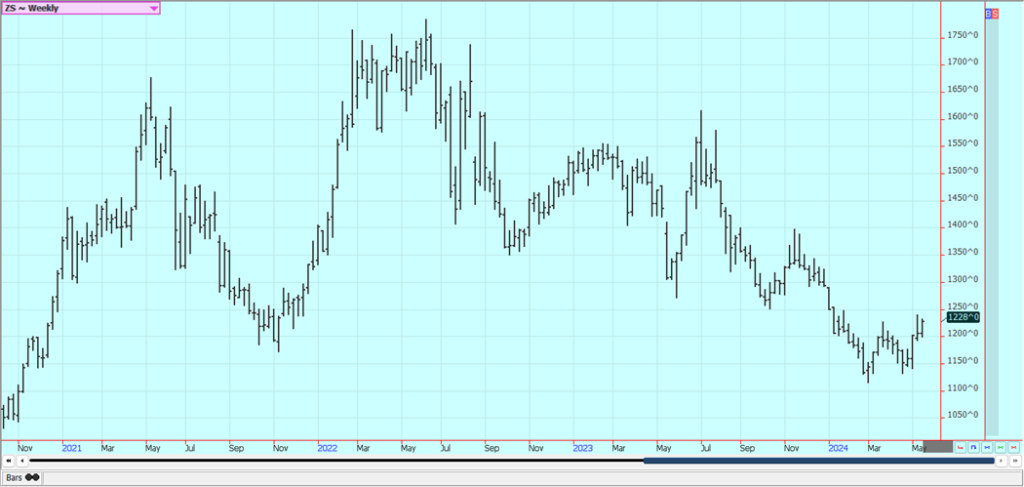

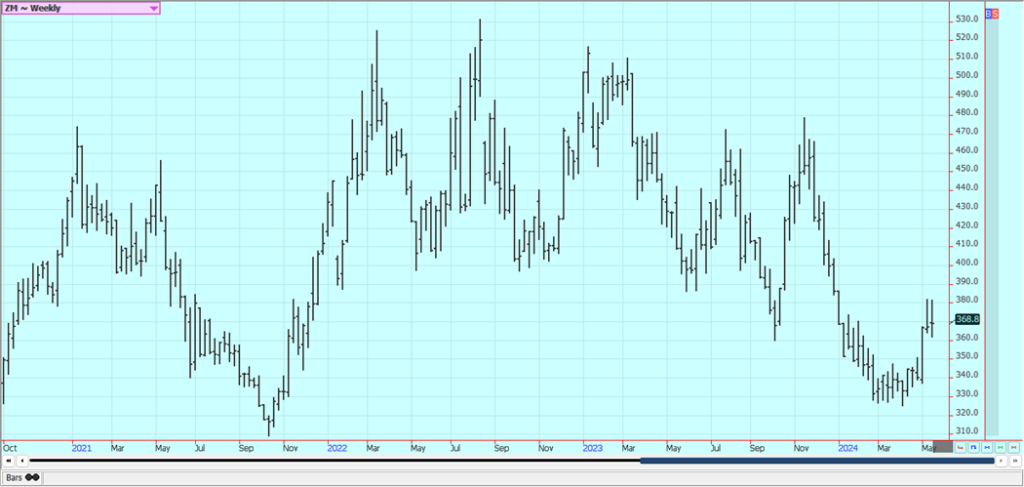

Soybeans and Soybean Meal: Soybeans and the products closed a little higher last week. Soybean Oil was higher on spreads against Soybean Meal. Soybean Meal was only slightly higher. Support for Soybeans came from reports of excessive rains falling in US growing areas, especially the eastern sections of the Midwest. USDA released its first estimates for the coming crop year and held production potential at high levels at 4.450 billion bushels.

Export and domestic demand were increased but ending stocks also were estimated higher qt 450 million bushels. Futures rallied anyway and the rally on what appeared to be negative news can often mean that higher prices are coming this week and for the next couple of weeks. Domestic demand has been strong in the US but has suffered as crushers were crushing for oil. Oil demand has suffered as cheaper alternatives for feedstocks hit the bio fuels market.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

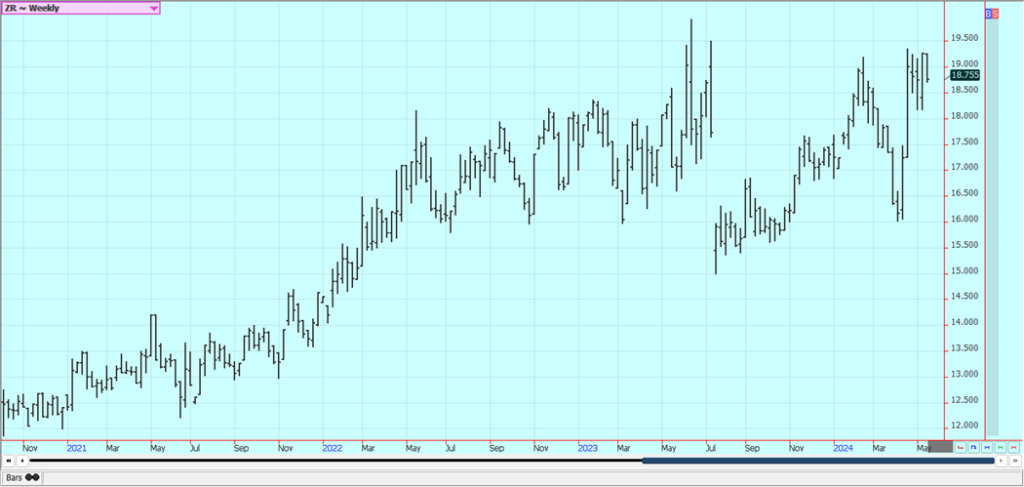

Rice: Rice closed mixed on Friday in consolidation trading, with July lower but the new crop months higher. Futures were lower for the week. The futures market overall remained in a short term trading range. The USDA export sales report indicated moderate sales. Support comes from adverse weather in South American growing areas while new selling is noted from the potential for a big crop in the US.

The big US crops are now in doubt from reports of extreme rains in southern growing areas and especially near Houston. Some more big storms are coming to this region in the next few days. Supply tightness is expected to give way to increased production this year and greatly increased supplies this Fall. These ideas are reflected in the prices seen in the old crop and the new crop.

Weekly Chicago Rice Futures

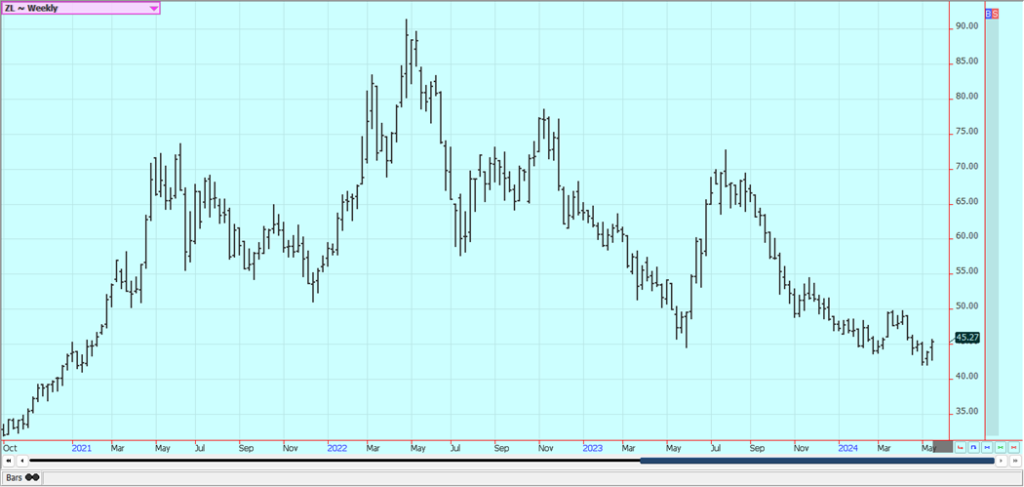

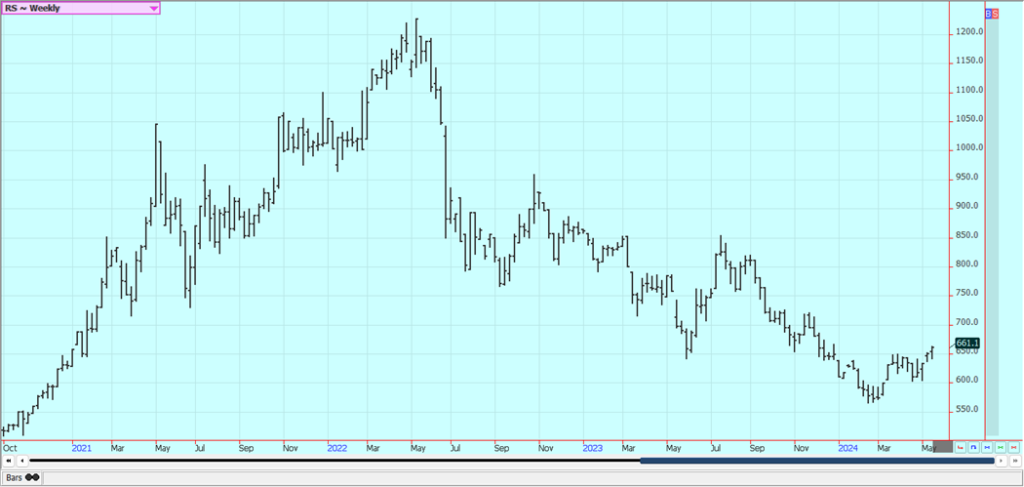

Palm Oil and Vegetable Oils: Palm Oil was higher last week on Chicago price action and despite news of weaker exports. There is also talk of increased supplies available to the market, but the trends are turning mixed on the daily and weekly charts. Canola was higher despite weaker prices in world vegetable oils markets as the market pays attention to Chicago price action and the flooding in Brazil. Farmers concentrate on fieldwork and not selling.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was lower last week but spent most of the week consolidating recent losses amid improved weekly export sales and ideas that the market was oversold. There are also some big problems with too much rain in the Delta and Southeast in recent days. Trends are turning mixed on the charts. The weekly crop progress report showed good planting progress and conditions are good in the southern US this week for growth. Some big storms are forecast for near the Gulf Coast, but rains farther inland should be more moderate.

USDA increased production for the coming year and also increased demand and ending stocks. The report was bearish for futures. Demand remains a problem. The export sales report showed poor sales once again and demand is not likely to improve with the Dollar stronger. USDA made no changes to the domestic supply or demand sides of the balance sheets but did cut world ending stocks slightly.

Trends are still down on the weekly charts. Demand has been weaker so far this year. The US economic data has been positive, but the Chinese economic data has not been real positive and demand concerns are still around. However, Chinese consumer demand has held together well, leading some to think that demand for Cotton in world markets will increase over time.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher and at new highs for the move last week on speculative buying from the USDA reports released aa week ago and fears of less production in coming reports. USDA said that Florida production was estimated at 17,8 million boxes, down 5% from the last estimate but still 13% above the production of last year. Florida early and mid season and navel production was left at 6.80 million boxes, unchanged from the previous estimate, but Valencia production was cut 8% to 11 million boxes.

Nielsen is reporting less retail demand due to the higher prices and volumes sold at retail have sagged. The reduced production appears to be at the expense of the greening disease. There are no weather concerns to speak of for Florida or for Brazil right now. The weather has improved in Brazil with some moderation in temperatures and increased rainfall amid reports of short supplies in Florida and Brazil are around but will start to disappear as the weather improves and the new crop gets harvested.

Weekly FCOJ Futures

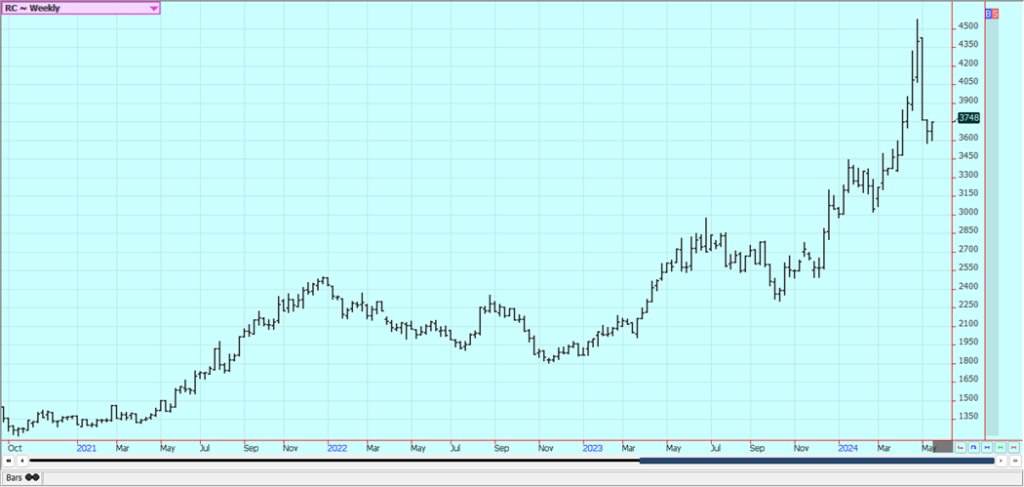

Coffee: New York and London closed higher last week on late week speculative short covering and despite reports of increased offers of Coffee, mostly Robusta from Brazil and in part from Vietnam, into world cash markets. Reports of very good rains are heard from Vietnam after a very dry period there, so production prospects are thought to be stronger.

There were indications that Brazil and Vietnam producers were now offering Coffee, Vietnamese producers are reported to have about a quarter of the crop left to sell or less and reports indicate that Brazil producers are reluctant sellers for now after selling a lot earlier in the year. Exports from Brazil have remained strong. The next Robusta harvest in Brazil is continuing and better production conditions are reported in Vietnam. Roasters and other buyers are pulling back from the market in hopes of lower prices down the road.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: Both markets closed lower last week and New York gapped lower on the weekly continuation charts and made new lows for the move. Trends remain down on the daily charts. There are still ideas that the Brazil harvest can be strong for the next few weeks if not longer and production data released a few weeks ago by CONAB indicated that the cane harvest could be less, but that Sugar production could be higher.

Harvest weather is called good in center-south Brazil. Indian production estimates are creeping higher but are still reduced from recent years. There are worries about the Thai and Indian production, but data shows better than expected production from both countries. Offers from Brazil are still active.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: Both cocoa markets were lower again last week but spent much of the week in a sideways range. Cocoa trends are mixed on the daily charts as futures held the low end of the recent trading range, but the market acts as if there is more down side price action coming. Cocoa production concerns in West Africa as well as cocoa demand from nontraditional sources along with traditional buyers keep supporting cocoa futures.

Cocoa production in West Africa could be reduced this year due to the extreme weather which included Harmat-tan conditions. The availability of Cocoa from West Africa remains very restricted and projections for another production deficit against demand for the coming year are increasing. Ideas of tight cocoa supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue. Mid crop harvest is now underway and here are hopes for additional supplies for the market from the second harvest. Demand continues to be strong, especially from traditional buyers of Cocoa.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Leonard Asuque via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Cannabis1 week ago

Cannabis1 week agoCannabis Clubs Approved in Hesse as Youth Interest in Cannabis Declines

-

Crowdfunding3 days ago

Crowdfunding3 days agoWorld4All, a Startup that Makes Tourism Accessible, Surpasses Minimum Goal in Its Crowdfunding Round

-

Fintech2 weeks ago

Fintech2 weeks agoKraken Launches Krak: A Game-Changing Peer-to-Peer Crypto Payment App

-

Crypto12 hours ago

Crypto12 hours agoThe Crypto Market Rally Signals Possible Breakout Amid Political Support and Cautious Retail Sentiment