Business

Coffee futures edge higher in New York and London markets

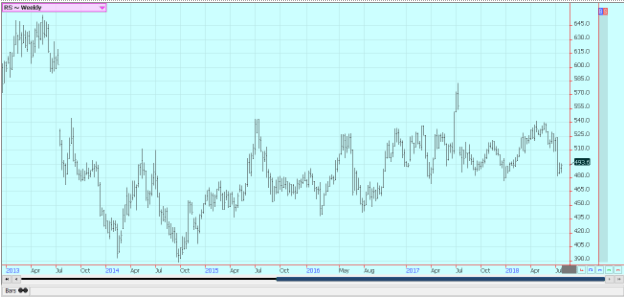

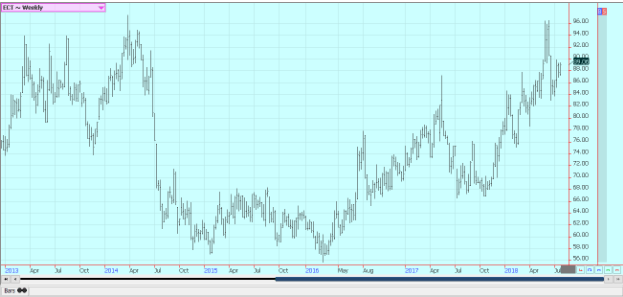

Coffee futures closed strong on daily and weekly charts in New York and held support on weekly charts in London.

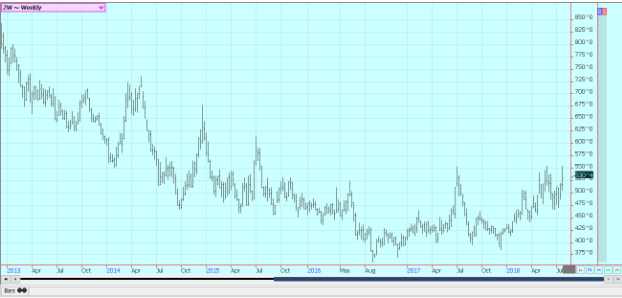

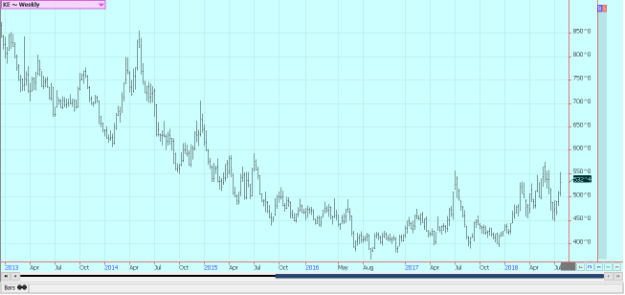

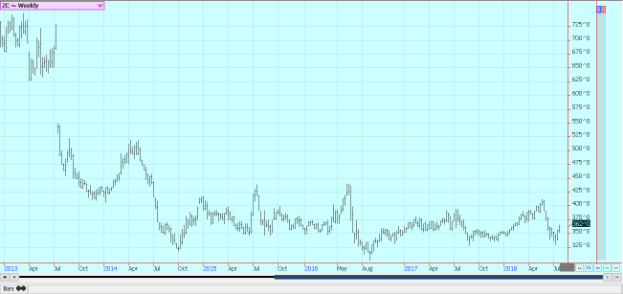

Wheat

Wheat markets were higher again last week but faded from the highs of the week and some chart resistance on the weekly charts on disappointing weekly export sales from USDA and on ideas that US wheat had gotten ahead of the competition in terms of prices. However, the overall chart patterns are strong and suggest that higher prices are coming. Weekly Chicago wheat continuation charts imply that a move to 560 or 570 basis the nearest futures is possible.

Wire stories still note the potential for losses to wheat in most of Europe. The harvest is active in southern Europe and yields are disappointing. A downgrade in production for European wheat is likely in coming months and comes on the back of earlier downgrades. East Europe and Russia remain mostly hot and dry, although spring wheat areas are now getting more favorable growing conditions. Australia is another producing country where some rains are badly needed, mostly in eastern and southeastern areas as western areas have seen enough rain.

The US winter wheat harvest will start to wind down soon. Spring wheat crops are developing well and the condition is holding strong amid periods of rains and warm temperatures. The spring wheat tour found better crops than last year, but yields were estimated at just 41 bushels per acre. The trade had expected yields of at least 45 bushels per acre based on history and crop condition ratings.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

Corn closed higher again on Friday and higher for the week. We took a quick trip to central Illinois on Saturday and checked on some corn fields in seven counties surrounding Bloomington. One field in Grundy County showed some pollination problems, and yield potential from our sample was limited to 145 bushels per acre. The rest of the samples showed very good yield potential, with most samples showing yields between 200 and 205 bushels per acre, and two samples in southern McClean and DeWitt counties showing potential between 230 and 235 bushels per acre.

Conditions, in general, looked very good, although the ground was starting to crack from a lack of rain in some fields. This snapshot suggests that a very good crop is possible in Illinois. The crops were in milk to early dent stages of development, and this is much ahead of normal. Corn is pollinating, but not always pollinating or filling well in the dry areas of the southwestern and eastern Midwest, and some northern crops are small and yellow from too much rain. Producers have said that the weather has been variable enough to think that the yields might be trimmed a bit. The trade had been talking about a national yield near 180 bushels per acre, but now some are suggesting that a national yield closer to 175 or 177 bushels per acre is more likely given the weather until now.

Demand remains at a very high level on the domestic and export sides. Crop conditions are fair to good here, and feed grains in Europe and Russia are being stressed due to the hot and dry weather there. US corn prices are as cheap as any in the world, so the US should do a lot of selling for a while. Producers show no interest in selling at current levels. Chart trends on daily and weekly charts suggest that a low has formed or is forming. Nearby futures could move to about 395 in a recovery trade.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and Soybean Meal

Soybeans and soybean meal were higher. Ideas that new demand is surfacing in the export market for US soybeans continue to be heard, and Gulf basis levels have held. Brazil basis levels have held very strong as the market continues to price in the Chinese tariffs against US soybeans. The export sales report last week was considered to be strong and showed that other buyers besides China are taking advantage of our lower prices. US soybeans are cheap when compared to Brazil. Prices for US soybeans reflect almost a 25 percent discount to those from South America due to the tariff wars.

We took a trip to central Illinois on Saturday to look primarily at corn fields to get a snapshot of yield potential. We looked at soybeans but made no measurements. In general, soybeans look great and a very big crop is possible. Growth has been good, and crops look uniform and with good color. This is not always true in eastern areas, where too much rain at planting time clearly took its toll. Dome fields featured very short soybeans that have little or no yield potential. Good weather through August should produce a very big crop in most of the fields we saw. US growing conditions have been variable, with hot and dry conditions in the east and southwest and too much rain in the north, so national yield potential could be somewhat variable.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice was trapped in a range on the weekly charts and closed a little higher for the week. The market focus has turned to the new crop and still worries about demand potential. Nearby months were firm as supplies available to the cash market are very tight. The export sales report was not large last week, but there is not much rice to sell.

Producers tell us that many parts of Texas and the southern half of Louisiana could be under active harvest by the end of this week. The crop progress is being pushed by the hot weather in many areas. That could mean less yield, but for now, the crops, in general, look good. No one will know of yield loss, if any, until the harvesters roll. The charts show a short-term sideways trend, but a new leg higher is still possible.

Weekly Chicago Rice Futures © Jack Scoville

Palm Oil and Vegetable Oils

World vegetable oils prices were higher in recovery trading last week. Futures had traded to new lows for the move the previous week on ideas of weak demand, but demand showed signs of recovery last week as private sources in Malaysia reported stable exports and as USDA showed better exports. There is plenty of supply. Indonesia said stocks were 4.85 million tons at the end of June, from 4.76 million tons the previous month. Malaysian stocks are thought to be increasing at this time on better production.

The markets still show the potential to work lower as production ideas remain generally high and as world vegetable oils demand has turned soft. Soybean oil was locked in a sideways trend all week and closed higher. Trends are sideways in the market. Canola was higher as Chicago prices firmed. Some parts of the western Prairies saw some beneficial rains last week, and most areas are reported in good condition. Some areas remain hot and dry and are getting stressed. Offers from farmers were down last week as they wait for higher prices and as they work in the fields.

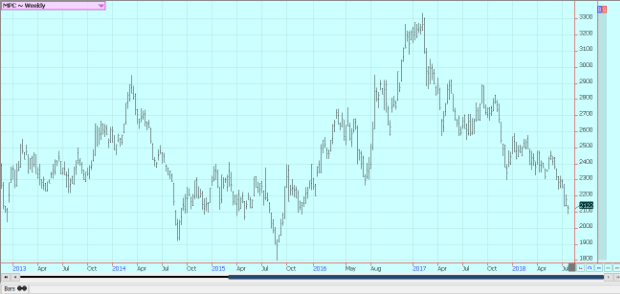

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was higher for the week and seems to be in a trading range. Bad crop conditions in parts of the US have kept the market supported, but the market worries about demand due to the China tariffs. US crop conditions are fading due to the extreme Texas weather and pockets of problems in other states. However, the market acts as if the bad weather news is part of the market. It has not really been able to extend gains from the limit up a day after the latest supply and demand reports earlier in the month.

Demand prospects are not as good as they were a couple of months ago because of the tariff war with China. Chinese tariffs against US cotton have forced buyers in China to look to India. Forward sales have increased and prices there have held firm. Crop conditions are good in the rest of the Southeast as these areas have been a little drier. Texas now is hot and dry again. The weather is improving in India and China as monsoon rains are reported in India and as China has turned drier. The monsoon has started in southern and central India and rains are now moving into northwest India and Pakistan

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ was lower last week and faded from some resistance areas on the weekly charts. It remains a weather market, but there is no storm development in the Atlantic at this time. Florida weather remains good. The only question is if FCOJ will be available in increased quantities from Brazil this year as production ideas there are down due to hot and dry growing conditions.

Florida producers are seeing good sized fruit, and work in groves maintenance is active. Irrigation is being used. Brazil could use more rain as Sao Paulo has been hot and mostly dry. The harvest there is active, but will start to wind down soon. Production is expected to be down significantly from last year.

Weekly FCOJ Futures © Jack Scoville

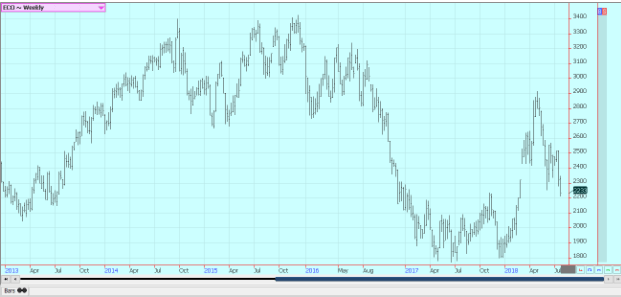

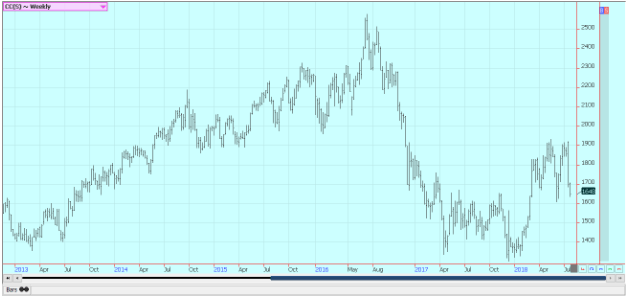

Coffee

Futures were higher in both markets again on Friday in light to moderate trading interest. It was a strong close on the daily and weekly charts for New York, so some follow-through buying should be seen this week. London closed on a weak note but held support on the weekly charts. There is not much Robusta on offer in the world markets right now even though supplies in storage in Europe are very high.

Brazil weather remains good for harvesting and as production is thought to be very big at around 60 million bags. The harvest is now entering its final stages. It has been dry in Vietnam, and there is little on offer from that origin as producers want to see how big the next crop will be and try to wait for higher prices. Better rains are reported to be improving crop conditions now.

The Vietnamese producer is mostly waiting in vain as prices internally have been moving lower for the last few weeks. It remains mostly dry in Arabica areas of Brazil, and there is no rain in the forecast for the next week. Temperatures have been moderate. Origin is still offering in Central America and is still finding weak differentials. Growing conditions are good.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were lower in both New York and London. London has become the weaker market as demand for refined sugar appears to be less. Meanwhile, raw sugar prices have held firmer, so processing and refining margins are getting squeezed. Ideas of big world production are keeping the market tone weak Traders note dry conditions in Brazil, the EU, and Russia, but also note very good conditions in Thailand and India. Brazil producers are also worried about cane production even with the rapid early harvest. Much of the early cane harvest in Brazil has been used to make ethanol.

The dry weather in much of Europe and in southern Russia near the Black Sea has hurt sugarbeets production potential in these areas. India is exporting Sugar again and has a large surplus to move. It could produce more than 35 million tons of sugar in 2018-19. Thailand has produced a record crop and is selling. Both countries are having trouble finding buyers according to wire reports.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures © Jack Scoville

Cocoa

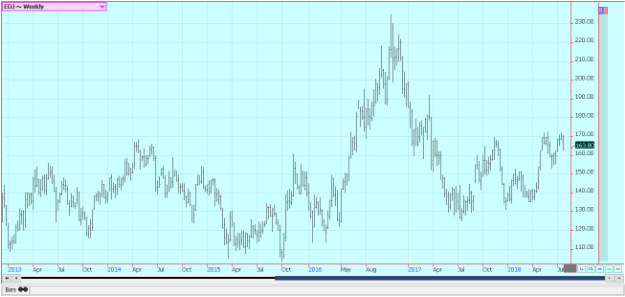

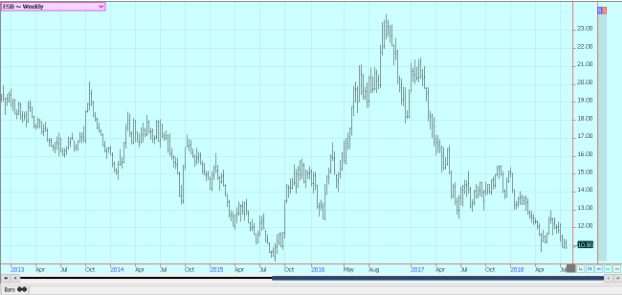

Futures were lower in both markets. Trends in both markets are down. The North American quarterly grind data showed a decline in processing, but the Asian data was very strong. The outlook for strong production in the coming year has been enough to keep the prices weak. Main crop production ideas for Ivory Coast are near 2.0 million tons.

Ideas that current weather conditions are good for the next crops in West Africa continue. There have been reports of good rains throughout the region and big yields are possible. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions in West Africa. Conditions also appear good in East Africa and Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crowdfunding1 week ago

Crowdfunding1 week agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter

-

Impact Investing4 days ago

Impact Investing4 days agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoBNP Paribas Delivers Record 2025 Results and Surpasses Sustainable Finance Targets

-

Impact Investing1 day ago

Impact Investing1 day agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

You must be logged in to post a comment Login