Featured

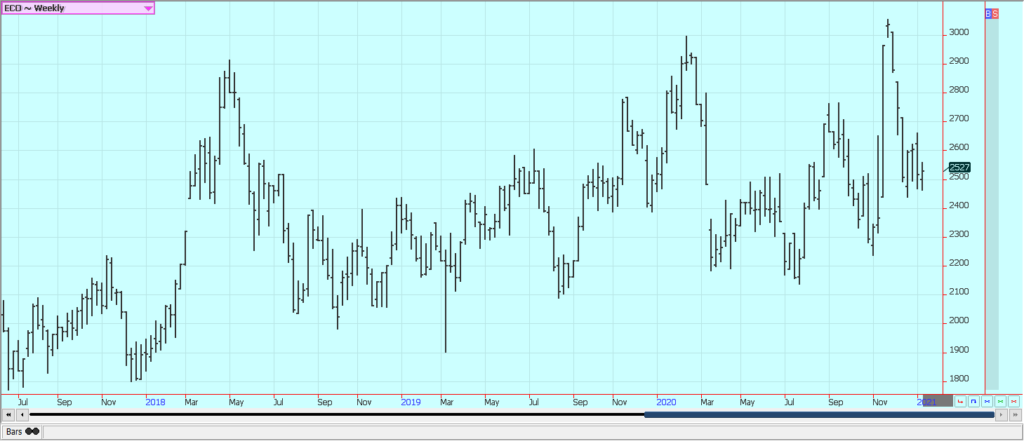

Why were coffee futures higher in both New York and London

Coffee futures were higher in New York and in London despite forecasts for good weather in Brazil and Vietnam. Speculators were the best buyers and appeared to be buying for chart based reasons. The market is looking ahead to next year and Brazil has been dry for flowering and initial fruit development. Sufficient rains are falling now to support crops. Vietnam has harvested its production under mostly dry conditions.

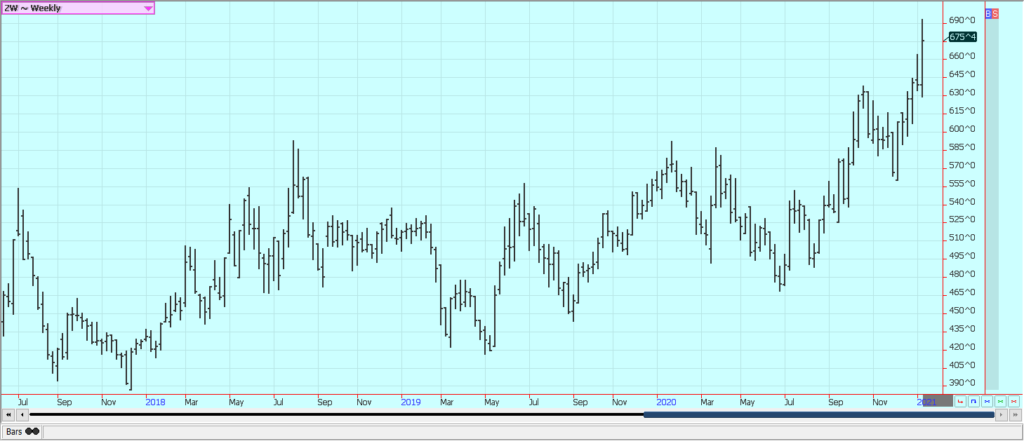

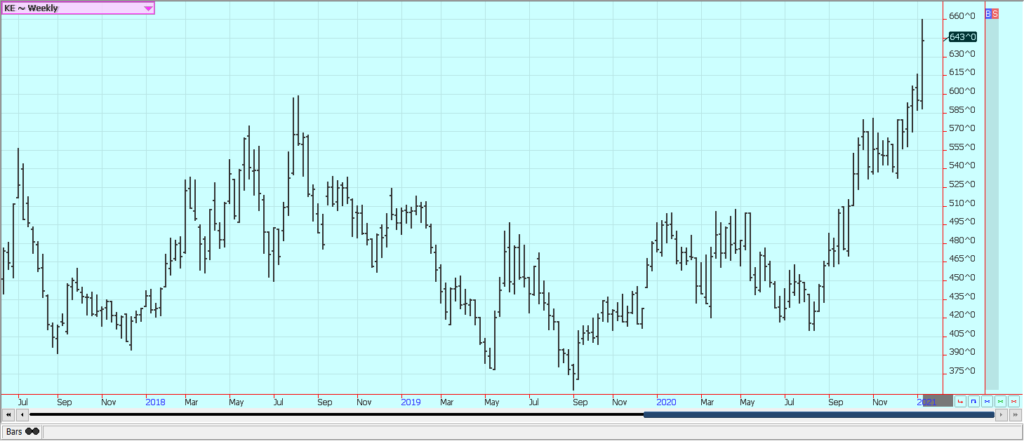

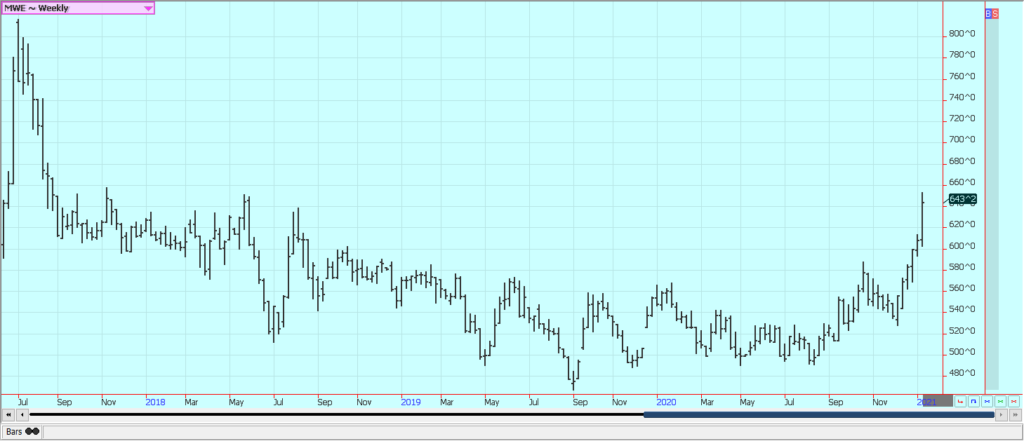

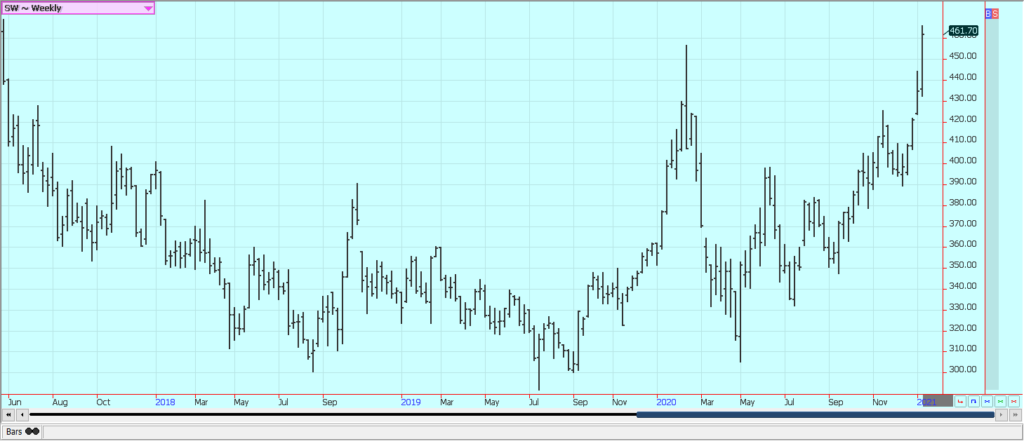

Wheat

Winter Wheat markets were higher and Chicago Winter Wheat markets made new high closes on the weekly charts despite a dramatic selloff on Friday. Minneapolis Spring Wheat markets also closed sharply higher and at new highs on the weekly charts. Russia is raising its export taxes in mid-March and the world market is reacting to the news. USDA showed more than expected feed demand in its reports on Tuesday to get the rally going. The Winter Wheat seedings report showed higher than expected planted area for SRW this year. Northern weather has improved with snow in the Great Plains except for some southern areas that remain dry. Canada is also better, and some rain and snow have fallen in southern Russia. It remains much drier than normal in Argentina.

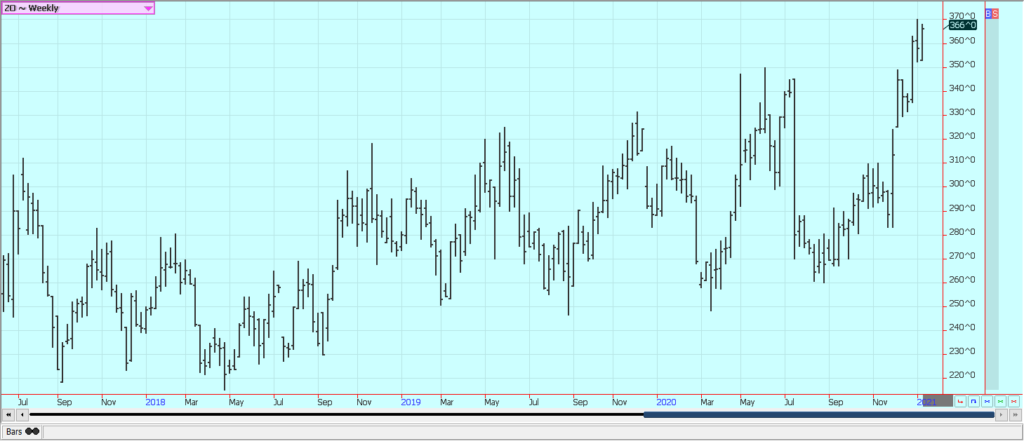

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

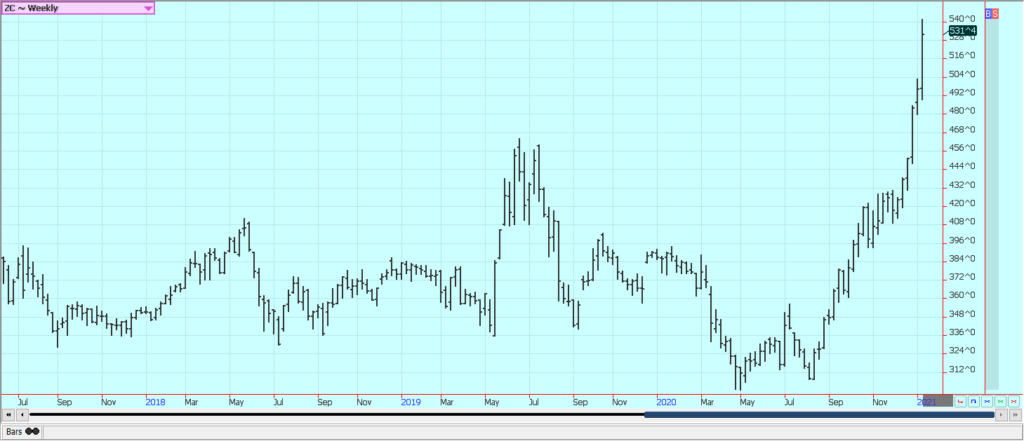

Corn

Corn was sharply higher and Oats were higher in response to a supply shock in the USDA reports released on Tuesday. USDA showed sharply lower yields and production for the crop this year and caught the market by complete surprise. It also lowered demand potential for the crop, but the result was lower ending stocks. Trends are up in both markets. Export demand has held relatively strong as US Corn is about the cheapest feed grain in the world market. It has rained in central and northern Brazil in the last week. Southern Brazil and Argentina got some very beneficial rain. It will turn dry again in Argentina this week. Drought could develop in Brazil and Argentina as the overall weather patterns have been dry and as dry weather is in the forecast for Argentina and southern Brazil. The drought is especially serious in South America for the first Corn crop but the second crop could also be affected due to late planting in central and northern Brazil. Dry weather has delayed the Soybeans planting and that will delay the second Corn planting later.

Weekly Corn Futures:

Weekly Oats Futures

Soybeans and Soybean Meal

Soybeans and Soybean Meal closed higher once again, this time in response to the USDA reports. USDA showed higher demand and low ending stocks levels, as expected. The reports were called bullish anyway as there is little sign the US price has rationed demand. Export demand reports from USDA were very strong last week. Production potential is being threatened in South America due to the lack of rainfall. The situation is improved in central and northern Brazil but remains dire in southern Brazil and Argentina. Southern Brazil and Argentina got some very beneficial rain last week but now it is turning dry again. The world will need very strong production from South America to meet the projected demand. The stocks to use ration for Soybeans is now very small and the situation is the tightest projected in years.

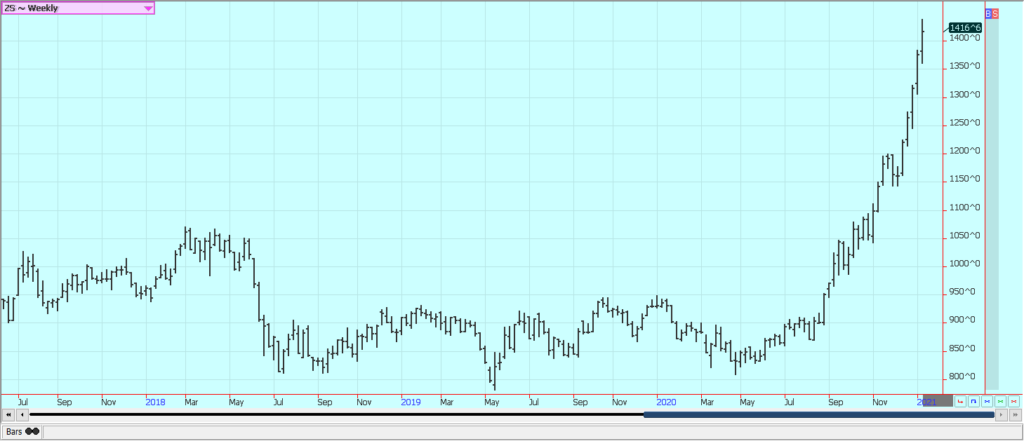

Weekly Chicago Soybeans Futures:

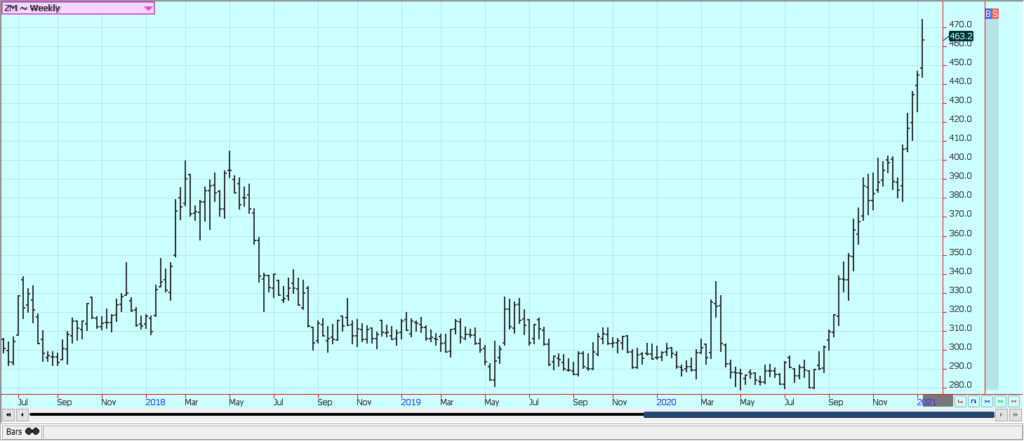

Weekly Chicago Soybean Meal Futures

Rice

Rice was higher last week and made a new weekly high close. The move caught traders by surprise. USDA showed a sharp increase in domestic demand in its reports on Tuesday and cut ending stocks levels. The cash market has not felt any increased demand lately and mill operations are reported to be on the slow side. Exports have been less in the last week and USDA showed this in the weekly export sales report. Exports had been strong until recently. Some traders are looking ahead to next year and are wondering how much Rice will get planted. Our ideas are that a normal crop will get planted as Rice prices compare favorable with Corn, Cotton, and Soybeans.

Weekly Chicago Rice Futures

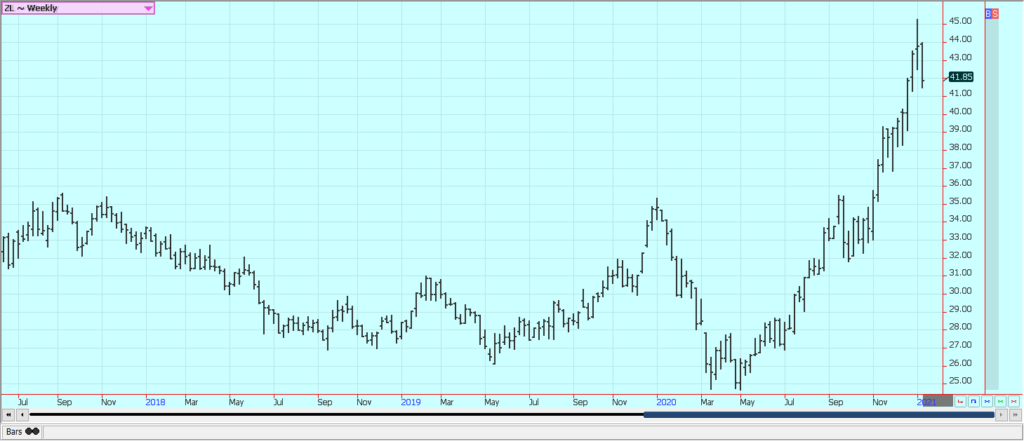

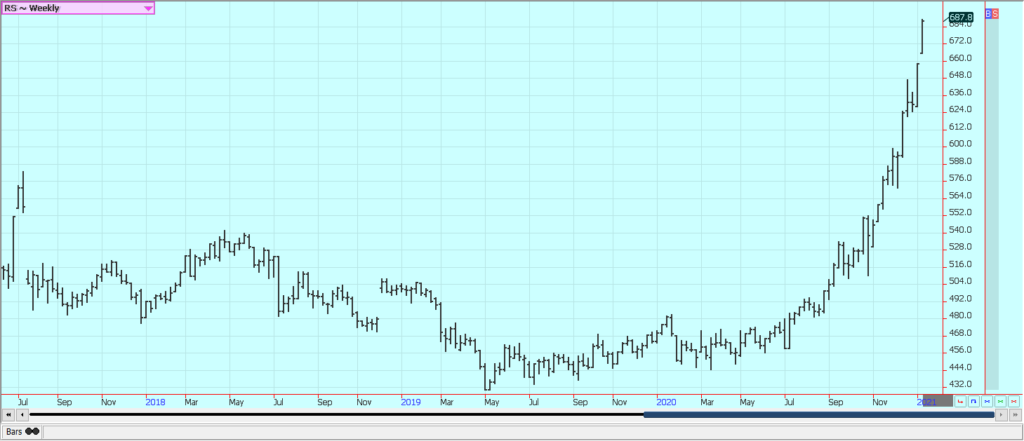

Palm Oil and Vegetable Oils

Palm Oil closed sharply lower as export volumes have been much less so far in January. Exports have been running at 44% less than last month so far, and the trend is expected to continue for the balance of the month. The market had been supported by ideas of tight supplies. The production of Palm Oil is down in both Malaysia and Indonesia as plantations in both countries are having trouble getting workers into the fields. Soybean Oil was lower along with Palm Oil, but Canola was higher on strong demand ideas and little on offer from farmers.

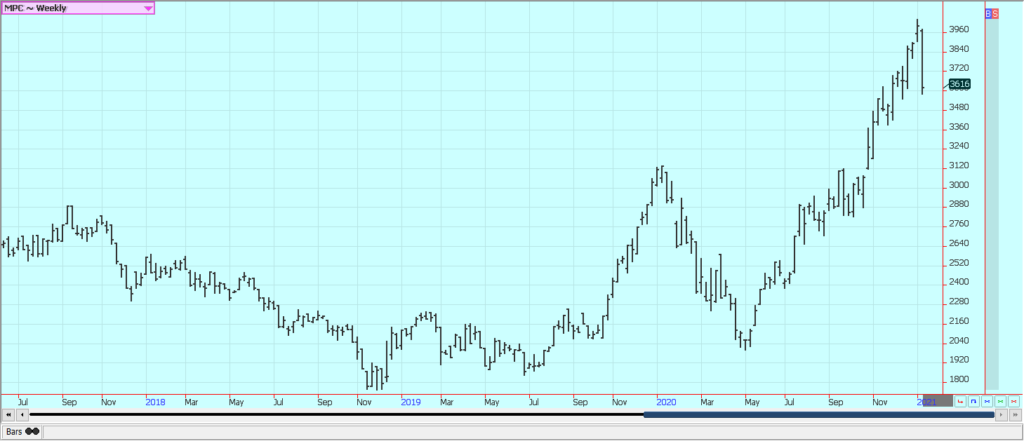

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton

Futures were higher in reaction to the USDA reports. Futures made a new high close on the weekly charts. USDA cut production and ending stocks levels again last week. The report was considered bullish by the trade and prices rallied. The weekly export sales report on Thursday showed strong demand for US Cotton once again, and the demand has been strong even with the Coronavirus around and getting worse. The overall weaker US Dollar has helped demand ideas as well. Lower production will mean tight supplies down the road and the futures market is trying to ration demand through price.

Weekly US Cotton Futures

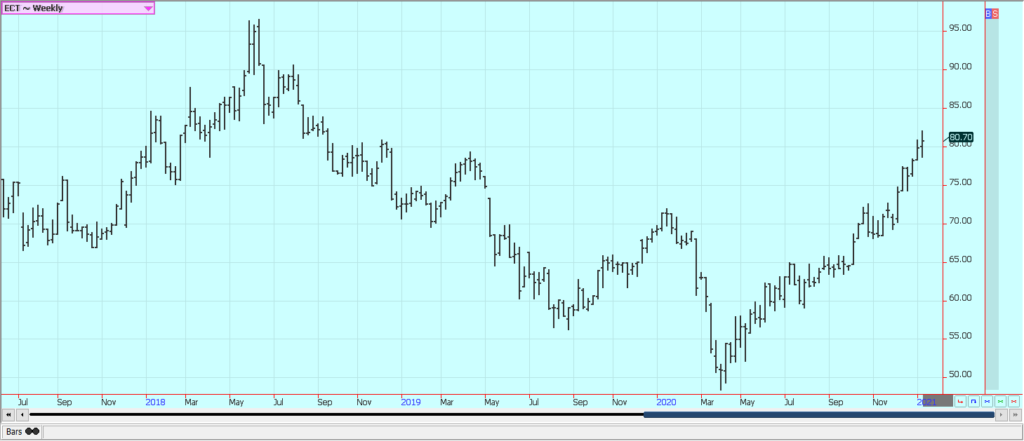

Frozen Concentrated Orange Juice and Citrus

FCOJ closed a little lower last week in choppy trading. The weather in Florida remains good for the crops although it has been cold recently. The Coronavirus is still promoting consumption of FCOJ at home. Restaurant and food service demand has been much less as no one is dining out. The weather in Florida is good with frequent showers to promote good tree health and fruit formation. Brazil has been too dry and irrigation is being used. Showers are falling in Brazil now and these need to continue to ensure good tree health. However, it could turn warm and dry again next week. Mexican crop conditions are called good with rains. USDA lowered its Florida Oranges production estimate on Tuesday, but the report was largely factored into the current price and did not affect prices that much at all.

Weekly FCOJ Futures

Coffee

Futures were higher in New York and in London despite forecasts for good weather in Brazil and Vietnam. Speculators were the best buyers and appeared to be buying for chart based reasons. The market is looking ahead to next year and Brazil has been dry for flowering and initial fruit development. Sufficient rains are falling now to support crops. Vietnam has harvested its production under mostly dry conditions. Some of those crops are starting to hit the market. Central America is also drier for harvesting. The demand from coffee shops and other food service operations is still at very low levels as consumers are still drinking Coffee at home. Reports indicate that consumers at home are consuming blends with more Robusta and less Arabica. The weather is good in Colombia and Peru.

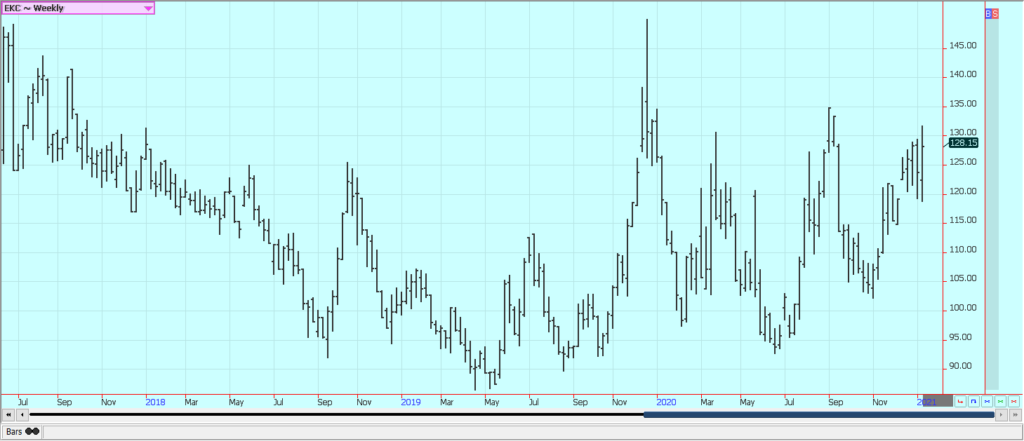

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

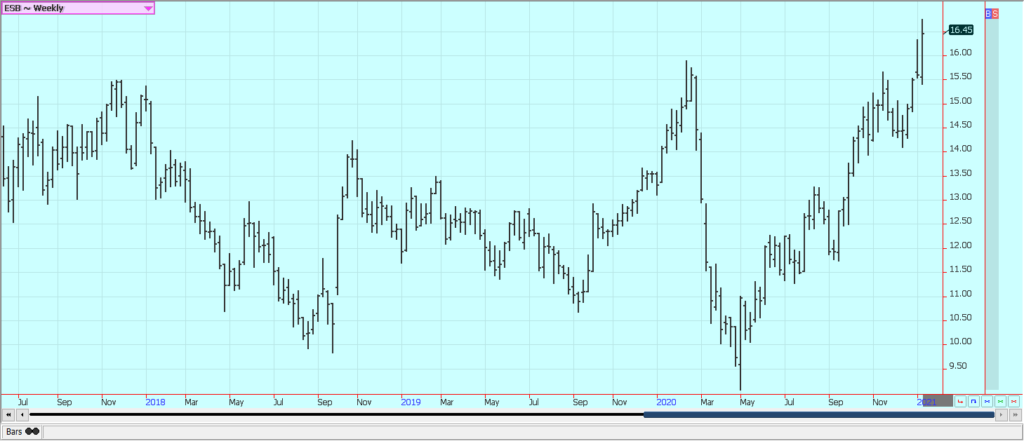

Sugar

New York and London closed sharply higher and both markets have now broken out to the upside. UNICA released new cane crushing data this week and the crushing rates were sharply lower. It has been raining in south central Brazil and the production of cane is winding down for the season. The rains have come late to the region. Production has been hurt due to dry weather earlier in the year. India has a very big crop of Sugarcane this year but no exports are coming out. Thailand might have less this year due to reduced planted area and erratic rains during the monsoon season. The EU is having problems with its Sugarbeets crop due to weather and disease. Coronavirus has returned to the world and has caused some demand concerns, especially for Ethanol.

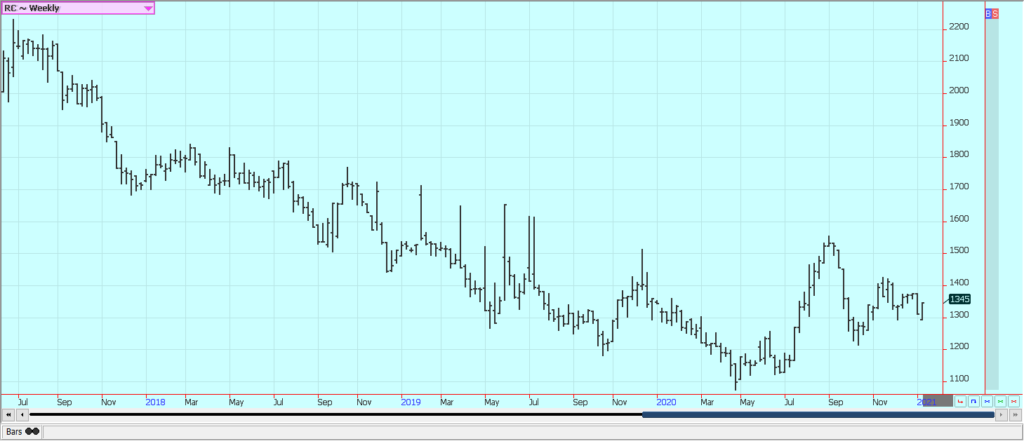

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

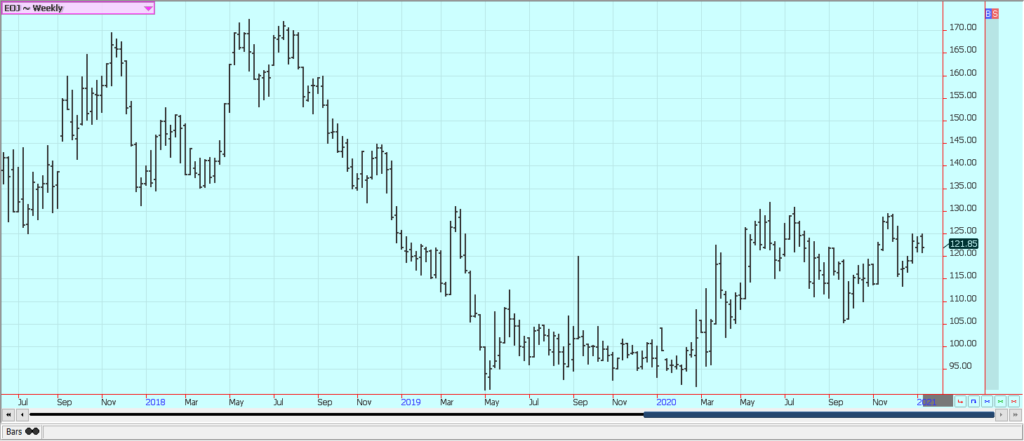

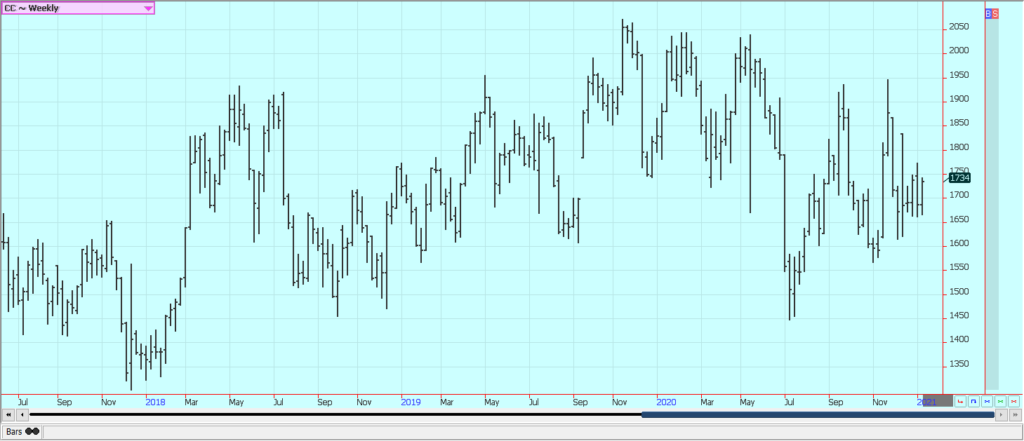

Cocoa

New York and London closed lower last week. Importers are still looking for ways to source Cocoa without paying a premium demanded by Ivory Coast and Ghana. Both countries have instituted a living wage for producers there and are looking to tax exports to pay the increased wages. Buyers have been accused of using certified stocks from the exchange instead of buying from origin. Origin has ample supplies to sell right now. There are a lot of demand worries as the Coronavirus is making a comeback in the US. Europe is also seeing a return of the pandemic. The next grind data is due out over the next couple of weeks. Ivory Coast has not been shipping as exporters have asked to hold off. There is about 100,000 tons ready to ship with no buyers at this time.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Burst via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Cannabis7 days ago

Cannabis7 days agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Crypto2 weeks ago

Crypto2 weeks agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments

-

Cannabis2 days ago

Cannabis2 days agoBrewDog Sale Leaves Thousands of Crowdfunding Investors Empty-Handed

-

Markets1 week ago

Markets1 week agoRice Market Slips as Global Price Pressure and Production Concerns Grow