Business

Corn and soybean prices closed higher while oats and wheat remain low

The grain markets in the U.S. continue to be volatile with wheat prices down while others like corn improve.

Corn and soybean closed higher on seasonal considerations while oats edged lower.

Wheat

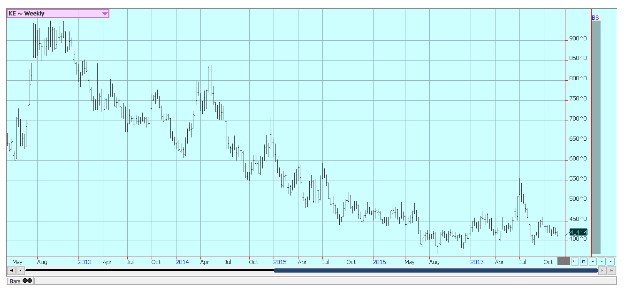

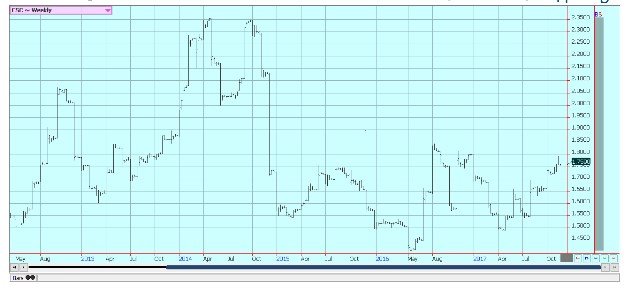

US markets closed lower again in Chicago last week. The weekly charts show that winter wheat prices are trying to set a base for a move in either direction. Minneapolis continues to hold an important support area, but do not seem able to move higher to any great degree. The market is noting dry conditions in western Kansas and other parts of the western Great Plains and the La Nina winter weather forecast. A fire danger was proclaimed in western Texas last week due to high winds and very warm and dry conditions. Other parts of the Great Plains are very dry as well.

The long-range forecast calls for warmer and drier than normal conditions to continue in the South and Southwest, and it is possible that Winter Wheat will suffer under more stressful conditions. Crop condition ratings for winter wheat in the region have started to move lower, and the ratings should continue to drop unless the weather starts to improve. The market continues to be worried about Russia and its ability to control the world wheat offer and price. Russia is still exporting a lot of wheat and has said that it expects another very big crop as the weather going into dormancy in winter wheat areas has been very good.

World estimates, in general, remain large and US offers will need to be low to take business. It will be another small US crop as farmers continue to reduce planted area year after year in response to the low world and US prices, due mostly to strong competition mostly from Russia. Prices might not improve much for the coming year as Russian production that could be big enough to offset lost production in places like the US and Canada and also Argentina and Australia.

Weekly Chicago Soft Red Winter Wheat Futures ©Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures ©Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures ©Jack Scoville

Corn

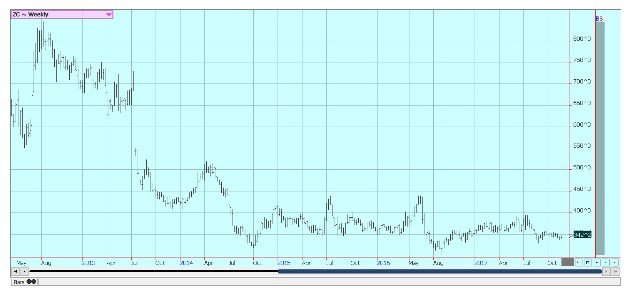

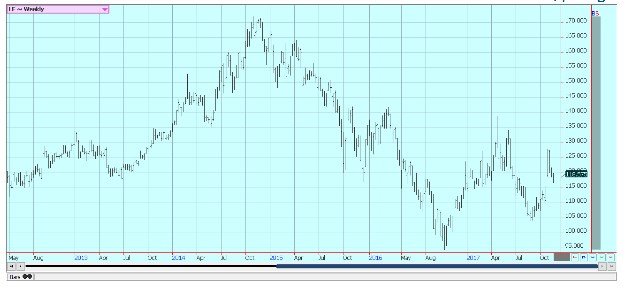

Corn closed slightly higher last week and oats closed lower. Some speculative buying was seen in corn, mostly for seasonal considerations, but also because funds and other large speculators hold the record or near record short positions in this market. Speculators have been very short and corn prices usually rally around Thanksgiving time. The trade is also looking at the potential for dry weather to develop in southern Brazil and Argentina.

Oats closed lower and prices are now through swing targets and support areas on the weekly charts. Trends have turned down and a move to 235-basis the nearest futures contract is possible. More and more traders expect a short covering rally in corn in the short term due to the big speculative short position. Ideas of big supplies and less than great demand keep pulling the market down fundamentally, but it has been the funds who have established a huge and near record short position in futures.

Farmers are not selling much corn even in the last part of the harvest due to weak basis and futures price levels. Basis levels have improved, but farmer offers remain down, although farmers have been actively delivering on contracts. Corn planting is reported to be active in Argentina and southern Brazil amid improved conditions as the rains have stopped for now and are not expected to return in the short term. Not much selling is reported in South America. La Nina has started and could create dry weather in South America that could really hurt yields. It is common for Argentina and southern Brazil to have drought in La Nina years, so the weather in these areas will be watched carefully.

Weekly Corn Futures ©Jack Scoville

Weekly Oats Futures ©Jack Scoville

Soybeans and Soybean Meal

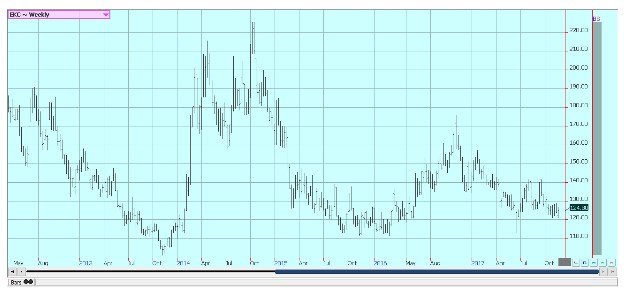

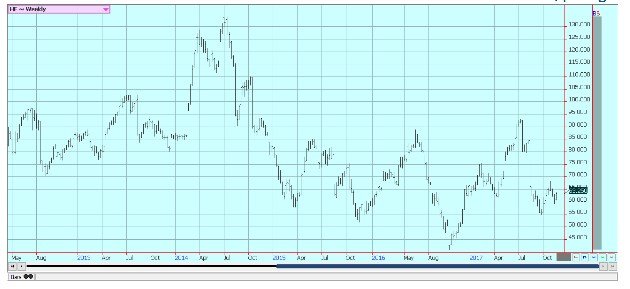

Soybeans and products were a little higher on Friday and higher for the week on seasonal considerations. Soybeans and products normally rally around Thanksgiving, and this year was not an exception to the rule. The fundamental reason for soybeans to work lower was fears of reduced Chinese demand and ideas of improved planting conditions in Brazil and the big production last year in South America that has had Brazil offering for the entire year. Brazil has been able to capture more business that otherwise would have gone to the US due to the huge crop last year.

China might be forced to reduce demand as the government is making it harder to get safety permits. Some GMO Soybeans have made it into the human food chain, and this news has caused the government to slow the process until it can identify the problems. It is wetter in the north of Brazil and drier to the south and into Argentina and planting speed has been increased. The crop is on an average planting pace now after a slow start.

Planting progress in Argentina is a little behind the averages, but at about the same pace as last year. Some beneficial rains have been reported in Mato Grosso and Mato Grosso do Sul, and reports indicate that fieldwork is active. It remains too wet to the south, but it has been drier in Argentina. The US harvest is now about over in all areas of the US. The yield data generally runs behind year-ago levels, but are still very strong overall. Basis levels continue to improve in the interior as the harvest comes to a close. Soybeans are still holding an uptrend that started in mid-August ut has found significant selling on rallies above $10.00 per bushel.

Weekly Chicago Soybeans Futures ©Jack Scoville

Weekly Chicago Soybean Meal Futures ©Jack Scoville

Rice

Rice closed higher for the week on follow-through buying. It was another strong week of export sales, with over 100,000 tons sold into the world market. However, the big sales reflect the Iraq purchase of 90,000 tons of long grain milled rice and that means a lot of the demand was already known and was part of the price. Reports of the sale caused the major rally to get underway a couple of weeks ago. The news caught speculators short in the futures market and some commercials perhaps a little short in the cash market.

Futures had been very undervalued in relation to the US domestic cash market, so the move higher has been fast. Futures and cash markets are now much more in line with each other, so upside potential might be limited in the short term. The volumes traded are on the light side and reflect the slow domestic cash market. Rice is reported to be mostly sold already in Texas and Louisiana and has been getting sold in other states. Farmers now are more interested in hunting or holiday activities and so buying paddy rice will be difficult.

The Delta harvest is over and farmers are holding out for higher prices. The second harvest in Texas and Louisiana is coming to a close with more variable yields and quality. Reports from the country indicate good to very good yields and quality for the main harvest. The charts show that futures are now close to some big resistance areas, so some pressure to move lower this week is possible.

Weekly Chicago Rice Futures ©Jack Scoville

Palm Oil and Vegetable Oils

World vegetable oils prices were lower for the most part last week. Trends are down in Palm Oil and are turning down in soybean oil. Canola charts show mixed trends. The big news to hurt prices came from India, where the government has moved to double import taxes on vegetable oils. India is the largest importer of vegetable oils in the world and buys a lot of palm oil and soybean oil. Private sources reported weaker exports from Malaysia once again last week.

Palm oil futures fell through an uptrend line that has held since the middle of July and also has taken out a sideways trend line, so trends are now down. Canola has held better than palm or soybean oil. It has turned cold in the Prairies and the harvest is about over, so farmers are not as willing to sell. Farmers in the US are not selling a lot of soybeans, either, and prices are starting to turn higher for seasonal considerations as the soy complex often rallies during the Thanksgiving week.

The US demand for soybean oil in biofuels should remain strong as the US moved to put punitive tariffs on imports from Indonesia and Argentina. Both countries are fighting these moves, and the process is moving to the courts. A final decision from the courts and then a real solution to the issue will likely take some time to be found.

Weekly Malaysian Palm Oil Futures ©Jack Scoville

Weekly Chicago Soybean Oil Futures ©Jack Scoville

Weekly Canola Futures ©Jack Scoville

Cotton

Cotton was higher again last week in response to another week of strong export sales and on ideas that overall demand has been underestimated. The market started to rally as the December contract prepared to go into the delivery period. Many mills had still not priced on call cash market positions and were forced to pay higher to get the pricing process done. The chart patterns suggest that futures could move higher over time as trends have turned up again.

The futures market is watching the harvest roll along and is debating the demand for the US and world cotton. The cotton quality has been dropping as the harvest moves forward, and the lower quality seems to be the biggest effects from the hurricanes seen during the growing season and then the freeze in the west at the tail end of the growing season.

Some traders say that USDA is seriously underestimating demand for the fiber, while the others look to the high USDA ending stocks estimates and suggest that any demand can be easily met. Futures had a muted reaction to the USDA reports and held to the range seen for the last few weeks. Farmers are reported to be quiet sellers right now. Harvest conditions are good in just about all areas as it starts to move into its final stages.

Weekly US Cotton Futures ©Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ closed with small losses last week in consolidation trading. The small crop in Florida continues to impact the market as prices overall remain strong and charts show the chance for prices to move higher. Production was lower again at 50 million boxes in the recent USDA reports and the market had held strong ever since. The report once again highlighted the damage from the hurricane this year, and ideas are that production in coming reports will drop even more.

Brazil weather has improved as groves are now getting rains, but suffered from drought at the flowering time. It was also very hot and it is possible that production from Sao Paulo state will be less. The weekly charts indicate that higher prices are coming over time. Trees in Florida that are still alive now are showing fruits of good sizes, although many have lost a lot of the fruit. Florida producers are actively harvesting what is left as cleanup from the hurricane is about over now. The emphasis is on the fresh fruit market now, with processors mostly getting packinghouse eliminations at this time.

Weekly FCOJ Futures ©Jack Scoville

Coffee

Futures were higher in New York and lower in London last week, with commercials scale down buyers and speculators turning to the buy side in New York after the lows for the first part of November held. The market closed back in the middle of the range on Friday, and the tone is somewhat positive. The trends are sideways on the charts in New York as traders look at the potential for a big crop in Brazil. The daily and weekly charts still imply that New York is about to complete a bottom and that prices could move higher for the next few weeks.

London trends are mostly down on fears of big production about to come into the market from Vietnam. The Brazil weather and tree condition is the main fundamental reason for movement in New York prices and could become the major reason to buy the market soon.

Rains have been reported to coffee areas in Minas Gerais again, and many areas are reporting good conditions now after the earlier stress caused by the cold and dry winter. The rains will need to continue and be in good amounts as it has been very dry and trees have been stressed for a year or more in some cases. Some were stressed after the production last year, while others suffered due to the dry and cold winter. Even so, improved weather now could mean a very good crop, although most likely not a huge crop of over 50 million bags.

Cash market conditions in Central America are more active as the harvest continues. Differentials have been stable but weak in the region. Colombian exports have held well as production appears to be good. Differentials have been stable and relatively strong.

Weekly New York Arabica Coffee Futures ©Jack Scoville

Weekly London Robusta Coffee Futures ©Jack Scoville

Sugar

Futures were higher and short-term trends in New York remain up. New York closed at the top end of the range. London chart patterns are also up. The market is rallying as mills in Brazil have decided to make more ethanol as world crude oil and products prices have turned very strong. Brazil is importing US ethanol to make up for short production, so the move by sugar mills in Brazil to supply the local ethanol market instead of the world sugar market makes economic sense.

The move comes even as the ISO now estimates the world sugar production surplus at 5 million tons for the year. There does not seem to be any big demand coming from any real direction, especially as China has cut back on imports and the year to year loss in demand is a very big amount. Upside price potential is limited as there are still projections for a surplus in the world production, and these projections for the surplus seem to be bigger. But, futures are going higher for now and have completed a big low on the daily and weekly charts.

Weekly New York World Raw Sugar Futures ©Jack Scoville

Weekly London White Sugar Futures ©Jack Scoville

Cocoa

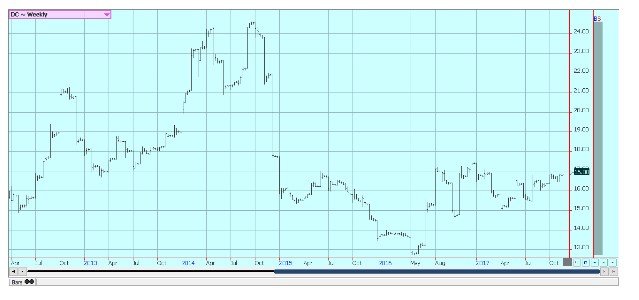

Futures closed a little lower for the week in consolidation trading. Prices remain strong overall and have held an important support area on the weekly charts in response to positive demand news from as the North American and the European grind data released last month, but the uptrend faltered again last week. The data showed increased demand. World production ideas remain high. Harvest reports show good to very good production will be seen this year in West Africa. Ghana and Ivory Coast expects a very good crop this year. However, there have been some reports in Ivory Coast that diseases are hitting the crops and could reduce output in the end. Farmers have invested less in chemicals to protect and nourish crops due to low prices. Nigeria and Cameroon are reporting good yields on the initial harvest, and also good quality. The growing conditions in other parts of the world are generally good. East Africa is getting better rains now. Good conditions are still seen in Southeast Asia.

Weekly New York Cocoa Futures ©Jack Scoville

Weekly London Cocoa Futures ©Jack Scoville

Dairy and Meat

Dairy markets were little changed. USDA reports ample supplies, but good to very good demand in just about all parts of the US. Milk and cheese demand has been mixed, but butter demand has weakened and prices in this market have moved sharply lower. Demand is good for cream, but cream has generally been available to meet the demand.

Cream demand for butter has been very good. Demand for ice cream has been mixed depending on the region but is holding well due to mild weather in much of the US until late last week. Cheese demand still appears to be weaker and inventories appear high. US production has been generally strong.

US cattle prices were stable and beef prices were higher, and futures prices were little changed for the week. Beef prices are mixed, and cattle traded about unchanged last week after ideas that prices could continue weaker. Ideas are that packers are still enjoying very strong margins at this time and can afford to pay more for cattle. This did not happen last week.

Cattle prices were steady to slightly weaker amid lighter than expected volume. It is the threat of increased supplies down the road that keeps the packers from buying aggressively. Feedlots are full, but ideas are that the big offer of cattle has passed. China is reducing taxes on US beef imports and increased demand is expected.

Pork markets and lean hogs futures were higher. Ideas are that futures are reflecting the weaker supply and demand fundamentals now, but the overall market seems to be holding. Demand has been improved for the last couple of weeks and this has affected pricing. There are still ideas of bug supplies out there, but the market seems to have the supply side priced.

The weekly charts show that the market is trying to form a low at current prices, and futures have been cheap enough that a low is possible at this time. The weekly charts suggest that futures are developing a new trading range between about 6000 and 6800 basis nearest futures. China has reduced taxes on US port imports and increased demand is expected.

Weekly Chicago Class 3 Milk Futures ©Jack Scoville

Weekly Chicago Cheese Futures ©Jack Scoville

Weekly Chicago Butter Futures ©Jack Scoville

Weekly Chicago Live Cattle Futures ©Jack Scoville

Weekly Feeder Cattle Futures ©Jack Scoville

Weekly Chicago Lean Hog Futures ©Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto6 days ago

Crypto6 days agoCaution Prevails as Bitcoin Nears All-Time High

-

Africa2 weeks ago

Africa2 weeks agoMorocco’s Wheat Dependency Persists Despite Improved Harvest

-

Africa1 day ago

Africa1 day agoBridging Africa’s Climate Finance Gap: A Roadmap for Green Transformation

-

Biotech1 week ago

Biotech1 week agoEcnoglutide Shows Promise as Next-Generation Obesity Treatment

You must be logged in to post a comment Login