Featured

Cotton Chart Trends Are Sideways

Cotton was a little lower last week and held to the recent trading range. The market acts firm and might work higher over time. The USDA supply and demand reports showed smaller ending stocks. Cotton retains bullish fundamentals after the reports. The weekly export sales report was just OK last week and featured light buying from many Asian countries.

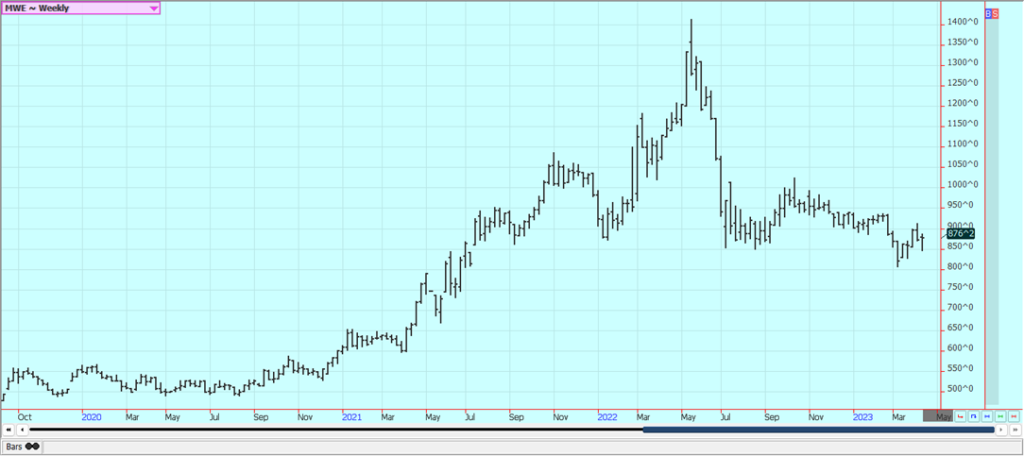

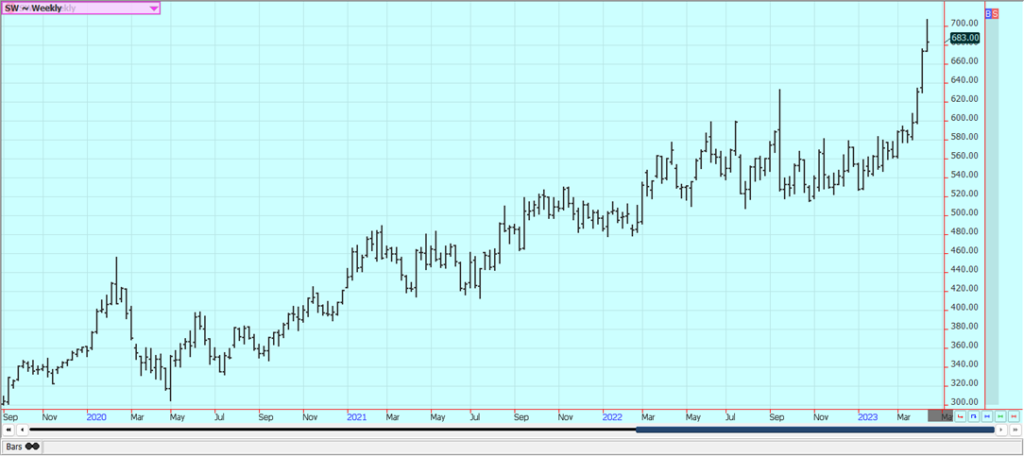

Wheat: Wheat markets were higher on Friday and for the week on what appeared to be massive fund short covering tied to uncertainty about the Black Sea Corridor deal being continued. The USDA reports were bearish for prices. There remains selling tied to uncertainty about exports from the Black Sea and bad growing conditions in the western Great Plains, where it remains very hot and dry with little or no relief in sight. Turkey and Russia are talking together about their own plan for exports from the Black Sea and are not including the UN in the talks. Russia has said that the current system cannot last. Ideas that big Russian offers and cheaper Russian prices would be a feature for a while in the world market were the driving force for the weaker prices. Ideas are that both Australia and Russia are harvesting record to near-record Wheat crops this year. The demand for US Wheat in international markets has been a disappointment all year and has been hindered by low prices and aggressive offers from Russia.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

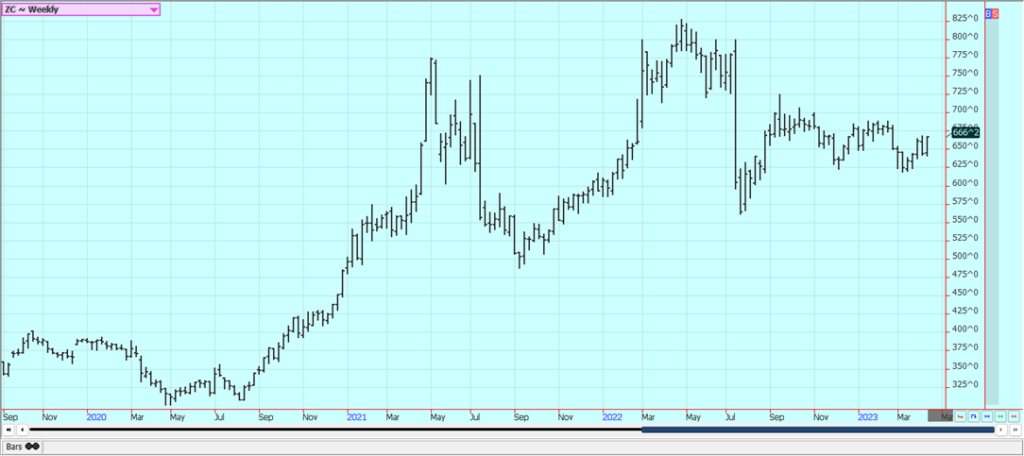

Corn: Corn closed higher and Oats closed lower last week, with Corn finding support from strong Chinese demand combined with little US producer selling interest. China bought almost 800,000 tons of US Corn last week. The weather is dry and warm in the Midwest and producers are concentrating on fieldwork and are not selling Corn, but the market wants Corn now. WASDE estimates released on Tuesday showed unchanged ending stock levels for Corn, but the market had anticipated a reduction in ending stocks to account for the less-than-expected quarterly stocks estimates released a couple of weeks ago. Instead, USDA cut imports and food demand by 10 million bushels each to leave the stocks unchanged. US prices are currently very competitive with those from South America as Brazil concentrates on Soybeans exports and not Corn and US demand has improved because of the price differentials and the lack of a Brazil offer into the market. This trend should continue for the next few months if not longer. Prices from South America should now remain strong as countries there concentrate on Soybeans exports and not Corn. NOAA is forecasting that La Nina will develop this Summer and replace El Nino. US growing conditions are usually good when this happens.

Weekly Corn Futures

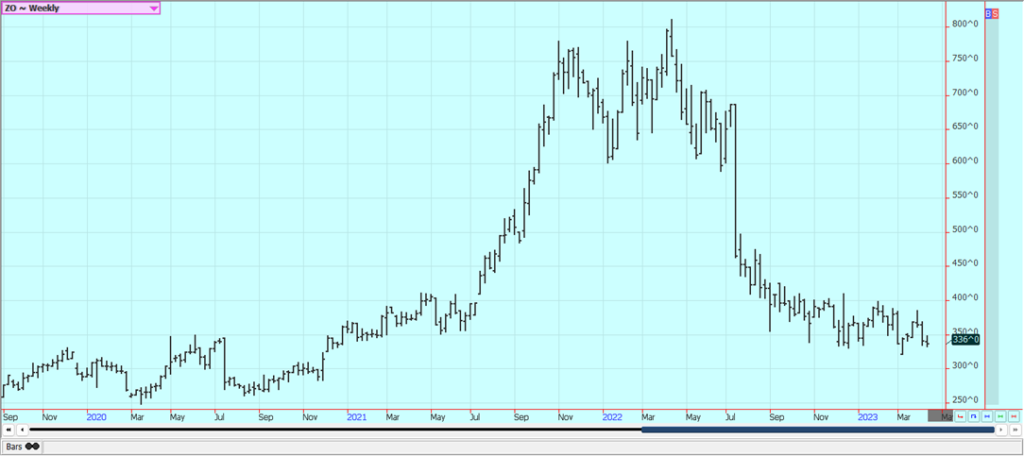

Weekly Oats Futures

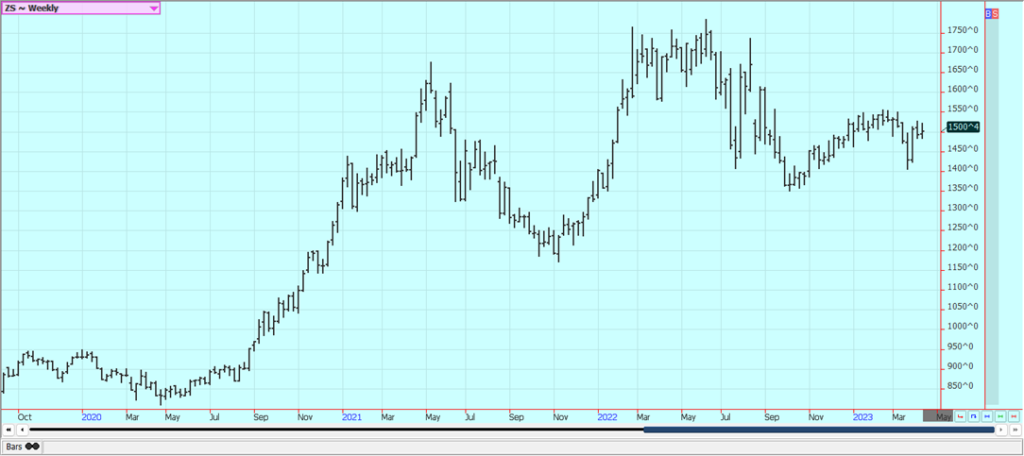

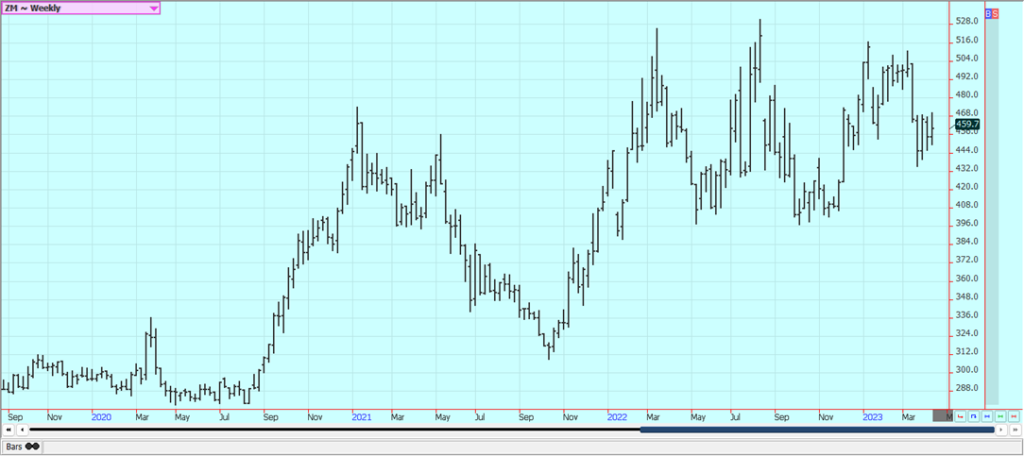

Soybeans and Soybean Meal: Soybeans and the products were lower Friday and mixed for the week, with demand ideas for US Soybeans supporting nearby months but good Midwest weather hurting new crop months. Ideas for the WASDE reports from USDA were for lower ending stocks, but USDA on Tuesday left ending stocks unchanged and made no changes to supply or demand. CONAB in Brazil raised production ideas to 164.7 million tons and USDA raised Brazil production estimates to 154 million tons. Reports from Brazil show that basis levels there are under pressure due to the large crop being harvested now. The basis might get higher later in the marketing period as total South American production is probably about the same as last year. Brazil has a very good crop, but the additional Soybeans grown in Brazil will be wiped out by the losses in Argentina. Argentina has been forced to import from Brazil to keeps its crushing facilities operating. Soybeans export demand is flowing to Brazil now. It remains hot but rains are reported in Argentina and crop conditions are getting stable. Even so, production ideas are no higher than 25 million tons, about half a crop. Forecasts from NOAA for very good growing conditions in the Midwest were also a factor, but there is too much rain in most growing areas right now.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher last week in reversal-type trading after a couple of days of buying tied to the USDA WASDE estimates released Tuesday. Trends are mostly up on the May daily charts and are turning up on the weekly charts again. Futures have been in a massive move lower for the past week, but that changed once USDA released its new supply and demand estimates that called for fewer imports and bigger domestic and export demand for all Rice and especially Long Grain. Medium and short grain estimates were unchanged but ending stocks for long grain dropped by 6.0 million cwt as did the ending stocks estimates for all Rice. The moves shocked the market and futures went from slight gains to big gains. Demand has been good from domestic sources and offers seem hard to find right now. Export demand has been uneven and was low last week. Export demand has been an issue for the market all year. Mills are milling for the domestic market in Arkansas and are bidding for some Rice. Markets from Texas to Mississippi are called quiet. Demand in general has been slow to moderate for Rice for exports. Planting remains active in Texas and southern Louisiana with field conditions called very good in Louisiana and too dry in parts of Texas.

Weekly Chicago Rice Futures

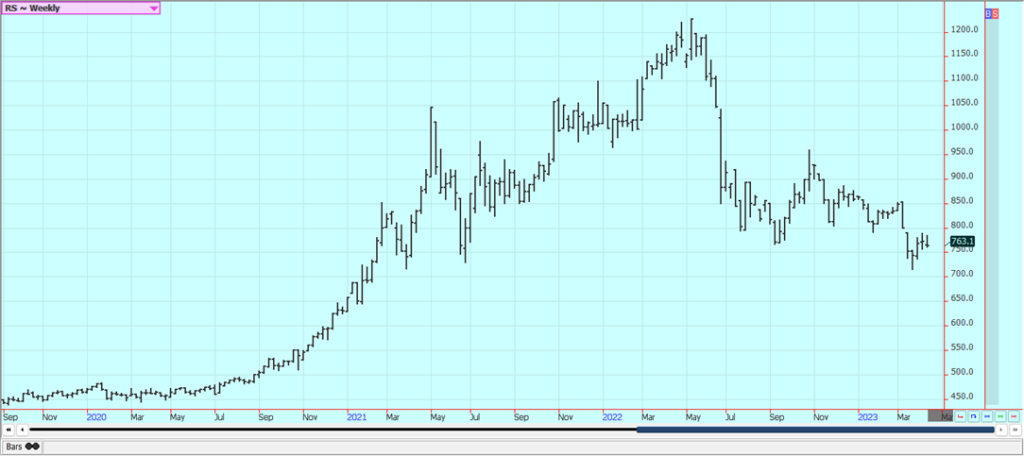

Palm Oil and Vegetable Oils: Palm Oil closed lower last week on the price action in Chicago Soybean Oil and strength in the Ringgit. Trends are down on the daily charts despite news that OPEC was cutting oil production again. Trends are sideways on the weekly charts. There are ideas are that prices can remain elevated due to bad weather in Malaysia but demand remains weaker than hoped for from India and China. Indonesia has not been offering as it tries to build stocks for its own biofuels industry but it is expected to start offering very soon. Canola was lower Friday on price action in Chicago and as planting and fieldwork delays are passing in favor of warmer and drier weather that is allowing producers to get into the fields. Futures were lower for the week after a very choppy week of trading. Trends are sideways on the daily and weekly charts. Forecasts are for warmer weather to show up in the Prairies this week could start to allow for fieldwork to start. Brazil is expected to dominate the oilseeds market for the next few months. Reports indicate that domestic demand has been strong due to favorable crush margins.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was a little lower last week and held to the recent trading range. The market acts firm and might work higher over time. The USDA supply and demand reports showed smaller ending stocks. Cotton retains bullish fundamentals after the reports. The weekly export sales report was just OK last week and featured light buying from many Asian countries. The prospective plantings report highlighted reduced planting ideas from producers. Ideas are that the world economic problems were fading into the background as the US stock market has rallied. Chart trends are sideways. Chinese buying should stay strong as the country improves economically as it opens up from the covid lockdowns.

Weekly US Cotton Futures

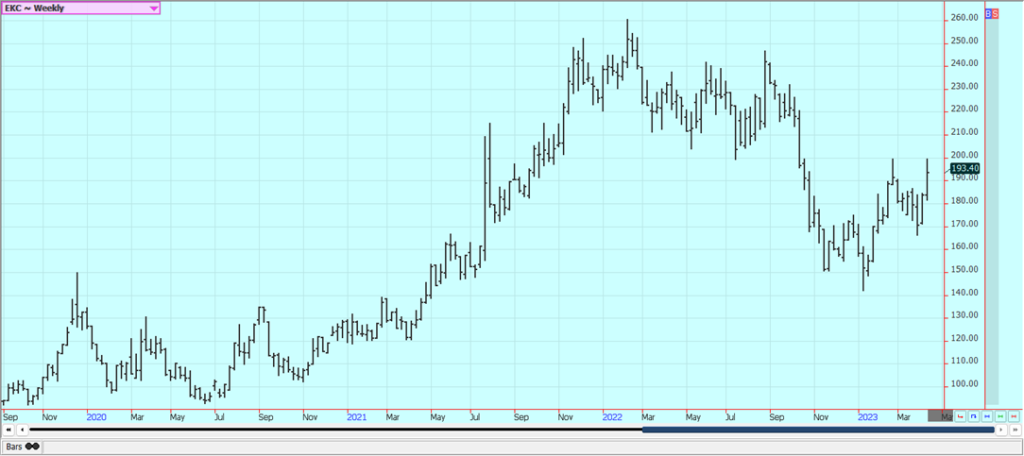

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little lower last week. The weekly charts show strong up trends, but the daily charts indicate that a top might be forming. The USDA reports released on Tuesday supported prices overall. Florida production was left unchanged at 16.1 million boxes, but the rest of the US saw decreased production by 2.0 % to 2.57 million tons. Futures remain supported by very short Oranges production estimates for Florida. Demand is thought to be backing away from FCOJ with prices as high as they are currently. But the market has not taken any note and continues to charge higher. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and the conditions are rated good.

Weekly FCOJ Futures

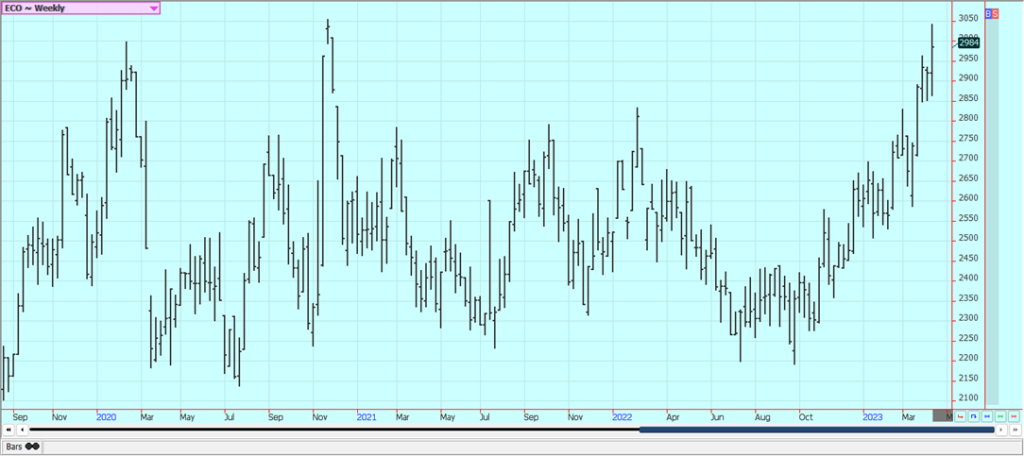

Coffee: New York and London closed higher last week and at new highs for the move on ideas of little on offer from producers and reports of increasing demand. Support also came as the Real is stronger against the US Dollar. CECAFE said that Brazil’s March exports were 19% less than a year ago at 3.1 million bags. The Robusta market has been especially tight and has been pushing on the Arabica price, but Arabica supplies are growing tight in the market as well. Producers in Vietnam are said to have low stocks left to sell and producers in Colombia and Brazil are also reported to be short on Coffee to sell. The lack of offers from South America and Vietnam is still supporting prices and reports indicate that demand for Robusta from Vietnam is strong and increasing due to price differentials with Arabica. Differentials are weakening in Brazil, Honduras, and Colombia, but reports indicate that differentials might start to firm up again as production ideas are low for Colombia and Brazil.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

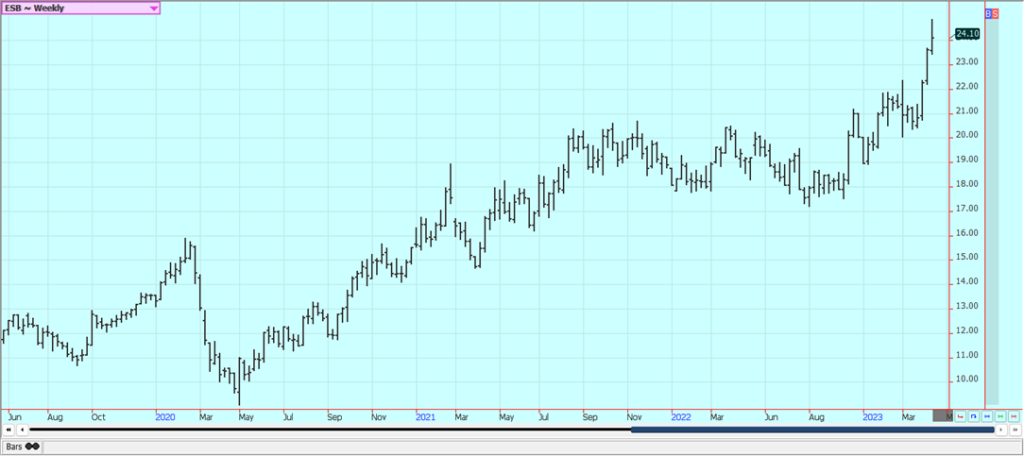

Sugar: New York and London closed higher last week but spent the second half of the week consolidating recent gains. Trends are still up on the weekly charts but are turning sideways on the daily charts. The production is not there to meet the demand. Indian production is thought to be less than 33 million tons this year as mills are closing early there and Pakistan also has reduced production. India has produced 30.0 million tons of Sugar so far this season, down 3.3% from last year. Thailand mills are also closing earlier than expected so the crop there might be less. Asian countries could face another year of short production as El Nino returns after years of La Nina. New crop Brazil production is solid this year but is still in the fields. Brazil old crop production has been good after mills ran out of cane to crush a year ago. European production is expected to be reduced again this year. Some analysts now say that Chinese production could be the lowest in six years due to bad growing conditions.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

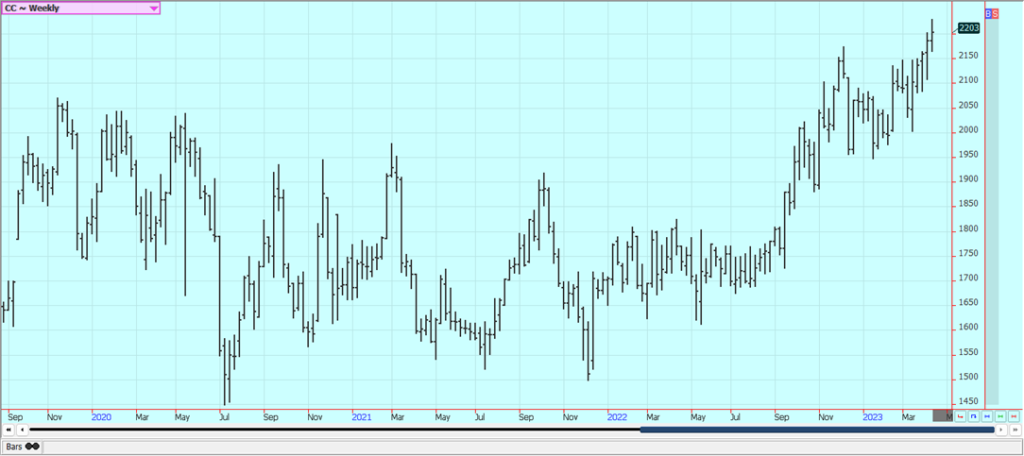

Cocoa: New York was lower and London closed higher Friday, but both markets were higher for the week and made a new leg up on the weekly charts. The lack of arrivals from West Africa to ports is still important to the trade. Wire reports suggest that producer selling increased on the recent rally in these markets. Trends remain up for at least the short term. The talk is that hot and dry conditions reported earlier in Ivory Coast could curtail main crop production, and main crop production ideas are not strong. Mid-crop production ideas are strong due to rains mixed with some sun recently reported in Cocoa areas of the country. Ghana has reported disease in its Cocoa to hurt production potential there, but overall production expectations are high. The rest of West Africa appears to be in good condition. The weather is good in Southeast Asia

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Karl Wiggers via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Africa2 days ago

Africa2 days agoAfrican Bank Appoints Manyathi as Interim CEO After Bungane’s Departure

-

Biotech1 week ago

Biotech1 week agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Impact Investing6 days ago

Impact Investing6 days agoEU Industrial Accelerator Act: Boosting Clean Industry and Resilient Supply Chains