Featured

Cotton Closed a Week of Choppy Trading

Cotton closed lower after a week of choppy trading on weaker Chinese economic data and a lower US stock market. Reports indicate that more showers continue to improve crop conditions in Texas and into the Southeast this week. Ideas of weaker demand due to economic problems in Asia and improved production prospects here at home continue. The weather has improved, but it had been very hot.

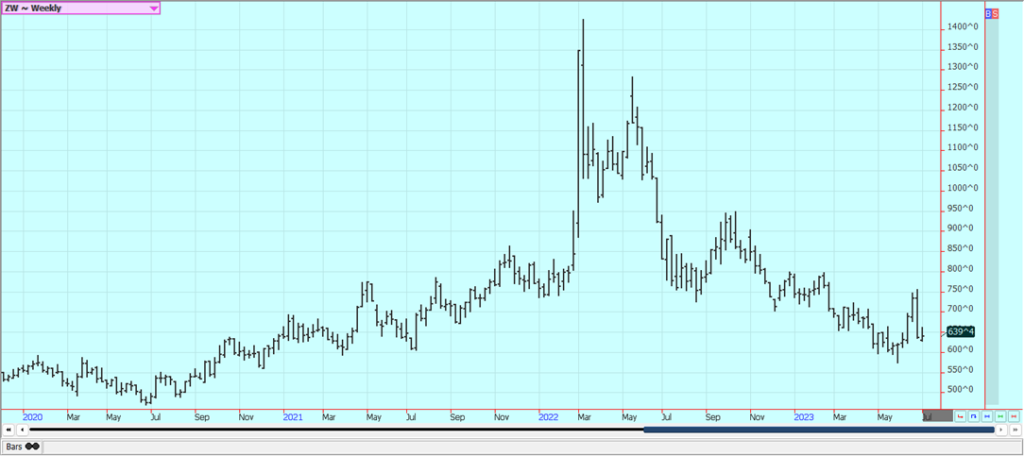

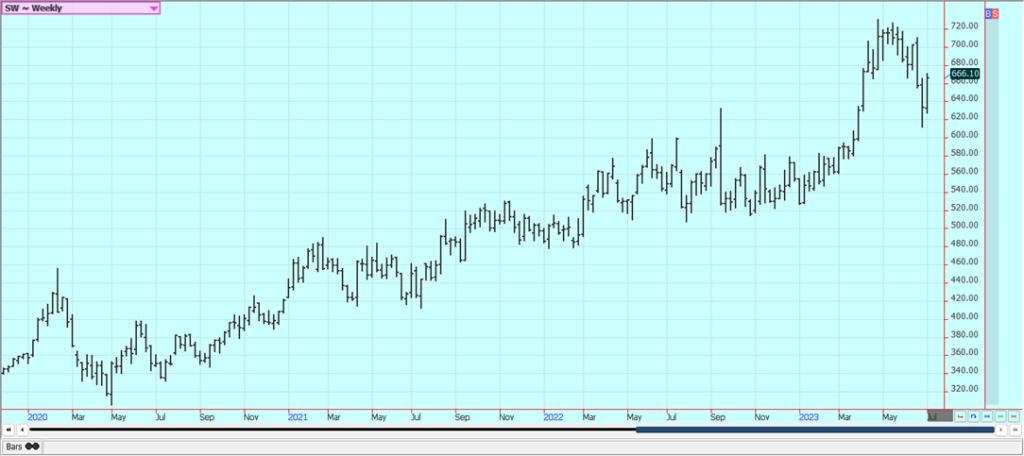

Wheat: Wheat markets were mostly higher last week on weather concerns. The market is operating in reaction to the slight deterioration seen in the crop updates released last Monday and on ideas that the HRW harvest is getting very delayed due to too much rain. Russia seems quiet although army officers and personnel are getting purged and the Russian Wheat exports keep flowing. Canada increased its Wheat planted area on Tuesday so production ideas from that country are higher. Uncertain world weather and Russia’s political problems that exploded last week were reasons to see stronger price action. Russian Wheat exports are continuing as if nothing happened so far, but that could change down the road, too. Rains are reported from the southern Great Plains to the Southeast, and the Midwest forecast features increasing chances for rain. The weather is still in focus around the world. Canada has been dry but is now getting some showers in parts of the Prairies.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

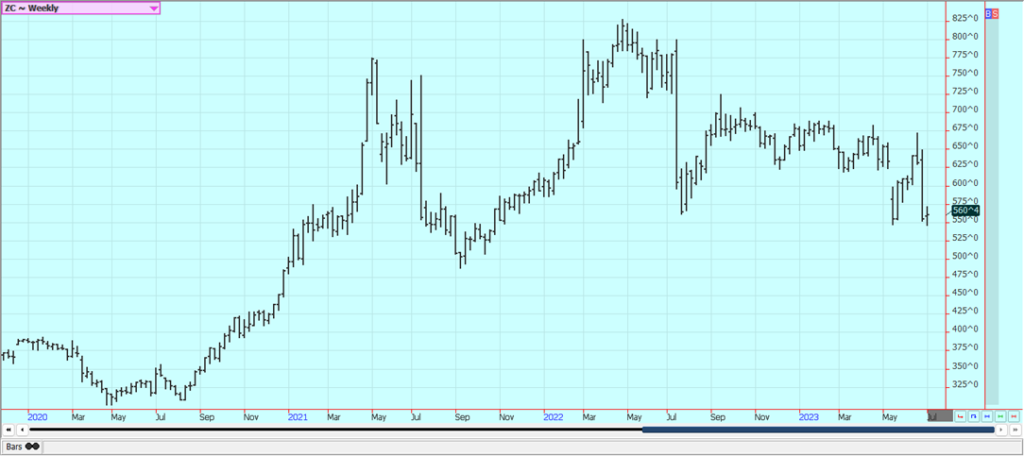

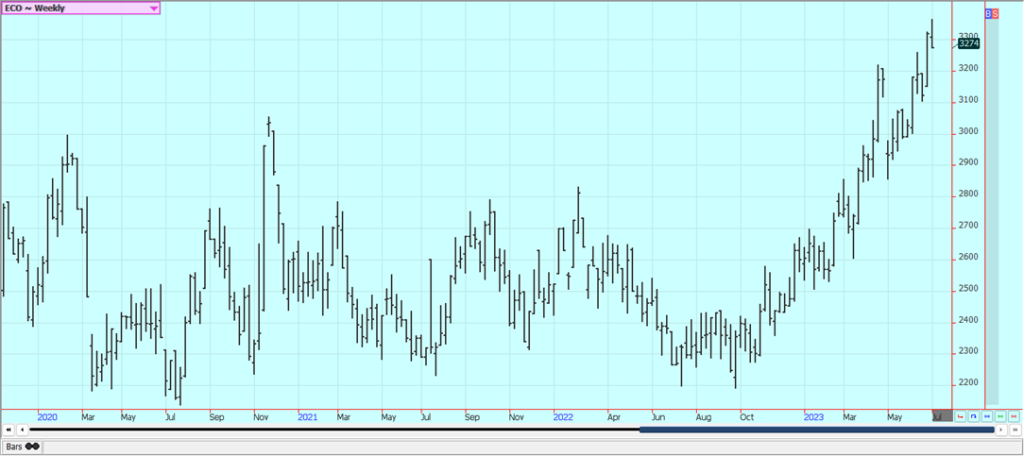

Corn: Corn was a little higher last week on what appeared to be speculative short covering. The market is at important support areas on the charts and it is possible that this support holds again this week. The weather features additional precipitation for major growing areas for the next couple of weeks after beneficial precipitation last week. Demand for US Corn in the world market has been very low and domestic demand has been weak due to reduced Cattle and other livestock production. Reports of dry initial development conditions were important. Ideas are that the top end of the yield potential is lost but that no serious damage has been done yet, but serious damage could be done to crops where the rains miss in the next few weeks. The Brazil Corn harvest is underway and so export prices for Corn from Brazil are getting relatively cheap and Brazil is getting the business.

Weekly Corn Futures

Weekly Oats Futures

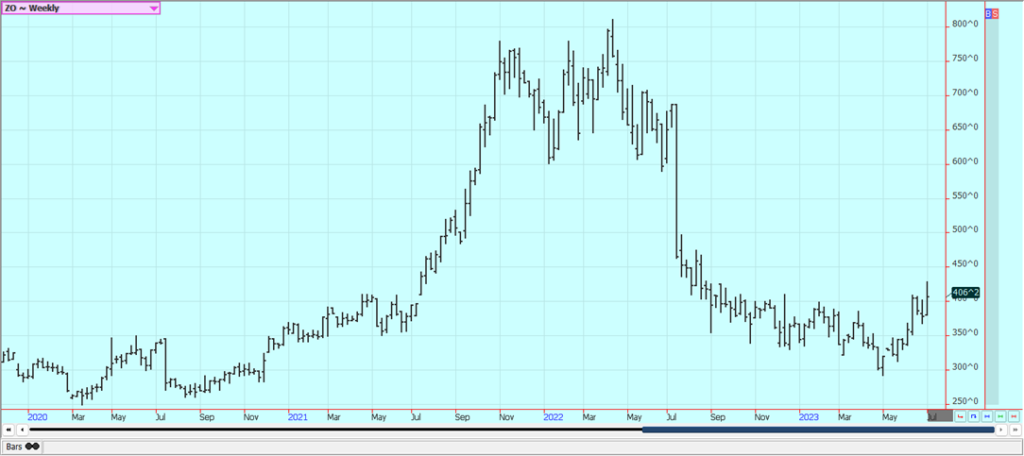

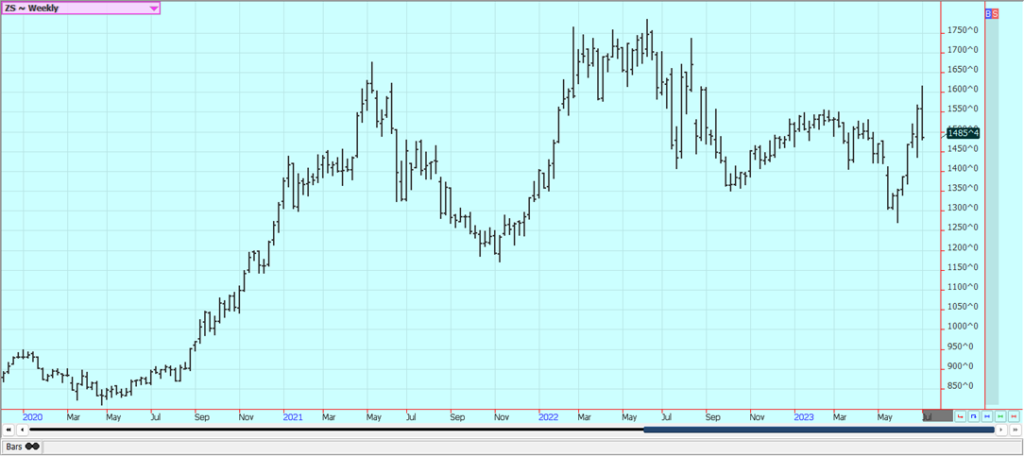

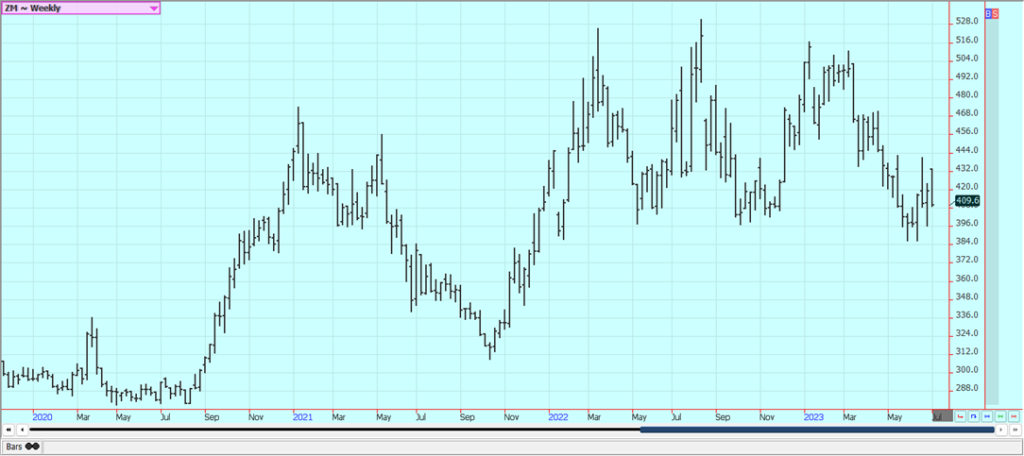

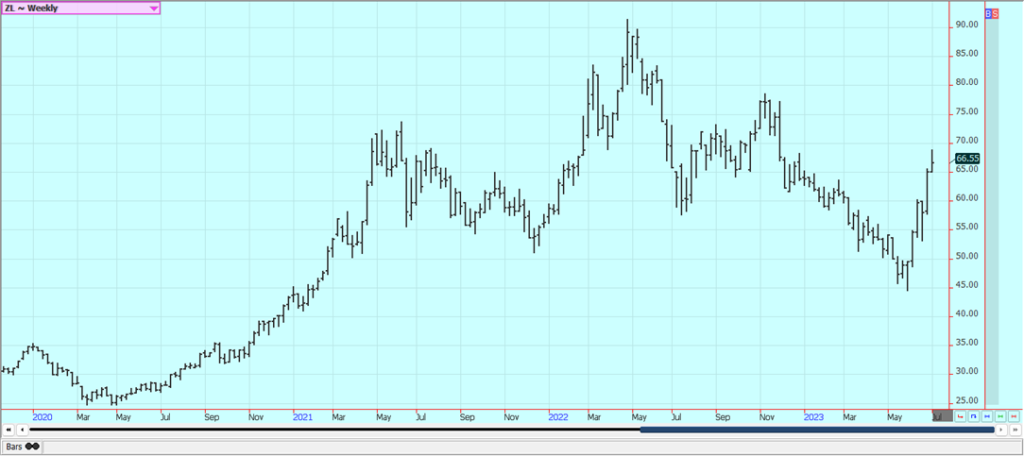

Soybeans and Soybean Meal: Soybeans and the products were lower on Friday and for the week on what appeared to be speculative selling tied to improving weather conditions and demand problems. Soybean Oil closed higher for the week. Off-and-on precipitation is forecast for the next couple of weeks but it is possible that not all areas will get beneficial rain. Big showers and storms were reported in Chicago and the rest of the Midwest last week. Ideas are that the top end of the yield potential is gone but severe damage has not been reported yet and the improved conditions make severe damage unlikely at this time. In fact, yield ideas are probably increasing due to the recent and forecast weather. Reports indicate that biofuels demand for Soybean Oil is very strong despite the moves in Washington to keep biofuels demand at more moderate levels and is pushing domestic demand for Soybeans. Brazil’s basis levels are still low and the US is being shut out of the market for most importers. Brazil is still selling a lot of Soybeans to China and other countries. Brazil has a very good crop, but the additional Soybeans grown in Brazil will be partially wiped out by the losses in Argentina.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

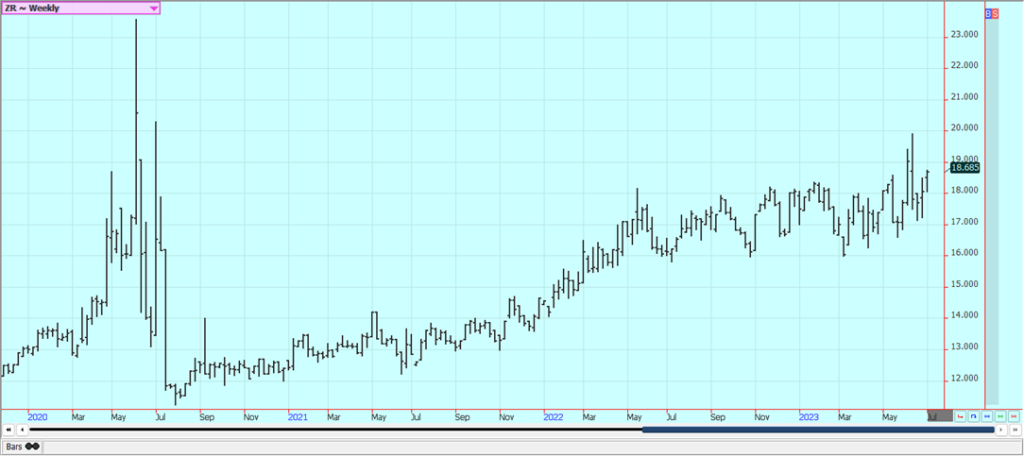

Rice: Rice closed mostly a little lower on Friday but July closed higher as the squeeze is back on for that month. The weekly charts show that futures closed at new highs for the move in response to the big rallies seen last week in July. The new crop months have been stuck in a sideways trading pattern. Growing conditions are good for the new crop despite very hot conditions in southern growing areas and the overall new crop price strength has not been good so far. The weather is still good for crop development. Export demand has been uneven. Mills are milling for the domestic market in Arkansas and are bidding for some Rice, but at least some mills say they now have enough bought to last until the harvest of the next crop.

Weekly Chicago Rice Futures

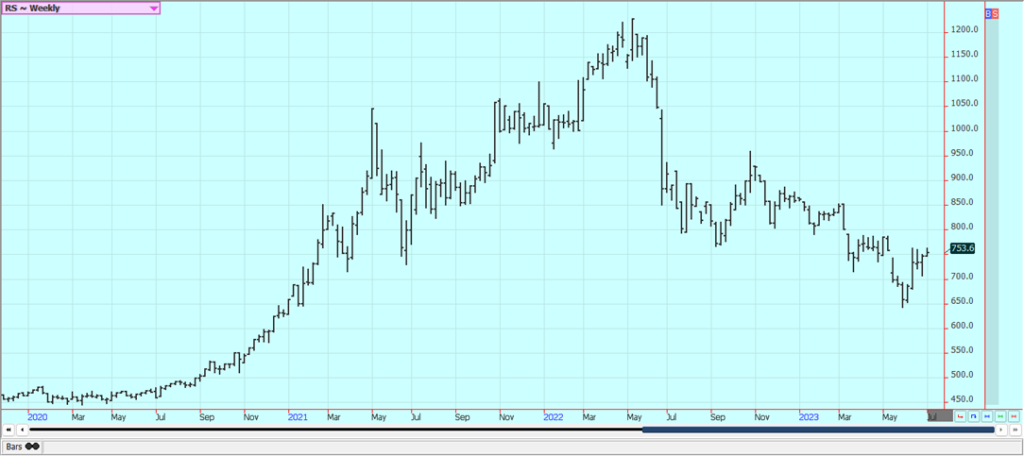

Palm Oil and Vegetable Oils: Palm Oil was little changed last week. There were ideas of reduced production in June and hopes for improved demand. Ideas are that current demand is generally weak, with China struggling to open its economy and India looking to Sun oil for imports at the expense of other vegetable oils. Canola was a little higher on Prairies growing conditions. Drier weather is forecast for the Prairies. Trends are up on the daily charts in sympathy with the price action in Chicago. Reports indicate that domestic demand has been strong due to favorable crush margins, but export demand is questioned, especially since the release of the weaker-than-expected Chinese economic data last week. Scattered showers and rains have been reported so planting and initial growth conditions are good but it has been dry since then.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton closed lower after a week of choppy trading on weaker Chinese economic data and a lower US stock market. Reports indicate that more showers continue to improve crop conditions in Texas and into the Southeast this week. Ideas of weaker demand due to economic problems in Asia and improved production prospects here at home continue. The weather has improved, but it had been very hot. There are still many concerns about demand from China and the rest of Asia due to the slow economic return of China in the world market and as China is trying not to buy from the US. Forecasts for showers are still showing in forecasts for West Texas to Oklahoma and Kansas and are expected to be beneficial. Showers are also forecast for the Delta and Southeast.

Weekly US Cotton Futures

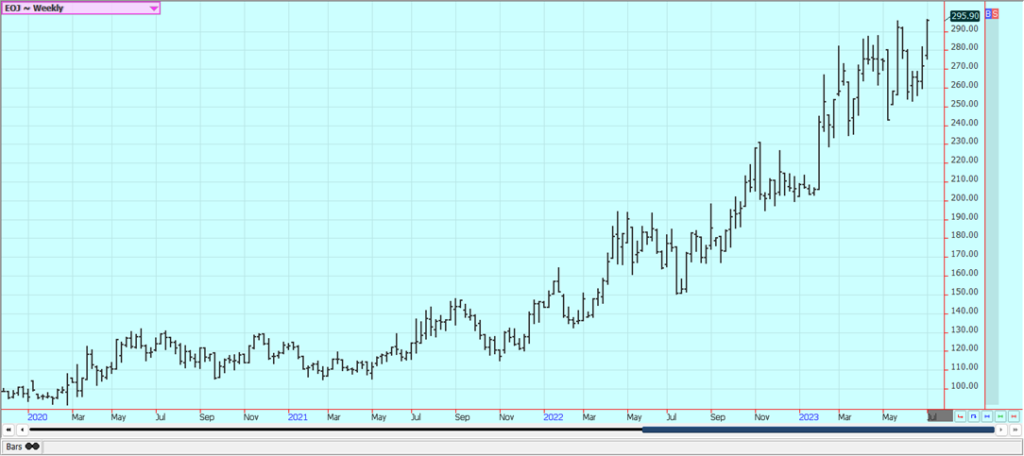

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher last week and trends are up on the daily and weekly charts. Futures remain supported by very short Oranges production estimates for Florida but seem to have factored in the production losses into the current prices. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that has hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and conditions are rated good.

Weekly FCOJ Futures

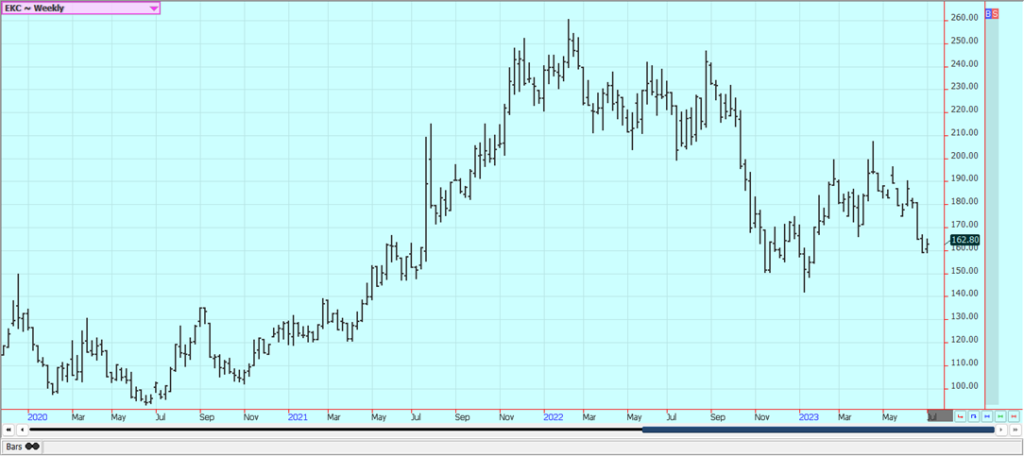

Coffee: Both markets closed higher last week, with a major rally in London on Friday turning short-term trends in that market to up. The Brazil harvest is moving quickly along. Ideas are that roaster demand is improving with more Coffee and cheaper prices seen in the market now. Cooxupe said last week that the harvest is 34% complete, just off the record pace of 36% made several years ago. There are reports of dry weather for the harvest in Arabica production in Brazil with high production expectations and that production is now being harvested and starting to get exported. The Arabica harvest has expanded and offers of Arabica from Brazil are increasing. There are still tight Robusta supplies for the market amid strong demand for Robusta, but the Brazil harvest is in the market now and is expected to take much of the demand. Producers in Vietnam and Indonesia are said to have almost nothing left to sell and producers in Colombia are also reported to be short Coffee to sell. The market really needs big offers from Brazil to sustain any downside movement. Southeast and South Asian producers could see another tough production year this year due to the effects of El Nino, but the weather appears to be good in these areas for now.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

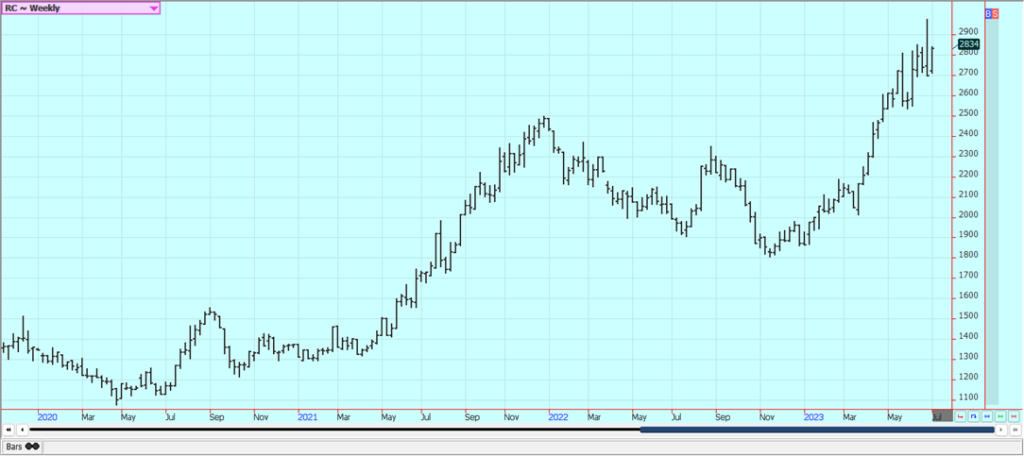

Sugar: New York and London closed higher last week on ideas of tight supplies in consumer markets. Reports indicated that Brazil’s production increasing and as the weather in Southeast Asia is currently good for their next crop production prospects so relief could be coming soon. Brazil production is apparently not enough to change the narrative of tight world supplies, but more Sugar is now available to the world market and prices are reacting. India will restrict imports until the first half of next year. The current year export quota is already gone and the government has no plans to allow for additional exports at this time. Indian production is less this year and Pakistan also has reduced production, but the monsoon has been good so far so both countries might have increased production next year. In addition, India announced a higher base price for Sugar paid to farmers to help promote additional planted areas.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

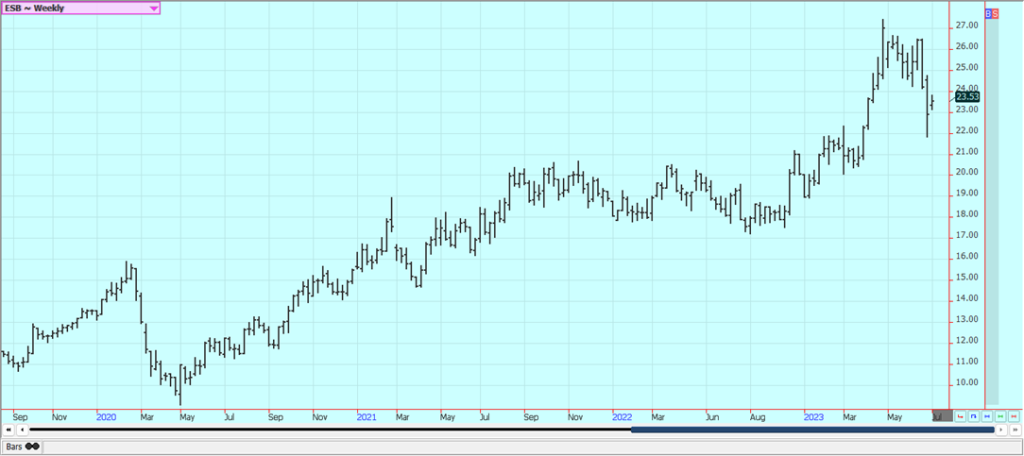

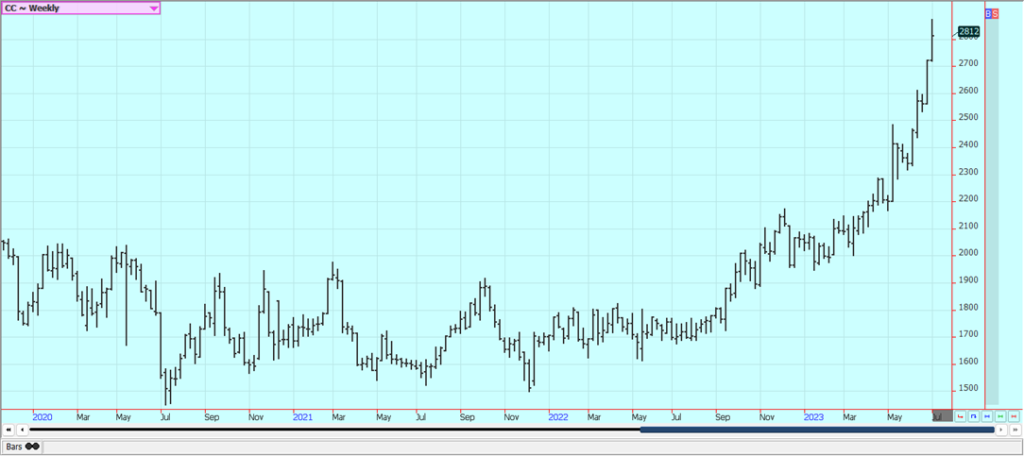

Cocoa: New York closed a little lower last week on ideas that futures were overbought but London was sharply higher as a squeeze is being reported there for July contracts on ideas of tight supplies continue and as July still holds a big premium to the back months. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue, Talk is that hot and dry conditions reported earlier in Ivory Coast could curtail main crop production, and main crop production ideas are not strong. Midcrop production ideas are strong due to rain mixed with some sun recently reported in Cocoa areas of the country.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Erbs55 via Pixabay)

DISCLAIMER: This article was written by a third-party contributor and does not reflect the opinion of Born2Invest, its management, staff, or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Africa1 week ago

Africa1 week agoMorocco’s Tax Reforms Show Tangible Results

-

Biotech3 days ago

Biotech3 days agoUniversal Nanoparticle Platform Enables Multi-Isotope Cancer Diagnosis and Therapy

-

Fintech1 week ago

Fintech1 week agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Impact Investing10 hours ago

Impact Investing10 hours agoMainStreet Partners Barometer Reveals ESG Quality Gaps in European Funds