Featured

Rice Trade Consolidation Moved the Price Higher

Rice closed a little higher last week in consolidation trading. Growing conditions are good for the new crop despite very hot conditions in southern growing areas and the overall new crop price strength has not been good so far. The weather is still good for crop development. Export demand has been uneven. Mills are milling for the domestic market in Arkansas and are bidding for some Rice.

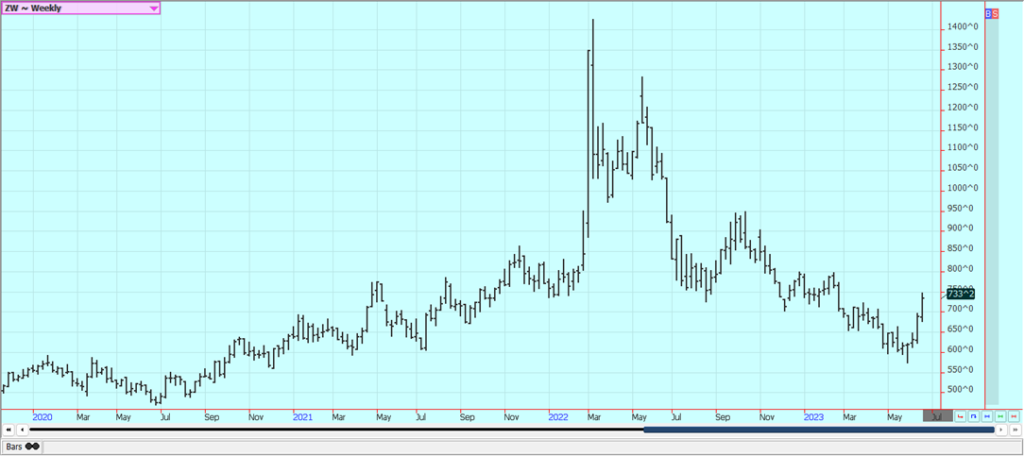

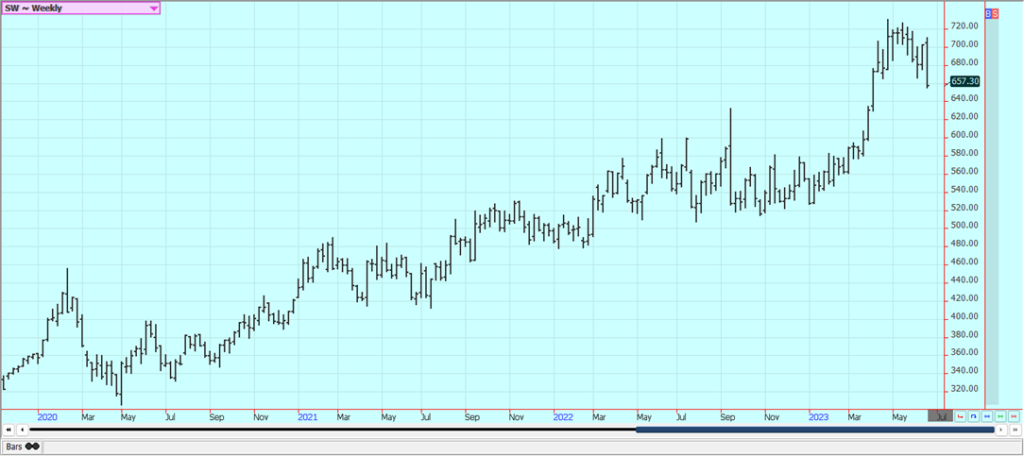

Wheat: Wheat markets were higher in all three markets again last week on uncertain world weather and Russia once again said that the grain corridor deal with Ukraine would not be renewed. The end of the deal could mean tighter world supplies for importers and could rally prices again. Russia is hoping for higher world prices for its Wheat exports anyway and is trying to set a floor of $240.00 per ton for its export sales. Rains are reported from the southern Great Plains to the Southeast, but the Midwest has for the most part missed any rain chances and the forecast looks dry for the next week or two. The weather is still in focus around the world. Canada has been dry. Dry conditions are a problem in Russia, especially in the Spring Wheat areas there. Australian production ideas have been fading as El Nino hits the country.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

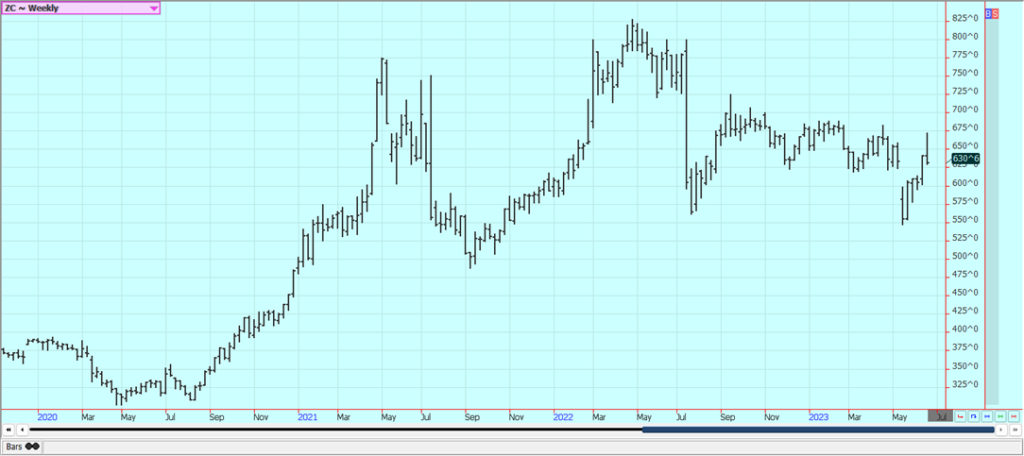

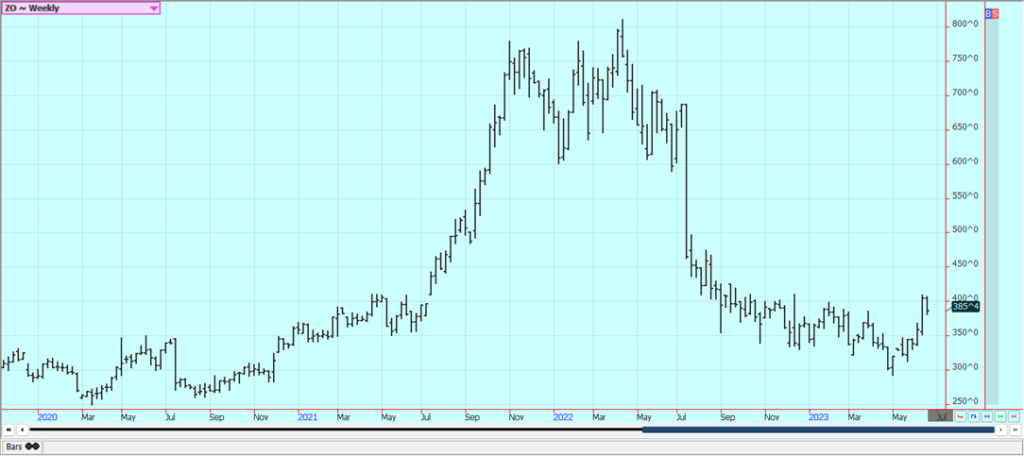

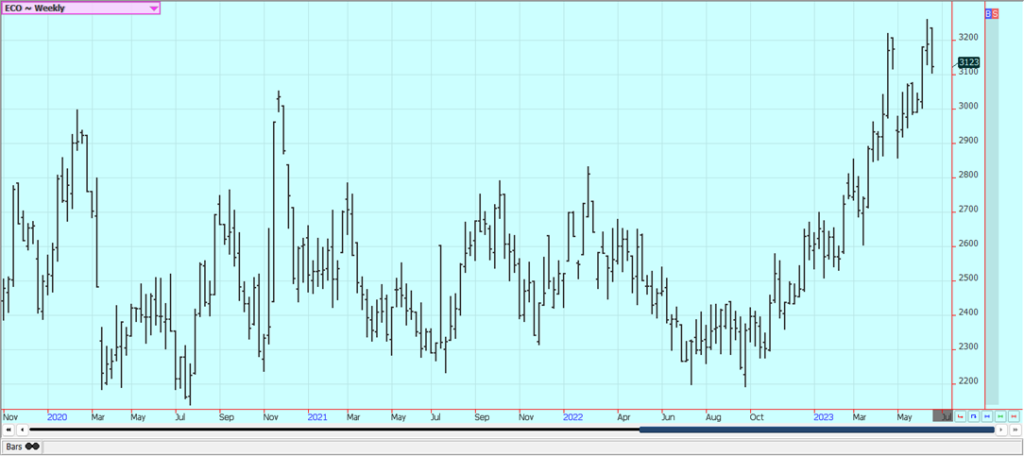

Corn: Corn and Oats were lower last week as Corn traders reacted to forecasts for some rains this past weekend and later this week. Demand for US Corn in the world market has been very low. Reports of dry initial development conditions were important. Dry and warmer conditions are in the forecast for the next few days but increasing chances for showers and storms are forecast for the weekend and into next week. Ideas are that the top end of the yield potential is lost but that no serious damage has been done yet. Corn is rolling leaves in central and southern Midwest areas but could be in better condition to the north where there have been a few showers. Corn is still finding some support from little US producers selling interest. The Brazil Corn harvest is underway and so export prices for Corn from Brazil are getting cheaper and Brazil is getting the business.

Weekly Corn Futures

Weekly Oats Futures

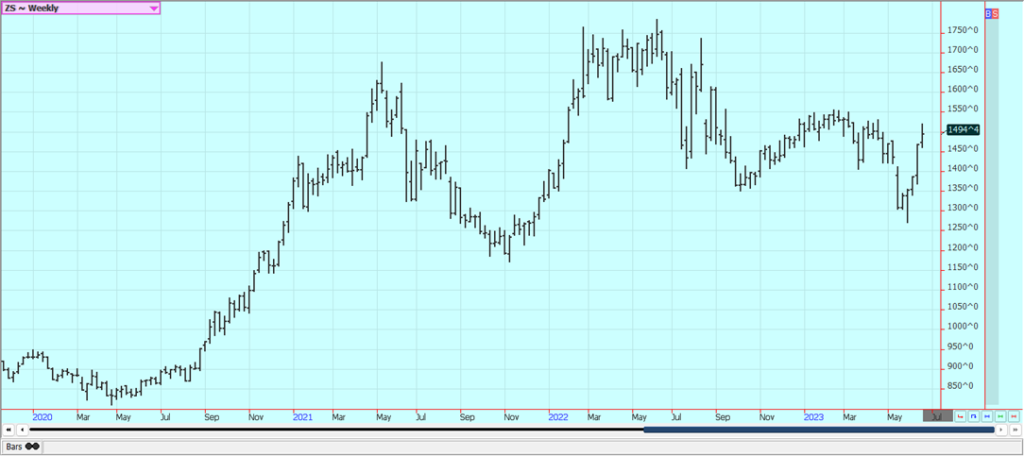

Soybeans and Soybean Meal: Soybeans closed higher and the products closed lower last week as reports of strong domestic demand against limited offers continued. Growing conditions feature cool but very dry weather. Warmer and wetter conditions were forecast for the weekend and into this week. Ideas are that the top end of the yield potential is gone but severe damage has not been reported yet. Reports indicate that biofuels demand for Soybean Oil is very strong despite the moves in Washington to keep biofuel demand at more moderate levels and is pushing domestic demand for Soybeans. Brazil’s basis levels are still low and the US is being shut out of the market for most importers. Brazil is still selling a lot of Soybeans to China and other countries. Brazil has a very good crop, but the additional Soybeans grown in Brazil will be partially wiped out by the losses in Argentina. Argentina has been forced to import from Brazil to keep its crushing facilities operating.

Weekly Chicago Soybeans Futures

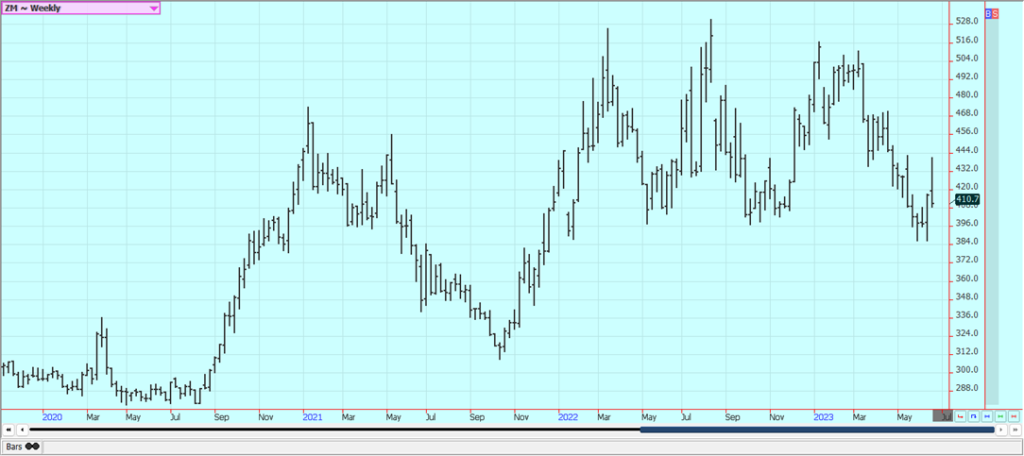

Weekly Chicago Soybean Meal Futures

Rice: Rice closed a little higher last week in consolidation trading. Growing conditions are good for the new crop despite very hot conditions in southern growing areas and the overall new crop price strength has not been good so far. The weather is still good for crop development. Export demand has been uneven. Mills are milling for the domestic market in Arkansas and are bidding for some Rice, but at least some mills say they now have enough bought to last until the harvest of the next crop.

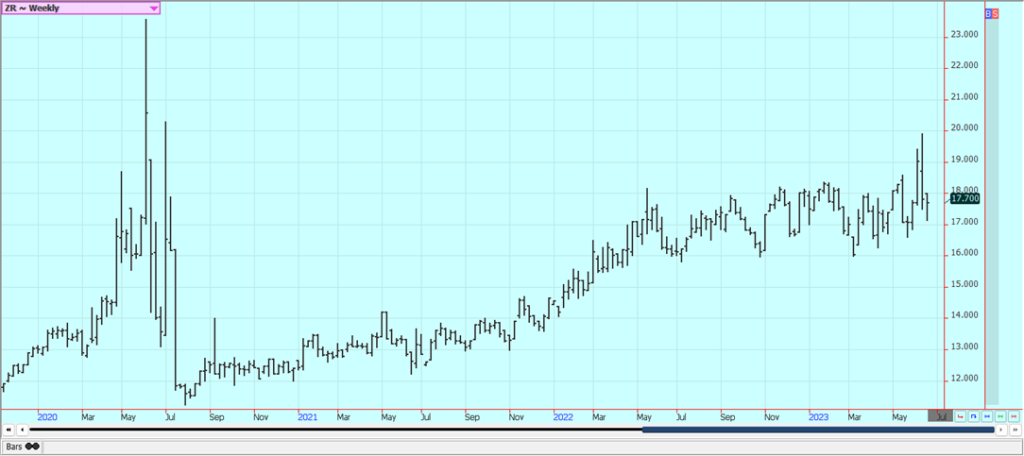

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was lower last week on ideas of reduced demand. The export reports from private sources have not been strong for several weeks. Ideas are that demand is generally weak, with China struggling to open its economy and India looking to Sun oil for imports at the expense of other vegetable oils. Canola was a little higher. Trends are mixed on the daily charts. Reports indicate that domestic demand has been strong due to favorable crush margins, but export demand is questioned, especially since the release of the weaker-than-expected Chinese economic data last week. Scattered showers and rains have been reported so planting and initial growth conditions are good.

Weekly Malaysian Palm Oil Futures

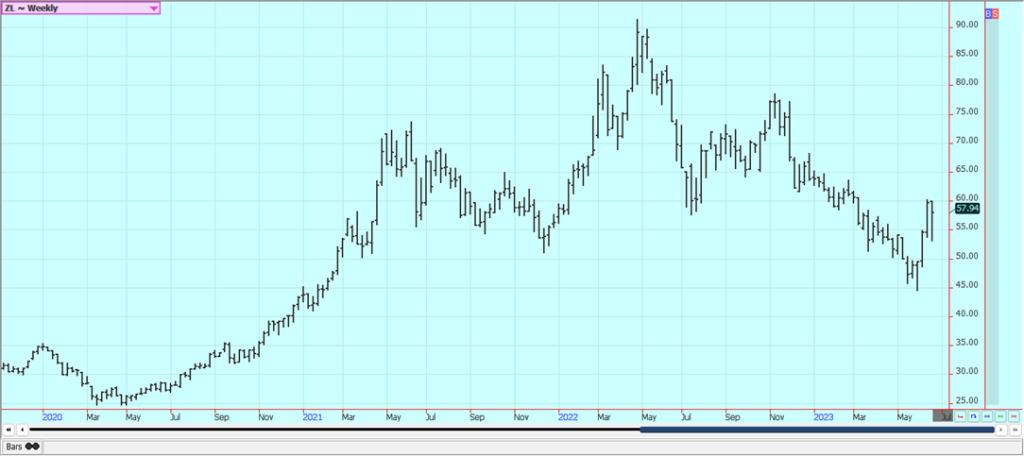

Weekly Chicago Soybean Oil Futures

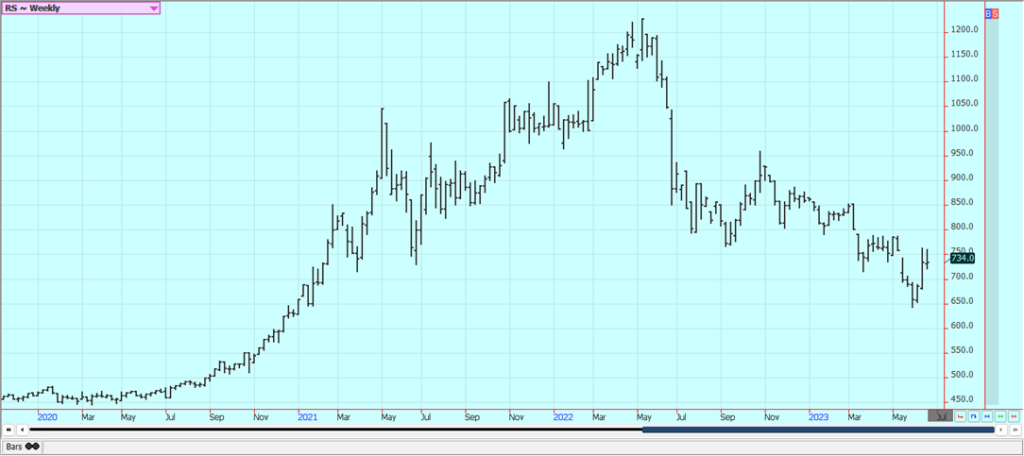

Weekly Canola Futures:

Cotton: Cotton closed lower last week despite reduced crop condition ratings as the trade concentrated on demand ideas. The weekly export sales report showed reduced demand once again and certified stocks have shown a sharp increase in the last few weeks. Ideas of weaker demand due to economic problems in Asia and improved production prospects here at home continue. The weather has improved in Texas and most growing areas are in good condition, but it had been very hot. There are still many concerns about demand from China and the rest of Asia. Forecasts for showers are still showing in forecasts for West Texas to Oklahoma and Kansas and are expected to be beneficial. Ideas are that the world economic problems were fading into the background as the US stock market has held strong and as the Chinese economy gets better after all of the Covid lockdowns.

Weekly US Cotton Futures

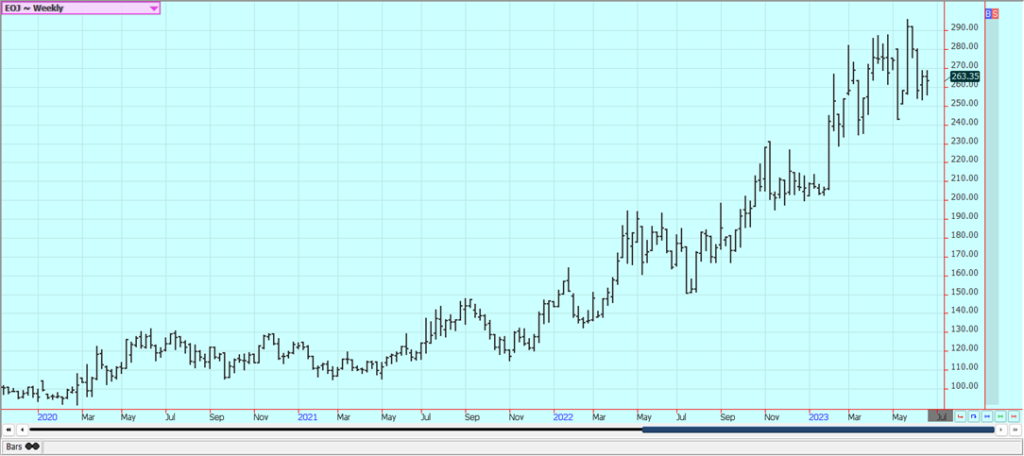

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little lower last week and trends remain mixed on the charts. Futures remain supported by very short Oranges production estimates for Florida. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that has hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and conditions are rated good. The latest Florida Movement and Pack report showed that inventories are now 40% less than last year.

Weekly FCOJ Futures

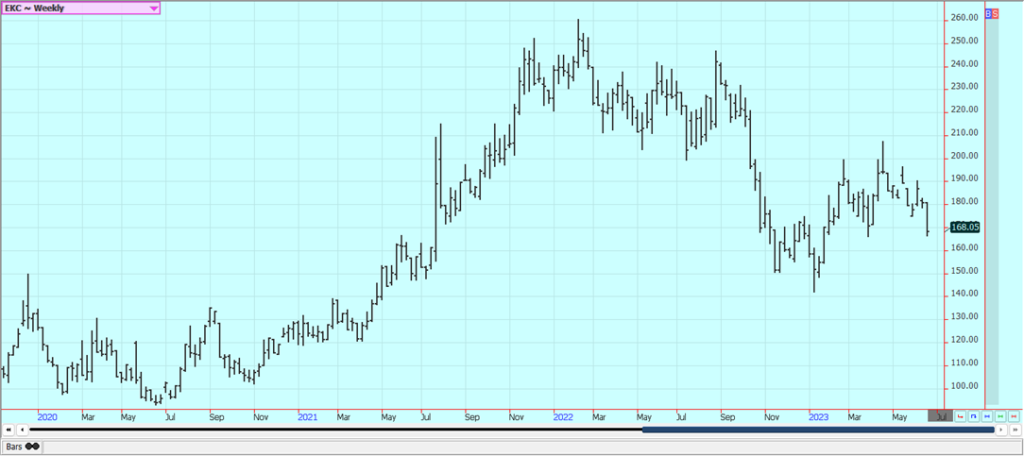

Coffee: Both markets closed lower last week on increasing export volumes from Brazil. Brazil’s offers are starting to increase and Cooxupe said that its harvest is now about 22% complete, from about 13% last year. There are reports of good rains and dry weather mixed in for Arabica production in Brazil with high production expectations. The Arabica harvest has started and offers of Arabica from Brazil are increasing. There are still tight Robusta supplies for the market amid strong demand for Robusta, but the Brazil harvest is in the market now and is expected to take some of the demand. Producers in Vietnam and Indonesia are said to have almost nothing left to sell and producers in Colombia are also reported to be short on Coffee to sell. The market really needs big offers from Brazil to sustain any downside movement. Southeast and South Asian producers could see another tough production year this year due to the effects of El Nino.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

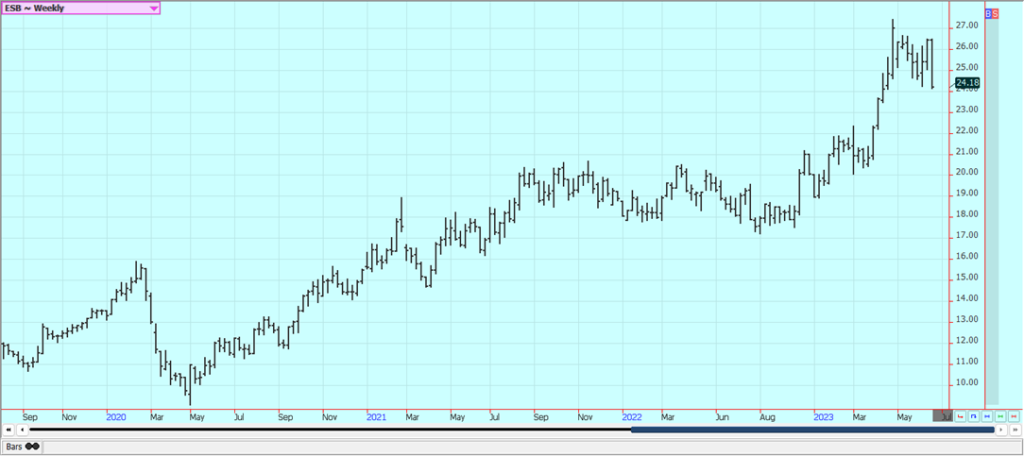

Sugar: Both markets were lower last week despite tight world supplies as news reports indicated that Brazil’s production increased in the last half month. Brazil’s production is apparently not enough to change the narrative of tight world supplies, but more Sugar is now available to the world market and prices are reacting. India will restrict imports until the first half of next year. The current year’s export quota is already gone and the government has no plans to allow for additional exports at this time. The market is still hurt by good growing and harvesting conditions in Brazil but supported by tight current supplies. The production is not there to meet the demand in many countries, with only Brazil among the major producers looking to have a good crop. Indian production is less this year and Pakistan also has reduced production. Thailand also has a smaller crop. Asian countries could face another year of short production as El Nino returns after years of La Nina. European production is expected to be reduced again this year. Chinese production could be the lowest in six years due to bad growing conditions.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

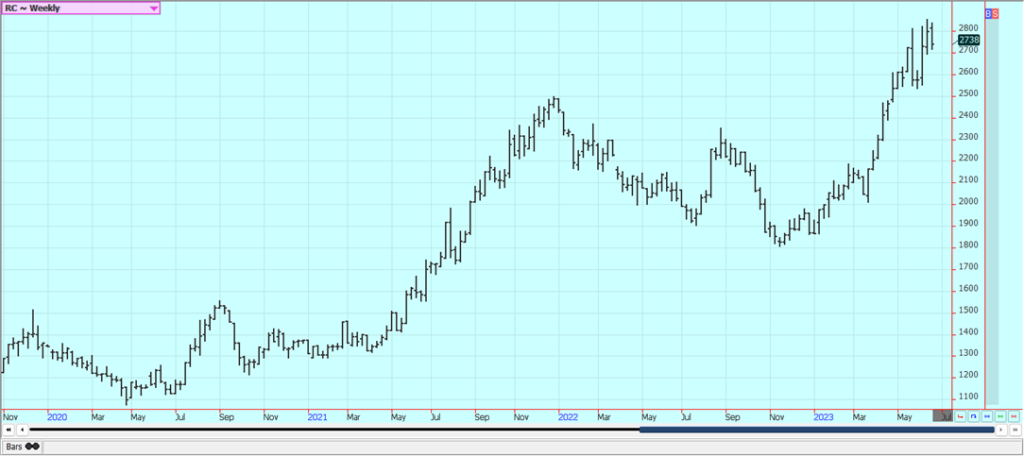

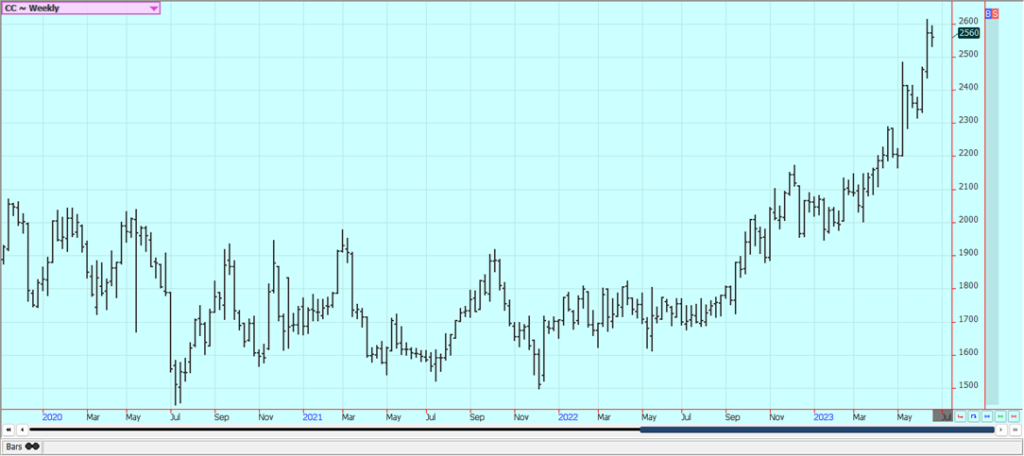

Cocoa: Both markets closed lower last week as the rally has stalled as ideas of tight supplies continue. Reports indicate that speculators were liquidating long positions. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast continue, Talk is that hot and dry conditions reported earlier in Ivory Coast could curtail main crop production, and main crop production ideas are not strong. Midcrop production ideas are strong due to rain mixed with some sun recently reported in Cocoa areas of the country.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by ThuyHaBich via Pixabay)

DISCLAIMER: This article was written by a third-party contributor and does not reflect the opinion of Born2Invest, its management, staff, or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Business4 days ago

Business4 days agoThe Dow Jones Teeters Near All-Time High as Market Risks Mount

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoWorld4All, a Startup that Makes Tourism Accessible, Surpasses Minimum Goal in Its Crowdfunding Round

-

Biotech1 day ago

Biotech1 day agoGut-Derived Molecule Identified as Early Marker and Driver of Atherosclerosis

-

Crypto1 week ago

Crypto1 week agoThe Crypto Market Rally Signals Possible Breakout Amid Political Support and Cautious Retail Sentiment