Featured

FCOJ Closed Higher on Friday Along With Most Other Commodities Markets

The FCOJ charts show a sideways range has developed and futures are near the middle of the range for both the daily and weekly charts. Futures remain supported by very short Oranges production estimates for Florida. Demand is thought to be backing away from FCOJ with prices as high as they are currently, but the market has not taken any note and continues to charge higher.

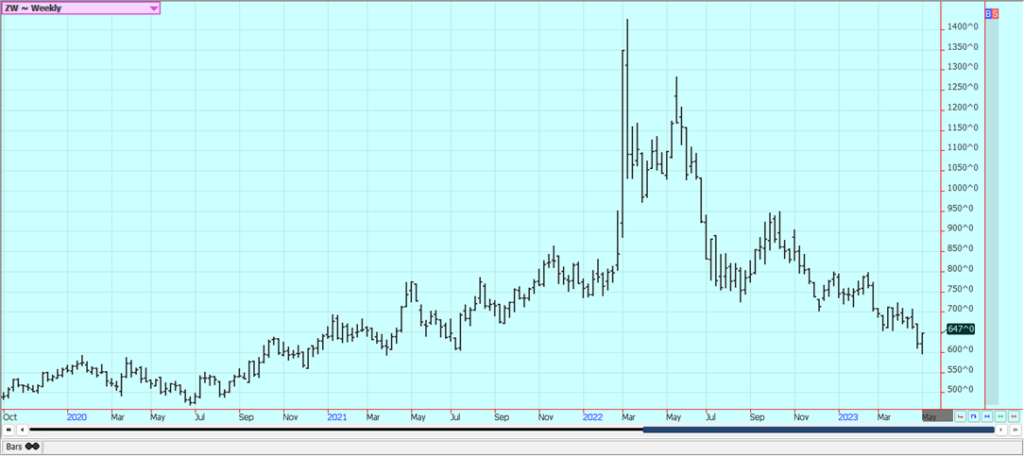

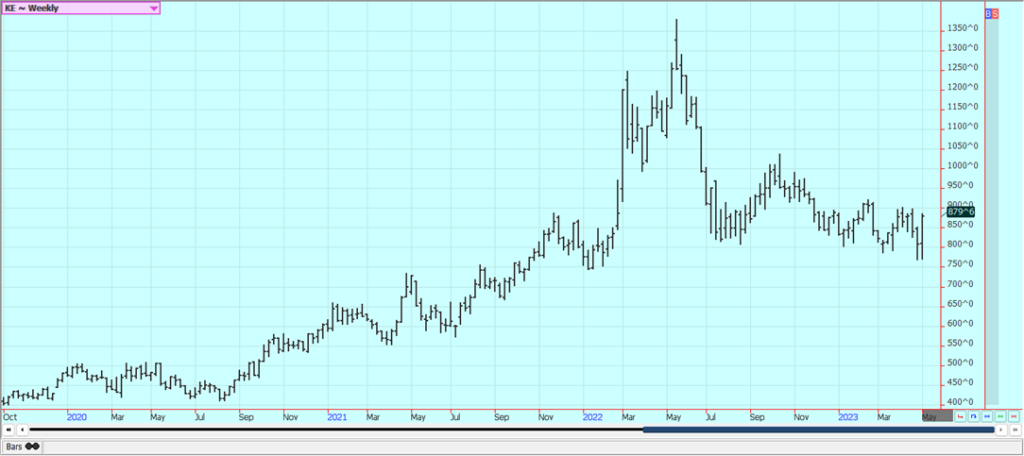

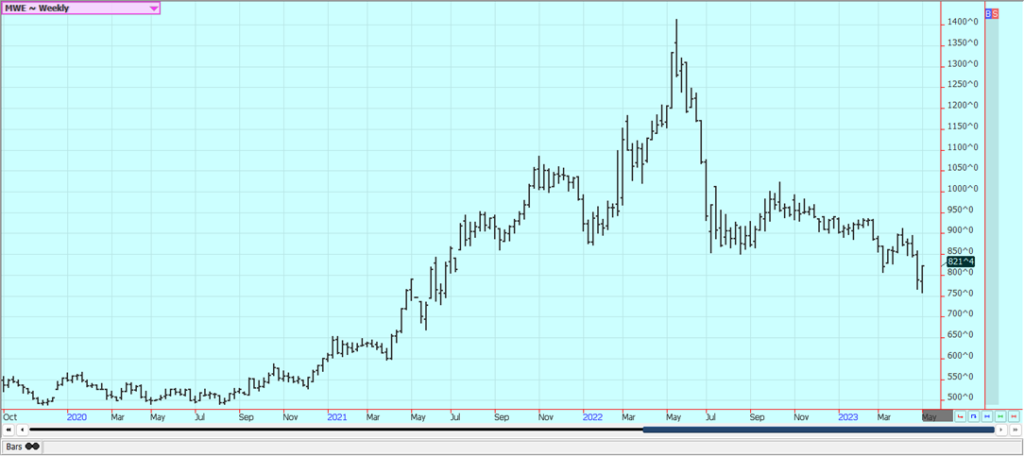

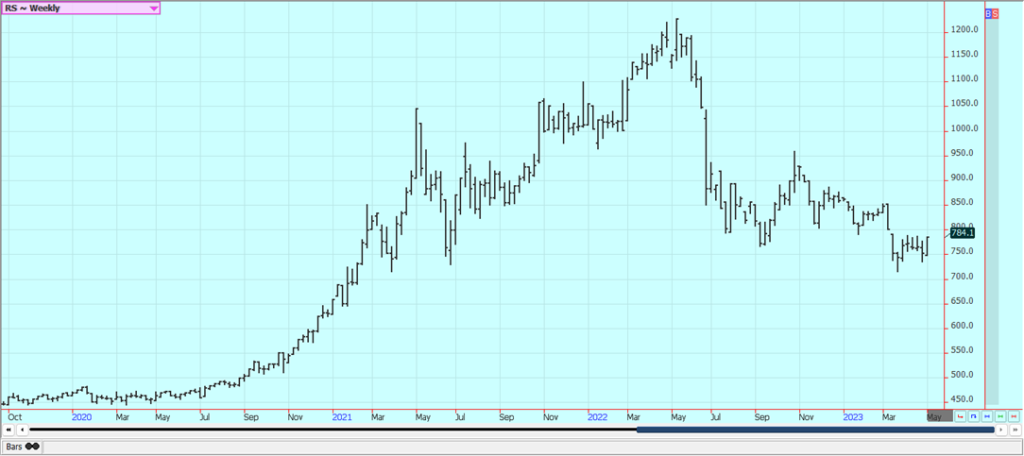

Wheat: Wheat markets were higher last week on buying seen in reaction to news that a couple of drones had flown into Moscow and might have tried to assassinate Mr. Putin. Some selling was seen before the news hit the market on weak demand ideas and on forecasts for rains in dry parts of the western Great Plains, but it looks like the fund shorts have decided that futures are cheap enough and are covering short positions. More showers are in the forecast for this week and will be welcome as not all areas got hit last week. The showers are expected to be more scattered this week. It is also dry in the Canadian Prairies, especially in western areas, and producers are worried about planting. US Spring Wheat planting progress has been slow due to wet soils caused mostly by the huge snows seen earlier this Winter that have been melting. Uncertainty about the Black Sea Corridor deal continued, but it now appears that Turkey will act as a go-between for Russia in Wheat and other grains payments. Russia has said that the current system cannot last and seems ready to kill the deal completely. It has been talking to Turkey about the deal and to the UN. Ideas that big Russian offers and cheaper Russian prices would be a feature for a while in the world market were the driving force for the weaker prices. Ideas are that both Australia and Russia are harvesting record to near-record Wheat crops this year. Both countries will have a lot of Wheat to export. The daily charts show up trends for all three markets. Weekly chart trends are down for SRW and Spring Wheat and mixed for HRW.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

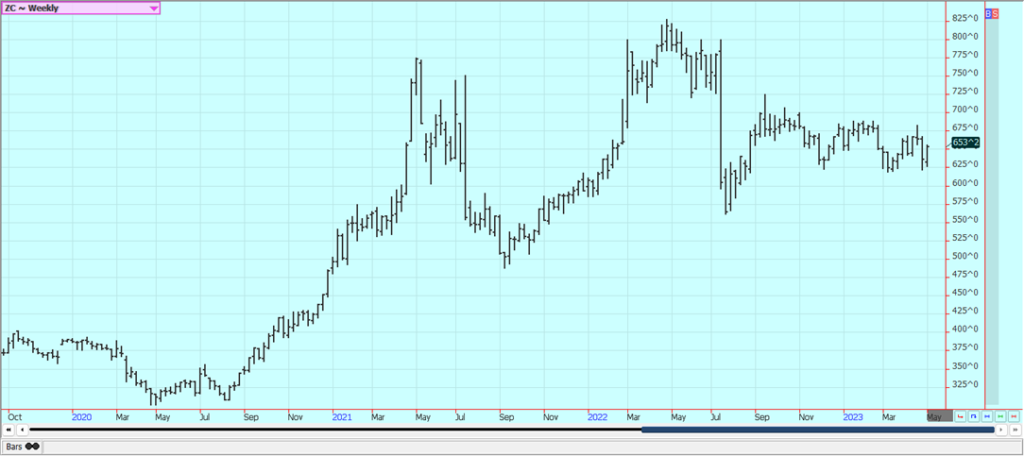

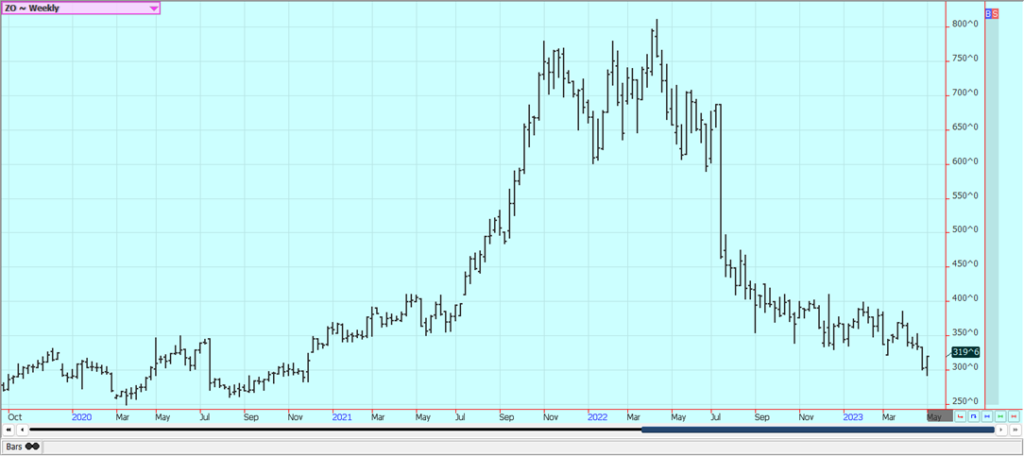

Corn: Corn and Oats closed higher on Friday and for the week, with both markets rallying on follow-through buying tied to news that drones had been seen in Moscow and the Russian government accusing Ukraine of sending them to kill Putin. It looked like the funds and other speculators were covering short positions. Trends are up on the daily charts for both markets, but weekly chart trends are mixed for Corn and still down for Oats. Corn is still finding some support from little US producers selling interest but getting hurt by little commercial and export buying interest. The weather was wet and cool in the Midwest last week and producers were not selling Corn, but the market wants Corn now. Producers are still inclined to wait and might have trouble sourcing trucks to haul grain, anyway. Most are in the fields and are not even worried about the market. Warmer and drier weather for good planting is expected this week. US prices are currently very competitive with those from South America as Brazil concentrates on Soybeans exports and not Corn and US demand has improved because of the price differentials and the lack of a Brazil offer into the market. This trend should continue for the next few months. NOAA is forecasting that La Nina will develop this Summer and replace El Nino. US growing conditions are usually good when this happens but there are concerns about ocean water temperatures that are increasing rapidly in the Pacific and have alarmed some forecasters.

Weekly Corn Futures

Weekly Oats Futures

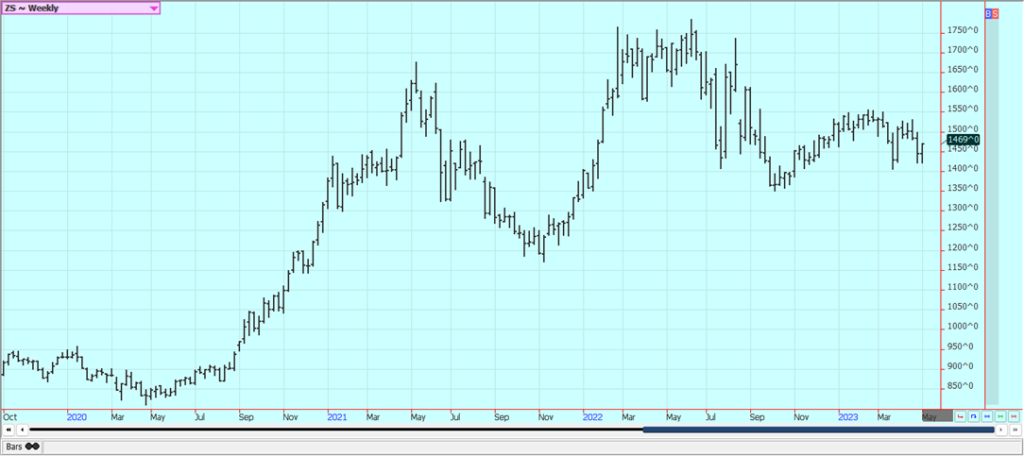

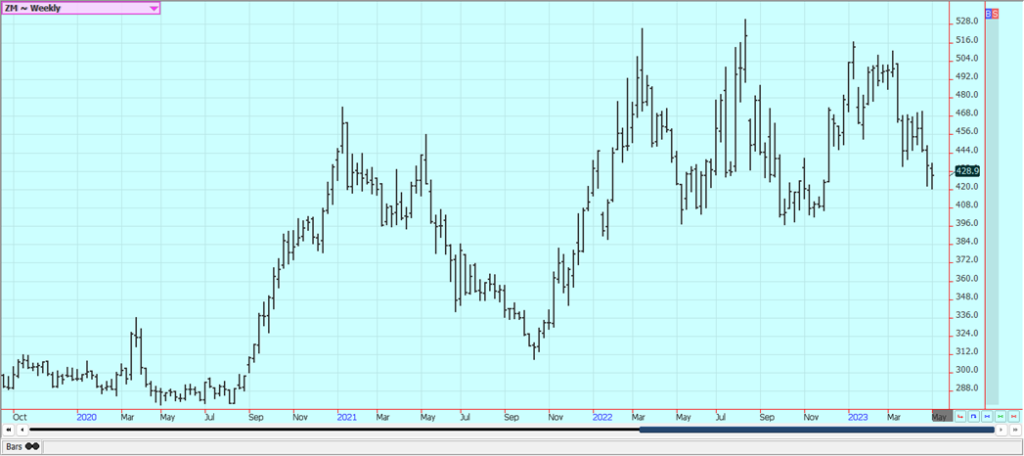

Soybeans and Soybean Meal: Soybeans and the products were mostly higher yesterday, but Soybean Meal closed lower in deferred months. Soybean Oil led the way and trends turned up on the daily charts. Trends are turning up in Soybeans but are sideways at best for Soybean Meal. Weekly chart trends are down for Soybeans and Soybean Meal and sideways for Soybean Oil. Speculative short covering from the news that drones had been seen in Moscow and the Russian government accusing Ukraine and the US of sending them to kill Putin. Brazil’s basis levels are still so low that some American processors can import more cheaply than buying from US producers. Reports last week indicated that the basis is forming in Brazil, but prices for Brazil Soybeans remain cheap compared to those found in the US. Brazil has been selling a lot of Soybeans to China to feed its record Soybeans demand. Brazil has a very good crop, but the additional Soybeans grown in Brazil will be partially wiped out by the losses in Argentina. Argentina has been forced to import from Brazil to keep its crushing facilities operating. The US might sell to China for storage purposes as well and could pick up some new business from countries other than China as Brazil ports will be loaded with ships bound for China. Production ideas in Argentina are less than 25 million tons or less than half a crop. Forecasts from NOAA for very good growing conditions in the Midwest were also a factor, but there are concerns about ocean water temperatures that are increasing rapidly in the Pacific and have alarmed some forecasters.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

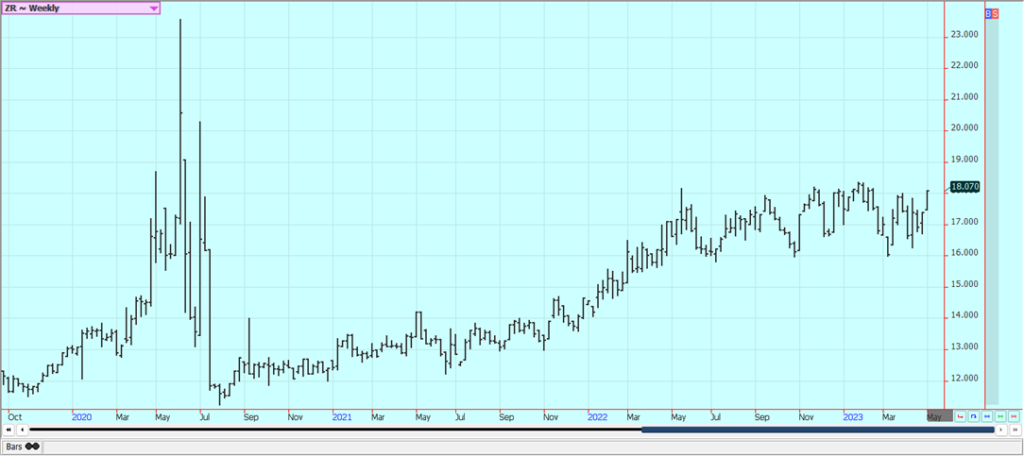

Rice: Rice was higher once again on Friday and for the week on follow-through buying. Futures continue to work higher and have apparently made a major low on the charts. Chart trends are up and overbought for the daily charts and are up on the weekly charts. The buying started when Bunge took almost all of the First Notice Day deliveries and has continued since then. Offers seem hard to find right now, but demand has been a problem all year. Export demand has been uneven and was low last week. Export demand has been an issue for the market all year. Mills are milling for the domestic market in Arkansas and are bidding for some Rice.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oil: Palm Oil was lower on late week buying tied to reduced April ending stocks expectations for Malaysia and on Chicago price action. Selling was seen earlier in the week from news that Indonesia will reduce its domestic supply requirement from 450,000 tons to 300,000 tons before exports can begin. The news means more Palm Oil will be released for export and in competition with Malaysia. Indonesia has not been offering as it tries to build stocks for its own biofuels industry but it is expected to start offering very soon. Indian imports are at a 14-month low. Trends are still sideways on the weekly charts but are up on the daily charts. Canola was higher last week and closed near the top end of the recent trading range on the weekly charts. Trends are up on the daily charts. Brazil is expected to dominate the oilseeds market for the next few months. Reports indicate that domestic demand has been strong due to favorable crush margins. It is very dry in the Canadian Prairies, and especially in western sections. Producers want to plant but are hoping for some moisture. Only isolated showers are in the forecast.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was higher again on Friday on a stronger-than-expected weekly export sales report that was released Thursday morning and on chart patterns. Trends are now up on the daily charts but are still mixed on the weekly charts. The report showed strong demand from just about all major buyers of US Cotton and was a sign that prices had gotten cheap enough. Forecasts for rain are still showing in forecasts for West Texas but the rains are expected to be lighter and more scattered than last week. The rains last week were spotty so more rain in new areas would be very beneficial. The rains will not solve drought problems but at least producers in the region can get started on fieldwork and hope for better yields this year. Ideas are that the world economic problems were fading into the background as the US stock market has held strong and as the Chinese economy gets better after all of the Covid lockdowns. The Fed raised interest rates by another 0.25% yesterday and there are ideas that the economy might suffer more with the higher interest rates.

Weekly US Cotton Futures

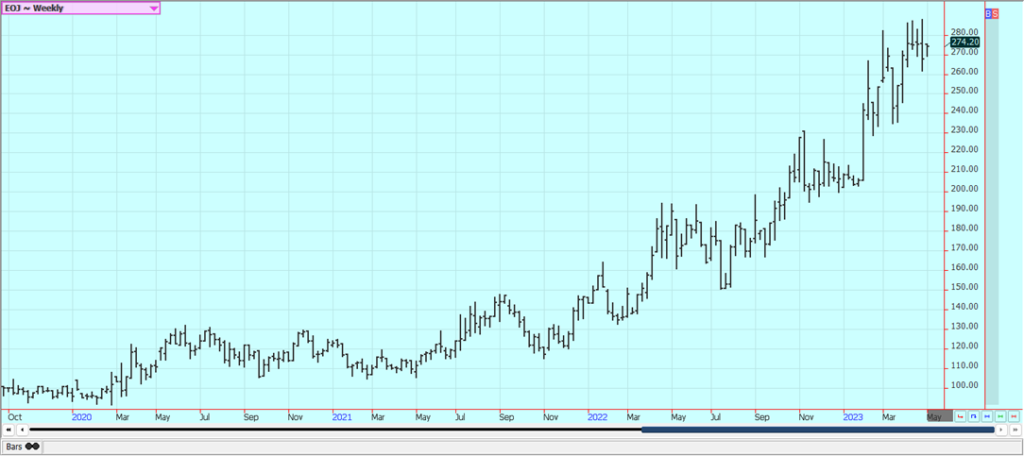

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher on Friday along with most other commodities markets. The charts show a sideways range has developed and futures are near the middle of the range for both the daily and weekly charts. Futures remain supported by very short Oranges production estimates for Florida. Demand is thought to be backing away from FCOJ with prices as high as they are currently, but the market has not taken any note and continues to charge higher. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that has hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and conditions are rated good.

Weekly FCOJ Futures

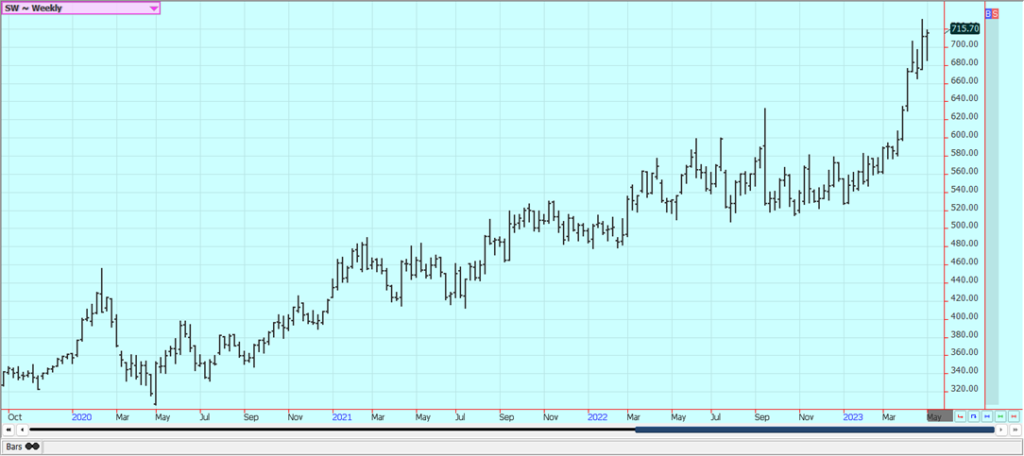

Coffee: New York was a little lower last week and London closed higher and made new highs for the last several years or longer on tight Robusta supplies for the market amid strong demand for Robusta. New York saw speculative selling tied to good weather forecasts for Brazil. The Brazil harvest of Robusta is in full swing and promising to help relieve tight supplies in that market. The Robusta market has been especially tight and has been pushing on the Arabica price, but Arabica supplies are growing tight in the market as well. Producers in Vietnam are said to have almost nothing left to sell and producers in Colombia and Brazil are also reported to be short Coffee to sell. The lack of offers from South America and Vietnam is still supporting prices and reports indicate that demand for Robusta from Vietnam is strong.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

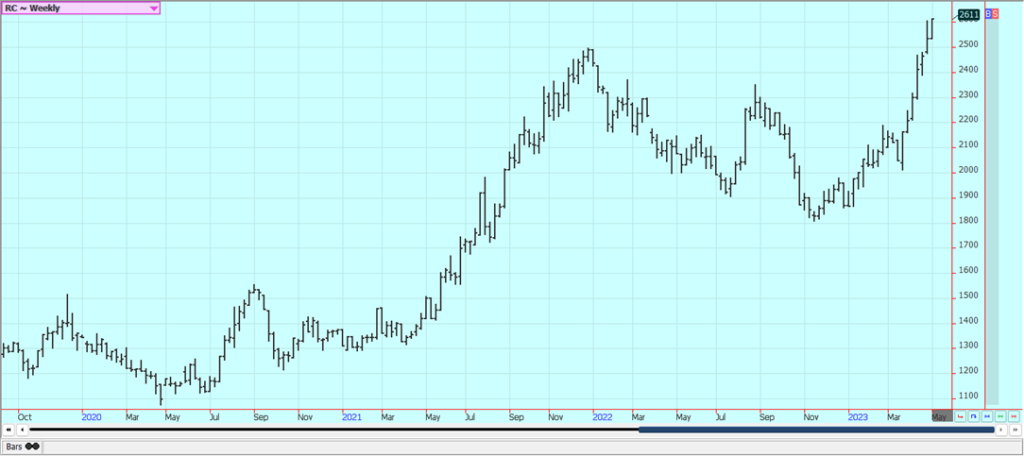

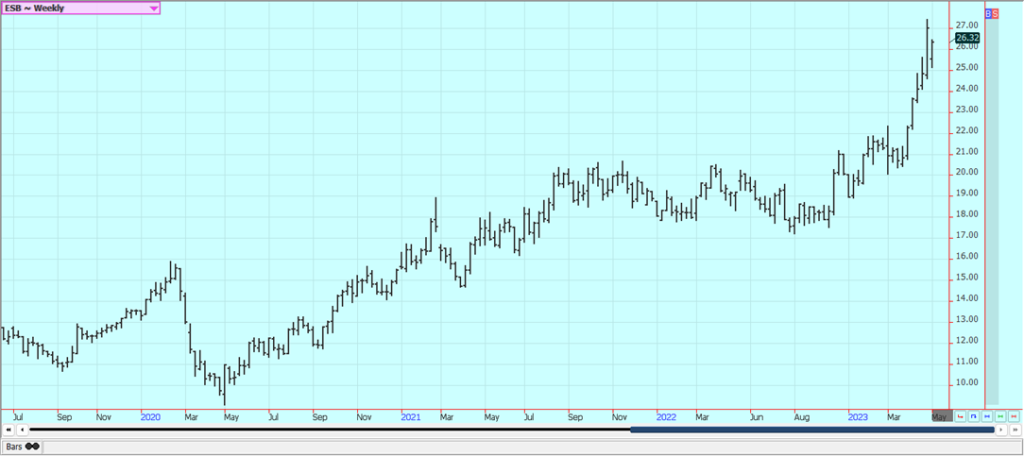

Sugar: New York closed higher last week, and London also closed higher, with the market hurt by good growing conditions in Brazil for New York but supported by tight current supplies. Concern was noted about Chinese demand and the Brazil harvest is now just a few weeks away. The production is not there to meet the demand in many countries, with only Brazil among the major producers looking to have a good crop. Indian production is thought to be less this year as mills are closing early there and Pakistan also has reduced production. Thailand mills are also closing earlier than expected so the crop there might be less. Asian countries could face another year of short production as El Nino returns after years of La Nina. New crop Brazil production is solid this year but is still in the fields. Brazil’s old crop production has been better after mills ran out of cane to crush a year ago. European production is expected to be reduced again this year. Chinese production could be the lowest in six years due to bad growing conditions.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

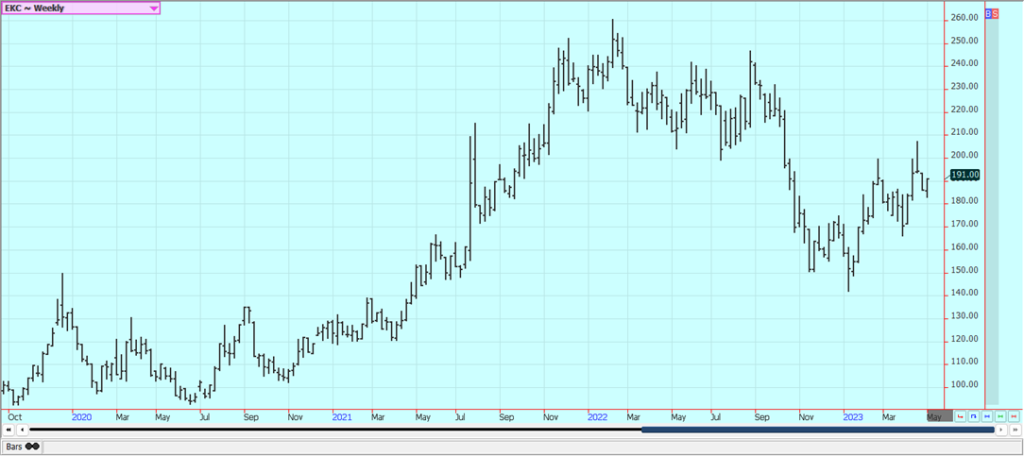

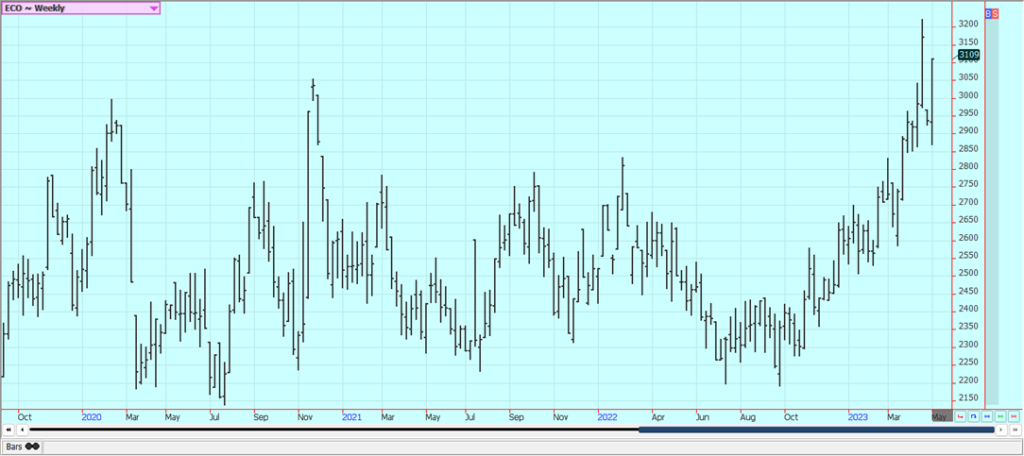

Cocoa: New York posted slight gains and London closed lower last week on ideas of tight supplies based on more reports of reduced arrivals in Ivory Coast. Ivory Coast arrivals are now 1.859 million tons, down 7.4% from last year. The lack of arrivals from West Africa to ports is still important and is supporting futures. The talk is that hot and dry conditions reported earlier in Ivory Coast could curtail main crop production, and main crop production ideas are not strong. Midcrop production ideas are strong due to rain mixed with some sun recently reported in Cocoa areas of the country. The rest of West Africa appears to be in good condition. The weather is good in Southeast Asia

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by PhotoMIX-Company via Pixabay)

DISCLAIMER: This article was written by a third-party contributor and does not reflect the opinion of Born2Invest, its management, staff, or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crypto6 days ago

Crypto6 days agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Biotech3 days ago

Biotech3 days agoSpain Invests €126.9M in Groundbreaking EU Health Innovation Project Med4Cure

-

Crypto2 weeks ago

Crypto2 weeks agoRipple Launches EVM Sidechain to Boost XRP in DeFi

-

Impact Investing6 days ago

Impact Investing6 days agoShein Fined €40 Million in France for Misleading Discounts and False Environmental Claims