Featured

Chinese Sugar Production Could Be the Lowest in Six Years Due to Bad Growing Conditions

New York and London closed higher and made new highs for the move with the market supported by tight supplies once again. Sugar production is not there to meet the demand in many countries, with only Brazil among the major producers looking to have a good crop. Indian production is thought to be less this year as mills are closing early there and Pakistan also has reduced production.

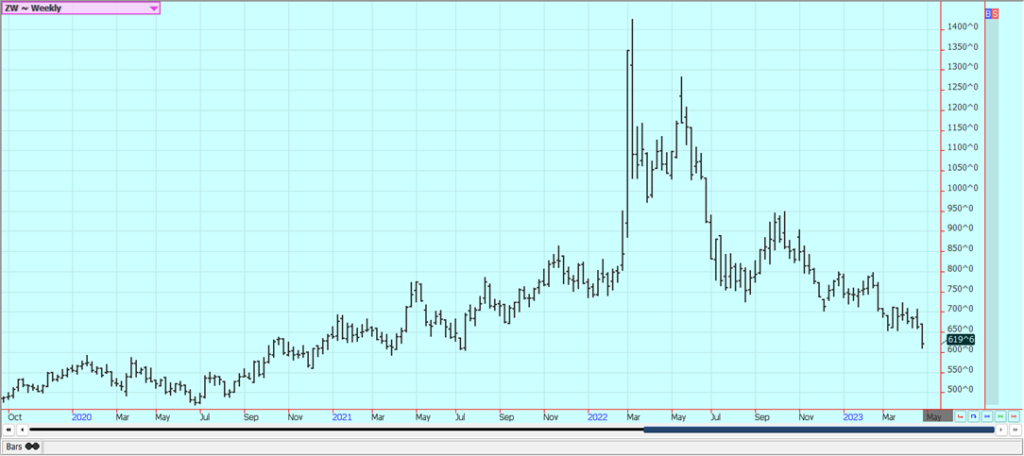

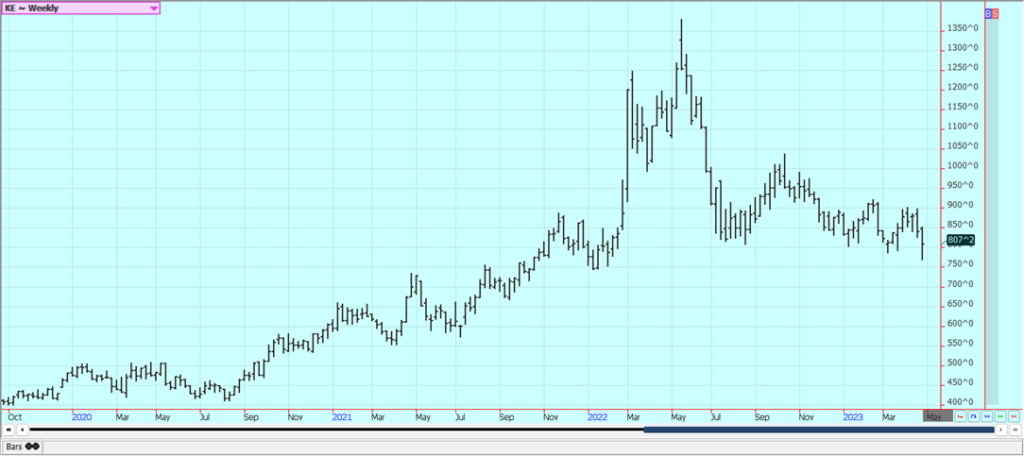

Wheat: Wheat markets were lower again last week on weak demand ideas and on forecasts for rains in dry parts of the western Great Plains. More showers are in the forecast for this week and will be welcome as not all areas got hit last week. The weekly export sales report was bad once again. Uncertainty about the Black Sea Corridor deal continued. The western Great Plains are getting showers and some areas are seeing very beneficial precipitation this week. Russia has said that the current system cannot last and seems ready to kill the deal completely. It has been talking to Turkey about the deal and plans to talk to the UN very soon. Ideas that big Russian offers and cheaper Russian prices would be a feature for a while in the world market were the driving force for the weaker prices. Ideas are that both Australia and Russia are harvesting record to near-record Wheat crops this year. Both countries will have a lot of Wheat to export.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

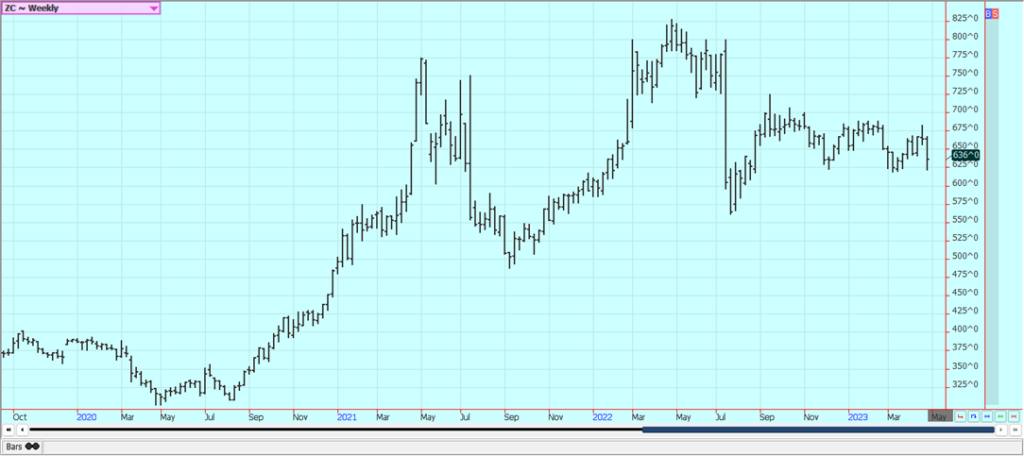

Corn: Corn and Oats closed lower again last week, with Corn still finding some support from little US producer selling interest but getting hurt from little commercial and export buying interest. The export sales report was bad and China canceled purchases again. Oats were lower and both markets started to form new legs down on the weekly charts. The weather was wet and cool in the Midwest last week and producers were not selling Corn, but the market wants Corn now. It is now wet and cold in the Midwest, but producers are still inclined to wait and might have trouble sourcing trucks to haul grain, anyway. Most are thinking about getting into the fields and are not even worried about the market. US prices are currently very competitive with those from South America as Brazil concentrates on Soybeans exports and not Corn and US demand has improved because of the price differentials and the lack of a Brazil offer into the market. This trend should continue for the next few months. NOAA is forecasting that La Nina will develop this Summer and replace El Nino. US growing conditions are usually good when this happens.

Weekly Corn Futures

Weekly Oats Futures

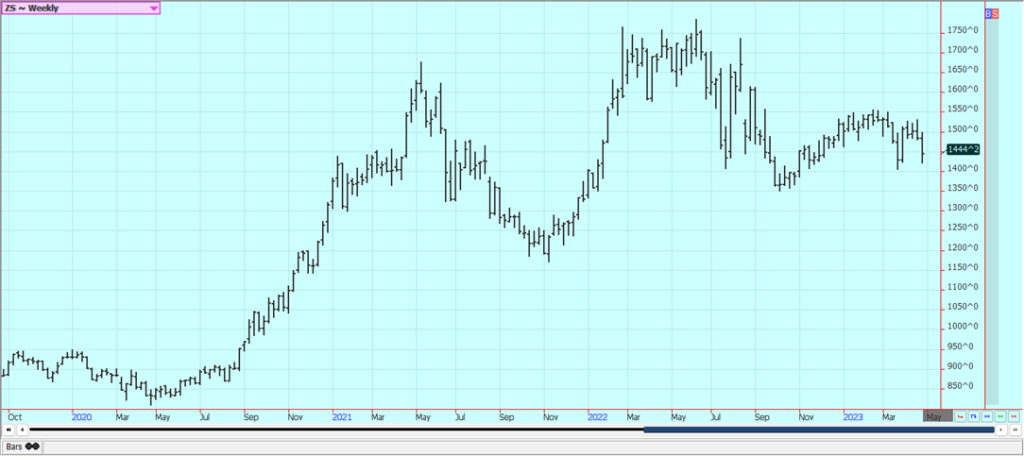

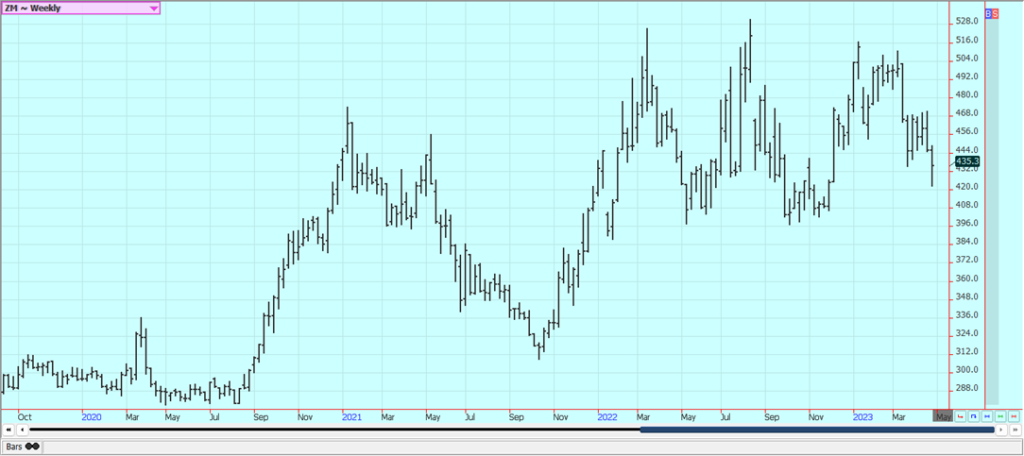

Soybeans and Soybean Meal: Soybeans and the products were lower last week on selling tied to reports that Brazil basis levels are so low that some American processors can import more cheaply than buying from US producers and shipping by rail. Brazil has been selling a lot of Soybeans to China to feed its record Soybeans demand. Brazil has a very good crop, but the additional Soybeans grown in Brazil will be partially wiped out by the losses in Argentina. Argentina has been forced to import from Brazil to keep its crushing facilities operating. The US might sell to China for storage purposes as well and could pick up some new business from countries other than China as Brazil ports will be loaded with ships bound for China. The US has also bought Soybeans in Brazil this year due to the extreme differences in prices. Production ideas in Argentina are no higher than 25 million tons, about half a crop, and are mostly lower than this amount. Forecasts from NOAA for very good growing conditions in the Midwest were also a factor, but there is too much rain in most growing areas right now.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

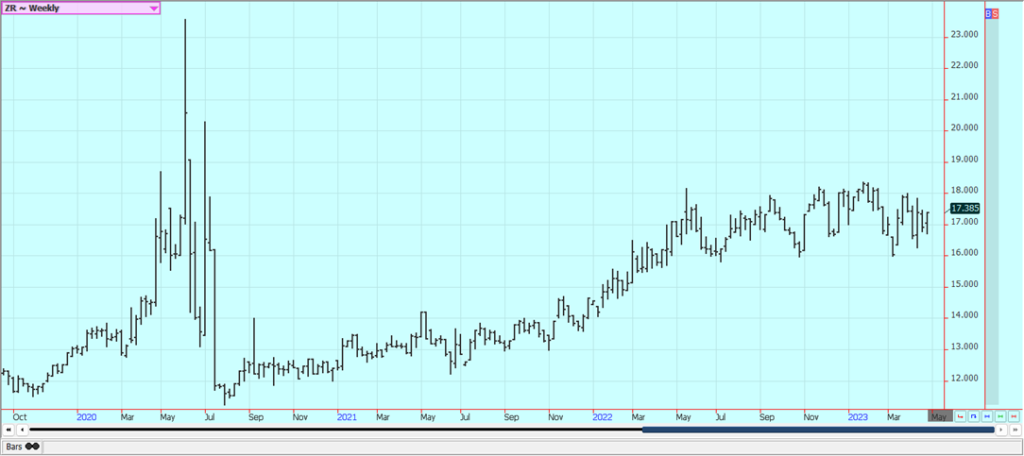

Rice: Rice was higher last week as big buying hit the pit on Friday after news that major commercial Bunge had taken just about all of the First Notice Day deliveries. Futures had traded in a relatively narrow range previously in the week. Trends are turned up on the daily charts with the price action on Friday. Offers seem hard to find right now, but demand has been a problem all year. Export demand has been uneven and was low last week. Export demand has been an issue for the market all year. Mills are milling for the domestic market in Arkansas and are bidding for some Rice.

Weekly Chicago Rice Futures

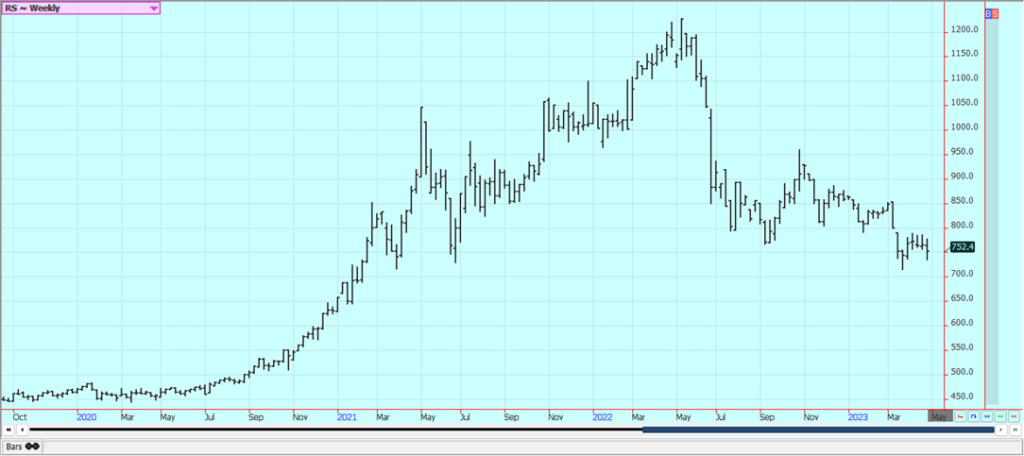

Palm Oil and Vegetable Oils: Palm Oil was lower on late week selling from news that Indonesia will reduce its domestic supply requirement from 450,000 tons to 300,000 tons before exports can begin. The news means more Palm Oil will be released for export and in competition with Malaysia. There are ideas that prices can remain elevated due to bad weather in Malaysia but demand remains weaker than hoped for from India and China. In fact, exports so far this month are down about 25% from last month. Indonesia has not been offering as it tries to build stocks for its own biofuels industry but it is expected to start offering very soon. Trends are still sideways on the weekly charts but are down on the daily charts and the daily charts now look oversold. Canola was lower last week on weakness in Chicago. Trends are sideways on the daily and weekly charts. Brazil is expected to dominate the oilseeds market for the next few months. Reports indicate that domestic demand has been strong due to favorable crush margins.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was higher last week on what appeared to be speculative short covering and some commercial buying amid improved export sales. The US stock market was higher on ideas of a solid economy that could benefit Cotton demand. Forecasts for rain are showing in forecasts for West Texas. The rains last week were spotty so more rain in new areas would be very beneficial. The rains will not solve drought problems but at least producers in the region can get started on fieldwork and hope for better yields this year. Ideas are that the world economic problems were fading into the background as the US stock market rallied. Chart trends are sideways or down. Chinese buying should stay strong as the country improves economically as it opens up from the covid lockdowns. Chinese CPI data was market positive this week.

Weekly US Cotton Futures

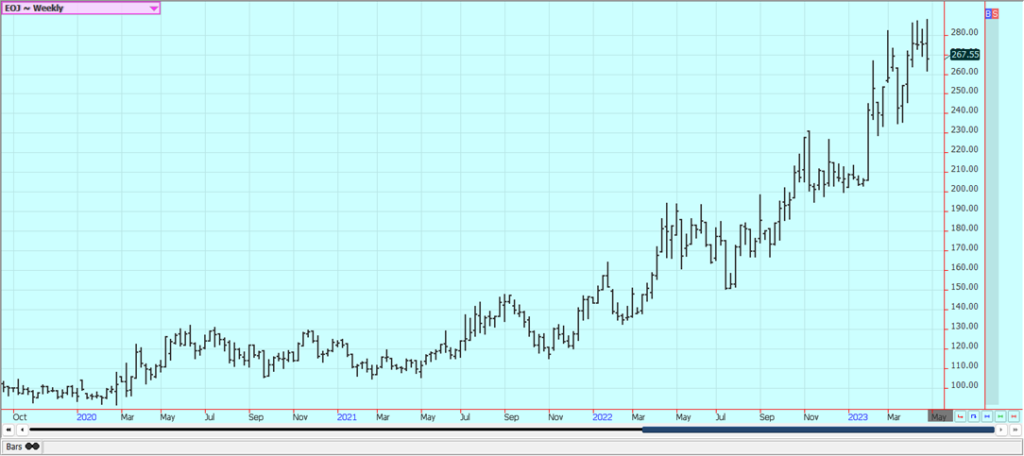

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week on what appeared to be follow-through speculative long liquidation combined with new commercial selling. Futures remain supported by very short Oranges production estimates for Florida. Demand is thought to be backing away from FCOJ with prices as high as they are currently, but the market has not taken any note and continues to charge higher. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and conditions are rated good.

Weekly FCOJ Futures

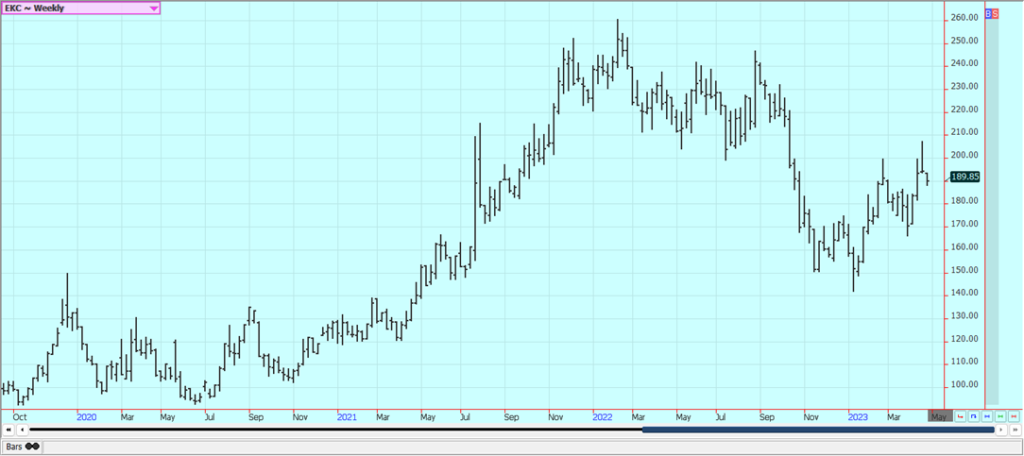

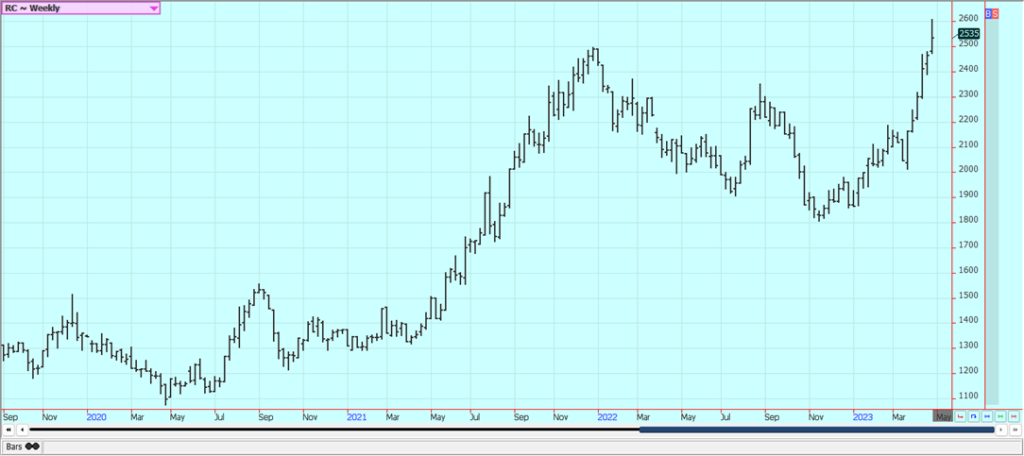

Coffee: New York was a little lower last week and London closed higher and made new highs for the last several years or longer on tight Robusta supplies for the market amid strong demand for Robusta. New York saw speculative selling tied to good weather forecasts for Brazil. The Brazil harvest of Robusta is in full swing and promising to help relieve tight supplies in that market. The Robusta market has been especially tight and has been pushing on the Arabica price, but Arabica supplies are growing tight in the market as well. Producers in Vietnam are said to have almost nothing left to sell and producers in Colombia and Brazil are also reported to be short Coffee to sell. The lack of offers from South America and Vietnam is still supporting prices and reports indicate that demand for Robusta from Vietnam is strong.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

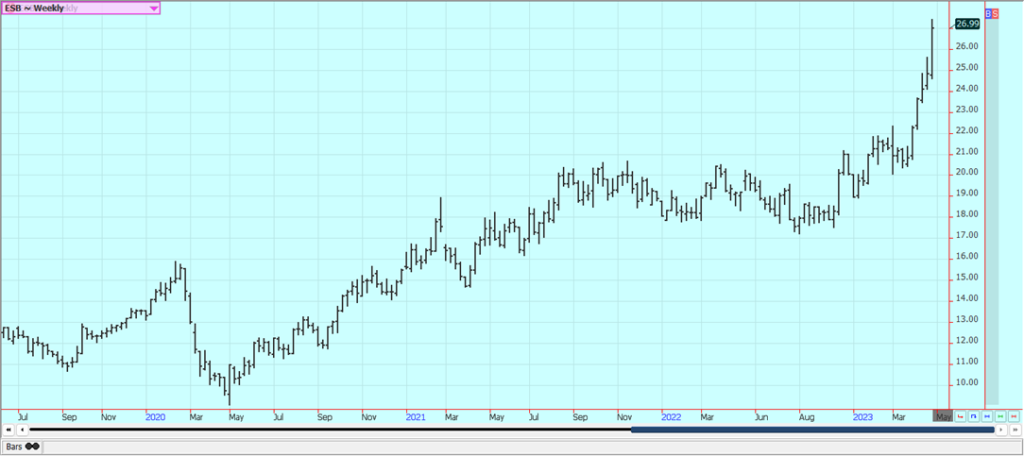

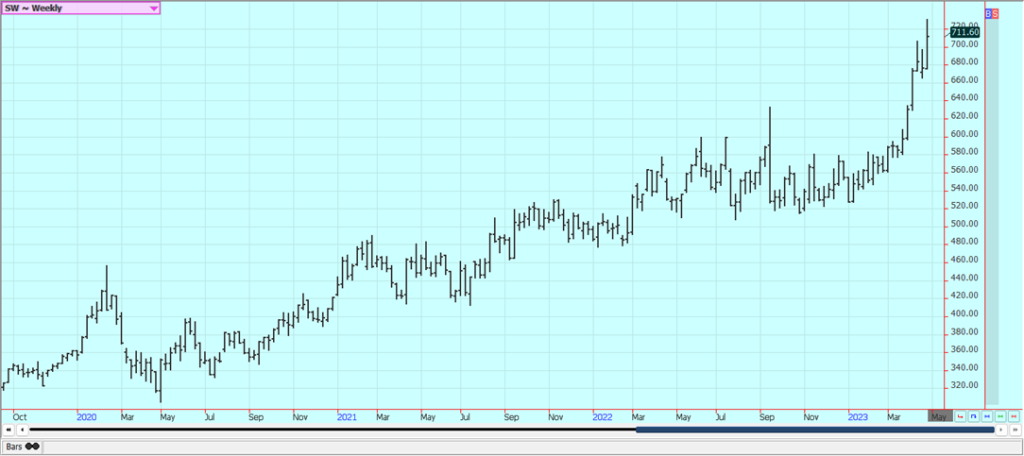

Sugar: New York and London closed higher and made new highs for the move with the market supported by tight supplies once again. The production is not there to meet the demand in many countries, with only Brazil among the major producers looking to have a good crop. Indian production is thought to be less this year as mills are closing early there and Pakistan also has reduced production. Thailand mills are also closing earlier than expected so the crop there might be less. Asian countries could face another year of short production as El Nino returns after years of La Nina. New crop Brazil production is solid this year but is still in the fields. Brazil’s old crop production has been better after mills ran out of cane to crush a year ago. European production is expected to be reduced again this year. Chinese production could be the lowest in six years due to bad growing conditions. Brazil will grow 637.1 million metric tons of sugarcane, Conab said in its first report for the season on sugar cane, sugar, and ethanol production. In the 2022-2023 growing season Brazil grew 610.1 million tons of cane. Sugar production will reach 38.8 million tons and the country’s mills will produce a total of 33.2 billion liters of ethanol in the current season. Center-south mills crushed 13.6 million metric tons of cane in the period, an increase of 157% from the same period a year earlier, Unica said Thursday. They produced 541,900 tons of sugar, up 313%, and made 768 million liters of ethanol, an increase of 95%.

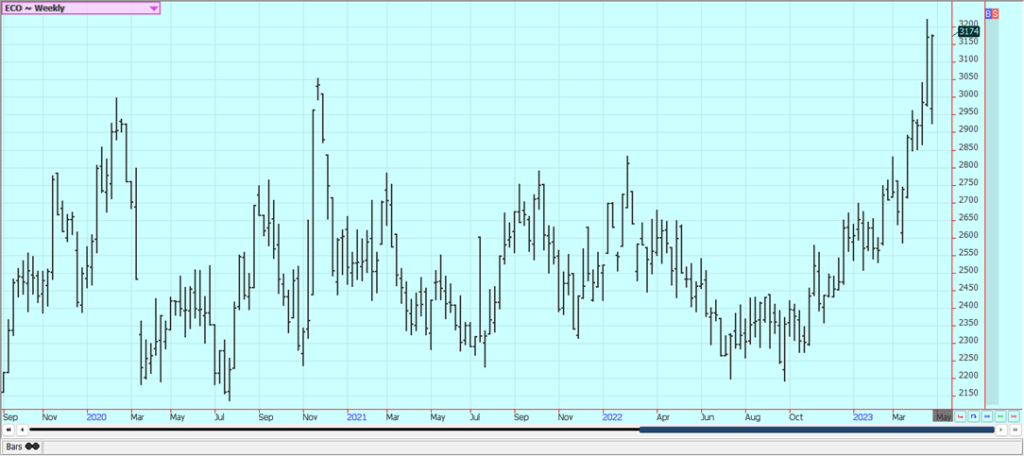

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

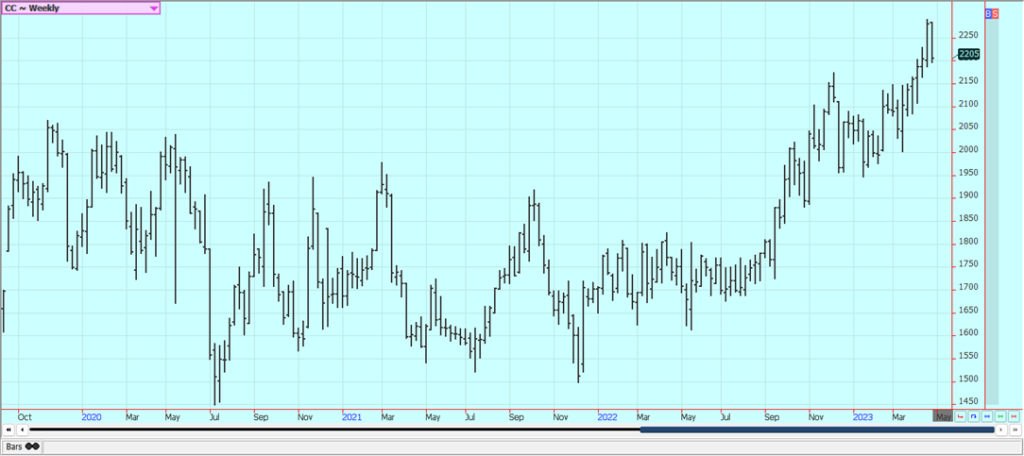

Cocoa: New York posted slight gains and London closed lower last week on ideas of tight supplies based on more reports of reduced arrivals in Ivory Coast. Ivory Coast arrivals are now 1.859 million tons, down 7.4% from last year. The lack of arrivals from West Africa to ports is still important and is supporting futures. The talk is that hot and dry conditions reported earlier in Ivory Coast could curtail main crop production, and main crop production ideas are not strong. Midcrop production ideas are strong due to rain mixed with some sun recently reported in Cocoa areas of the country. The rest of West Africa appears to be in good condition. The weather is good in Southeast Asia

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Faran Raufi via Unsplash)

DISCLAIMER: This article was written by a third-party contributor and does not reflect the opinion of Born2Invest, its management, staff, or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Biotech5 days ago

Biotech5 days agoPfizer Spain Highlights Innovation and Impact in 2024 Report Amid Key Anniversaries

-

Cannabis2 weeks ago

Cannabis2 weeks agoGermany’s Cannabis Crossroads: Progress, Profits, and Public Concern

-

Markets11 hours ago

Markets11 hours agoStock Markets Surge Amid Global Uncertainty, But Storm Clouds Loom

-

Cannabis1 week ago

Cannabis1 week agoAurora Cannabis Beats Expectations but Faces Short-Term Challenges