Business

Cotton sees strong export sales while coffee prices could rise in coming weeks

Reports may have underestimated the demand for cotton.

Cotton last week moved higher in the market as export sales were strong and demand improved. Meanwhile, coffee prices could rise in the next few weeks.

Wheat

US markets closed slightly lower again in Chicago last week as demand from the export market remains a big problem. Futures also closed lower in Minneapolis, but higher in Kansas City. The export sales report was weak last week and this is a big problem for the market as US prices are reported to be competitive in the world market. The weekly charts show that winter wheat price trends remain down, although Kansas City could be forming a low area.

The weather in the US could become a more supportive factor for prices this week. The market is noting dry conditions in western Kansas and other parts of the western Great Plains and the La Nina Winter weather forecast. It will turn very cold in the Great Plains this week as temperatures could easily drop below freezing in most production areas. The crop has not established itself well due to the dry weather, and some winterkill is possible. The dry weather forecast means that there will be no snow cover to protect the crops from the cold, and some losses are possible. The current very warm weather means that none of the crops is dormant to gain some protection that way, so the crop should be more vulnerable than normal.

Crop condition ratings for winter wheat in the region have started to move lower, and the ratings should continue to drop unless the weather starts to improve. The market continues to be worried about Russia and its ability to control the world Wheat offer and price. Russia is still exporting a lot of Wheat and has said that it expects another very big crop as the weather going into dormancy in winter wheat areas has been very good.

World estimates, in general, remain large and US offers will need to be low to take business. However, the market is noting some excessive rains in Australia and it is possible that crops there suffer from quality and yield loss. It will be another small US crop as farmers continue to reduce planted area year after year in response to the low world and US prices.

Weekly Chicago Soft Red Winter Wheat Futures ©Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures ©Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures ©Jack Scoville

Corn

Corn closed slightly higher last week and Oats closed lower. Some speculative buying was seen in Corn as funds and other large speculators hold the record or near record short positions in this market. The trade is also looking at the potential for dry weather to develop in southern Brazil and Argentina. Some light showers were reported in the drier areas of both countries over the weekend, but forecasts call for dry weather again this week and maybe for the next few weeks.

Ideas for big supplies and less than great demand keep pulling the market down fundamentally, but it has been the funds who have established a huge and near record short position in futures. Farmers are not selling much corn even in the last part of the harvest due to weak basis and futures price levels. Basis levels have improved, but farmer offers remain down due to the weaker futures prices.

Corn planting is reported to be active in Argentina and southern Brazil. Not much selling is reported in South America. La Nina has started and could create dry weather in South America that could really hurt yields. It is common for Argentina and southern Brazil to have drought in La Nina years, so the weather in these areas will be watched carefully. The trends remain down in Oats and a test of the 235 December area is possible. March futures could test support below the 250 area.

Weekly Corn Futures ©Jack Scoville

Weekly Oats Futures ©Jack Scoville

Soybeans and Soybean Meal

Soybeans and soybean meal were higher for the week on seasonal considerations. Soybean oil was lower on disappointment in the EPA decision to continue biofuels mandates at unchanged to slightly higher levels. The market had hoped for increased levels, but it was just a few weeks ago that EPA tried to change the requirements in a way that would have reduced overall demand for corn and soybean oil. This move was rebuffed in Washington, but EPA is not really moving to increase biofuels use in the near term.

Soybeans have been stronger due to fears of potential crop losses in southern Brazil and Argentina. It has been generally dry in both areas, although Argentina got some light precipitation over the weekend. Dry forecasts are in the future for both areas now and there are no real forecasts for relief for at least the next week and maybe longer. The fundamental reason for soybeans to work lower was fears of reduced Chinese demand and ideas of improved planting conditions in Brazil and the big production last year in South America that has had Brazil offering for the entire year. Brazil has been able to capture more business that otherwise would have gone to the US due to the huge crop last year.

China might be forced to reduce demand as the government is making it harder to get safety permits. Some GMO Soybeans have made it into the human food chain, and this news has caused the government to slow the process until it can identify the problems. It is wetter in the north of Brazil and drier to the south and into Argentina and planting speed has been increased. Soybeans have found significant selling on rallies above $10.00 per bushel.

Weekly Chicago Soybeans Futures ©Jack Scoville

Weekly Chicago Soybean Meal Futures ©Jack Scoville

Rice

Rice closed higher for the week in mostly light volume trading. It was another strong week of export sales, with over 75,000 tons sold into the world market. This good demand has been noted and reflects better US quality and less competition in the western hemisphere. Mercosur countries have had less to offer, and the US has benefitted from the reduced competition. Futures had been very undervalued in relation to the US domestic cash market. Futures and cash markets are now much more in line with each other, so upside potential might be limited in the short term.

The volumes traded are on the light side and reflect the slow domestic cash market. Rice is reported to be mostly sold already in Texas and Louisiana and has been getting sold in other states. Farmers now are more interested in hunting or holiday activities and so buying paddy rice inside the US will be difficult. The Delta harvest is over and farmers are holding out for higher prices. The charts show that futures are now close to some big resistance areas.

Weekly Chicago Rice Futures ©Jack Scoville

Palm Oil and Vegetable Oils

World vegetable oils prices were lower again last week, and trends in all three futures markets are down. The US EPA failed to increase mandated production levels for biofuels in its announcements last week, and this was considered another bit of bad demand news for a market sector that needs some new demand to appear. The export demand for palm oil has been suffering due to reduced demand from India. India is the largest importer of vegetable oils in the world and buys a lot of palm oil and soybean oil. Private sources reported weaker exports from Malaysia for November.

Canola has held better than palm or soybean oil, but trends turned down last week. It has turned cold in the Prairies and the harvest is about over, so farmers are not as willing to sell. However, deliveries to elevators have been strong due in part to forward selling earlier in the year. Farmers in the US are not selling a lot of soybeans, either, and prices are starting to turn higher.

US demand for soybean oil in biofuels should remain strong as the US moved to put punitive tariffs on imports from Indonesia and Argentina. Both countries are fighting these moves, and the process is moving to the courts in proceedings that should begin in the next couple of weeks. A final decision from the courts and then a real solution to the issue will likely take some time to be found.

Weekly Malaysian Palm Oil Futures ©Jack Scoville

Weekly Chicago Soybean Oil Futures ©Jack Scoville

Weekly Canola Futures ©Jack Scoville

Cotton

Cotton was higher again last week in response to another week of strong export sales and on ideas that overall demand has been underestimated. The market is now pushing to test spike highs on the weekly charts at 7615 basis the nearest futures contract. The futures market is watching the harvest roll along and is debating the demand for the US and world cotton.

Harvest weather has generally been dry and warm, so producers have had good conditions to pick the last quarter of the crop. It will turn very cold in Texas this week to make harvesting more difficult. The cotton quality has been dropping as the harvest moves forward, and the lower quality seems to be the biggest effects from the hurricanes seen during the growing season and then the freeze in the west at the tail end of the growing season.

Some traders say that USDA is seriously underestimating demand for the fiber, while the others look to the high USDA ending stocks estimates and suggest that any demand can be easily met. Farmers are reported to be quiet sellers right now. Harvest conditions are good in just about all areas.

Weekly US Cotton Futures ©Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ closed lower again last week and short-term trends are turning down on the charts. However, the downside potential might be limited. The small crop in Florida continues to impact the market as prices overall remain strong. Attention will turn to the next round of USDA reports that will be released in just over a week. Production was lower again at 50 million boxes in the most recent USDA reports and the market had held strong ever since. The report once again highlighted the damage from the hurricane this year, and ideas are that production in coming reports will drop even more.

Brazil weather remains good as groves are now getting rains, but suffered from drought at the flowering time. It was also very hot and it is possible that production from Sao Paulo state will be less. The weekly charts indicate that higher prices are possible. Trees in Florida that are still alive now are showing fruits of good sizes, although many have lost a lot of the fruit. Florida producers are actively harvesting what is left as cleanup from the hurricane is about over now. Deliveries are being made to fresh fruit packers and to processors.

Weekly FCOJ Futures ©Jack Scoville

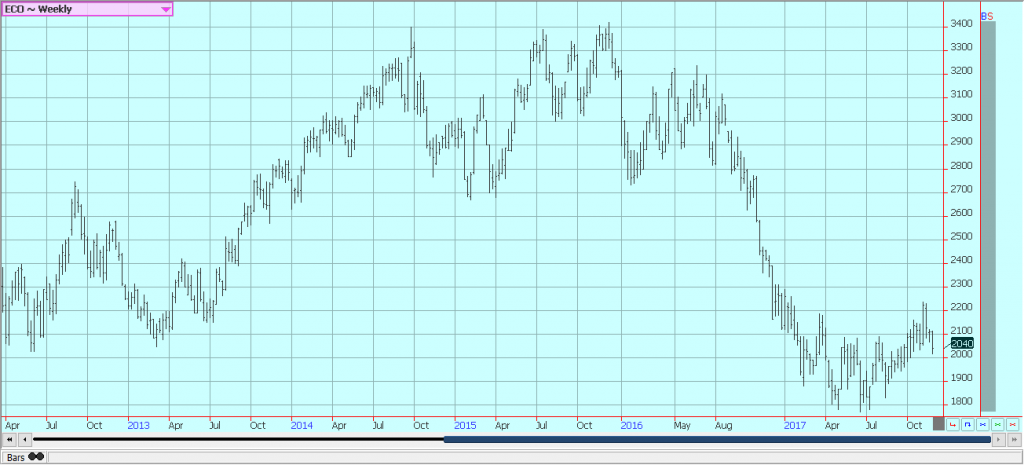

Coffee

Futures were a little higher in New York and lower in London last week. The trends are sideways on the charts in New York as traders look at the potential for a big crop in Brazil. The daily and weekly charts still imply that New York is about to complete a bottom and that prices could move higher for the next few weeks. The key resistance lies at about the 130.00 area on the weekly charts.

London trends are down on fears of big production about to come into the market from Vietnam, but the offer has been slow to develop and is not likely to appear now until futures show at least a small move higher. The Brazil weather and tree condition is the main fundamental reason for movement in New York prices and could become the major reason to buy the market soon. Rains have been improved in the last few weeks in Arabica areas, and many areas are reporting good conditions now after the earlier stress caused by the cold and dry winter.

The rains will need to continue and be in good amounts as it has been very dry and trees have been stressed for a year or more in some cases. Some were stressed after the production last year, while others suffered due to the dry and cold winter. Improved weather now could mean a very good crop, although most likely not a huge crop of over 50 million bags. There is just too much stress to trees and pruning of dead material from trees caused by the stress to allow for a very big production. Cash market conditions in Central America are more active as the harvest continues. Differentials have been stable. Colombian differentials have been stable.

Weekly New York Arabica Coffee Futures ©Jack Scoville

Weekly London Robusta Coffee Futures ©Jack Scoville

Sugar

Futures were lower as ideas of big supplies continue to be heard. However, the buying due to ideas of expanded ethanol production from sugarcane in Brazil continue to support the market overall. New York closed at the lower end of the range and could start a correction trade this week. London chart patterns are mixed. The market is rallying as mills in Brazil have decided to make more ethanol as world crude oil and products prices have turned very strong.

Ideas are that these prices can continue strong as OPEC and Russia have agreed to keep production constrained compared to world demand. Bullish petroleum traders say that the fracking industry can’t pick up the slack quickly enough to avoid higher prices for at least the short term. Brazil is importing US ethanol to make up for short production, so the move by sugar mills in Brazil to supply the local ethanol market instead of the world sugar market makes economic sense.

The Brazil government moved to support ethanol production through some new laws last week. The move comes even as the ISO now estimates the world Sugar production surplus at 5 million tons for the year. There does not seem to be any big sugar demand. Upside price potential is limited as there are still projections for a surplus in the world production, and these projections for the surplus seem to be bigger.

Weekly New York World Raw Sugar Futures ©Jack Scoville

Weekly London White Sugar Futures ©Jack Scoville

Cocoa

Futures closed lower for the week in both markets, and trends are starting to turn down as the West African harvest hits the market. Prices remain strong overall and have held an important support area on the weekly charts in response to positive demand news from as the North American and the European grind data released last month, but the uptrend faltered again last week and a return to the trading range seen for several months might be coming.

World production ideas remain high. Harvest reports show good to very good production will be seen this year in West Africa. Ghana and Ivory Coast expects a very good crop this year. However, there have been some reports in Ivory Coast that diseases are hitting the crops and could reduce output in the end. These reports have been factored into the price for now. Farmers have invested less in chemicals to protect and nourish crops due to low prices. Nigeria and Cameroon are reporting good yields and also good quality. The growing conditions in other parts of the world are generally good. East Africa is getting better rains now. Good conditions are still seen in Southeast Asia.

Weekly New York Cocoa Futures ©Jack Scoville

Weekly London Cocoa Futures ©Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Business1 day ago

Business1 day agoEchoes of 1929: Inflated Valuations and Warning Signs in Today’s Dow

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Impact Investing6 days ago

Impact Investing6 days agoOceanEye: EU Launches €50 Million Initiative to Strengthen Global Ocean Monitoring

You must be logged in to post a comment Login