Business

Weak petroleum futures pull down cotton demand, lowered sugar prices

Poor petroleum futures have affected the commodities market in the past week. Cotton had improved sales in China while there are plenty of sugar supplies.

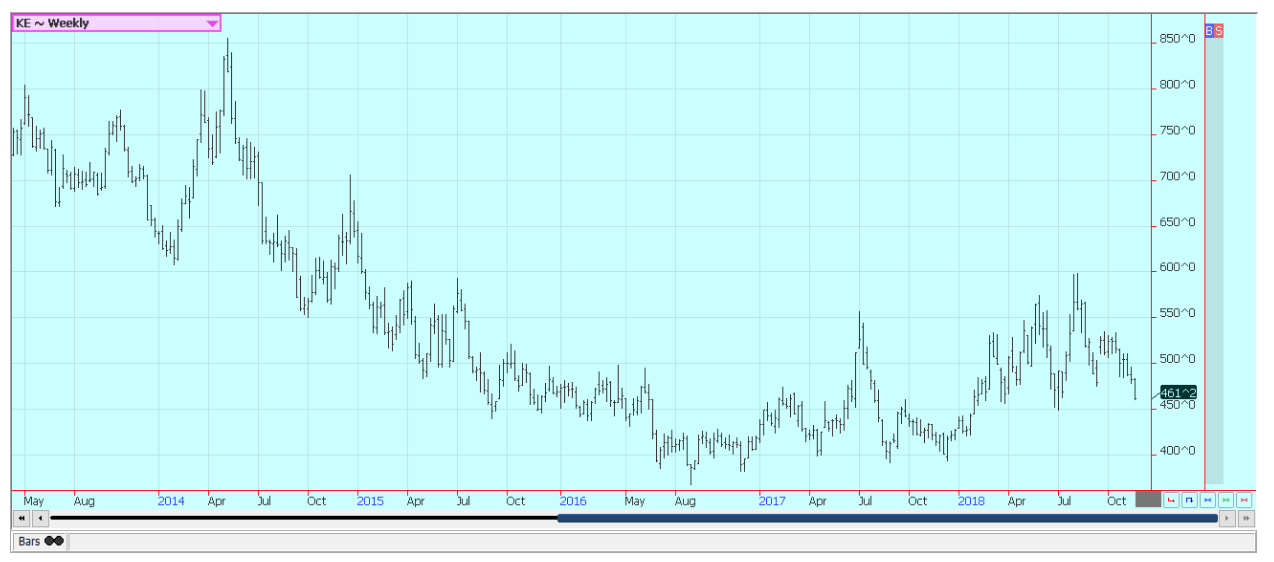

Wheat

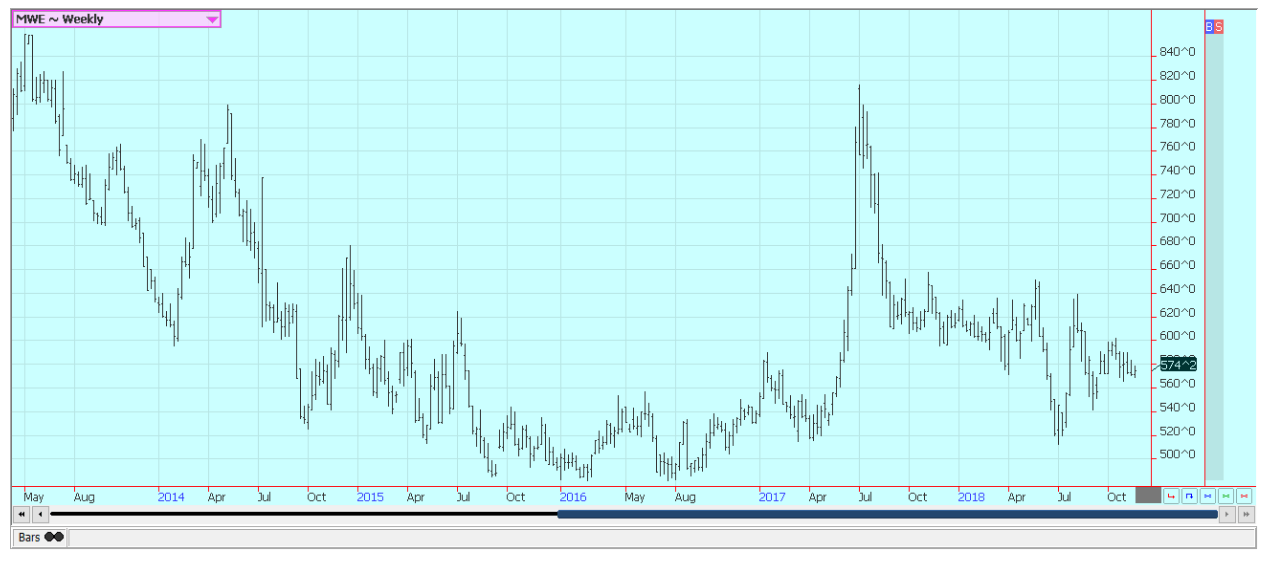

Wheat was lower for the week in both Chicago Winter Wheat markets, while Minneapolis Spring Wheat closed slightly higher. The price weakness came despite new purchases of US SRW by Egypt and new purchases of US wheat by Tunisia.

Traders noted the wide spread in offers for wheat from Russia and said it was an indication that exporters are having more problems sourcing wheat from Russian producers. The new demand was welcome news as the weekly export sales report was routine and not considered bullish to the market.

Meanwhile, planting of the Winter Wheat crops in the US has been delayed due to bad weather. Too much rain and too much cold weather has made getting the crop in and established timely very difficult. These problems have shown up in the weekly crop progress reports, but not in the condition reports. Crop condition for the new Winter Wheat has been on par with last year and the five-year average. A new update will be issued later today.

World crop reports continue to indicate less production and tightening supplies. Firm prices extend from Russia to Australia on reduced world production, although Russia showed the potential for strong exports this year. It remains very dry in Australia, although some eastern areas have seen some rain and conditions are called generally good in the west.

It is reported to be wet and cold in Siberia for the Spring Wheat harvest there, and planting conditions are reported to be dry near the Black Sea. The Spring Wheat harvest in Siberia has been delayed due to snow storms.

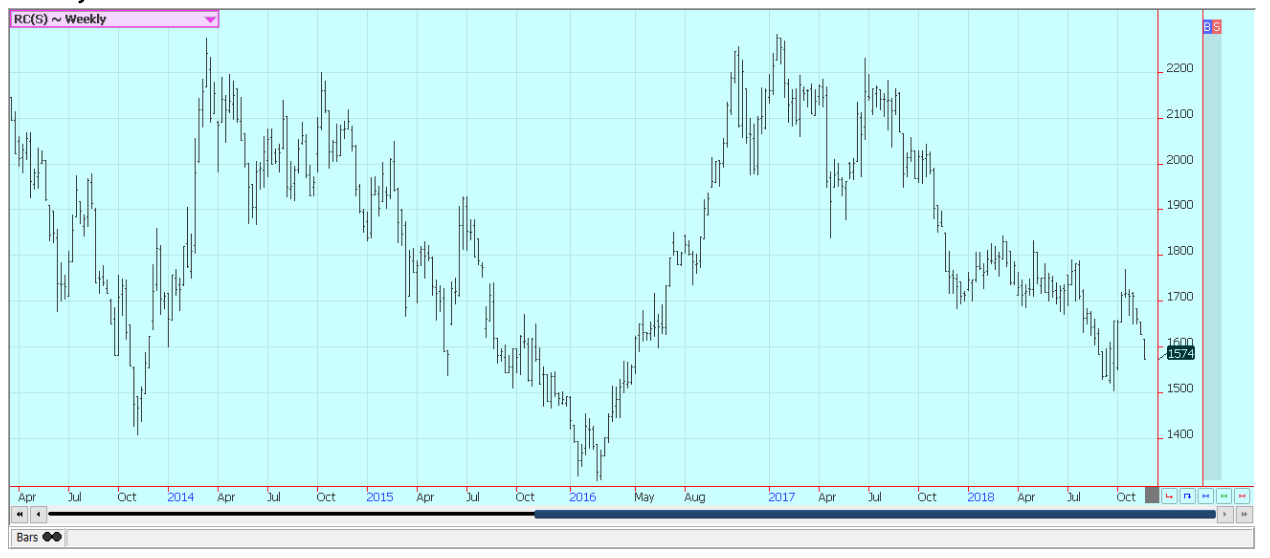

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

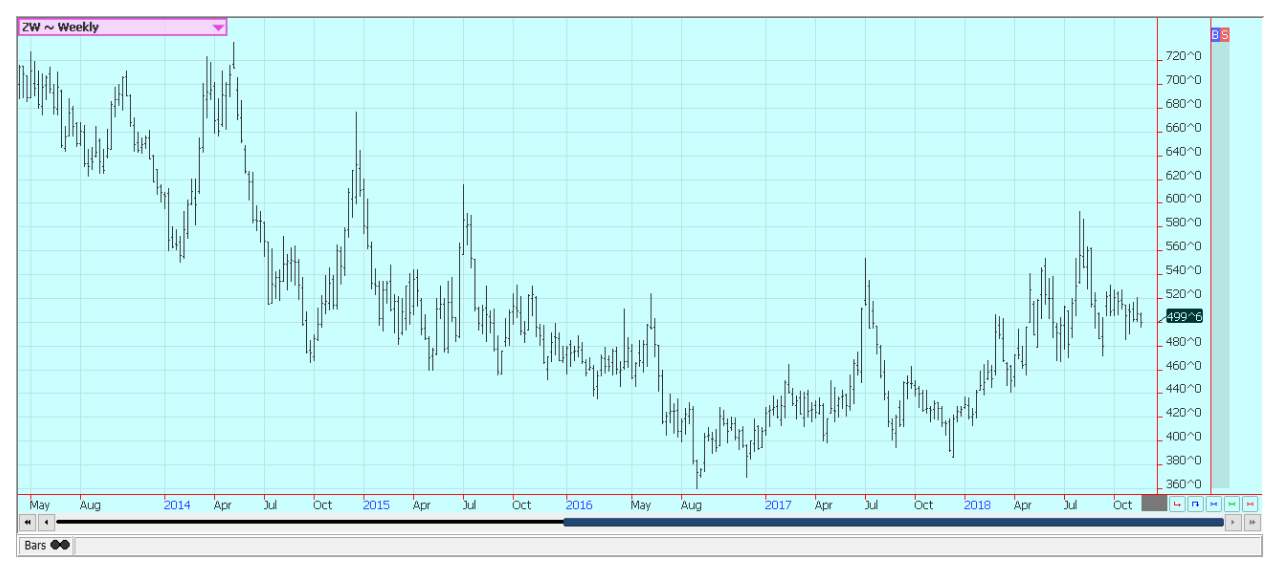

Corn

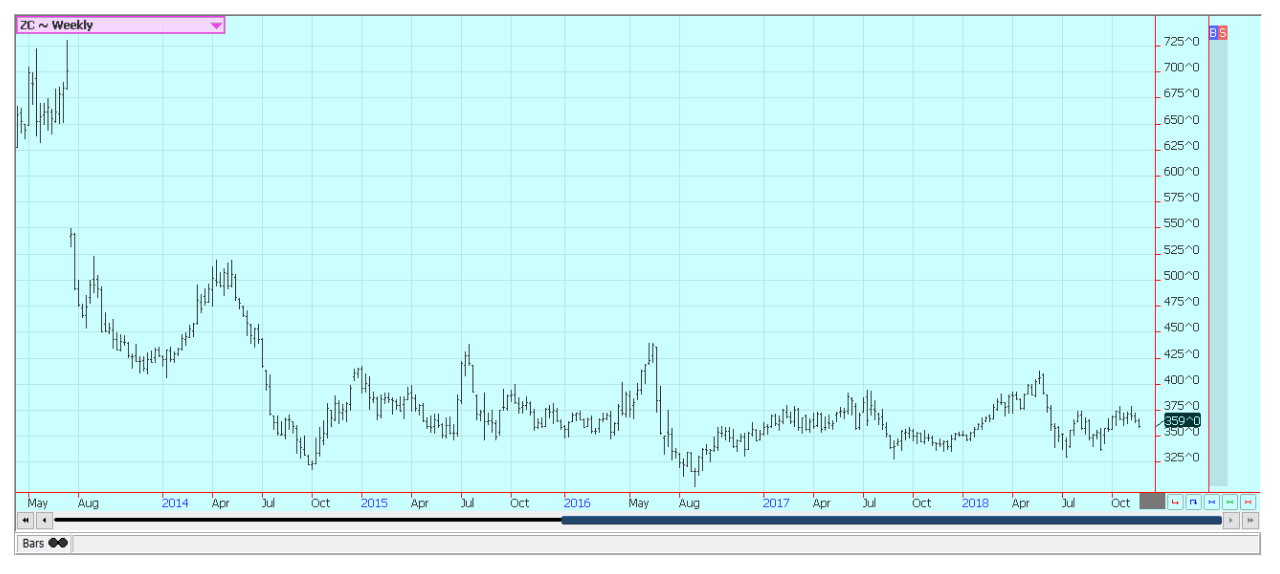

Corn was lower for the week and trends are down on both the daily and weekly charts. The daily charts point to moves to about 355 December and then 342 December, while the weekly charts show initial targets of about 346 basis the nearest contract.

Export demand as noted in the USDA weekly sales reports was in line with expectations but not real strong. The market also has started to worry about ethanol demand. This demand has held up, but crude oil futures have been in a free fall since the beginning of October, and there are concerns that ethanol prices might start to be too high for the blenders here and overseas.

The weather in the Midwest was not very good for harvesting over the long holiday weekend. The temperatures finally moderated from some extreme cold levels for this time of year, but precipitation was noted, including some snow for Iowa and northern Missouri that extended into parts of northern Illinois. The snow could cause some delays to whatever is left to be harvested in these areas.

USDA was to release one more estimate of harvest progress on Monday to give everyone an idea of how much corn might not get harvested or get harvested timely. Planting progress in southern Brazil is reported to be ahead of the normal pace.

Argentine planting progress is in line with its average pace. The Brazil Corn will most likely stay in the country as the short crops last year led to shortages and imports. Brazil could still be forced to import more corn from Argentina in the near term as well. Brazil is not expected to be a player in corn in the world market until the Winter crop becomes available in the middle of next year.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

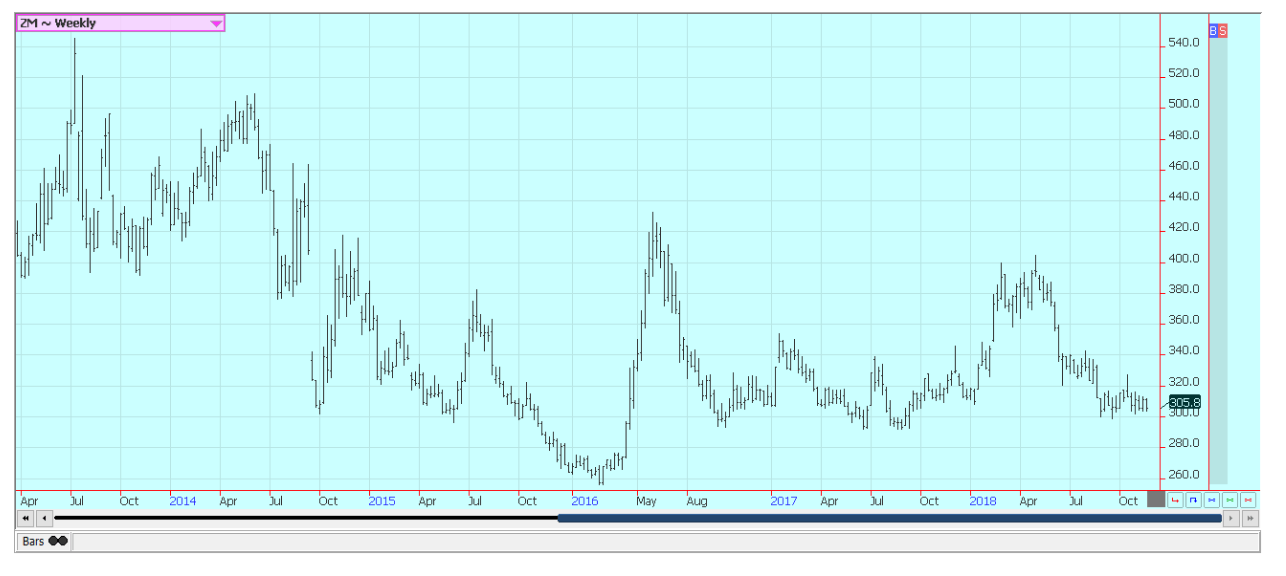

Soybeans and soybean meal

Soybeans and soybean meal were a little lower last week. The market is being held hostage by the tariff wars between the US and China. China has refused to buy US soybeans due to the trade disputes, and the US farmer has suffered. He is getting prices much lower than other world sellers even though the US export sales pace has been respectable. The problem is that this is the time when China had sourced soybeans from the US and sales reports are usually very strong. Plus, the US had a huge crop this year as producers anticipated stronger prices and strong Chinese demand. The chances for either happening now are growing less by the day.

Brazil has been planting and plans on bigger crops. Argentina is also planting, but most of the trade attention is on Brazil. Producers in southern areas are ahead of the normal pace for planting progress, and there are ideas that the country could start to ship new crop soybeans to China by the middle of January, a full month or more ahead of normal.

Meanwhile, ending stocks projections for the US are very high and give little reason to expect a major rally anytime soon. The two presidents are scheduled to meet at the G-20 meetings later this week, and it is hoped that at least some progress toward a resolution in the trade disputes is made. No one seems to expect the disputes to be fully resolved, however, so the tariffs and the lack of business might not change after the meetings. Support appeared to come from commercials who are in need of soybeans for domestic processing needs.

The weather this week should feature moderating temperatures after a very cold start to the week and drier conditions. More snow is expected more generally in the Midwest by the start of the new week this week. Futures are still supported by some variable yield estimates from producers, and some production could be lost due to the snow and cold temperatures.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

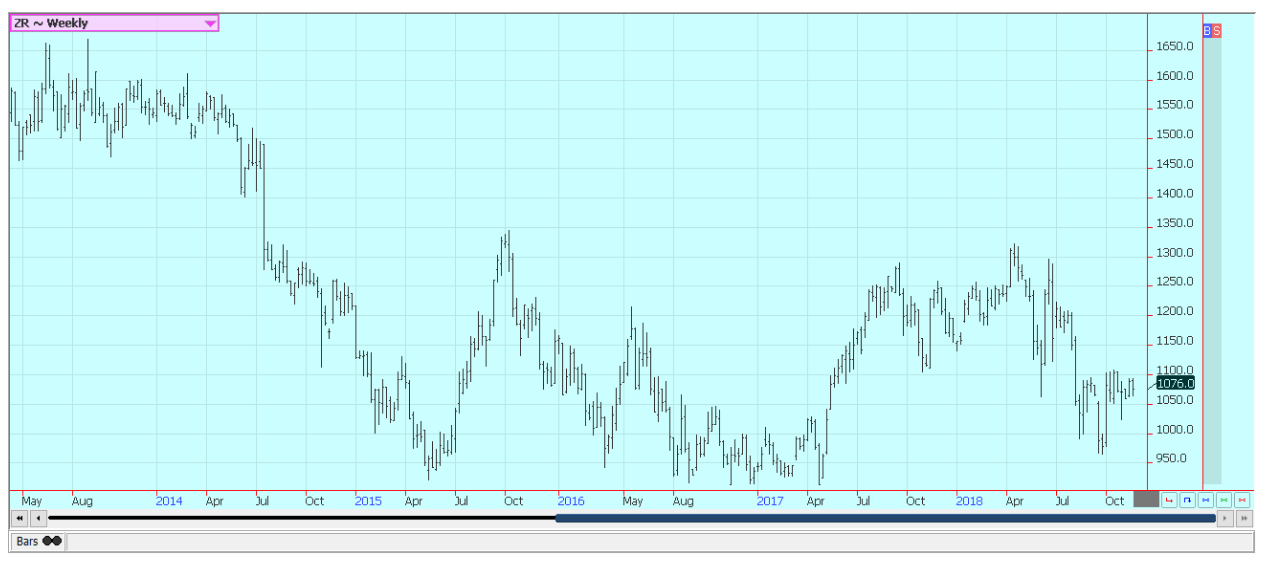

Rice

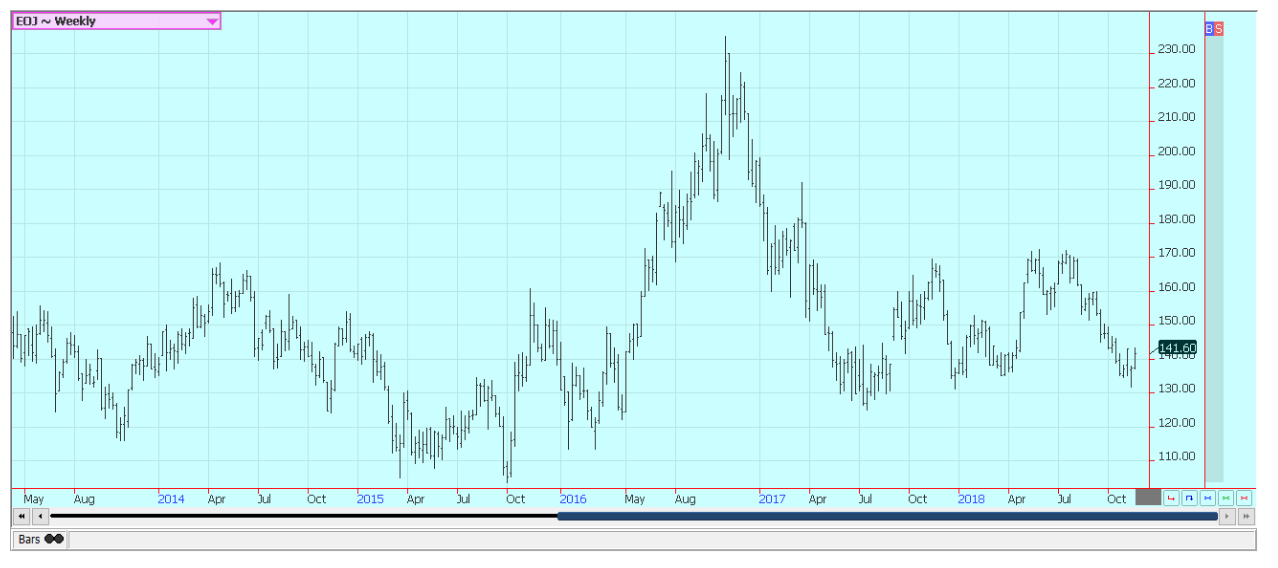

Rice was a little lower on Friday and a little lower for the week. The futures market remains stuck in a trading range for now. The southern harvest is over and what had to be sold out of the fields has been sold. Mills and processors are reported to be slow in picking up purchases from producers and driers so far this year, but the already committed rice is moving slowly to its destination.

Producers do not seem interested in further sales at this time, so it might take a rally to get them to offer once again. It is the holiday period, and this time is always a slow time for US rice futures. Most producers would rather take part in holiday activities or go hunting rather than sell rice, and the mills appear covered for now.

The export demand is holding strong with another good weekly export sales report seen again last week. However, the exporters appear to be covered for now as well. It might take until after the first of the year to see much movement in rice futures as the futures and cash markets. This is normal for the US rice market.

Prices also appear to be stable in world markets, but have held well in Asia and are reported to be firming in South America. All indications are that South America will once again reduce area planted to rice in favor of more profitable crops such as soybeans.

Planted area estimates for Mercosur countries are reduced this year, and there are some ideas that these countries will not be in a position to compete in the export market against the US. These ideas could help force US prices higher after the first of the new year, but prices could remain stagnant for all of December and part of January until more is known about Mercosur production and demand for US rice.

Weekly Chicago Rice Futures © Jack Scoville

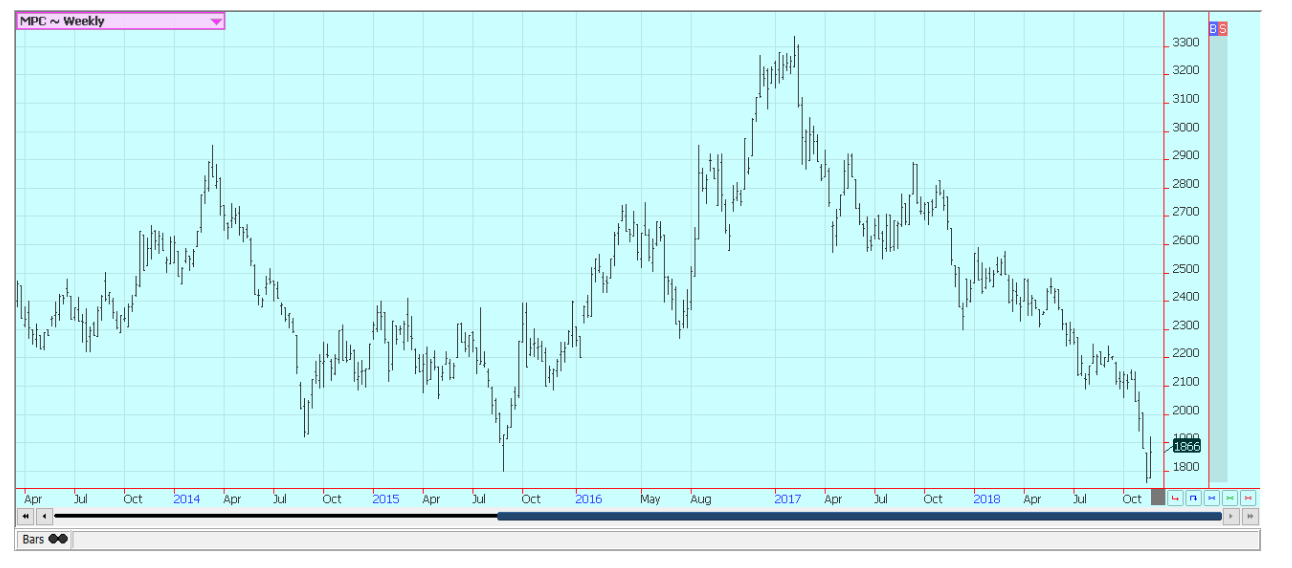

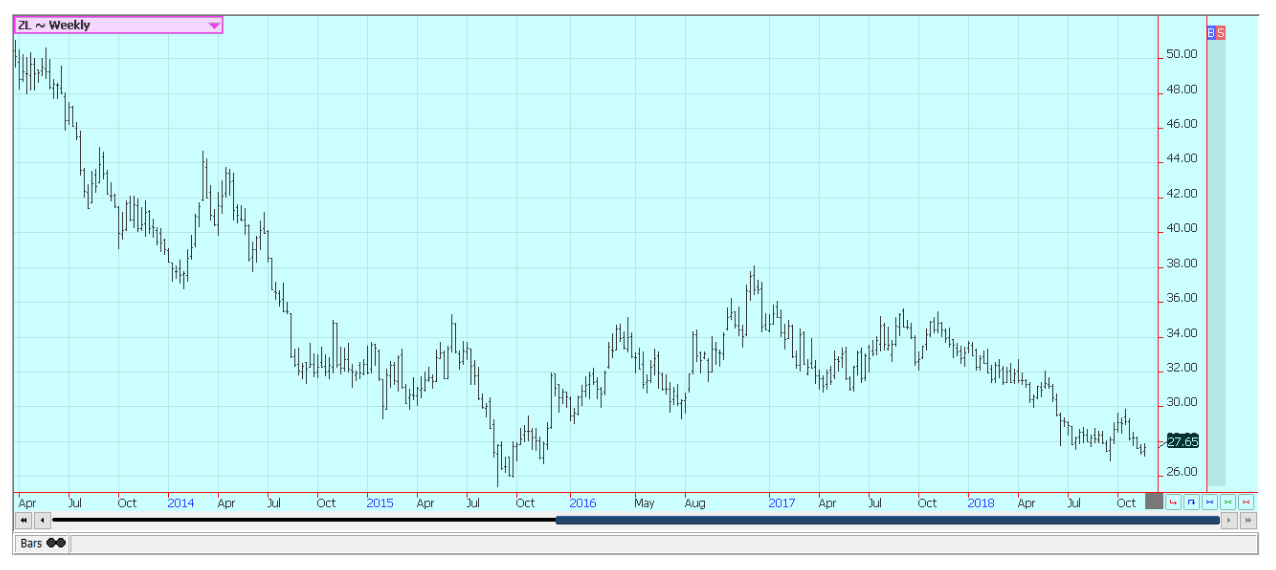

Palm oil and vegetable oils

World vegetable oils prices were generally higher last week on what appeared to be speculative short covering amid oversold chart patterns. The oversold nature of the market was especially true for palm oil. Demand remains below optimal levels in palm oil, and most in the market are worried about finding enough demand to take up the increasing supplies.

Production has been trending seasonally higher but should start to fall soon as the weather will change and inhibit palm production. Daily charts show mixed trends and weekly charts show futures in a down trend.

Soybean oil closed slightly higher in reaction to the strength in palm oil and despite weaker petroleum prices. Selling came late in the week as the petroleum markets are collapsing and causing biofuels markets to move lower. Support is coming from less offer from South America.

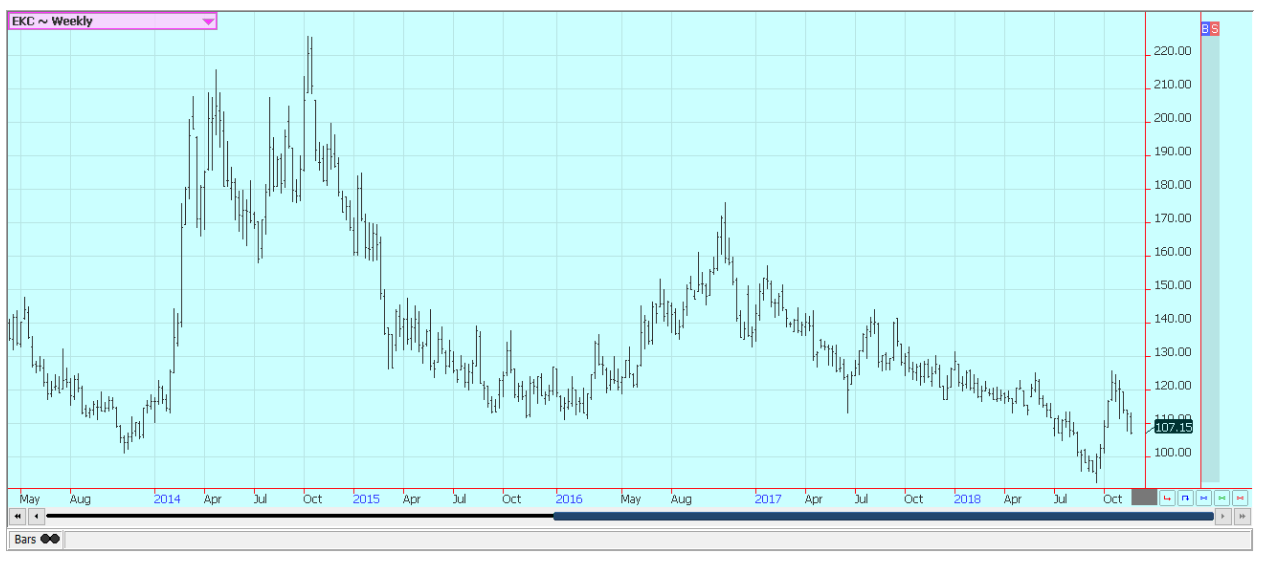

Canola was slightly lower on improved weather and as demand is only routine. The harvest is finally over. Farmers had a tough time getting into the fields due to rains, especially in the west, but finally wrapped up a week or so ago. Progress had been significantly behind normal, so the trade expects yield new losses. Yield reports are said to be below expectations.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

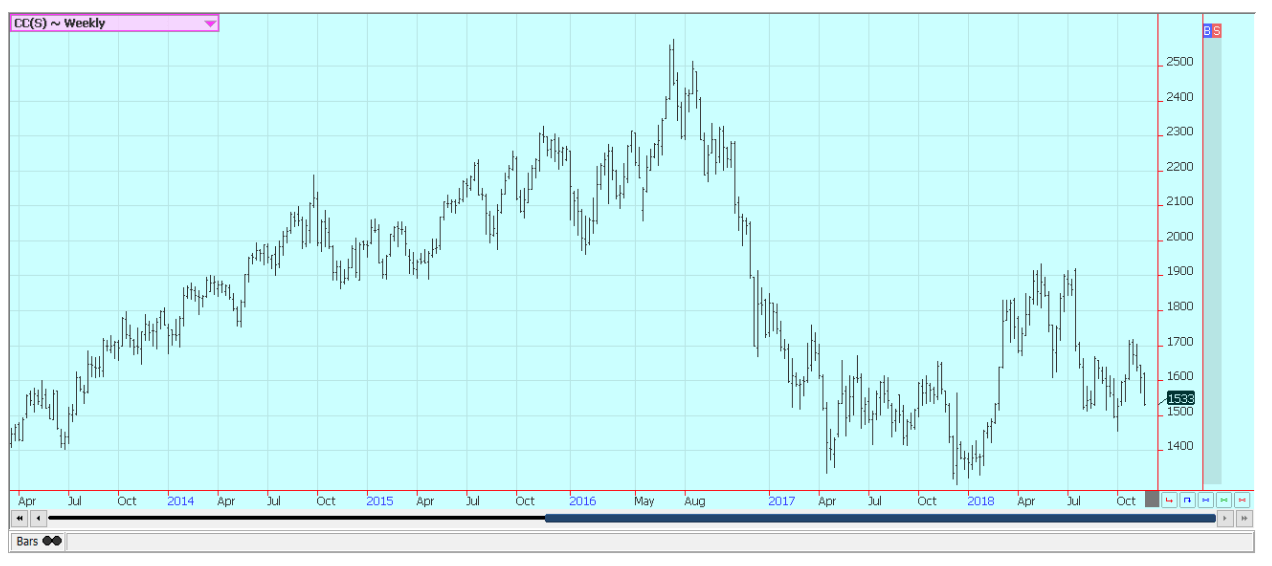

Cotton

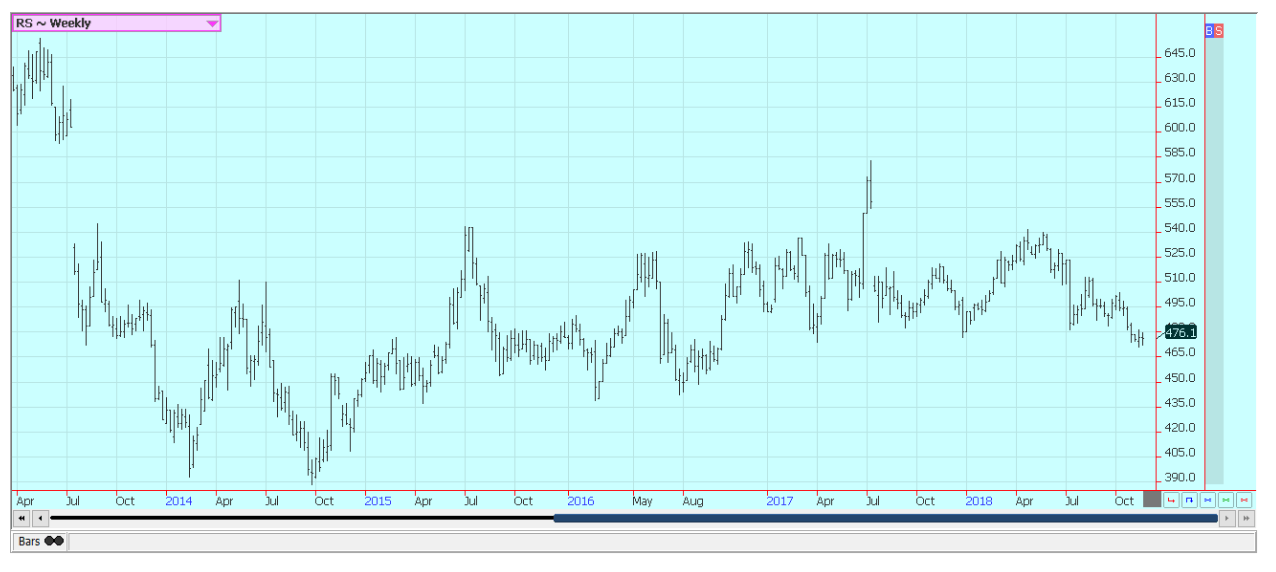

Cotton was lower last week, with most of the selling seen on Friday in response to weak demand ideas. The weekly export sales report showed much improved sales as China did not cancel any previous purchases, but the sales were still not enough to support the market. Speculators were the bestsellers and were selling based on the charts showing a short-term failure for the uptrend and weaker outside markets, especially in petroleum futures.

Wire and anecdotal reports still suggest that the harvest pace is poor. Most of the delays have been in Texas due to too much rain, but some delays in the Southeast have also been reported. The delayed harvest could cause yield and quality losses. The market needs new demand.

Export sales for the last few weeks have been poor, and last week when sales were good. However, the better sales for one week were not enough to change attitudes about demand, and the weakness in petroleum futures meant that more poly products could be produced cheaper to compete with Cotton. The weaker petroleum futures hurt many commodities on Friday as the selling in crude oil and products has been extreme since the beginning of October.

Weekly US Cotton futures © Jack Scoville

Frozen concentrated orange juice and citrus

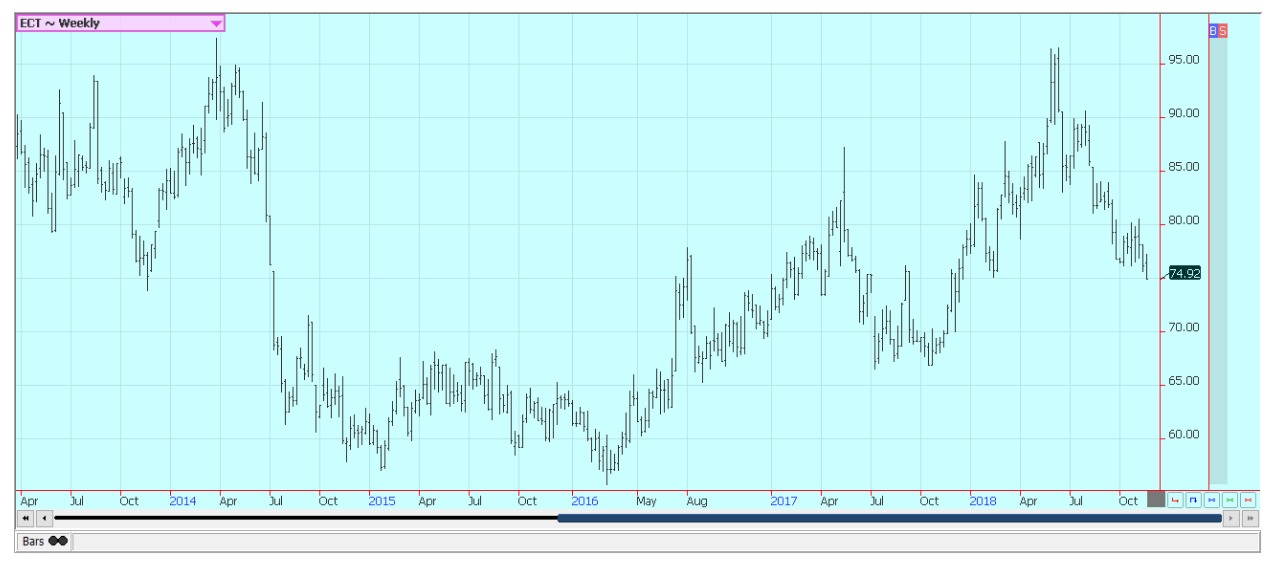

FCOJ was higher on Friday and higher for the week on speculative short covering as the weather remains non-threatening. More speculative buying and short covering is expected as shorts cover positions or get long for the coming freeze season. It is still possible that a short term low has been made.

The oranges harvest is active in Florida under good weather conditions. The fruit is abundant but small. Chart trends are turning mixed. Overall growing conditions in Florida are good to very good, and the hurricane season is over. Florida producers are seeing small-sized to good-sized fruit, and work in groves maintenance is active. Irrigation is being used in all areas. Packing houses are open to process fruit for the fresh market, and a couple of major processors are open in the state to take packing house eliminations.

Weekly FCOJ Futures © Jack Scoville

Coffee

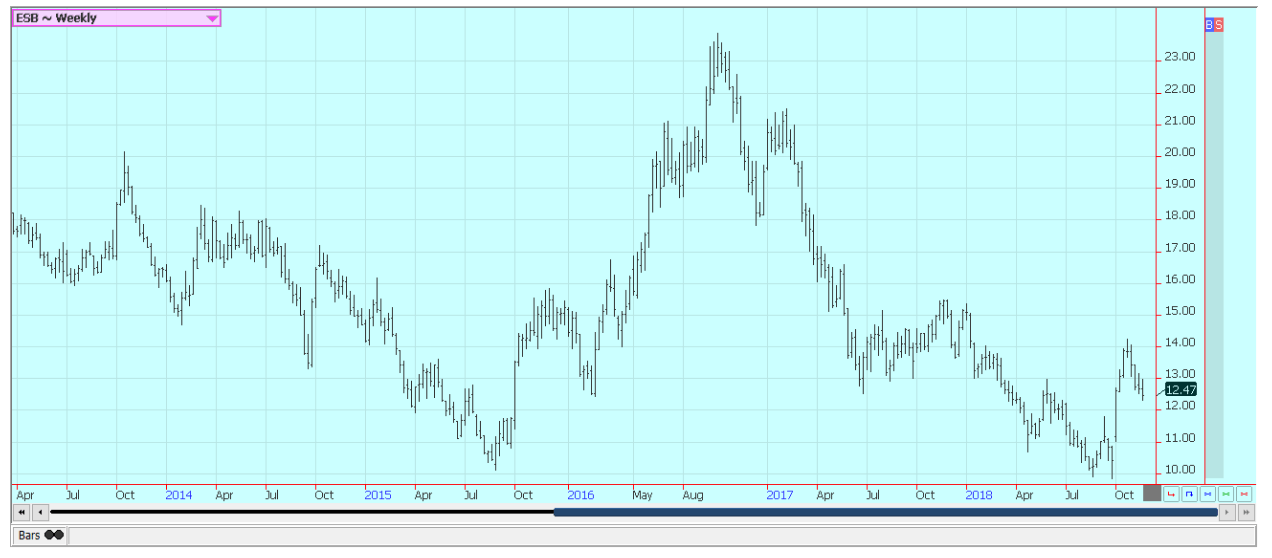

Futures were lower in New York and in London last week. Currency relationships, and especially the rate between the US Dollar and the Brazilian Real, continue to be the driving force in coffee trading, and weaker outside markets such as the extreme weakness in petroleum futures added to find selling interest on Friday.

Commercials were said to be the best buyers. The Brazil crops are getting harvested now, but are not always finding their way to the market due to the overall Real strength against the Dollar. Producers are also looking ahead to next year.

El Nino remains in the forecast and coffee areas in Brazil could be affected by drought. This is the off year for production there, anyway, and a drought would mean even less production. Vietnam is getting close to its next harvest. Production in Vietnam is estimated at or above 30 million bags. Producers in both countries are not selling much. Some problems with too much rain have been noted in Central America. Drier conditions are wanted for harvesting, and mostly dry weather is in the forecast.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

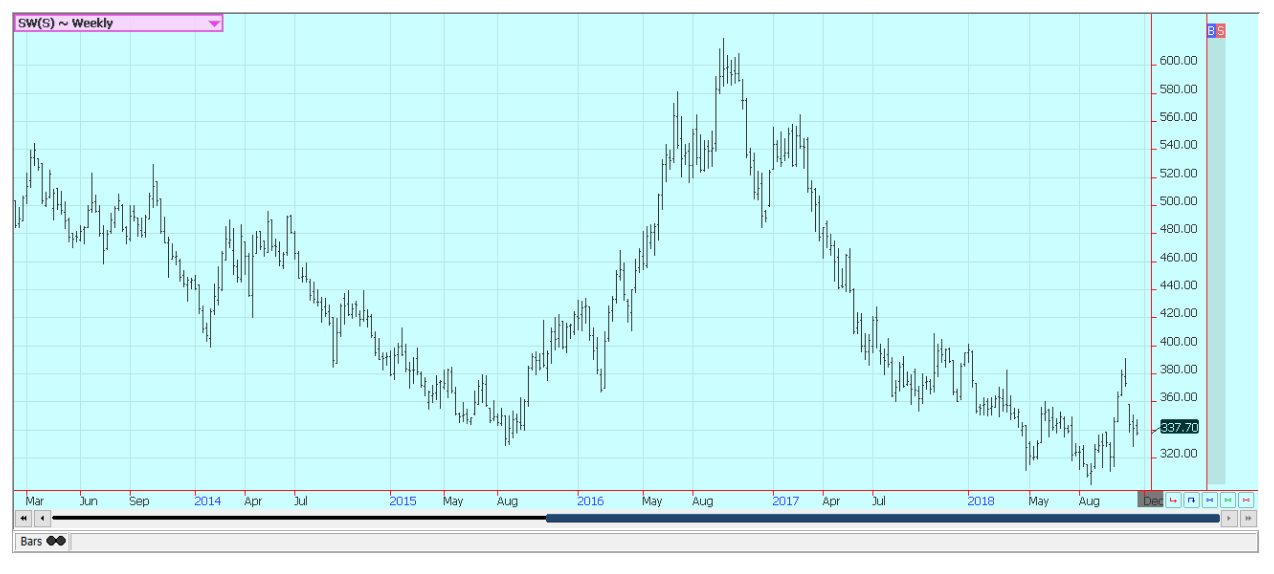

Sugar

New York closed lower last week. London was lower as well. Prices fell in part to the weakness in petroleum futures and on ideas that there are plenty of supplies out there. The downside potential of the market should be limited on ideas that world production is in fact dropping.

Sugar was supported by reduced selling in Brazil due to the stronger Real against the US Dollar. The Real has been gaining on the US Dollar and this has served to limit export interest in Brazil. There are now doubts on just how much production will be seen this year in India.

Wire reports indicate that pests have invaded Sugarcane fields and are eating and destroying the crop. There is no indication of losses yet, but the implication of the reports is that the losses could be significant.

Northwest India had been experiencing hot and dry weather that could cut yields. Dry conditions continue in Brazil, the EU, and Russia, but conditions are mostly good in Ukraine. Very good conditions are reported in Thailand. Brazil producers are worried about Cane production, and the market still talks about less production there this year. The dry weather in much of Europe and in southern Russia near the Black Sea has hurt Sugarbeets production potential in these areas.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

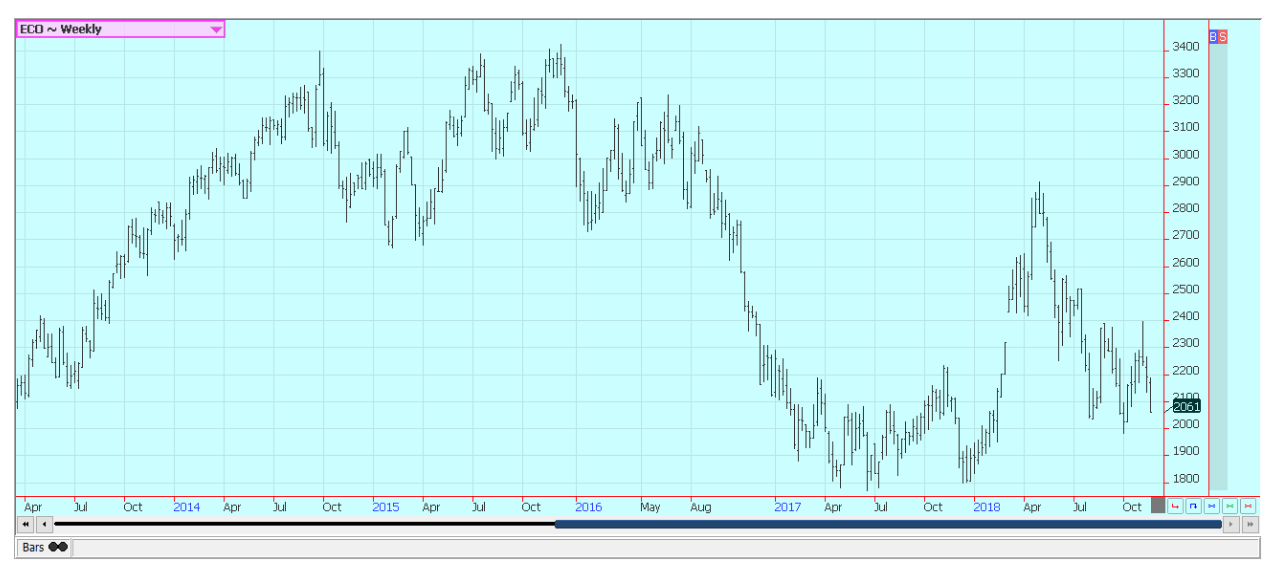

Cocoa

Futures closed lower in New York and lower in London as the new main crop harvest comes to market in West Africa. Trends are down in both markets. The outlook for strong production in the coming year is still around, and ports are said to have plenty of Cocoa on offer. The main crop harvest is in its earliest stages in some parts of West Africa. Main crop production ideas for Ivory Coast and Ghana are being reduced, with Ivory Coast now estimating its main crop production at 1.985 million tons, down from previous estimates just over 2.0 million tons. Conditions appear good in East Africa and Asia. Demand is said to be improving as offers from the new harvest start to increase.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality

-

Markets1 day ago

Markets1 day agoMiddle East Escalation Sparks Market Uncertainty as Oil and Gold Poised to Rise

-

Cannabis2 weeks ago

Cannabis2 weeks agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

-

Crypto6 days ago

Crypto6 days agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

You must be logged in to post a comment Login