Markets

Cotton Prices Decline Amid U.S. Tariffs, Weak Chinese Demand, and Strong U.S. Production Outlook

Cotton prices fell last week amid downward trends. Lower-than-expected Trump tariffs on China and weak Chinese consumer demand, coupled with economic struggles, weighed on the market. Despite China’s planned 2025 stimulus, weaker demand and expectations of strong U.S. cotton production continue to pressure prices.

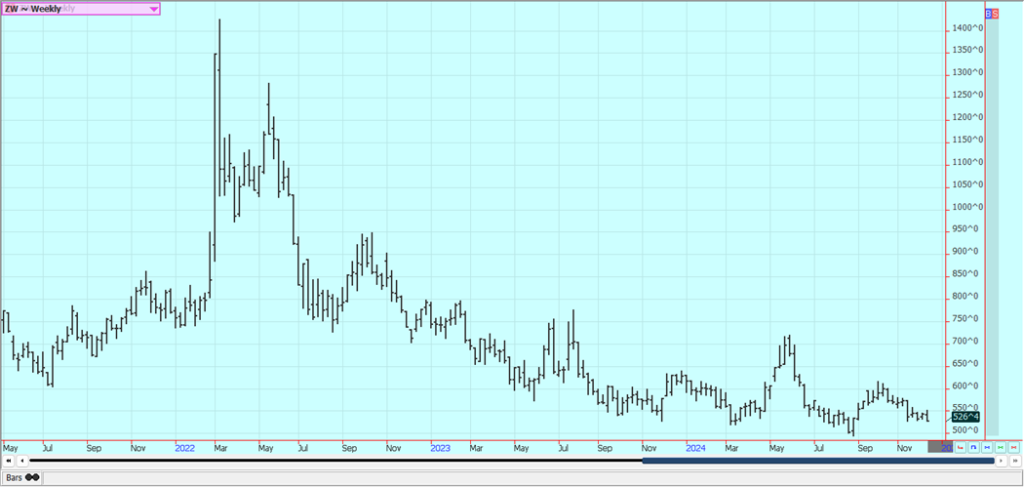

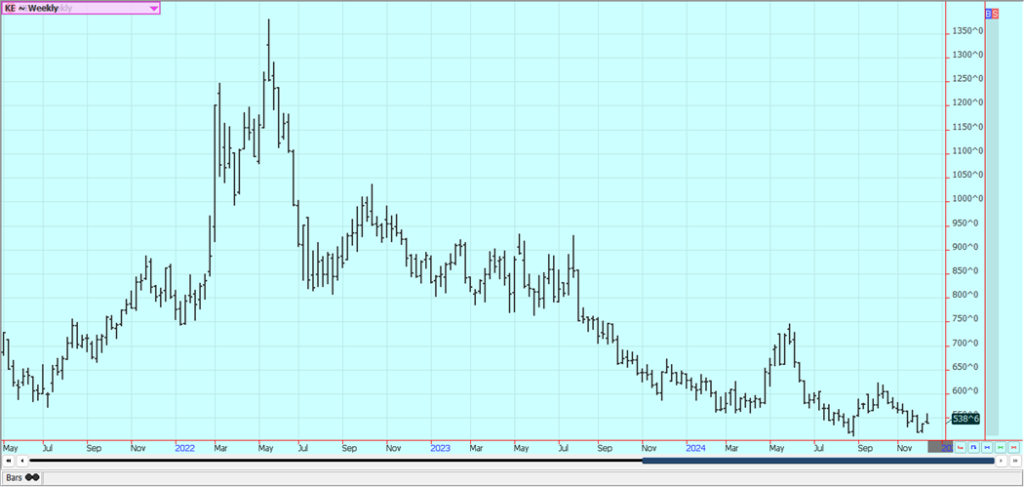

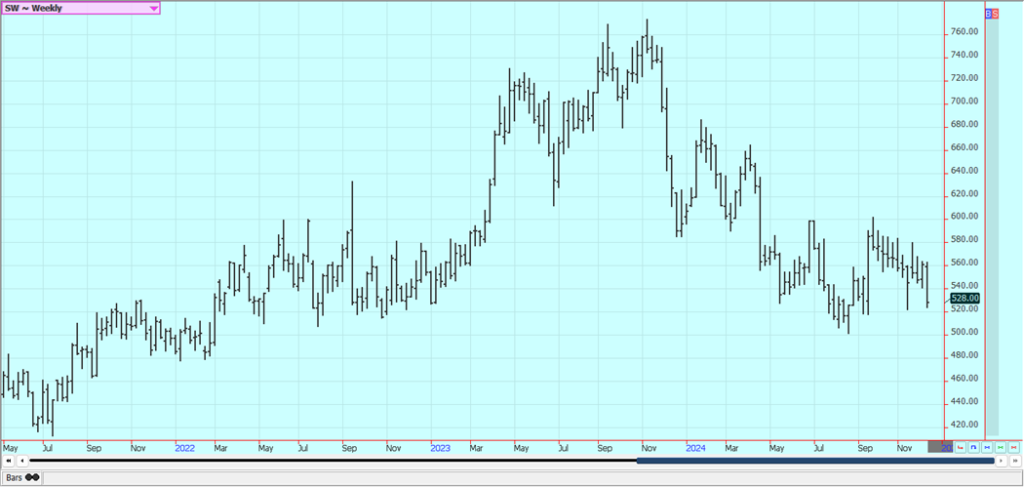

Wheat: The markets were lower last week in all three markets after USDA showed poor export demand in the weekly reports. Tensions remined high between Ukraine, the US, and Russia.

The growing conditions in the US are very good. Reports of very beneficial rains for the Great Plains and Midwest and reports of steady to firm prices quoted in Russia and steady prices Argentina were around and helped keep the US market mostly steady in current ranges. Wheat farmers in the US planted the Winter crops under good conditions. Australia has seen too much rain recently that has downgraded Wheat quality, but Australia still has a very big crop to sell into world markets.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

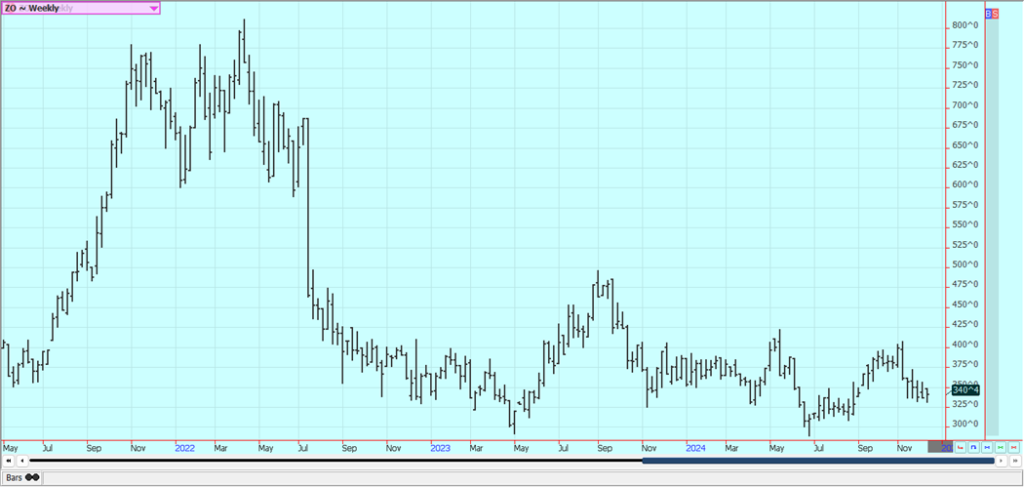

Corn: Corn closed a little lower last week after making new highs for the move. The US export demand was a little less in the weekly reports. Farmers were sellers along with speculators. The export demand in recent weeks has been very strong and it seems like some of the buying is in anticipation of the new presidential regime starting here in January.

President Trump has promised new tariffs on goods and services and some buyers may be making purchases now to avoid the potential for the tariff at a later date. There were no sales announcements in the daily reports from USDA in the last week. Oats were higher.

Weekly Corn Futures

Weekly Oats Futures

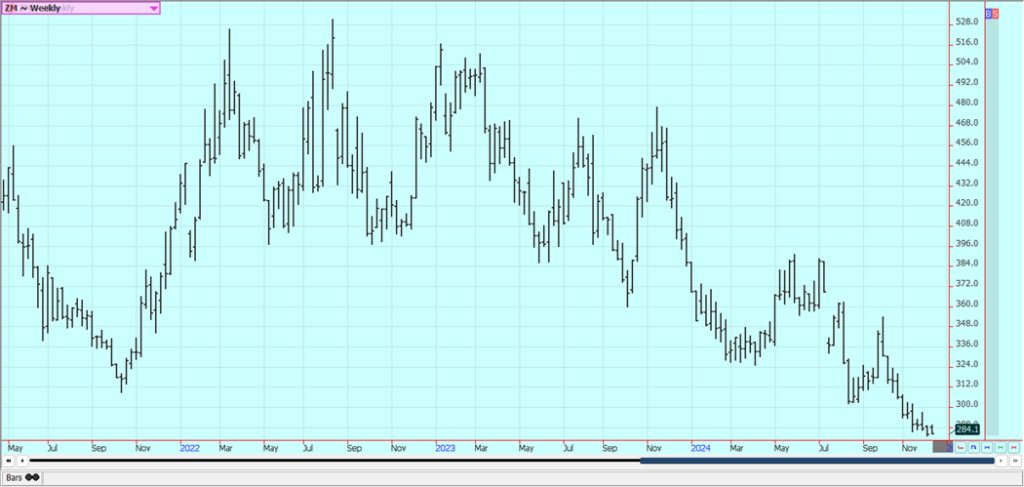

Soybeans and Soybean Meal: Soybeans closed a little lower and the products were slightly higher last week on strong weekly and daily export sales. The tariffs that Trump plans to impose could be a detriment to sales of all products. Brazil looks to produce much more than a year ago and some estimates range as high as 175 million tons for the country. Brazilian farmers have planted what is expected to be a very big crop in central and northern areas of the country.

Warm and dry weather in the Midwest this year has hurt US production ideas due to ideas of small and very dry beans in the pods. Soybeans were often harvested at moisture levels below 10% this year. Demand has been very strong so far this year, in part as many buyers try to get bought ahead f any new tariffs that the Trump administration might impose. Even so, supplies are very large and ending stocks projections for the USDA WASDE reports are a burden for prices. Central and northern Brazil rains will continue. Soils are in much better shape in southern Brazil and Argentina.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

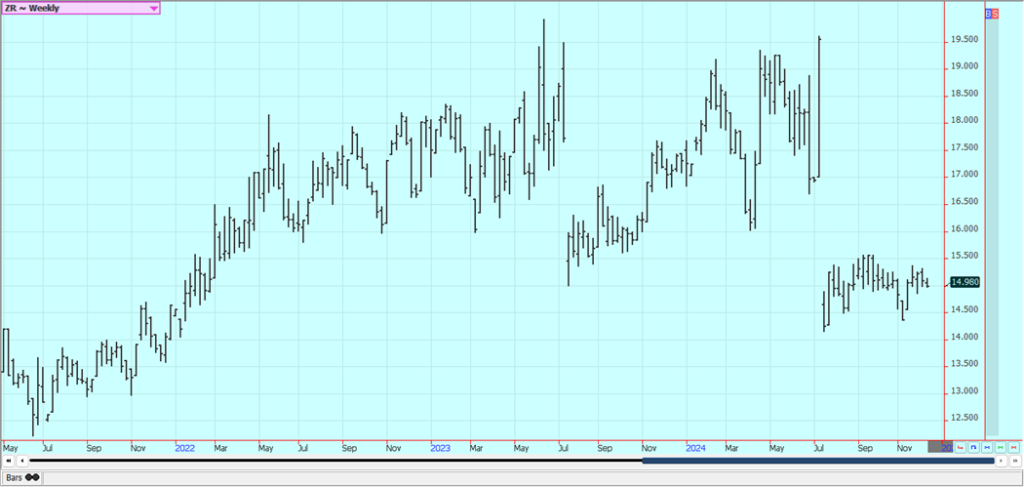

Rice: Rice closed a little lower last week and the holiday market seems to be underway. The trends are still mixed on the weekly charts but are turning down on the daily charts. Generally weak Asian prices are still reported. Brazil prices remain strong and well above US prices.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was lower last weej on ideas that the price was too high to attract new demand. Soybean Oil demand has been very strong and has captured much of the new business from places like India. Demand from China has not been good, but demand from India has been seasonally strong. Ideas of weaker production caused by too much rain and reports of good demand provided support. The private surveyors have indicated that exports have improved so far this month.

Canola was a little higher last week on reports of speculative profit taking on long positions taking the market from its highs set early in the week. The charts show that a low has been completed but that the rally off the lows has run out for now. The harvest is over in Canada and the crops are locked away in the bin. Producers will try to wait for higher prices before selling much, especially with the cold weather in place now.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

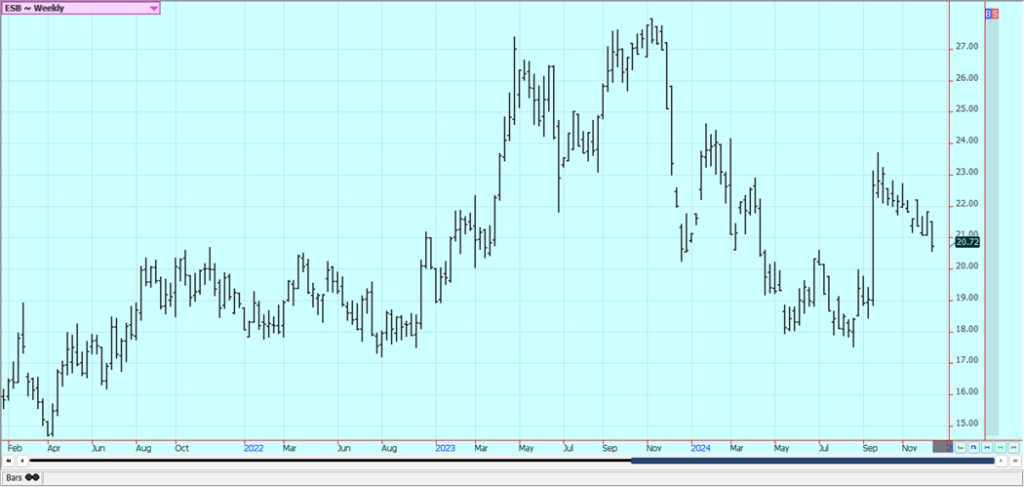

Cotton: Cotton was lower last week and the trends are still turning down. Cotton selling has come from news that Trump will impose some big tariffs on China, but the tariffs posted were not as high as he had threatened before during the campaign. China has big problems with its domestic economy with consumer buying interest not strong and many people not working.

The government has said it will take stimulus measures for the economy there next year. There are still reports of weaker cotton demand potential against an outlook for good US cotton production in the coming year.

Weekly US Cotton Futures

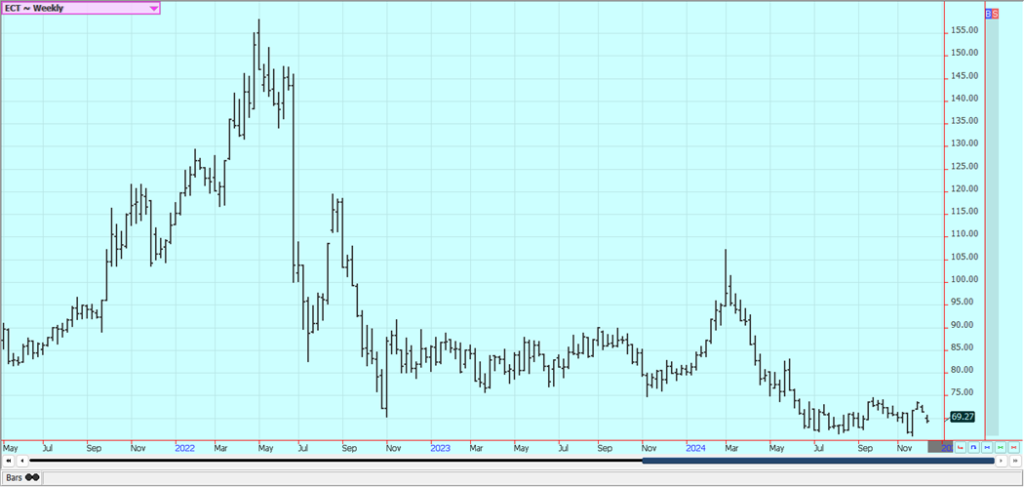

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher last week and the chart trends are up on the daily charts but mixed on the weekly charts. USDA estimated all Oranges production at 2.48 million tons for the US and 12 million boxes. The estimates are down a lot from early forecasts and from the previous year. The short term supply scenario remains very tight.

The market remains well supported in the longer term based on forecasts for tight supplies in Florida. The reduced production appears to be mostly at the expense of the greening disease and some extreme weather seen in the last couple of years. There are no weather concerns to speak of for Brazil or Florida right now. Nielsen said that November retail Orange Juice sales were 24.68 million gallons, up about 3.0 million gallons from October.

Weekly FCOJ Futures

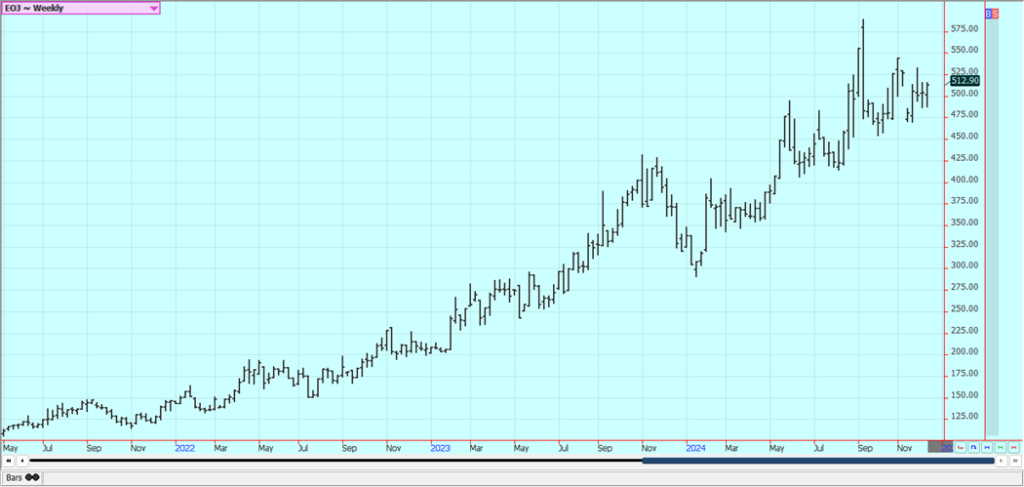

Coffee: New York was lower last week after moving to new highs and London closed higher. It appears that New York made a reversal on Tuesday. There were reports that another large trade house has pegged top producer Brazil’s coming crop at 40 million bags, in contrast to Volcafe, which cut its Brazil arabica forecast by 11 million bags to 34.4 million. Reports of reduced offers from Brazil on weather induced short crops continue and there are also reports of too much rain in parts of Central America damaging crops there.

There are reports from Brazil that producers have already sold a lot of Coffee and are holding back on selling more even with good demand. Offers from Vietnam are increasing now as the harvest has been expanding. The chart trends are still up in both markets. There are reports for good rains in Brazil as the rainy season is now under way after very dry conditions.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London closed lower last week despite supportive production data from Brazil. Traders had expected even lower production estimates. UNICA said that the second half of November crush was down 15% from the previous year at 20.4 million tons. Sugar production was 1.1 million tons, down 23%, and ethanol production was 1.2 billion liters, down 5%. Both markets are starting new moves lower.

The current Brazil rains have kept the harvest and crushing pace down but could provide a boost to production for next year. Trends are down in both markets on the daily charts and on the weekly charts in both markets. Indian and Thai mills are expecting strong crops of cane. It is also wet in Brazil, and this has affected harvest progress. Supplies available to the market could be less in the next six months due to adverse growing conditions seen in Brazil during the production period. Total Brazil pro-duction has been affected by drought seen earlier in the year and the fires that destroyed crops in some areas.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

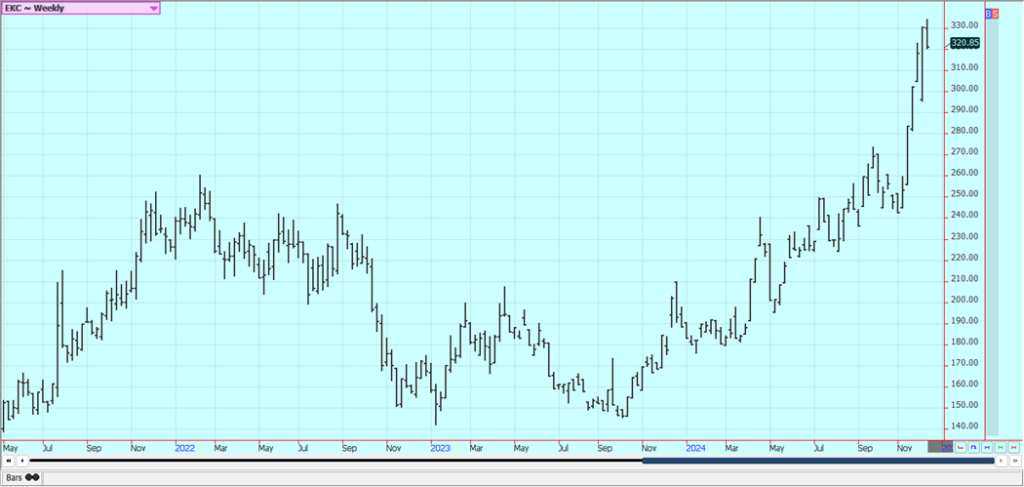

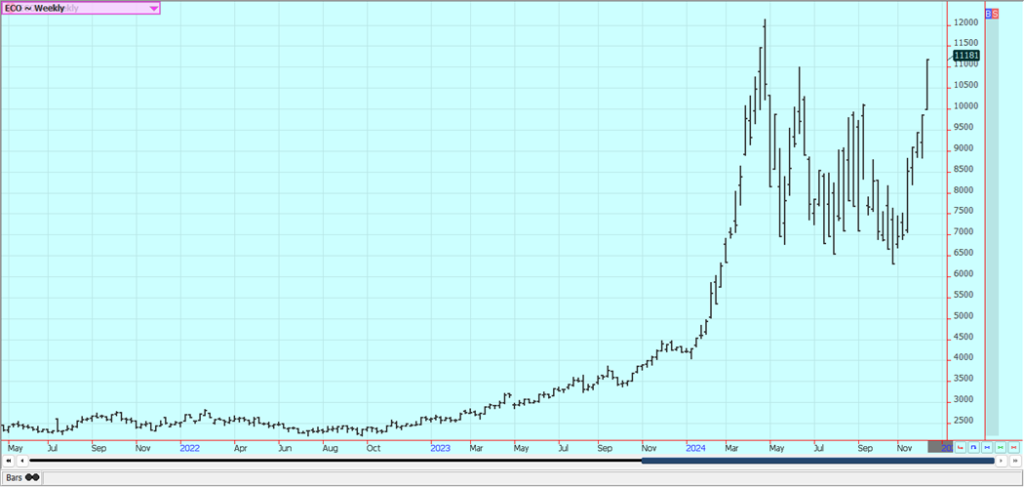

Cocoa: New York and London closed higher and at new highs for the move on weather and production related buying. There is talk that production will be short of demand for the fourth year in a row. Chart trends are up in both markets on the daily charts. Producers in Ghana and in Ivory Coast have been fighting against too much rain that has made it hard to harvest and deliver crops.

It has been very dry in West Africa lately. The trade also noted ICE-certified cocoa stocks have been rising of late, but that overall cocoa supply is set to remain sharply constrained for several seasons due to structural prob-lems in Ivory Coast and Ghana. Ivory Coast’s cocoa grind fell 9.9% year on year in October but rose 16.1% in November.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Karl Wiggers via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Business1 week ago

Business1 week agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Fintech1 week ago

Fintech1 week agoFirst Regulated Blockchain Stock Trade Launches in the United States

-

Africa2 weeks ago

Africa2 weeks agoAir Algérie Expands African Partnerships

-

Cannabis3 days ago

Cannabis3 days agoAurora’s Electric Honeydew Debuts in Poland, But Shared Registry Raises Patient Caution