Business

Cotton production in Asia is increased due to improved monsoon rains

The market remains concerned about the US and international growing weather.

What is new in the agriculture market?

Wheat

US markets were generally lower again last week, but there are widespread expectations that higher prices could return in the short term. US export demand is improving again as US prices are very competitive in the world market. USDA will issue production reports again this Thursday, and the trade expects spring wheat production to be cut again as the US Northern Great Plains and western sections of the Canadian Prairies continue to see dry weather. The real hot weather has left for the short term, but the heat is expected to return for one more visit in the next couple of weeks. World growing conditions are problematic as well. Australia has been very hot and dry and production estimates there are now not more than 20 million tons after early hopes for production above 24 million tons this year. Europe has also had problems due to wet and cold weather in northern areas. Both Germany and Poland have seen too much rain and production potential and quality have been downgraded. These conditions should help keep a bullish tone in prices, and prices will also find support from the weaker US dollar.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

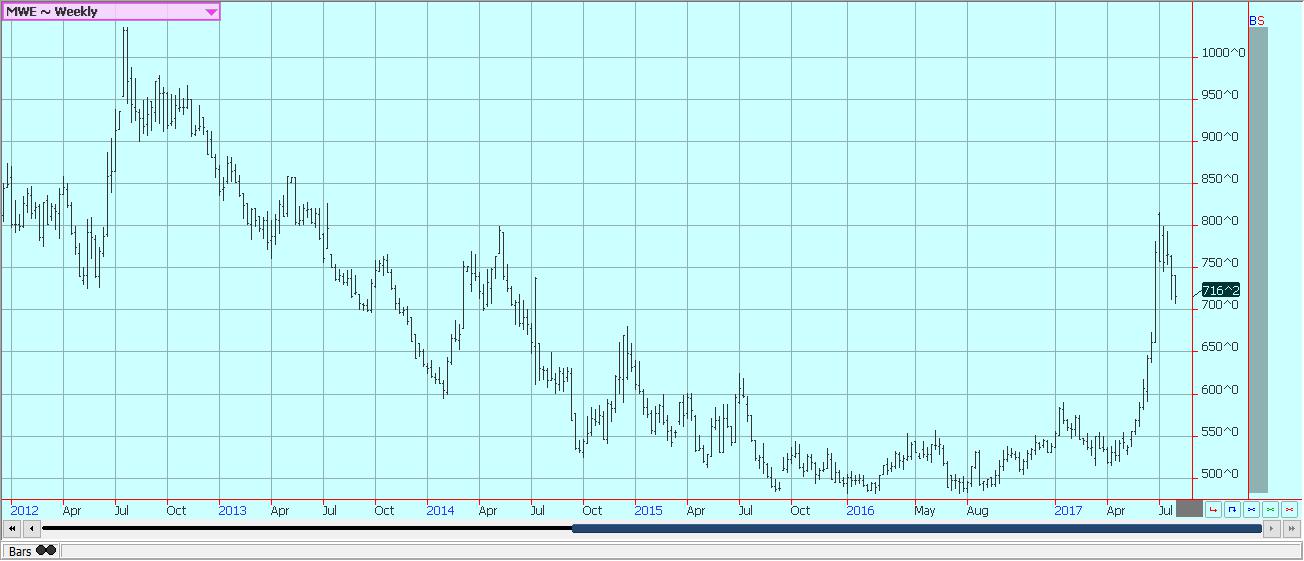

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

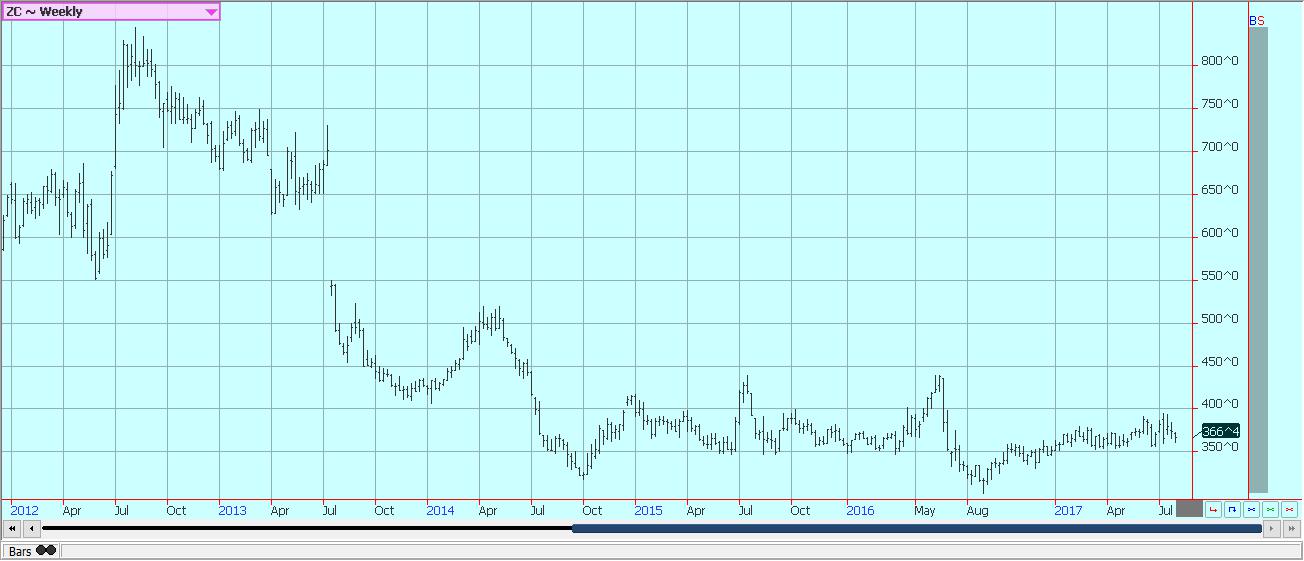

Corn and oats were a little lower last week as some rain and cooler temperatures moved through the Midwest. Some rains had been expected in Iowa last week, but the rains were light and not all that helpful. The state is still in drought and joins the Great Plains in this condition. Variable growing conditions continue in much of the rest of the Midwest as pollination comes to an end and kernel fill begins. The initial data from this survey might push yield estimates closer to the higher end of the private estimates. Trends are sideways on the daily charts and also the weekly charts. The charts show that futures gave a test of some important support areas last week and these areas held. These lows should continue to hold until more is known about US production potential. Up side potential for prices might be limited due to reports of increasing competition in the export market from Corn produced in Brazil and Argentina. That makes a range trade between 575 and 400 December likely for this month.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

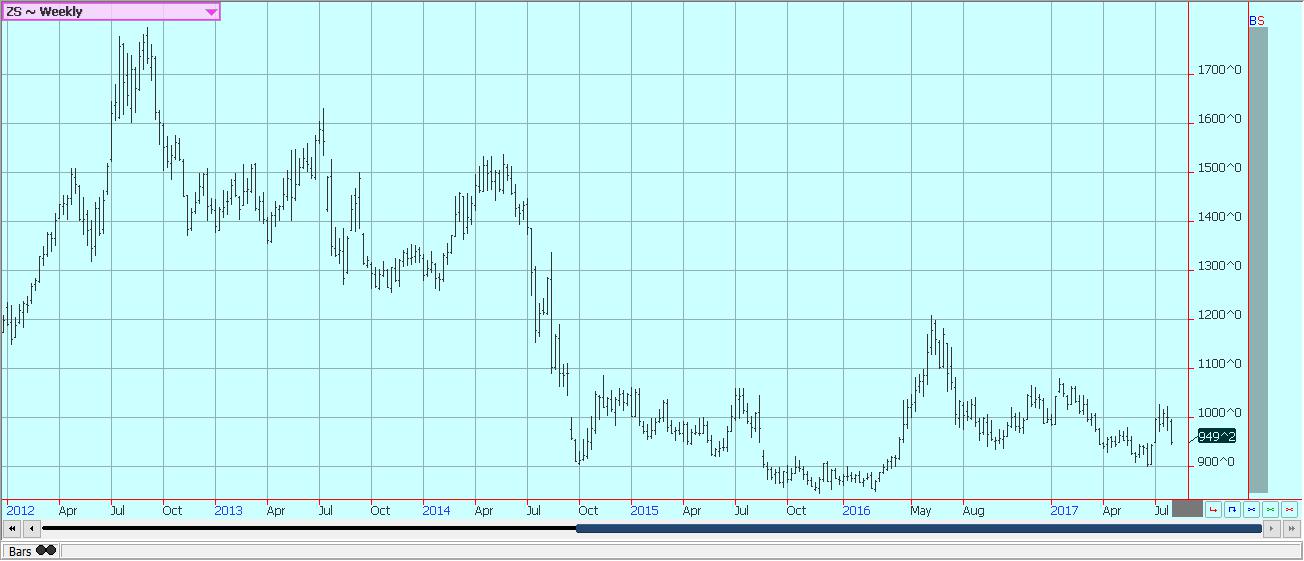

Soybeans and soybean meal

Soybeans and soybean meal were lower last week on ideas of somewhat better rains for the crops in the Midwest and on the potential for China to retaliate against the US in a trade dispute by restricting Soybeans imports from the US. Private production ideas are being circulated as the market prepares for the USDA production reports on Thursday. Most expect at least a small drop in yield estimates from the trend line yields of 48 bushels per acre used by USDA until now. However, any changes made by USDA might be minor as it has very little useful information about the crop. The crop was planted late in many areas and is only starting to flower and set pods now. the weather has been variable.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice closed a little lower last week as the US harvest became more active and as Asian prices remained soft. The Asian market has been weaker in the last few weeks. Thai exports in the first half of the calendar year were 8% higher than the previous year as the Thai government liquidated the last of the stocks that had been built up in the rice mortgage scheme promoted by the previous government. The program is winding down and the Thai export pace should start to drop now. Texas is in good to very good condition and initial yield results from the harvest have been very good. California has good looking crops, but the crops were planted late so top yields are not likely. Parts of Southwest Louisiana are already harvesting, but frequent rains have caused delays. Harvest yields have not been very good, but so far the quality appears to be satisfactory. Producers are hopeful for good crops in Arkansas and Missouri after a rough start to the growing season. USDA production and world estimates will be watched carefully for production data, but it will not have much to work with and might not stray far from its economic models for this round of estimates. Growing conditions are improved in India as the monsoon has been better, but coverage of rains has been spotty until now and there are still chances for weaker production than expected in India this year. The weekly charts show that the rally could move higher over time, with final targets near 1275 basis the nearest futures contract possible.

Weekly Chicago Rice Futures © Jack Scoville

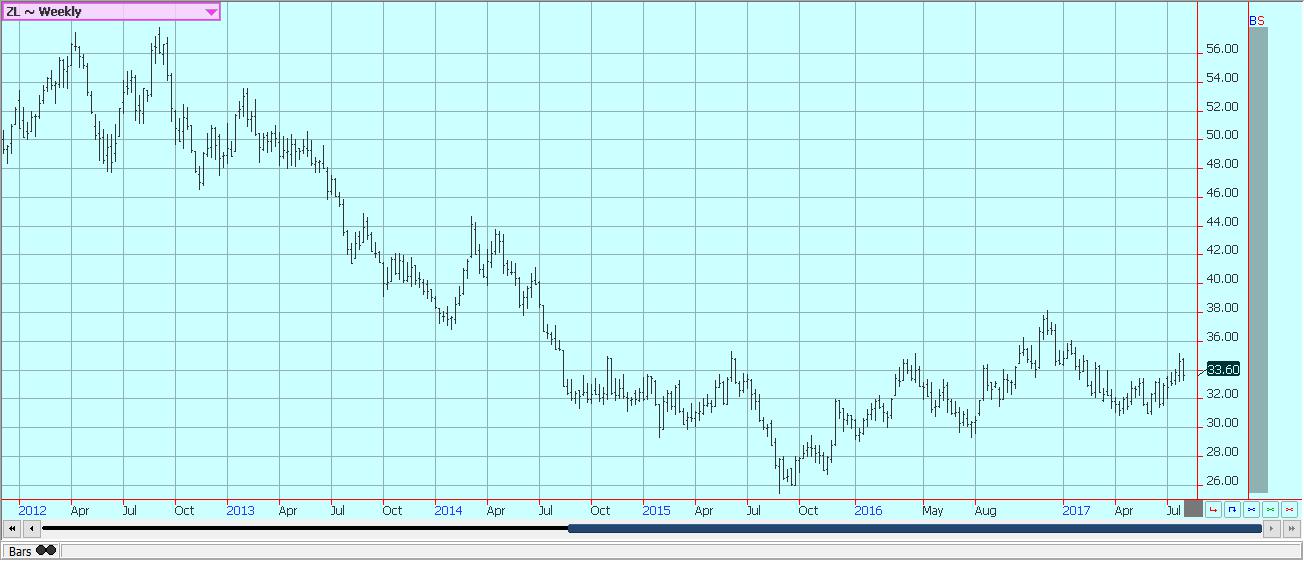

Palm oil and vegetable oils

World vegetable oils markets were lower last week. Palm oil futures closed at the bottom of the weekly range on ideas of increasing production that went against ideas better demand. The market remains in a trading range on the weekly charts, but any additional weakness now could imply that a new leg lower is coming for the next several weeks. MPOB will release its July data this week and is expected to show production near 1.68 million tons for Malaysia, up from 1.51 million tons in the previous month. Export reports from the private sources so far this month are higher than last month, and MPOB is expected to reflect this as export estimates are about 1.43 million tons, from 1.38 million tons in the previous month. Chinese buying was reported to be very strong in Malaysia last week. Eastern areas have seen good rains, but many eastern areas have seen too much rain and crop production potential is suffering. Demand from both the processor side and the export side has been strong enough to generally support the market.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was higher as the weather continued to hurt production potential and as export demand remained strong. The market remains concerned about the US and international growing weather. The daily charts show the potential for a low to be forming. The growing weather in the eastern half of the US is generally good and crop conditions are reported to be good by producers and observers. These areas include parts of Texas, the Delta, and the Southeast. Warmer temperatures have arrived and there has been enough rain. Texas and the desert Southwest and into California has seen extreme heat and mostly dry weather, but the temperatures have moderated and rains have started to fall. Cooler and wetter weather is expected this week in most of these production areas. There is increased production potential in Asia, and mostly in India and Pakistan due to improved monsoon rains. However, the monsoon has been uneven, with some areas in India flooding out and forcing some producers to replant if possible. Some areas have missed out on rains for the last few weeks and yields are hurting in these areas.

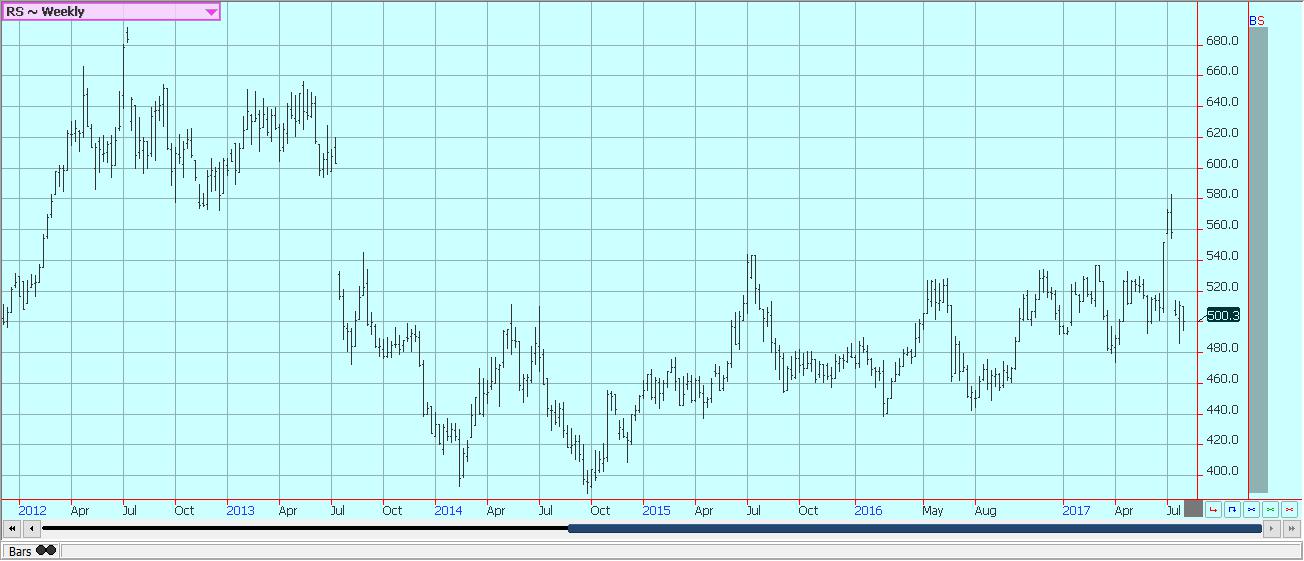

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ closed a little lower last week and remains in a trading range. Florida weather is very good as rains are reported each day and as no hurricanes have yet formed in the Atlantic. There are no systems in the Atlantic to cause concern about tropical storm development that could be detrimental to trees and fruit. The busiest part of the hurricane season is coming in the next few weeks. The demand side remains weak and there are plenty of supplies in the US. Brazil has been exporting FCOJ to the US to cover the short Florida crop. Domestic production remains very low due to the greening disease and drought.

Weekly FCOJ Futures © Jack Scoville

Coffee

It was a higher week once again in New York and September made its first objectives and then some. London has had more trouble holding the recent rally as there has not been much news to support buyers, but the market has been holding. New York features buying support from speculators as they have become more two sided in trading the market as the Winter season continues in Brazil. They were also buying as the Real moved higher and the US Dollar moved lower against just about all other currencies. Brazil is now at harvest, and traders and producers are reporting low quality and small beans. London had been stronger as supplies in the cash market are tight due to reduced Vietnamese selling and tight supplies in the country. Indonesia and Brazil have been very low on supplies as well, but Brazil is now harvesting its next Robusta crop. It should be a small crop as well. The market should remain firm as the smaller crop is factored into the market.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures in London and New York were lower as disappointed longs liquidated positions. It still looks like the market has now turned trends up and that good speculative buying might be seen on further any price weakness, but the failure to hold above 1500 October has been noted and might be a reason for more selling this week. The big harvest in Brazil continues, but some of the processing will probably switch now to ethanol due to tax changes this week. The harvest pace has been below last year until now but is now above a year ago. Production potential in India and Thailand seems improved for now as monsoon rains have been better than last year. It is raining in much of India now as the monsoon is active, but rains have been uneven. Some northwest areas have been flooded due to big rains. Other areas are too dry and there could be some damage to crops if more rains do not show up fairly soon.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

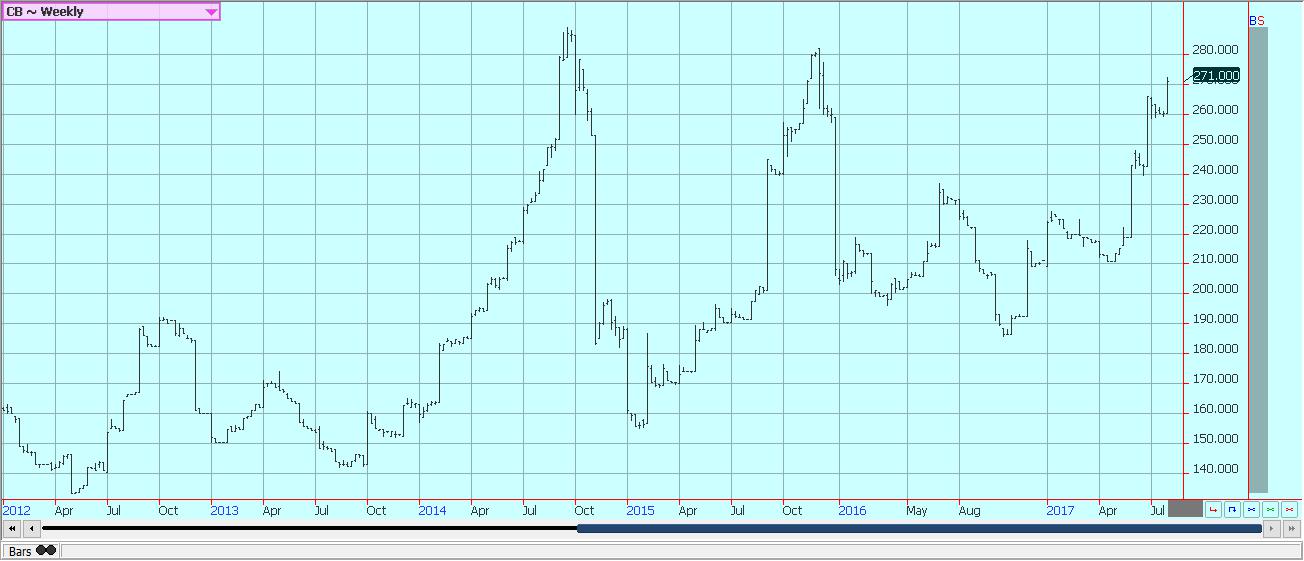

Futures markets were lower last week on long liquidation after the market could not move above some strong resistance areas on the charts. More selling is possible early this week on what should be speculative long liquidation and perhaps some producer selling. Harvest activities for the previous crop in West Africa are completed. The next harvest gets underway in a couple of months. The demand should continue to increase if prices remain relatively cheap and as retail prices continue to move lower in important consuming areas like Europe. The next production cycle still appears to be big on the growing conditions around the world are generally very good, but might be smaller than last year due to lower prices. West Africa has seen much better rains this year and now getting some showers mixed with hot and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

Dairy markets were lower last week, but longer term trends remain up. Butter prices continue to be the strength of the market on reports of very good demand and adequate supplies. Cheese prices have been relatively weak, but are holding firm now. Cream demand for Butter has been very good. Demand for Ice Cream has been mixed depending on the region. Cheese demand still appears to be weaker. US production conditions have featured some abnormally hot weather in the west that is hurting milk production. The weaker US Dollar is helping on export ideas that might not mean much as US prices are higher, but the US Dollar weakness takes the edge off the higher internal prices.

US cattle and beef prices were higher and trends in cattle futures remain down. The beef market remains weaker in the last couple of weeks, and cattle prices have been under pressure since the release of the monthly cattle on feed report and the semiannual inventory report that showed bigger supplies are coming. Feedlots are filled with supplies and are concerned about extreme heat in feedlots that could hurt weight gain. However, ideas are that more supplies are coming as weight per carcass is high and more cattle is coming to the market. A seasonal demand increase is likely now, and October is very cheap to cash, so downside potential in futures might be limited.

Pork markets and Lean Hogs futures were firm and held on the weekly charts despite ideas a seasonal trend to lower demand. Ideas are that futures are too cheap to cash and that spread between the two need to come together more than they are now. Demand has been lower for the last couple of weeks and this has affected pricing. Demand starts to work lower as most of the Summer buying is done. There are big supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Crypto1 day ago

Crypto1 day agoCrypto Markets Surge on Inflation Optimism and Rate Cut Hopes

-

Biotech1 week ago

Biotech1 week agoSpain Invests €126.9M in Groundbreaking EU Health Innovation Project Med4Cure

-

Biotech4 days ago

Biotech4 days agoAdvancing Sarcoma Treatment: CAR-T Cell Therapy Offers Hope for Rare Tumors

You must be logged in to post a comment Login