Featured

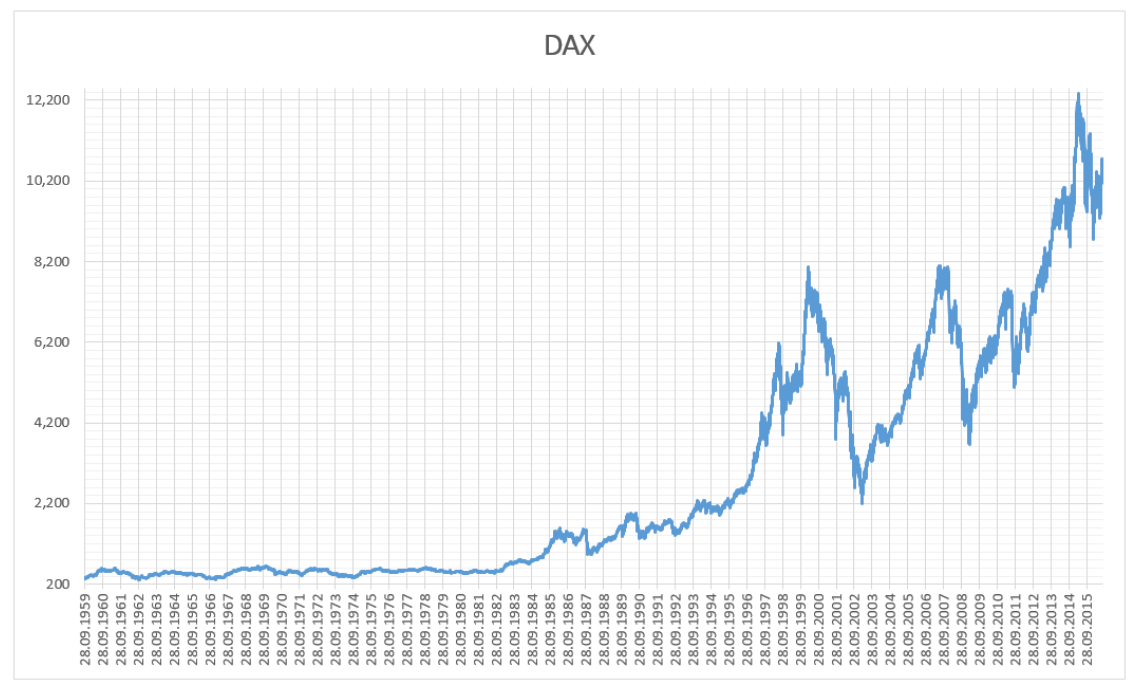

The DAX 30: Europe’s own version of the DJIA

What is the DAX 30 and what makes it a benchmark for core economic performance in Germany and the rest of the Eurozone?

The DAX, as it’s most commonly known, is the largest of the indices on the European mainland, generally seen as the benchmark for core economic performance. The name is an abbreviation of Deutscher Akienindex (German stock index) and is run by Xetra, a subsidiary of Deutsche Boerse. The 30 part indicates that it has that number of components. Stocks on the index trade in Frankfurt, and it is based on that exchange’s prices that the index is calculated.

Often, the index is seen as the German equivalent to the Dow Jones Industrial Average, albeit with a smaller volume, and market cap has given Germany has a smaller economy overall than the U.S.

Because it has a relatively small selection of stocks, it’s not seen as a gauge of economic performance in Germany, let alone in the entire Eurozone. However, being a composed of bluechip stocks with commercial activities weighted on exports, it can be seen as an indicator of core performance—similar to how the DJIA is in America.

The DAX trades on the Orbex platform as GER 30.

What’s on the index?

Xetra has two criteria for considering a company to be put on the index: order book volume and market capitalization. This contributes to adding some stability to the market by preventing over-heated stocks with high P/E ratios (such as tech stocks) displacing companies with bigger sales footprints. The index is evaluated every quarter to include the companies that fit the criteria. However, given the stringent standards, it is relatively rare that a company is excluded (and therefore another is included), with changes in the index happening on average, less than once a year.

The DAX also has two versions:

1) Performance index: This is the more commonly quoted version that you will find on major news media and is the one tracked on our platform. This measures the total return, which includes the value of dividend payments.

2) Price index: Which excludes the dividend payments, and is, therefore, more similar to other indexes that consider the weighted price valuations of the stocks on the index.

The DAX has a broad range of companies covering most sectors with the “smallest” (that is, the one with the least weighting considering sales and market cap) being Lufthansa and the “largest” being Siemens.

© OrbexFX

Why it’s important

As the premier stock indicator of Germany, it gives insight into the performance of the largest economy in the Eurozone. Typically, the DAX is the last index to be impacted by market fluctuations, since all of its components are bluechip core stocks. Significant DAX moves are, therefore, indicative of an economic issue affecting the Eurozone core.

Germany is also seen as the haven within Europe, having a stronger economy and more resilient to economic fluctuations. Consequently, it benefits during periods of uncertainty in the periphery, leading to support in German equities.

On the other hand, given the relatively small size of the index, fluctuations in the currency have much more impact on the DAX than the other way around. Most of the companies on the DAX rely on exports to the rest of the Eurozone, and also outside of it—so increases in the Euro can be seen to have a negative impact on the DAX due to increasing cost to export.

Concerning Forex, the DAX is best read in conjunction with other major Eurozone indices, such as the CAC-40, IBEX and FTSE MIB.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing5 days ago

Impact Investing5 days agoOceanEye: EU Launches €50 Million Initiative to Strengthen Global Ocean Monitoring

-

Cannabis2 weeks ago

Cannabis2 weeks agoColombia Moves to Finalize Medicinal Cannabis Regulations by March

-

Markets7 days ago

Markets7 days agoMiddle East Escalation Sparks Market Uncertainty as Oil and Gold Poised to Rise

-

Fintech5 days ago

Fintech5 days agoMeta Plans New Dollar-Backed Stablecoin for Facebook, Instagram, and WhatsApp

You must be logged in to post a comment Login