Business

America’s Debt Spiral: A Crisis of Soaring Deficits, Diminishing Buyers, and Looming Collapse

The U.S. faces a worsening debt spiral, with surging deficits, record-high interest payments, and diminishing demand for Treasuries. Total debt now exceeds $37 trillion, projected to hit $67 trillion by 2035. With weak growth, rising defaults, and vanishing foreign buyers, the Fed may soon monetize debt again—risking inflation, asset collapse, and financial instability.

The debt spiral in the U.S. is an accelerating crisis that is threatening our standing as the predominant world power. Surging deficits are being combined with massive rollovers from our existing humongous debt pile. This is compounding into untenable interest payments, which will soon force the Federal Reserve into being a perpetual buyer of Treasuries—one that is the purchaser of first and last resort.

To appreciate the gravity of the situation, consider that Gross national debt stood at less than $6 trillion in 2000. It has now surged past $37 trillion in mid-2025, marking a 520% increase in just 25 years. Worse yet, our debt equals 740% of federal revenue. This guarantees insolvency unless aggressive reforms are undertaken.

The national debt is projected to exceed $67 trillion by 2035, even under optimistic assumptions about economic growth. To put this in context: it took America 250 years to accumulate the first $37 trillion. The country will add $30 trillion more in just one decade – the fastest debt accumulation in modern history.

Deficits continue to spiral. For FY2025, the shortfall already stands at $1.36 trillion – a 14% increase over last year, with less than four months remaining in the fiscal calendar year. Annual deficits now represent 6.4% of GDP, and the CBO projects they will rise to 9% of GDP, or $2.7 trillion, by 2035.

According to Treasury data, $9.2 trillion of debt is scheduled to mature in calendar 2025 – nearly 31% of GDP. Even if federal spending were to freeze overnight, the government would still need to refinance almost one-third of all the economy’s output at materially higher interest rates. That is a death spiral in motion.

Interest payments have overtaken defense as the second-largest line item in the federal budget. The U.S. now pays $1.11 trillion in annual interest, more than the entire $1.10 trillion spent on national defense. According to CATO, this will rise to $2 trillion per year over the next decade.

Debt service should be crowding out private sector spending and sending borrowing costs spiking higher, but that’s where the Fed has stepped in to abrogate the free market. Maniacal money printing has led to high rates of inflation. This is happening just as the foreign appetite for Treasury issuance is vanishing. The sad truth is that Washington D.C. is looking more like a banana republic.

Will We Grow Our Way Out?

Even if yearly deficits were eliminated, excluding interest payments, the debt-to-GDP ratio would not decline unless the economy achieved sustained growth of over 3%. But such growth is virtually impossible for the following reasons:

First, the labor force in the United States is shrinking, while productivity declined by 1.5% in the first quarter. Immigration caps and border closures have reduced labor participation, effectively halving GDP growth. At the same time, inflation has severely eroded the financial stability of the middle class, with 60% of Americans now holding less than $1,000 in savings. Consumer credit defaults are on the rise: 10% of FHA loans are currently delinquent, and 9 million borrowers remain delinquent or in default on their student loans following the end of the forbearance period.

This is not the foundation of a strong recovery. It’s a powder keg waiting for a spark.

There are a few short-term tailwinds, such as the extension of the Tax Cuts and Jobs Act (TCJA). Additionally, there is the continued allowance of 100% expensing for capital purchases. Select elements of the so-called “Big Beautiful Bill” are also included. However, these are unlikely to make a significant difference. Most provisions maintain current tax rates. And, tariffs are taxes and they are a large one–$600 billion per year.

The truth is that growth is anemic, earnings are stagnant, and fiscal multipliers are weak. According to the BEA, corporate profits declined by $118.1 billion in Q1. With weak top-line growth and margin compression from rising wages and input costs, earnings per share will struggle to justify today’s valuations.

The most crucial question remains: Who will absorb the tsunami of new Treasury issuances?

Historically, the Federal Reserve and foreign central banks have operated as a coalition of buyers of last resort. But for now, both are retreating.

Since the start of quantitative tightening in 2022, the Federal Reserve has sold off $2.3 trillion in assets. It is now in the unusual process of actively shrinking its balance sheet rather than absorbing longer-term securities. Additionally, foreign central banks, particularly those in China and Japan, can no longer be relied upon as dependable buyers. In Japan, the 40-year government bond rate has risen to 3.37%, offering domestic investors a more competitive return.

Furthermore, the imposition of tariffs, asset confiscations, and sanctions has injected additional political risk into the market for Treasury securities.

Meanwhile, trade flows have collapsed. Surpluses are declining. Global dollar reserves are thinning. There is a buyer vacuum, and it is only widening.

Some argue that the Federal Reserve can easily save the day yet again with another round of debt monetization. They are wrong

During the GFC, the Fed printed $4.5 trillion and absorbed toxic mortgage assets. But that liquidity remained on Wall Street, suppressing yields and inflating asset prices, without triggering CPI inflation.

Fast forward to today, and annual deficits have already surpassed $2 trillion. When the next recession arrives, these deficits are projected to soar further, potentially reaching between $4 and $6 trillion each year.

If, or more accurately stated, when the Fed deploys Helicopter Money 2.0, the credit will flow directly to Main Street instead of swirling around the canyons of Wall Street. Inflation will be ignited like never before. Broad monetary aggregates will explode. And benchmark yields could surge.

All forms of consumer debt – mortgages, student loans, and auto loans – are tied to the 10-year Treasury note. If short-term rates fall but long-term rates rise, the Fed’s “put” will fail. The result: a collapse in housing, credit, and equity prices.

The bond crisis is real, and its triggers are numerous, including the firing of Powell and his replacement with a presidential puppet. Add that to a recession-induced deficit explosion paired with intractable inflation, and the debt death spiral has arrived.

Total non-financial U.S. debt is now 257% of GDP, surpassing the GFC peak of 234%. The credit, real estate, and equity bubbles—what I call the triumvirate of false prosperity–are products of 20 years of negative real interest rates. That era is ending.

The tremors are already visible. The dollar is weakening. Yields are rising. Credit markets are on the precipice. When the bond market enters panic mode and liquidity dries up, it will serve as the catalyst that bursts the real estate bubble, the business credit bubble, and the equity market bubble in tandem.

Traditional portfolio models, such as the 60/40 blend of long-duration bonds and passive equity exposure, will crumble under the weight of rate volatility and earnings compression. Instead, investors may be far better off owning the short end of the yield curve right now while actively trading the equity portion according to the second derivative of inflation and growth. It is ok to ride these bubbles while they last. But you better have a method of identifying when the great reconciliation of asset prices has begun before your retirement plans get delayed for decades.

Our Inflation/Deflation and Economic Cycle Model’s output indicates there is still some room left to the upside but it is very limited and specific. India, Australia, US defense, technology, along with precious metals. Treasuries make sense but you must be on the short-end of the yield curve. Most investors are displaying the maximum amount of complacency. That is when smart investors should remain the most alert.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check” and Author of the book “The Coming Bond Market Collapse.”

__

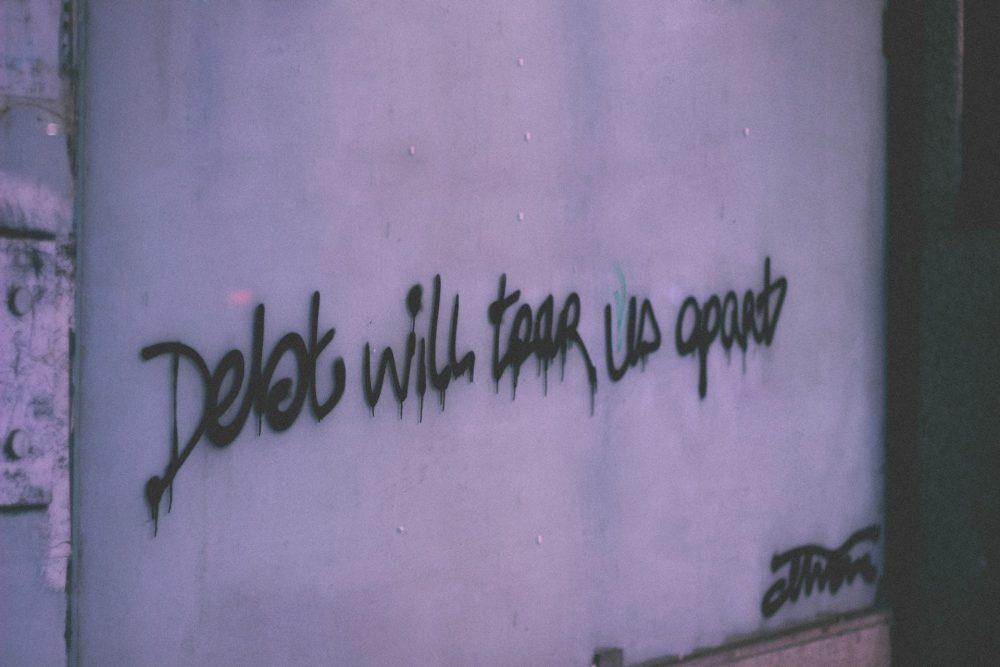

(Featured image by Ruth Enyedi via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Business3 days ago

Business3 days ago2.5 Billion People Watch Quiz Shows Every Day. Masters of Trivia (MOT) Is Letting Them Compete

-

Crypto1 week ago

Crypto1 week agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Business6 days ago

Business6 days agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move