Featured

Is the demand on the futures market making a comeback?

FCOJ closed lower last week as there was no bullish news for the market. In fact, USDA said in its world update last week that the production of oranges remains very strong around the world and noted very good weather conditions in Mexico and Brazil. World production was estimated at 49.361 million tons, from 45.732 million tons last year, and consumption estimated down at 1.607 million tons, from 1.66 million last year.

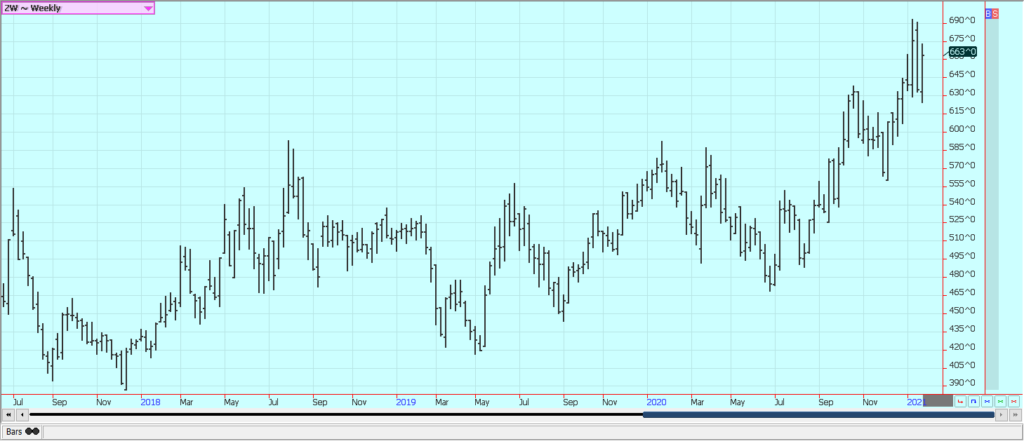

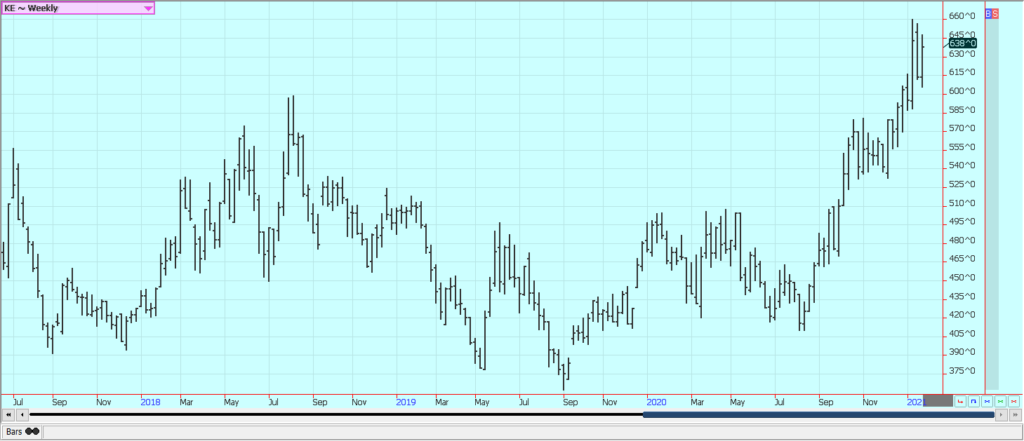

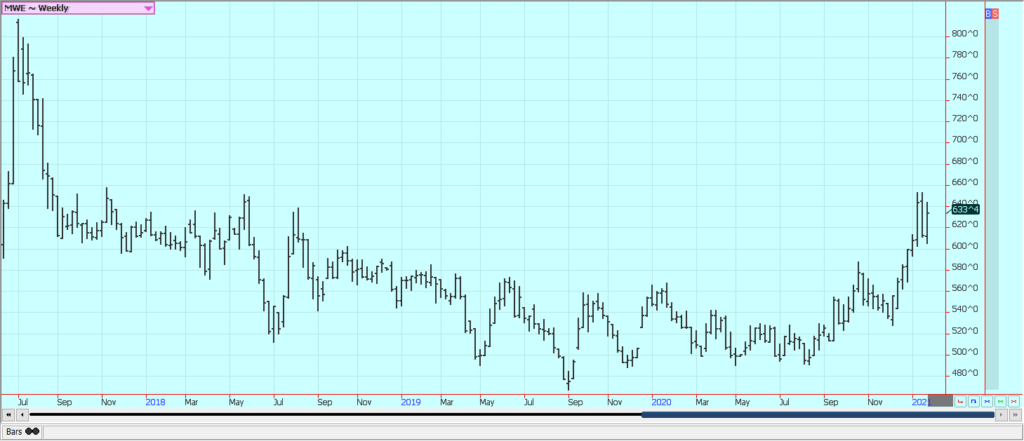

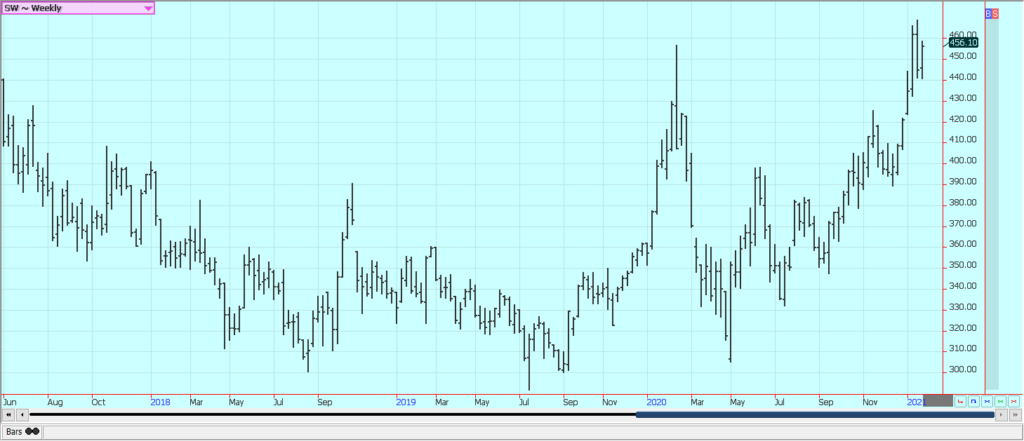

Wheat

Wheat markets were higher last week in recovery trading. Most traders now expect less or no Wheat offers from Black Sea ports after the middle of March. No one is sure about Russia and its new tax regime. Russia is raising its export taxes in mid-March but farmers there are not selling. The Russian government move has apparently caused lower prices internally and farmers have reportedly pulled back for the market. Many world buyers such as Egypt have indicated that they still intend to buy Russian Wheat even with the new taxes, so the overall Wheat situation might not change that much even if Russia decides to move ahead with the new taxes in the end. Great Plains weather has improved with snow except for some southern areas that remain dry. Canada is also better although it remains drier than normal, and some rain and snow has fallen in southern Russia. It remains much drier than normal in Argentina.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

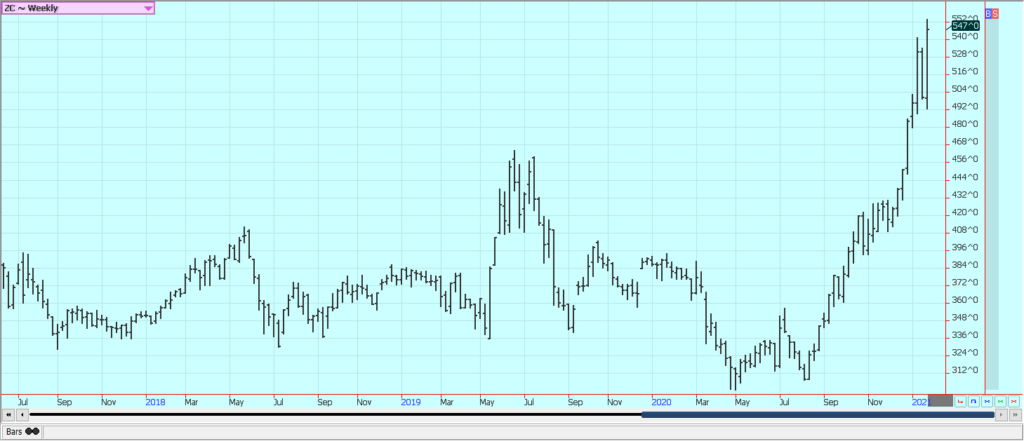

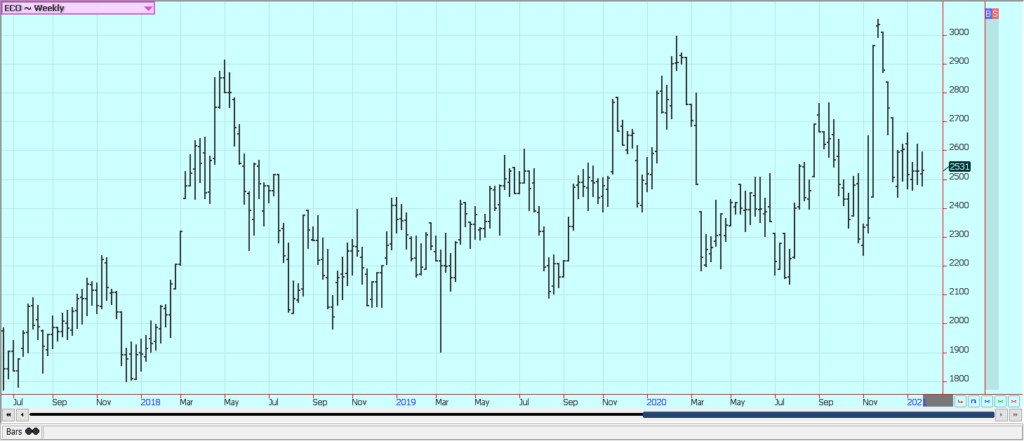

Corn

Corn was higher and made a new weekly high close and Oats were lower on apparent fund liquidation. Big demand from China was the feature last week as the country booked at least 5.0 million tons of US Corn. It was a big week for Corn sales for anybody. The export sales report was very strong last week. Export demand has held relatively strong as US Corn is about the cheapest feed grain in the world market. It has rained in central and parts of northern Brazil in the last week. Southern Brazil and Argentina also got some excessive rain. The main crop harvest has started in parts of Brazil, but progress will be slow due to the spread out planting dates due too dry conditions earlier in the year.

Weekly Corn Futures:

Weekly Oats Futures

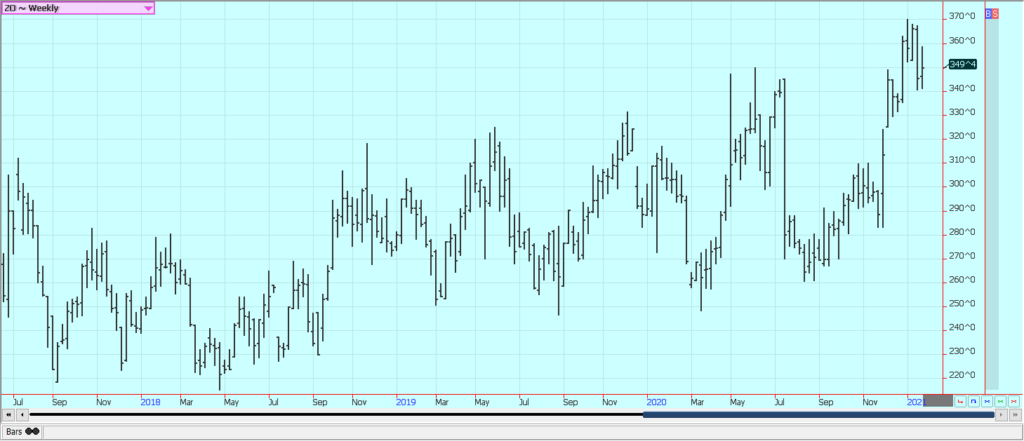

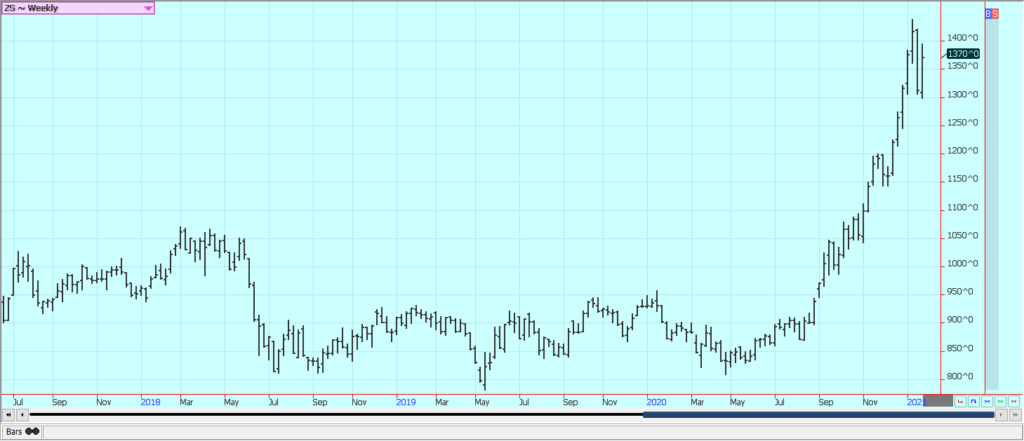

Soybeans and Soybean Meal

Soybeans and Soybean Meal closed a little lower on fund selling. The selling probably came on ideas that the impending Brazil harvest will kill current demand for US Soybeans. China has been buying for this year and next year here. Soybeans are now starting to be harvested in Brazil. Very little has been done so far and the progress might be slow due to the spread out planting earlier this year caused by dry conditions. Now it is raining too much for harvesting and there are some concerns that the quality could suffer. Many areas had problems with the weather during different parts of the growing season, so yield report estimates have been a little less. There is little sign the US price has rationed demand. Export demand reports from USDA were weaker last week for old crop Soybeans, but very strong for new crop Soybeans. The strong demand for exports and for domestic use means there is little room for error and that the US could even come close to running out of Soybeans to sell.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice

Rice was a little higher last week in mostly light volume trading. Iraq announced a global tender for 30,000 tons of Rice last week. Ideas are that countries other than the US will make the sale and that a US only tender will come somewhat later. The cash market has not felt any increased demand lately and mill operations are reported to be on the slow side. Exports had been strong until recently and were moderate last week. Texas is about out of Rice, but there is Rice available in the other states.

Weekly Chicago Rice Futures

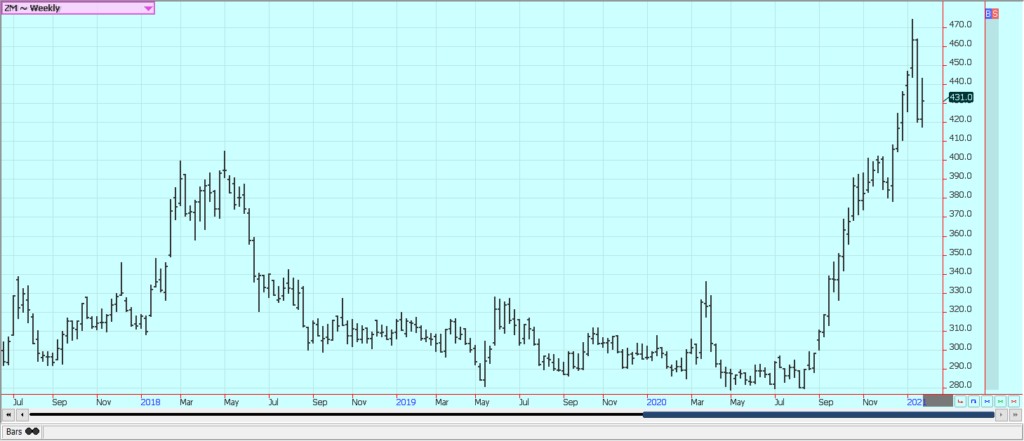

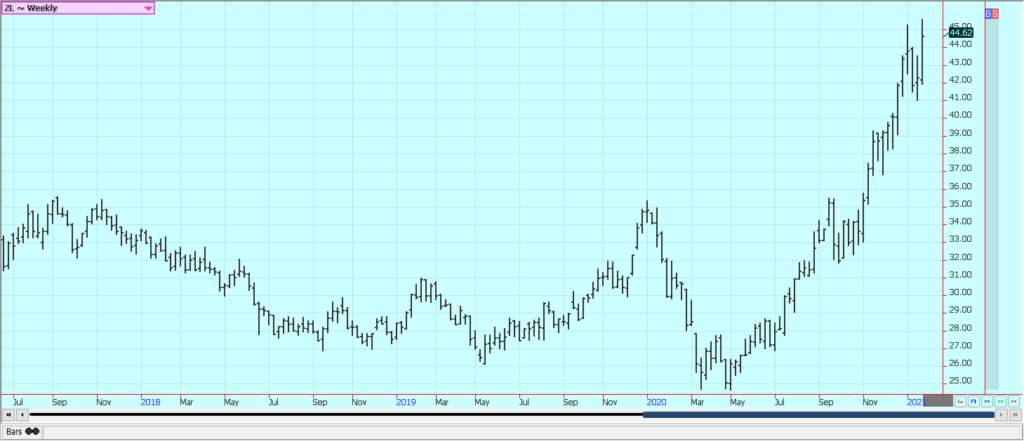

Palm Oil and Vegetable Oils

Palm Oil closed higher as export volumes have been much less so far in January. Ideas are that the export demand could recover some in February. Exports have been running at 44% less than last month. The market had been supported by ideas of tight supplies in Malaysia. Indonesia has increased its export taxes in the last week. The production of Palm Oil is down in both Malaysia and Indonesia as plantations in both countries are having trouble getting workers into the fields. Wet weather has caused even more delays. Soybean Oil was higher along with Palm Oil and on ideas of increasing demand, and Canola was higher as speculative profit taking hit the market after a string of new contract highs. Commercials were the best buyers

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

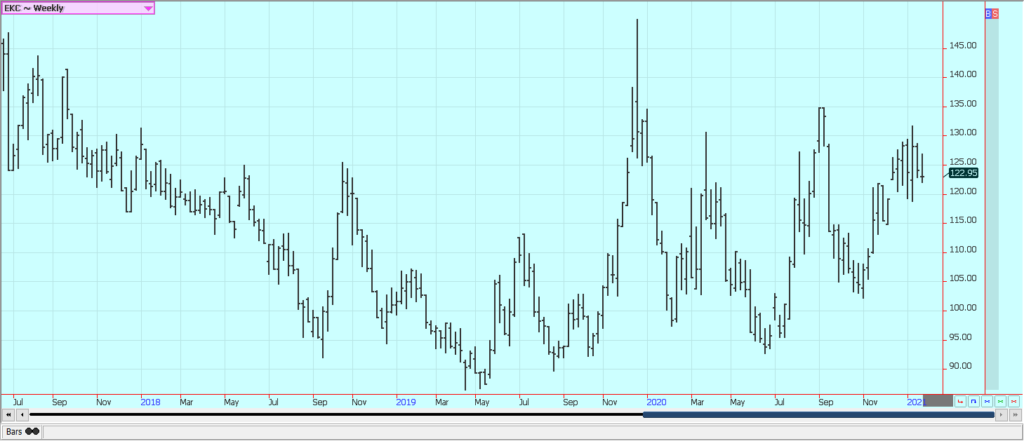

Cotton

Futures were lower for the week with fund selling noted. The selling was probably speculative long liquidation. The weekly export sales report on Thursday showed strong demand for US Cotton once again, and the demand has been strong even with the Coronavirus around and getting worse. The overall weaker US Dollar has helped demand ideas as well. The US stock market has been generally firm to help support ideas of a better economy here and potentially increased demand for Cotton products. Production was rated as less in the most recent USDA production reports so supplies could turn tight if the demand remains strong.

Weekly US Cotton Futures

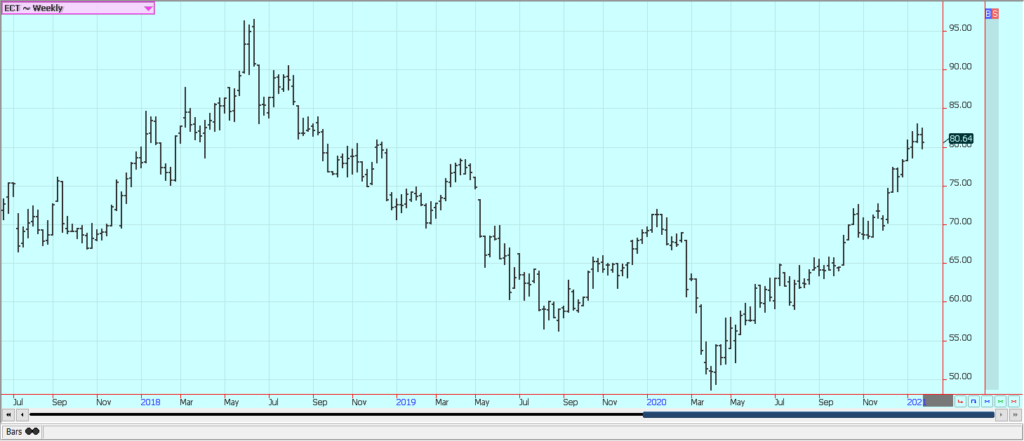

Frozen Concentrated Orange Juice and Citrus

FCOJ closed lower last week as there was no bullish news for the market. In fact, USDA said in its world update last week that the production of oranges remains very strong around the world and noted very good weather conditions in Mexico and Brazil. World production was estimated at 49.361 million tons, from 45.732 million tons last year, and consumption estimated down at 1.607 million tons, from 1.66 million last year. Orange Juice production should be 1.82 million tons, from 1.545 million tons last year. The weather in Florida remains good for the crops and the harvest is active. The Coronavirus is still promoting consumption of FCOJ at home. Restaurant and food service demand has been much less as no one is dining out. The weather in Florida is good with frequent showers to promote good tree health and fruit formation. Brazil has been too dry and irrigation is being used. Showers are falling in Brazil now. Mexican crop conditions are called good with rains.

Weekly FCOJ Futures

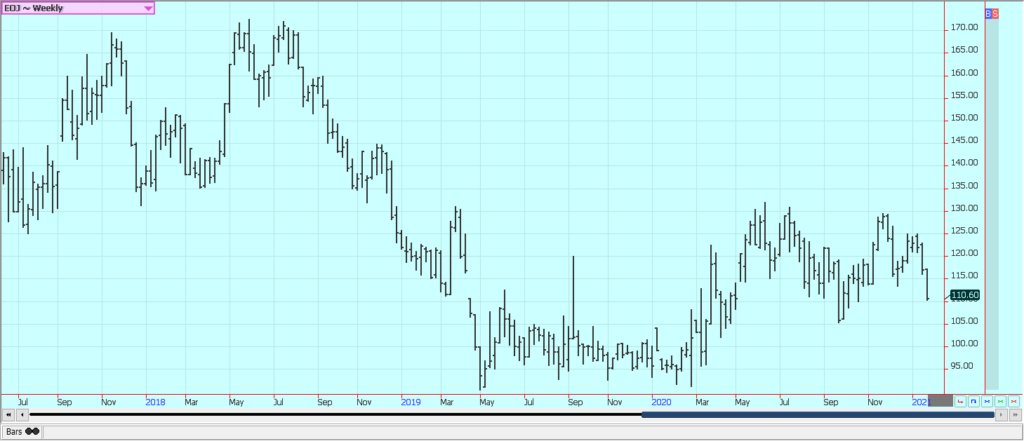

Coffee

Futures were a little lower in New York and slightly higher London after a mostly sideways trading week. There are reports of good weather in Brazil and Vietnam and on the potential for increased exports from Vietnam. However, Brazil has been dry for flowering and initial fruit development and it has been warm and dry now. These conditions could last for another week. Vietnam has harvested its production under mostly dry conditions. Some of those crops are starting to hit the market. Central America is also drier for harvesting. Good growing conditions are reported in Colombia and Peru. The demand from coffee shops and other food service operations is still at very low levels. Reports indicate that consumers at home are consuming blends with more Robusta and less Arabica.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

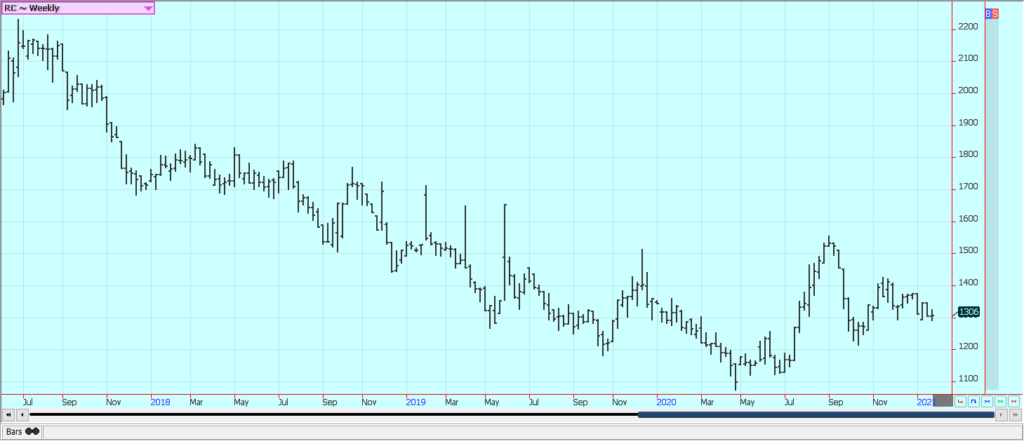

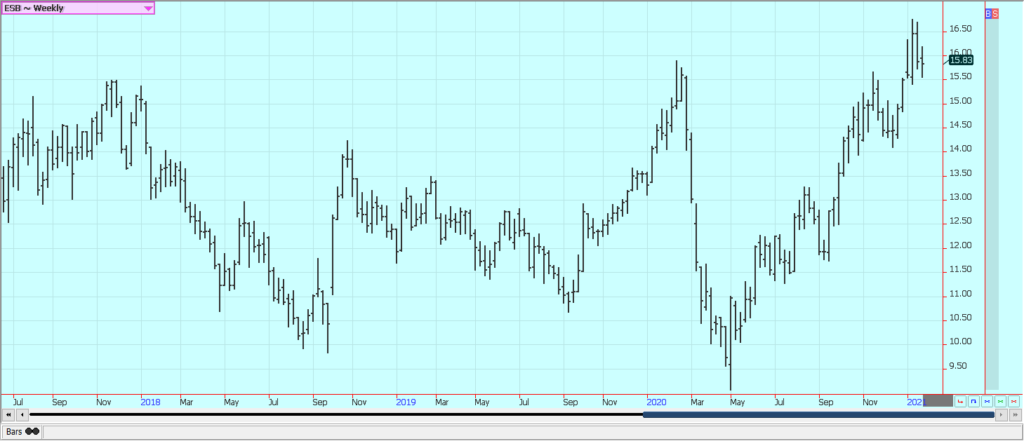

Sugar

New York and London closed higher as buying appeared on Friday. Rains were reported again in Brazil. It has been raining in south central Brazil and the production of cane is winding down for the season. The rains have come late to the region but they are supporting whatever crops are still in the ground now. Production has been hurt due to dry weather earlier in the year. India has a very big crop of Sugarcane this year but no exports are coming out as the government has been very slow to approve export subsidies. Thailand might have less this year due to reduced planted area and erratic rains during the monsoon season. The EU Sugar crop is less this year as is the crop in Russia. Coronavirus has caused demand concerns for ethanol but demand for Sugar seems solid.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

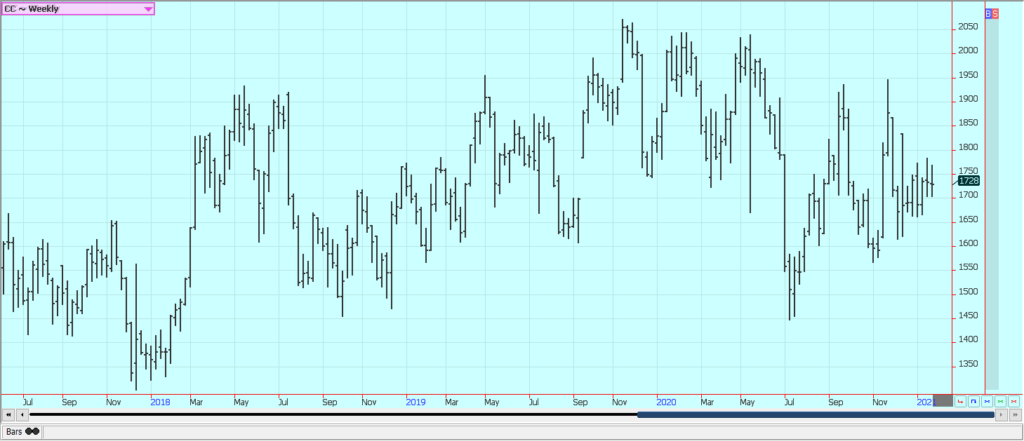

Cocoa

New York and London closed slightly lower in choppy and sideways trading. The grind data has been weaker again implying less demand for chocolate. Importers are still looking for ways to source Cocoa without paying a premium demanded by Ivory Coast and Ghana. Both countries have instituted a living wage for producers there and are looking to tax exports to pay the increased wages. Origin has ample supplies to sell right now. Ivory Coast has not been shipping as exporters have asked to hold off. There is about 100,000 tons ready to ship with no buyers at this time.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by James Baltz via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa1 week ago

Africa1 week agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks

-

Crypto6 days ago

Crypto6 days agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments

-

Biotech2 weeks ago

Biotech2 weeks agoEurope Launches Personalized Cancer Medicine Initiative

-

Markets2 days ago

Markets2 days agoRice Market Slips as Global Price Pressure and Production Concerns Grow