Featured

Demand on rice hold up well this week, giving hope for higher prices down the road

Markets for products such as sugar, coffee, rice, vegetable oil, and wheat are constantly changing. Trading futures and options involve a substantial risk of loss and may not be appropriate for all. The valuation of futures may fluctuate and, as a result, customers may lose more than their original investment. This is why it is important to maintain the permanent monitoring of these markets.

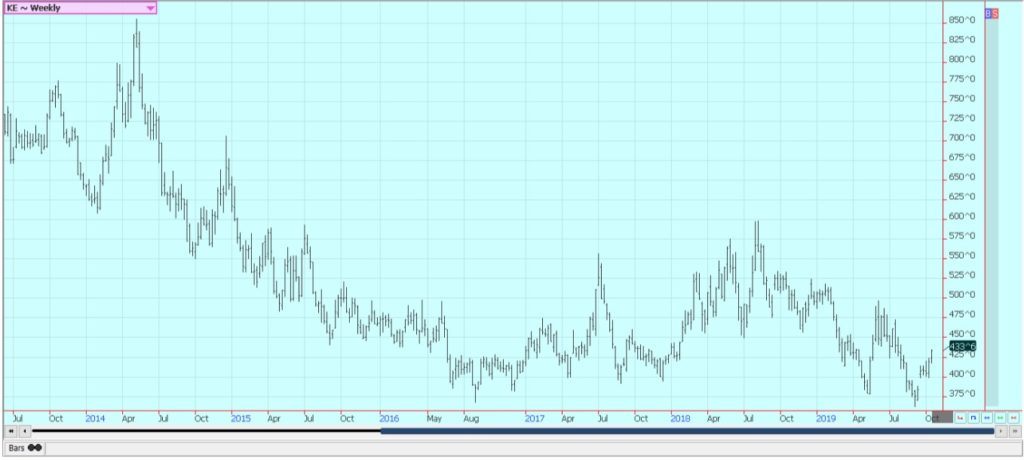

Wheat

Wheat markets were mixed last week as Chicago SRW and HRW prices moved higher and Minneapolis Spring Wheat prices moved a little lower. Chicago Winter Wheat futures are being led higher by strength in world cash prices. Egypt. in order to satisfy their demands, bought over 400,000 tons of Wheat last week, mostly from Russia but also from Ukraine and France.

It paid higher prices. Black Sea Wheat has been the lowest-priced Wheat over the last few years and Russia has set the world price for quite a while. The fact that prices are moving higher there gives the rest of the world a chance to charge more. There are big problems with Wheat crops in Australia again this year due to the ongoing drought situation.

Southern and western areas are most affected. The Bank of Australia estimated production as low as 15.5 million tons for the country. Australia can normally produce 21 or 22 million tons. There has been the talk of adverse weather in Argentina, too. Meanwhile, the storms have moved out of the Canadian Prairies and northern Great Plains and left behind some damaged Wheat.

The fact that no more damaging weather is coming caused some speculative selling and increased harvest activity in Canada caused some commercial selling. The overall trends are generally up and prices can work higher in the near term.

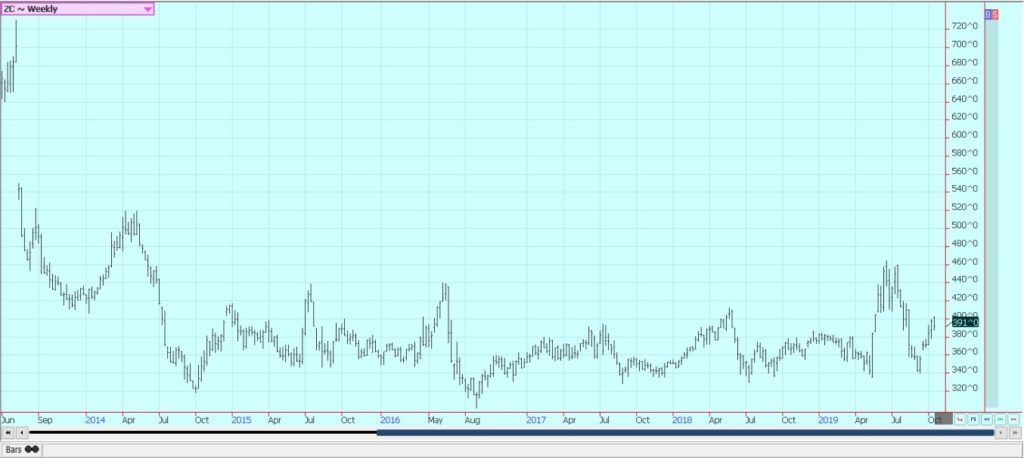

Corn

Corn closed lower and Oats closed higher last week. Price action was disappointing for bulls in both markets as both closed closer to the lower end of the weekly trading range and might move lower again this week. The harvest is finally starting to get more active now that the weather has turned drier in the Midwest.

It was a great weekend in the region with warmer temperatures and some sun to help dry soils and Corn. Farmers are concentrating mostly on harvesting Soybeans but there has been some Corn harvested as well. Yield reports seem stronger in the western Corn Belt than in the east.

Many think that the best Corn is being harvested now and that yield reports will show less Corn as the harvest progresses. Demand remains hard to find and this was reflected fin the USDA reports released on Friday. Oats saw increased pressure as the weather improved in the Canadian Prairies.

The US harvest is over but there is still grain to be harvested farther north. The Canadian Dollar turned stronger against the US Dollar but this did not support Oats prices.

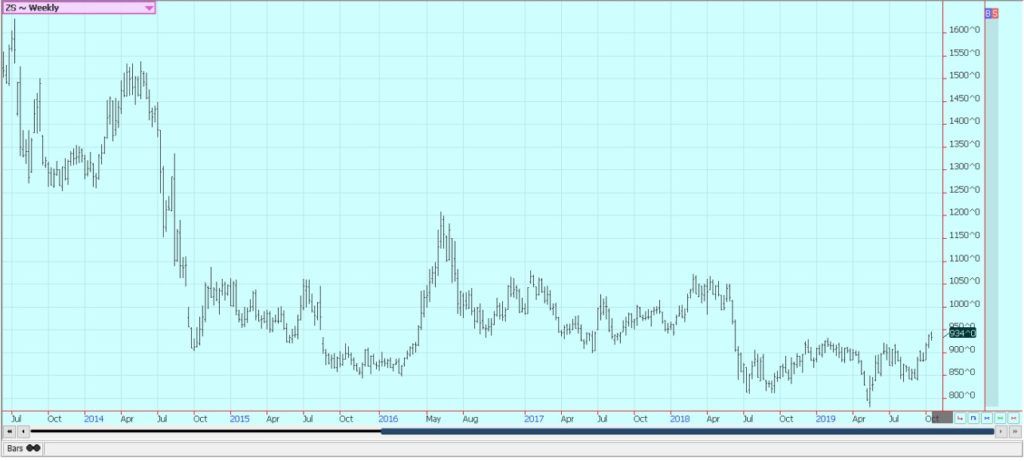

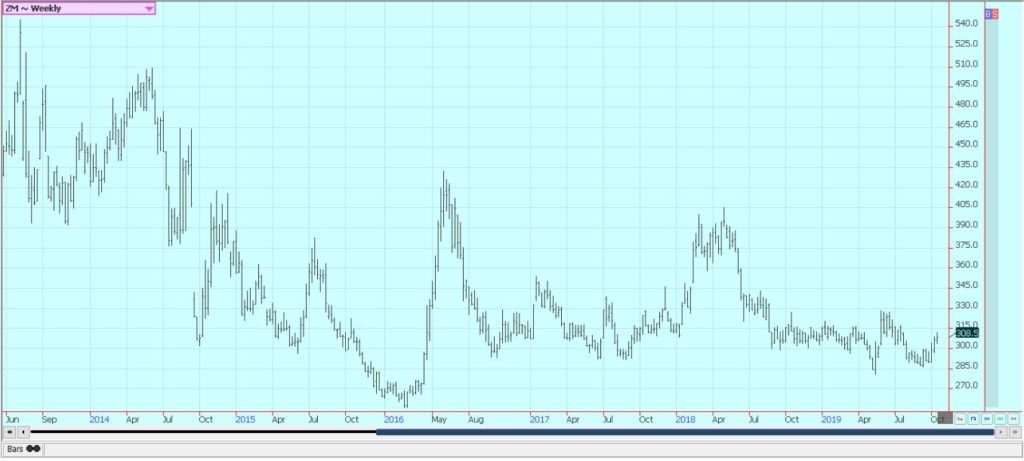

Soybeans and Soybean Meal

Soybeans were slightly lower for the week but Soybean Meal was higher. Soybeans ere hurt by ideas of expanding harvest activity and closed with small losses despite more Chinese buying of US Soybeans. The weekly USDA data showed that farmers were more focused on the Soybeans harvest than Corn last week and data released on Monday should show this trend as well.

Yield reports show that yields are generally better in western areas than to the east. China continued to buy US agricultural products including pork and Soybeans and tariff increases from the US were held in check. The two sides hope to have a Phase One deal ready in November for signing at the G-7 meetings. There will be more meetings to find a more comprehensive deal that can be signed by both presidents.

The market is also starting to keep a closer eye on the weather in South America. It has been too dry in parts of central and northern Brazil and the planting progress has been delayed. There are forecasts for more rains to allow better planting progress appearing in the next couple of weeks. Soybeans could trade sideways to lower this week.

Rice

Rice was lower and continued to hold its ground as the US harvest starts to wind down. The harvest is winding down in all areas except California and field yields appear to be generally below last year but still stronger than some analysts had expected. Milling quality is said to be lower on later harvested Rice but was very good for the early harvested Rice.

Basis levels are reported to be firmer as the harvest comes to an end and Rice gets put in on-farm storage. There are ideas that not much Rice is available to the cash market right now as much of the new Rice has been put into storage. Producers will hold out for higher prices as they feel that prices overall are too cheap.

Export demand has been holding well and this gives hope for higher prices down the road. The best buyer has been Mexico but Central America has been buying in greater volumes as well. The charts maintain a bullish outlook but many short term objectives have already been hit. Even so, the price action has had a positive feel and prices might try to go higher this week.

Palm Oil and Vegetable Oils

World vegetable oils markets were mixed with Palm Oil and Soybean Oil higher but Canola a little lower. Palm Oil got stronger export news, as demand grow last week when the private surveyors showed that the export pace for the first half of the month is now above from the pace of the previous month. Short term trends have been up in the market but prices are stalling just below the Summer highs.

The price action implies that futures can move higher this week as it moves through the resistance areas. Soybean Oil was slightly lower as Soybeans struggled to hold the gains of the previous week. Weakness in Petroleum futures hurt Soybean Oil prices. The US is facing increased competition for sales now from South America, and mostly from Argentina. Argentina has traditionally been the major source for Soybean Oil in the world market as it prefers to use other oils at home for its cooking needs.

The charts indicate that Soybean Oil can rally this week. China is opening its markets to Argentine Soy products in a move that hurts US export prospects longer term. Canola was lower last week as the harvest remained active. Progress has been slow and some damage and loss were possible last week due to the freeze event, which my effect demands.

The weather has improved and farmers have been active sellers. The Canadian Grain Commission reported record movement off farms to processors and exporters in its data last week. Trends are turning down for the short term in Canola.

Cotton

Cotton was higher on follow-through buying tied to talk that the US and China were close to a partial deal that would allow agricultural exports to flow to China in exchange for a truce in the tariff increases. Cotton producers hope that China will buy some Cotton from the US but China has not been doing this. It has concentrated on Soybeans and Pork purchases instead.

The market is still finding support from deteriorating crop conditions. Weekly USDA reports still show a tale of two crops with some crops very good to excellent but some crops very poor. This trend has been a feature of the market all year as the Texas Panhandle and nearby areas have been very hot and dry for a big part of the growing season.

Crops in the southeast have seen perhaps too much rain and much cooler weather. Another system moved through southern Georgia and through the Carolinas with some significant rain that might hurt Cotton quality. The weekly report showed increased stress in the southeast last week. The export demand remains weak.

Frozen Concentrated Orange Juice and Citrus

FCOJ was slightly higher in range trading. Futures have held the same rang for months now and show no signs of going higher or lower. Good growing conditions and increased oranges production estimates by USDA are bearish, but the market seems to have found a minimum area for now. USDA estimated Florida production at 74 million boxes.

The weather has been great for the trees as there have been frequent periods of showers and no hurricanes or other severe storms so far this year. Some areas have been dry lately and some irrigation has been used. A storm moved through central and northern areas of the state over the weekend but mostly brought rain.

Crop yields and quality should be high for Florida this year. Inventories of FCOJ in the state are high and are more than 30% above last year. Rains are falling in Brazil and trees should be flowering now.

Coffee

Futures were lower on a lack of buying interest rather than any big new selling interest. Trends in both markets are down. New York was higher despite more reports of good flowering in Brazil as Real started to rally against the US Dollar. The Real rallied after testing recent lows. London has been the weaker market as the Asian harvest is underway.

Vietnam exports remain behind a year ago, but the market anticipates bigger offers as producers and traders will need to create new storage space and are expected to do this by selling old-crop Coffee. The Arabica growing areas got needed rains to start the flowering last week and reports indicate that flowering is off to a very good start.

More rain is expected this weekend or early next week. Many now anticipate a big crop from Brazil next year. However, there were some extreme cold and drought conditions earlier in the year that might have stressed trees and could hurt production potential for this year despite the good weather now.

Vietnam crops are thought to be big despite some uneven growing conditions this year. It has been warm and dry at times, then the growing areas have seen some very heavy rains. The rains are more moderate now. Demand has been quiet over the last couple of weeks. Differentials have been stable but buyers are not aggressive.

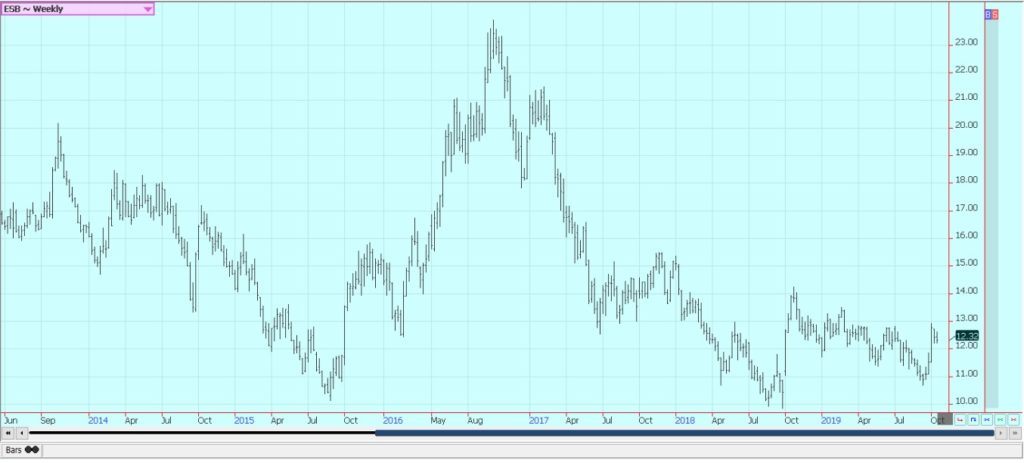

Sugar

Futures closed higher on Friday but lower for the week as the US Dollar. London was also higher on Friday but lower for the week as it appears that lower production in Europe has been priced into the market. Futures remain in a trading range but have been showing that some weakness is still around.

Europe and Russia are probably buying in the world market after poor growing seasons affects the demand for this product. Reports of improving the weather in Brazil imply good crops there. World petroleum prices are relatively cheap and are not supporting ethanol demand ideas. Reports from India indicate that the country is seeing relatively good growing conditions and still holds large inventories from last year.

The weather there has improved with the monsoon and some areas are seeing some excessive rains The weather has been much more uneven in production areas from Russia into Western Europe. Those areas had a very hot and dry start to the growing season and there are reports of crop losses this year.

Cocoa

Futures closed a little lower again Friday and lower for the week as the market continues to correct following the rally attempt earlier in the week. Chart trends are turning down. Ideas for increasing harvest pressure kept the sellers interested. The reports from West Africa imply that a big harvest is possible in the region, but no one knows how to handle new marketing and producer support programs imposed by the governments of the Ivory Coast and Ghana.

Ivory Coast arrivals are off to a fast start and are above year-ago levels two weeks into the season. The weather in Ivory Coast has improved due to reports of frequent showers. The precipitation is a little less now so there are no real concerns about disease. Ideas are that the next crop will be very good and will help to satisfy demands better.

Both Ivory Coast and Ghana are doing what they can do boost Cocoa prices and maintain good earnings for producers by paying a living wage differential and are looking to regulate the flow of Cocoa into the world market. The moves could force the big Cocoa processors and grinders to pay more as they contract for Cocoa well in advance to ensure adequate supplies in order to satisfy demands.

—

(Featured picture by Graphic Node via Unsplash)

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever?

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purposes and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Cannabis3 days ago

Cannabis3 days agoCannabis Company Adopts Dogecoin for Treasury Innovation

-

Biotech1 week ago

Biotech1 week agoPfizer Spain Highlights Innovation and Impact in 2024 Report Amid Key Anniversaries

-

Markets5 days ago

Markets5 days agoStock Markets Surge Amid Global Uncertainty, But Storm Clouds Loom

-

Africa2 days ago

Africa2 days agoMorocco Charts a Citizen-Centered Path for Ethical and Inclusive AI