Featured

What are the disadvantages of a robo-advisor?

Investments made using robo financial advisors appear to be easier, however, there are still caveats for using them.

Robo-advisors, sometimes called robo-financial advisors, are automated financial advisors that manage your investment dollars for the greatest returns with the least amount of risk. Some offer human financial access, others don’t. The various robo AI providers all offer their own twist to the service.

What’s not to love?

It sounds like the Holy Grail of Investing.

After all, you’re busy, you’ve got some money to sock away for tomorrow. You don’t want to make mistakes when you invest. Why not choose a robot to manage your money? They won’t be caught in malfeasance like Bernie Madoff or Wells Fargo. Or will they?

Don’t get me wrong, I love robo-advisors. I think they offer superb investment management for low fees. But, they aren’t for everyone, and they are not all alike.

5 cons of robo-advisors

1. You can’t choose your own investments.

There are scores of asset classes, and if you’re an investor seeking an extremely diversified portfolio that includes more investment choices than diversified U.S. and international stocks and bond ETFs, then you might not be a good candidate for a robo-advisor.

Most robo-advisors offer a limited number of ETFs. If you want a Global real estate ETF in your portfolio or a commodities fund and the robo-advisor doesn’t offer it, then you’re out of luck. Exceptions: M1 Finance and Motif allow you to choose your own investments and also offer a robo-advisor to manage them.

2. There are limited contact methods and hours.

Some robo-advisors only offer email, chat box and text contact. Others have limited phone hours. Several robo-advisors aren’t accessible during the weekends. This can be a problem since you’re working during the week and attend to your investments on the weekends.

Exceptions: There are a few robo-advisors with weekend contact hours and telephone access.

Investments can be tricky to manage so choose the best manager for you. (Source)

3. Frequent rebalancing might hurt you.

All robo-advisors rebalance your account. When you start investing, the digital investment advisor assesses your risk comfort and then creates an asset allocation plan. In other words, you have a certain percent of your money in stock investments and a certain percent in bond investments.

After market ups and downs, your 70 percent stock versus 30 percent bond portfolio might drift to an 80% stock v 20% bond mix. When your investment percentages get out of whack the robo-advisor sells the overperforming assets and buys more of the underperforming holdings to get the mix back to your preferred asset allocation.

Some robo-advisors rebalance daily, others monthly, quarterly or other frequency. Excessive rebalancing could result in many transactions and fees. Also, sales in a taxable account can trigger capital gains taxes according to a recent CNBC.com article, “5 Mistakes to Avoid When Rebalancing a Portfolio”, by Jeff Brown.

Exceptions: Less frequent rebalancing, or rebalancing based on 5 -10 percent drift from the desired allocation is preferable.

4. They are unproven during a down market.

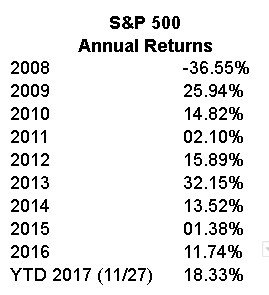

Betterment, one of the first robo-advisors was founded in 2008 and Personal Capital was launched in 2009. Most other robo-advisors evolved more recently. The S&P 500 annual investment returns for the past 9 years are predominantly positive:

© Barbara Friedberg (Source)

During the lifetime of the oldest robo-advisors, nine years, the only negative return year of the S&P 500 was 2008. Since 2009, the stock market has delivered positive returns.

Investors are typically happy when their investment portfolios go up.

When the investment markets go south, as they do every so often, it’s unclear how investors will react. Will they flee their investment robo-advisors?

Investors are concerned about how the robo-advisors will perform in a down market. This could be a disadvantage of robo-advisors. For example, if the robo-advisor algorithms lean towards aggressive investing allocations, it’s unclear how clients will react to a major market decline and subsequent portfolio losses and how the platform will handle the market reversal. Although, low fee robo-advisors won’t avoid a market decline, they will cut your overall investment expense.

Exception: Some robo-advisors have a delay when markets fall and other strategies in place to handle market drops.

5. Tax-loss harvesting can create headaches at tax time.

Tax-loss harvesting is when you sell a security at a loss for tax purposes. Then you use the loss to offset any capital gains you might have, up to $3,000. You’re not actually eliminating tax payments, you’re just deferring them.

There are problems with tax-loss harvesting as they can create excess accounting paper work. Additionally, your robo-advisor must be mindful of the ‘wash rule’ which disallows any loss that occurs when a similar security is repurchased within 30 days. There’s dispute whether tax-loss harvesting is worth it or not.

Exception: Some robo-advisors ask to view your entire investment portfolio, not only the portion invested with the robo-advisor. That way they can avoid violating the ‘wash rule’.

Wrap up

Clearly, there are some problems with robo-advisors. Yet, in general they provide a sensible investment management alternative to higher fee financial advisors. Despite the cons of investing with robo-advisors, I like the ease and discipline of investing with a robo-advisor for many investors. When choosing to invest with a robo-advisor, read reviews and find the one that’s right for you.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEU Eases CO2 Tax Burden on SMEs with Revised CBAM Rules

-

Fintech10 hours ago

Fintech10 hours agoRobinhood Expands to Europe with Tokenized Stocks and Perpetual Futures

-

Business1 week ago

Business1 week agoAmerica’s Debt Spiral: A $67 Trillion Reckoning Looms by 2035

-

Crowdfunding4 days ago

Crowdfunding4 days agoTasty Life Raises €700,000 to Expand Pedol Brand and Launch Food-Tech Innovation

You must be logged in to post a comment Login