Featured

Economists warn: Japan may be facing second D-Day

Japan is faced with an aging population, but will the country’s demographics show any signs of improvement?

Demographic death day.

It’s maybe not as bloody as the battlefield in Normandy but equally as devastating in the long-term.

What’s in store for Japan’s economy?

Japan’s Baby Boom started to slow down in 1942 coming into World War II and peaked—forever—in 1949 after soldiers came home from war and made a lot of babies.

It was the first major developed country to peak on a 47-year lag for spending in its economy.

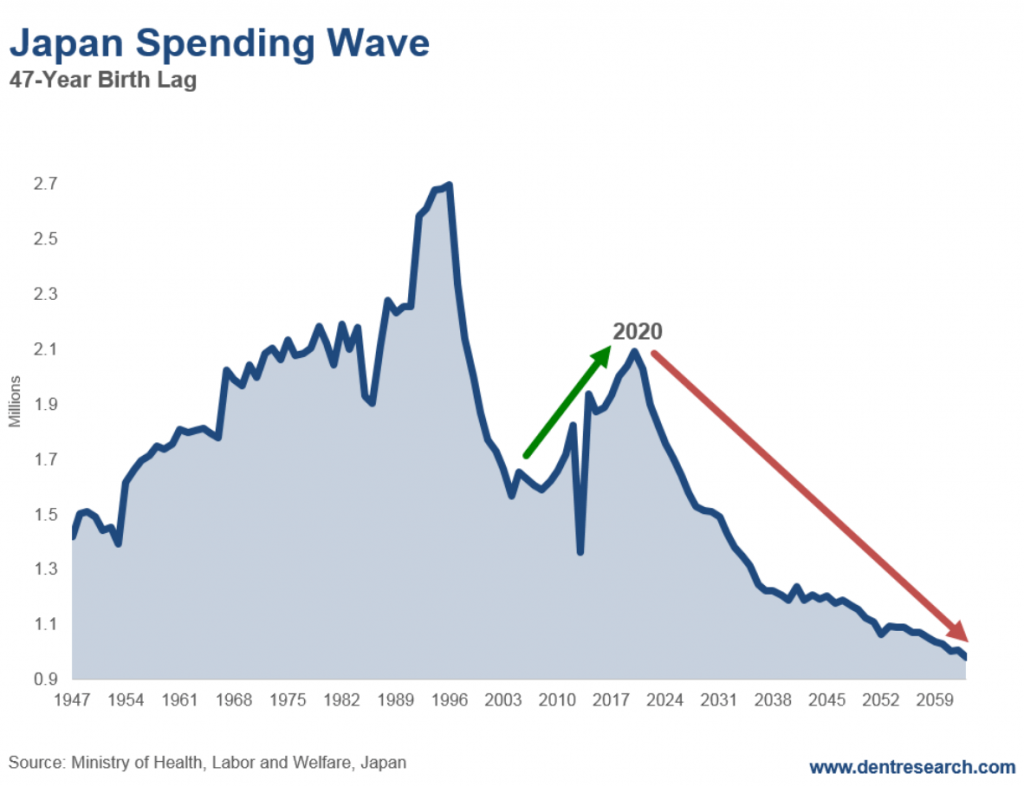

The effects of that first drop-off in births during WWII hit the country after 1989. The second, bigger hit arrived in 1997, and it has felt the negative effects ever since. Look at Japan’s Spending Wave below:

Source: Ministry of Health, Labor and Welfare, Japan

Japan has been in an endless slowdown with ever-escalating QE ever since 1997.

Even when its millennial generation turned up mildly around 2003, and its stock market bottomed down 80%, it has only seen a rise back to 21,000 recently. That’s nowhere near its 39,000-peak in late 1989 (a peak we forecast, I’ll add when we saw the first Demographic D-Day coming and warned of its massive stock and real estate bubbles bursting).

Well, Japan has a second D-Day coming after 2020, right after we likely endure a global market and economic collapse in the next two or three years.

Make no mistake about it: Japan is dying

The country’s demographic decline will only get much worse again after 2020. So, any reprieve in its economy from the endless stimulus and super-low interest rates will be short-lived.

Germany is the next to collapse demographically in Europe following Greece, Portugal, and Italy. Spain comes last, but with an equally bitter decline after 2025.

South Korea peaks the last for the East Asia “Tigers” in 2018.

When I lecture in South Korea, my summary statement is that “you are Japan on a 22-year lag.” That’s the difference between their Baby Boom peaks—1949 and 1971.

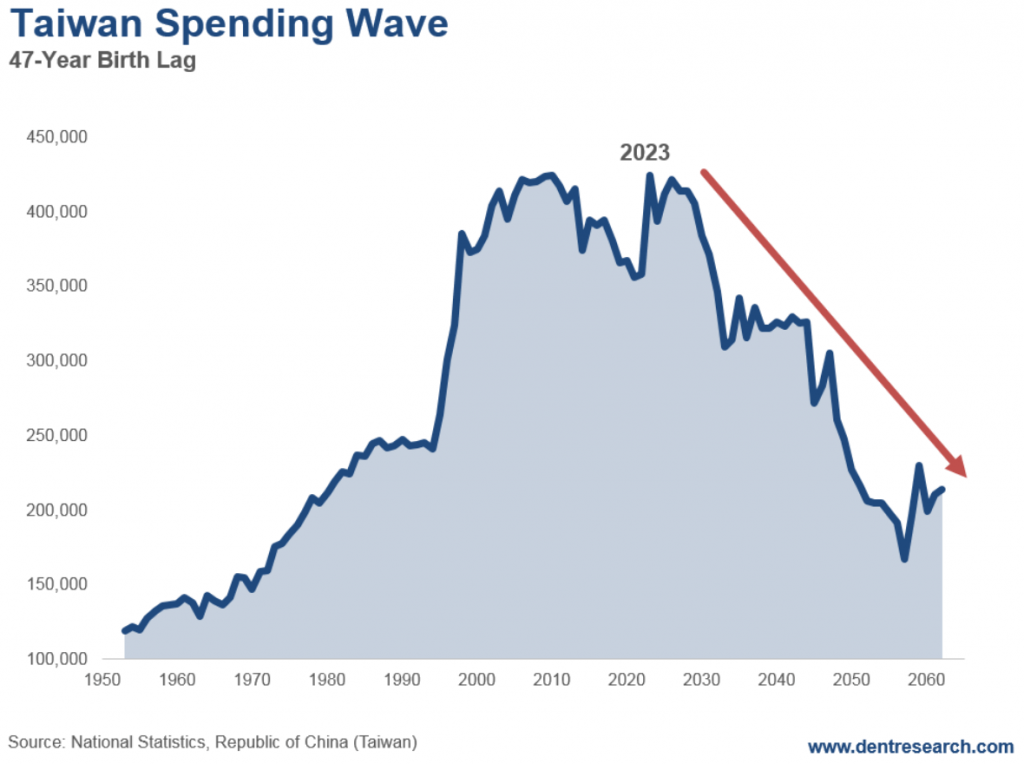

Taiwan, in the chart below, also has already peaked and will see downtrends in consumer spending for decades. This started in 2008 already but will accelerate after 2023.

Source: National Statistics, Republic of China (Taiwan)

The greater part of the developed world has peaked

Consider Japan in late 1996, the U.S. in late 2007, most of Europe in late 2011…and now the rest of East Asia and Japan’s final demographic D-Day.

This is demographic destiny: The greatest global boom in history turns into the greatest bust. Yes! There are cycles in everything. Affluent, urban households have fewer kids and that reverses the very boom that they created.

If central bankers think they can offset these increasing demographic declines and unprecedented debt levels with “something for nothing” free money—they’re in for a nasty surprise!

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEU Eases CO2 Tax Burden on SMEs with Revised CBAM Rules

-

Fintech2 days ago

Fintech2 days agoRobinhood Expands to Europe with Tokenized Stocks and Perpetual Futures

-

Business1 week ago

Business1 week agoAmerica’s Debt Spiral: A $67 Trillion Reckoning Looms by 2035

-

Crowdfunding6 days ago

Crowdfunding6 days agoTasty Life Raises €700,000 to Expand Pedol Brand and Launch Food-Tech Innovation

You must be logged in to post a comment Login