Business

How do you estimate the value of a brand?

Brand valuation is a smart and risky approach to selling a product in terms of a brand-product match.

Brand valuation refers to the process of determining how much a brand is worth in terms of the financial value perceived or money that a third party is ready to pay for.

It includes two aspects: economic value and social aspect. When businesses are in negotiations for getting acquired, they look for leveraging some of their intangible assets so as to spruce up their balance sheet.

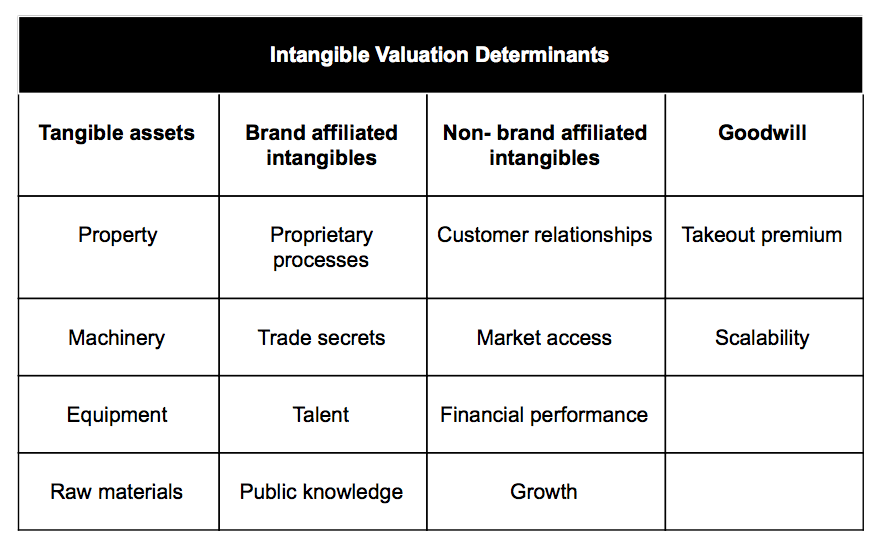

Hence, business assets are categorized as tangible and intangible assets as described in the table below:

In brand valuation, companies need to consider useful life and risk more seriously, especially for brands that hold less than a number one to three positions in their respective markets.

A good indicator of brand persistence by industry is if brands are replaced post-acquisition or maintained by retention. For example, in case of brand licensing, a licensee takes brand rights over a product line and focus on making a profit by creating and selling merchandise around it.

In return, the brand-owning company charges the manufacturer a fee (Royalty Rate) for using its brand.

For example, tech company Apple did not get involved in the manufacturing of accessories for its iPhones. The company instead encouraged vendors to build accessories around the said brand, motivating the development of innovative products.

A similar case was Videocon, which sold a multitude of products like Sansui, Kelvinator, Electrolux and Kenstar aside from making for Philips and Hyundai. One of the major advantages of licensing brand value is that it enables them to gain fees in the form of royalty from the product of companies, for they sell every such licensed product aligned to customer needs leveraging the brand of the licensor entity.

IND AS 36, 38 and 103: Goodwill and purchase price allocation valuation

In India, with the lack of regulatory requirements, most of the listed companies do not report the brand values separately rather categorized under asset categories. In such cases, a researcher also finds it very difficult to estimate the brand value of any closed transactions. Now with the adoption of Ind AS, brand valuation has started gaining more significance because Ind AS 36 & 38 speaks about impairment of goodwill, recognition of intangible assets, determination of the carrying value and amortization.

Furthermore, under Ind AS 103, the identification of intangible assets during acquisition is mandatory. Therefore, the importance of purchase price allocation comes. Some commonly identifiable intangibles in purchase price allocation include customer contracts, customer relationships, brand, and technology. There are various factors that affect PPA for a business, which include nature of the acquired business and reasons for the acquisition, consideration paid, remaining useful life for intangible assets, amortization methods assumed for intangibles, discount rates, growth rates, and tax benefits.

Brand valuation methodology

Valuation of the enterprise or its brand depends upon its worthiness for an investor who may be prepared to pay premiums. This exercise is carried out based on generally accepted methodologies, the results of which could vary significantly depending upon the basis used, the specific circumstances and professional judgment of the valuer.

Different factors help in comparing brand value: a) Brand value to enterprise value b) Brand value to sale and c) Brand profit margin to sales, or brand royalty rate. Brand valuation methodologies can be mainly categorized into market, cost and income approach.

However, inter-brand, real option, brand sale comparison and royal relief approaches are the most reliable. The market approach is based on the estimation of the anticipated price if it is to be sold in an open market. The brand sale approach estimates the value based on the differential price to sale ratio technique, which computes the brand value as the product of the difference between the anticipated price to sale ratio of an unbranded firm and the sales of the branded firm.

The royalty relief approach perceives that the ownership of the brand is with a third party and determines its value based on the royalty fees gained through product sale. On the other hand, the inter-brand approach focuses on factors like leadership, trend, internationalization, and protection.

Finally, the real option approach deals with the multi-stage process of brand development. Further, the brand due diligence helps determine the real worth of any company in terms of its brand value especially at times of its acquisition. Various aspects such as legal-market and brand image review are the key. For example, documents related to company’s patents, copyrights and trademarks must be reviewed.

The brand valuation methodology depends on three things: market, cost, and income approach. (Source)

Key factors: Royalty rate, remaining useful life and discount rate

A number of global research companies, in ranking top global brands by evaluating them, act as a marketing tool for the brands of businesses. Most of them work in conjunction with brand owners with the intention of bringing their brand value to light and thus infuse a sense of pride and satisfaction amongst customers owning the brand. Rankings are not consistent and grossly vary with a wider margin.

For example, let’s take the case of Google, which was valued between $68.6 billion and $158.8 billion during 2014. Similarly, Microsoft, when it acquired LinkedIn in 2016, was valued at $26.9 billion. Here again, most of the brand valuation companies’ ranking failed.

Hence, one can say that brand valuation is a subjective thing, which highly depends on the royalty rate, brand equity, useful life, discount rate and valuation ratios like Brand/EV, Customer/EV, and Goodwill/EV. These are key factors determining the brand value of any company.

Professional service sector companies like Deloitte, PWC, Grant Thornton etc. having two kinds of client based on a) ongoing or recurring basis, i.e., audit, tax and accounting, outsourced services etc. and b) onetime or project-based i.e., transaction advisory, consulting and advisory. In case of recurring basis, client size is more important compared to brand value whereas for advisory-based services brand plays an important role because here the margin is also high. During brand valuation, understanding the revenue model and the target segment is an important factor, and consulting industry breakdown of ratios like brand/EV, customer/EV and price/revenue is thus essential.

Royalty fees depend on Intellectual Property (IP) rights, the cost-revenue structure of a licensee and resulting profitability. Differences between royalty rates of Adidas and Reebok are perfect examples of brand equity. The expected remaining life is a key determinant of an asset’s value. Most of IPs have a finite life. For example, in case of patents, the remaining lifetime is determined by its expiry date. Copyrighted works depreciate faster, while trade secrets cannot be updated anymore and lose value over time. Another challenging task in brand valuation is the determination of discount rates. Most often, a brand valuer uses the weighted average cost of capital (WACC) to arrive at a required return on intangible assets.

However, if the risk of the intangible assets is higher or lower compared to the overall risk of the company, the WACC overestimates or underestimates the required return on intangibles. Since most of the intangible assets are funded with equity, the unlevered cost of equity, therefore, can be used. However, for valuation of intangibles, the weighted average return on assets approach is the best, which divides company assets into four different categories: working capital, tangible assets, intangible assets and tax shield. Few influential factors need to be considered as key factors, and these include the product lifecycle, brand specificity and its architecture, strength attained by the brand and the current market cycle in which the industry is operating.

The best example showing the importance of royalty rate, remaining useful life and the discount rate is the brand valuation of Kingfisher Airlines, which started its operations in 2005, five years prior to the valuation. The airline came from United Breweries Group, the parent company of the famous Kingfisher beer. Insights into the beer brand supported the faster penetration and growth of Kingfisher Airlines, paving the way for the rise of a successful company and its entrepreneur. The airline’s brand valuer, Grant Thornton, expected 64% of all future profits generated by Kingfisher to come from its brand. Some leading banks also agreed to lend Kingfisher unsecured loans because of its brand alone.

Here, the question about the valuation parameters (royalty rate, use life & discount rate) used by the valuer to arrive at such a high valuation arises.

Finally, one should understand that brands are extremely difficult to sell without understanding the underlying state of the business. Lenders accepting brand value as collateral ought to rethink their current lending patterns.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets1 week ago

Markets1 week agoSilver Dips Sharply, While Gold Gains Amid Mixed Stock Market

-

Africa6 days ago

Africa6 days agoTunisia Holds Interest Rate as Inflation Eases, Debate Grows

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum’s Growing Capacity Puts Pressure on Layer 2 Platforms

-

Fintech1 day ago

Fintech1 day agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-400x240.jpg)

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-80x80.jpg)

You must be logged in to post a comment Login