Markets

Why the FCOJ Market Remains Well Supported in the Longer Term

FCOJ closed sharply lower on Friday and lower for the week, and trends are down on the daily and weekly charts. The Brazil government is asking Congress there for new taxes on Ag exports of up to 20% and this news added support to the futures market as the flow of FCOJ to export channels could be reduced as producers hold back product from the market.

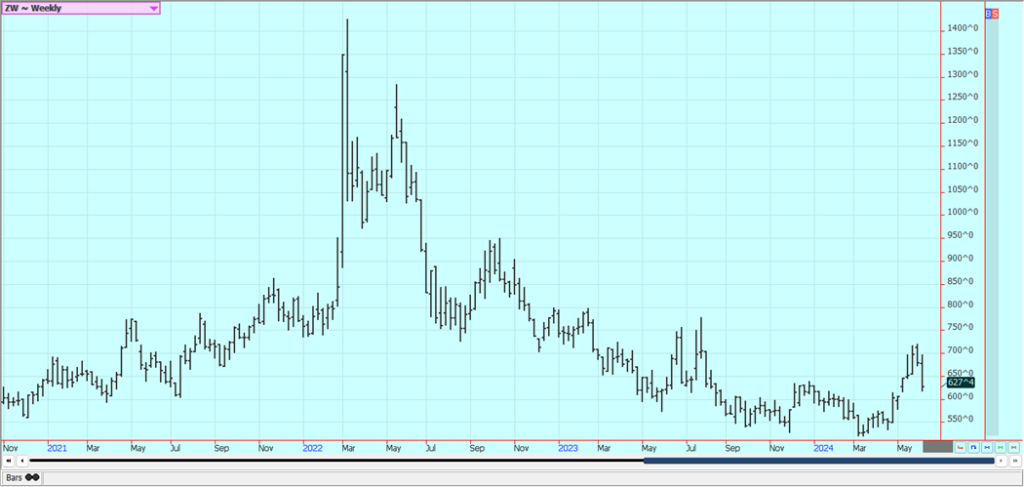

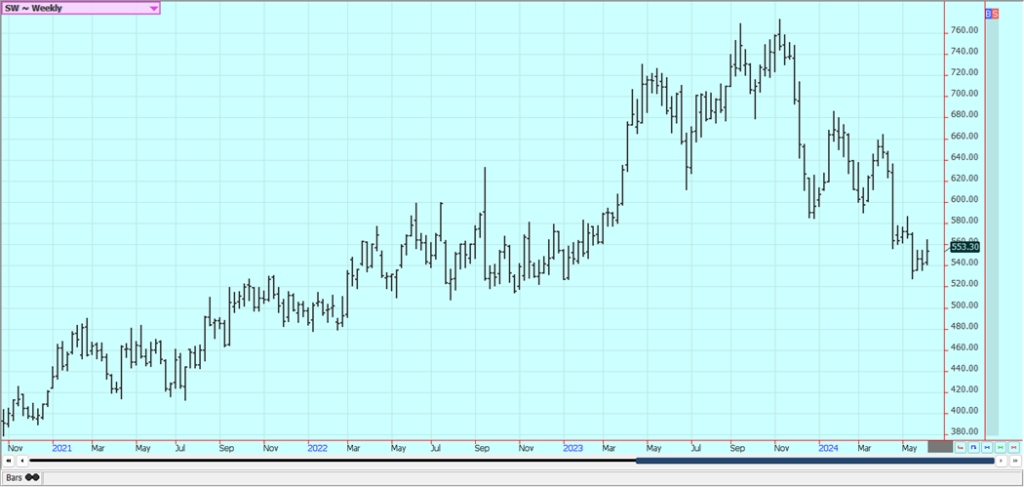

Wheat: Wheat was lower in all three markets last week as the US harvest expands and even as adverse world growing conditions are still around. There are more reports of hot temperatures coming this week to Russian growing areas. It has also been very dry there.

The weather is still a key, with extreme dryness reported in Russia and parts of the US and too wet conditions reported in Europe. However, US producers are reporting strong yields so far. Big world supplies and low world prices are still around. Export sales remain weak on competition from Russia, Ukraine, and the EU as those countries look to export a lot of Wheat in the coming period. Black Sea offers are still plentiful.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

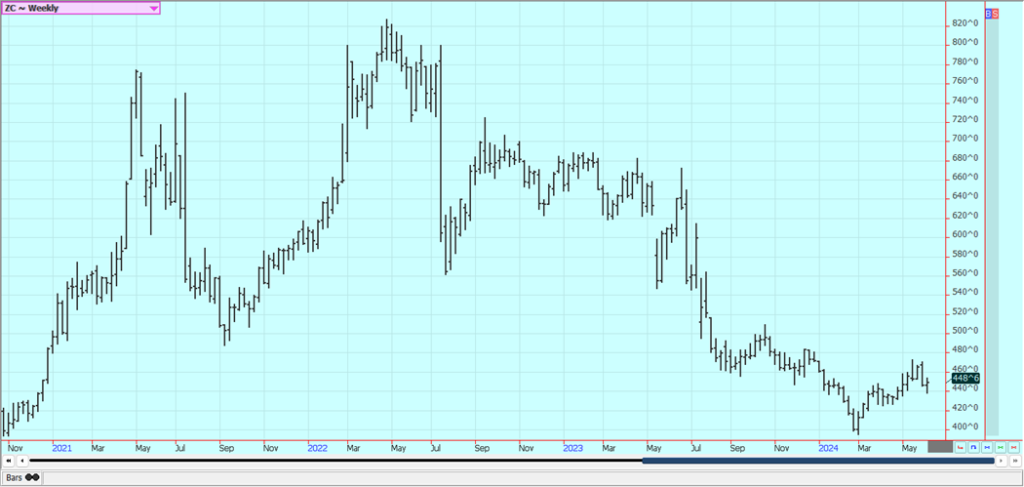

Corn: Corn closed a little higher last week on news that Brazil has proposed new export taxes on Agricultural goods of 20%. Congress must approve the measure, but farmers there are already reported to be halting sales to see what happens next. The US Midwest is still seeing good growing conditions.

The market anticipated that crop condition ratings would be very high in the USDA reports last week and will anticipate high crop ratings this week. Oats were lower on good growing conditions found in the northern US and into Canada. The weather in the Midwest has been very wet but it is drier now. Demand has been the driving force behind the rally. Increased demand was noted in most domestic categories along with rising basis levels, and export demand has been strong.

Weekly Corn Futures

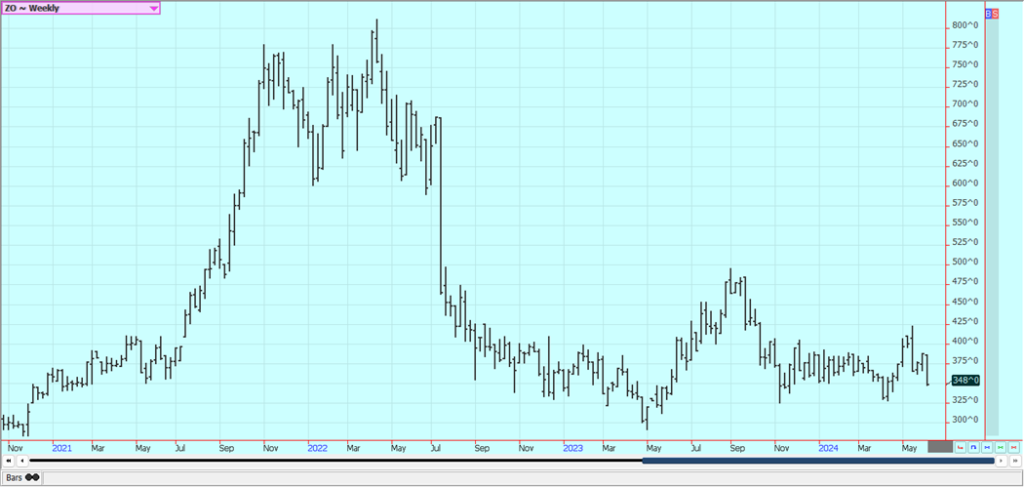

Weekly Oats Futures

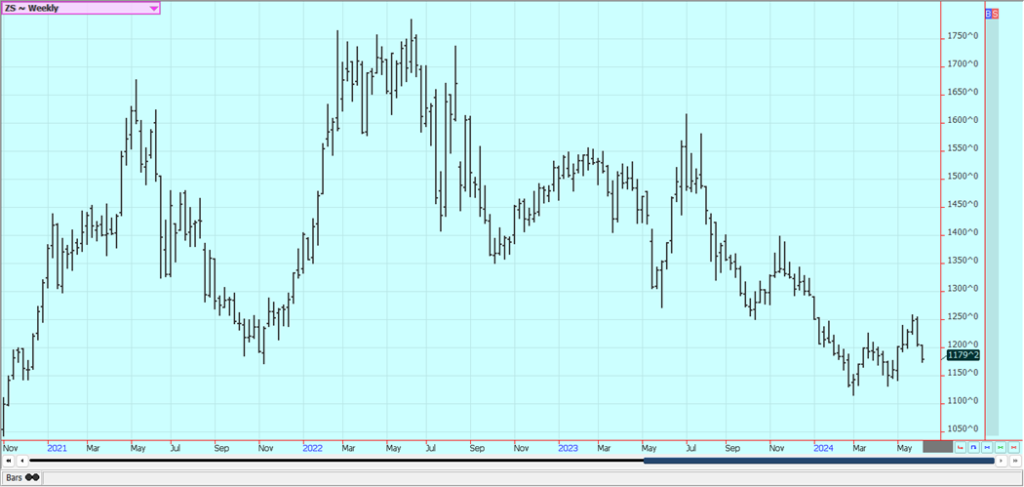

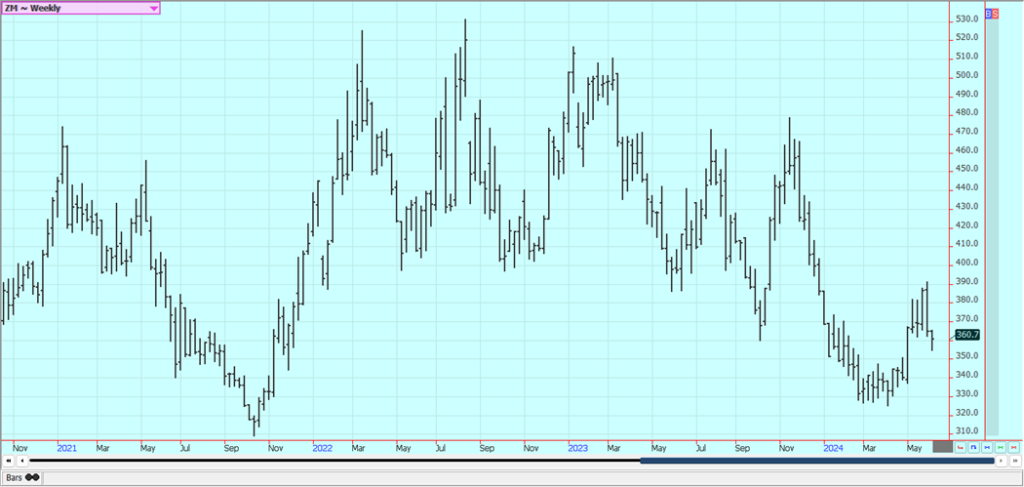

Soybeans and Soybean Meal: Soybeans and the products closed lower last week on good growing conditions in the US against weaker demand ideas and despite reports of increased taxes for Brazil farmers. The government there has proposed a new tax on farm production and exports of up to 20%. Congress must approve the measure, but reports indicate that Brazil farmers are pulling back from sales to see what happens next.

There were wire reports that China prices are weakening amid veery strong imports from Brazil. Reports indicate that China remains an active buyer of Soybeans in Brazil but might have to cut back on demand if the domestic market does not improve. China said that it has increased exports of Soybean Meal due to the weaker internal demand. Domestic demand has been strong in the US but has suffered as crushers were crushing for oil. Oil demand has suffered as cheaper alternatives for feedstocks hit the biofuels market.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

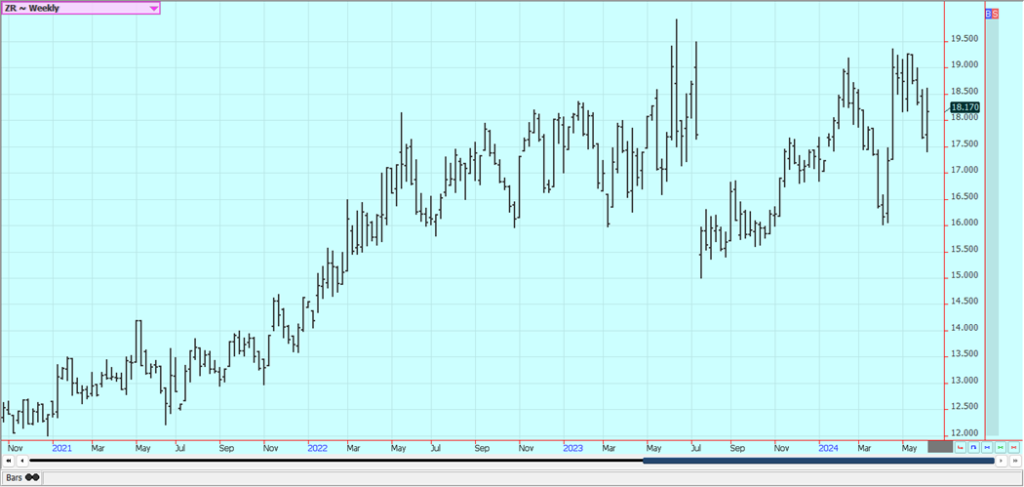

Rice: Rice closed sharply higher in July last week on news that the Brazil government wants to impose a new 20% tax on agricultural exports. The proposed tax must be approved by congress there, but producers have decided to withdraw from the market to await further news. New crop months closed a little lower on improving weather for Rice crops.

The big US crops are now in doubt from reports of extreme rains in southern growing areas and especially near Houston. Supply tightness is expected to give way to increased production this year and greatly increased supplies this Fall. These ideas are reflected in the prices seen in the old crop and the new crop. Big storms have brought significant rains to crops in Texas.

Weekly Chicago Rice Futures

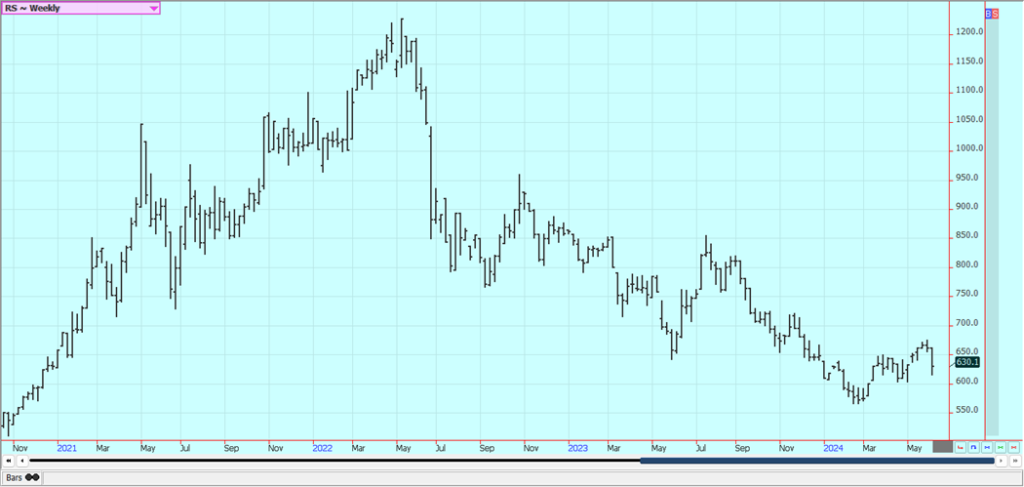

Palm Oil and Vegetable Oils: Palm Oil was lower last week on weekly continuation charts due to the monthly roll, but higher in the individual months on ideas of good export demand despite ideas of increasing production. It was closed today for a holiday.

Export demand has been very strong in recent private reports. There is talk of increased supplies available to the market, but the trends are up on the daily and weekly charts. Canola was also lower last week on reports of generally good conditions in Canada.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

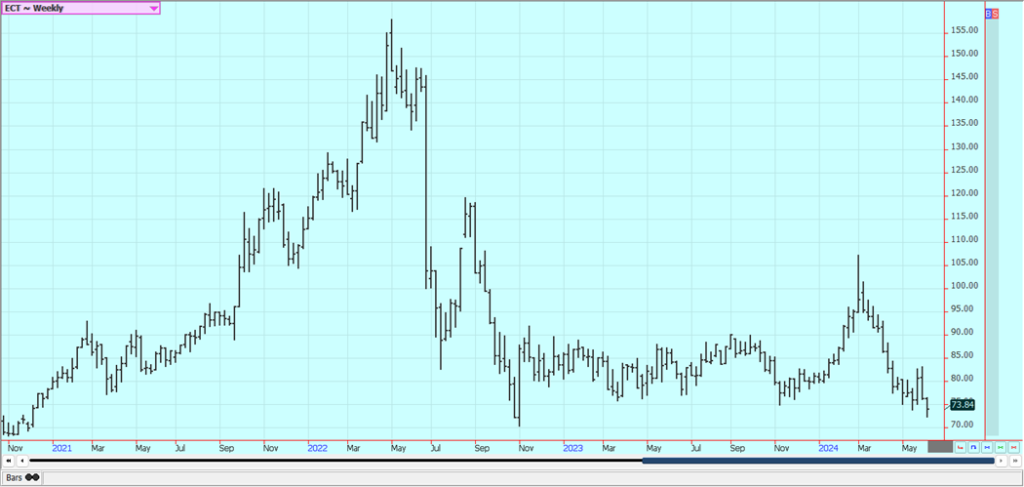

Cotton: Cotton was lower last week and trends turned down on the weekly charts. The daily charts show that the market has entered into a short term trading range. The Brazil government is asking Congress there for new taxes on Ag exports of up to 20% and this news added support to the futures market as the flow of Cotton to export channels could be reduced as producers hold back product from the market.

USDA said that 60% of the US crop was rated good to excellent on Tuesday afternoon. Big storms were reported in Texas recently that could have damaged some crops. There are also some big problems with too much rain in the Delta and Southeast in recent weeks. Demand has been weaker so far this year but there are hopes for improved demand with the lower prices. Chinese consumer demand has held together well, and Chinese demand for Cotton has started to increase.

Weekly US Cotton Futures

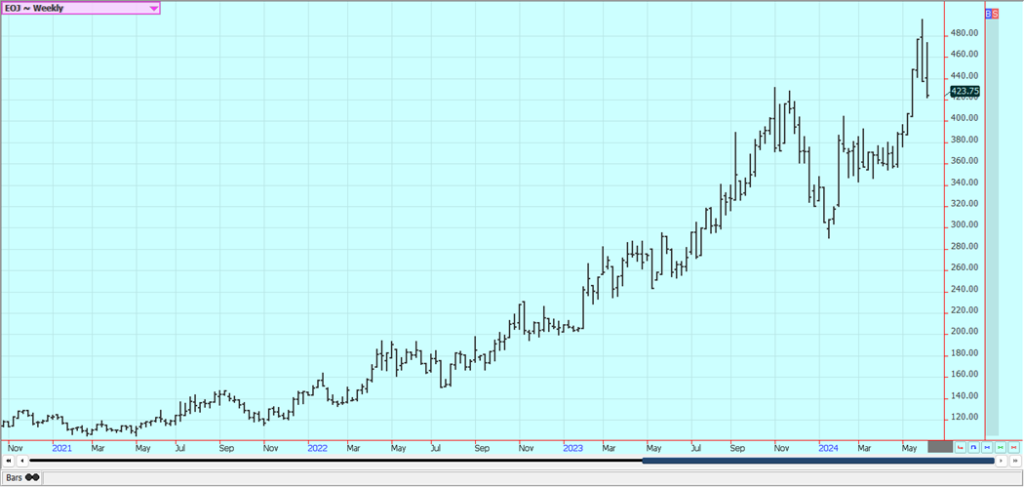

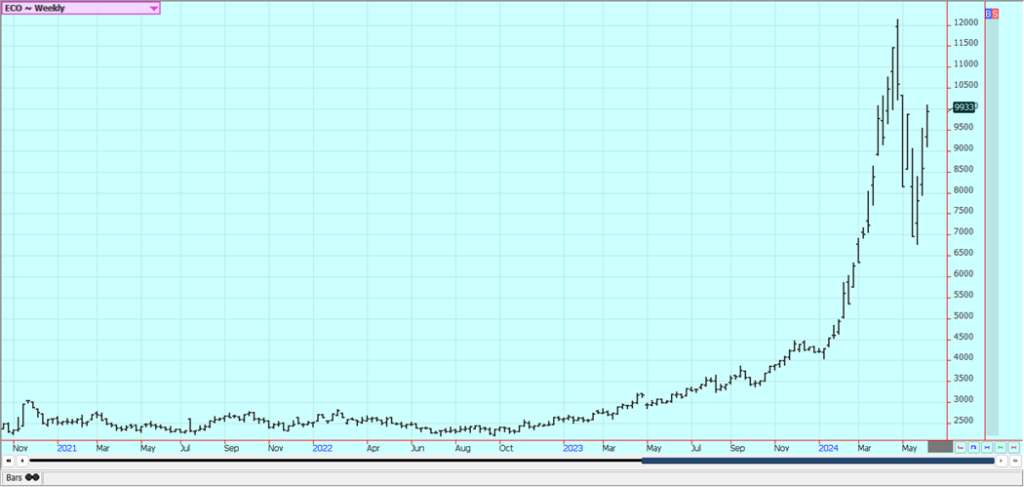

Frozen Concentrated Orange Juice and Citrus: FCOJ closed sharply lower on Friday and lower for the week, and trends are down on the daily and weekly charts. The Brazil government is asking Congress there for new taxes on Ag exports of up to 20% and this news added support to the futures market as the flow of FCOJ to export channels could be reduced as producers hold back product from the market. The FCOJ market remains well supported in the longer term based on forecasts for tight supplies and very hot weather in Florida.

The FCOJ weekly charts show a key reversal down. Retail prices in May hit a new record high of $9.69 a gallon, 9% higher than last year. The reduced production appears to be at the expense of the greening disease. There are no weather concerns to speak of for Florida or for Brazil right now. The weather has improved in Brazil with some moderation in temperatures and increased rainfall amid reports of short supplies in Florida and Brazil are around but will start to disappear as the weather improves and the new crop gets harvested.

Weekly FCOJ Futures

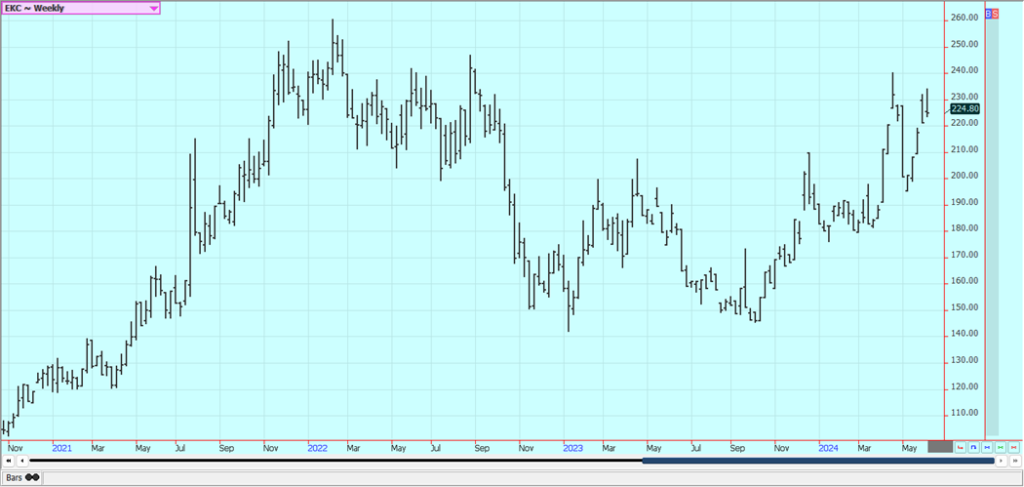

Coffee: New York closed a little higher last week on short supplies that could be made worse by news that the Brazil government might impose a 20$ tax on agricultural exports and London closed a little higher last week on ideas of reduced offers of Robusta and on forecasts for another couple of weeks of dry weather in Vietnam.

There were also reports of poor Robusta yields in Brazil during the harvest. Ideas of less production in Vietnam are driving the rally. There were indications that Brazil and Vietnam producers were now offering Coffee, buts in small amounts, Vietnamese producers are reported to have about a quarter of the crop left to sell or less and reports indicate that Brazil producers are reluctant sellers for now after selling a lot earlier in the year. Exports from Brazil have remained strong.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York closed higher last week despite harvest progress in Brazil and the charts show that trends are turning up. London closed higher. Trends are mixed on the daily charts and up on the week-ly charts. End users need Sugar but are not finding too much available in the cash market. There are still ideas that the Brazil harvest can be strong for the next few weeks amid dry harvest weather. Har-vest weather is called good in center-south Brazil. There are worries about the Thai and Indian produc-tion, but data shows better than expected production from both countries.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

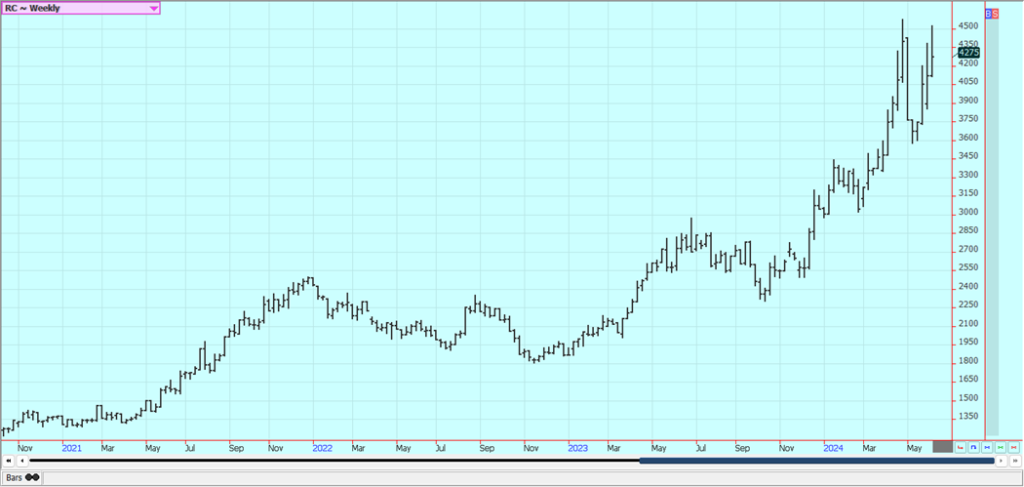

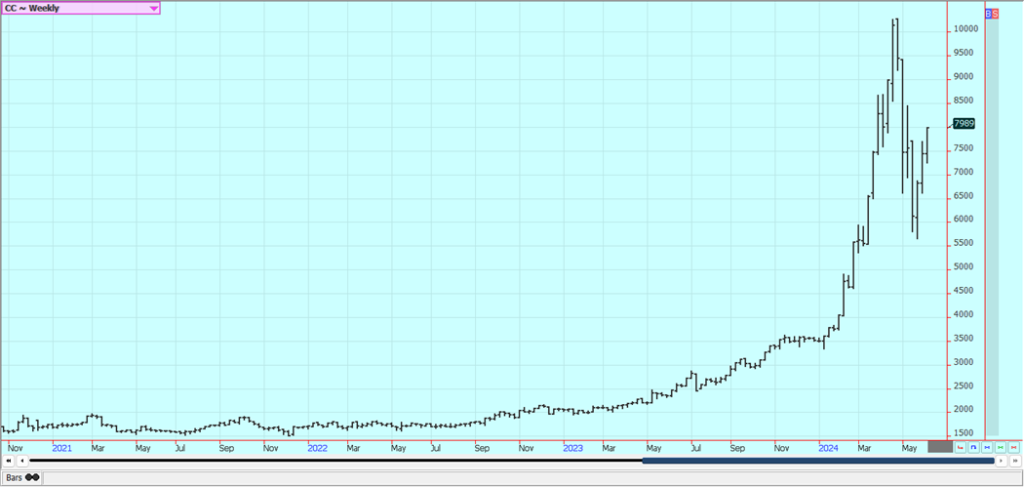

Cocoa: Both markets were higher last week and chart trends are up again. Production concerns in West Africa as well as demand from nontraditional sources along with traditional buyers keep supporting fu-tures. Production in West Africa could be reduced this year due to the extreme weather which includ-ed Harmattan conditions.

The availability of Cocoa from West Africa remains very restricted and pro-jections for another production deficit against demand for the coming year are increasing. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue. Mid crop harvest is now underway and here are hopes for additional supplies for the market from the second harvest. Demand continues to be strong, especially from traditional buyers of Cocoa.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Mateusz Feliksik via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Impact Investing7 days ago

Impact Investing7 days agoOceanEye: EU Launches €50 Million Initiative to Strengthen Global Ocean Monitoring

-

Cannabis2 weeks ago

Cannabis2 weeks agoColombia Moves to Finalize Medicinal Cannabis Regulations by March

-

Markets2 days ago

Markets2 days agoOil Shock Risks: How Conflict with Iran Could Impact Markets

-

Markets1 week ago

Markets1 week agoMiddle East Escalation Sparks Market Uncertainty as Oil and Gold Poised to Rise