Featured

Why are Fintech Startups growing rapidly in 2020?

While the coronavirus pandemic has put businesses around the world at a standstill, with the travel sector seeing historic lows, one sector is benefiting from the current crisis. The fintech sector is growing significantly and gaining a steep rise in the market share. One fintech service that has gained a huge momentum in the Coronavirus pandemic period is digital mortgage.

Since the day Coronavirus hit Wuhan, a 180-degree change has been experienced in the business world. Both startups and establishments have been suffering at different degrees and are exploring ways to remain in the market.

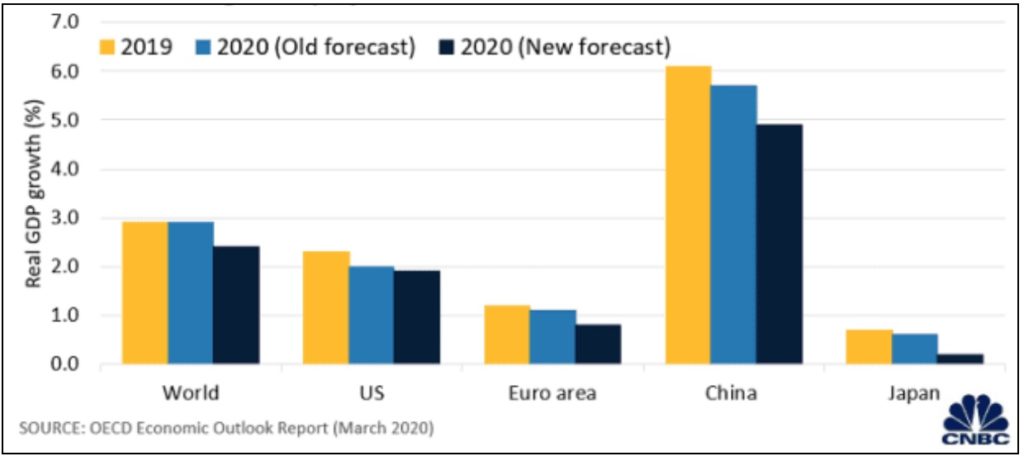

While manufacturing companies got disconnected from the world’s supply chain market, China, travel has seen an unbelievable number of cancelations because of the banning of nations’ boundaries globally. Restaurants have reached the verge of shut down due to social distancing, the stock market has crashed down, many movies and award shows have been either canceled or postponed. In fact, it has been concluded that the global economy is getting worse; indicating an upcoming recession.

However, in the midst of this, one of the business verticals which are experiencing a steep rise in its market share is Fintech.

Simply known as the amalgamation of financial services and technology, this business segment is growing significantly. It is emerging out of niche use cases and demographics and bringing forth better opportunities. Something that is making both investors and business leaders partner with reputed finance app development companies and step into this market.

But, the main question associated with this is – What made fintech startups and brands gain profits from Coronavirus? How is this business vertical able to grow in the year 2020?

Contactless Payments

With the rise of fear that currency notes or the public areas can hold coronavirus for long and transmit to others, people are avoiding paying in cash. It has also been reported that currency notes in different nations like China and South Korea are either taken for disinfection or burnt.

In such a scenario, the only medium people are relying upon for paying all the utility bills and other expenses in 2020 is contactless payments. Implying, using payment apps such as Google Pay, Venmo, Square Cash, etc., along with debit/credit cards for paying the bills.

A result of which is that Mastercard has expanded the contactless payment limit to CA$250 across Canada. Also, the number of free e-payment transactions has increased 150% and then nearly doubled each week for the forecasted three weeks. Whereas, the number of debit and credit card transactions remained almost the same.

Online Money Transfer

During the coronavirus pandemic period, banks and other institutions have cut down their working time to a half, while consumers have also begun hesitating to stand in the queue for transferring money to their near and dear ones. This is when online money transfer portals are becoming popular among the consumers.

These platforms are enabling users transfer money in real-time across the globe, and that too with a few taps on their devices.

Digital Banking

Not only money transferring, the fintech mobility solutions is also providing users with opportunities to cater to their banking needs such as checking account balance, investing in a policy, going through the account history, and more in the year 2020.

Besides, these banking applications are designed using the best of security-related techniques and tools that add both pace, flexibility and trust to the process.

Robo-Advising

What was once the job of a banking and insurance consultant has now become a responsibility of an AI-enabled robot. This year, these robots operating with the power to mimic human intelligence using heaps of real-time user data are helping people with getting solutions to all these financial problems effortlessly. Especially those that arise because of panic situations.

Digital Mortgage

Another fintech service that has gained a huge momentum in the Coronavirus pandemic period is digital mortgage.

With the recession about to hit the global economy, people are getting more anxious about loans and other facilities. Fintech startups that might have been sitting on the fence about investing in digital mortgage technology are showing a sense of urgency these days.

An impact of which is that a digital mortgage software provider Blend, the one that serves 230 bank clients, is now processing 15,000 to 20,000 of applications each day and handling daily loans of worth $8 billion. Not just this, the company has been seeing a significant increase of 85%-95% in mortgage purchase in the past one year.

Wrapping Up

So, as we have covered in this article, the market for fintech services is mushrooming with the growing effect of Coronavirus. Users are reaping the benefits of using these tech-based financial services and are hoping to interact with many more. Also, business leaders and investors are looking for better opportunities and approaches to gain higher profitability and make their name in the market. And, with the passing time, this perspective of users and investors is becoming more significant; giving an impression that fintech will not solely prove itself to be a significant element in the financial solutions market, but will overtake it in the future.

—

(Featured image by Christiann Koepke via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Markets1 week ago

Markets1 week agoRising U.S. Debt and Growing Financial Risks

-

Business2 weeks ago

Business2 weeks agoDow Jones Near Record Highs Amid Bullish Momentum and Bearish Long-Term Fears

-

Africa5 days ago

Africa5 days agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoThe Youth Program at Enzian Shooting Club Is Expanding Thanks to Crowdfunding