Featured

Florida Oranges Are the Main Food Stock for the FCOJ Processors

FCOJ was limited down on Friday but still sharply higher for the week and closed at new highs for the move. The limit-down move on Friday cautions for at least a short-term top in prices and the fundamentals suggest strong prices so there are some conflicts developing in the price action. The moves were supported by a new round of USDA production reports released on Wednesday.

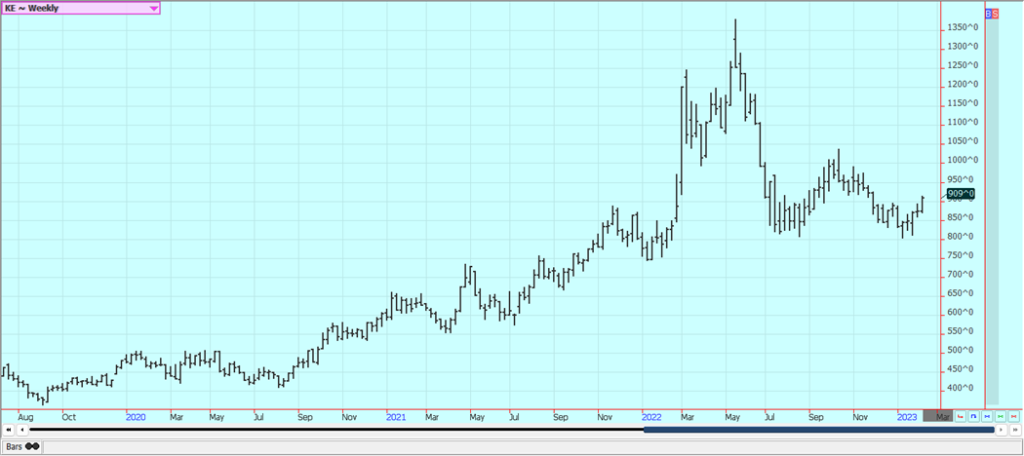

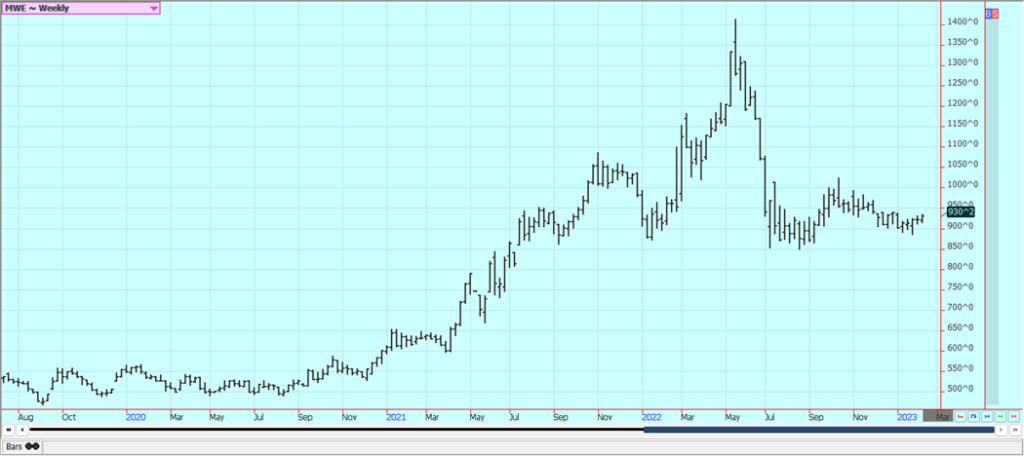

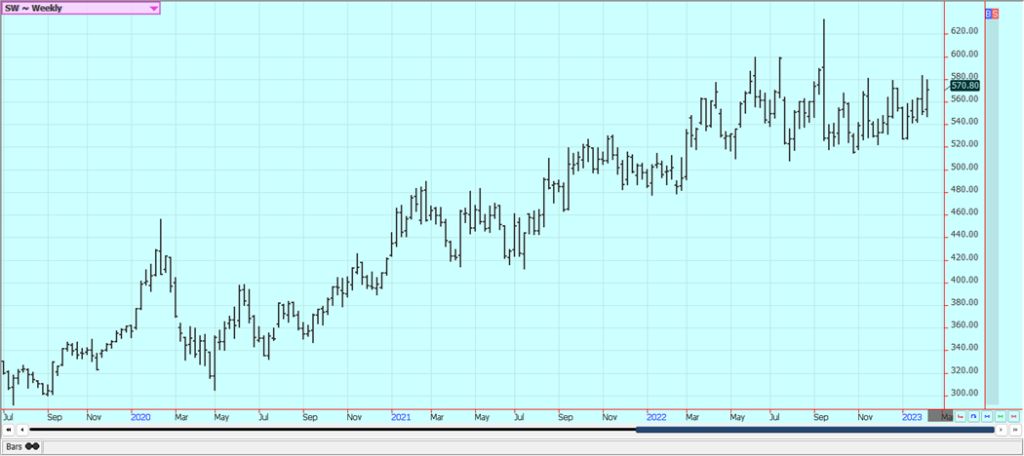

Wheat: Wheat markets were higher on Friday and for the week last week in response to news that Russia was launching a new offensive in Ukraine. Russia appears to be sending three divisions across the border to fight and it looks as though this could be a major operation for the Russian army. Fears of deliveries of Wheat from the Black Sea are surfacing again. USDA in its WASDE reports released on Wednesday made only minor changes to the demand data and ending stocks were increased by just one million bushels. Trends are turning up in all three markets on the daily and weekly charts. Ideas are that both Australia and Russia are harvesting record to near-record Wheat crops this year. Russia is said to be plotting a huge new invasion of Ukraine that could prevent farmers in Ukraine from harvesting Wheat and planting Corn. Russia has a large production and is undercutting most world prices in the international market. However, Russian production estimates have dropped recently. The demand for US Wheat in international markets has been a disappointment all year and has been hindered by low prices and aggressive offers from Russia. Ukraine is also looking for new business for its crops and Russia is aggressive in the world market as it looks for cash to fund the war.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

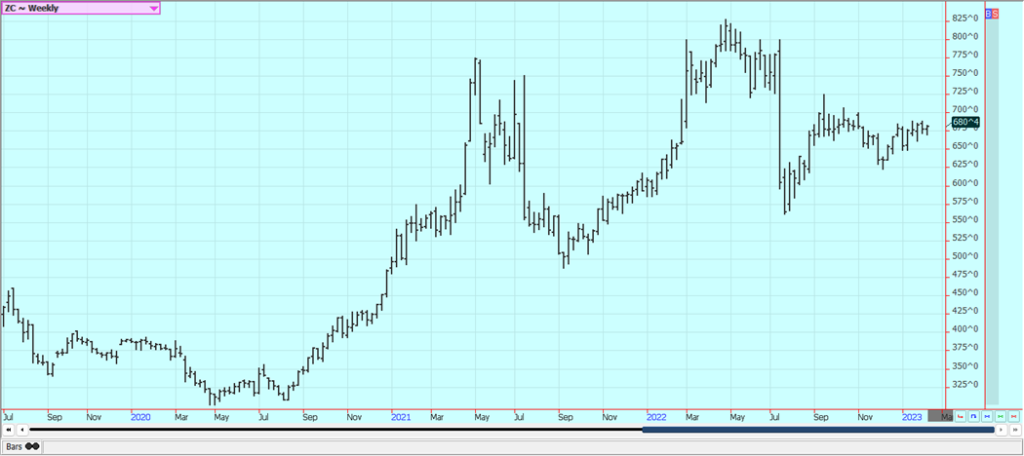

Corn: Corn closed higher and Oats closed lower last week on another week of positive export sales as shown in the USDA reports released Thursday. On Wednesday, USDA cut Corn demand and added to ending stocks estimates that are now at 1.267 billion bushels. USDA cut ethanol demand and increased ending stocks for Corn by 25 million bushels. There had been fears of a cut to export demand and a larger increase in ending stocks estimates, but USDA chose to hold off on any export demand changes for now. Both markets remain in up trends established in early December although the short term trend is now sideways in Corn and down in Oats. The export demand was solid last week even though demand remains well behind the pace to make USDA objectives. Brazil has been hanging on for its Summer crop although losses are now being reported. Argentina has suffered through some extreme drought and losses could be large. The Brazil Winter crop is harvested and China is buying the surplus. The Summer crop and the Argentine crop is developing under stressful conditions. The next Winter crop is going into the ground in good conditions, but it has been wet so the Soybeans harvest has been delayed and the Corn planting is becoming delayed as well. There are concerns about demand with the Chinese economic problems caused by the lockdowns creating the possibility of less demand as South America has much better crops this year to compete with the US for sales. China is now moving rapidly to open the economy and allow people to move around with no lockdowns so the demand could start to improve

Weekly Corn Futures

Weekly Oats Futures

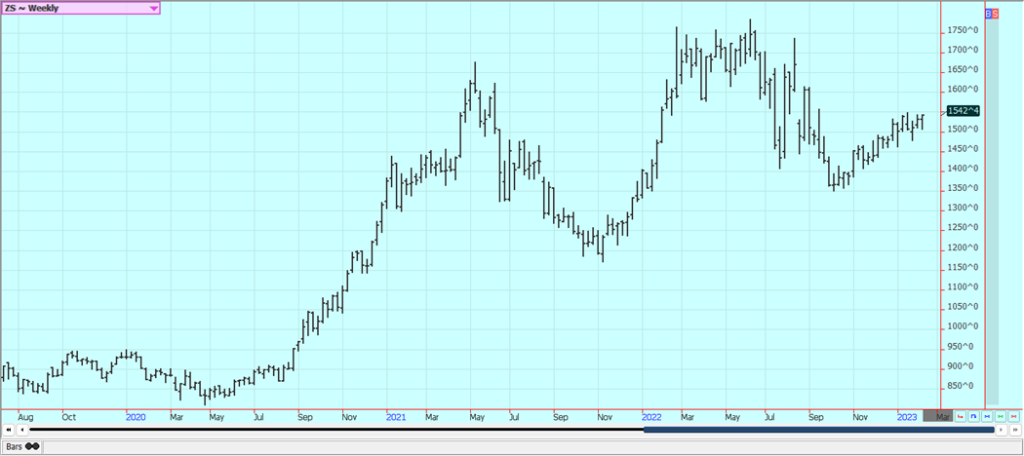

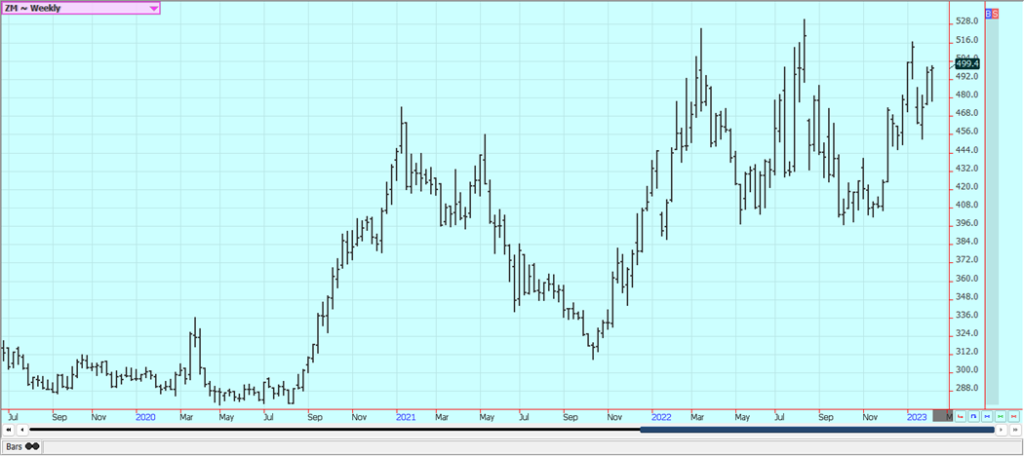

Soybeans and Soybean Meal: Soybeans and the products were higher on Friday on South Americn weather. It remains hot and dry in Argentina and southern Brazil and crop conditions are getting worse. Central and northern Brazil have seen harvest operations interrupted with too much rain. Soybean Meal saw strong weekly export sales as Argentina is having to withdraw from the market for Soy products sales due to the drought in the country and the fact that they have already sold a lot of Soybeans into the world market. They are now buying from Brazil. USDA cut domestic demand and increased ending stocks on Wednesday which was a small surprise for the market. But it was not real bearish so the market embarked on a sell-rumor and buy-the-fact type of trade. USDA left Brazil production estimates unchanged but cut back on production estimates for Argentina. The pattern in southern Brazil and Argentina is dry again. The harvest in Brazil is slowly expanding in central and northern areas. These areas have seen too much rain and the harvest has been slow. Production potential for the Brazil is called very strong even with potential problems and losses in the south. Even so, production of less than 150 million tons is possible now although most estimates remain near 153 million tons. Argentine production ideas continue to drop with the drought as planting is delayed and the crops already in the ground are stressed. Production estimates are now closer to 435 million tons. Ideas that Chinese demand will improve, but this could take a few more weeks as a very large part of the population now has Covid. This has delayed a robust economic return for the country.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

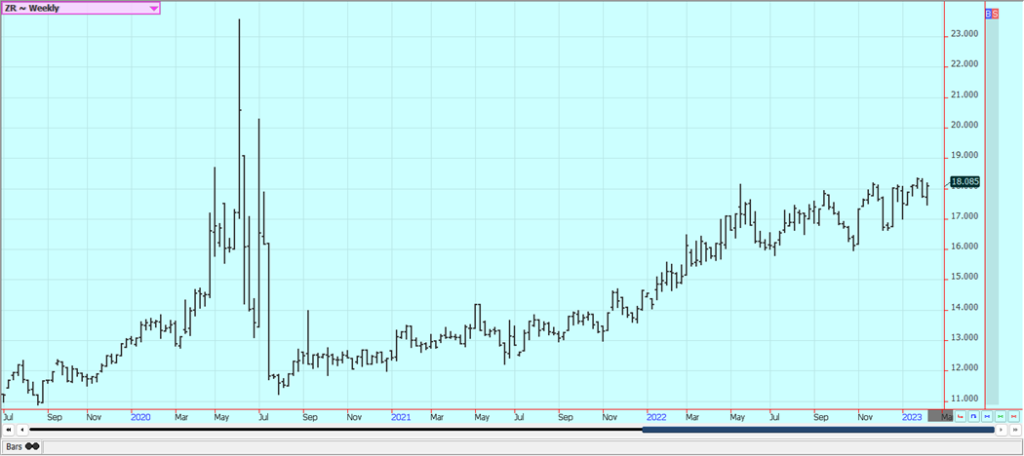

Rice: Rice was higher last week in response to the USDA reports from Wednesday and the weekly export sales report that showed much-improved sales on Thursday. The market had expected reductions in demand and increases in ending stocks. That is what they got, but not at levels big enough to keep the selling pressure on so the market rallied in a major way. Demand has been an issue for the market all year. There is not much going on in the domestic market right now although mills are milling for the domestic market in Arkansas and are bidding for some Rice and although some Rice moved in Tein quiet trading at what were called very good prices. Demand in general has been slow to moderate for Rice for exports and solid for domestic uses.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil closed higher last week on mostly supply concerns although better demand is also expected. Export demand was less last month but could improve as the new controls in Indonesia are enacted. Current forecasts call for the rainy season to end soon and for fieldwork and harvest conditions to improve. China has tried to relax some Covid restrictions so that the economy can start to function again. However, new outbreaks of the virus are being reported and infection rates are rapidly increasing but will start to decrease soon as most have now had Covid. Ideas are that supply and production will be strong, but demand ideas are now weakening and the market will continue to look to the private data for clues on demand and the direction of the futures market. There are still reports of too much rain in Malaysia. Canola was a little higher last week in sympathy with the price action in Chicagpo and Malaysia. Reports indicate that domestic demand has been strong due to favorable crush margins. Production was much improved this year on better weather during the Summer. Producers are holding on t crops right now as the prices rally and will wait for a top before selling again.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was a little lower last week in directionless trading and still remains inside the trading range created since the beginning of November. The market recovered much of its losses after the WASDE report weas released. WASDE showed less domestic use and an increase in ending stocks to 230,000 bales. World data showed less production to help futures recover from the lows. Futures still appear destined to trade down to the bottom of that range at about 8000 March. Futures are still showing bad demand fundamentals as the weekly export sales reports have shown moderate sales at best. Sales were moderate in the reports released yesterday. Overall, the demand for US Cotton has not been strong although better demand has developed over the last couple of weeks. Some ideas that demand could soon increase as China could start to open its economy in the next couple of months as Covid outbreaks should start to weaken as people get vaccinated or immune. Covid is now widespread in China so the beneficial economic effects of the opening are being delayed but these effects should start to be felt as the people there achieve immunity over the next few weeks.

Weekly US Cotton Futures

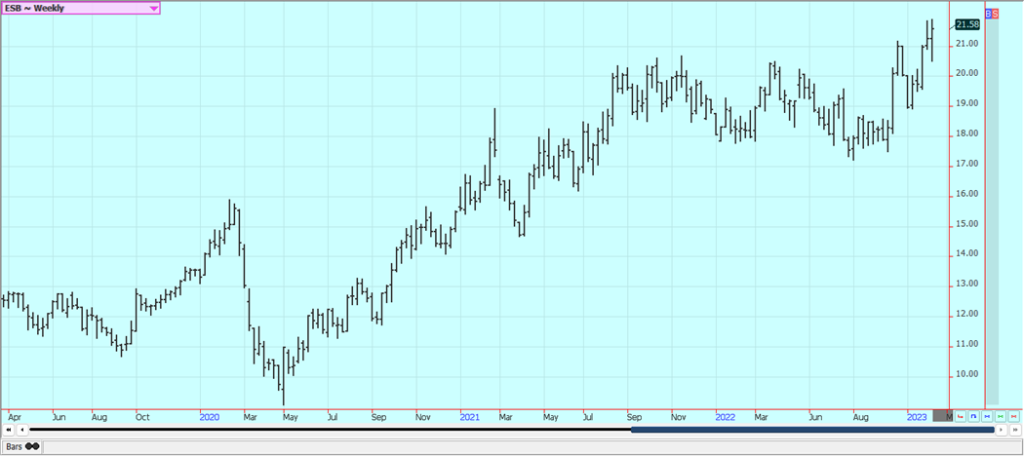

Frozen Concentrated Orange Juice and Citrus: FCOJ was limited down on Friday but still sharply higher for the week and closed at new highs for the move. The limit-down move on Friday cautions for at least a short-term top in prices and the fundamentals suggest strong prices so there are some conflicts developing in the price action. The moves were supported by a new round of USDA production reports released on Wednesday. The reports showed that Florida produced only 16 million boxes of Oranges this year. Florida oranges are the main food stock for the FCOJ processors. Chart trends are up on the daily and weekly charts. Demand should start to improve as the northern Winter passes by. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and conditions are rated good. Bloomberg reported on Friday that Brazil Oranges production is now estimated by Fundicitrus at 316.2 million boxes, up 20% from last year and up from 314.1million boxes estimated last month. The Florida Dept of Citrus said that imports in December were 59.3 million gallons, up 95^ from last year due mainly to an increase in imports from Brazil. Total calendar year 2022 purchases were 498 million gallons, up 22% from 2021.

Weekly FCOJ Futures

Coffee: New York and London closed higher on Friday and a little higher for the week. Price trends are sideways on the charts. Ideas of big production for Brazil continue due primarily to rains falling in Coffee production areas now and as offers stayed strong from Brazil and increasingly from Vietnam. Vietnam is estimated to have veery good production this year due to a good growing season and less rain now as harvest expands again. There are ideas that production potential for Brazil had been overrated. The weather in Brazil is currently very good for production potential but worse conditions seen earlier in the growing cycle hurt the overall production prospects as did bad weather last year. Cecafe said that Brazil exported 2.8 million bags of Coffee in January, down 16.7% from last year. Arabica exports were down 18.7% from last year at 2.4 million bags and Robusta export were 12.3% lower at 87,584 bags. Ground, roast, and soluble Coffee sales were 0.6% lower at 322,506 bags.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

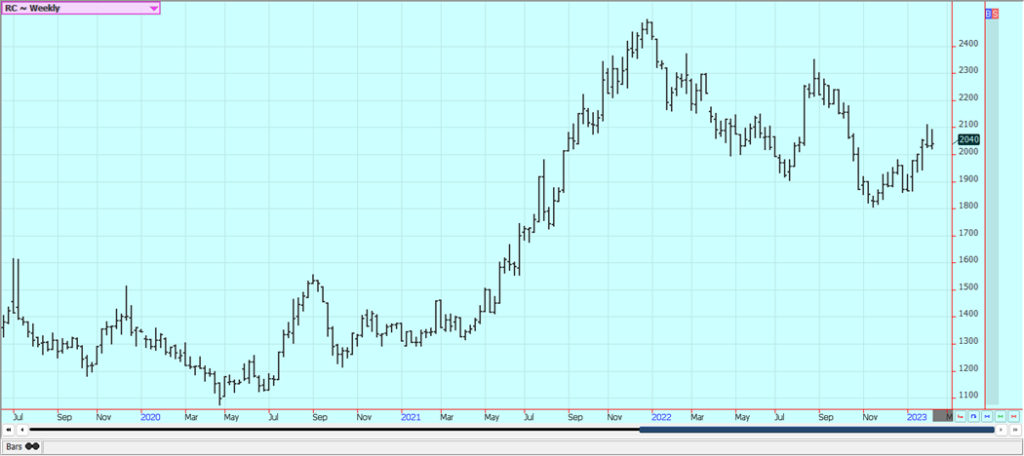

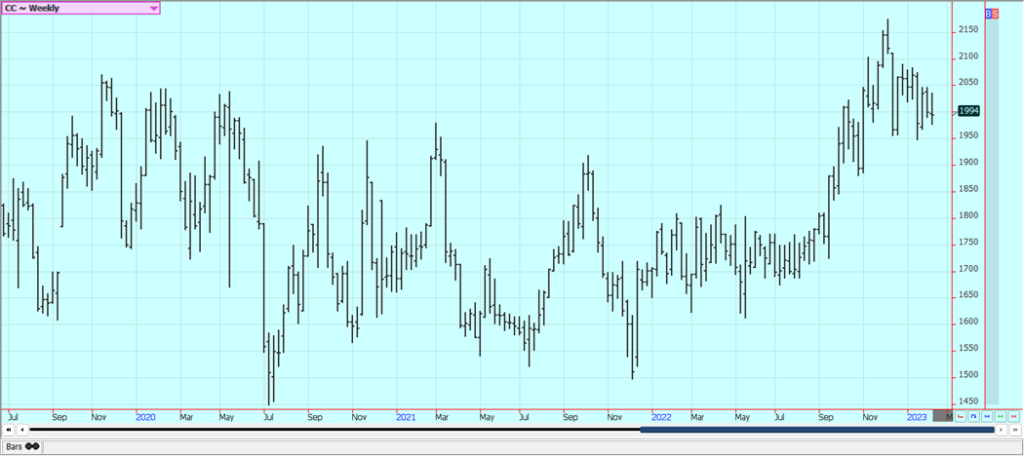

Sugar: New York and London closed higher again Friday and trends are turning up on the daily charts. Both markets closed higher for the week. New York closed at new highs for the move on the weekly charts and London closed near the weekly highs that have held this market since September. Ideas are that the market has priced in production losses in India and is providing remuneration for Indian and Thai exporters who want to sell. Ideas of better supplies coming might keep futures prices in check even with a rather tight nearby scenario. Good production prospects are seen for crops in central and northern areas of Brazil, but the south should turn dry again and so should some northern areas. The harvest is active in Thailand. Australian and Central American harvests are also active. Mills in Brazil are shutting down now with the majority of the harvest now complete and processed. UNICA said that Brazil mills crushed 307,300 tons of Sugarcane in the most recent fortnight, from 0 tons in the same period last year. The production mix was 43.12% Sugar and 56.9% Ethanol.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

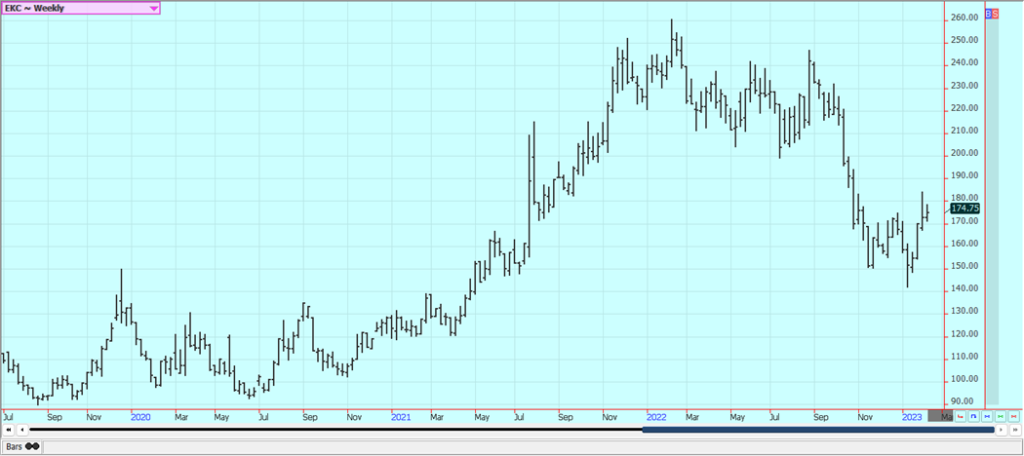

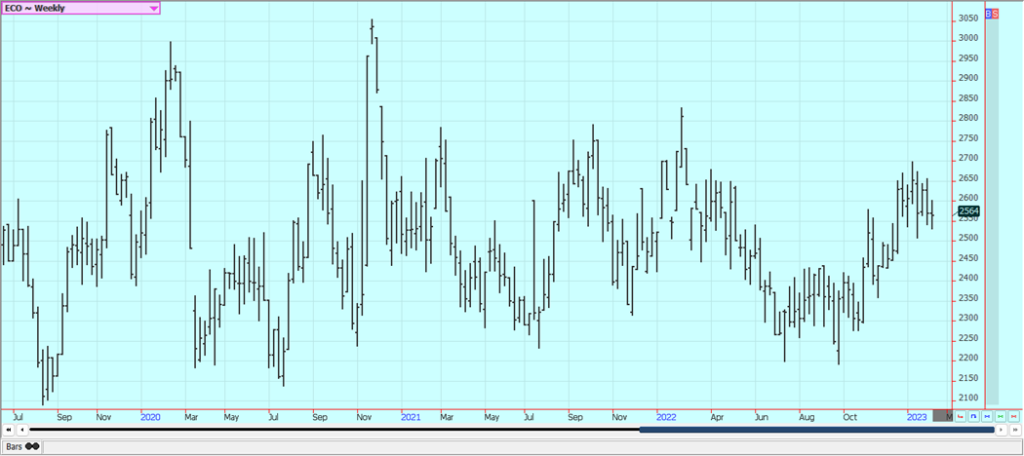

Cocoa: New York closed mixed and London closed a little higher Friday with currency considerations most important. New York closed slightly higher for the week while London closed slightly lower. Both markets show that futures are starting to turn down from mostly a range trade, with London leading the way down. The talk is that hot and dry conditions reported in Ivory Coast could curtail mid-crop production, but main crop production ideas are strong. Ghana has reported disease in its Cocoa to hurt production potential there. The rest of West Africa appears to be in good condition. The North American grind was 8.1% lower and the EU and Asian grinds were about 2% lower. Good production is reported for the main crop and traders are worried about the world economy moving forward and how that could affect demand. Supplies of Cocoa are large at ports. The weather is good in Southeast Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by PhotoMIX-Company via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Business7 days ago

Business7 days agoLegal Process for Dividing Real Estate Inheritance

-

Markets2 weeks ago

Markets2 weeks agoStock Markets Surge Amid Global Uncertainty, But Storm Clouds Loom

-

Fintech4 days ago

Fintech4 days agoPUMP ICO Raises Eyebrows: Cash Grab or Meme Coin Meltdown?

-

Africa2 weeks ago

Africa2 weeks agoMorocco Charts a Citizen-Centered Path for Ethical and Inclusive AI