Featured

Why Coffee Futures Closed Lower This Past Friday

Coffee futures in New York and London closed lower on Friday on what appeared to be long liquidation. Futures closed higher for the week in New York but lower in London. New York charts still indicate that moves above 200.00 and perhaps well above that level are possible in the coming weeks. Ideas of a big production for Brazil continue due primarily to rains falling now in Coffee production areas.

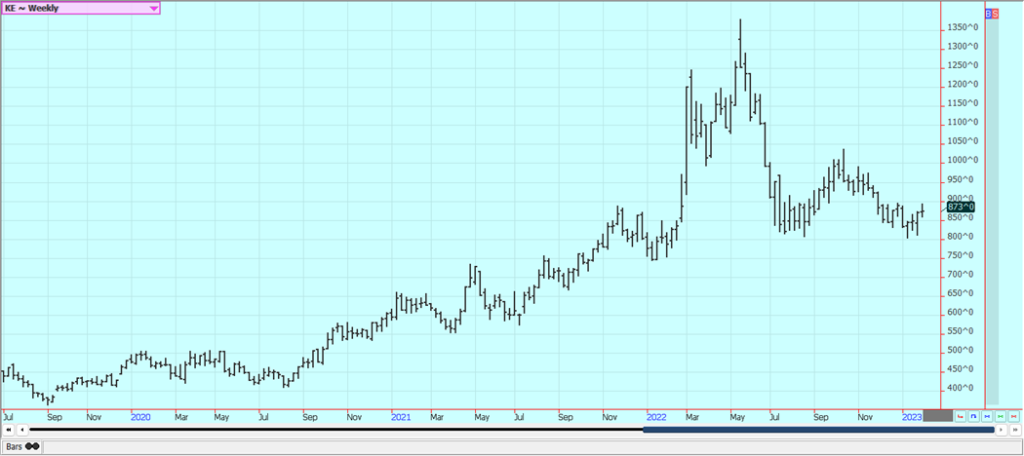

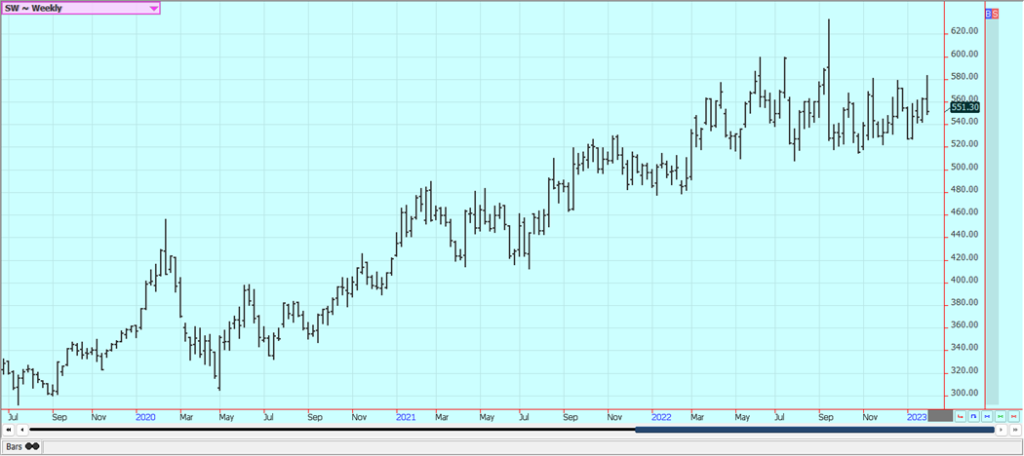

Wheat: Wheat markets were a little higher last week and trends are sideways in all three markets on the daily and weekly charts. The rally came on buying tied to news that the US and Germany were about to supply tanks to Ukraine, allowing the war to get hotter while the Wheat develops and the Corn maybe gets planted in Ukraine. Russia is said to be plotting a huge new invasion of Ukraine as well. Russia has a large production and is undercutting most world prices in the international market. However, Russian production estimates have started to drop recently. There have been ideas that boats would not haul Russian or any Black Sea Wheat due to the insurance companies pulling the underwriting, but so far the lack of insurance has not increased demand for US Wheat as the Russian Wheat is still moving. The demand for US Wheat in international markets has been a disappointment all year and has been hindered by low prices and aggressive offers from Russia. Ukraine is also looking for new business for its crops and Russia is aggressive in the world market as it looks for cash to fund the war.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

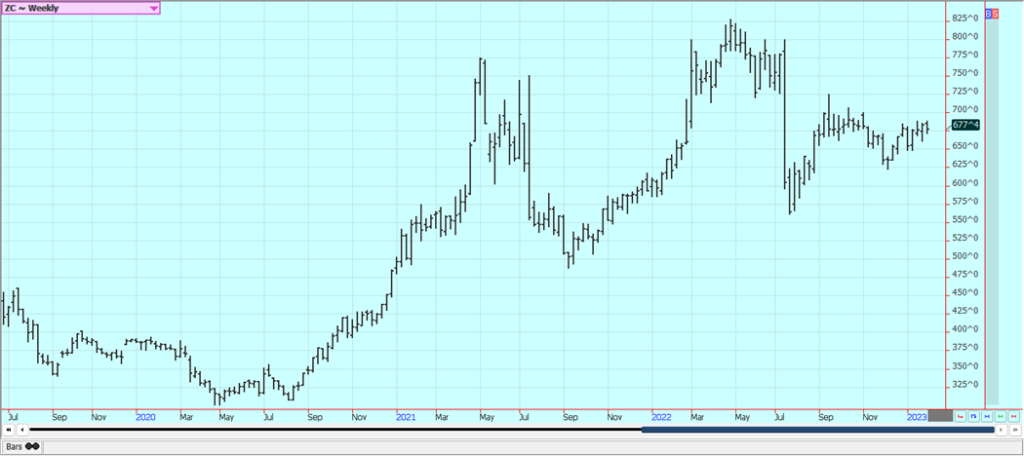

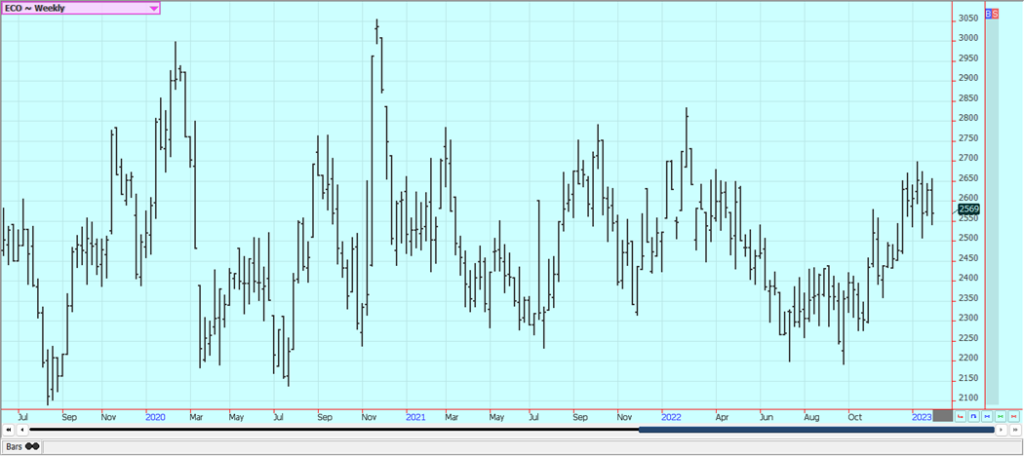

Corn: Corn closed a little higher and Oats closed lower Friday on a very strong weekly export sales report for Corn. Both markets remain in up trends established in early December although the short-term trend in both is now sideways and are turning down in Oats. The export demand was solid last week even though demand remains well behind the pace to make USDA objectives. Brazil has been hanging on for its Summer crop although losses are now being reported. Argentina has suffered through some extreme drought and losses could be large. The Brazil Winter crop is harvested and China is buying the surplus. The Summer crop and the Argentine crop is developing under stressful conditions. The next Winter crop is going into the ground in good conditions, but it has been wet so the Soybeans harvest has been delayed and the Corn planting is becoming delayed as well. Weak demand overall for US Corn remains a big problem for the market. There are increasing concerns about demand with the Chinese economic problems caused by the lockdowns creating the possibility of less demand as South America has much better crops this year to compete with the US for sales. China is now moving rapidly to open the economy and allow people to move around with no lockdowns so the demand could start to improve. China was a buyer of US Corn last week for the first time in months and reflected both higher prices in South America and an opening economy.

Weekly Corn Futures

Weekly Oats Futures

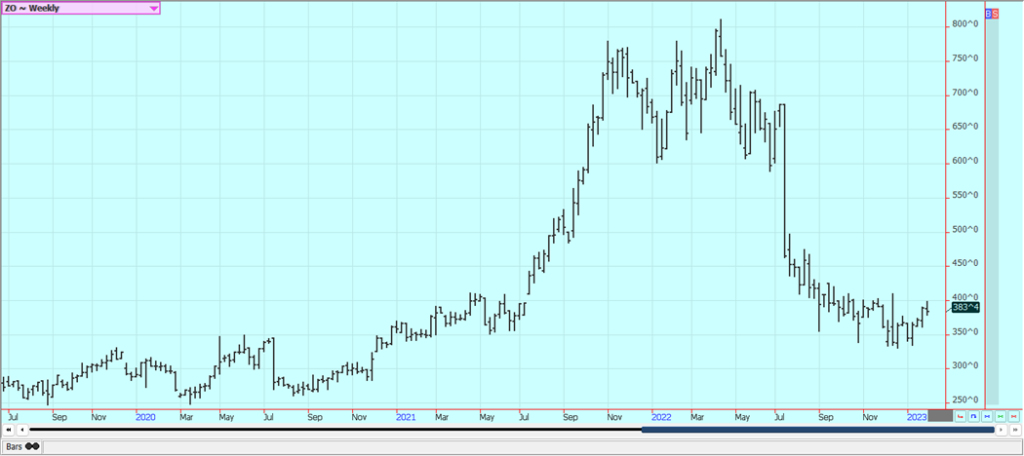

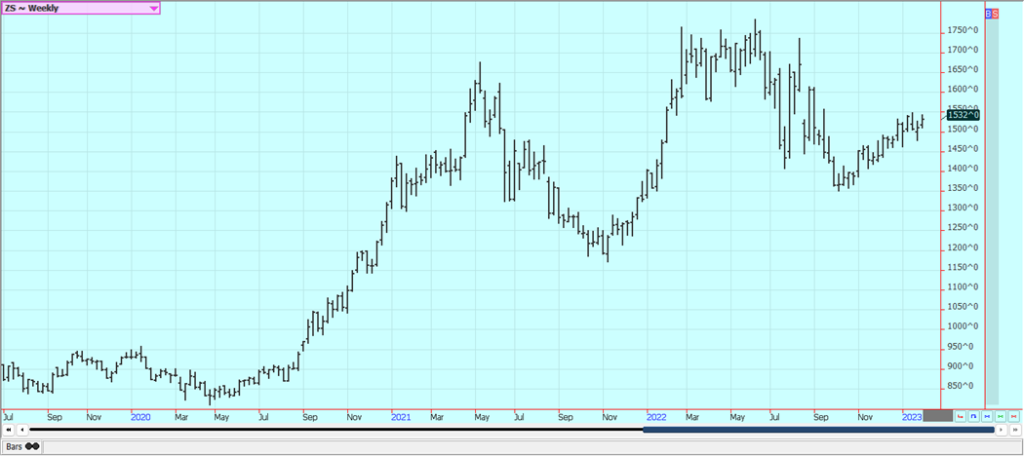

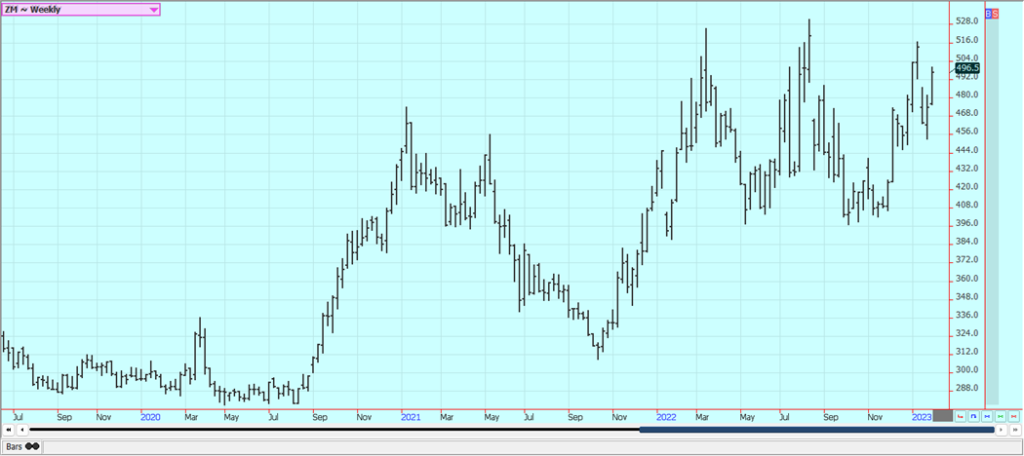

Soybeans and Soybean Meal: Soybeans were a little lower on Friday, but higher for the week. Soybeans seem to have settled into a trading range amid conflicting fundamentals. The products were mixed, with Soybean Meal closing higher and Soybean Oil closing lower along with a weakness in petroleum values. The pattern in southern Brazil and Argentina is shifting back to dry again. Price trends are turning up for Soybeans and Soybean Meal as the harvest in Brazil starts to expand in central and northern areas. These areas have seen too much rain and the harvest has been slow. Production potential for Brazil is called very strong even with potential problems and losses in the south. Even so, production of fewer than 150 million tons is possible now although most estimates remain near 153 million tons. Argentine production ideas continue to drop with the drought as planting is delayed and the crops already in the ground are stressed. Production estimates are now closer to 40 million tons than original projections near 50 million. Ideas that Chinese demand will improve, but this could take a few more weeks as a very large part of the population now has Covid. This has delayed a robust economic return for the country.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

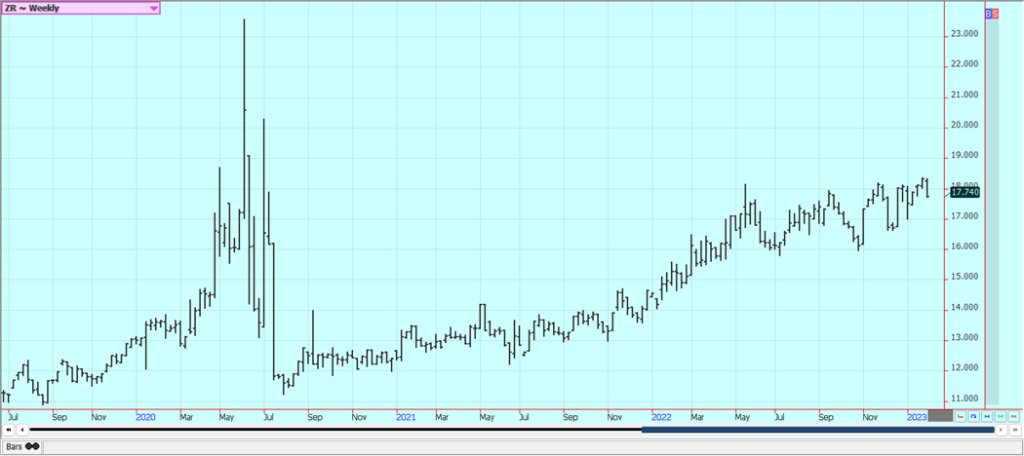

Rice: Rice was a little lower Friday and was lower for the week. The short-term trends remain down in this market. Demand has been a problem for bullish traders. There is not much going on in the domestic market right now although mills are milling for the domestic market in Arkansas and are bidding for some Rice and although some Rice moved in Tein quietly trading at what was called very good prices. Demand in general has been slow to moderate for Rice for exports and solid for domestic uses.

Weekly Chicago Rice Futures

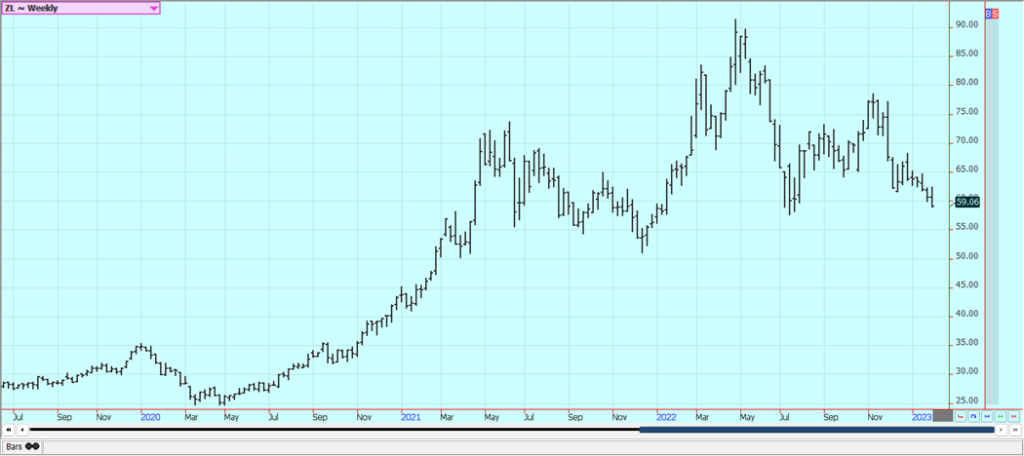

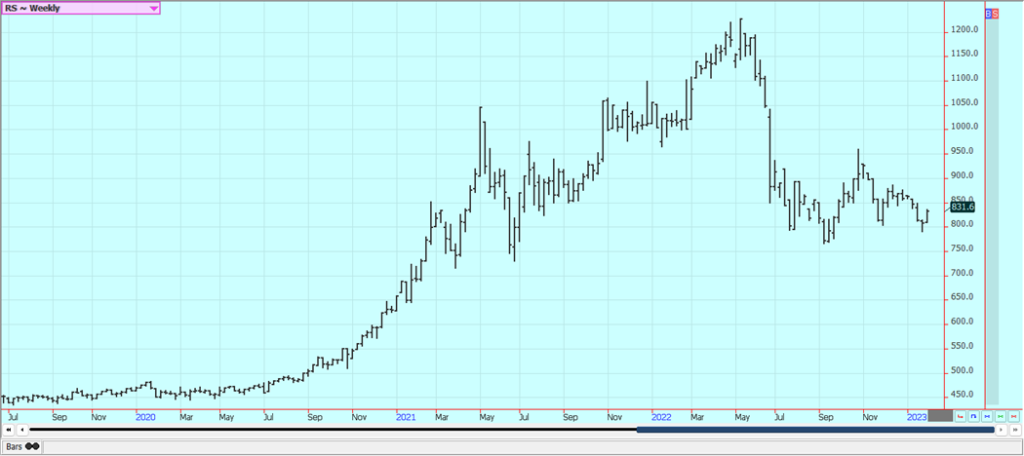

Palm Oil and Vegetable Oils: Palm Oil traded lower last week on demand concerns and on price action in Chicago Soybean Oil. Export demand was less last month. Current forecasts call for the rainy season to end soon and for fieldwork and harvest conditions to improve. China has tried to relax some Covid restrictions so that the economy can start to function again. However, new outbreaks of the virus are being reported and infection rates are rapidly increasing but will start to decrease soon as most have now had Covid. Ideas are that supply and production will be strong, but demand ideas are now weakening and the market will continue to look to the private data for clues on demand and the direction of the futures market. There are still reports of too much rain in Malaysia. Canola was higher last week on news that Argentine and southern Brazilian weather could turn hot and dry again and further affect overall Soybeans production in South America. Reports indicate that domestic demand has been strong due to favorable crush margins. Production was much improved this year on better weather during the Summer.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was lower and still remains inside the trading range created since the beginning of November. Futures are still showing bad demand fundamentals that have kept prices from rallying through resistance areas. The weekly export sales report showed moderate sales. Overall, the demand for US Cotton has not been strong although better demand has developed over the last couple of weeks. Some ideas that demand could soon increase as China could start to open its economy in the next couple of months as Covid outbreaks should start to weaken as people get vaccinated or immune. Covid is now widespread in China so the beneficial economic effects of the opening are being delayed but these effects should start to be felt as the people there achieve immunity over the next few weeks.

Weekly US Cotton Futures

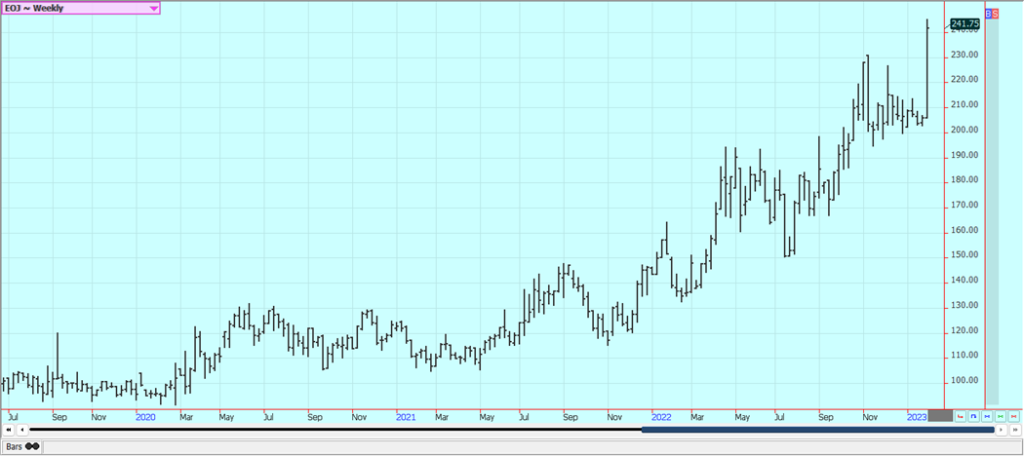

Frozen Concentrated Orange Juice and Citrus: FCOJ was higher on Friday and sharply higher for the week. Futures closed at new highs for the move. Chart trends are up again on the daily and weekly charts. Demand should start to improve with the holidays now over and cold air being reported over much of the country. Historically low estimates of production due in part to the hurricanes and in part to the greening disease has hurt production remain in place. The weather remains generally good for production around the world for the next crop but not for production areas in Florida that have been impacted in a big way by the two storms. Brazil has some rain and the conditions are rated good. Mostly dry conditions are in the forecast for the coming days. The FCOJ Movement an Pack report showed that inventories are now 38.6% less than the same time last year.

Weekly FCOJ Futures

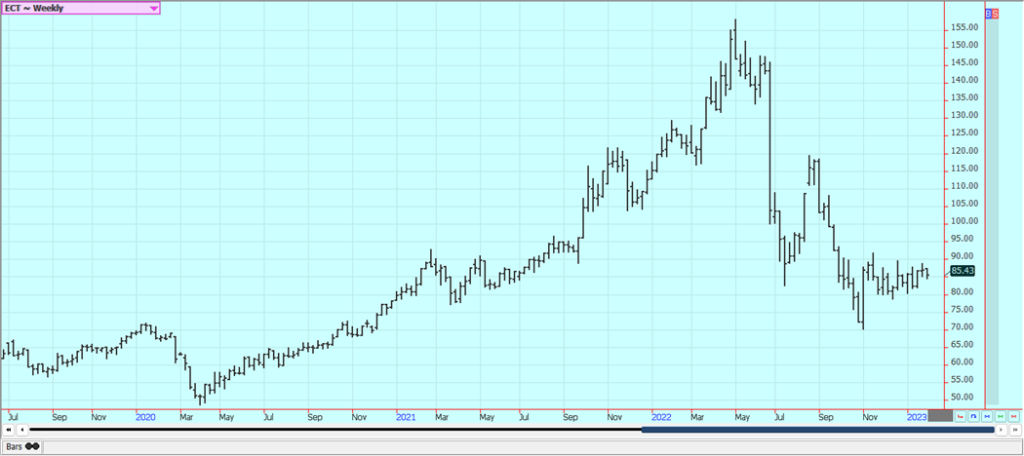

Coffee: New York and London closed lower on Friday on what appeared to be long liquidation. Futures closed higher for the week in New York but lower in London. New York charts still indicate that moves above 200.00 and perhaps well above that level are possible in the coming weeks. Ideas of a big production for Brazil continue due primarily to rains falling in Coffee production areas now and as offers stayed strong from Brazil and increasingly from Vietnam. There are ideas that the production potential for Brazil had been overrated and reports of too much rain in Vietnam affected the harvest progress. The weather in Brazil is currently very good for production potential but worse conditions seen earlier in the growing cycle hurt the overall production prospects as did bad weather last year. Vietnam exported 160,000 tons of Coffee in January, down 30.9% from last year.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

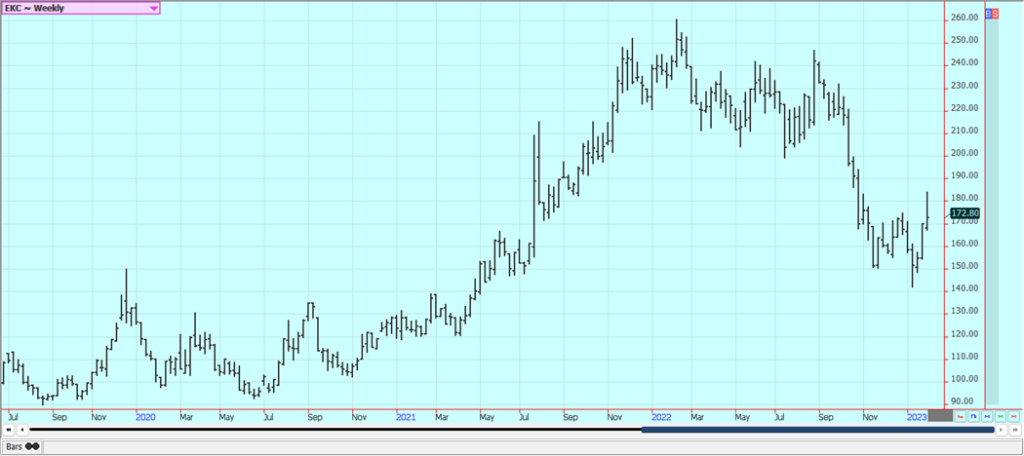

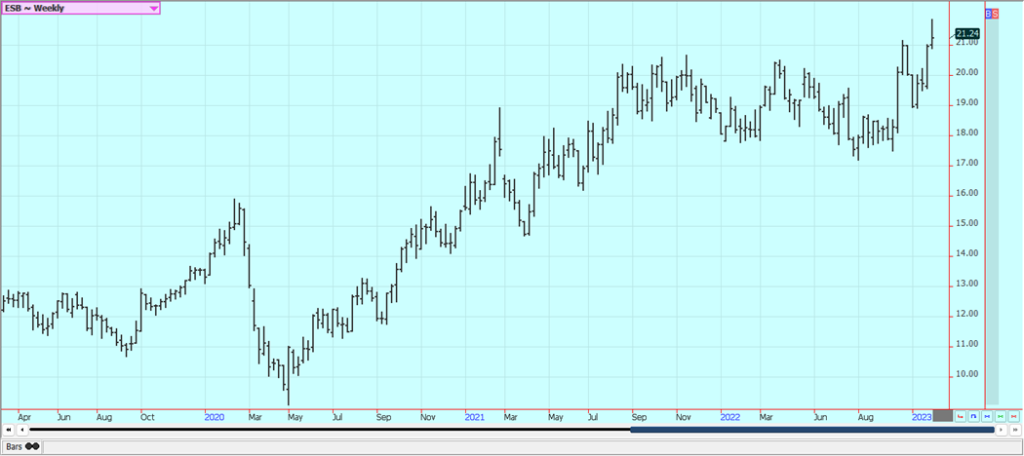

Sugar: New York and London closed lower on Friday and for the week in both markets. The charts show that short-term down trends are developing. Ideas of better supplies coming might keep futures prices in check even with a rather tight nearby scenario. Good production prospects are seen for crops in central and northern areas of Brazil, but the south should turn dry again after some rains in the last week or so. The harvest has been delayed in Thailand. Australia and Central America harvests are also delayed but are more active now. Mills in Brazil are shutting down now with the majority of the harvest now complete and processed. Ideas are that India will produce about 34.3 million tons of Sugar this year, about 4% less than the previous outlook.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

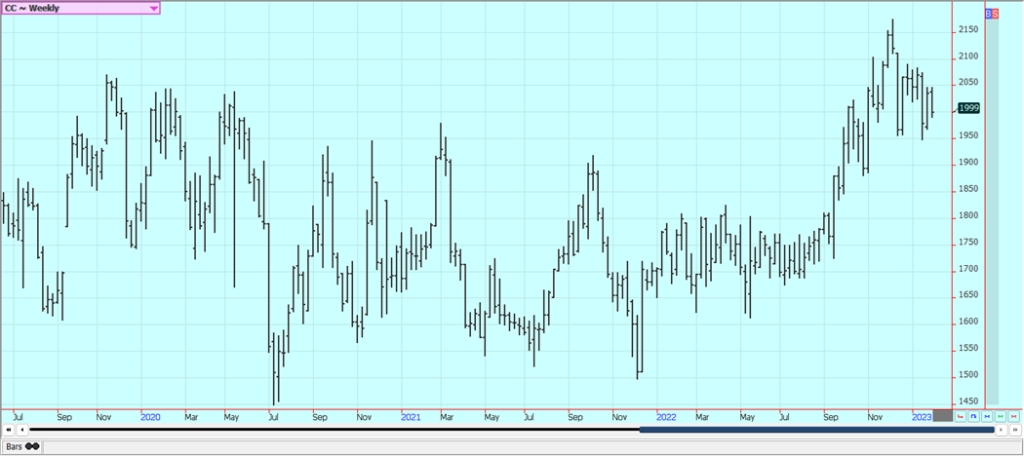

Cocoa: New York closed lower and London closed mixed, with only March trading lower on Friday. Futures were lower last week. Both markets show that futures are starting to turn down from mostly a range trade. Weaker demand is shown by the grind data that got released recently. The talk is that hot and dry conditions reported in Ivory Coast could curtail mid-crop production, but main crop production ideas are strong. Ghana has reported disease in its Cocoa to hurt production potential there. The rest of West Africa appears to be in good condition. The North American grind was 8.1% lower and the EU and Asian grinds were about 2% lower. Good production is reported for the main crop and traders are worried about the world economy moving forward and how that could affect demand. Supplies of Cocoa are large at ports. The weather is good in Southeast Asia. Ivory Coast port arrivals now total 1.50 million tons for the current marketing year, up 5.7% from last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Alexas_Fotos via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoDolci Palmisano Issues Its First Minibond of the F&P “Rolling Short term” Program

-

Africa2 days ago

Africa2 days agoBLS Secures 500 Million Dirhams to Drive Morocco’s Next-Gen Logistics Expansion

-

Fintech1 week ago

Fintech1 week agoRipple Targets Banking License to Boost RLUSD Stablecoin Amid U.S. Regulatory Shift

-

Biotech5 days ago

Biotech5 days agoBiotech Booster: €196.4M Fund to Accelerate Dutch Innovation