Featured

Why should you follow sustainable investing strategies?

There are investment strategies that are not only socially responsible but also sustainable.

There are infinite ways how savings can be invested, driven by common sense, all should be based on personal investment goals. No matter if someone is saving for retirement or seeks short-term investment opportunity, all these goals can be met in a sustainable way.

My first personal encounter with sustainable investing arrived through a TED talk video, where my personal idol, one of the most successful traders and hedge fund managers, Paul Tudor Jones explained how narrowly people value companies by only looking at profitability ratios and how this exaggerates income inequality and other social problems.

While Paul’s contribution to fixing the profit mania problem relies on helping corporations to change their views, there is a way how ordinary retail investors like you and me can contribute to enhancing socially beneficial behavior in personal finance.

Adding ESG focus leads to higher returns

ESG—environmental, social and governance—driven investing is essentially very simple and even more, importantly does not require sacrificing a single penny of return. In other words, there is no tradeoff between profit and ethics, there is no performance or sustainability question anymore.

As a recent brief study from MSCI finds: “2017 may be the year that ESG grows up.”

Instead of going into a philosophical excursus why hundreds of ESG data points like energy efficiency, employee satisfaction rate, workplace equality or down-to-earth executive salaries increase company value, I will show the most important factor. Return on investment.

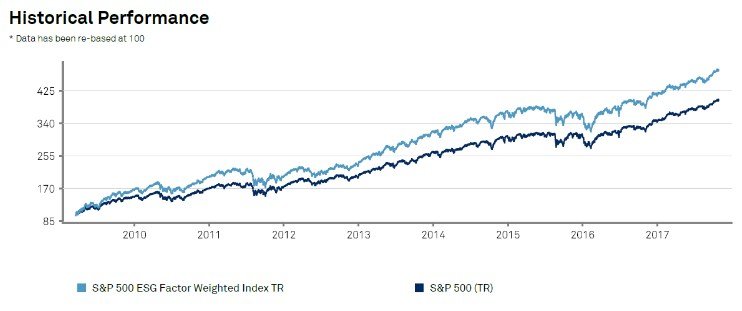

Source: S&P Dow Jones Indices

What the chart shows is the comparison of S&P 500 ESG Index—first broad-market sustainability index—to the ordinary S&P 500 index that simply includes the largest NYSE listed companies by their market cap. Both baskets include the same exact companies, the difference is that the weights are determined by ESG Score Factors for the sustainable index and not by size.

The five-year annualized net return for the ESG index was 1,5 percent higher for the period, yielding 15,01 percent per annum. For a $100.000 USD investment, the difference between the two returns was $7500 bucks over the five years.

The point is here that socially responsible investing is not only an option for hardcore vegan peace activists but for all conscious investors.

How do you invest in socially responsible instruments?

Anyone can find ESG driven investment opportunities. Being a client of a wealth service provider is advantageous as portfolio managers have access to professional databases like RobecoSAM, that ranks and rates companies by ESG data points, hence they can easily construct a portfolio for you. Self-driven investors have also plenty of opportunities.

Get the right ESG benchmark index.

MSCI and S&P 500 are the two leading index providers with in-house ESG research expertise. Start your journey of becoming an SRI expert by examining the brochures of these ESG indices. Look for the different types of sub-indices, historical price performance and especially index constituents if you plan to “mimic” a benchmark index on your own.

DIY approach.

Having an online brokerage account or being a client of a robo-advisor will allow you to construct your own socially responsible portfolio of high ESG rated companies. You will have to copy the weights of the different constituents the same way as the S&P 500 or MSCI ESG indices include them.

Once the shares are purchased, you will have to stick to passive investment strategy, but rebalance your portfolio at least semi-annually. The research firms change the weights based on the scorings as well, so you need to track it. The result of your DIY approach should be close to the rate of return of your benchmark ESG index.

Personal investment goals can be met by sustainable investing. (Source)

Top performing ETFs and mutual funds

In case you would like to avoid all the fuss around building your own portfolio, you can just buy ETFs (Exchange Traded Funds) or invest in mutual funds. The best and most reliable database sites are ETFdb.com and Morningstar, both have updated lists for socially responsible funds.

The big advantage of ETFs is that they are cheap and already include diversification, an essentially important investment feature. Don’t be surprised if you find online brokers offering ETFs with zero commission, but generally competitive fees range from 1-10 USD.

Summing up ESG investing

Even if it is hardly visible, capitalism on Wall Street is changing. The narrow-minded view of exclusive profit chasing is losing supporters, smart investors are discovering alternative metrics. Incorporating ESG factors to one’s investment strategy is not only ethical but also financially beneficial. The only thing I don’t get yet, is why socially responsible investing isn’t compulsory?

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech1 week ago

Biotech1 week agoBiotech Booster: €196.4M Fund to Accelerate Dutch Innovation

-

Business5 hours ago

Business5 hours agoThe TopRanked.io Weekly Affiliate Marketing Digest [The Top VPN Affiliate Programs Roundup]

-

Crypto1 week ago

Crypto1 week agoBitcoin Traders Bet on $140,000: Massive Bets until September

-

Crypto2 weeks ago

Crypto2 weeks agoCaution Prevails as Bitcoin Nears All-Time High

You must be logged in to post a comment Login