Featured

Foreign holders of US treasury debt

What’s odd about last week is that after Monday’s astounding advance, a Dow Jones 1610 point advance from Friday’s close to the high of Monday’s trading, on a daily closing basis the Dow Jones has yet to see a new all-time high. I’m no “market expert”; but as far as I can figure, what the FOMC is doing is safeguarding the banking systems’ short positions in the OTC interest rate derivative market.

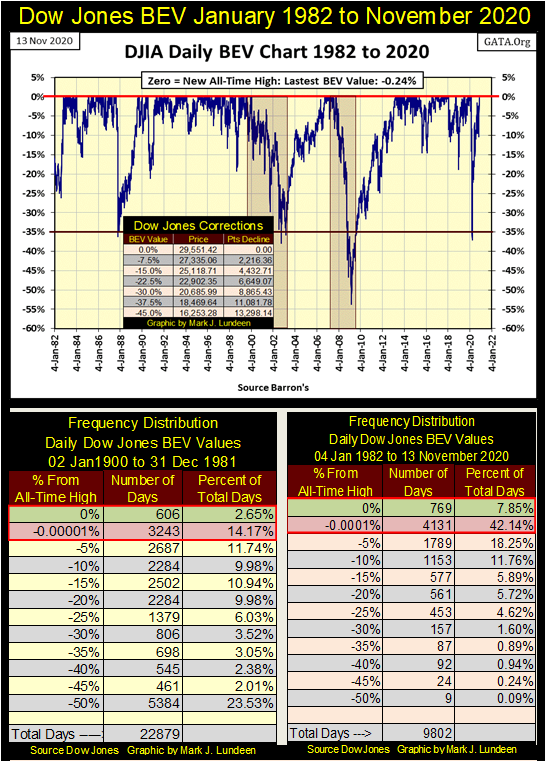

First up, and a few pages below, is the Bear’s Eye View for the Dow Jones going back to January 1982. As I see it, our current bull market began in August 1982 when the Dow Jones began an advance that took it above, and kept it above 1000 to this day. Now in November 2020, some thirty-eight years later the Dow Jones is approaching 30,000, but it’s not there just yet.

The Dow Jones’ last all-time high was on February 12th as it closed at 29,551. This week it closed at 29,479, or 72 points short of last February’s BEV Zero. Can the bulls push the Dow Jones up above last February’s BEV Zero below? If they can’t, we can forget about the Dow Jones above 30K.

Let’s take a quick look at our thirty-eight year bull market in the BEV chart below. It began in August 1982 as the Dow Jones advanced from its BEV -25% line to its BEV Zero line, where until August 1987 it made many new all-time highs.

The “Flash Crash” of October 1987 was the next big event in the chart, where all the computers on Wall Street were programed with similar parameters for buying and selling. It was called “portfolio insurance” at the time, where when the market was down by so much these programs would automatically begin selling losing positions and shorting into market weakness for profits. All of this made good sense; what could go wrong?

The Dow Jones last all-time high was on 25 August 1987, where it closed at a most impressive 2722.42. Beginning in late August, the market began a correction where on 16 October 1987 the Dow Jones had declined to its BEV -17.5% level. The next day the market must have declined below the program’s “insurance” threshold, and every major market maker on Wall Street’s computer began selling their losing positions and shorting into market weakness. No one saw this coming. In a single day the Dow Jones crashed 20% because everyone was afraid to pull the plug on the computers to stop the selling.

It proved a point that was common around that time, but still holds true today; that anyone can make a mess of things, but if someone really wants to totally screw things up, they needed a computer.

The next Dow Jones 35% correction happened following the NASDAQ High Tech bubble of the 1990s. Funny how this Dow Jones 35% correction was connected to computers too, but the corrections for computer, semiconductor and software companies were much deeper than just 35%. In October 2002 the NASDAQ Composite itself was down 78% from its highs of 2000.

The sub-prime mortgage boom and bust was also a high tech market event. Wall Street hired actual rocket scientists to program super-computers to dice and slice mortgages’ principal and interest streams into tranches, which could then be recombined in such a way that even mortgages held by deadbeats could be rated as AAA debt. This was called “structured finance” and high tech was at the heart of it.

“Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. These improvements have led to rapid growth in subprime mortgage lending . . . fostering constructive innovation that is both responsive to market demand and beneficial to consumers.”

– Alan Greenspan (At the Federal Reserve System’s Fourth Annual Community Affairs Research Conference, Wash D.C. April 8, 2005

Anyway, as per Alan Greenspan that was the theory. As it worked out, during the Dow Jones’ 2008-09 54% market crash, trillions-of-dollars of abandoned mortgages remained worthless no matter how the rocket scientists’ computer models sliced and diced them. Who could have seen that happening?

The latest, and fourth post August 1982 35% market correction happened last February / March. The mainstream financial media said this crash was the result of the CCP virus, and maybe that is so. But high finance’s romance with computers is a fickled affair, one prone to sudden and violent break ups. Especially worrisome is the hundreds-of-trillion dollar market in OTC derivatives, a market totally dominated by computers and the software running on them.

Let’s look at the two frequency tables at the bottom of the chart above. In these tables we’re looking at a 120 year history of the Dow Jones in Bear’s Eye View (BEV) format, where decades of market data is compressed into a range of only 100 percentage points.

The 20th Century’s first Dow Jones all-time high (BEV Zero) was 68.36 seen on 05 February 1900. The BEV format treats the Dow Jones’ first BEV Zero exactly the same as it does its last all-time high seen on 12 February 2020 (29,551), reducing it, and every other all-time high in-between to a 0.00%. Those daily closings not a new all-time high are registered as a percentage decline from its previous BEV Zero, with -100% a total wipeout in valuation.

The table on the left is from 02 January 1900 to 31 December 1981. The table on the right is from 04 January 1982 to today; the Dow Jones’ BEV data set seen in the above BEV Chart.

Keep in mind the US Treasury abandoned the Bretton Woods $35 gold peg in August 1971; ten years before the split in these two tables. Freeing the “Policy makers” from the restraints of the $35 gold peg have had massive impact on the stock market, as seen in these two tables.

To analyze this data we compare one table with the other. For instance, the daily hits in the 0% row (new all-time high daily closes); from 1900 to 1981 the Dow Jones saw a new all-time high in only 2.65% of its daily closings, while since January 1982, 7.85% of its daily closings have been new all-time highs.

Combining the 0% & -0.0001% rows, which includes all the daily closings at or within 5% of a new all-time high, from January 1900 to December 1981, the Dow Jones was at a new all-time high or within what I call scoring position of one (<5%) in 16.82% of its 22,879 daily closings.

With the FOMC freed from the shackles of a $35 gold peg, what a difference the next thirty-eight years would be with the Dow Jones closing at or within 5% of a new all-time high in 49.99% of its 9802 daily closings.

People much smarter than me have predicted a horrible end to this massive inflationary bubble the market has benefitted from since August 1982. But predicting exactly when Mr Bear’s terrible day of reckoning is to come has so far proven hazardous to all market prognosticators’ reputation who have dared to try. Still, Mr Bear’s terrible day of reckoning is pending.

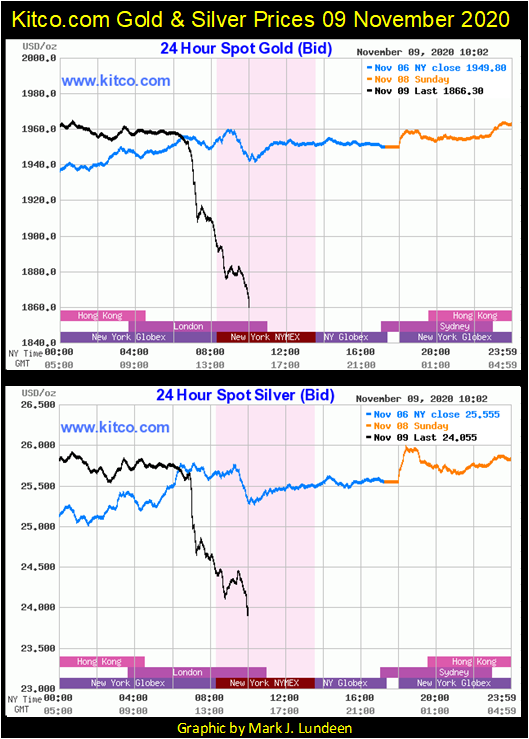

Look at the Dow Jones these past two weeks in the chart below. It rises up from below its BEV -10% line (26,596) to 29,994, the highest value ever on a daily high basis on Monday November 9th, as gold crashed by $100 at the same time. The mainstream financial media said it was an announcement that the CCP virus finally had a vaccine. I say it was because the stock market received a big “injection” of “liquidity” from the FOMC while the COMEX paper gold markets got whacked by tons of nonexistence gold flooding into the market until the precious metal bulls’ positions were broken.

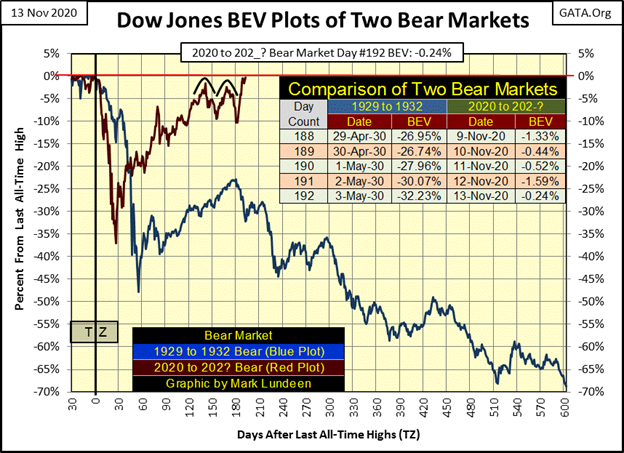

What’s odd about last week is that after Monday’s astounding advance, a Dow Jones 1610 point advance from Friday’s close to the high (not close) of Monday’s trading, on a daily closing basis the Dow Jones has yet to see a new all-time high. Looking at my chart showing the Great Depression market crash along with our current market correction (below), the table lists the daily BEV values for last week and we’ve yet to see the Dow Jones close at a new all-time high.

Will we see the Dow Jones in record territory? The smart money is betting it will, and a 0.00% for a daily close will cause me to put away this chart until the next time the Dow Jones sees a significant correction.

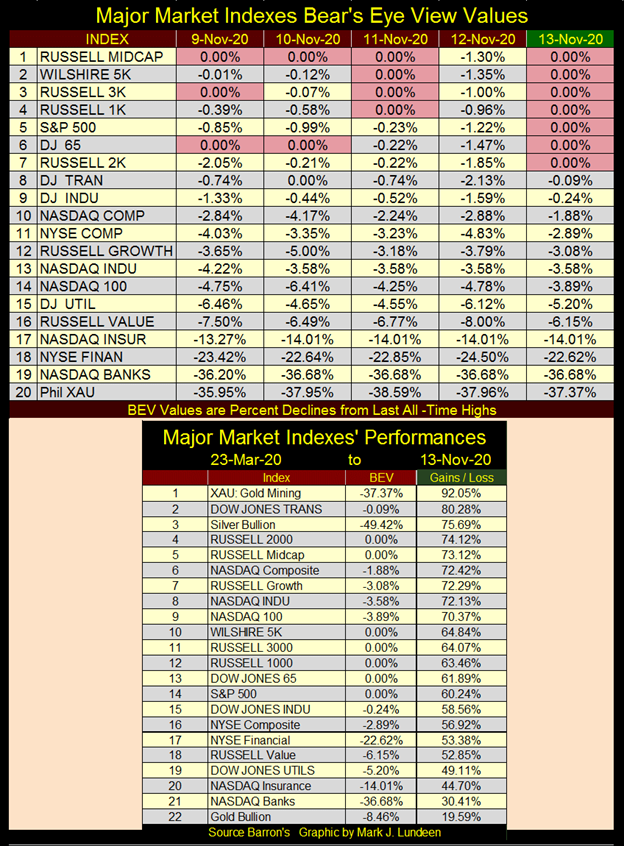

Here are the BEV values for the major market indexes I follow. Last week was a good week for the bulls, with seven of these indexes closing the week at new all-time highs, and indexes from #8 to #14 in scoring position or <5% from making a new all-time high.

Currently I have no exposure to the broad stock market. But sitting in the market’s peanut gallery, it makes sense to begin to cheer for the bulls in the FOMC, because if you can’t beat them, you might as well join them.

What about gold, silver and the PM miners? Take a look at the table above; the XAU and silver remain top performers since March’s market bottom and there is no reason to assume that will change anytime soon. And gold? It will take care of itself. Somethings just won’t be hurried, just as somethings are inevitable.

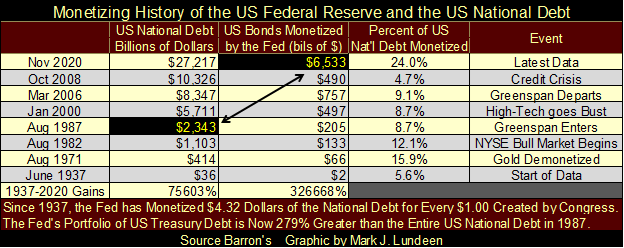

The table below is something to keep in mind as the Dow Jones approaches a new all-time high. In November 2020 the FOMC’s holding of Treasury debt is now 179% more than the * ENTIRE US NATIONAL DEBT * when Alan Greenspan became Fed Chairman in August 1987. That plus the Fed has in November 2020 also monetized 24% of the national debt.

But down there in the playing field, and high up here in the market’s peanut gallery nobody cares, and nobody will until the day comes when everybody does care. The shift in market psychology will be sudden and brutal as interest rates and bond yields once again begin to advance to unimaginable levels; something over 5% and rising.

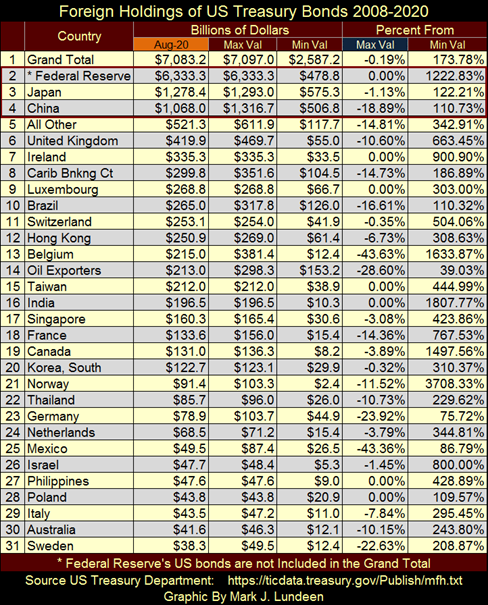

I updated my foreign holders of US Treasury debt, so let’s take a look at who is holding Uncle Sam’s IOUs.

https://ticdata.treasury.gov/Publish/mfh.txt

The table below is sorted on its Aug 20 column, the columns are as follows:

- Aug-20: the latest data from the US Treasury;

- Max Val: largest value since May 2008;

- Min Val: smallest value since May 2008;

- % From Max Val: Bear’s Eye View of Max Value;

- % From Min Val: Percent Increase from Min Value.

Note; the US Treasury does not include the Federal Reserve’s holdings of US Treasury debt, but as I have the data I include it. If you look at #2-4 in the table’s the Minimum values, before December 2008 the holdings of T-debt by the Federal Reserve had been less than either Japan or China.

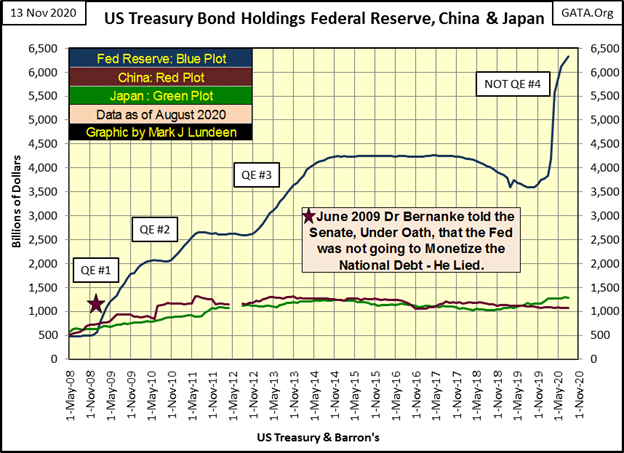

In the chart below we see the T-debt holdings for China, Japan and the Federal Reserve. The Federal Reserve’s holdings (Blue Plot) didn’t exceed China or Japan’s until Dr. Bernanke’s QE#1. Since then the Federal Reserve, using monetary inflation to fund its operations, has been the most aggressive purchaser of Treasury debt.

Small wonder how since May 2008, when the US National Debt was $9.3 trillion, yields on Treasury debt had fallen to historic lows (chart below) as the National Debt increased to over $27 trillion. The Federal Reserve is manhandling bond yields ever lower by buying US Treasury debt and now even junk bonds in the corporate bond market, in volume and at prices no one else is willing to pay. This is what the FOMC calls “monetary policy.”

I’m no “market expert”; but as far as I can figure, what the FOMC is actually doing is safeguarding the banking systems’ short positions in the OTC interest rate derivative market. They’re keeping bond yields down because should they increase, hundreds-of-trillions in notional value OTC derivative contracts would come into the money.

As neither the global banking, nor central banking systems could survive a margin call of hundreds-of-trillions of dollars, the Federal Reserve continues buying bonds to maintain the current market’s historic low bond yields. Should they stop, and bond yields once again rise up to say 5% (?) a prairie fire of counter-party failure would engulf the global debt market, or so I suspect it would.

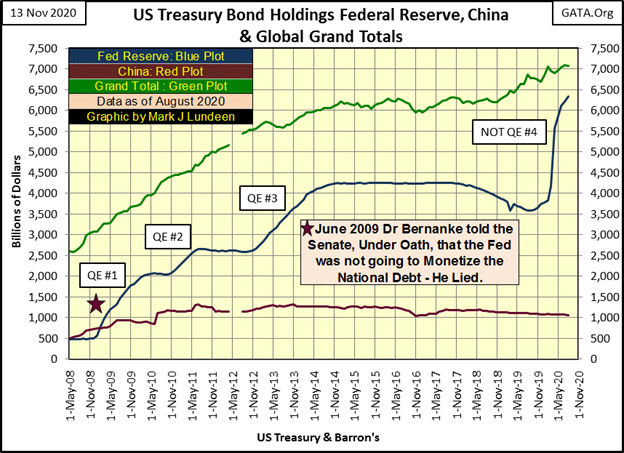

My next chart plots the T-debt holdings of;

- Federal Reserve;

- China;

- Total in the Treasury’s report.

In May 2008 the Federal Reserve’s holding of T-debt was less than that of China. Twelve years later (August 2020), their holdings are approaching that of the Treasury’s total for all foreign holdings.

There is something fundamentally wrong with that, something investors in the financial markets would want to, or should want to know. But unless someone is a data hound, someone who maintains their own data series as I do, absolutely no one is aware of this. This universal ignorance of what the FOMC is doing above is by design, with the full cooperation of the FAKE NEWS financial media who makes it a point to appear as ignorant on matters of “monetary policy” as their audience of investors certainly are.

Do you want to see something really ignorant? How about last week when I predicted gold would see a new all-time high before December. That was on Saturday night. In the first few hours into Monday’s trading gold dropped by $100 – ouch!

The thing about being ignorant is that ignorance can be all encompassing; that not only is one ignorant of the facts, but they are also ignorant there are facts to be aware of. This enables people, and I’m people just as much as anyone else, to not care about this $100 drop in the price of gold, and continue predicting that gold will see a new all-time high before December.

But ignorance should not be confused with being stupid. Ignorance allows me to continue predicting a new all-time high in gold before December, but not being stupid prevents me from risking any of my money that gold could actually do it.

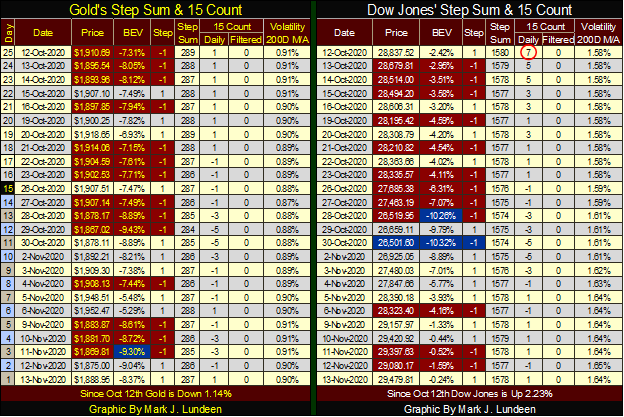

What am I talking about? Well last week gold closed the week 5.29% from a new all-time high, only a $108 advance with fifteen trading days to do it in. This week is a completely different story as gold closed the week 8.46% from a new all-time high ($175) with only ten trading days remaining in November.

Could gold close in record territory in the next ten trading days left in November? Well the Dow Jones in the past ten trading days went from being 10% from a new all-time high to just a whisker from being one. I wouldn’t count on gold doing the same, but who knows?

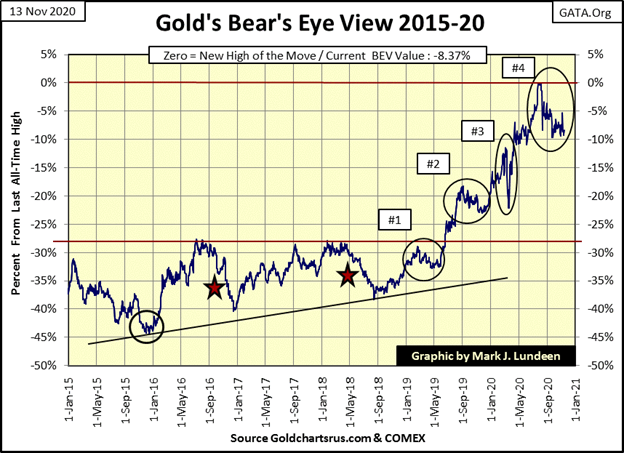

Let’s look at gold’s BEV chart next. Whether or not gold can break up to its BEV Zero line by December, since early August gold has still refused to break below its BEV -10% line. As noted last week, gold’s 15 count was a +13 on August 6th. As it closed above $2000 an ounce for the first time in history, the gold market for fifteen days saw only one daily decline.

Not since 1969 has gold been this overbought, and so three months later it is still digesting its $2000 daily closes of last August. Some things will not be hurried; still gold’s BEV chart below looks very good.

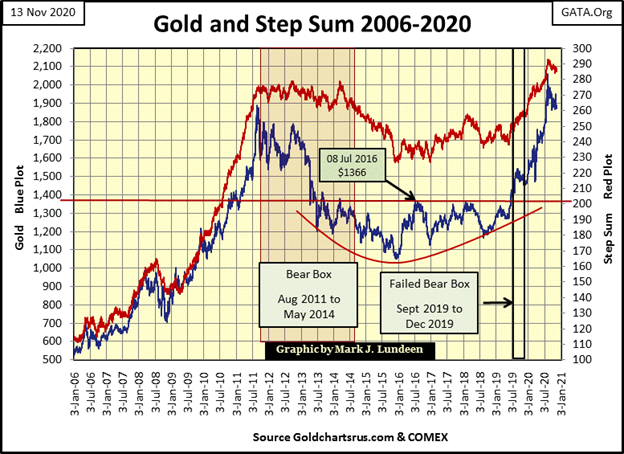

Gold’s step sum chart below is also strongly bullish. The market action seen below since gold’s August 2011 top has constructed an extremely strong base for future advances in the price of gold. Anticipating another multi-year advance, seen below from 2006 to 2011, where gold increased from $500 to $1888 (a 277% advance) isn’t an outrageous assumption when gold once again decides to move. That would take gold up to $7540 an ounce in the next few years.

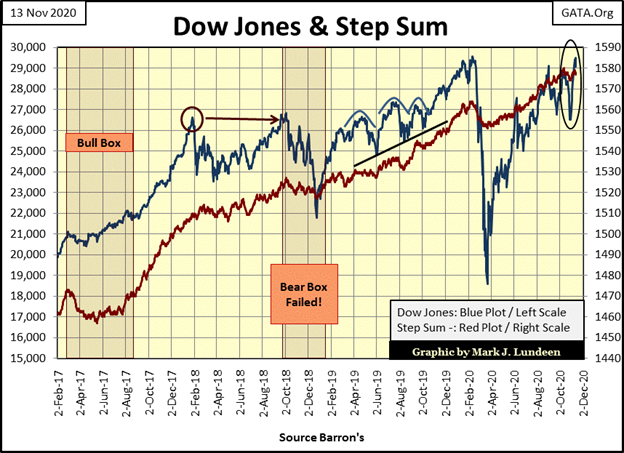

Here is the step sum chart for the Dow Jones. Market reality (Blue Plot / Valuation of the Dow Jones) is the stock market is moving up. Market expectations (Red Plot / Step Sum Plot) is most investors expects this advance will continue. Apparently everyone is expecting the Dow Jones to break above into the 30K level relatively soon, and who am I to argue?

Below are the step sum tables for gold and the Dow Jones. Gold isn’t going anywhere anytime soon, and won’t be as long as it continues seeing so many down days. Still, so far the bears have been unable to drive gold below its BEV -10% line. I highlighted in blue the low point gold saw since October 12th; a BEV of -9.30% seen on November 11th.

I’ve kicked the habit of making market predictions. It really is a bad habit. That’s not to say with “monetary policy” as we’ve seen above, the future for gold isn’t brilliant – because it is! But short term, I wouldn’t be surprised seeing gold break down to and maybe below its BEV -15% line ($1751) in the coming weeks and months. And then just maybe we’ll see gold at a new all-time high before December.

For myself, I’ve got my precious metals positions in, and Eskay Mining is doing good things for my personal net worth. So, I’m going to remain sitting in the market’s peanut gallery, cheering, for no particular reason the bulls in the stock market while booing the bears in the gold and silver futures markets because I hate them.

But truth be told; the big bulls in the stock market are the same people who are the big bears in the COMEX precious metals futures market. You know – them!

Look at what the Dow Jones did. In late October it saw a double bottom, where it twice broke below its BEV -10% line (highlighted in blue), and then in ten NYSE trading sessions almost broke into record territory. Give a cheer for the idiot savants at the FOMC!

__

(Featured image by Brett_Hondow via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto4 days ago

Crypto4 days agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Markets2 weeks ago

Markets2 weeks agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Business4 days ago

Business4 days ago2.5 Billion People Watch Quiz Shows Every Day. Masters of Trivia (MOT) Is Letting Them Compete