Markets

Commodity Futures Snapshot: Wheat Softens, Corn Pressured, Soybeans Steady

The last week has seen mixed performance across agricultural commodities futures after favorable U.S. harvest progress and strong export sales were offset by pressure from large supply forecasts, favorable weather in key regions, and currency-driven headwinds. Geopolitics, weather, and energy markets shaped price action, and OPEC-led oil production cuts boosted ethanol demand prospects.

Global agricultural commodity futures markets saw mixed performance last week, with price movements driven by harvest progress, shifting weather patterns, export demand, and geopolitical developments. While some crops found support from strong U.S. export sales and supply concerns in key producing regions, others came under pressure from expectations of large upcoming harvests and favorable growing conditions.

Weather remained a key theme, with improved rainfall benefiting parts of the U.S. Midwest and northern Great Plains, while dryness persisted in areas of Canada, Russia, and Ukraine. In the Southern Hemisphere, crops are generally progressing well. Currency fluctuations, changes in global petroleum prices, and policy shifts—from central bank rate hikes to evolving trade agreements—also played an influential role across multiple markets.

Against this backdrop, here’s how major agricultural commodities performed over the past week.

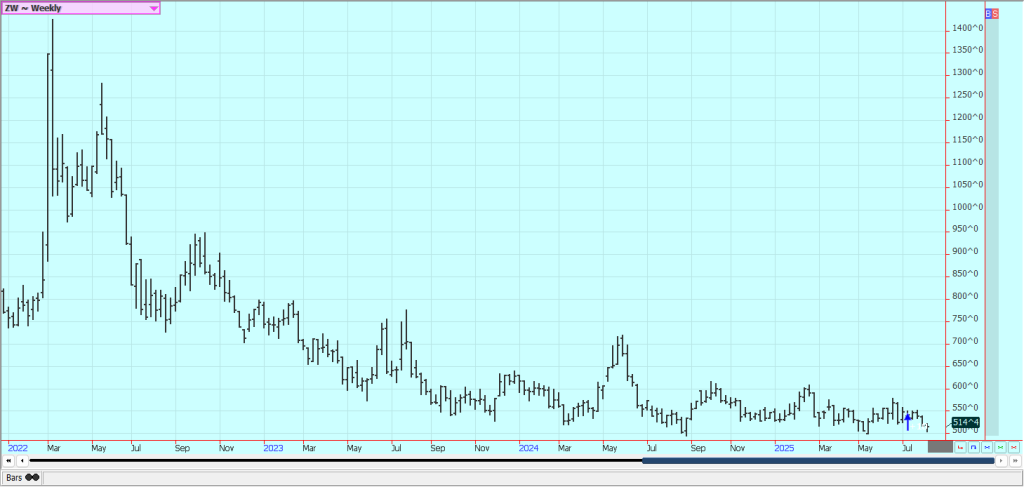

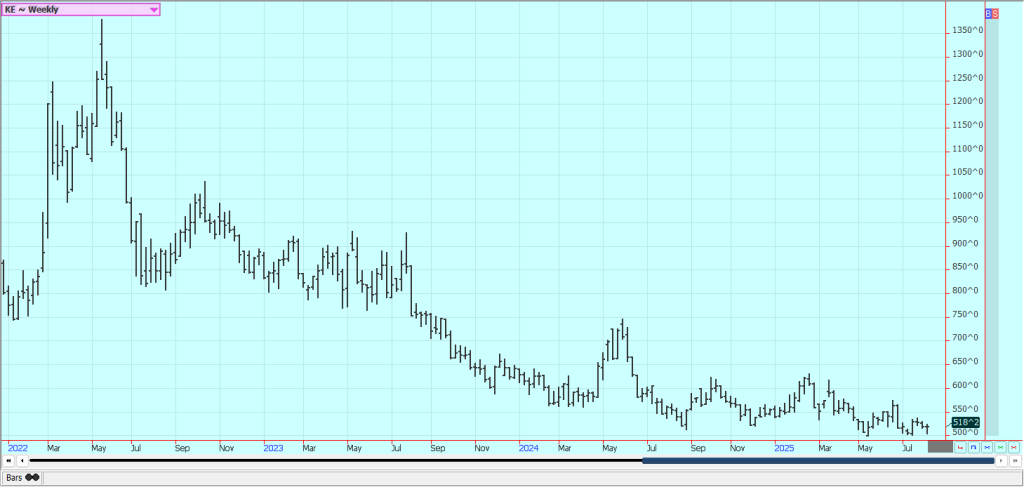

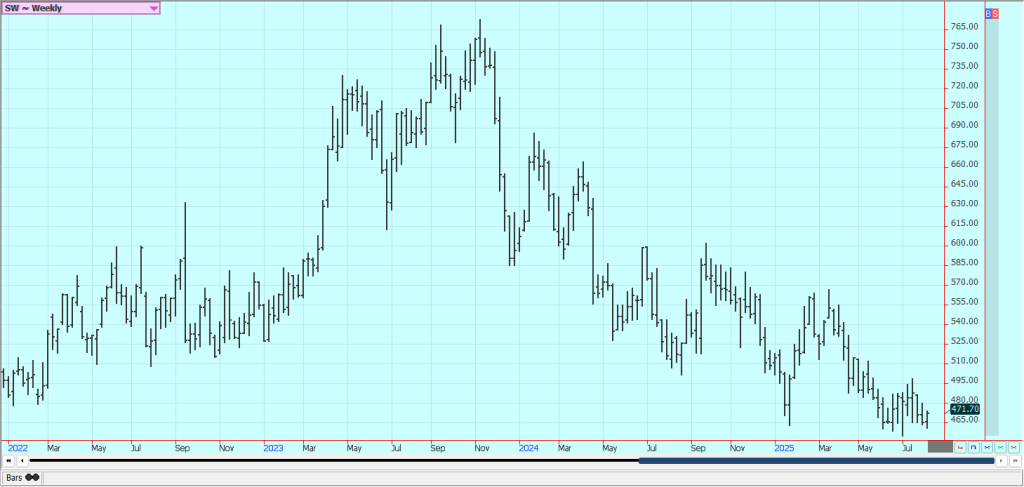

Wheat Futures

Wheat was slightly lower last week in response to the strong weekly export sales report and rising world prices for good-quality wheat. There was talk that Russia’s wheat crop had a significant infestation of pests, making it more difficult to sell. Ideas of solid harvest progress and good yields persist, pressuring prices lower.

Harvest conditions for U.S. winter wheat appear to be favorable, and spring wheat development is currently good. Rains have been beneficial in the northern Great Plains, but Canada has been somewhat too dry for optimal yield potential. Hot and dry conditions earlier in the year also affected parts of the northern Plains. Despite this, Canada could still produce an average to above-average crop.

Russia is being watched for ongoing dry weather that has hurt yields, while Ukraine faces the same concerns along with the impact of the war, which could destroy some fields. Russian Black Sea prices have been firming as producers hold back sales, seeking higher prices to offset yield losses. Southern Hemisphere crops appear to be in good condition.

The weekly export sales report showed sales within trade expectations.

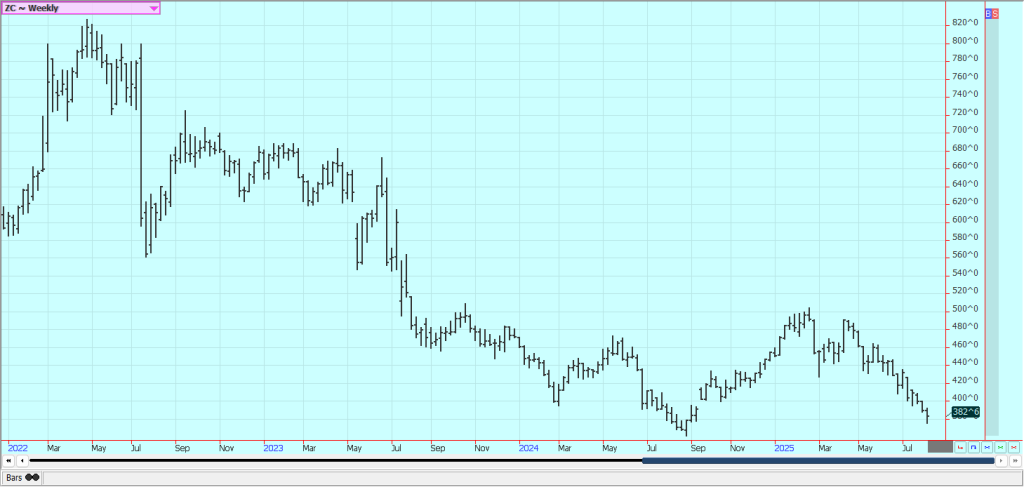

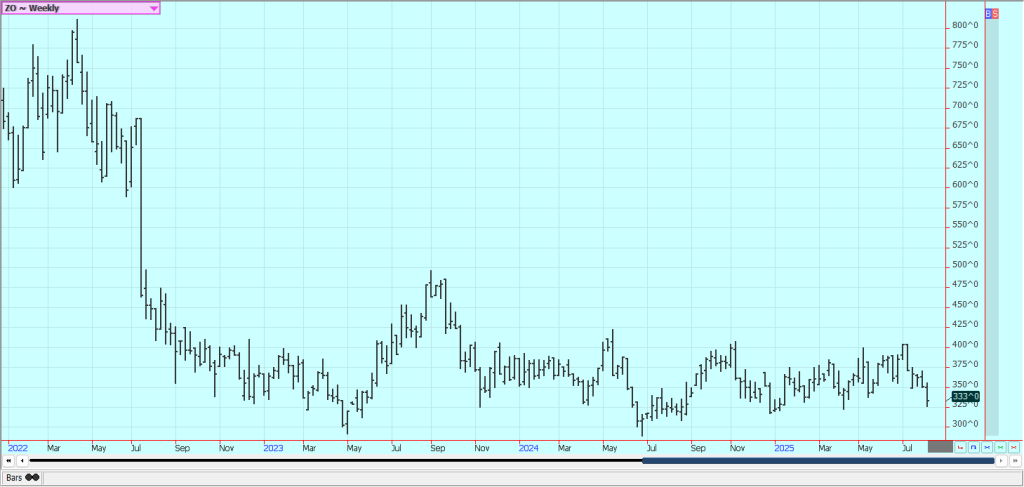

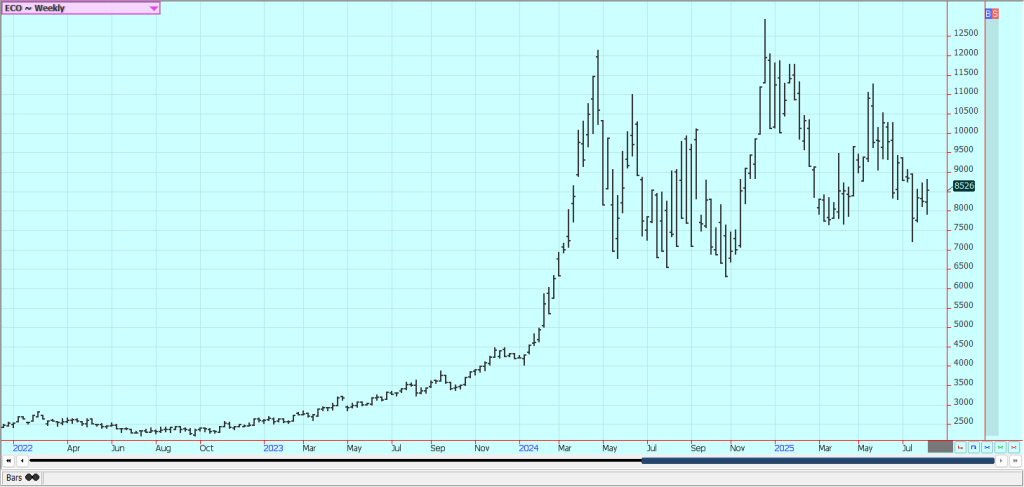

Corn

Corn was lower last week on expectations of large supplies from the U.S. and ongoing harvest in Brazil, but closed mid-range due to a very strong weekly export sales report. USDA reported over 3.1 million tons of corn sold in the most recent week.

Speculative selling continued amid widespread record crop production predictions, supported by forecasts for improving Midwest weather. A slow warming trend is expected through the weekend, with mostly dry conditions. Most of the Midwest has received adequate or above-average precipitation, and production estimates remain high. Yield forecasts of 186 bushels per acre are common, though analyst surveys suggest closer to 183 bushels per acre.

World corn demand remains strong. Oats were sharply lower on the weekly charts. Futures traded within recent ranges as the U.S. dollar strengthened following the Federal Reserve’s 0.5% interest rate hike, raising recession fears. USDA cut export demand by 75 million bushels, adding the same to ending stocks, now estimated at 1.257 billion bushels.

Corn prices also reflected geopolitical tensions. Ukraine reportedly bombed a bridge linking Russia and Crimea, prompting Russian retaliation in several Ukrainian cities. This has increased concerns that the Black Sea grain export deal could collapse, potentially impacting both Ukraine’s and Russia’s export capacity.

Low water levels in the Mississippi River continue to restrict barge traffic, with no significant improvement forecast. Meanwhile, OPEC and Russia’s decision to cut petroleum production could boost ethanol demand, potentially improving processor margins.

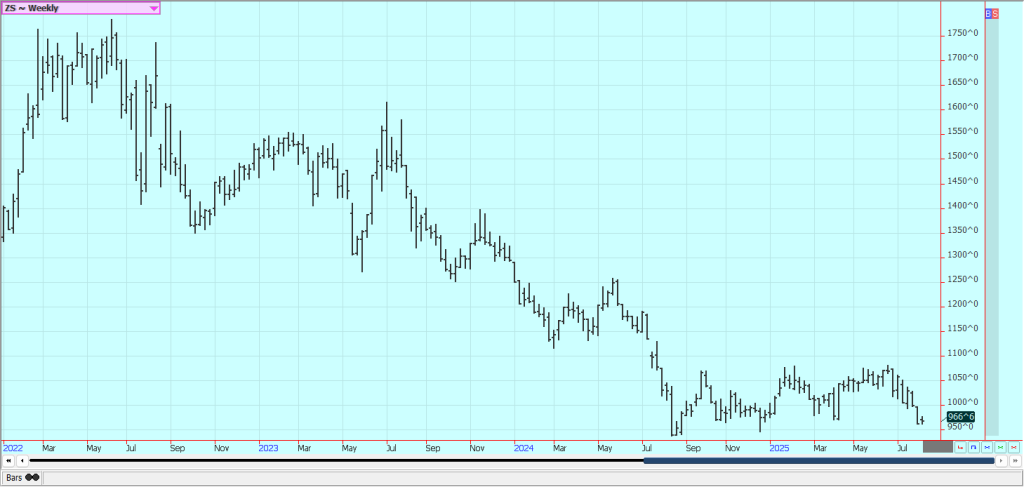

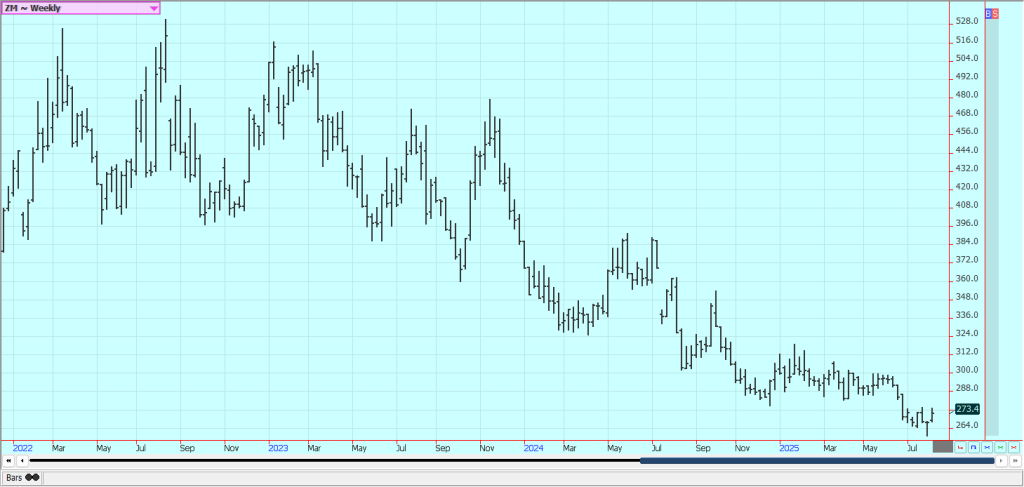

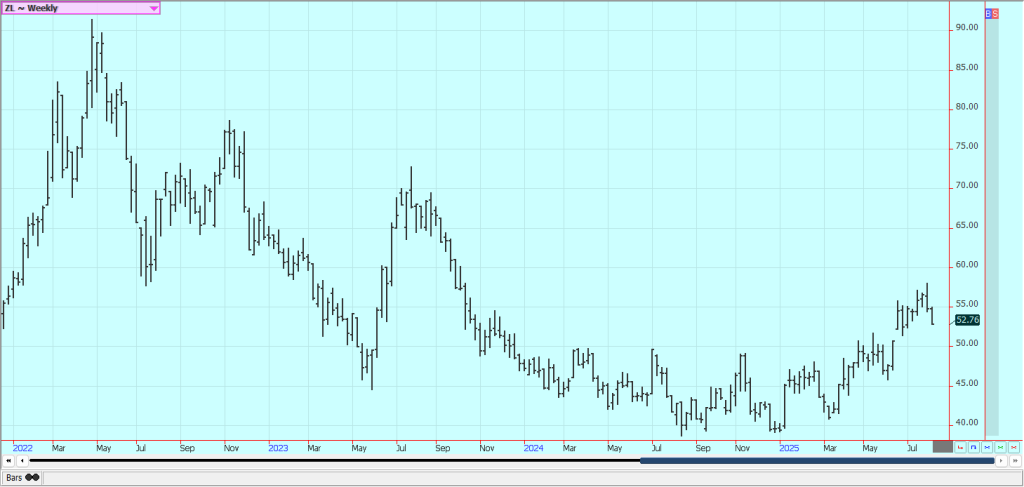

Soybeans and Soybean Meal Futures

Soybeans ended slightly higher last week, soybean meal was higher, and soybean oil was lower as favorable U.S. growing conditions continued. The weekly export sales report showed combined old- and new-crop sales of about 1.0 million tons.

Brazilian prices are now reported to be higher, but China and other buyers continue purchasing there for political reasons. U.S. export demand remains reduced, with China sourcing most of its needs from South America. Trade estimates for next week’s USDA crop report are around 55 bushels per acre, but wire-service surveys suggest closer to 53 bushels per acre.

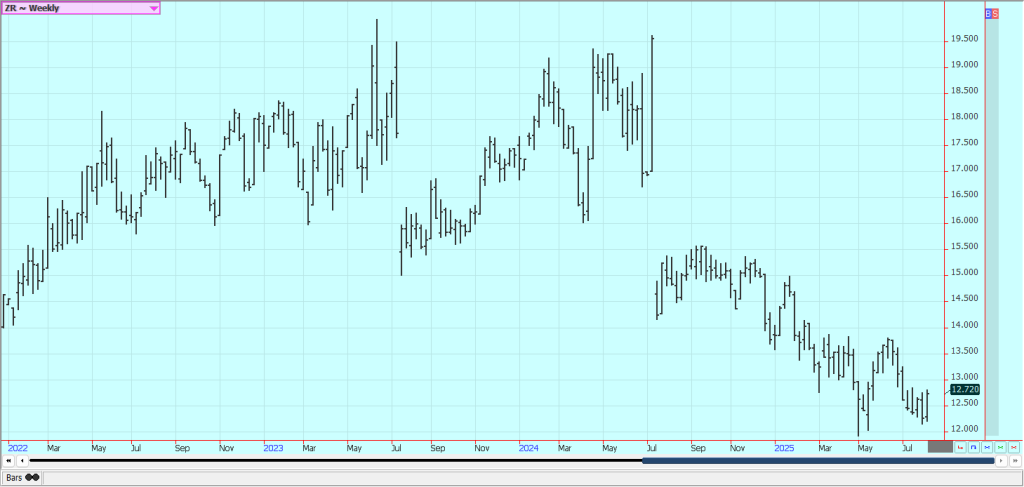

Rice Futures

Rice moved higher last week, with the market attempting to form a second low on the weekly charts. Chart trends are mixed to up on daily charts. Cash market activity remains slow, with low domestic bids and average or below-average export demand.

New crop harvesting has started in Louisiana, with reports of good but not outstanding yields and quality. Concerns remain in Arkansas due to very hot conditions. Milling quality of the old crop remains below standards, requiring more rough rice to meet market needs. Most growing areas are now heading, and harvest has begun along the Gulf Coast.

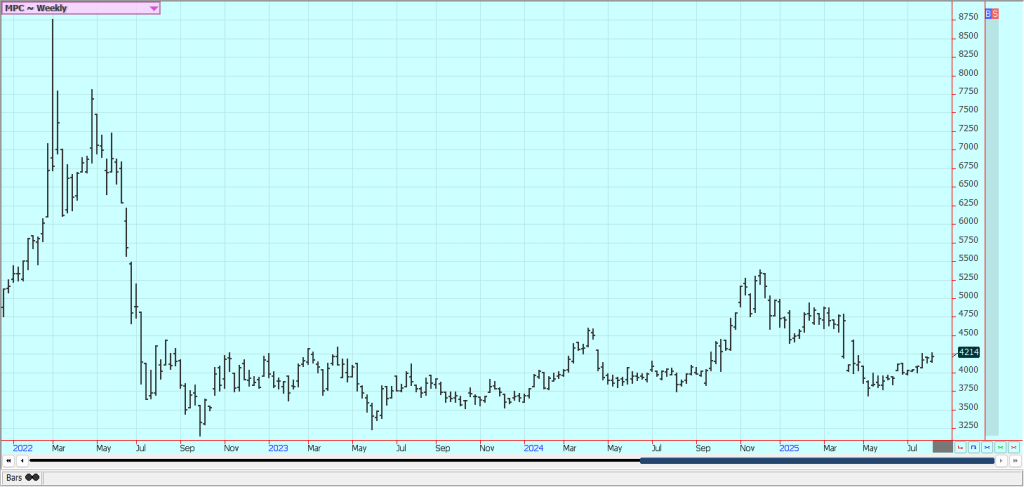

Palm Oil and Vegetable Oils Futures

Palm oil futures were slightly higher last week ahead of Monday’s MPOB report release. Expectations are that India will increase purchases ahead of upcoming festivals. However, increased production levels are likely to result in higher inventories in the MPOB data.

Canola ended lower last week, with mixed trends on daily and weekly charts. Prairie weather has been mostly warm and dry, limiting crop development.

Cotton Futures

Cotton traded slightly higher in mostly sideways action last week. Many traders are awaiting Tuesday’s USDA WASDE report, which could show lower demand and slightly higher ending stocks. The weekly export sales report showed relatively strong sales.

Better weather is expected in the Delta and Southeast, with crop condition reports mostly unchanged. West Texas remains hot and dry, though some improvement has been noted. The Indian monsoon is performing well, supporting the possibility of good production there.

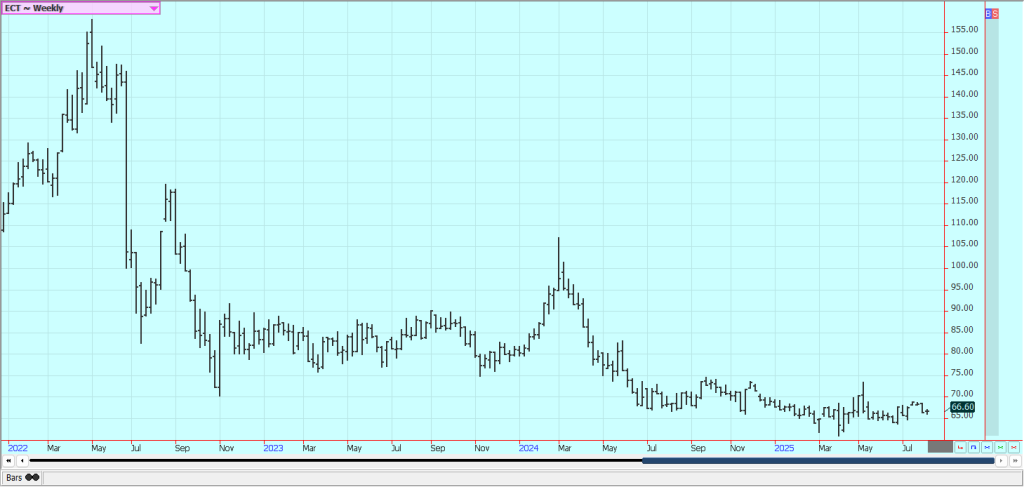

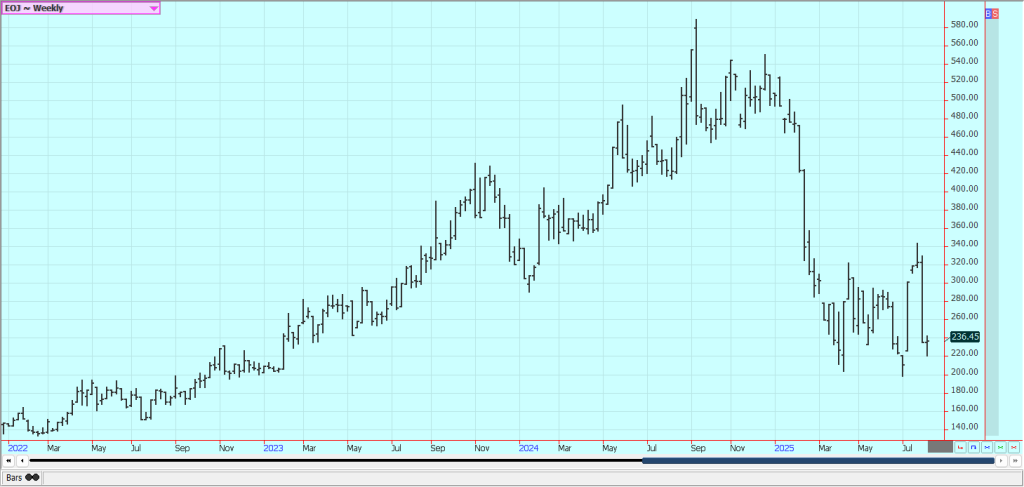

Frozen Concentrated Orange Juice (FCOJ) and Citrus Futures

Futures were slightly higher last week after making new lows. Daily chart trends are mixed; weekly trends remain down. Prices reacted to news that President Trump removed OJ from earlier-announced punitive tariffs on Brazil.

Development conditions in Florida are currently favorable, but production potential remains poor due to both weather and citrus greening disease, which has significantly reduced tree populations.

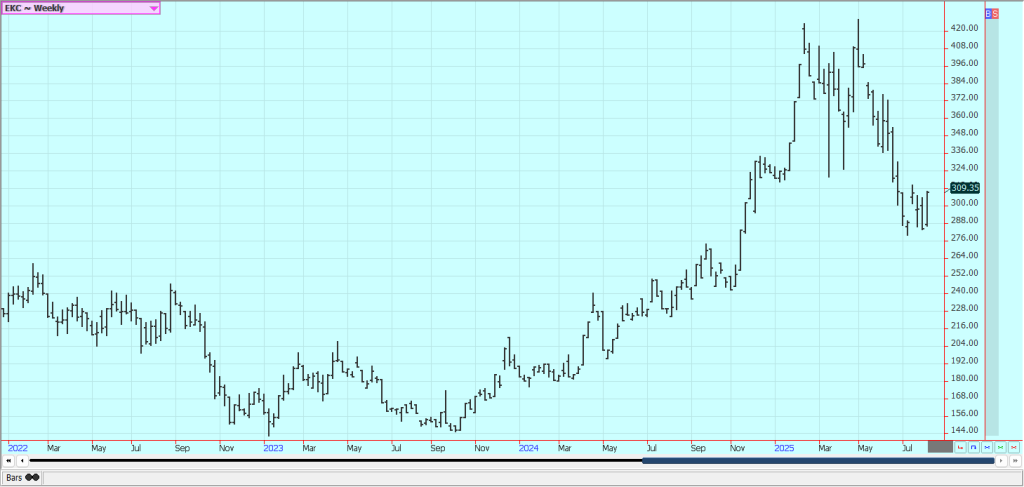

Coffee Futures

New York and London coffee futures were both higher last week, with New York showing the largest gains as deliverable stocks declined. Robusta remains more available, with Brazil seeking non-U.S. markets due to U.S. tariffs.

Arabica prices have been pressured by favorable weather in Brazil. The Robusta harvest continues in Brazil and Indonesia; Vietnam has finished its harvest, with domestic prices firm. The Brazilian Arabica harvest is nearly complete and expected to be smaller than last year.

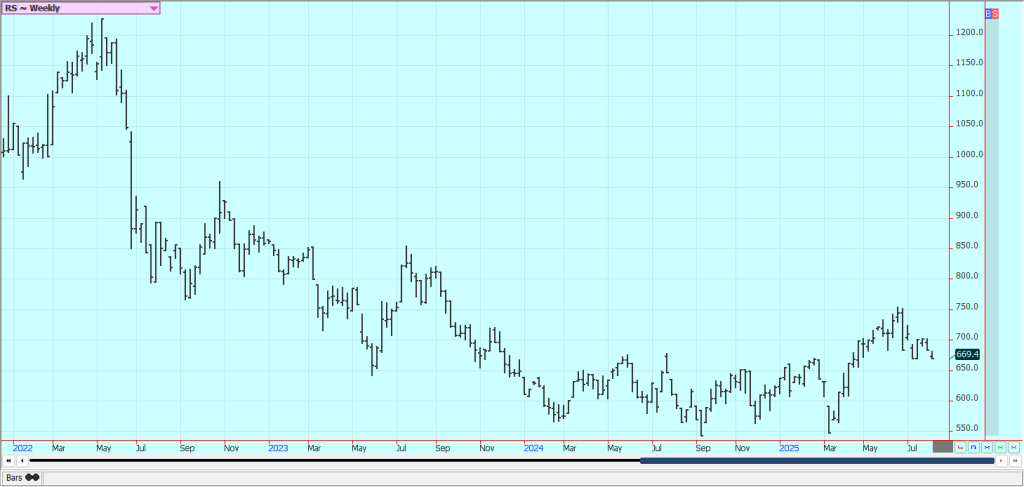

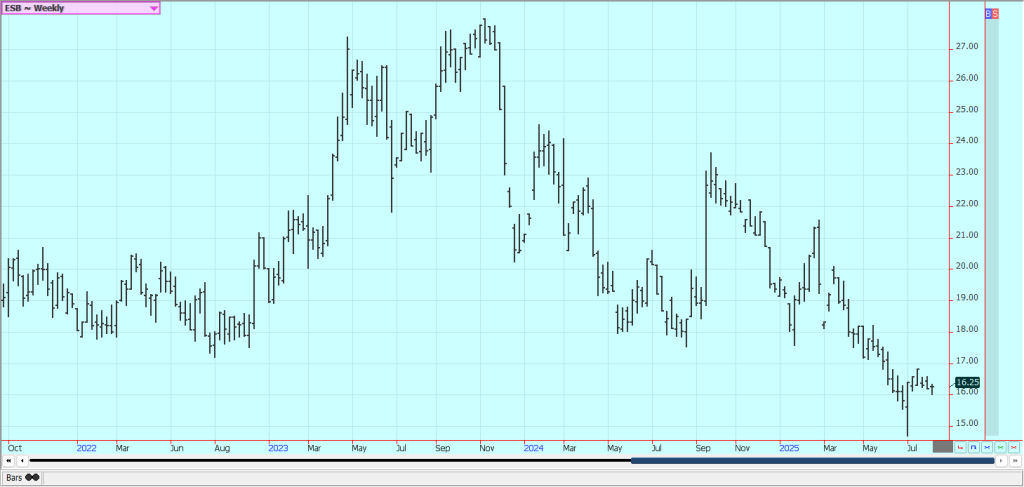

Sugar Futures

Both New York and London sugar markets moved higher last week on short covering. There are expectations of reduced European production later this year, though no rally has materialized yet.

Pakistan issued a new tender for 100,000 tons of white sugar. Global growing conditions remain mostly favorable, with faster harvest pace in Center-South Brazil and good conditions in India and Thailand. However, total recovered sugar juice in Brazil is down this year.

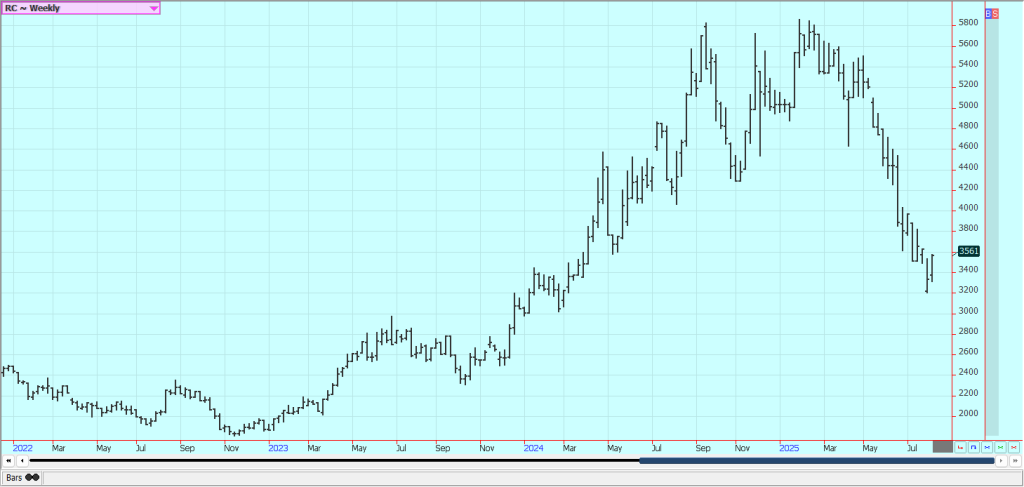

Cocoa

New York cocoa closed higher, while London was near unchanged as the British pound strengthened. Demand concerns emerged after the Swiss Chocolate Association warned that new U.S. tariffs would hurt sales.

Reports continue of increasing production potential in Asia and Central America, alongside good soil moisture in Ivory Coast supporting a healthy October-to-March main crop.

__

(Featured image by Tom Fisk via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Markets1 week ago

Markets1 week agoCotton Market Weakens Amid Demand Concerns and Bearish Trends

-

Fintech1 week ago

Fintech1 week agoFintech Alliances and AI Expand Small-Business Lending Worldwide

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoSpain’s Real Estate Crowdfunding Boom: Opportunity, Access, and Hidden Risks

-

Crypto2 days ago

Crypto2 days agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets