Featured

Global economic recovery is here but where are the new safe-haven assets?

Global economic recovery is happening but cautious optimism is still advised as the major economic powers are struggling to find new safe-haven assets.

Investors, economic analysts, business owners, and the man and woman on the street alike should not be overly optimistic about any bit of news that says that the global economy is rebounding.

It’s not that the news is false—it is quite true. However, no permanent recovery or robustness is possible unless the powers-that-be determine the safe-haven assets that can support it. Safe-haven assets are like the global economy’s emergency funds, a source of funding should supply run low. If the entire industrialized world were to be likened to a hardworking individual, then the safe-haven assets are like his bank account savings.

Although, there do not seem to be any solid safe-haven assets that can guarantee that the global economic recovery can sustain itself. That is the warning given by Bloomberg which points out that although China and emerging nations are generating and saving wealth, their respective local markets do not have the necessary financial tools that are totally risk-free.

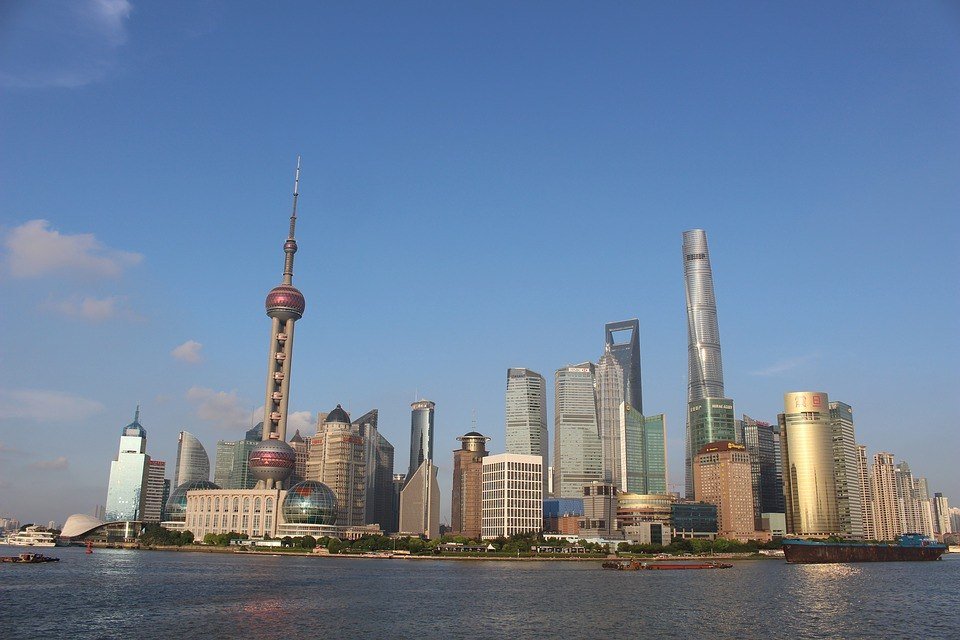

China and other economic powers must find new risk-free instruments during the global economic recovery happening now. (Source)

In the past, the currencies of the United States, the United Kingdom, and Germany had served these roles, but their growing scarcity the past few years had created an imbalance that can throw the global economy off-kilter. The rest of the world might continue to rely on U.S. Treasuries, which can create a deceptively promising bond bubble.

China is an ideal economic partner to lay the groundwork for safe-haven assets. However, its Western allies are still leery of entrusting that role to the Asian superpower because of disagreements over human rights and government control.

Some investors are flocking to the cryptocurrency known as Bitcoin, says the Crypto Coin News. The rapid rise of the value of the bitcoin has given them equally quick and substantial returns. A $100 investment 17 years ago would be worth $88 million today. This development has even made some financiers and advocates champion bitcoin as a safe-haven asset.

-

Crowdfunding6 days ago

Crowdfunding6 days agoTasty Life Raises €700,000 to Expand Pedol Brand and Launch Food-Tech Innovation

-

Biotech2 weeks ago

Biotech2 weeks agoDiscovery of ACBP Molecule Sheds Light on Fat-Burning Tissue Suppression and Metabolic Disease

-

Cannabis2 days ago

Cannabis2 days agoCannabis Clubs Approved in Hesse as Youth Interest in Cannabis Declines

-

Impact Investing1 week ago

Impact Investing1 week agoFrance’s Nuclear Waste Dilemma Threatens Energy Future

You must be logged in to post a comment Login