Crypto

Grayscale Bitcoin ETF Price Pressure Nearing End, According to JPMorgan

The launch of GBTC as an ETF now gave investors the opportunity to realize the “discount” as a profit. Many people did the same, including the insolvency administrators of the crypto exchange FTX. JPMorgan had forecast through analyst Nikolaos Panigirtzoglou that these GBTC sales could amount to around $3 billion, roughly offsetting the capital inflow from the other nine Bitcoin ETFs.

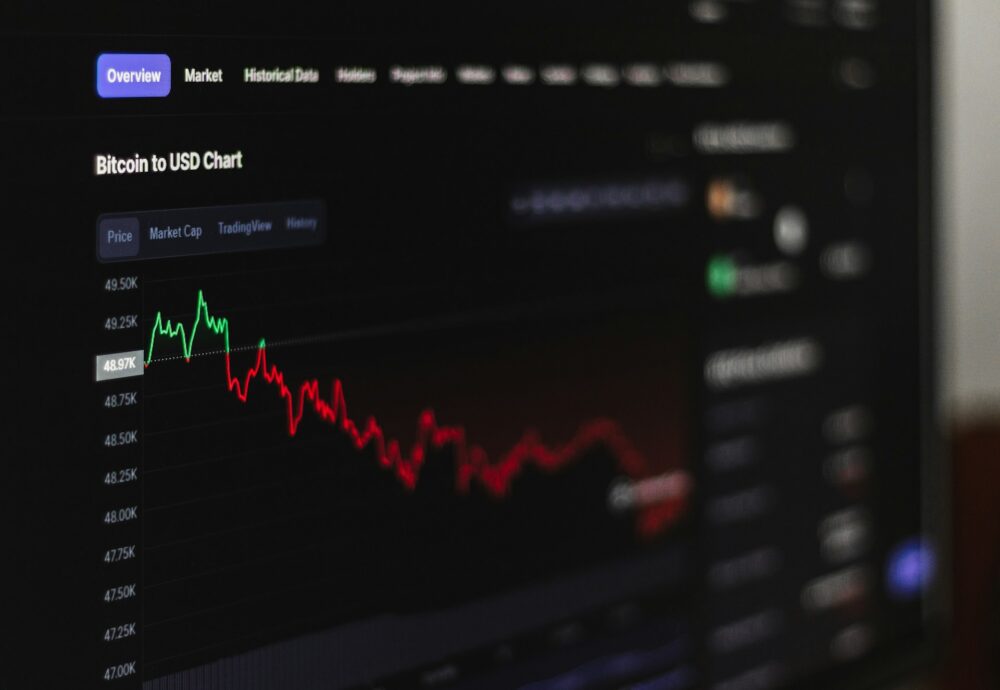

The price curve of Bitcoin (BTC) fell 13 percent in the first two weeks of ETF trading. The Grayscale Bitcoin ETF (GBTC) plays an important role in the background.

Bitcoin (BTC) was trading at around $40,000 at the end of this week. This is in contrast to all the optimism that spread with the approval and start of trading of Bitcoin ETFs two weeks ago. At that time, the price curve of BTC shot up to more than 46,000 US dollars and from then on it quickly slipped by 13 percent into the red. But this downward trend could now come to an end, predict analysts at the major US bank JPMorgan. Let’s take a closer look at the situation.

Read more about the importance of Grayscale Bitcoin ETf on the BTC price, and find the latest business news of the day with the Born2Invest mobile app.

The impact of Grayscale Bitcoin ETF

On January 11th, Bitcoin ETFs were launched on US stock exchanges for the first time and achieved record results in terms of trading volume and theoretical capital inflow. But among the ten Bitcoin ETFs that are now competing with each other in the USA, Grayscale’s, which runs under the ticker abbreviation GBTC, plays a special role.

Grayscale has been organizing a closed Bitcoin fund for several years and has now converted it into an ETF. The special thing: The former Grayscale Bitcoin fund with more than 600,000 BTC behind it (the equivalent of a good $28 billion) temporarily slipped into a situation at the beginning of 2022 where, if you calculate soberly, you could get a “discount” of almost 30 percent when investing in Bitcoin.

The launch of GBTC as an ETF now gave investors the opportunity to realize the “discount” as a profit. Many people did the same, including the insolvency administrators of the crypto exchange FTX. JPMorgan had forecast through analyst Nikolaos Panigirtzoglou that these GBTC sales could amount to around $3 billion, roughly offsetting the capital inflow from the other nine Bitcoin ETFs.

In reality, $4.3 billion of GBTC has been sold off so far – which is why JPMorgan now thinks this drag on Bitcoin’s price curve may be nearing an end.

Conclusion: Bitcoin ETFs are proving to have a noticeable impact

It remains to be seen whether JPMorgan is right with its revised forecast. Because the Grayscale Bitcoin ETF has a second special feature. It charges 1.5 percent fees, while competitors from BlackRock and Fidelity, for example, only charge 0.25 percent. The Bitcoin ETFs from BlackRock and Fidelity have attracted by far the largest new capital so far, at $1.9 billion and $1.8 billion respectively.

If GBTC does not radically reduce its fees soon, capital outflow or reallocation could continue, which also has a psychological impact on Bitcoin’s price trajectory. But one thing is clear: Anyone developing their Bitcoin strategy should now also include ETFs in the USA in their considerations.

__

(Featured image by Behnam Norouzi via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in BLOCK-BUILDERS.DE. A third-party contributor translated and adapted the articles from the originals. In case of discrepancy, the originals will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us

-

Markets1 week ago

Markets1 week agoCotton Market Weakens Amid Demand Concerns and Bearish Trends

-

Fintech6 days ago

Fintech6 days agoFintech Alliances and AI Expand Small-Business Lending Worldwide

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoSpain’s Real Estate Crowdfunding Boom: Opportunity, Access, and Hidden Risks

-

Crypto1 day ago

Crypto1 day agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets