Business

Has Your Company Had an IPO Recently? Here’s How to Decide Whether to Hold or Sell Your Stock

In 2021, many companies with IPOs saw huge increases in their stock prices in a short time, adding millions in wealth for investors and company employees alike. In this article, a financial expert covers the most critical things people who are working for these companies should know about IPOs, from how these investments impact personal portfolios to ways to preserve newfound IPO wealth

After a steep decline and sharp rebound in 2020, domestic stocks have continued to surge throughout 2021. A number of record-setting IPOs have helped fuel the investing frenzy over the last twelve months, creating massive wealth for shareholders.

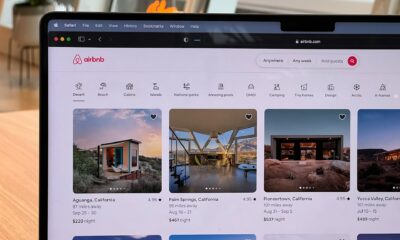

Last September, for example, cloud infrastructure firm Snowflake (NYSE: SNOW) hit the markets at a $33.2 billion valuation — marking the largest software IPO in history. And in December, IPOs from vacation rental platform Airbnb (NASDAQ: ABNB) and food delivery startup DoorDash (NYSE: DASH) created even bigger splashes, debuting with $47 billion and $39 billion valuations, respectively.

The trend hasn’t slowed in 2021, which has included successful public offerings from Robinhood (NASDAQ: HOOD), an incredibly popular trading platform, and dating app company Bumble (NASDAQ: BMBL).

In general, companies that have IPO’d recently have done well, and share prices of many of the above continue to climb. For employees at these and other newly public firms, this past year has undoubtedly been filled with excitement and uncertainty. Lockup periods typically last between 90 and 180 days, and if you’re holding post-IPO equity, you’re probably asking the same question every investor faces at some point: “Should I hold or sell my stock?” Of course, it’s imperative to consult your financial advisor prior to making any choice that will impact your portfolio, but the information here hopefully will give you additional confidence in your post-IPO equity decisions.

Assessing the Environment After an IPO

It’s hard not to be prisoners of the moment — and especially when money is concerned. The current bull market has created substantial financial gains for retail investors, institutions, and employees alike, and everyone wants to join the party. Although cycles like these inevitably lead to talk of bubbles (after all, what goes up must eventually come down), it wouldn’t be shocking to see momentum continue into 2022. Investors have shrugged off concerns about the lingering COVID-19 pandemic, and even companies hit hard by the pandemic are trending back toward profitability.

Even so, as an employee of a public company, there’s no reason to try and time the market after your IPO. Instead, your decision to hold or sell your stock should revolve mostly around tax implications, and those implications will vary depending on the type of equity you own. In addition to your salary and benefits, your compensation package likely includes equity in one of two forms: restricted stock units (or RSUs) or incentive stock options (or ISOs).

RSU Tax Implications

When compared to ISOs, RSUs are generally more straightforward as far as taxes are concerned. You don’t have to take immediate action when RSUs vest to you, for example, but once that happens, the IRS classifies the money as taxable income. In addition to the corresponding income taxes, this event could place you into a higher tax bracket, which could cause some headaches.

For instance, let’s say that your salary is $150,000, with an additional $100,000 in RSUs that will vest over the upcoming calendar year. Your salary alone would put you in the 24% tax bracket, but the vested RSUs will propel you into the 35% bracket. If your employer has only withheld enough to cover taxes at the 24% rate, you’ll be on the hook for the remainder.

If you’re holding RSUs, your first order of business is to ensure you’re not eventually hit with a tax bill you can’t pay. Try to determine what tax bracket you’ll be in based on your combined compensation and equity, and ask your employer to hold back enough shares to cover taxes. Then, as you decide whether to sell or hold your shares, ask yourself if you have any high-interest debt (above 8%) or any short- or intermediate-term plans that will come with hefty price tags, such as a family vacation or a down payment on a new home. If the answer is “yes” to either of these, consider liquidating your shares for cash. Otherwise, consider holding them or liquidating and reinvesting the money into an outside account.

ISO Tax Implications

There are three key variables to consider when it comes to ISOs. First, there’s the grant date, which is the date you can access the stock. You don’t technically own them at that point, but you should remember this date for tax purposes. Second, there’s the exercise date, which is when you exercise your right to ownership. You can either pay for the shares with cash or acquire them through a cashless transaction. But remember to take note of the exercise price, which is based on the market value of the underlying security at the time of exercise. Third, there’s the bargain element, which is the difference between the exercise price and the fair market value of the stock at the time of sale.

When thinking about the tax implications of ISOs, you’ll want to focus on how the bargain element will be taxed. If, for example, you wait two years from your grant date and one year from your exercise date to sell the shares, you’ll benefit from what’s called a qualifying disposition. The gain will be taxed as a long-term capital gain rather than as income, which not only raises your taxable liability, but also could put you in a higher tax bracket. However, if you sell the shares within two years of the grant date and a year of the exercise date, you’ll have to recognize the difference (i.e., the bargain element) as earned income on your taxes.

With ISOs, taxes aren’t withheld on the exercise date, so work with your financial advisor and tax planner to ensure you have the funds to cover your payment. Don’t try to finesse the system. Even in the case of a qualified disposition, you could be liable for what’s called an alternative minimum tax (or AMT), which places a floor on the amount you owe the government.

Important Considerations When Determining What to Do With Post-IPO Equity

Whether you’re holding post-IPO equity in the form of RSUs or ISOs, you’ll want to consult a professional to help you understand how to reduce taxes after your IPOand create a plan for maintaining your wealth. Here are three additional tips to consider as you make decisions:

1. Past performance isn’t an indicator of future performance.

Next year might be another banner year for your company, but very few companies outperform the market over the long term. Holding a concentrated stock position(or investing in just one company), and even in a successful company that you love being a part of, exposes your portfolio to significant risk. Moreover, the bigger your company gets, the harder it will be to maintain exponential growth in shareholder returns. Ultimately, the market decides share prices, which is why it’s best to practice equity diversification and hold no more than 10% of your liquid assets into your company’s stock.

2. Being proactive is better than being reactive.

Equity compensation can create generational wealth for your family, but a lack of planning can also lead to long-term financial hardships. Being part of a company that’s going public can be stressful, and watching your stock prices fluctuate with the market before you can sell often amplifies that stress. However, take the time to create a proper plan for what to do with your post-IPO equity so you can save yourself far more stress down the road.

3. It’s not all black and white.

As a financial advisor, it’s my job to find the “right” answers for clients making complex financial decisions. By rule, I encourage equity diversification because it’s a strategy that generally yields the most positive long-term impact on portfolios. That said, you might have a deep connection to your company and a desire to remain financially invested. In that case, I’d encourage you to seek a middle ground. Rather than selling all of your equity and reinvesting it or holding all of it and inviting unnecessary risk, think about how much you can hang onto while still moving closer to the financial goals you’ve established.

I often compare the situation to dating rather than being married. It’s usually easier for companies to cut ties with employees (much like it is when in a dating relationship rather than a marriage) than it is for employees to unload company stock. Try to take the emotions out of the decision so that you can do what’s best for you and your family and create a post-IPO equity plan that helps you reduce taxes and preserve your newfound wealth.

—

(Featured image by GotCredit CC BY 2.0 via Flickr)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa5 days ago

Africa5 days agoMorocco’s Industrial Activity Stalls in January 2026

-

Crypto2 weeks ago

Crypto2 weeks agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Crypto3 days ago

Crypto3 days agoBitcoin Surges Past $72K as Crypto Market Rallies and Kraken Secures US Banking License

-

Crypto1 week ago

Crypto1 week agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi