Featured

Investing only in U.S. stocks? It might be hurting your portfolio

Investors are encouraged to diversify as there are lots of opportunities abroad.

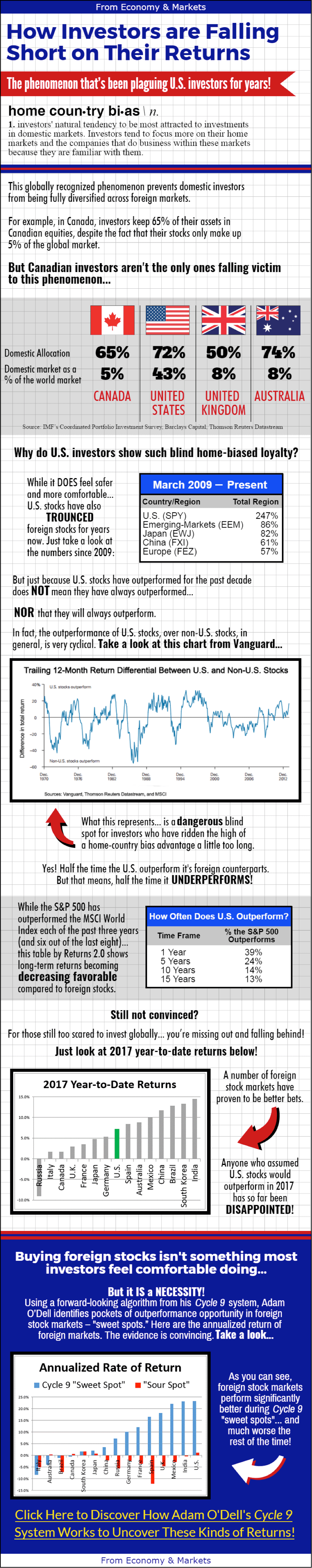

Hear of the investing phenomenon of home-country bias? It’s pervasive across time and geography, and it can be very damaging to your investment portfolio if ignored.

It may make investors feel all warm and fuzzy inside, but it generally tricks us into accepting lower returns and higher volatility from domestically-tilted portfolios.

In the U.S., this is particularly prevalent. Americans prefer investing in U.S. stocks because, psychologically, it feels like the right thing to do.

But it’s not!

And it’s hurting your portfolio.

In the following infographic, we look at several different reasons why you should avoid falling prey to the phenomenon of home-biased investing and what could happen if you take advantage of opportunities abroad.

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Cannabis4 days ago

Cannabis4 days agoAurora’s Electric Honeydew Debuts in Poland, But Shared Registry Raises Patient Caution

-

Markets2 weeks ago

Markets2 weeks agoRising U.S. Debt and Growing Financial Risks

-

Biotech2 days ago

Biotech2 days agoAI and Real-World Data Boost Oncology Clinical Research

-

Africa1 week ago

Africa1 week agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances

You must be logged in to post a comment Login