Featured

5 investment jargons explained in simple terms

Some investment jargons have simple definitions. The key is reading materials to get to know them better.

People get intimidated by numbers easily. Moreso, when they are used with highly-technical terms or jargons, especially in the finance and investment industry.

Here are five investment jargons you will be surprised to know in basic terms.

1. Capital

Per The Telegraph, capital is usually in the form of cash. It is a long-term investment in a company. It can be recouped by getting a share of the company’s profits. Of course, there is always the risk in not getting the ideal return of investments for investors. That is the risk they should be aware of.

2. Equities

Equities mean company shares. A shareholder is entitled to equities which means, on top of getting dividend payments, he or she also owns voting rights in the company. When a company goes public, the people will be given a chance to buy stocks and become a stockholder depending on the number of shares they will acquire.

3. Asset allocation

Assets are in form of cash or investments. A good investor does not put all his eggs in just one basket. The key is to diversify in the form of equities, bonds or funds. Careful evaluation of risks and rewards must also be considered in asset allocation.

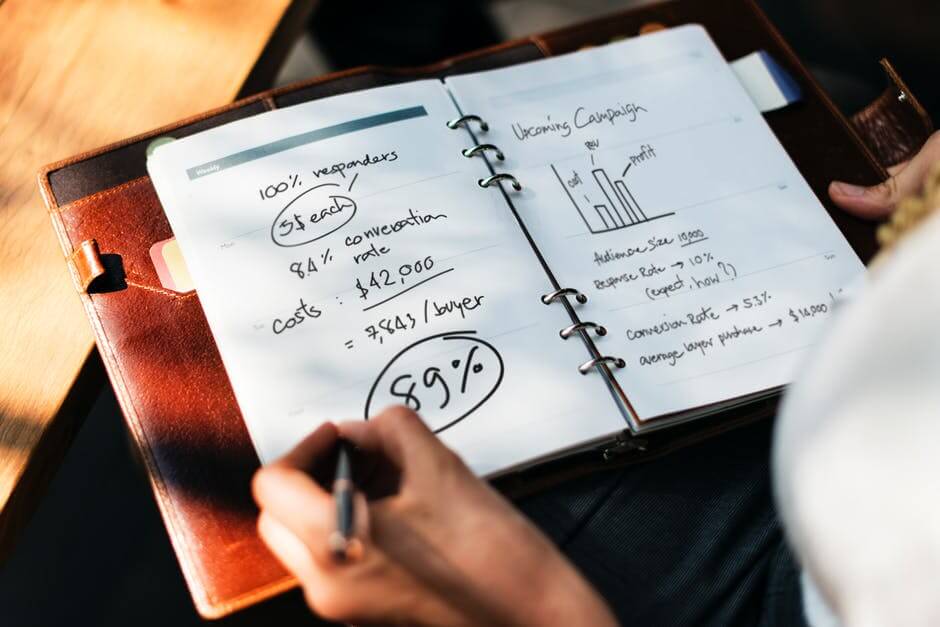

Overcoming the fear of investment jargons require reading a lot of references to the material. (Source)

4. Volatility

In a list compiled by JP Morgan, volatility refers to the ups and downs of investment value. For example, in stocks market, if the price fluctuates, it means it is highly volatile. Meanwhile, if the price rarely changes, it is considered low volatile.

5. Active management

Active management means getting professional help in managing your investment fund. The professional fund managers will be handling a portfolio of assets and monitor their performance and recommend movements based on economic conditions. Of course, active management requires a fee and it is not cheap. However, the price to be paid for convenience and professional advice is usually high.

Unfamiliarity breeds confusion and confusion leads to fear. In order to overcome this unfamiliarity with investment jargons, one has to read as much as he can. Business Insider has a list of books highly recommended for beginners who aspire to become an investor someday.

-

Crypto1 week ago

Crypto1 week agoCaution Prevails as Bitcoin Nears All-Time High

-

Africa4 days ago

Africa4 days agoBridging Africa’s Climate Finance Gap: A Roadmap for Green Transformation

-

Biotech2 weeks ago

Biotech2 weeks agoEcnoglutide Shows Promise as Next-Generation Obesity Treatment

-

Business2 days ago

Business2 days agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [uMobix Affiliate Program Review]

You must be logged in to post a comment Login