Business

How investors can leverage the looming crisis

The developed world has become addicted to two economic tools since the Great Recession: low-interest rates and quantitative easing (QE). Both were supposed to be a temporary fix, in the aftermath of the biggest recession in a generation, to jumpstart the economy. Yet they stayed. Not only did they become infused into economic life, but they also made us dependent on their utilities.

The global survivalism (prepper) movement has had a big shot in the arm this year. And just as they did prior to the depression of the 1920s, tens of thousands of preppers are making daily preparations for impending disaster; mainly through stockpiling, upskilling and homesteading.

Historically this fringe group never attracted much attention. But its membership ballooned after the Great Recession and was further expanded when many esteemed business figures joined their ranks after Donald Trump was elected president of the US. The prepper community has always been ridiculed by the mainstream media for being a group of nutjobs. Many sneered at them for prepping for events they said would never happen. But the same was said to a small group of Jews who found safe havens for themselves and their financial interests, just as the Nazis took power in Germany in the 1930s.

In history, we clearly see an indelible correlation showing how markets are intricately linked to the global geopolitical landscape and that events in one will inevitably and invariably heavily influence the outcome of the other. Consequently, if you are not yet a prepper, then before you even start considering stockpiling on canned food, you might be better off tweaking and prepping your investment portfolio to make it crisis-proof. After all, it is the portfolio that will give you the financial firepower to make real-life prepping.

Let’s not beat about the bush. What we are seeing today in the market is scary. The entire world is at a pivotal moment and vulnerable to a crisis at least as severe as the Great Recession. The time for action, therefore, is right now.

What will happen?

The developed world has become addicted to two economic tools since the Great Recession: low-interest rates and quantitative easing (QE). Both were supposed to be a temporary fix, in the aftermath of the biggest recession in a generation, to jumpstart the economy. Yet they stayed. Not only did they become infused into economic life, but they also made us dependent on their utilities. So much so, it is hard to imagine life without these two tools. We became so addicted that central bankers were even calling for legislators to make QE a legal obligation in the event of a future crisis. But what are the underlying side-effects of these quick fixes?

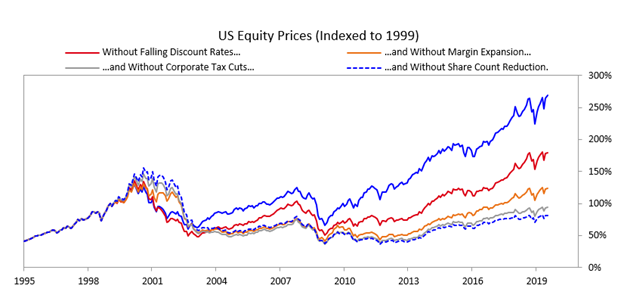

The effect of sustained low rates and QE has been asset price inflation. What we have seen is that a series of medium-term fiscal and monetary policies have been responsible for a large portion of the gains in the US equity market (which is a good proxy for the developed economies), as demonstrated in Figure 1. Furthermore, it seems that the effect of these policies was far more pronounced in the recent decade than the past. It implies that much of the gains in the financial market in the recent decade had been down to government intervention rather than the fundamental strength of the economy. Here lies the critical weakness of our economy: without such continued intervention, the growth would have been far smaller.

Source: Ray Dalio

We believe that the Great Recession has simply depleted the number of tools available to governments to handle the next crisis. Our economy is like a patient kept alive by an array of life-support machines. Any additional illness will simply overwhelm the patient and send him into terminal decline. Specifically, we see risks in the following areas:

- The economic and political decoupling between the US and China, leading to deglobalisation that will suppress growth in the long-term.

- High asset valuation across the developed economies, making them susceptible to corrections

- Over-reliance on debt as a form of financing and growth, making firms vulnerable during economic downturns.

- Persistent and long-term neglect of cash as a viable asset class, leading to its diminished status and making the world reliant on complex financing. The term “cash is king” seems to have been replaced by “cash is trash”.

Consequently, in our view, the world is mired in problems which together make all the ingredients for an incoming financial crisis. It is not a question of if but when. Given the world’s economy has grown by over 30% since the Great Recession, the next crisis will hit us on a scale of unimaginable magnitude and cause trillions in losses. The question is, therefore, how do we prepare for it?

Enter the safe-haven.

The hallmarks of safe havens

In prepping, there is a key concept called a “bug-out retreat” (or BOR). This refers to a secure and often secluded location that preppers go to when disaster strikes. It contains all the necessary elements (food, water, shelter, energy) to sustain life on a permanent basis. It is a safe haven. Having a functioning retreat is, therefore, a hallmark of advance prepping.

Equally, in the financial world, there are certain asset classes that investors flood into during turbulent times, because they offer a high probability of value preservation. These assets not only prevent value erosion during a crisis but in many instances actually increase in value, benefiting from the influx of other panicking investors seeking protection. They are financial safe havens.

There are many different haven assets, each with unique characteristics and which behave differently under stress. The following are the main gold-standard haven assets because they usually appreciate in value during times of every crisis.

Swiss franc

Switzerland as a country has historically been regarded as a haven country and it is a jurisdiction favoured by aristocrats, royalties and magnates over the centuries. This is down to several unique features of the landlocked Alpine nation:

- Declared political neutrality combined with unfavourable geography means the country is unlikely to be ever invaded (even the Nazis decided against it during WW2).

- A stable, diversified and advanced macroeconomic system with conservative and prudent fiscal and monetary policies.

- A strong legal system that respects the rule of law, property rights, and democracy.

- A highly developed financial system.

Consequently, Swiss Franc-denominated assets tend to be stable during normal times but perform exceptionally well during crises. Having exposure to Swiss franc is thus a fast proxy for owning Swiss assets as investors who need to buy real Swiss assets must conduct the transaction in CHF (thereby increasing its value due to rising demand). We can see this clearly in Figure 2 when during the Great Recession, USD depreciated significantly against CHF, cementing its safe-haven status.

Gold and other commodities

Gold has been a reliable store of value since the first civilizations emerged thousands of years ago. It is rare, quantifiable, and universally recognized and accepted. Gold will endure the most challenging market circumstances and emerge unscathed. Many preppers believe it will be as valuable as food, water, and ammunition in a post-apocalyptic world.

As Figure 3 below indicates, during any significant market upheaval (e.g. 2008 Great Recession, 2011 market correction, 2016 Brexit vote), the price of gold shoots up like bamboo after rain. On the flip side, unlike the Swiss Franc, gold tends to depreciate in value once the crisis is over because it has very little inherent utility.

Source: Goldprice.org

There are other non-precious metal commodities that can also serve as a haven asset. For example, copper and aluminum have fared well during past recessions because their demand was perceived as being stable. However such sentiment tends not to last very long and it is possible that these metals will behave differently in the next crisis.

Notably, crude oil is a poor hedge against crisis because it is a political (as well as economical) asset and the supply of oil is heavily influenced by a cartel that makes the market almost impossible to predict unless you are from Saudi Arabia.

Land investing

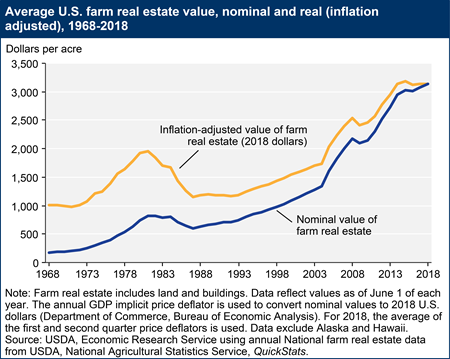

An alternative to the standard commodity would be land investing (i.e. the practice of buying up and banking areas of land for future use). Land is one of the few raw commodities that has an immediate finite supply (there is a fixed number of usable acreage on the planet) and as a result, its value will tend to increase over time. In fact, it does not matter whether a recession is on the horizon or not, people still need somewhere to eat, live, grow crops and be entertained. As a result, it is a relatively stable asset class that can weather adverse economic conditions, as demonstrated by Figure 4 below. An added bonus is that land is inherently less liquid than many other asset classes described here and thus (as we will see later on) it is far less susceptible to market sentiments and investor emotions.

Figure 4. US farmland price has been increasing since the mid-1980s with little decline

Cash

Cash is a much-overlooked asset. In fact, many investors do not even consider it an asset as it is so ubiquitous. But its significance should not be underestimated. The importance of cash is that it acts as a cushion in a portfolio by maintaining its nominal value and preventing excess volatility. Take a 100% equity portfolio for example. It will fluctuate significantly more than a 50:50 equity-cash one. In fact, when combining cash, with a safe haven currency like the Swiss Franc, it is very likely you can make gains against your base currency through a process called arbitrage. So, people who complain about cash being boring might want to think again, because when deployed correctly it can bring sizable dividends.

A sustainable and profitable business

Another overlooked asset class, but perhaps the one with the greatest potential is owning a business that enjoys sustainable profits. It is one of the golden keys for investors looking to protect and enhance their net worth.

These businesses typically exhibit specific characteristics:

- Simple and stable business models, often in sectors like healthcare, property, luxury-segment hospitality

- Healthy and diversified revenue streams with consistent profitability

- Fairly valued, often not publicly listed, thereby escaping from the stampede of investor emotions

As a result, these opportunities are hidden below the radar of the mass market, which is why they became dubbed hidden gems. We will review a couple of examples below.

1. Gentilcure. A hedge against pandemics for your portfolio

Website: www.gentilcure.ch

Gentilcure provides nursing and mental care to elderly and terminal patients in their own homes, in order to maximise the quality of their lives as they enter their twilight years. The business is founded on the ethos of keeping clients at home for as long as possible, to enhance their comfort and maintain a high-quality standard of living. Thanks to a large and growing number of ageing people in the developed world this sector is surging in growth and therefore its profitability is unlikely to dip. Furthermore, it has a relatively high entry barrier (government licensing, high setup cost, reputational capital) and thus faces little competition. It is definitely a hidden gem worth investigating further.

What makes it a good candidate for a portfolio of financial preppers?

- Makes good profit during the good times, and even better profit during the bad times (like the COVID-19 pandemic)

- Not overvalued, P/E around 5-7

- Operates as an oligopoly as only 5 licenses in this space have been granted

2. Le Bijou. A hospitality business champion, uncorrelated with global markets

Website: invest.lebijou.com

Le Bijou is the market leader in providing boutique luxury short-term accommodation in prime locations across cities in Switzerland. It provides unparalleled hospitality services to visitors to Switzerland by combining ultra-private first-class properties with sophisticated technology and on-demand five-star hotel services.

Investors can choose to be either equity holders in the business or bondholders. The former will enjoy the increase in valuation of the business as well as a share of the profit while the latter can benefit from a fixed quarterly return on their capital. Due to the profitability of the business, Le Bijou has been able to consistently return 7-14% per year to its investors.

What makes it a good candidate for a portfolio of financial preppers?

- Benefits from a stable market with high growth potential (the Swiss tourism sector)

- Multiple asset classes available to invest within the same company

- Highly profitable business as a result of strong execution by the management

3. Darwin Fund. Owns parks – leisure properties that are always in demand, no matter if there’s a crisis or not

Website: www.darwinleisurepropertyfund.com

Darwin Leisure Property Fund is the owner and operator of 19 holiday theme parks across the UK. Fuelled by rising consumer confidence and increased demand for entertainment, the British leisure and hospitality sector has seen double-digit growth over the past decade. Riding the crest of this growth, the Darwin Leisure Property Fund has become a best-in-class operator within the sector and has made significant investments to improve the quality of its assets. Being listed on The International Exchange and with no gearing in the portfolio, Darwin has the ability to withstand economic downturns fairly well while also enabling investors to enjoy liquidity in their investments.

The fund has outperformed the FTSE All-Share Index since inception, however with a TER at almost 1.5%, it is a relatively expensive option.

Looking forward

After the longest bull-run in history, it almost goes without saying that investors need to pause and reflect on the fundamentals of the market. The broader economy has not kept pace with the financial market and living standards in the developed world have barely eclipsed the levels enjoyed before the crash of 2008. Most of the gain has been artificially created through the use of low rates and quantitative easing. As a result, most portfolios are at the mercy of central bankers.

This makes for more, not less dangerous conditions for most investors. Like real-life preppers, investors today need to take preemptive measures to protect their financial future from actors whose actions are beyond their control. Actions which may cause irreparable financial damage. Safe-haven assets then are the most obvious and viable escape route.

—

(Featured image by Karolina Grabowska via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Biotech2 weeks ago

Biotech2 weeks agoPfizer Spain Highlights Innovation and Impact in 2024 Report Amid Key Anniversaries

-

Business1 day ago

Business1 day agoLegal Process for Dividing Real Estate Inheritance

-

Markets1 week ago

Markets1 week agoStock Markets Surge Amid Global Uncertainty, But Storm Clouds Loom

-

Africa6 days ago

Africa6 days agoMorocco Charts a Citizen-Centered Path for Ethical and Inclusive AI