Featured

How long does this bull market have to live?

2017 was a hard act to follow because of double digit gains. Despite bull market optimism as early as now, investors try to temper down their enthusiasm.

We called this explosive Trump rally. Right after the election. After Dow futures fell 800 points overnight and the S&P 500 and Nasdaq futures hit their 5 percent limit, which halts trading, and then everything turned around and opened the day in the green — an extreme reversal on high volume.

We sent an email to subscribers saying we would see a Trump rally that would see the market gain 20 percent to 25 percent, if not more. I had been cautious up to that point, after an apparent rolling top in 2015. But Wall Street was convinced they would get another massive free lunch. And they recently got what they wanted with the tax reform bill.

Now, this rally is looking very, very stretched. Yet, there are NO signs of divergences or technical indicators to warn that a peak is near.

So, the million-dollar questions are: How long does this bull market have to live? And will any of the usual warning signs appear or be as obvious as they were in early 2009?

It’s an impossible question to answer because this rally is the first in history to primarily be driven by artificial stimulus and not natural fundamentals and “animal spirits.”

This is more than a bubble. It is an artificial bubble, like the Mississippi Land Bubble in France in 1720 that was driven by a government scheme of finance. This isn’t a case of a good-times boom that has just gone too far, like 1925 to 1929 and 1995 to 2000, or 1985 to 1989 in Japan.

Given that fundamentals have had little to do with this bubble, and the tools I usually turn to when forecasting market movement are no longer as effective, or may not show up at all, I find that patterns in stock charts are the best fallback.

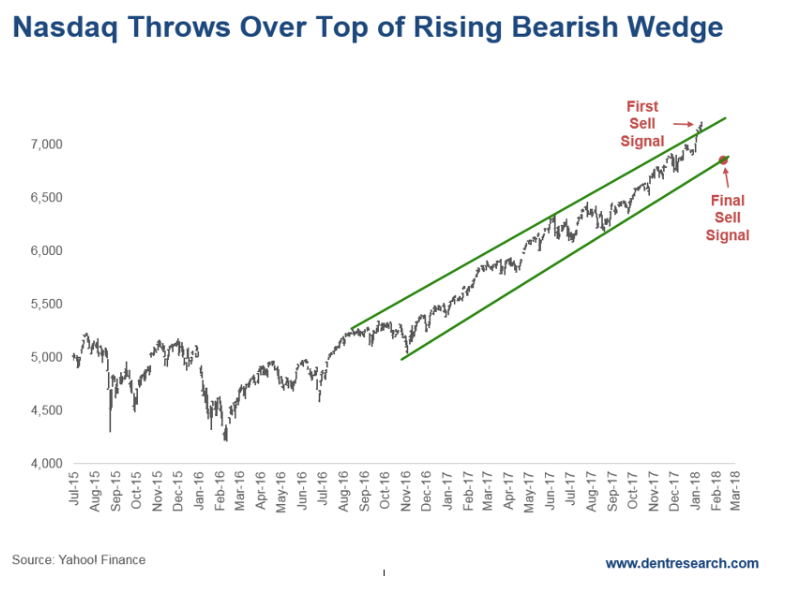

And what I’m seeing on these charts is that we have some accelerated rising wedges and channels that clearly look like topping patterns in the making.

That’s why, in the January issue of The Leading Edge, I show readers how powerful this pattern can be and what it’s warning right now. I shared 10 charts with them, discussing the patterns and the points at which it would be best to take money off the table.

I can’t share all of those details with you — for that you’d need to become a lifetime member to Boom & Bust — but I will show you one chart …

The Nasdaq.

The Nasdaq bubble, from December 1994 to March 2000, was the steepest one we’d seen to that point.

One of the warnings that the bubble was in its orgasmic final stage was the Internet Index (Bloomberg) bubble that only came alive from November 1998 to March 2000. It made more than eight-times gains in just 16 months — more than the entire Nasdaq gain of 6.3 times in 5.4 years. But that overall bubble came into a final steep channel from late 1999 to early 2000.

Well, guess what? We find ourselves in an eerily similar situation today!

On Friday, Jan. 12, we got a slight throw-over rally (meaning the top trend line of the rising bearish wedge was broken) on the Nasdaq, with new highs of 7,221.

That was an aggressive place to look to get any passive investments (like those in your 401K) out of the overall market, even if only partially. The higher probability sell signal would come around 6,600 near term, with a break of the lower trend-line, about 8 percent to 9 percent lower.

Here’s what I’m looking at.

Really, all we need to pop this bubble now is a pin. And I’ve mentioned several times already that I think Bitcoin is it!

Bitcoin has gone up 20 times in a little over a year. Its bubble is greater than even the infamous tulip bubble. This is the best sign of a major top ahead.

My prediction is that, within a year, Bitcoin will crash 95 percent or more, down to $1,000 or so. As that happens, investors will begin to question all bubbles, just like they did with the internet bubble crash in 2000.

Buckle up. This could get interesting.

And stay tuned.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

(Featured image via Deposit Photos)

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoNewcleo Raises $85 Million to Advance Fourth-Generation Nuclear Reactors

-

Markets3 days ago

Markets3 days agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Biotech1 week ago

Biotech1 week agoDNA Origami Breakthrough in HIV Vaccine Research

-

Cannabis7 days ago

Cannabis7 days agoWhen a Cutting Becomes a Cannabis Plant: Court Clarifies Germany’s Three-Plant Rule

You must be logged in to post a comment Login