Crypto

How safe is bitcoin?

Bitcoin has been in a safe spot recently. Even so, one must consider the risk that the acquisition of this digital currency does not always guarantee a good return. Data gathered and published by Coindesk shows how safe crypto investments are these days. Bitcoin’s performance during the economic crisis might be useful in measuring how cryptocurrencies respond to world affairs in the future.

The digital currency Bitcoin has looked pretty good lately, and its rise in value has prompted many investors to jump on board and put their money where their digital mouths are.

No investment is a “sure thing” guaranteed to make a return, and pay back money. Investors are curious to understand why Bitcoin Exist: it is a digital gold, like the other assets founders. If it is a digital gold then it must be a haven in terms of crisis – a ‘risk-off’ assets.

Now the question is, “How bitcoin is safe” or “Is Bitcoin a safe investment option?” We may be about to find out. Based on Coindesk research white paper “How safe is Crypto Investment?” we looked at the report “how bitcoin performed during the economic crisis that might be used to measure bitcoin’s response. This article will present an up-to-date look at a few of those metrics.

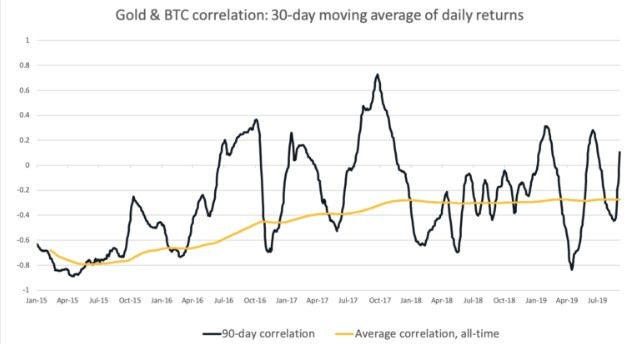

Bitcoin vs gold

In certain articles, you may have seen a correlation between the Bitcoins and Gold. Yet, bitcoin costs can never be connected with gold, either in positive or negative ways, for any period of time, since mid-2015.

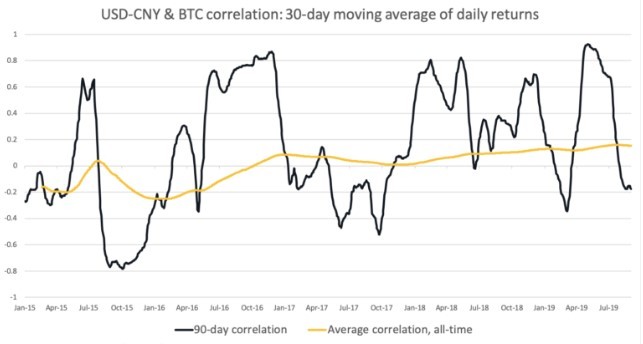

Bitcoin vs. the yuan

There are a few purposes behind the thought of Bitcoin in China. China has its very own control over its money and has a decent economy. Its populace and complete worth are likewise higher than Venezuela’s. Along these lines, the potential effect of Bitcoin cost is more prominent in China.

The previous five years have a solid relationship between’s USD-CNY and Bitcoin. This is the explanation when Yuan solid in contrast with USD then the digital currency Bitcoin value frequently rises. This is the positive marker for the individuals who feel that Yuan currency crisis may prompt the Bitcoin market value.

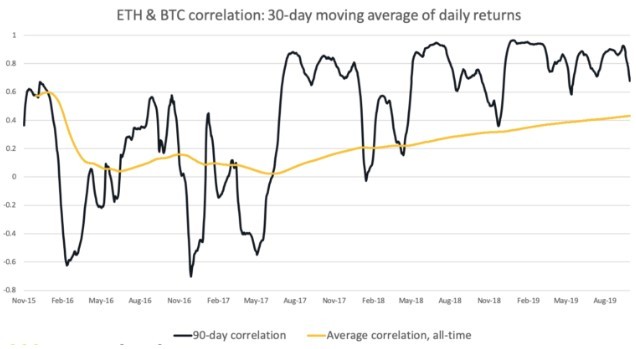

Bitcoin vs. ETH

Bitcoin is a crypto assets about which we could even examine but other assets may be compelling which clearly represents risk-on bets against a vision of future adoption that may take years to prove. If bitcoin is becoming a “risk-off” asset, bitcoin returns should begin decoupling from other crypto resources. With ethereum’s ETH, bitcoin returns are clearly establishing a stronger positive correlation over time. There is no decoupling here.

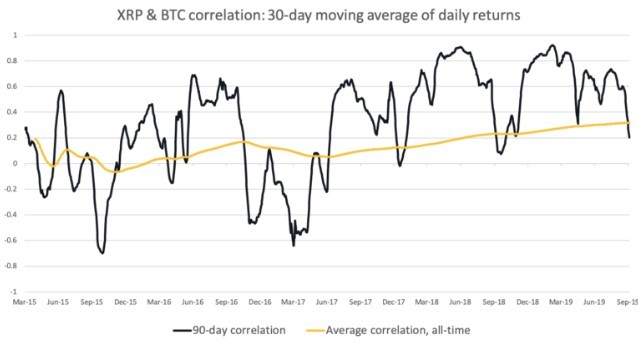

Bitcoin vs XRP

Ethereum has jumped from story to incoherent story; presently it’s “money” (OK). No one realizes what Ripple, er, XRP is.

Like ethereum’s ETH, Ripple’s XRP has a more grounded positive relationship with Bitcoin. There is no decoupling here too.

Note on the data

It’s difficult to pinpoint whether bitcoin is moving toward realizing that narrative, or not. Bitcoin’s volatility and 24/7 trading frustrate any attempt to correlate its daily returns with those of other assets.

For this blog entry, we took a 30-day moving normal of daily returns and estimated the 90-day relationship after some time. The outcomes are for the most part like the 30-day returns we utilized in the white paper, “Is Bitcoin a Safe Haven?” They likewise coordinate the outcomes we got utilizing week after week returns. The information keep running from four years of age or the soonest accessible, through the keep going business sector close on the morning of Monday, Sept. 30.

Conclusion

All these state that Digital currency Bitcoin doesn’t have a credible story as a save haven assets. But it is not like that it isn’t one today. It might be a risk-off assets during the next downturn, or the one after that. Even Jerome Powell gets this: bitcoin is a “theoretical store of significant worth,” Powell has said. Its financial specialists are estimating that it will end up being a store of significant worth.

—

(Featured image by David McBee via Pexels)

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech2 weeks ago

Fintech2 weeks agoImpacta VC Backs Quipu to Expand AI-Driven Credit Access in Latin America

-

Fintech1 day ago

Fintech1 day agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Impact Investing1 week ago

Impact Investing1 week agoClimate Losses Drive New Risk Training in Agriculture Led by Cineas and Asnacodi Italia

-

Crowdfunding4 days ago

Crowdfunding4 days agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality