Featured

How’s the Stock Market Going to Close this Summer

With the understanding that my past market prognostications have sometimes been something less than to be desired, I’m going to make a market prediction that the Dow Jones will close above 35,500 by the close of August. Unless Mr Bear begins rattling the market’s cage like a big ape, slinging extreme market events at the Dow Jones and the NYSE, I think 35,500, and then some on the Dow Jones by September 1st is a sure thing.

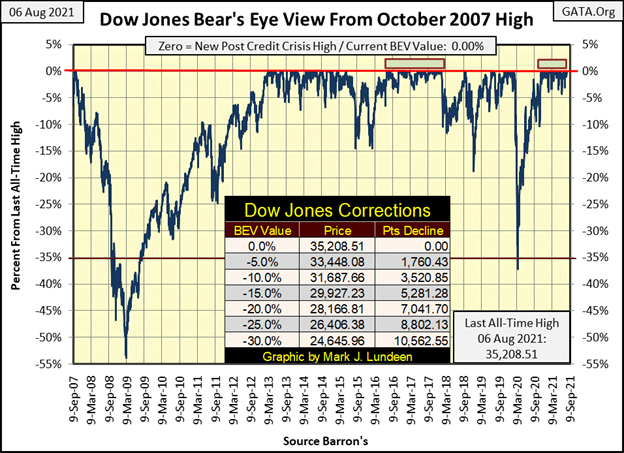

This week closed with the Dow Jones sitting on a new BEV Zero (new all-time high of 35,208), #37 since last November. I have nothing to say except Go Bulls Go! What else is there to say? Yes, the market’s valuations are being inflated by the FOMC, but who really cares as long as the Dow Jones continues going up?

Sure, the naysayers warn of the coming days of pending disaster. If so, that day of disaster isn’t here yet as the Dow Jones is now within reach of 35,500, a target within the grasp of the next two, or three BEV Zeros. As we’ve seen six new BEV Zeros since July 2nd, it is legitimate assuming we’ll see another five or six of them sometime in the next month or so, as has been the case since last November.

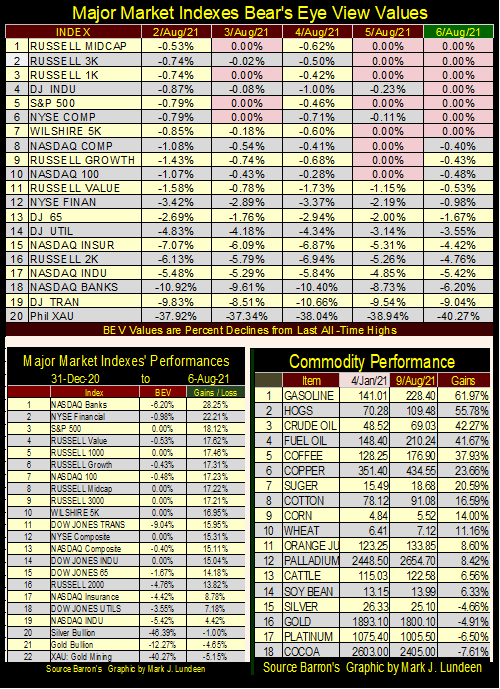

But looking at the tea leaves in the table below, showing this week’s BEV values for the Major Market Indexes, the other indexes aren’t seeing as many BEV Zeros as they have in the past when the Dow Jones saw its BEV Zeros. Nothing to panic about, but still, something to be aware of. Because as surely as night follows day, the stock market will someday see a correction from its current lofty heights. With wild overvaluations and fragile corporate balance sheets as far as the eye can see, that can’t be good for the bulls.

But when? I haven’t a clue. Remembering market history, October is a month where the stock market is known to stumble, though not always. So, my bullish instincts remain the same; I’m going to remain bullish until the Dow Jones once again see a series of its dreaded days-of-extreme volatility (Dow Jones 2% days), and the NYSE its days-of-extreme market breadth (NYSE 70% A-D days). Extreme market events the market has seen only a few in the past year.

In the table above, the Dow Jones at #14 isn’t the best performing index. But then the venerable Dow contains only thirty old fogy, dividend-paying, blue-chip stocks. So, the indexes above it must contain the current glamor companies with all the sex appeal. Sex appeal is good on the upside. But come the next big correction, these flamboyant blossoms’ shares will trade as soiled doves; fallen angels the market will soon realize have contracted a loathsome disease; something like illiquidity.

In the Dow Jones’ daily bar chart below, on Friday this week it appears the Dow Jones is making a move to get above, and stay above its 35,000 level. Since it approached this level last May, getting past 35,000 is something the Dow Jones hasn’t been able to do. Go Bulls Go!

With the understanding that my past market prognostications have sometimes been something less than to be desired, I’m going to make a market prediction that the Dow Jones will close above 35,500 by the close of August. Unless Mr Bear begins rattling the market’s cage like a big ape, slinging extreme market events at the Dow Jones and the NYSE, I think 35,500, and then some on the Dow Jones by September 1st is a sure thing.

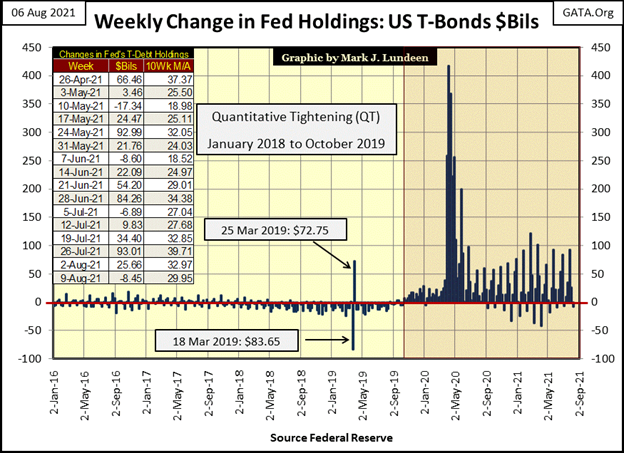

Apparently, the FOMC isn’t fearful of Mr Bear doing something stupid, a prerogative the FOMC reserves for itself. As seen below, this week the idiot savants actually withdrew $8.45 billion from the financial system, and still the stock market advanced and the debt markets didn’t crash. Call it “market stability.”

Let’s take a look at risk, which for investors is making decisions that may lose them money. If someone chooses to become an investor, they first have to open an account with a broker, deposit their money into the account, and then order the broker to take positions in the market using their money. After all this, ideally investors hope to profit, but the risk is they may not. And the history of Wall Street is one of retail investors ultimately losing their money, becoming bitter from the experience.

Here’s an insight to become a successful, long-term investor; taking a ride in the market is always a round trip. Too many investors believe their ride is a one-way journey, that the market will always advance. But that’s not true, as markets go both up and down. One must accept that the market will at some point will go down, sometimes for years. Successful investing requires that one be prepared to exit the market during these market declines, and let it go down without your money going down with it.

No one knows what the ultimate top of an advance will be, or how far a market will decline in a bear market. James Dines said if investors can exit within 10% of a bull-market top, and come back within 10% of a bear-market bottom, that’s about as good as anyone can get on Wall Street. That sounds very reasonable.

Now let’s look at market tops and bottoms. The risks of losing money are always greatest at bull market tops. One reason for this is that share prices are seriously overvalued at market tops. Also, market tops, because they are market tops, offer bulls little in the way of profits. Think about that.

The best time to buy is at bear-market bottoms. Market risks; the potential for losing money in the market, decreases greatly as the market descends toward its ultimate bottom. Sure, the market losses suffered in the bear-market decline have been horrible. But what is that to anyone who is buying at the bottom? That plus share prices at big market bottoms, are at values seen only at big bear market bottoms.

All this sounds so obvious. So, why mention it here? Because investors should understand that psychologically, people, for reasons of vanity and greed, find it very difficult to sell within 10% of a bull-market top. The same for buying within 10% of a bear-market bottom, because bottoms are frightening experiences. Investors don’t live in a vacuum, market euphoria; the psychological appeal of buying at market stops is infectious, as is the despair and gloom to be found at all bear-market bottoms.

Knowing this is key to becoming a successful investor, to know all market advances ultimately come to a top where one must sell, though most investors and the financial media remain bullish. At bear-market bottoms, there will be no one to tell you about the incredible bargains to be had at deep discounts from their bull market highs. Instead, at market bottoms, all market talk is about the immense losses taken during the frightening market decline. But at bottoms, these losses become historical, losses taken by someone else. Still, never doubt it takes courage to buy at bear-market bottoms.

It’s just a historical fact, since 1885 any time the Dow Jones declines 40% from an all-time high, the bottom of a bear market is very near. For the past 136 years, a 40% market decline in the Dow Jones provided investors with a superb, low risk entry point into the stock market, with share prices at deep discounts that didn’t remain that way for long.

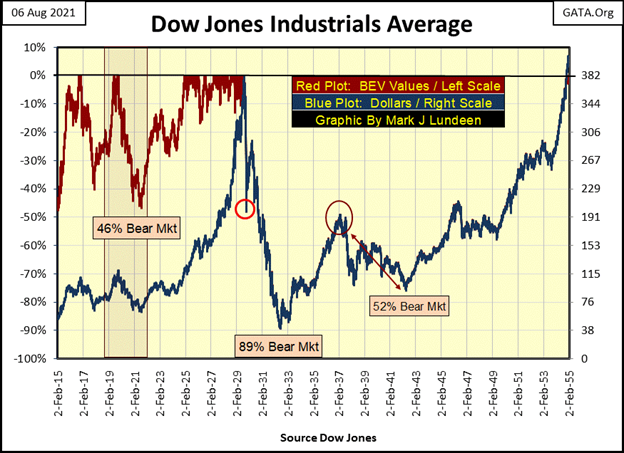

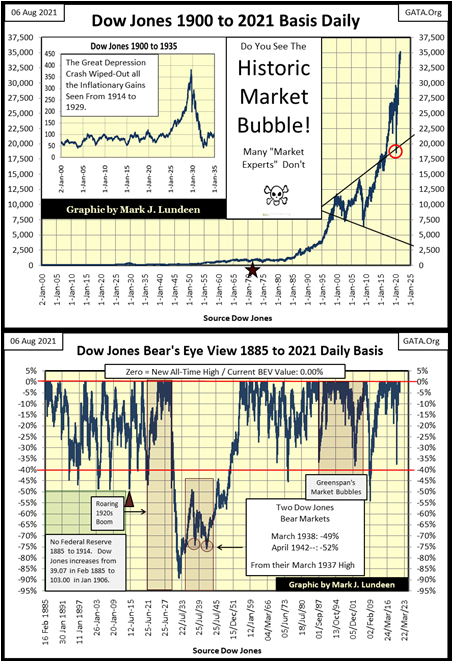

So, let’s look at market history, the forty-years from 1915 to 1955 to see what insight we may gain from these turbulent years on Wall Street. In the chart below, I’ve plotted the Dow Jones in both Bear’s Eye View (BEV Red Plot Format / Left Scale), and in dollars (Blue Plot / Right Scale).

Before 03 September 1929, the red BEV plot and the blue dollar plots are separate and distinct. But 03 September 1929 was the Dow Jones’ last all-time high of the Roaring 1920s bull market, which makes it a Terminal Zero (TZ), the last BEV Zero of the Roaring 1920s bull market. The Dow Jones would not see another new all-time high (BEV Zero) until 23 November 1954: twenty-five years later.

In between BEV Zeros, it’s possible to place the BEV plot of a market series and its dollar plot on top of each other, and that’s what I did. So, from September 1929 to November 1954, one can see how far the Dow Jones is from its last all-time high of September 1929, in percentage terms, by looking at the blue plot’s left scale, or its dollar valuation on its right scale.

With all the above in mind, let’s look at the bull market top of 03 November 1919, when the Dow Jones made the last (for this advance) all-time high of 119.62. At market tops, investors have an abundance of high self-esteem. But today, we know something investors of November 1919 were ignorant of. A fact that may have taken a year or more for them to discover on their own; the next day the Dow Jones began a 46% bear market that would bottom two years later in August 1921.

I can’t say what this or that individual did a century ago in the stock market. But taken as a group, the bulls of November 1919, as bulls typically do, did not sell near the top of the bull market, but sometime deep into the pending bear market. Here is the great tragedy of being a bull, as is the same for all of us; we learn nothing from history.

Be that as it may be, come August 1921 the Dow Jones had found a bottom. From its bull market high of 119.62 in November 1919, it declined 46%, down to 63.90 two years later, and with it came the Post WWI recession everyone feared. At the time, the world was a fearful place, which made August 1921 a great time to buy stocks, at greatly discounted prices.

The Dow Jones then began its amazing advance; the Roaring 1920s Bull Market. In eight years, rising from 63.9 in August 1921, to 381.17 (496%) in September 1929. And with each dollar advance, the market risk increased as the potential for profit decreased.

Then as all advances do, the Dow Jones topped and began a stunning 46% market decline in November 1929 (Red Circle). Like the Dow Jones 46% bear-market bottom of August 1921, buyers came in – but it was a bull-trap. Maybe the bulls should have been suspicious, that, unlike the TWO YEAR (1919 to 1921) 46% market decline, this 46% market decline took ONLY FORTY-EIGHT NYSE TRADING SESSIONS – Geeze Louise! Anyway, come April 1930, the Dow Jones began its historic Great Depression 89% market decline.

From its last all-time high of 381.17 in September 1929, the Dow Jones deflated to 41.22 in July 1932; a three-year, 89% bear market. The Dow Jones had never seen an 89% market decline before. Never before were market valuations so compelling, or the risk of losing money in the stock market so low as they were in July 1932.

However, the bulls of 1929 were nowhere to be found to scoop up these truly compelling, once-in-a-lifetime bargains. But someone did, as did the Rockefellers, Kennedys, and DuPonts, who as we all know, did very well in the following decades.

There was something very different about the 1920s bull market and the Great Depression’s 89% crash that followed. This was the first boom / bust cycle the Federal Reserve created using inflation. Though in the 1920s, inflation took the form of easy credit (bank loans at attractive rates) for consumer debt and NYSE margin debt, mortgages too. But they, the “policymakers” did it; inflated stock-market valuations to absurd levels in 1929. And since they took the dollar off the Bretton Woods’ $35 gold peg in August 1971 (Red Star), they’ve done the exact same thing again, as seen in the charts below.

In August 2021, market risk has never been so high as they are today, or the potential for profiting from taking these risks so low. I’ve said it before, and I mean it, I’m sitting high in the market’s peanut gallery, cheering the bulls on. Currently, the stock market is strictly a spectator’s sport for me.

What would it take for me to become a roaring bull for the general stock market? I can’t really say, but seeing the Dow Jones deflate 89% in the next three to five years might do it. Is that even possible? Yes, it is!

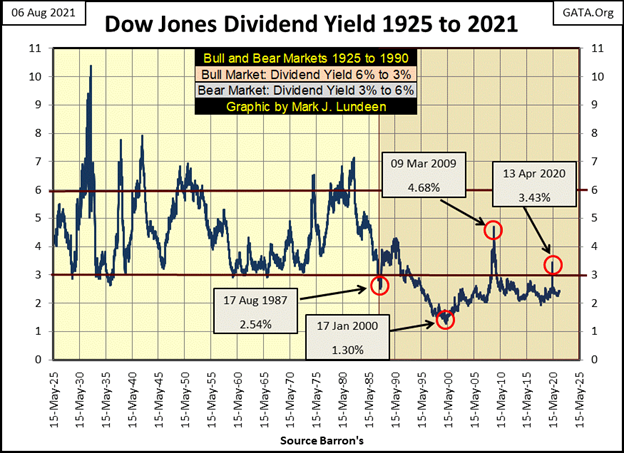

Before the Greenspan Fed (1987 to 2006), using the Dow Jones as a proxy for the broad-stock market, the market was understood to be cheap (bear market bottom) when the Dow Jones dividend yield was 6% or more. The stock market was “fully priced” (bull market top) when the Dow Jones’ dividend yield approached 3%.

But after Alan Greenspan became Fed Chairman in August 1987, all that changed, as seen in the chart below. Since 1992, anytime the Dow Jones is yielding something over 3%, the FOMC is in a state-of-panic, initiating one of their quantitative easings. That is 100% correct, as seen in March 2009 and again in April 2020. Today, the market is so overvalued on a dividend basis, from “liquidity injections” from the FOMC, a 6% yield on the Dow Jones would be a catastrophe for retail investors.

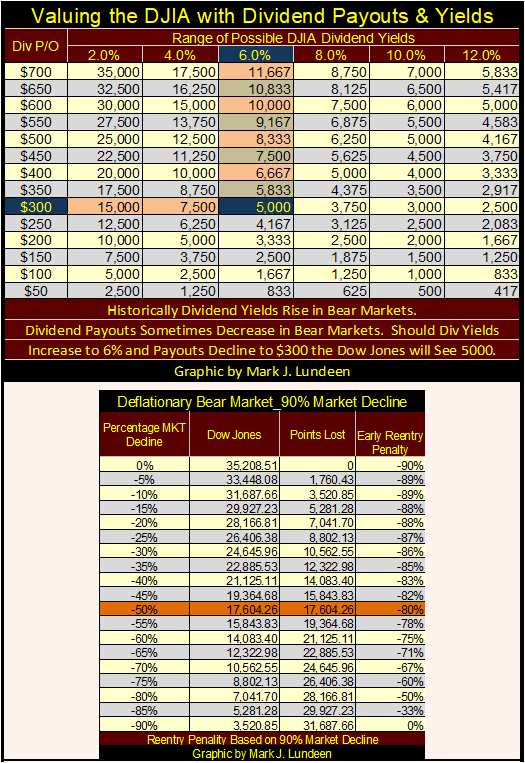

In the chart above, what would happen should the Dow Jones once again see a dividend yield of 6%, something it has done many times since 1925. To answer that question, we go to the table below.

Historically, during big-bear markets, dividend yields rise, and dividend cash payout fall. At this week’s close the Dow Jones was yielding 1.79% and paying out $630.23, fixing the value of the Dow Jones at 35,208. Should the Dow’s dividend yield increase to 6%, and its cash payout decline to $300, a little more than a 50% reduction in cash payout (it’s happened before), that would fix the Dow Jones’ value at 5,000 in the table below.

In the table above, should the Dow Jones deflate to 5000, that would be a greater than 85% reduction from this week’s closing price, another Great Depression market event. But it could get much worse.

Much of corporate America’s dividend cash payout is financed by selling junk bonds, and has been for years. Come Mr Bear’s cleanup crew in the next big-bear market, how much of the Dow Jones’ cash payout can survive? During the Great Depression Crash, the Dow Jones dividend payout was reduced by 79%.

At the bottom of the Great Depression Bear Market, the Dow Jones yielded over 10% (chart above). In the table above, a $100 cash dividend payout, with a 10% yield fixes the valuation of the Dow Jones at 1,000; a total wipeout of the post August 1982 advance. Which is exactly what happened in the Great Crash of 1929 to 1932; Mr Bear wiped out all of the Dow Jones’ gains since 1914 (see chart above).

Oh yeah, I’m sitting high in the market’s peanut gallery cheering for the bulls; Go Bulls Go!

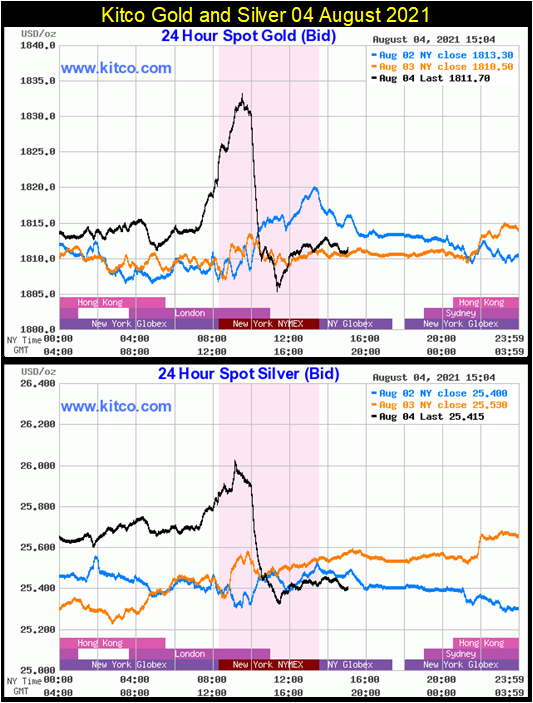

What’s happening in the gold and silver markets? The usual underhanded games happened again this week at the COMEX futures markets.

On August 4th both gold and silver got a proper spanking in the futures market. For us old guys, this is nothing we haven’t seen before. No reason to not be bullish on the old monetary metals, both currently trade at compelling valuations. I still believe both gold and silver represent low risk investments for retail investors, if they actually purchase their bullion rather than trade them via ETFs in the stock market or their future contracts at the COMEX.

But being compelling values today, doesn’t mean they can’t become even more compelling bargains tomorrow, as we saw happening last Wednesday in the charts below.

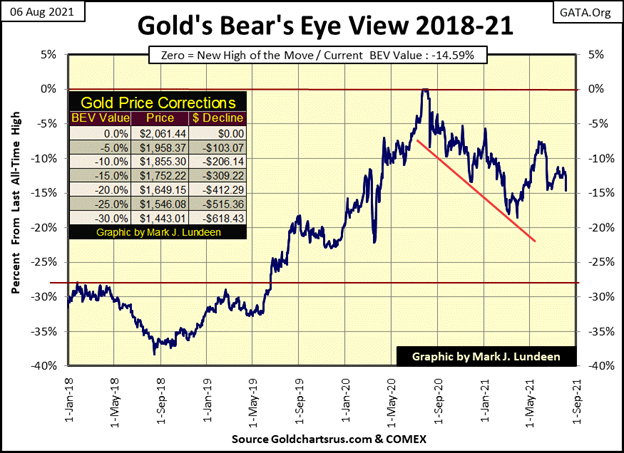

Here’s gold’s BEV chart below. Since June I’ve wondered which BEV line gold would cross over next; its BEV -10% or -15% lines. Feeling optimistic last week, I speculated gold would next cross over its BEV -10% line. This week I don’t feel so optimistic.

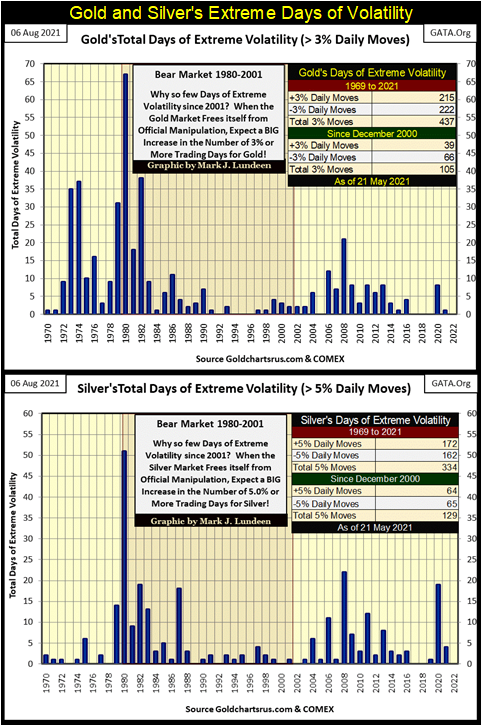

As I see it, a big problem for the old monetary metals is their daily volatility is way too low. Here are charts plotting their days of extreme volatility going back to 1970. With the stock market, Dow Jones 2% days are always negative factors in the market. However, for gold and silver it’s different.

For these metals, seeing lots of extreme days indicates money is flowing into or out of the gold and silver market. Like their most extreme year, 1980, which began very bullishly, for the first three weeks of January 1980, but ended as the first year of a twenty-year bear market.

So far in 2021, gold has seen only one negative 3% day (-3.56%) on January 8th. Silver has seen two negative and two positive 5% days, but all before February 2nd, with no extreme volatility for either gold or silver since. And this lack of volatility makes a difference.

Below I have gold and silver plotted as indexed values. This allows us to directly compare one with the other. For both metals below, since August 2015, the only year they saw any excitement was in 2020. Now compare the 2015 to 2021 plots below with the annual totals of extreme days of volatility in the chart above; 2020’s pickup in extreme days occurred as money flowed into the precious metals market for the first time in many years.

In 2021, patience is a virtue in the gold and silver market, as some things will not be rushed.

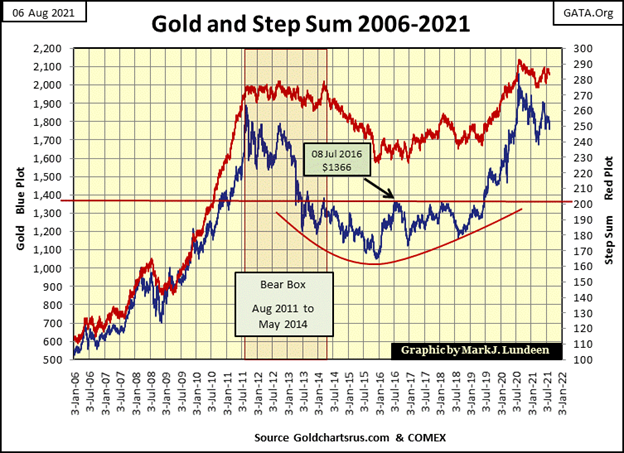

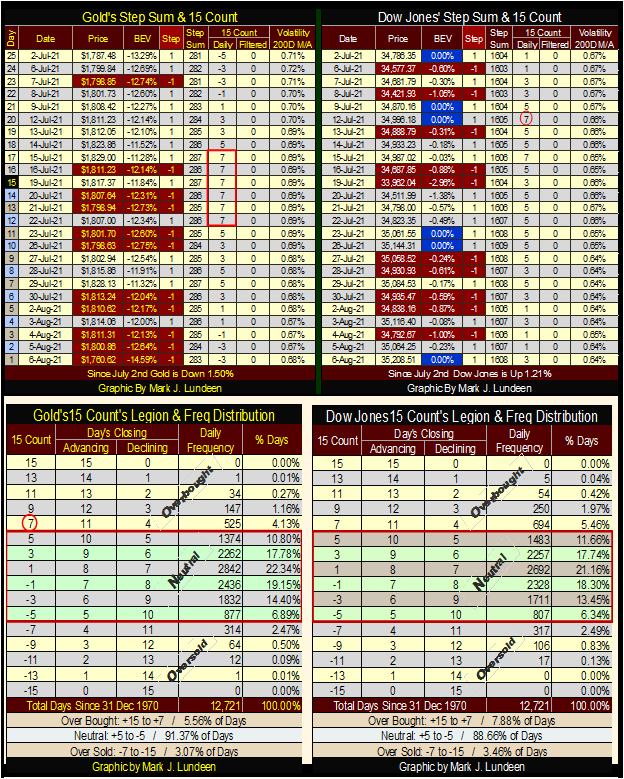

Gold’s step sum chart continues looking amazing, with its decade long

Teacup With a Handle chart pattern (2011 to 2021). Bullish market events in the gold market may not be happening as fast as you or I would desire, but the outlook for gold remains very positive. So, I’m going to cheer for the bulls in the gold and silver markets too; Go Bulls Go! And unlike the broad-stock market, this is a market I have much exposure to.

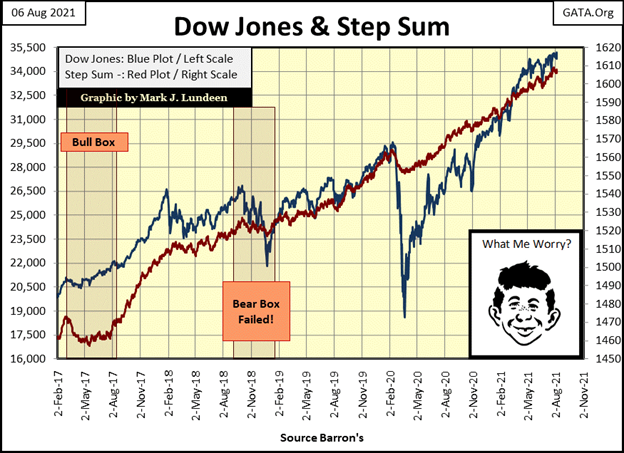

Here’s the Dow Jones step sum chart. And like most “market experts”, Alfred isn’t worried either. Dow Jones at or above 35,500 before September? Sure, why not?

Gold was overbought in late July with a 15-count of +7. Then the COMEX goon squad was trucked in, and began doing what they do so well, selling fictional gold that will never be delivered into the market. Lots of red on the gold side of the table after July 15th.

One thing I notice, the price of gold was holding up pretty well from July 15th, until just this Friday’s close, when it gapped down $40 from Thursday’s close. Are we looking at a short-term capitulation for the bulls at the COMEX? Capitulation by the bulls is typical of market bottoms.

I’ll be very curious to see what happens next week in the gold market. Are we going to see a $100, or greater gap-down in the price of gold, or are the bulls going to counterattack and pull up the price of gold once again above $1800?

If the goon squad continues to hammer down the price of gold next week, why are they doing this now? In the past the “policymakers” have sent in the goons to suppress the prices of gold and silver just before a big market event becomes public. This is what happened in March 2008, just before Bear Stearns, the big Wall Street investment bank when under.

With October approaching, do our “masters-of-the-universe” know something that we’ll all be reading about later this year, as the Dow Jones once again begin upchucking dollars? Like me, my readers will have to wait to find out.

For the Dow Jones side of the table, we see six BEV Zeros since July 2nd, and there is nothing more bullish than seeing a market-making multiply new all-time highs. The Dow Jones’ 15-count close the week at a neutral +3, I like that. And daily volatility’s 200-day moving average is a low 0.64%, which for the stock market is very bullish.

But things in the market can change very quickly. As October 2020 approaches, the possibility for some drama in the market is present.

Here’s a six-minute video on Seabridge Gold, a company that shares a border with my favorite exploration company: Eskay Mining. I’m including this video to illustrate the potential for not just Eskay Mining to discover world-class precious metal ore bodies, but any of the companies now prospecting in British Columbia’s Golden Triangle. Watch the video, you’ll be glad you did.

As far as Eskay Mining goes, nothing new since their last press release of July 20th. I tried to get Mac Balkam (Eskay’s CEO) to leak a little news on their on-going drilling program, something like when does the company expect its first assay report? Mac was mum on that, and any other topic I’d like to learn a little about concerning this year’s drilling program. He’d only say they are pulling out many meters of core samples every day. When the assay results will be delivered to the company is unknown to him, and everybody else.

Uggh! I hate waiting!!

—

(Featured image by sergeitokmakov via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Fintech5 days ago

Fintech5 days agoFirst Regulated Blockchain Stock Trade Launches in the United States

-

Africa2 weeks ago

Africa2 weeks agoAir Algérie Expands African Partnerships

-

Cannabis11 hours ago

Cannabis11 hours agoAurora’s Electric Honeydew Debuts in Poland, But Shared Registry Raises Patient Caution

-

Markets1 week ago

Markets1 week agoRising U.S. Debt and Growing Financial Risks