Featured

Improved demand pushes corn markets higher amid economic slowdown

Corn closed higher on ideas of improving demand and varying reports for the initial harvest. Still, investors are hoping for stronger sales. This comes as the US administration is making a big push to get the new trade agreement with Canada and Mexico approved by congress. Meanwhile, cotton demand has been weak due to the continuing tensions between the US and China.

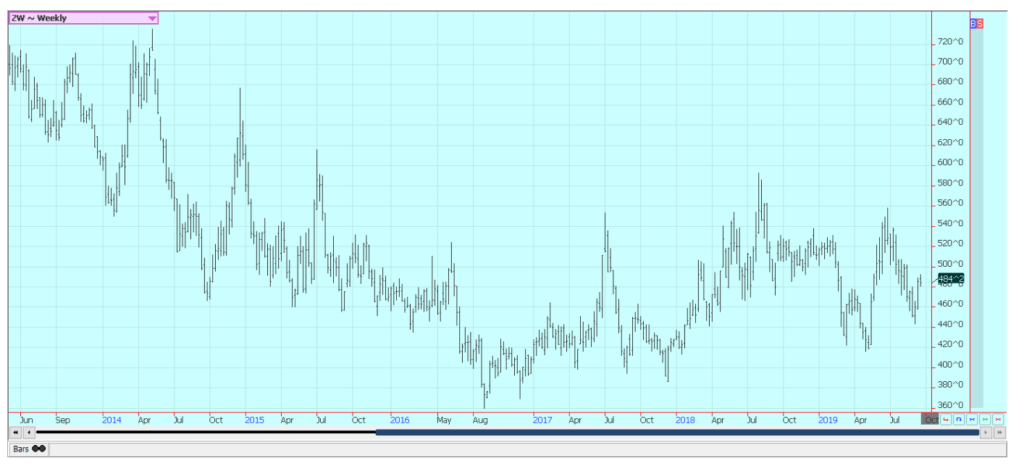

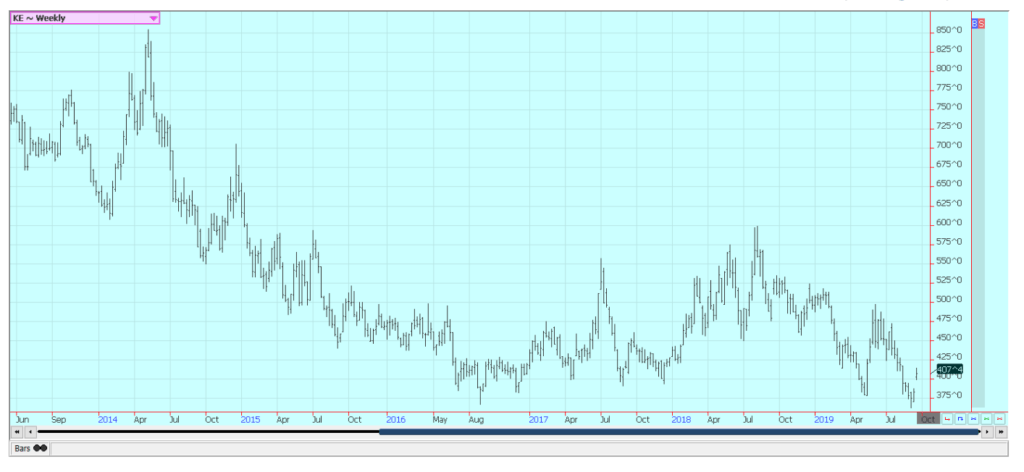

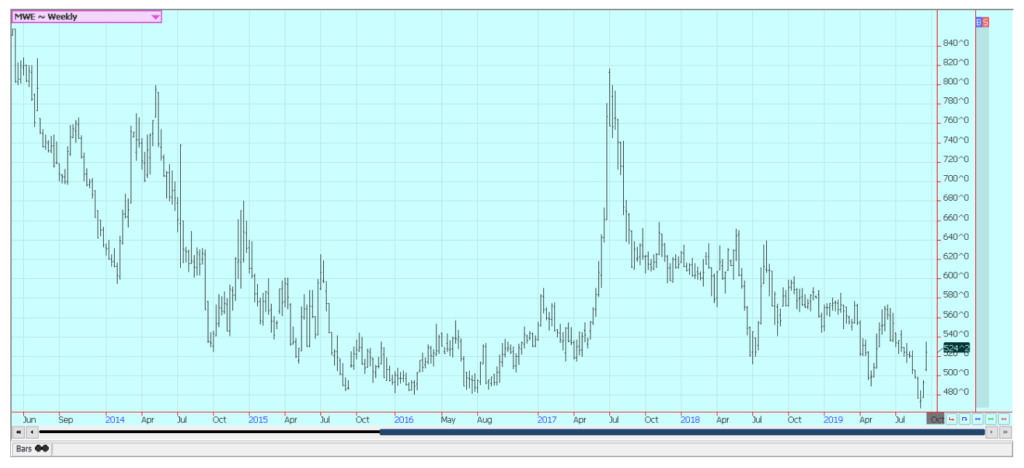

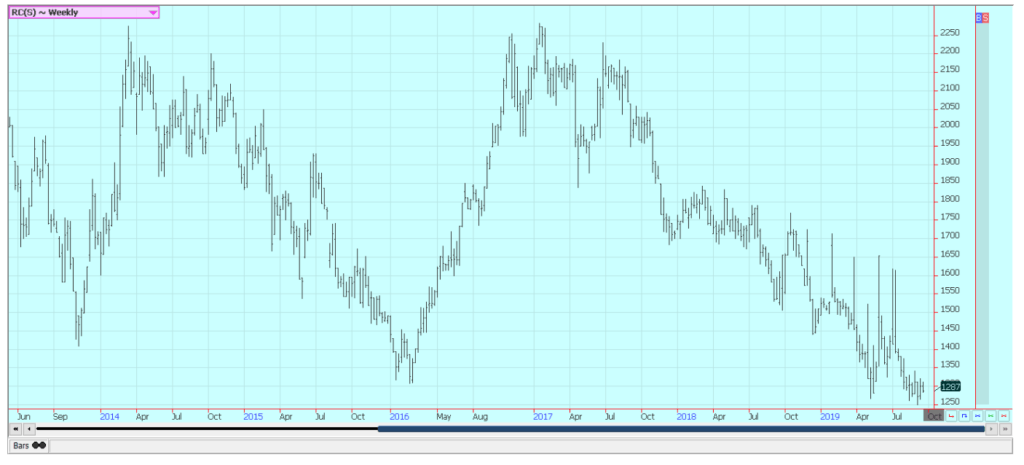

Wheat

Wheat markets were mostly higher last week with Minneapolis Spring Wheat the leader to the upside. Chicago Soft Red Winter Wheat closed slightly lower for the week. Spring Wheat futures rallied as rains interrupted harvest progress in the northern Great Plains. The rains have hurt the already slow harvest progress and could affect quality if the rains continue. Harvest is underway in Canada with most progress made in Saskatchewan and very little progress reported in Manitoba and Alberta.

Planting of the next Winter Wheat crop is now underway under mostly good conditions in the central Great Plains and Midwest. It has been hot and dry in west Texas so planters might wait in this area to see if the rains return. North African buyers were busy last week with Algeria buying from western Europe and mostly France and Egypt buying from Russia. It is hot and dry in Ukraine and planting has been delayed there.

Australia and Argentina have also been hot and dry and crop production expectations are being reduced. US export sales were lower last week and were very disappointing. There is just a lot of Wheat on offer around the world and that will limit any upside potential for US export demand and for Wheat prices.

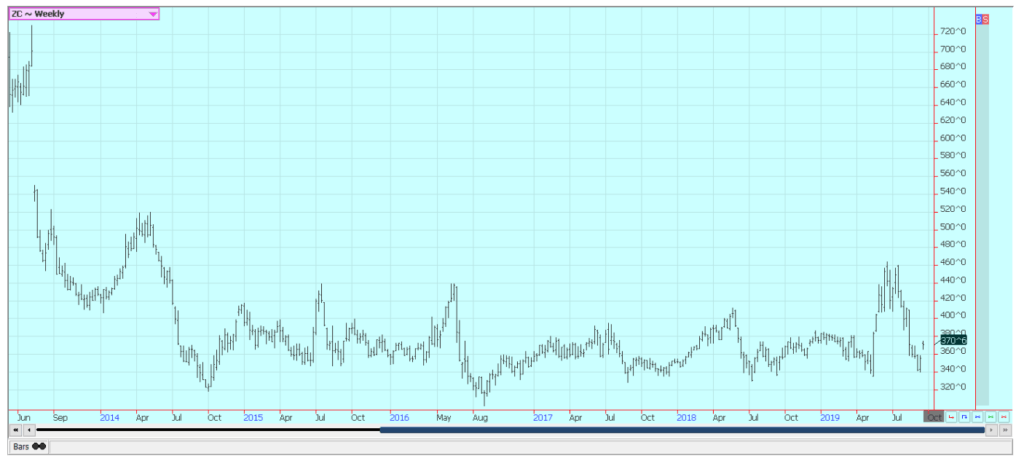

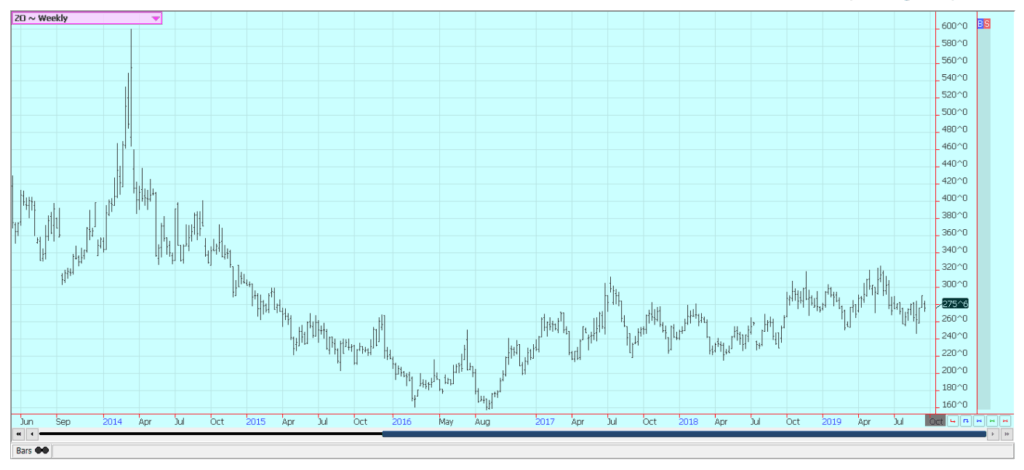

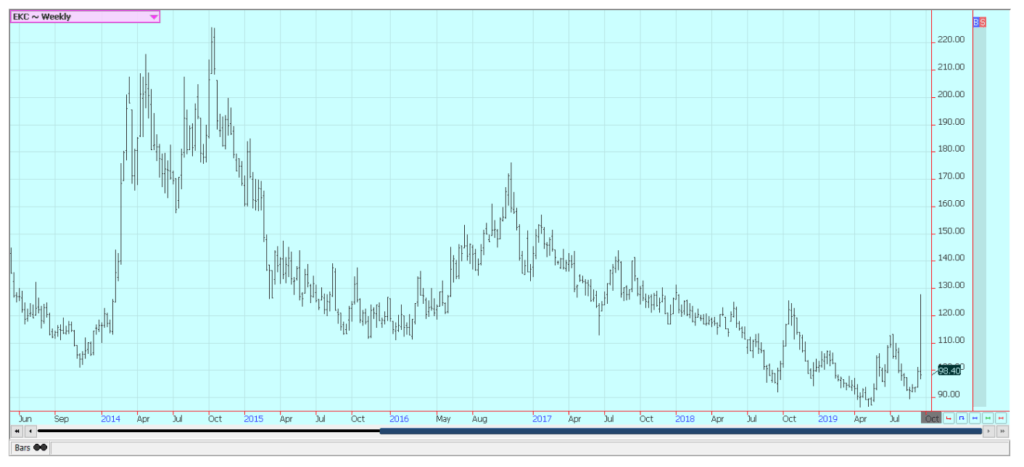

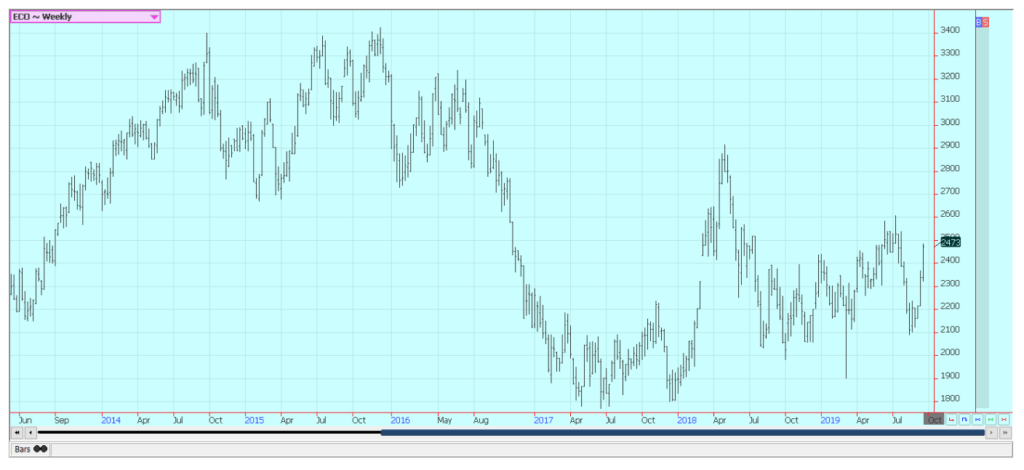

Corn

Corn closed higher on ideas of improving demand and varying reports for the initial harvest. The weekly export sales report was as strong as it had been in months as all of the big Mexican purchases made the list. There were no big sales announced in the daily system last week, but hopes for generally stronger sales persist as the administration is making a big push to get the new trade agreement with Mexico and Canada approved by Congress.

It is also working hard to get biofuels demand improved after tossing away a lot of the demand by granting waivers to 31 refineries a couple of weeks ago. Good progress is reported in the negotiations although no deal has been announced yet. The new program would make E-85 more available in the US although logistics have to be worked out. It would not replace all of the lost demand but it would be a start.

The harvest has begun in parts of the Midwest and variable yields have been reported. A vast majority of the yields have been below a year ago. This could indicate that the crop will be much smaller than projected by USDA in its monthly estimates. The crops harvested first were planted first and were thought to have the highest yield potential. Yield reports from the country will now become very important for traders and could dictate price direction for the coming weeks.

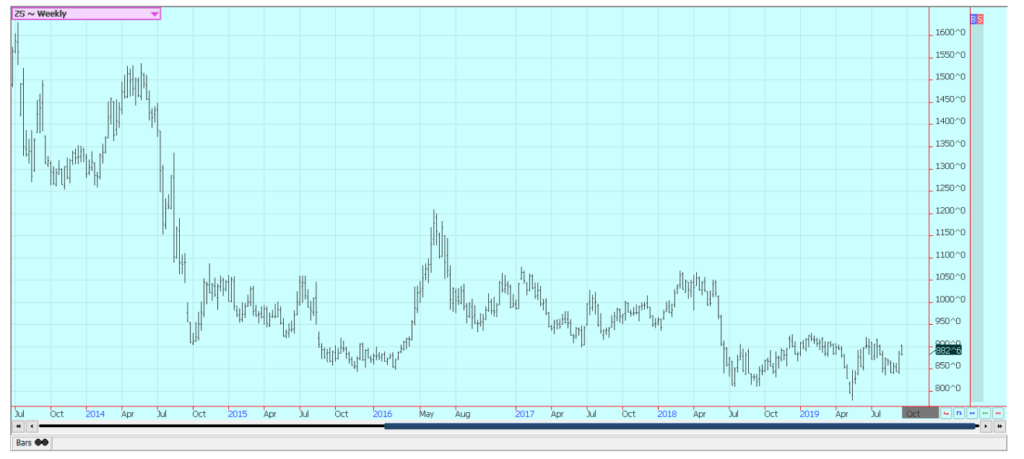

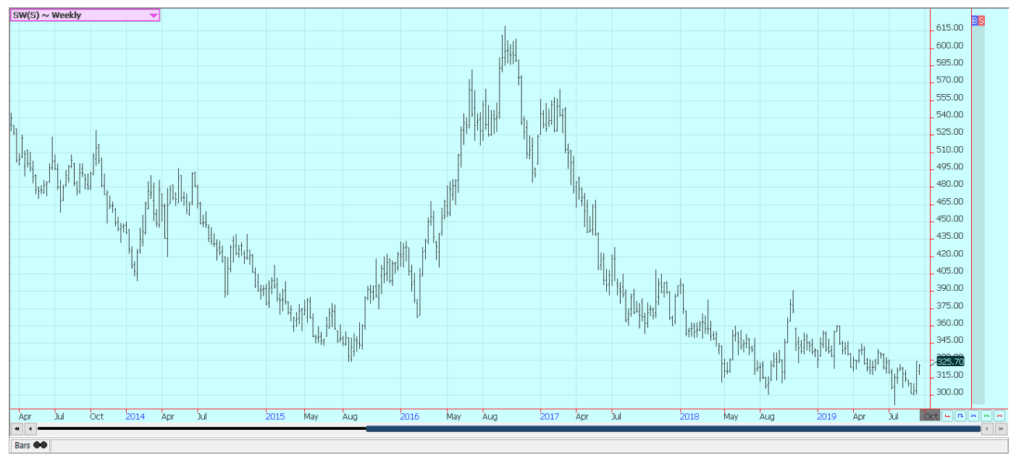

Soybeans and soybean meal

Soybeans and Soybean Meal were lower last week with much of the selling coming late in the week. Futures had been rallying on demand hopes as the Chinese negotiating team came to the US to try to move a trade deal along and get at least a partial deal done. Progress was reported and the market hoped that China would at least start buying US agricultural products, mostly Soybeans and Pork, while the rest of the deal was worked out.

The president dashed those hopes in a single tweet when he said he wanted only a complete deal. Chinese negotiators had been scheduled to visit some farms in Nebraska and Montana after the negotiations were completed on Friday but changed plans and just went back home instead. Futures moved to the lows of the day and the lows of the week on the news.

A quick trip south of Chicago late last week showed that Soybeans were starting to turn color in a lot of fields with one or two fields cut already. The harvest is not far away and yield reports will be monitored. No one is exactly sure how the crop will turn out but the betting is still that USDA is too high with its yield estimates. A smaller crop will not mean a big change in pricing and a big rally if the US is not selling and it needs to get a trade deal with China to sell in a big way.

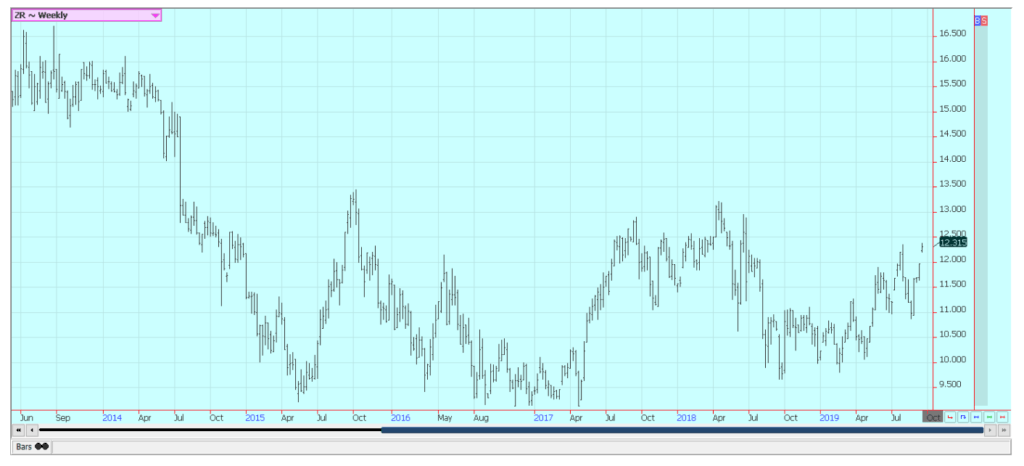

Rice

Rice was higher once again last week. Harvest is moving along at roughly a normal pace but the trade still expects greatly reduced long-grain production this year. The main harvest is winding down in Texas and southern Louisiana despite some big rains from a tropical storm last week. Yield reports are generally average to below average for these areas. Yield results are not expected to improve as the harvest moves north.

Producers to the north had a terrible time getting crops planted and then fields saw big rains at the time through the Summer. Some of the crops are getting more big rains as the remains of the tropical system moves north. This is not good news for producers who are trying to dry down the crops and prepare them for harvest. Yield reports are expected to be variable in Arkansas and the rains will not improve the potential at all.

The trade still thinks there are lower production estimates coming as planted and harvested area along with yields should be smaller. Export demand is holding at mostly good levels even though demand does not appear to be spectacular so far. Sales are primarily to Latin America these days and the US will be the primary supplier to these countries as Brazil and the rest of Mercosur are producing less this year.

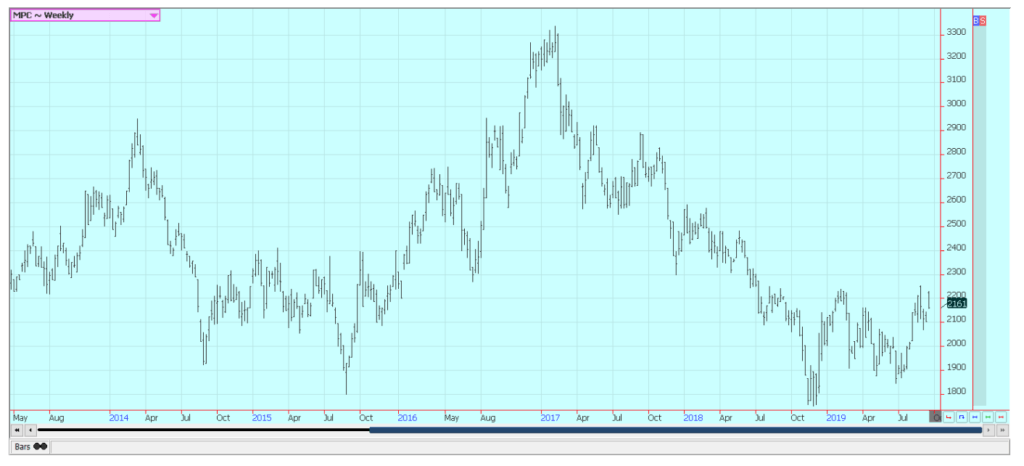

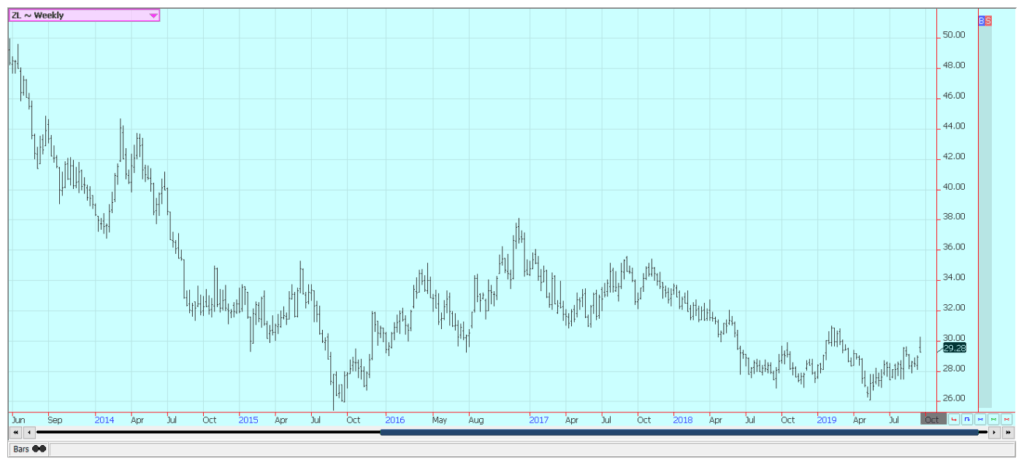

Palm oil and vegetable oils

World vegetable oils markets were mixed last week, with Palm Oil and Soybean Oil a little higher and Canola a little lower. Palm Oil and Soybean Oil started the week near the weekly highs and finished the week near the weekly lows. Palm Oil got weaker export news last week as the private surveyors showed that the export pace for this month remains behind last month. MPOB the previous week had shownc lower production and good demand and ending stocks for the month were lower.

The weaker demand news might not last but all depends on China and its demand. China is disappointed it could not improve trade relations with the US and will continue to look elsewhere for needed supplies including vegetable oils. Soybean Oil was higher as the US government looked for ways to improve biofuels demand after granting the waivers to 31 small refineries a couple of weeks ago.

The US government has proposed to increase the amount of biofuels blended into gasoline and diesel. This could help a little bit but will go only partway to restoring the lost demand caused by the government waivers a few weeks ago. The US is facing increased competition for sales now from South America, and mostly from Argentina. Argentina has traditionally been the major source for Soybean Oil in the world market as it prefers to use other oils at home for its cooking needs.

China is opening its markets to Argentine Soy products in a move that hurts US export prospects longer term. Canola was slightly lower last week as the harvest remained active. Parts of the Prairies remain too dry although rains have increased lately. The provincial reports have noted the uneven conditions as the growing conditions have been rated less than 50% good to excellent. The rains have kept harvest progress slow, especially in western areas.

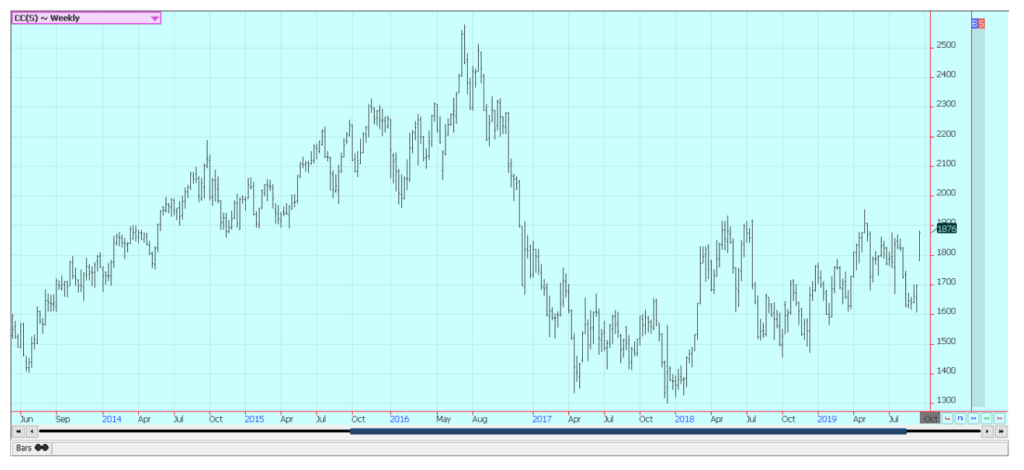

Cotton

Cotton was lower and closed near the lows of the week in reaction to weak demand and improving crop conditions. It was a disappointing week for those who want to see higher prices. The export demand remains weak and Cotton traders got no bullish help from Washington when the president tweeted that he would not accept increased agricultural demand and a partial trade deal.

World demand has been weak in part due to the US-China tensions and fears of a recession or at least a global economic slowdown are keeping buyers away. World prices are weak. Production ideas remain elevated despite bad weather in the Texas Panhandle.

It remains generally hot and dry there. Producers in the Southeast have dodged some bullets in the past few weeks as tropical storms and hurricanes have stayed away. Harvest is underway now and will increase in the next couple of weeks, so there are not many reasons to look for much upside in prices for a while.

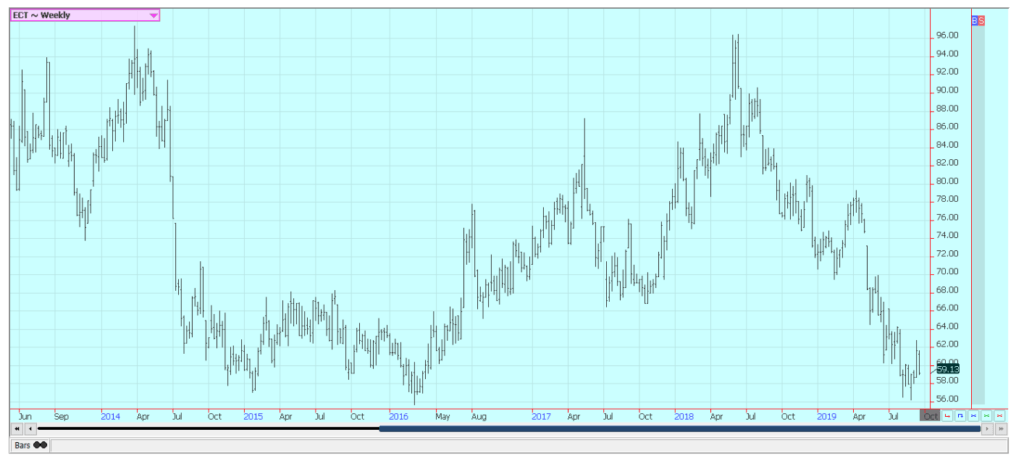

Frozen concentrated orange juice and citrus

FCOJ was a little lower last week. Traders were keeping a close eye on tropical systems that could hit Florida. The state has been lucky this year as the storms have curved away from the state and moved into the US farther north or remained out at sea. It is just past the high point in the hurricane season and forecasters are still keeping close eyes on the Atlantic.

Chart patterns are mixed in response to the hurricane threats and the potential for more systems to form in the short term. The weather in Florida had been good as the state has seen frequent showers and storms that have aided in development in the fruit. Inventories in Florida are still well above a year ago. Fruit for the next crop is developing and harvest will be starting soon. Crop conditions are called good.

Coffee

New York closed a little lower for the week. The Arabica growing areas are waiting for rains to restart flowering after some rains earlier in the year. Rains are forecast to start next week. Vietnam crops are thought to be big despite some uneven growing conditions this year. It has been warm and dry at times, then the growing areas have seen some very heavy rains. The harvest there will be underway soon.

Demand has been increasing over the last few years on the consumer level, but production potential is growing faster. Producers in Brazil have the best chances to make money at current prices as they have more mechanized farming. Vietnam has more mechanization, too. Both countries are forecasting big production that may or may not materialize.

The rest of the Coffee origin world will struggle due to more difficult growing terrain and higher costs of production. Production in these areas has been weaker. The weaker production this year should help to hold prices from going much lower and the price action from last week implied that futures have found a low value for now.

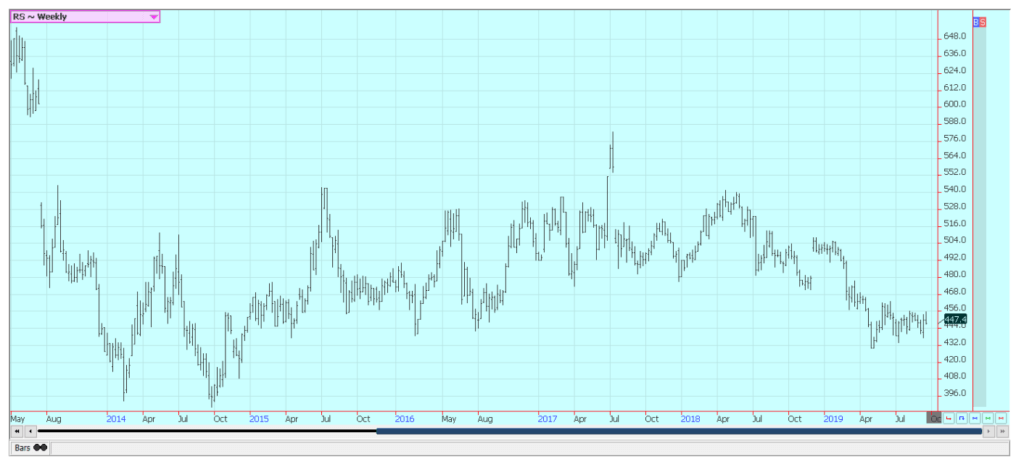

Sugar

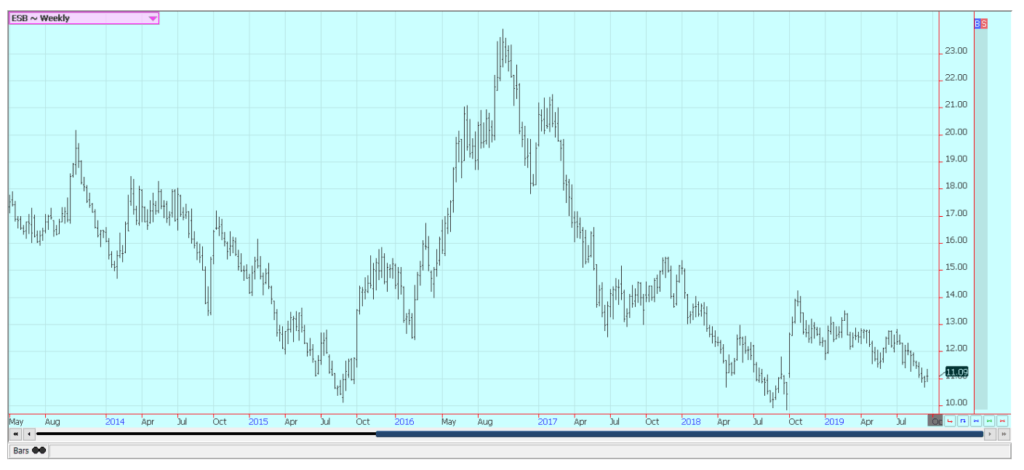

New York closed higher for the week in New York, but lower in London. London got support from reports of poor yields for Sugar beets in Europe and Russia, but ideas of big supplies in India and Thailand hurt the market. New York was higher on hopes for improved ethanol demand as ideas of big supplies and just average demand for Sugar continue to circulate.

World supplies still appear ample for the demand potential. Reports from India indicate that the country still has a large surplus of White Sugar that probably must be exported. India is reporting very good monsoon rains and production prospects for this year are strong. Brazil mills are refining mostly for ethanol right now as has been the case all season. The fundamentals still suggest big supplies, and the weather in Brazil is good enough. India has improved to support some of the big production ideas.

The weather has been much more uneven in production areas from Russia into Western Europe. Those areas had a very hot and dry start to the growing season. Better weather was seen in early August then it turned hot and dry again. These areas need more rain and some cooler weather to provide better conditions for the final development of the crops.

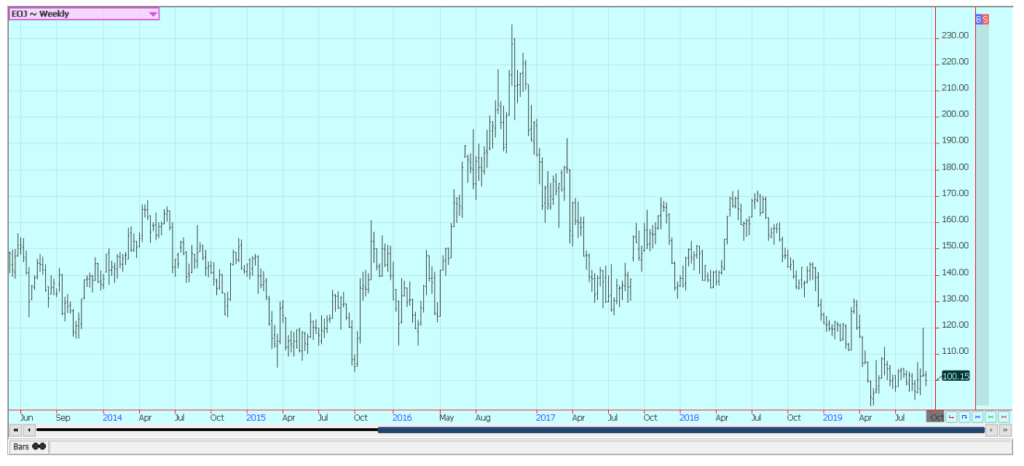

Cocoa

Futures closed higher and trends are up in both markets. Reports from West Africa imply that a big harvest is possible in the region. The market could start to act weaker as the next main crop harvest comes closer to reality in West Africa. In fact, some initial harvesting is being reported in Nigeria, but most areas will not start the harvest just yet.

The weather in Ivory Coast has improved due to reports of frequent showers. The precipitation is a little less now so there are no real concerns about disease. Ideas are that the next crop will be good. Growing and harvesting conditions in Asia are also reported to be good.

The harvest is ongoing amid somewhat drier weather. More and more Asian Cocoa has been staying at home and processed in Indonesia for export in the region. Demand in Asia has been growing and Indonesia has been eager to be the primary source of Cocoa.

(Featured image by DepositPhotos)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech2 weeks ago

Biotech2 weeks agoTwogee Biotech Advances Industrial Enzyme Solutions for Circular Production

-

Crypto5 days ago

Crypto5 days agoUniswap and BlackRock Partner to Launch BUIDL in DeFi

-

Cannabis2 weeks ago

Cannabis2 weeks agoScientifically Verified F1 Hybrids Set New Benchmark for Indoor Cannabis Yield and Consistency

-

Biotech22 hours ago

Biotech22 hours agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments