Business

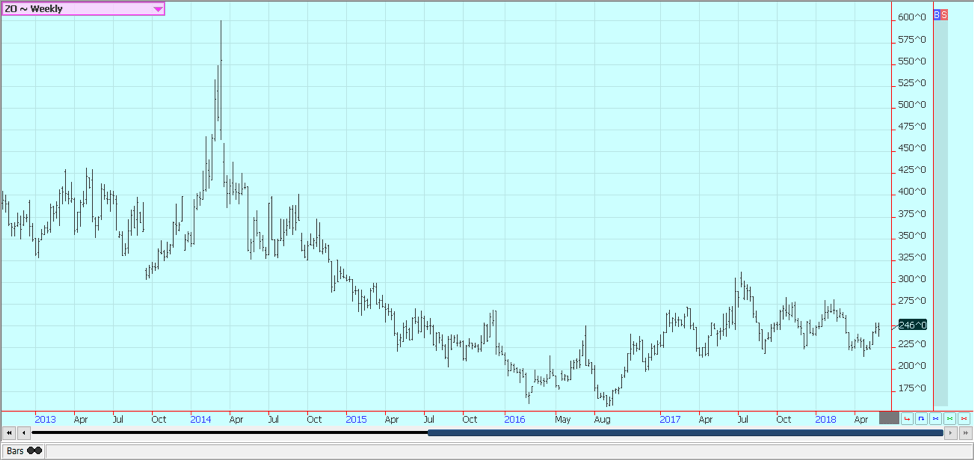

Cotton saw explosive rally, rice dipped lower

Cotton maintains a strong export demand despite uneven planting and dry weather. Rice moves down for now but plantation is starting to progress.

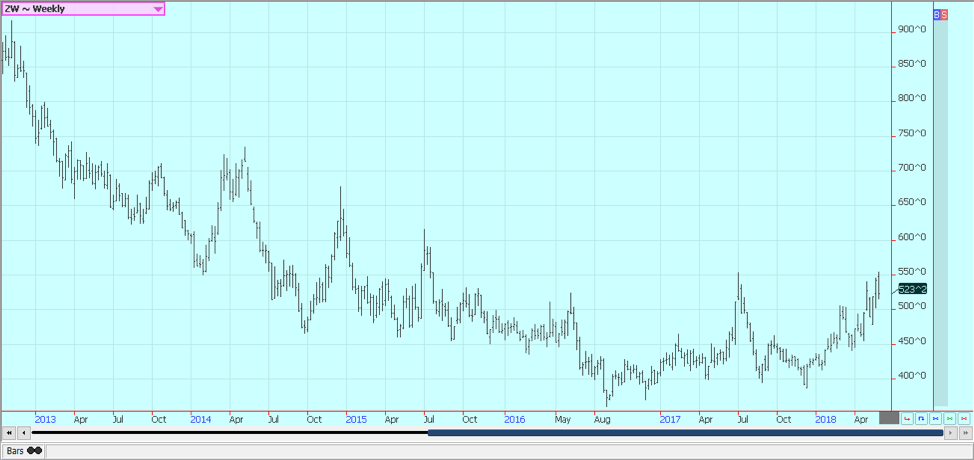

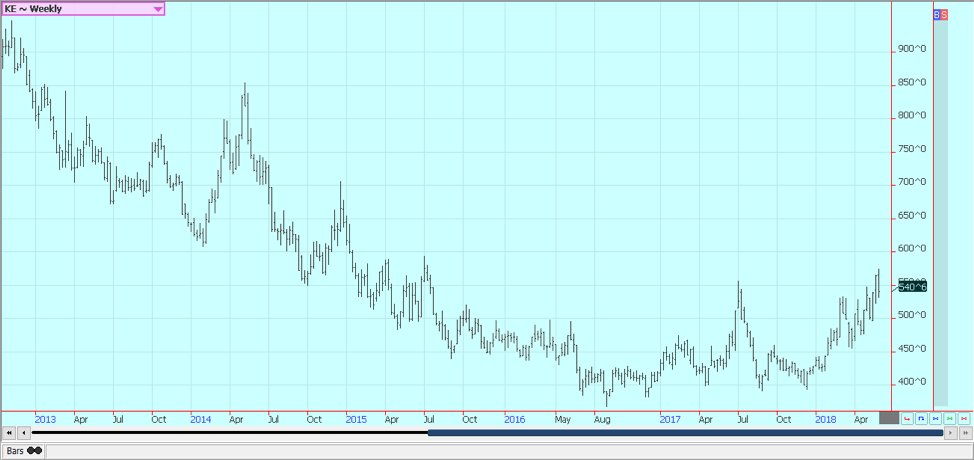

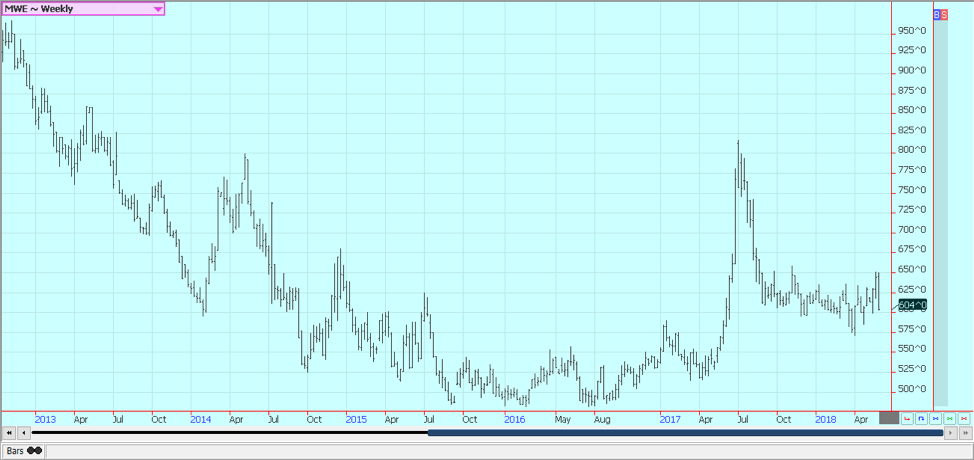

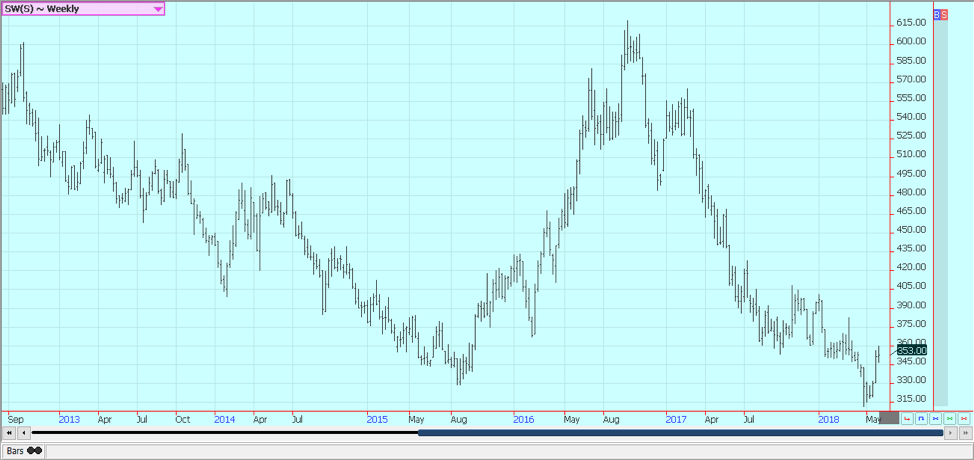

Wheat

Wheat markets were lower on the week after testing a previous spike high on the weekly charts. The previous high was made in July of last year at 553.5 basis Chicago futures. July futures made a high of 554 before turning lower and moving to a test of chart support at about 518 on the weekly charts. The harvest is underway in the southern half of the Great Plains, and yield reports are highly variable. One report indicated yields anywhere from in the teens to about 50 bushels per acre. There is no real estimate of abandoned acres available.

The harvest is expected to move fast due to the generally sharply reduced yield potential due to dry conditions in the western Great Plains. Minneapolis spring wheat is weak due to improved conditions in the northern Great Plains that are allowing for good planting progress and initial growth. Parts of Canada have seen rains, although many areas are still too dry.

Conditions in other parts of the world remain important to the trade. The weather focus is now mostly on the Black Sea area, or Ukraine and southern Russia and then into Kazakhstan. These areas are too dry and there is the talk of yield loss. Western Spring Wheat areas have been too wet and cold. Australia has been dry. India and Pakistan have been very hot. Black Sea prices remain cheaper but are now starting to turn higher due to the weather problems.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

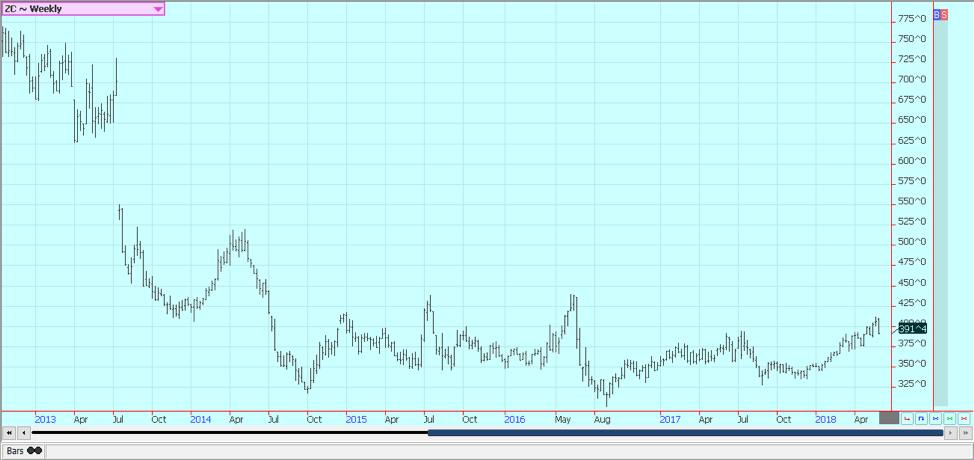

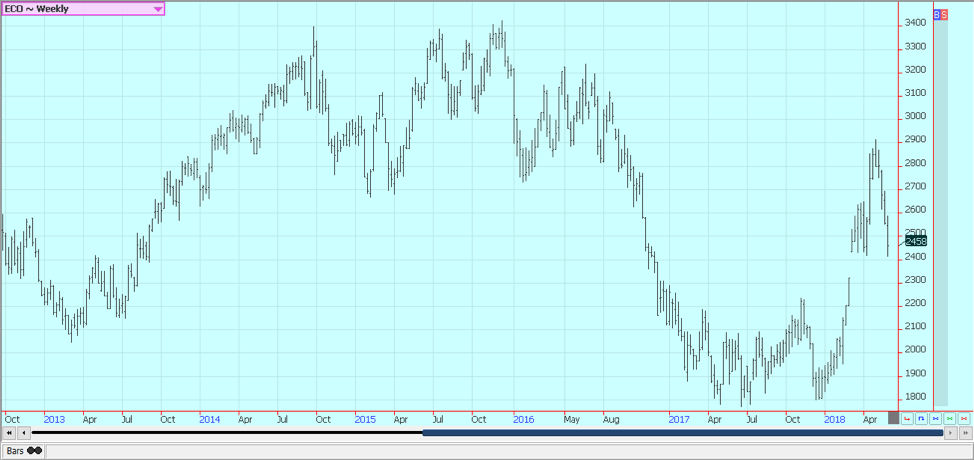

Corn

Corn closed lower on ideas that corn crops are in good condition in the Midwest and on trade fears created by the US government. The US announced new tariffs on metals imports from Mexico, Canada, and the EU on Thursday and the targets began to announce their own retaliation on Friday. It was bad news for the corn market as Mexico especially imports a lot of US corn. Mexico targeted meats and other farm products, but not grains, and Canada announced new tariffs on mostly processed foods and drinks. The EU is expected to target grains and FCOJ.

Corn planting progress and emergence were strong in the USDA reports last week, and the overall condition is very high. The weekly progress and condition reports should show that corn is planted and the condition is very good in the reports tonight. Domestic demand remains strong, and demand for ethanol is expected to remain strong ethanol production rose to 1.041 million barrels per day in the week ending May 25, up from 1.028 million the previous week and 1.020 million the previous year. Ethanol used an estimated 107.2 million bushels of corn in the week ending May 25, versus 105.9 million the previous week and 104.9 million the previous year. Marketing year to date estimated corn use for ethanol production totaled 4.094 billion bushels. Ethanol stocks fell to 21.3 million barrels for the week ending May 25, from 22.1 million the previous week and 22.8 million the previous year.

Export demand is also be holding strong. There is not a lot of corn available from other world sellers right now, and corn is enjoying a significant price advantage over the competition. Strong sales should remain a feature for a couple more months and maybe longer, depending on the production of the winter corn crop in Brazil. The Safrinha crop is in trouble in parts of Parana and Mato Grosso at a key time in its development cycle as the weather has already turned hot and dry. It could be that the rainy season has ended early. If so, yield potential will shrink dramatically as the development of the crop will be sharply reduced. Private estimates for corn production in Brazil have been lowered again with most ideas near 83 million tons for the total Brazil crop.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

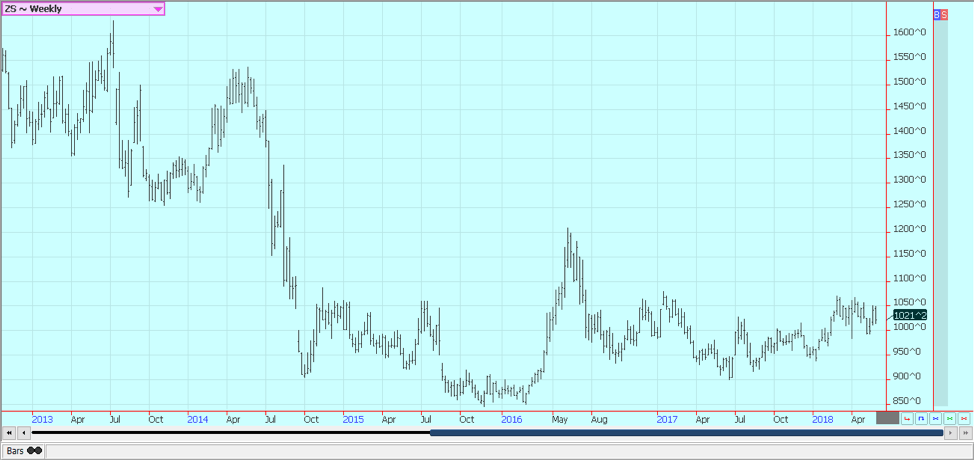

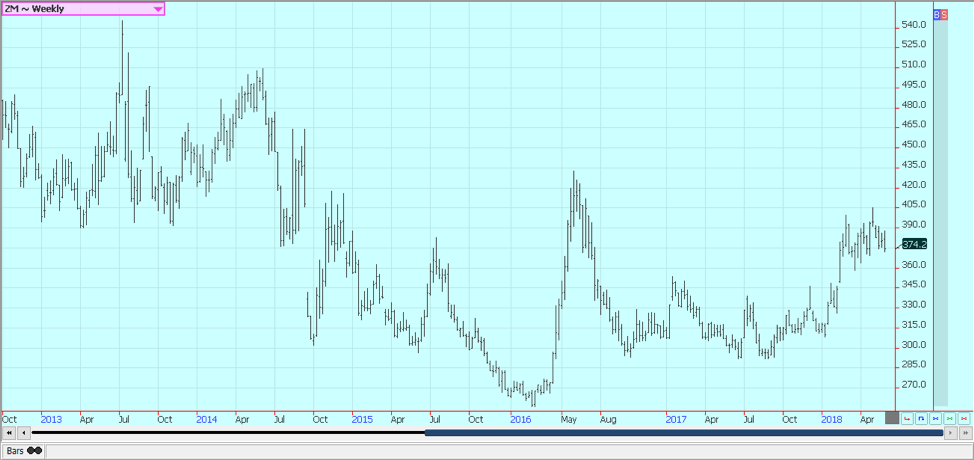

Soybeans and soybean meal

Soybeans and the products were lower last week. The US and China have continued talks to try to resolve the trade dispute. An agreement was found on some issues in the first round of meetings, but there are still a lot of issues that need to be resolved, and the differences are said to be big on some of these items. Prices have been pressured since Tuesday after the Trump administration said it was moving ahead with tariffs even though the negotiations between the two countries were going very well.

There were ideas that tariffs could be applied as a tactic to pressure China, and this move appeared mostly designed to get legal and formal hurdles out of the way as a precaution. The US went ahead with tariffs on metals imports from the EU, Canada, and Mexico last week. There will be retaliation, and it is possible that grains and oilseeds will see new or increased tariffs. USDA showed very good planting progress, and farmers should move quickly now to complete planting as corn is now mostly in the ground. Only double-crop soybeans will be left and will need to wait until the wheat is harvested. Farmers in much of the Midwest are almost done or are done planting.

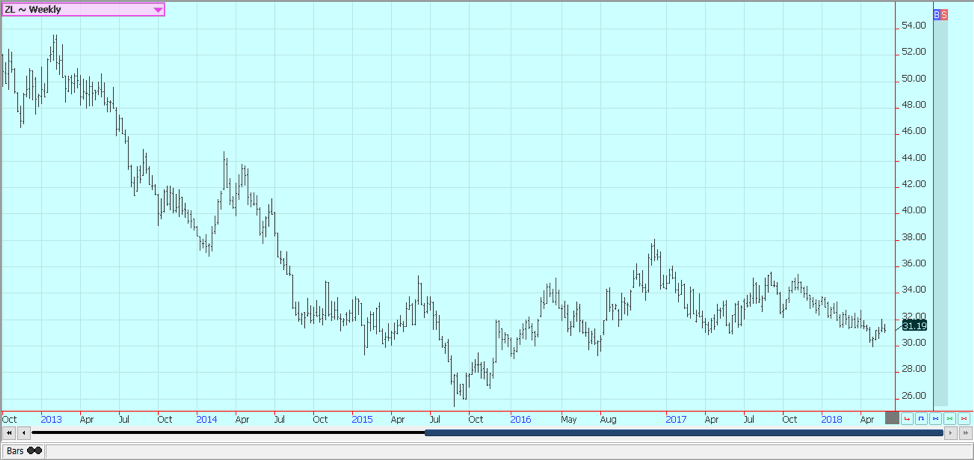

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

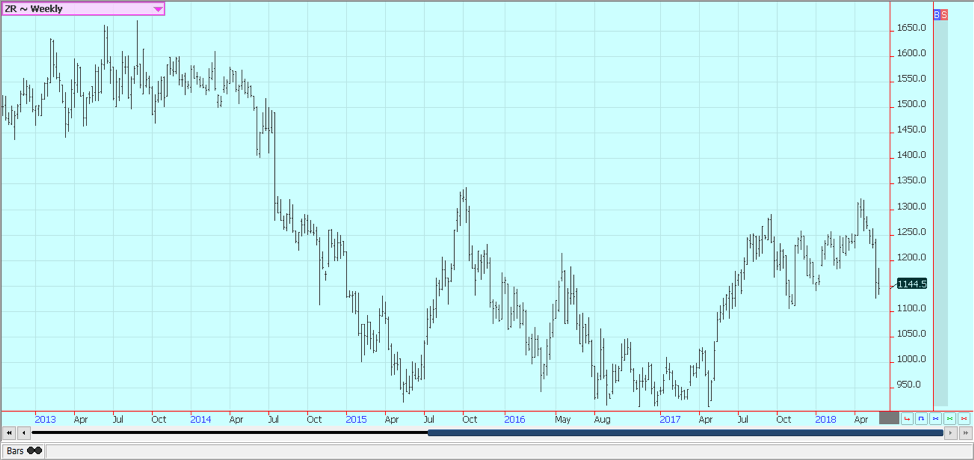

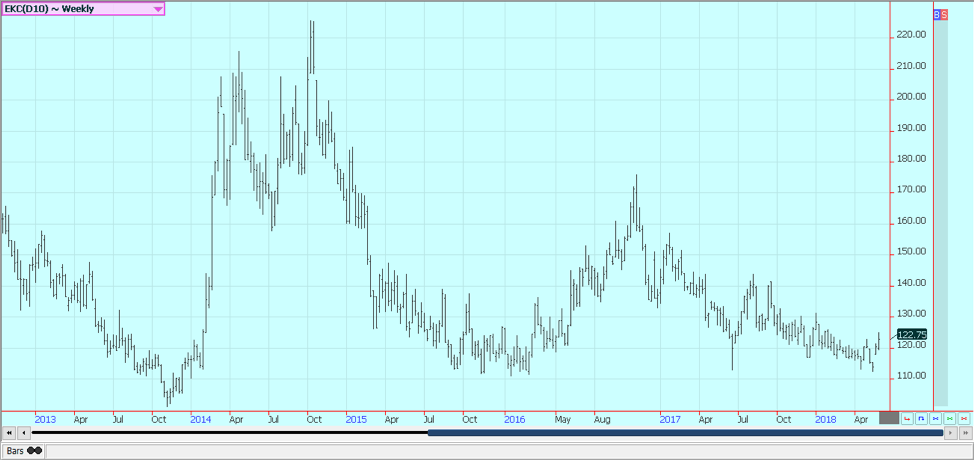

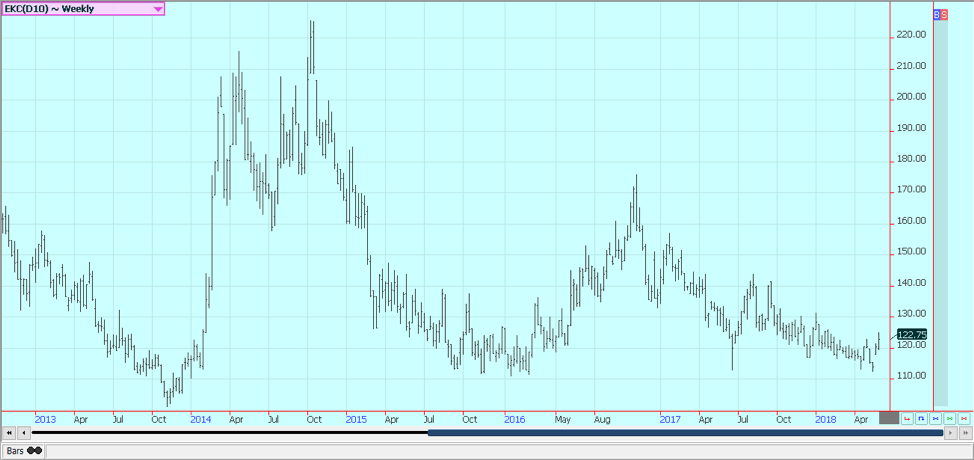

Rice

Rice was lower for the week but held the weekly lows for the move on ideas that demand is waning and the crop is starting to progress. President Trump has decided to move ahead with tariffs on metals imports from Mexico, the EU and Canada. Mexico announced some of the markets it would use to retaliate against the US tariffs, and grains were not on the list. However, the US sells a lot of rice to Mexico, and it is our biggest customer. Cash market traders say that the domestic cash market remains about unchanged.

USDA showed that the crop is in good condition last week, and good conditions should be seen again in the weekly reports that will be released this afternoon. Progress is at or above average for the date. The crop is almost completely planted. Emergence is happening quickly with warmer temperatures, and crops in the south are in flood or going into a flood. There are a few concerns about yield loss due to late planting in many areas.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils prices were a little higher again last week. Palm oil moved a little lower on weaker demand reports from the private sources. They showed that month-to-month export demand was down between 9 percent and 10 percent. Much of the crop in demand was due to Ramadan and demand from Muslim countries is less. The market has held well despite the reduced demand and has held firm overall.

The weekly charts show that futures are mostly in a big trading range. The US-China trade dispute could shift some of the demand to palm oil, especially since the soybeans and soybean meal market has been under pressure in China. China has been importing mostly from Indonesia. Soybean oil was locked in a sideways trend all week and also closed lower.

Canola found some support from the trade war and the weather but closed lower when some beneficial rains were reported. Farmers were active planting, although some parts of the Prairies have turned very dry. Some parts of the western Prairies saw some beneficial rains last week, but many areas were missed. Offers from farmers were down last week as they plant and wait for higher prices and as they work at getting the planting done.

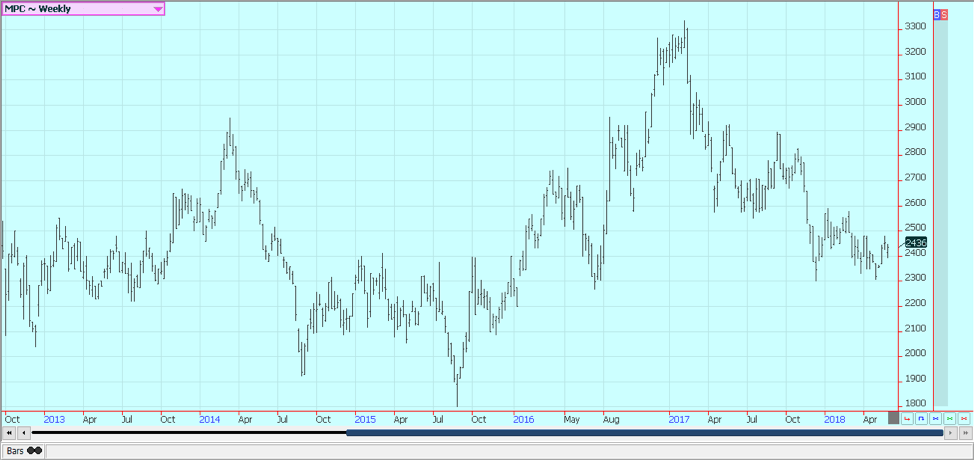

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

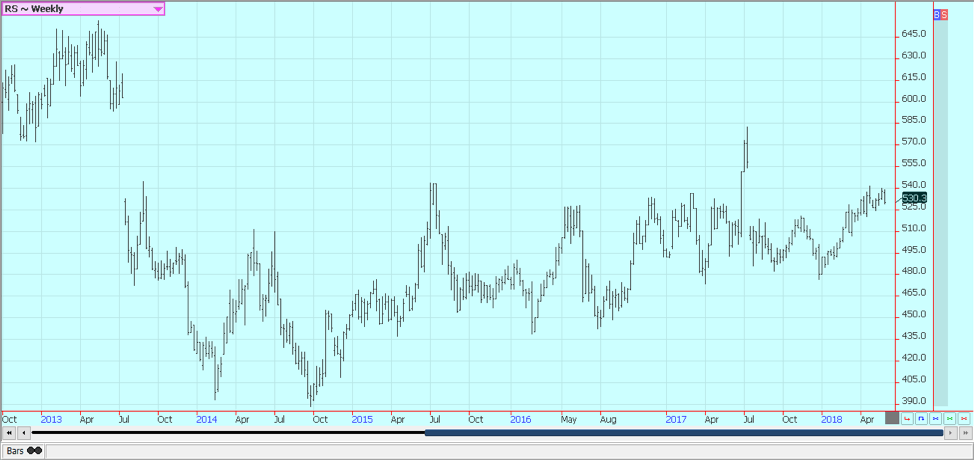

Weekly Canola Futures © Jack Scoville

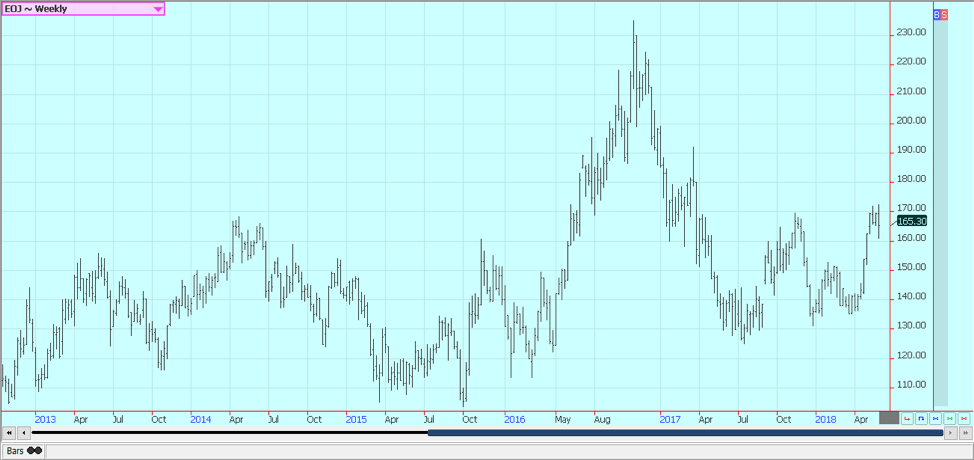

Cotton

Cotton was higher again last week, and trends are up on the weekly charts. It was an explosive rally, and futures are now trading at levels not seen since 2014. Ideas are that US cotton especially is in a bad spot due to the extremely dry and hot weather in western Texas. The current weather is less than ideal in West Texas as hot and dry conditions continue and is not good at other producing areas around the world. The Southeast US is too wet but began to dry out over the weekend. The weather is bad in India and China, with big heat seen in India and Pakistan and too much rain in China. Lost Chinese production could mean increased sales for the US, especially now that the US will have the quality the Chinese need.

Futures traders are looking at a market that still has strong export demand and has seen some very uneven planting and growing conditions in the US. Much of the Southeast and parts of the Delta have seen big rains, especially in the last couple of days. Texas has seen some precipitation, but dryland areas are still very dry. Temperatures have turned hot. Oklahoma and Kansas have improved conditions due to recent rains. It has been hot and dry on the Indian Subcontinent and also in China. China did see some beneficial rains and somewhat cooler temperatures last week. There are ideas that the US is now running short of high-quality cotton to deliver to the exchange and to overseas buyers. Demand remains strong in export markets.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was lower on what appeared to be long liquidation from speculators. Traders are worried about demand and are noting improved production prospects for Florida. In particular, President Trump announced tariffs on metals imports from Mexico, Canada, and the EU. The EU imports a lot of FCOJ and these exports could be hurt by any retaliation made by Europe. The EU has indicated that FCOJ will be on the list of items subject to increased tariffs.

The growing conditions in Florida should continue to improve as the rainy season appears to be underway. The market is still dealing with a short crop against weak demand. Demand is bad enough that year on year inventories are increasing even with the very bad production last year. Florida producers are seeing golf ball sized fruit. Conditions are reported as generally good. Irrigation is being used, but less now after the rains. Brazil also could use more rain as Sao Paulo has been hot and dry. Generally good conditions are reported in Europe and northern Africa.

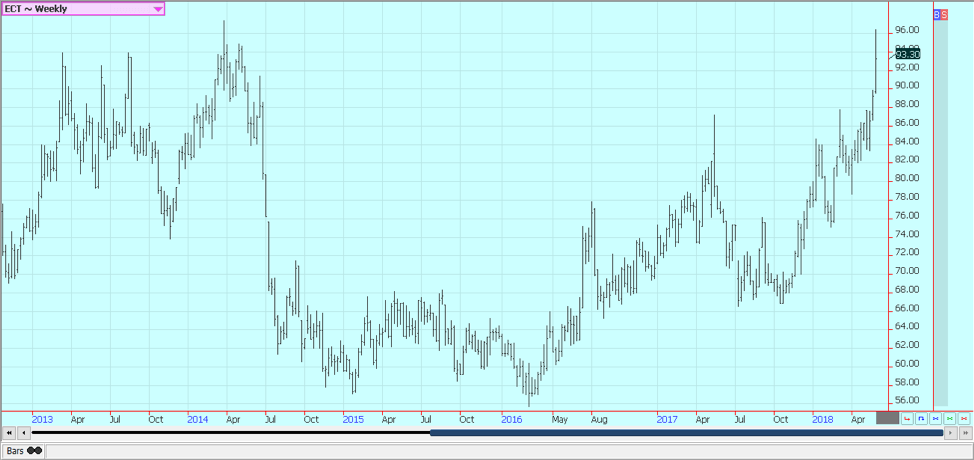

Weekly Frozen Concentrated Orange Juice Futures © Jack Scoville

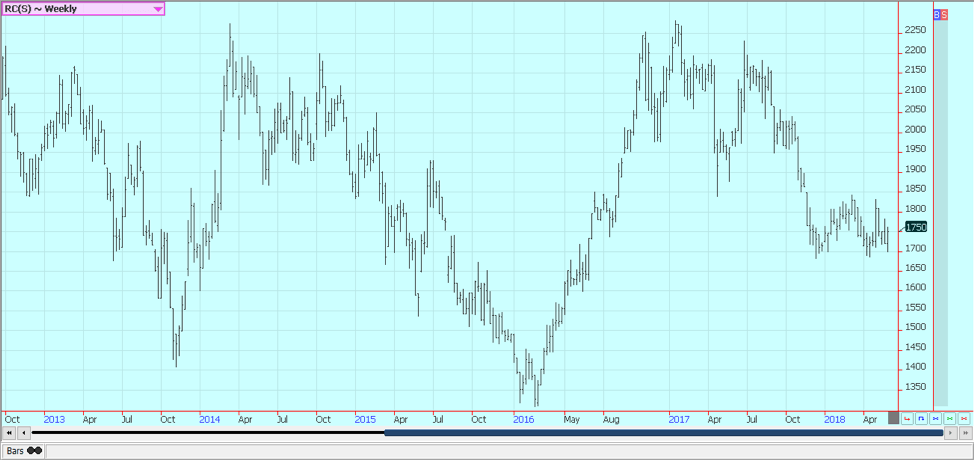

Coffee

Futures in New York and London were a little lower on Friday but higher for the week as the truckers strike in Brazil continued to delay shipments of coffee from the country and on some forecasts for cold temperatures in southern Brazil over the weekend. It is not clear that the cold will move far enough north to hurt coffee. More cold weather is coming sooner or later as the winter season has just started. It remains mostly dry in Arabica areas, and there is no rain in the forecast for the next week. The truckers strike has delayed shipments for a significant amount of coffee just as the harvest is beginning. However, it does not appear that buyers are looking for alternatives right now.

Origin is still offering in Central America and is still finding weak differentials. It has been a little dry so far this year in the region. Speculators anticipate big crops from Brazil and from Vietnam this year and have remained short in the market. Robusta remains the stronger market as Vietnamese producers and merchants have not been willing to sell at current prices. Vietnamese cash prices are weaker this week with good supplies noted in the domestic market. Current rains in the country are favorable for the crops.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were higher in both markets for the week as Brazil was dry and cold. Both markets have formed bottoms on the daily and weekly charts. New York gave back the best gains of the week after failing to overcome strong resistance at 1300 on the weekly charts. Prices have been supported by the dry weather in Brazil and also the truckers strike there that is now over two weeks old. Shipments to mills and ports have stopped due to the action. The cold air in southern Brazil could get cold enough to damage sugarcane still in the fields. Most traders remain focused on the big world production.

It is dry in parts of Brazil, including some sugarcane production areas, and there are some talks of losses to the crop in the near future unless rains return soon. There are no real rains in the forecast for now. However, the initial harvest has been big and processing has been more active than last year. India is back to export sugar this year after being a net importer for the last couple of years. The government is subsidizing industry and producers to help maintain an active market flow and to prevent the buildup of sugar in storage. India could raise the internal price or try to stockpile supplies in meetings that are now scheduled for this week. Thailand has produced a record crop and is selling. The Middle East and North African buyers are reported to be buying normal or less than normal amounts of sugar in the world market right now.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

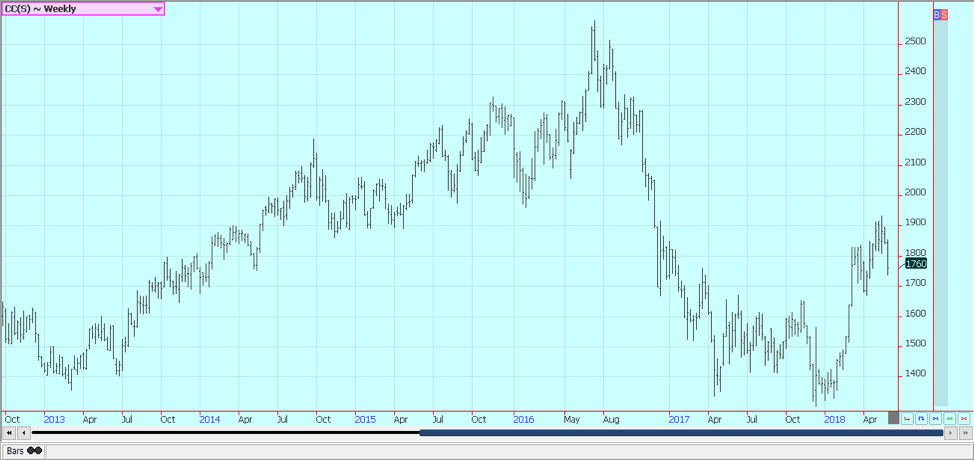

Cocoa

Futures were lower in both markets last week. The ICCO cut its production surpluses for 2017-18 to 10,000 tons, down from an estimate of 105,000 tons in February. Production was estimated at 4.744 million tons, from 4.748 million in February. It is possible that cocoa has now made a significant top in both markets. Funds have turned sellers and appear ready to continue to liquidate long positions due in part to the trend change.

Fears that developed about the EU economy over the weekend spilled into cocoa as Europe is the largest per capita consumer of chocolate in the world. Italy is having problems again and there are fears that the problems there could spread to other EU states. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions in West Africa. Conditions also appear good in East Africa and Asia. The mid-crop harvest is active in West Africa.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech1 week ago

Biotech1 week agoBiotech Booster: €196.4M Fund to Accelerate Dutch Innovation

-

Markets2 weeks ago

Markets2 weeks agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

-

Crypto4 days ago

Crypto4 days agoBitcoin Traders Bet on $140,000: Massive Bets until September

-

Crypto2 weeks ago

Crypto2 weeks agoCaution Prevails as Bitcoin Nears All-Time High

You must be logged in to post a comment Login