Featured

Improved demand gives the futures market a shot in the arm

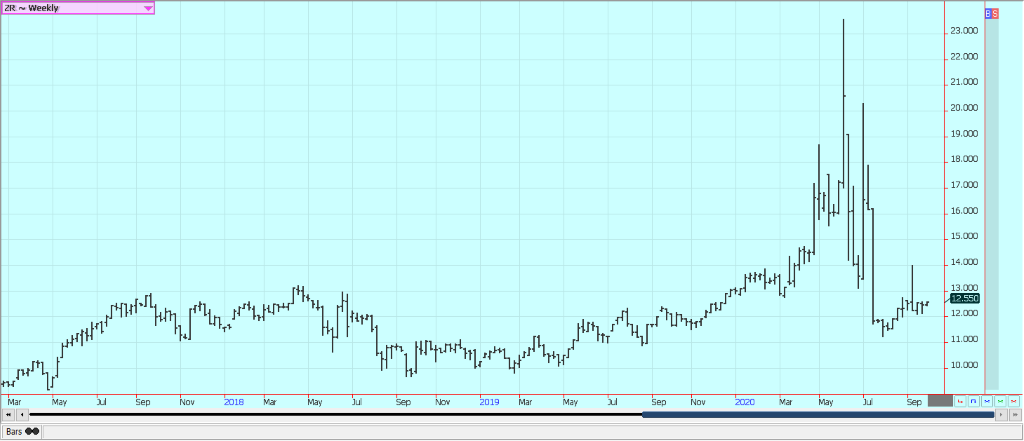

Rice was slightly higher last week as the harvest pressure went against improved demand ideas. US export demand was very strong last week with over 121,000 tons sold. Brazil was the main buyer with over 70,000 tons purchased. Mexico and Honduras were also good buyers. There was talk in the market that Iraq had tendered, but there was no result announced.

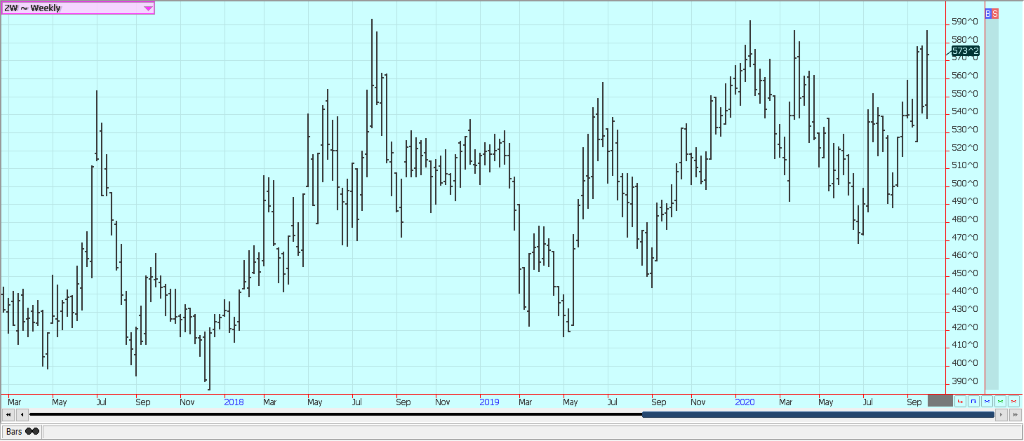

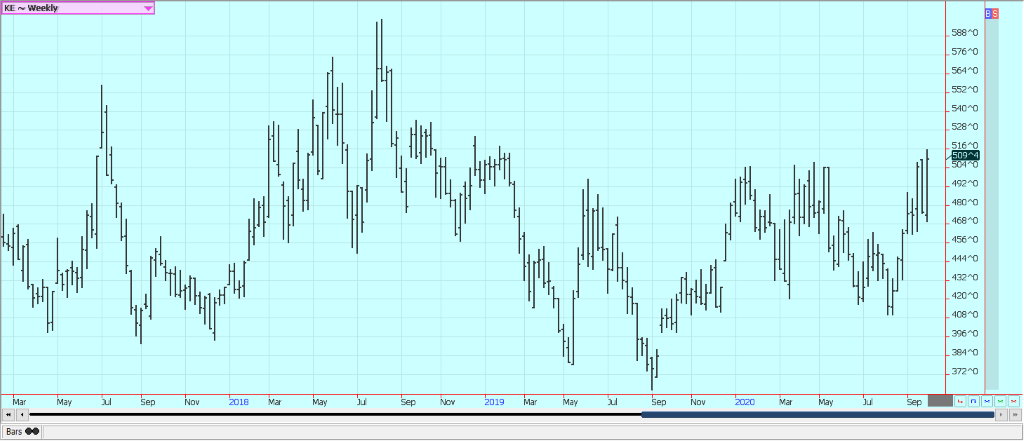

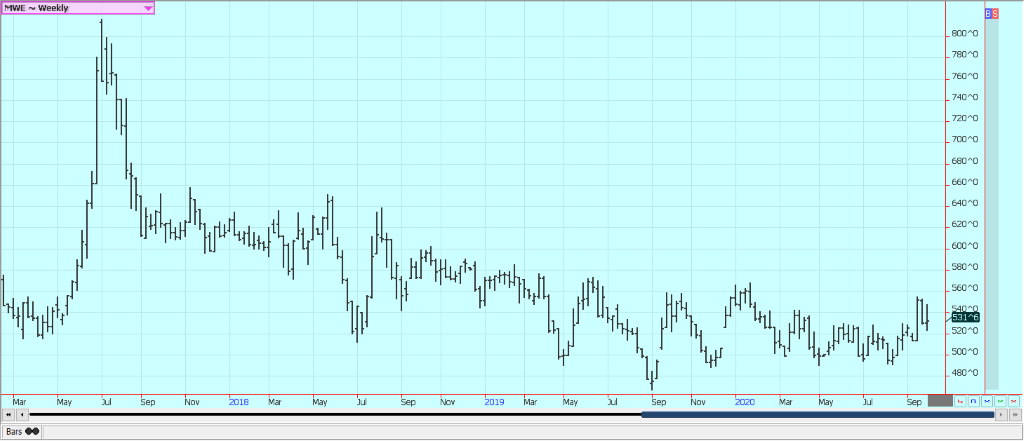

Wheat: Winter Wheat markets were higher and made new highs for the move last week. USDA released its stocks estimates and stocks were close to expectations at 2.158 billion bushels. US Wheat production for 2020 was estimated by USDA at 1.83 billion bushels, down 5% from 2019. Soft Red Winter and Hard Red Winter production were down, but increases were noted for White Winter, Durum, and Other Spring Wheat. The world demand for US Wheat depends mostly on lower prices for US Wheat to compete with Russia, Europe, and other sellers. The overseas weather is mixed. Western Europe is likely to get some big rains in the short term, but southern Russia could stay dry. Some showers are forecast for Ukraine this week. The country has also been dry. These areas are trying to plant the next Winter Wheat crop but the dry weather and the dry soils are keeping farmers out of the fields. Less production is likely in Argentina due to drought. About a quarter of Argentine growing areas are affected after some beneficial rains in some areas last week. Conditions are improved in the US after some rains fell in the Great Plains but the western Great Plains remains mostly hot and dry. The Midwest has had good rains.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

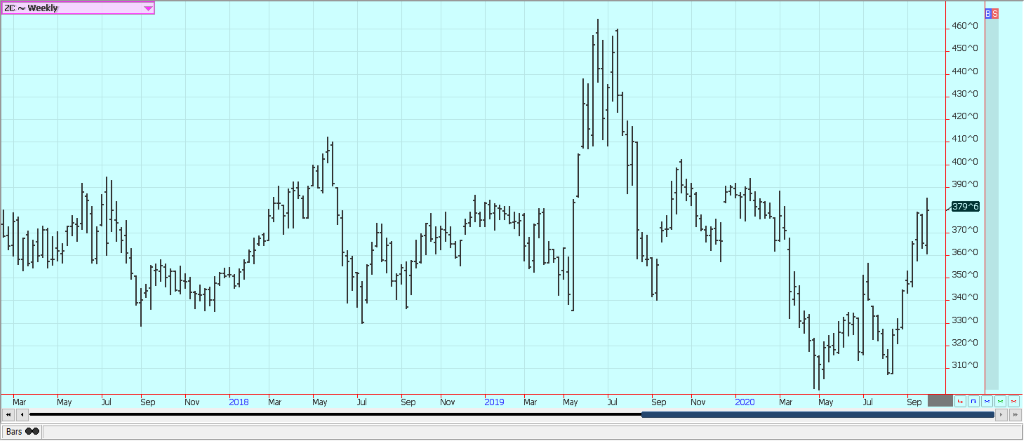

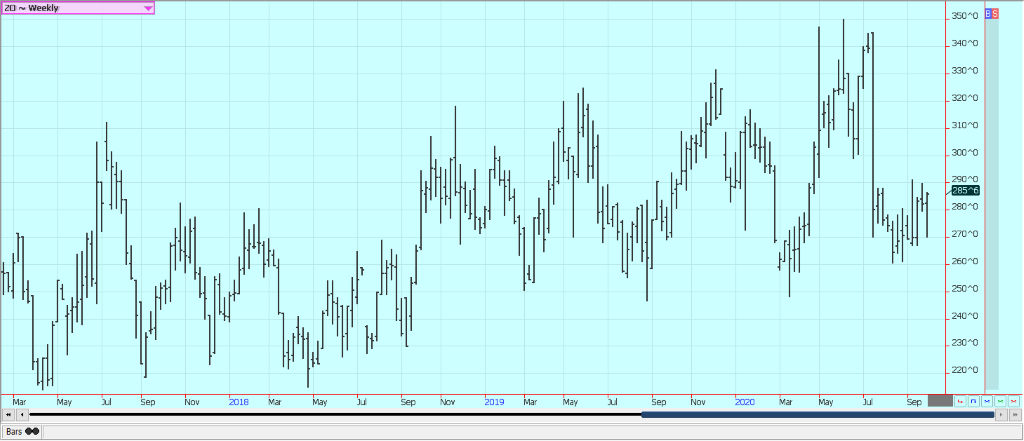

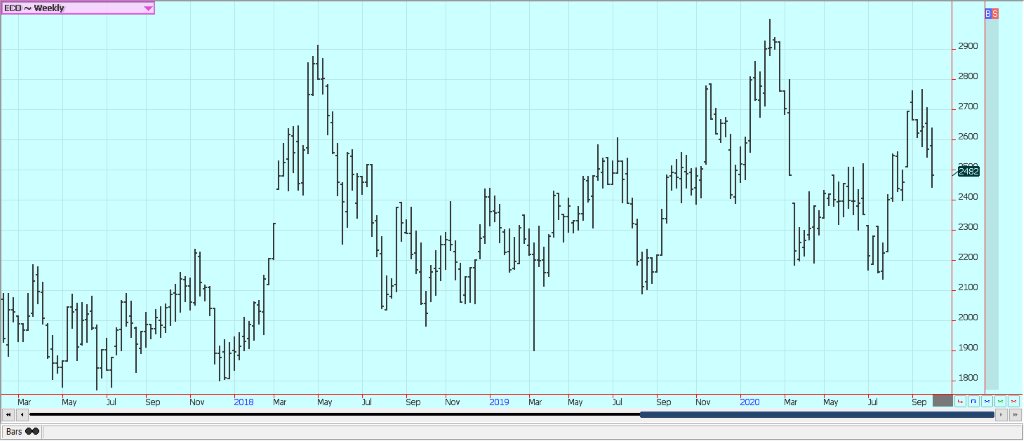

Corn: Corn moved higher in response to the bullish USDA stocks in all positions reports. USDA said that Corn stocks were 1.995 billion bushels, below the average trade guess and below the lowest trade guess. It was much less than what USDA had forecast in the WASDE reports just a month earlier. Demand is holding strong for exports, but it is harvest time and initial yield reports have been mixed but generally strong. The demand has come primarily from China as the state companies bought for the reserve, but that buying appears to be almost complete now. The harvest is still concentrated in the southeast and Delta for now but has expanded into the Midwest with very good harvest conditions. The Midwest harvest has been slow as the Corn is slow to dry down. The yield reports have been mixed but appear to be good overall. The harvest will produce a good crop, but maybe not a great crop.

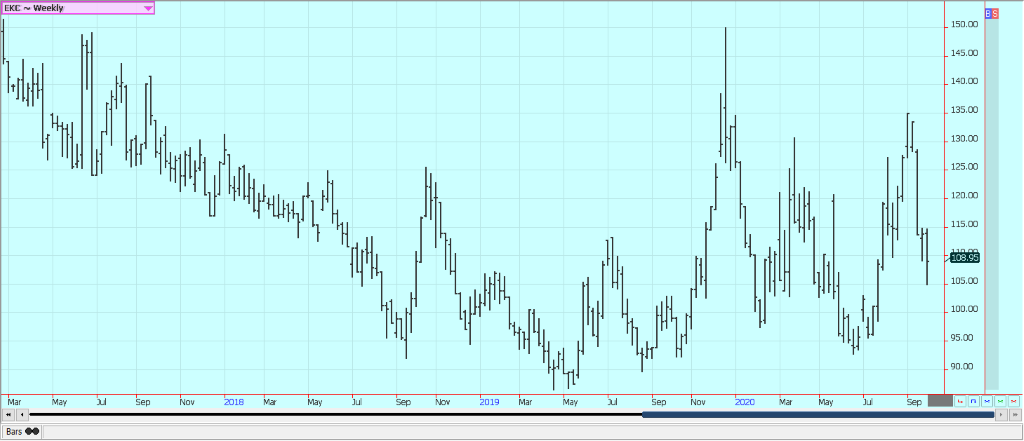

Weekly Corn Futures:

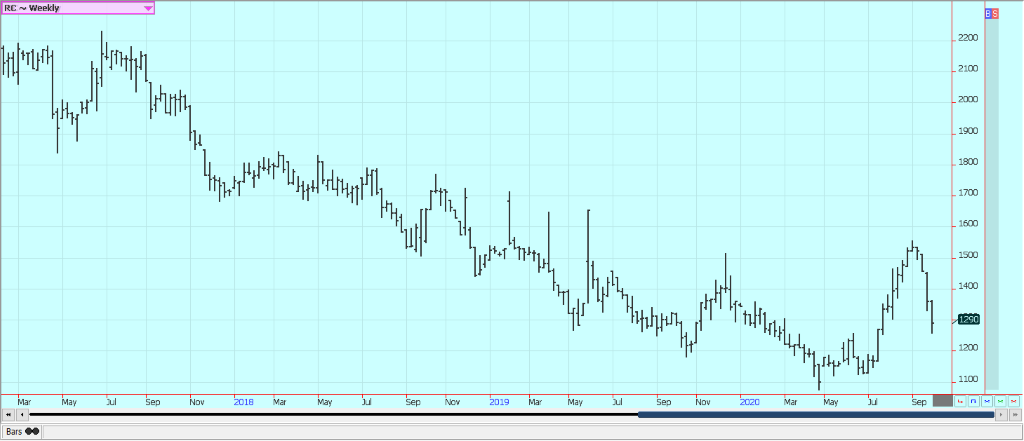

Weekly Oats Futures

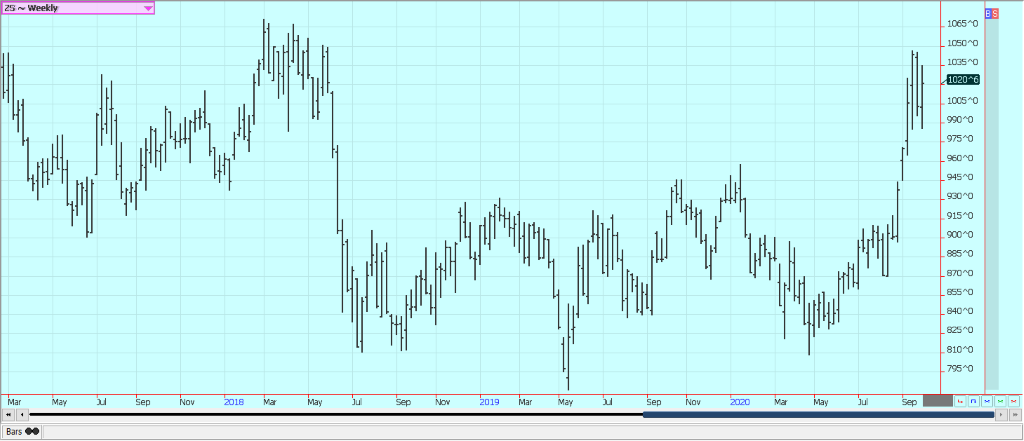

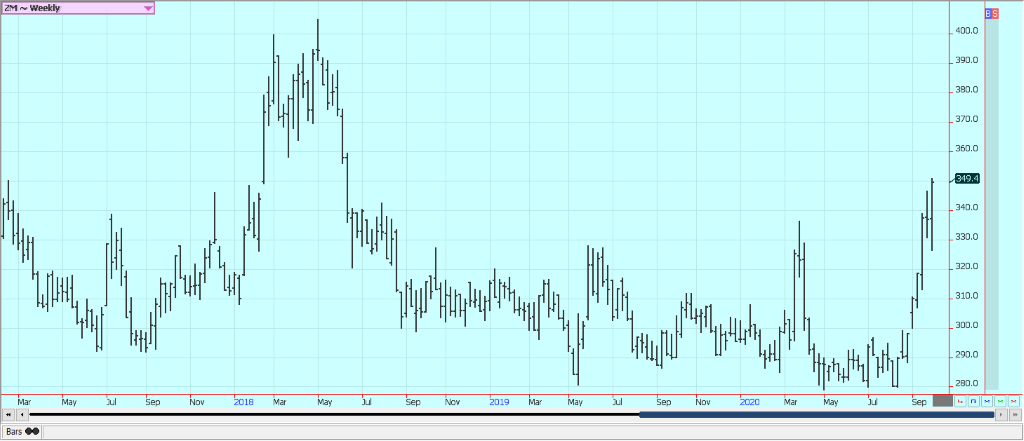

Soybeans and Soybean Meal: Soybeans and Soybean Meal closed higher for the week in reaction to the USDA stocks in all positions report. The report showed US Soybeans stocks at 523 million bushels, lower than the average trade guess and lower than the lowest trade guess. The harvest has started to expand and reports indicated that the producer is selling Soybeans right off the combine or is delivering against previous contracts. Chinese buying for the reserve is almost finished. Ideas are that individual crushers are still with positions to buy. Soybeans were the leader to the upside due to the strong Chinese demand until this week. The trade generally expects China to shift its buying back to Brazil in the near future, but Brazil has been hot and dry and parts of Argentina have also been dry and some of the early planting has been delayed. That might keep the Chinese buying in the US for a little longer, but only for the crushers and not for the reserve. Buying volumes should be less from China and the weekly export sales report should start to reflect less demand in the near future.

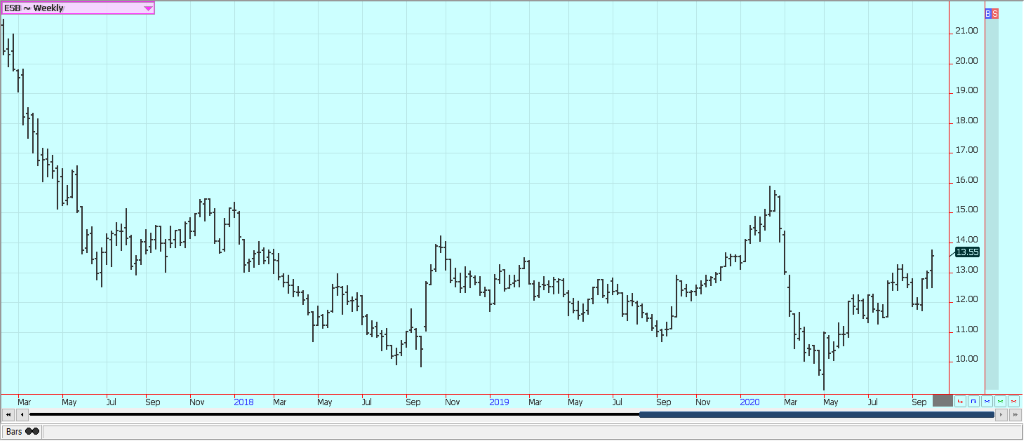

Weekly Chicago Soybeans Futures:

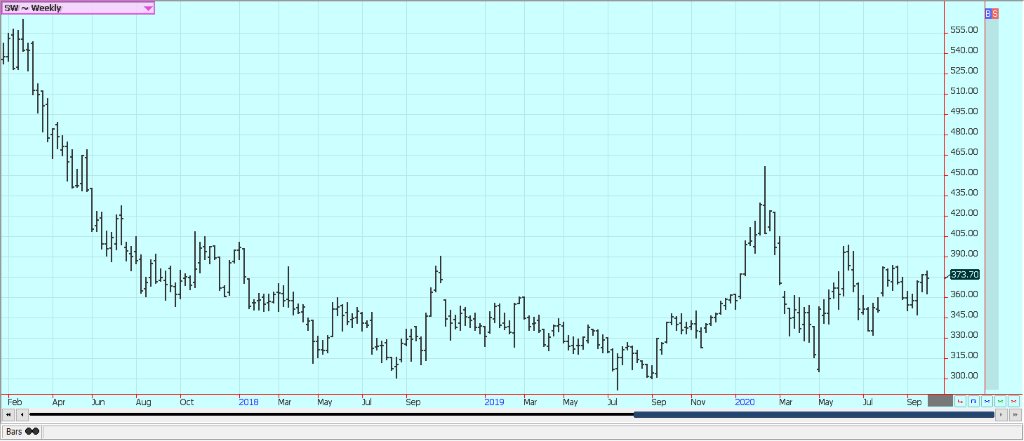

Weekly Chicago Soybean Meal Futures

Rice: Rice was slightly higher last week as the harvest pressure went against improved demand ideas. US export demand was very strong last week with over 121,000 tons sold. Brazil was the main buyer with over 70,000 tons purchased. Mexico and Honduras were also good buyers. There was talk in the market that Iraq had tendered, but there was no result announced. The rebound in demand supported futures and pushed the market to test recent highs for the move. The harvest has been active in most states with good field yields reported. Southern Louisiana and Texas are down with the first crop harvest and are waiting for the second crop to mature. Quality is said to be very good, especially in Arkansas. Milling yields are higher and appearance is very good with minimal chalk or peck showing.

Weekly Chicago Rice Futures

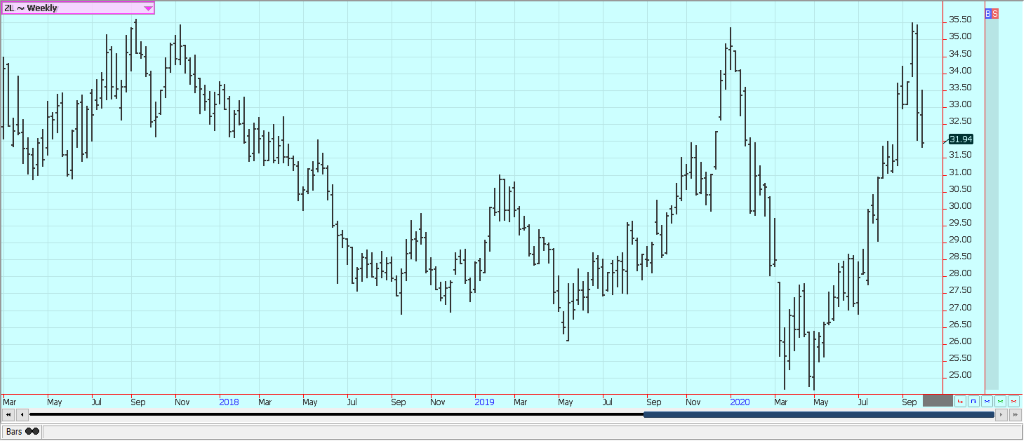

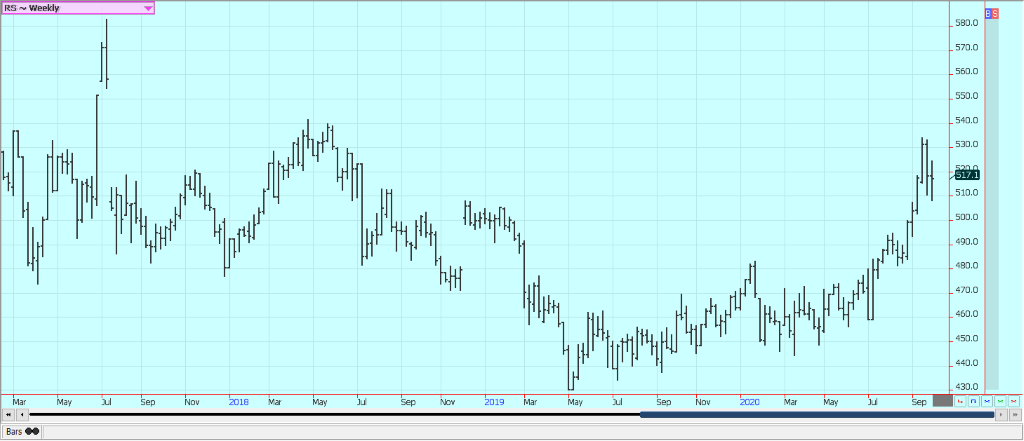

Palm Oil and Vegetable Oils: Palm Oil closed lower on ideas of increasing production and weaker demand. China is on holiday this week and China has been the big buyer in Palm Oil. It is seasonally a time for trees to produce more due to more regular rains. Getting workers to do the harvest has been hard, though, and the lack of labor has been a big problem. At least some of the plantation owners have asked for more migrant workers to cover the lack of workers that can be sourced locally. Demand reports from the private surveyors are stronger this month. Soybean Oil was lower and Canola was a little higher. Canola farmers and speculators are selling due to harvest pressure. The Canadian Dollar has weakened and this has helped support Canola.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

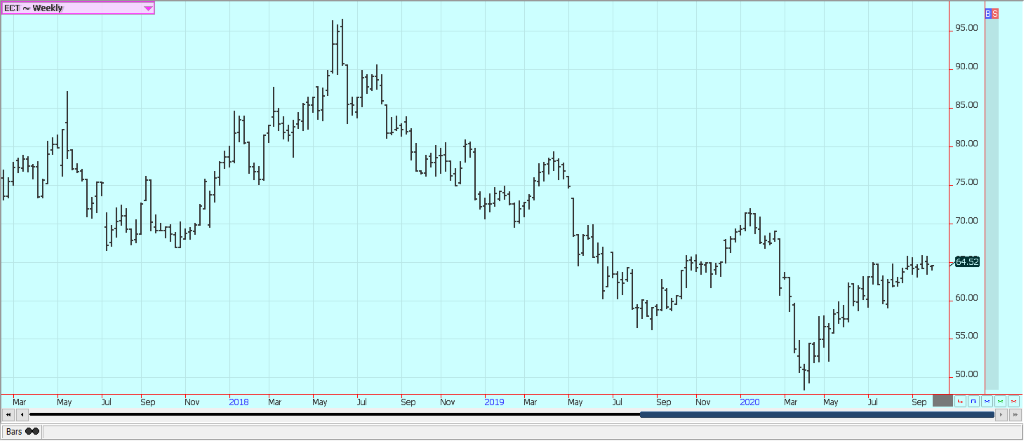

Cotton: Cotton closed about unchanged for the week and trends are still sideways on the weekly charts. Demand has improved over the last couple of weeks but the weekly export sales report showed just moderate demand last week. There was no major Chinese demand, but China and Turkey were the best buyers of US Cotton. Demand should stay weak as long as the Coronavirus is around. Shopping is hard to do and many people are still unemployed. This is true in just about all countries. Hurricane Sally moved into the Southeast and brought some heavy rains. Ideas are that most of the Cotton crops in the region escaped any major damage that the storm could have brought. The supply losses are in the market now. However, the Harvest is under way and the tropical season is active.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was higher in recovery trading last week. Florida has been spared any hurricanes or other serious storms this year in a year that has been very active for tropical storms with a record amount of tropical storms hitting the US. The lack of damaging weather usually means lower prices for futures. The Coronavirus is still promoting consumption of FCOJ at home. Restaurant and food service demand has been much less as no one is really dining out. Florida production prospects for the new crop were hurt by an extended flowering period, but the weather is good now with frequent showers to promote good tree health and fruit formation. Import demand to the US should be minimal as US prices remain below those of Europe. Brazil has been too dry and irrigation is being used.

Weekly FCOJ Futures

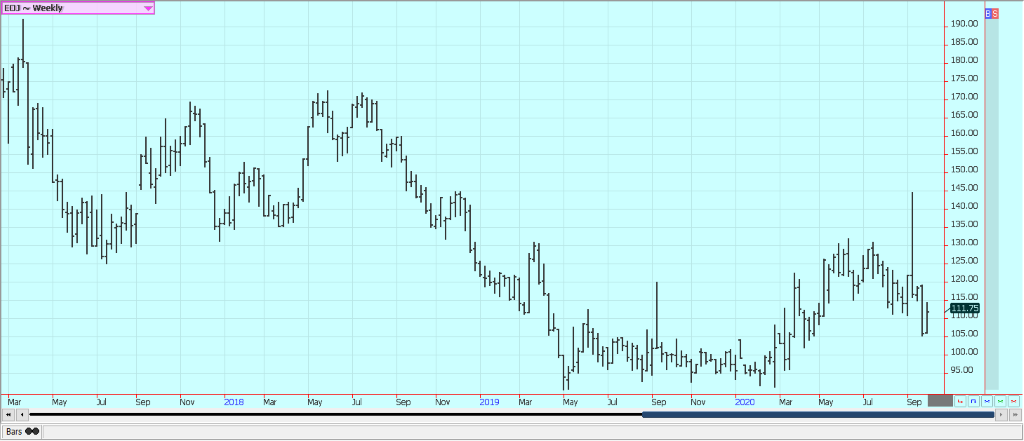

Coffee: Futures were lower last week in New York and in London in choppy trading. New York ran to test the previous weeks highs near 115.00 December and then failed. London had been better supported due to stronger demand ideas and worries about the weather in Vietnam but the country is getting some rain now and the worries have abated. The demand from coffee shops and other food service operations is still at very low levels. Consumers are still drinking Coffee at home. Reports indicate that consumers at home are consuming blends with more Robusta and less Arabica. The Brazil harvest is over and producers are selling due to extreme weakness in the Real. Ideas are that production is very strong this year as it is the on year for the trees.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London were higher although the fundamentals are still negative and as the Brazilian Real is very weak. World petroleum prices are weaker, implying less Ethanol demand. Brazil mills have been producing more Sugar and less Ethanol due to weak world and domestic petroleum prices. It has been dry lately to affect Sugarcane production. India has a very big crop of Sugarcane this year. Thailand might have less this year due to reduced planted area and erratic rains during the monsoon season. There are reduced flows from rivers from China to hinder irrigation of the crops. Demand appears to be about average.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

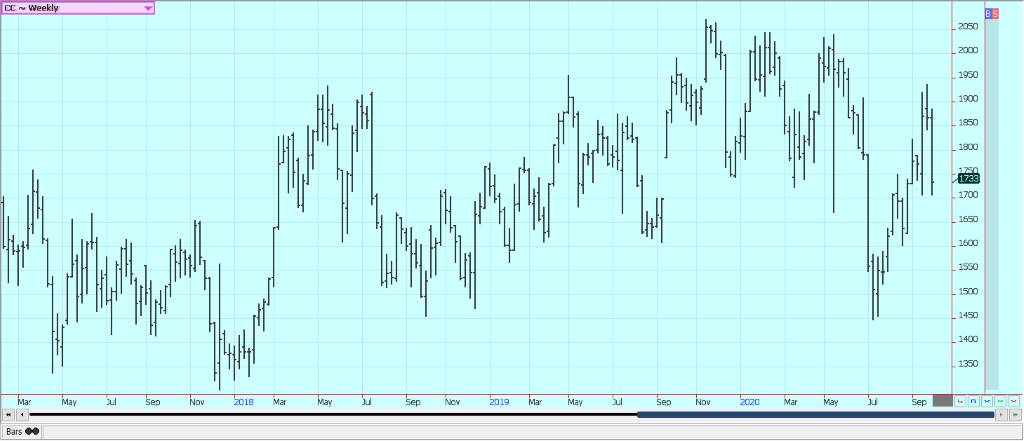

Cocoa: New York and London closed lower and trends are turning down in both markets. The harvest for the next main crop is spreading to much of West Africa and very strong production is expected. There are a lot of demand worries as the Coronavirus is not going away and could be making a comeback in the US. Europe is also seeing a return of the pandemic.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

_

(Featured image by Peter H via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoIntesa Sanpaolo’s 2026–2029 Growth and ESG Strategy

-

Business4 days ago

Business4 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Health Trader Affiliate Program Review]

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Hosting.com Affiliates]

-

Crypto6 days ago

Crypto6 days agoEthereum Pushes AI Integration With ERC-8004 and Vision for Autonomous Agents