Markets

Indexers revolt at the stock exchange

There are now hordes of overvalued assets that have no justification for their overvaluation, except that index funds have to own them.

Crawford & Co has two classes of stock, Class A Common Stock and Class B Common Stock. The Class A shares pay a dividend that is 2 cents a quarter higher than the Class B shares. There are differences in voting rights, but as there’s a control shareholder, those are irrelevant.

Therefore, a simple analysis says that the A shares ought to trade at a moderate premium to the B shares to account for the nearly 1% higher annual dividend yield. NOPE!! The B shares are in the Russell 2000 index and the B shares now trade at roughly a 35% premium to the A shares.

Now, I’m not here to pass judgment on the investment merits of Crawford and the A or B shares. I have done no analysis on the company and have no opinion on if it is a good investment or not. However, I know that the A shares are better than the B shares as you get a higher dividend and there is no logical reason for the B shares to trade at a huge premium except that the Russell 2000 index has to keep buying them as more money is allocated to the index.

Two years ago, I noted how index funds and ETFs were warping asset valuations and creating opportunities for those who were willing to seek them out. This trend has only accelerated since then and has grown from something of a curiosity in certain asset classes into a true bubble that is doomed to eventually pop. There are now hordes of overvalued assets that have no justification for their overvaluation, except that index funds have to own them. Like all bubbles, this one too will burst.

In the interim, there will be huge opportunities created by how index funds misallocate capital. As I said earlier, I know nothing about Crawford, but if I wanted to own it, I sure as hell wouldn’t be buying the B shares when compared to the A shares. Additionally, I feel pretty confident in saying that at some point in my career, the A shares will trade at a premium to the B shares—as they deserve to. At the same time, I wouldn’t be betting that this spread collapses anytime soon either. Shorting indexing has been a widow-maker for many in the hedge fund industry—it’s hard to fight against fund flows. In finance, when a trend gets in motion and the marketers start pushing it (indexing and ETFs today) you can expect it to go further than is logically possible, but the hangover will be pretty epic.

Along the way, there will be a lot of money made by better understanding the flaws in these indexes and front running them—much as I front-ran the marketing department back in March.

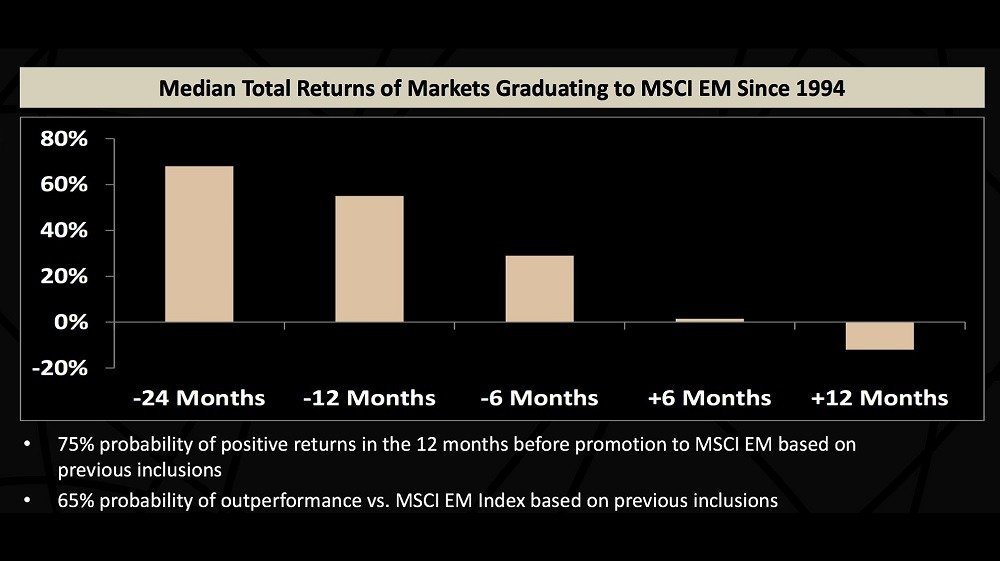

As a final note, I’d like to share a chart with you from Passport Capital showing the median total returns of markets graduating to the MSCI EM since 1994. If you can’t beat the indexers, you might as well make money off of them by getting there first.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business2 weeks ago

Business2 weeks agoLegal Process for Dividing Real Estate Inheritance

-

Fintech12 hours ago

Fintech12 hours agoJPMorgan’s Data Fees Shake Fintech: PayPal Takes a Hit

-

Fintech1 week ago

Fintech1 week agoPUMP ICO Raises Eyebrows: Cash Grab or Meme Coin Meltdown?

-

Africa3 days ago

Africa3 days agoSurging Expenditures Widen Morocco’s Budget Deficit Despite Revenue Growth

You must be logged in to post a comment Login