Featured

Things to know about investing in the automotive sector

How well do you understand the investment side of big-name automotive companies like Ford, Toyota or Honda?

Everyone has heard of companies such as Ford, General Motors, Hyundai, Volkswagen, Toyota, Honda, and the list goes on. But not many have an understanding of the investment side of these companies. Unlike other industries, the automotive industry has its own set of characteristics. Investors looking to invest in any of the automotive companies should be aware of what they are getting into because it can make a difference between making a profit or a loss.

Automotive companies are highly cyclical

Automotive companies are highly cyclical, which means if the economy is doing well, then generally, automotive companies will do well also. The reason for this is consumers generally make large purchases when the economy is humming along. During a recession, consumers are less likely to buy.

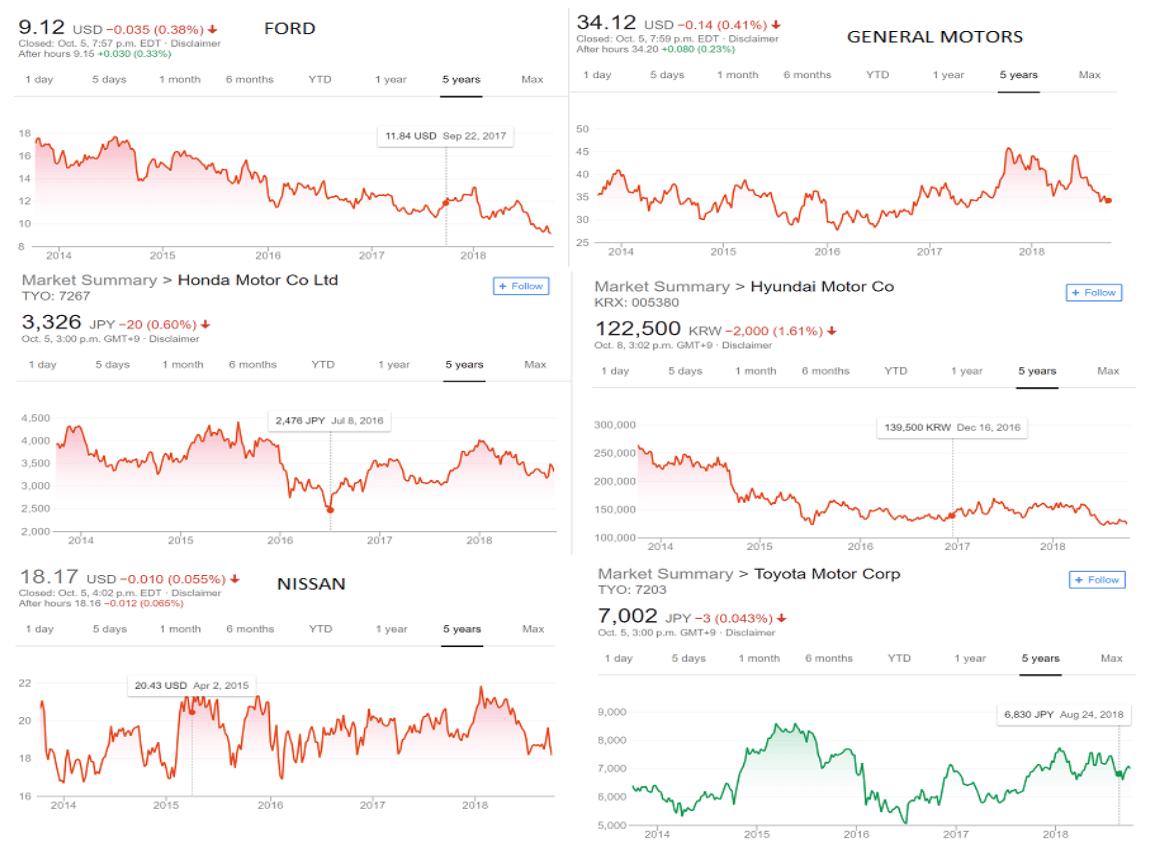

Below is a five-year stock market performance of six global automotive companies:

© Sherif Samy

What is interesting to note here is the stock price of each of these companies above are fluctuating between its five-year high and lows (seesawing over time). That is why the buy and hold strategy will likely not work here.

Investors looking to invest in the auto industry should try to anticipate when the stock is at its low and sell it when its high. One way of determining this is to see if the economy is just recovering from a recession because generally car sales tend to pick up once the economy starts booming again.

Automotive companies are too big to fail

The automotive companies employ thousands of people and through its suppliers’ network, this number is probably in the hundreds of thousands. Employing so many people of this magnitude means these companies are too big to fail.

There are huge financial consequences if any of the automotive companies go under. This is why GM and Chrysler were given a government bailout in 2009 and emerged from bankruptcy with assistance from the U.S. government. For Chrysler, this bailout was not the first time; in 1979 the U.S. government had bailed it out once before.

From the investor’s perspective, this means that although the stock price of these companies may fall, it will never reach the point where the company goes to zero. So investors who are thinking about investing in automotive stocks will know that the likelihood of completely losing out on the investment is low.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Crypto2 days ago

Crypto2 days agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip

-

Business1 week ago

Business1 week agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Fintech6 days ago

Fintech6 days agoFirst Regulated Blockchain Stock Trade Launches in the United States

You must be logged in to post a comment Login