Business

TopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [IQ Option Affiliate Program Review]

If you saw what China just did to the US stock market and your first thought was “how do I make affiliate $$$ on this?”, then boy do we got something for you. And if that wasn’t your first thought but you’d still like to make some money, then stick around. Just don’t skip the IQ Option Affiliate Program review along the way unless you’re prepared to turn your nose up to 80% rev share commissions.

Quick Disclosure: We’re about to tell you how the IQ Option Affiliate Program is a great partner program for sportsbook offers. And we really mean it. Just know that if you click on an IQ Option Affiliate Program link, we may earn a small commission. Your choice.

Quick question.

What do this…

… and this…

… have in common?

Answer — it’s not what you think.

Read on for nice affiliate profits.

TopRanked.io Affiliate Partner Program of the Week — IQ Option Affiliate Program

Alright, so in a minute, we’re gonna tell you how to make some money off of this whole Deepseek moment.

But to do that, you’re gonna need a nice program that’ll help you help others to short sell stocks as quickly and easily as possible (and pay you a killer commission for doing so).

And that pretty much leaves us with one option — the IQ Option Affiliate Program.

Let’s take a look.

IQ Option Affiliate Program — The Product

Alright, so we already know the IQ Option Affiliate Program is all about selling a trading platform. And we all know the trading platform behind the IQ Option Affiliate Program lets you short sell stocks.

What else do you wanna know? Some specifics?

Okay, here goes:

- The main ‘vehicle’ for short selling behind the IQ Option Affiliate Program are CFDs — a “contract for difference”.

- With the IQ Option Affiliate Program, you can also promote crypto and forex CFDs, along with regular stocks.

- You can promote the IQ Option Affiliate Program in 178 different countries.

- The trading platform behind the IQ Option Affiliate Program also has a bunch of nice bells and whistles you can use to drive conversions, like newsfeeds and alerts, slick trading software, and more.

Anyway, that’s enough on the IQ Option Affiliate Program’s product for now. Let’s get to the stuff you really wanna know about the IQ Option Affiliate Program.

IQ Option Affiliate Program — The Commissions

Alright, hold onto your jaw because I’m about to make it drop.

The IQ Option Affiliate Program pays up to 80% rev share commissions.

Yes, you read that right — the IQ Option Affiliate Program pays up to 80% commissions.

Now, obviously, the IQ Option Affiliate Program is like any other ‘trading’ affiliate program — what you’re actually getting a cut of is the brokerage commissions. So don’t be thinking you’re gonna get 80% of whatever your referrals trade.

But that’s still a lot. Especially if you consider the IQ Option Affiliate Program pays up to 80%.

Here’s an example.

Right now, the “spread” on Tesla is 0.055%.

If you take your 80% cut from that, that’ll leave you with 0.044%.

And 0.044% of, let’s say, $100k, is $44.

Now, I know that doesn’t sound like much.

But don’t forget, with the IQ Option Affiliate Program, you’ll mostly be selling to active traders, not “buy and hold” types.

And that means your IQ Option Affiliate Program referrals could be buying and selling enormous volumes of stock each and every day. And every time they do, you’re getting a few bucks sent your way.

Multiply those few bucks by a few thousand trades per month, and I think you’ll agree, the IQ Option Affiliate Program can be very, very profitable.

But if you don’t believe me and you still find yourself turned off by those tiny numbers, then fear not. The IQ Option Affiliate Program also offers CPA deals if that’s more your style.

Or, you can even mix and match the two offers in the same IQ Option Affiliate Program account.

IQ Option Affiliate Program — Next Steps

Let’s be serious for a minute here — try and name me one other affiliate program that offers 80% rev share?

Chances are, you’re not gonna think of too many besides the IQ Option Affiliate Program.

But hey, I get it. I know there’s more to life than commissions. And that’s why we’ve got a full, in-depth IQ Option Affiliate Program review over on TopRanked.io.

Or, if you’d rather not wait to get your hands on those juicy 80% commissions, head here to sign up for the IQ Option Affiliate Program today.

Affiliate News Takeaways — Deepseek Spells Deeps**t for US Stocks

By now, most of you have probably heard the Deepseek news.

What you might not have thought about is how this little “event” could potentially make you some serious affiliate bucks.

But I’ll get to that in a moment.

First things first, let me get the 5% of our audience who’re currently living under their respective rocks up to speed.

Deepseek — Here’s What You Missed

A little under 2 weeks ago, some shady Chinese startup unleashed a new AI model.

That startup, Deepseek, said it was just a side project.

At first, not much happened. Then, over the weekend, things went viral.

That caught the attention of investors who all responded “not stonks” in unison.

And so, come Monday, a bunch of stocks tanked.

Especially tech stocks.

And especially Nvidia, which saw about $600 billion creamed off the top of its market cap.

So, what makes Deepseek so special?

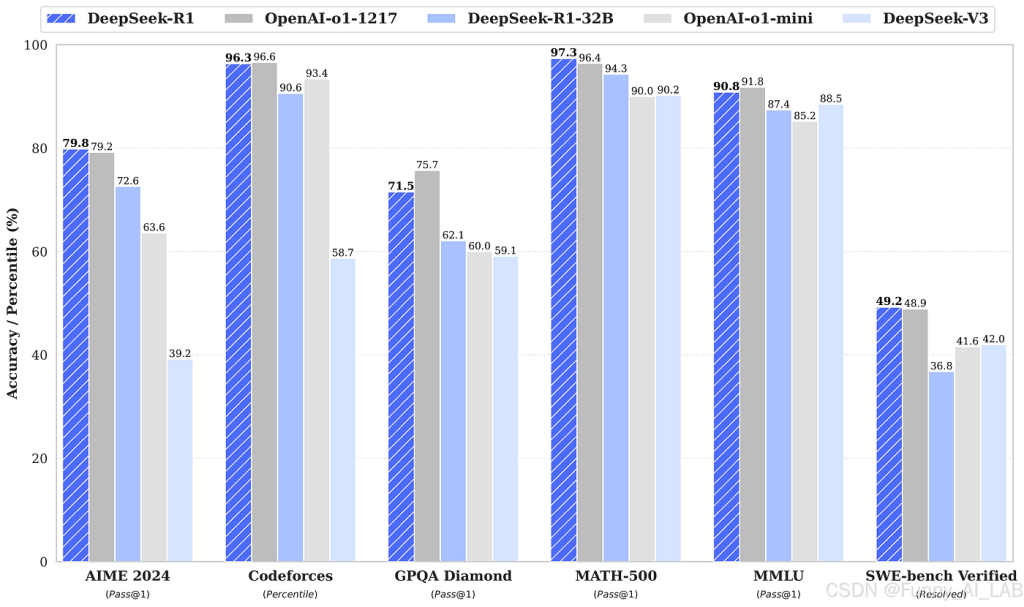

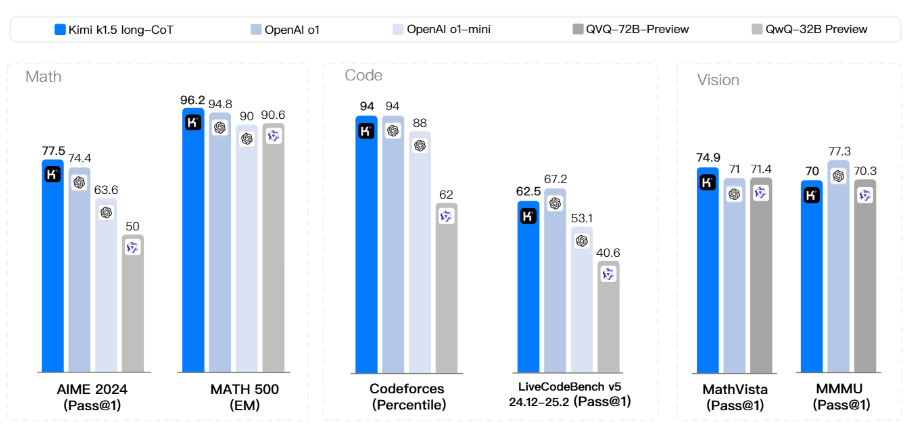

Well, for starters, it’s basically as good as OpenAI’s o1 model.

Here’s the benchmarks.

But as if that wasn’t enough, Deepseek also claims to have done it waaayyyy cheaper than OpenAI.

But some of that stuff’s a little bit… questionable.

For example, no one really knows how much it cost to train.

A popular claim you’ll see a lot of says “they did it for under $6 million.”

But, if you follow the <$6 million dollar claim all the way down, you eventually end up on this article. That was published on Jan 1 in the South China Morning Post (weeks before R1 dropped), and was talking specifically about Deepseek’s V3 model — an earlier, inferior model.

But here’s the bit that is true.

Deepseek’s way way way cheaper to run.

Right now, it’s “R1” model — the model that’s equivalent to OpenAI’s o1 — costs $2.19/million output tokens, and $0.55/million input tokens.

Compared to OpenAI’s prices ($60/million output tokens, $15/million input tokens), that’s pretty much 30x cheaper.

In fact, it’s even cheaper than GPT-4o by about 4-5x.

Them’s be some crazy low prices.

Naturally, at this point Altman and his seedy little band of specious grifters are mad. So now, they’re releasing a bunch of false or vastly hypocritical stories to fight back.

The favorite that everyone seems to have picked up on is OpenAI crying about how Deepseek violated its Terms of Service by using ChatGPT outputs to train its models.

The OpenAI argument basically goes something like this:

- When we, OpenAI, violate the Terms of Service of basically every site on the internet, it’s a good thing.

- When anyone violates our Terms of Service, it’s a bad thing.

But hey, calling that hypocritical is just the take of a bunch of poor boy internet users.

And let’s face it, poor boy internet users are nothing compared to OpenAI’s next $40 billion raise, which will no doubt go along way towards proving in the courts that it’s not a violation of terms of service/copyright/whatever so long as it’s OpenAI doing it… but it is when anyone else does it.

Then, there’s also a bunch of empty claims about how all Deepseek did was “distill” OpenAI’s pioneering work.

Basically, it’s a grown up equivalent of complaining to the teacher that someone copied your homework.

But that whole “they just copied us” thing kinda doesn’t stand up if you listen to anyone who knows what they’re talking about… so long as they don’t have a vested interest in keeping the OpenAI pyramid scheme alive.

For instance, during a lengthy CNBC interview, Perplexity’s CEO was all like, “actually, if you look at their research, there’s some really innovative stuff in here.” (Not his actual words… but it was a really long interview so I had to sum it up.)

So now you’re all caught up, here’s the stuff you probably missed.

And Here’s What You Probably Missed

If you thought Deepseek was all China had to offer, then think again.

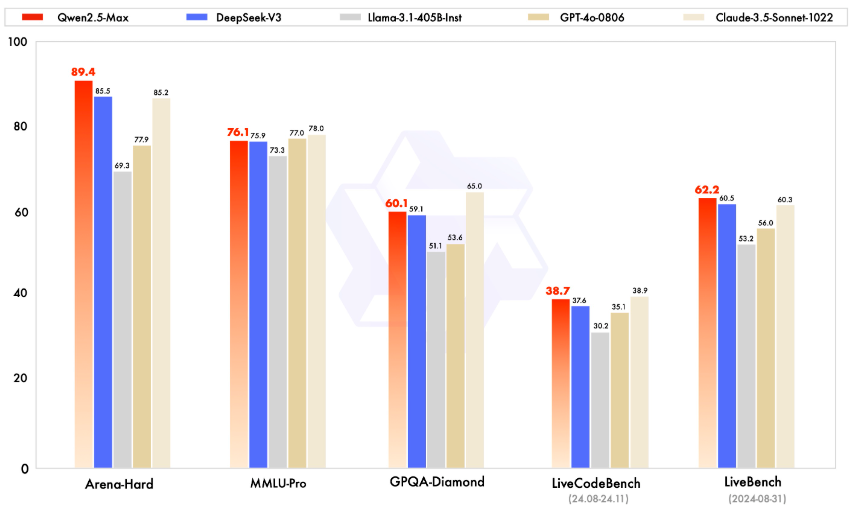

For starters, just a couple of days ago, Alibaba dropped its Qwen2.5 model. And that either outperforms, or is pretty darn close to GPT-4o and Claude Sonnet 3.5.

But that’s not even the big one.

Enter “Kimi K”. Specifically, Kimi K1.5 — a new model that some Chinese group called “Moonshot AI” just dropped.

That’s just given OpenAI’s o1 a proper spanking in the benchmarks, too.

Now, while the makers of Kimi K have dropped all of their research here, just like Deepseek has, it’s also pretty light on “details”.

You know, like how much it cost to train. Stuff like that.

But, honestly, there’s a pretty good chance that all of that’s besides the point.

And if that is besides the point, then there’s a chance to make some serious affiliate bucks here.

Coincidence?

Look, this next bit’s going to get a bit conspiratorial. So if you’re looking for something a bit more concrete… well, then, this probably isn’t for you.

So here goes.

Let’s begin with one of the more benign conspiracy theories. This one’s at least got the backing of Bill Ackman.

Ackman, and a few other conspiratorial nutjobs seem to think Deepseek was used by High-Flyer (the Chinese hedge fund behind Deepseek) to turn a quick profit. Basically, the idea here is that High-Flyer bought up a bunch of short-dated put options on stocks like Nvidia, unleashed Deepseek, then sat back and watched their Robinhood accounts go ka-ching as.

But that only explains Deepseek.

What about all the other stuff coming out of China?

Well, here’s another conspiracy theory.

Did you notice how Trump’s softened his stance on Chinese tariffs since he took office on January 20?

And that’s despite the fact he’s remained just as firm on Mexico and Canada?

Wanna know why?

Here’s a hint — do you know what else happened on January 20?

Yep, that’s the day Deepseek’s OpenAI-killing model dropped.

You might have also noticed governments getting involved in the whole saga.

On the US side, you’ve got Trump’s AI and Crypto “czar” (David Sacks) basically parroting whatever Altman tells him to say.

And on the Chinese side, you’ve got the Chinese Communist Party blaming American hackers for the ongoing cyber attacks being fired Deepseek’s way.

Gotta love the CCP.

Anyway, put all of that together, and you kinda get something that smells like there’s something more than just a little free market capitalism going on here.

It’s kinda almost like China’s making a thinly-veiled threat here — “continue with this anti-China stuff, and we’ll turn your stonks into not stonks quicker than you can type proomt enjinir.”

Deepseek… Kimi K… all that is just a warning.

Takeaway

Look, there are two takeaways here.

The obvious one is this — if you’ve had some hairbrained idea for an AI-based project, but got turned off by the costs, now’s the moment to reconsider. This stuff’s getting insanely cheap to the point that it’s basically free.

But here’s another idea that I think might be worth taking a bet on — a China vs US economic war.

What do I mean here?

Well, at this stage, it’s too early to say for sure if this will be a thing.

But let’s imagine that next week Trump drops some off-the-cuff comment about how he’s going to destroy China. And in response, China gives us another Deepseek moment.

There’s a thousand and one of these moments China could create. For example, maybe China decides to put export restrictions on batteries and battery metals to limit US auto makers from accessing its markets.

That would hurt Tesla, which currently relies on China for about 40% of its batteries.

Or maybe, just maybe, the CCP might decide to subsidize cloud computing costs on Huawei and Alibaba Cloud.

That would give us one very sad Bezos.

Or maybe, if they wanted to get really cruel, China could put export restrictions on a bunch of pharmaceutical ingredients, many of which the US pharma industry is dependent on.

Hopefully, you’re getting the point.

But what’s this got to do with affiliate marketing?

Well, here’s an idea.

Build an audience predicting stock/financial market moves based on different “If China does this” scenarios.

You can literally get an AI to spit out dozens of ideas.

Here’s a few I got ChatGPT to spit out:

- Bans chip material exports (e.g., gallium, germanium) → Chip stocks (INTC, QCOM, TSM) tank

- Disrupts Taiwan supply chain → Apple (AAPL), semiconductor ETFs crash

- Restricts API exports for U.S. pharmaceuticals → Big Pharma (PFE, JNJ) panic

- Holds back medical equipment exports → Healthcare stocks slide

- Cuts LNG imports, tanking U.S. energy prices → Energy stocks (XOM, CVX) dip

- Dumps cheap solar panels & EVs globally → U.S. renewables (ENPH, FSLR) struggle, EV makers (TSLA, F, GM) crash

- Strengthens ties with Russia & OPEC+ → Oil spikes, inflation fears hit stocks

- Limits rare earth exports (neodymium, terbium, etc.) → Tesla (TSLA), defense stocks (LMT, RTX) fall

- Restricts lithium & cobalt exports → EV makers (TSLA, F, GM) crash

- China launches ultra-cheap AI models → Big Tech (GOOGL, MSFT, NVDA) drop

So go get Deepseek/whatever to spin you up a bunch of content based around this. Then go build a following somewhere with it.

And then, once you have your following, help them do what High-Flyer probably did — take out a bunch of put options on whatever US stocks China’s gonna tank next.

The IQ Option Affiliate Program might help.

Closing Thought

In case you haven’t noticed, there’s one word that’s getting a pretty heavy work out these last couple of weeks.

That word is Uncertain.

The Fed’s uncertain.

VC’s are every synonym of uncertain.

Drug prices and the future of the IRA are uncertain.

Wall Street is uncertain.

Basically, everyone’s uncertain.

But here’s a funny coincidence.

Today, I was looking at a new affiliate program we’ll be publishing a review for on TopRanked.io very, very soon.

And as I was looking at it, I came across something I’d never seen before — this affiliate program’s product is a sales/CRM suite geared towards “activity-based selling”.

Now, maybe some of you have heard of it. But for the rest of us, a quick little explainer is in order.

Activity-based selling is a sales methodology that’s built on accepting that you can’t control the outcomes of your sales process.

You know, stuff like the number of sales you make, or how big the $$$ values on your deals are. That kinda stuff.

You can’t control it.

You might even say it’s… uncertain.

But, before you write activity-based selling as some sort of nihilistic religion for failed salespeople, there is some light at the end of the tunnel.

Activity-based selling also says you do have control.

But that control is over the activities that lead to sales outcomes.

Hence the name — activity-based selling

And here’s where it gets really nice — you can apply this to everything in life.

Basically, you accept what you can’t control, and work on gaining control of the activities that lead to desirable outcomes.

Need a concrete example?

Alright.

As an affiliate, you can’t really control how big your affiliate check is going to be each month.

But you can control a bunch of activities that lead to you receiving a big affiliate check. So that’s what you should focus on — the activities that influence your affiliate check.

Like the idea of that?

Good.

Now here’s an activity that will have a big positive impact on your affiliate earnings — go sign up for a killer affiliate program right now. The IQ Option Affiliate Program would be a good place to start.

__

(Featured image by SevenStorm JUHASZIMRUS via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Markets2 weeks ago

Markets2 weeks agoRising U.S. Debt and Growing Financial Risks

-

Biotech4 days ago

Biotech4 days agoAI and Real-World Data Boost Oncology Clinical Research

-

Africa2 weeks ago

Africa2 weeks agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances

-

Africa6 days ago

Africa6 days agoMorocco’s Industrial Activity Stalls in January 2026