Featured

Lack of Semiconductors Leads to 15% Drop in Vehicle Production in Spain So Far This Year

The semiconductors shortage is affecting the production of vehicles around the globe. Spain remains the world’s eighth-largest vehicle producer ahead of Brazil. In February, exports fell by 12.5% compared to the same month last year, with 160,053 vehicles in total shipped outside Spain’s borders. For the cumulative 2022, a decline of 14.1% is recorded, with 315,800 units shipped.

The shortage of semiconductors continues to take its toll on Spanish factories. As expected, the first quarter of the year was going to be complicated due to the lack of these components.

In February, vehicle production fell by 12.9% year-on-year, with a total of 189,145 units manufactured. Thus, in the first two months of the year, vehicle production has fallen by 15.2% compared to the same period of the previous year, to 369,053 units assembled, according to data from Anfac, the association of car and truck manufacturers.

Thus, so far this year, production is down 25.4% compared to the same period in 2019, before the pandemic, while accounting for 26.5% less than in the first two months of 2020. These data do not yet fully reflect the conflict in Ukraine, given that it began on February 24th.

Find more about the semiconductors shortage and how it affects the vehicle production industry with our companion app. The Born2Invest team of experienced journalists brings you the most important financial headlines of the day so you can stay informed.

With these figures, Spain remains the world’s eighth-largest vehicle producer ahead of Brazil, a position it regained last January after ending 2021 as the ninth-largest producer

Thus, Brazil has produced a total of 311,352 vehicles in the first two months of the year, which is 21.6% less year-on-year, according to data from the Brazilian manufacturers’ association Anfavea.

For Anfac, the lack of components that was marking the pace of vehicle production, not only in Spain but throughout Europe, has been compounded in recent weeks by the shortage of certain components, such as cables, aluminum, nickel, or palladium, from Ukraine and Russia. Likewise, the increase in energy costs, derived from the economic sanctions imposed on Russia, the main exporter of gas and oil to Europe, is a conditioning factor that also affects vehicle factories.

In addition, the main European markets continue to record registration figures well below those of the pre-pandemic period. Specifically, falls of 28% in Germany, 33% in France, or 28% in the United Kingdom have been recorded in the two months of 2022 compared to 2019.

The production of alternative vehicles (electric vehicles, plug-in hybrids, non-plug-in hybrids, LPG, and natural gas) in February reached 22,100 units, which represents a drop of 4.5% compared to the previous year, mainly due to the sharp decline in the production of gas and LPG vehicles. Despite this figure, alternative vehicles increased their share of production by one point, representing 11.7% of total national production.

Electrified vehicles continue to grow in total production, accumulating 9.8% of the manufacturing share in February and 10.4% in the cumulative two months of 2022.

Spain registered a drop in exports

In February, exports fell by 12.5% compared to the same month last year, with 160,053 vehicles in total shipped outside Spain’s borders. For the cumulative 2022, a decline of 14.1% is recorded, with 315,800 units shipped.

The slow recovery of the main European markets is the main factor behind the drop in vehicle exports. In February, shipments to European markets accounted for 65.6% of the total, a total of 3 percentage points less than February 2021.

Anfac’s CEO, José López-Tafall, explained that “the shortage and rising cost of basic materials together with the increase in energy costs complicate a situation that is already difficult for the entire value chain of the sector.”

__

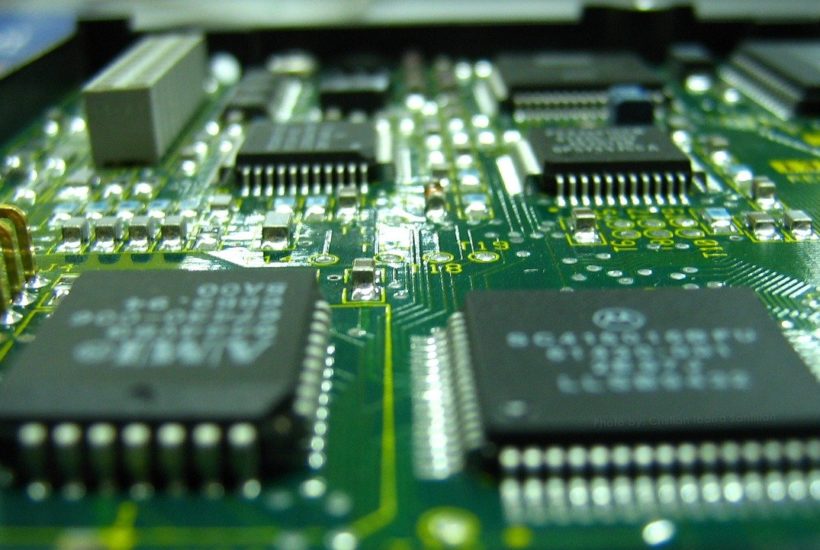

(Featured image by CristianIs via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in elEconomista.es, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Crypto3 days ago

Crypto3 days agoBitcoin Surges Past $69K as Ethereum Staking Hits Record Levels

-

Impact Investing1 week ago

Impact Investing1 week agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]