Biotech

Laminar Pharma Seeks €30 Million to Quell Glioblastoma

Of the total amount that Laminar Pharma estimates it needs, $10.7 million (€10 million) correspond to bank financing already agreed with Banca March. In addition, the company has just opened a round with Capital Cell. The majority of the resources raised by the company will be dedicated to the clinical study of LAM561 and the rest will go to various preclinical and clinical studies

Laminar Pharma is in search of financing, to develop its drug against brain tumors. The Balearic company specialized in the rational design of drugs needs $32 million (€30 million) to be able to carry out clinical studies of its product LAM561, indicated against glioblastoma, an aggressive type of cancer that is generated in the brain or spinal cord.

This was recognized by Pablo Escribá, CEO and founder of Laminar Pharma, to PlantaDoce, which wants to launch this product on the market at the end of 2023 or the beginning of 2024. Of the total amount that Laminar Pharma estimates it needs, $10.7 million (€10 million) correspond to bank financing already agreed with Banca March, according to the company’s founder.

Regarding the other $21.4 million (€20 million), the company has already made a move and has just opened a financing round of $1.7 million (€1.6 million) through the crowdfunding platform Capital Cell, with which it has so far raised around $750,000 (€700,000) with the participation of more than one hundred investors. In 2019, Laminar Pharma closed its first round via Capital Cell raising $2.14 million (€2 million).

Read more about Laminar Pharma and find the most important financial news of the day with the Born2Invest mobile app.

Laminar Pharma is confident of launching its drug against glioblastoma by 2024 at the latest

The majority of the resources raised by the company will be dedicated to the clinical study of LAM561 and the rest will go to various preclinical and clinical studies with investigational drugs in Laminar Pharma’s portfolio.

Laminar Pharma is a company working on the design of innovative drugs based on a proprietary technology platform called membrane lipid therapy (melitherapy). Most drugs are directed towards proteins or nucleic acids, but until now no therapies have been directed towards the other large group of macromolecules, the lipids that make up cell membranes.

Since 2006, the company has been researching the lipid alterations that occur in the cell membrane, studying their relationship with various pathological processes and developing pioneering and innovative therapeutic molecules to improve the quality of life of people affected by serious diseases.

LAM561 is currently in clinical phase III

LAM561 is currently in clinical phase III and is expected to apply for marketing approval within a year. The clinical trial aims to make LAM561 the first-line and standard of care treatment for glioblastoma. The company is 80% owned by a group of fifteen to twenty shareholders, including the founder of Laminar Pharma.

Pablo Escribá invented and developed melitherapy and is the co-inventor of the patents under development by Laminar Pharma and its licensees. In addition, he has conducted research studies in the United States (New York, Kansas City, and Charleston), Switzerland, and Hungary.

Another of the company’s shareholders is the Matutes family. In fact, the board of Laminar Pharma includes Manuel Matutes Mestre, founding partner of Aguaduna.com, Kei Cities, and director of the Palladium Hotel group.

__

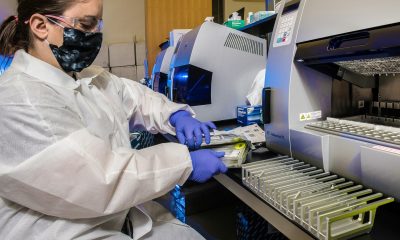

(Featured image by Lucas Vasques via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Crypto17 hours ago

Crypto17 hours agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip

-

Business1 week ago

Business1 week agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Fintech5 days ago

Fintech5 days agoFirst Regulated Blockchain Stock Trade Launches in the United States