Featured

Last week in agriculture: what happened with wheat, corn, oats and soybeans

Corn was lower and Oats closed a little higher last week. Soybeans and soybean oil were lower too. The market was also affected by news headlines about the trade talks with China. It appears that a Phase One deal is progressing well and that tariffs on both sides would be cut back as a part of any deal and this has helped to support futures for much of the week.

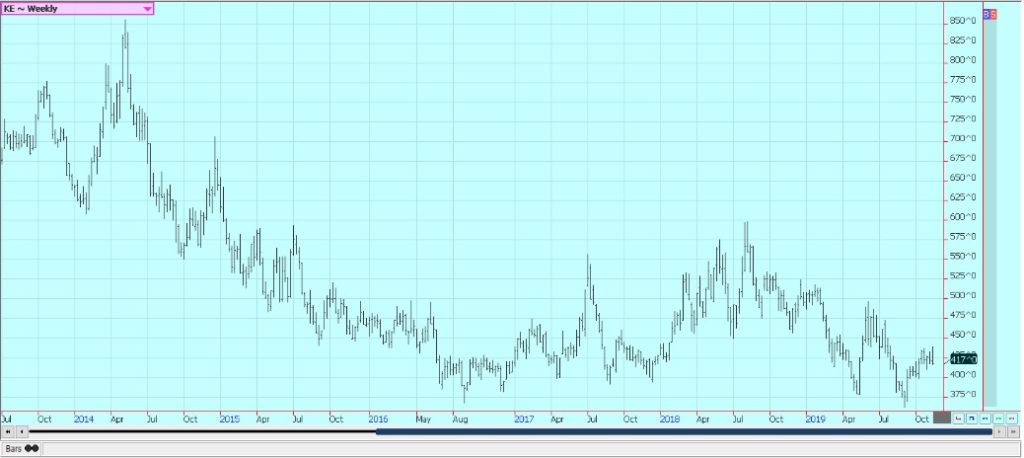

Wheat

Wheat markets were lower on Friday and lower for the week. Minneapolis and HRW markets were the weakest on ideas of plentiful supplies of higher protein Wheat in the world market. SRW is finding some support on reduced production but also faces poor demand. Production increases in the northern parts of the world are greater than production decreases in southern countries and that has hurt the bull case for improved US Wheat demand. World prices have been weaker in the last couple of weeks and this was seen by the Egyptian tender where even the EU could not compete with Russia and eastern Europe. World prices will still be dictated by what happens in Europe and the Black Sea area and US prices will most likely remain a follower as the US tries to compete for sales. Chart patterns on daily and weekly charts imply more down pressure on prices this week.

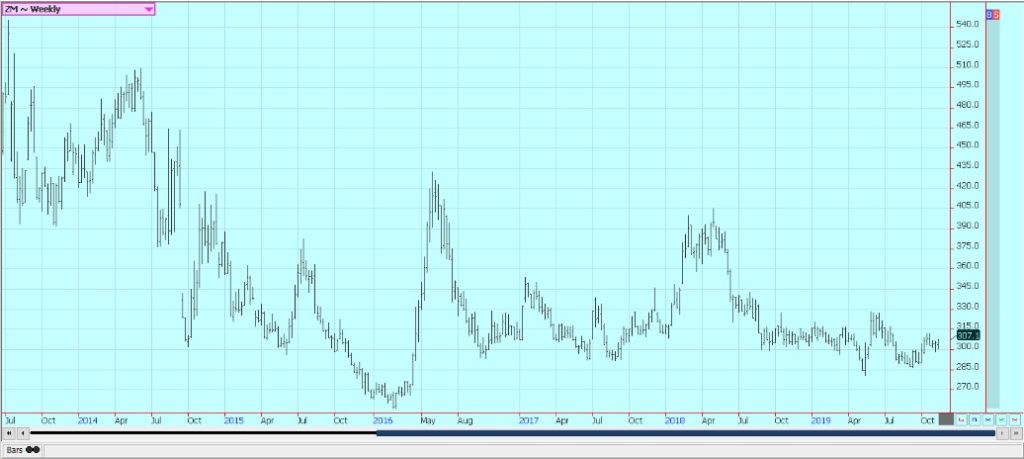

Corn

Corn was lower and Oats closed a little higher last week. Trends are down on the daily and weekly charts for Corn. Oats still look ready to rally more in the coming weeks based on the weekly charts but shows the potential for a double top to form on the daily charts. Corn is still feeling harvest pressure and the lack of demand. The export sales report was released on Friday and showed improved demand but not nearly enough improvement for the market to change its theme of overall weak demand. Ethanol demand was improved as well. Feed demand should be strong right now as it has been very cold in the Great Plains and Midwest. Warmer temperatures have returned to the Great Plains but Midwest temperatures remain below normal although are much warmer than last week. Producers are about done with the Soybeans harvest and many are back harvesting Corn. Reports still indicate wide variability in yields. USDA is still expected to drop yields and production in its January reports. But the problem for Corn is the demand and US Corn remains high priced in the world market.

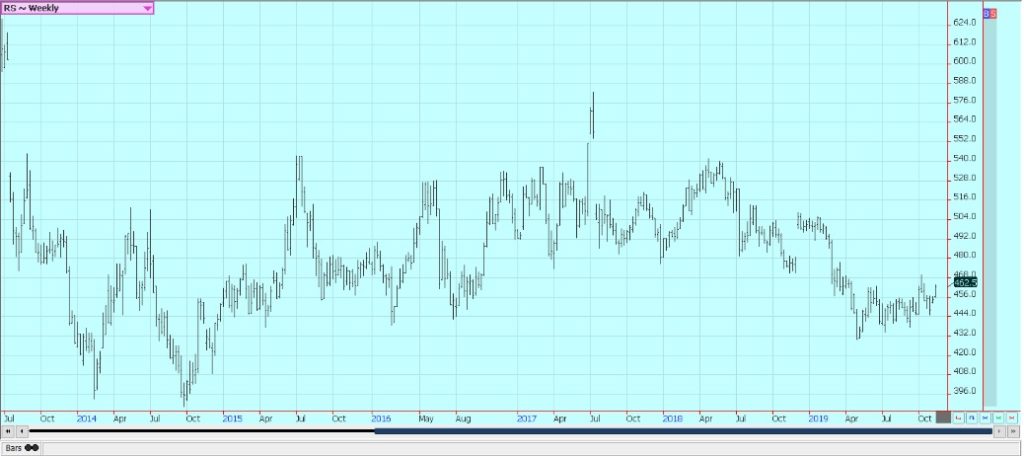

Soybeans and Soybean Meal

Soybeans were slightly lower for the week and Soybean Meal was higher. Soybean Oil was lower. The US harvest is entering its final stages now and many producers are putting their Soybeans into storage and not selling. This has caused basis levels to firm in the country and at the Gulf of Mexico. Domestic demand was strong in the NOPA data on Friday and implied that USDA might have been too quick to cut crusher demand in its monthly supply and demand estimates released a couple of weeks ago. The market was also affected by news headlines about the trade talks with China. Word most of the week that a Phase One deal was progressing well and that tariffs on both sides would be cut back as a part of any deal helped support futures for much of the week. USDA showed that China continued to be a strong buyer in the US market in its weekly reports on Friday. The market has not been that strong given the great export sales reports and news of more sales on the daily system.

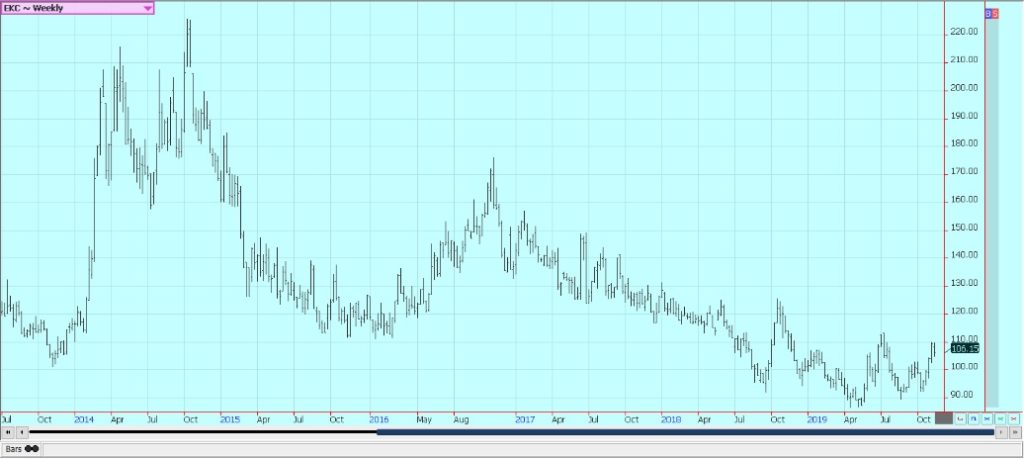

Rice

Rice was a little higher on Friday and higher for the week. The weekly charts still display a bullish market and higher prices this week would be positive for the medium term. Demand for US Rice remains generally positive although the weekly export sales report was not that string. It was better than last week but still below the rolling average of weekly sales. The export sales pace in general has been very good and USDA could be forced to increase export demand and cut ending stocks estimate in future reports. The US domestic market is now quiet with the harvest mostly done and no one real interested in selling. Mills and exporters are thought to be covered but anyone who needs to buy paddy Rice from farmers will be forced not find much selling interest at all.

Palm Oil and Vegetable Oils

World vegetable oils markets were lower on speculative selling tied to profit taking and ideas that vegetable oils were pricing themselves above the demand. Palm Oil got positive production news from MPOB to go with stronger export news that has been seen for the last few weeks. MPOB showed that production in October was 2.5% lower than in September and this was less than expectations. Demand increased by 16.43% for Palm Oil exports and 12.7% for Palm Kernel exports. Ending stocks were down 4% from a month ago. The increase in demand has been dramatic and could continue as China has been buying. Malaysia signed trade deals with China for another 1.5 million tons in 2020 and India for another 1.0 million tons. Soybean Oil was lower and was the weakest market. Trends are up in Palm Oil but less well defined for Soybean Oil after a failed attempt to move higher. Canola was higher last week as the harvest is almost over. Progress has been slow but producers have been active and have been delivering into the commercial system. The rate of deliveries is starting to back down now as farmers prepare to store the rest of the crop for the Winter.

Cotton

Cotton was little changed last week. The market got some good news on Friday as USDA reported the strongest week of export sales for the year. China was included as a buyer which has been considered important for Cotton demand moving forward. China has also been buying Cotton from Brazil as it needs higher quality Cotton to blend with its domestic production. The market also displayed little reaction to the lower than expected production and ending stocks estimates released by USDA the previous week. The market has not been able to move a lot in terms of price for the last month as the harvest has been ongoing amid some stressful conditions. Last week featured very cold temperatures and some worry about quality but not enough to affect prices much. The harvest will start to wind down over the next couple of weeks and certified inventories have been steadily growing but will soon start to level off. The market could hold to a sideways to weaker pattern until the tail end of the harvest.

Frozen Concentrated Orange Juice and Citrus

FCOJ was higher for the week in narrow range trading. Overall chart patterns suggest that the market is in a trading range. Futures had held the same range since April. USDA showed strong production last month at more than 77 million boxes of Oranges from Florida and demand remains weaker. Good growing conditions and increased oranges production estimates by USDA this season have been bearish. The weather has been great for the trees as there have been frequent periods of showers and no severe storms so far this year. Many areas have been dry lately and irrigation is being used. Crop yields and quality should be high for Florida this year. Inventories of FCOJ in the state are high and are more than 33% above last year.

Coffee

Futures were lower for the week in New York and a little higher in London. Rains were reported in Brazil Coffee areas to help ideas of big production in the coming year. The Brazilian crop is developing but some exporters say they are out of previous crop supplies to sell. The Asian harvest is underway but producers do not seem to be selling on ideas that prices are too low to provide profits. Vietnam exports remain behind a year ago, but the market anticipates bigger offers as producers and traders will need to create new storage space and are expected to do this by selling old crop Coffee. Reports from Brazil indicate that flowering is off to a very good start. Rains are expected again in Coffee areas this week. Overall the Coffee areas remain in a rain deficit but have had some timely rains to start the flowering. Vietnam crops are thought to be big despite some uneven growing conditions this year. A tropical system hit production areas in the last couple of weeks but so far there have been reports of some damage and losses.

Sugar

Both markets closed higher for the week despite lower prices on Friday. Overall charts trends are trying to turn up for the medium term in New York but are sideways in London. Reports indicate that little is on offer from India. Thailand might also have less this year due to reduced planted area and erratic rains during the monsoon season. There is still more than enough Sugar for any demand and that India will have to sell sooner or later. Reports from India indicate that the country is seeing relatively good growing conditions and still holds large inventories from last year. However, these supplies are apparently not moving and this could be due to less government subsidy for mills and exporters. Reports of improving weather in Brazil imply good crops there. The Real has been trading near recent lows against the US Dollar and this should encourage export sales from Brazil as well. ABIOVE showed a big increase in cane processing in the last two weeks so the industry is ramping up to sell both Sugar and Ethanol.

Cocoa

Futures closed sharply higher and the weekly charts imply that a significant rally is underway. It seems that the market is short Cocoa for the demand even through arrivals have been stronger so far this season from West Africa. Harvest is now active in West Africa and reports are that good volumes and quality are expected. Ideas are that demand is currently very strong due to the current price action. The reports from West Africa imply that a big harvest is possible in the region. Ivory Coast arrivals are strong and are above year ago levels. The weather in Ivory Coast has improved due to reports of frequent showers. The precipitation is a little less now so there are no real concerns about disease. Ideas are that the next crop will be very good. Both Ivory Coast and Ghana are doing what they can do boost Cocoa prices and are inviting Nigeria and Cameroon into the minimum pricing system they are creating.

—

(Featured image by Warren Wong via Unsplash)

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results.

Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa1 week ago

Africa1 week agoAir Algérie Expands African Partnerships

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum Pushes AI Integration With ERC-8004 and Vision for Autonomous Agents

-

Markets3 days ago

Markets3 days agoRising U.S. Debt and Growing Financial Risks

-

Business1 week ago

Business1 week agoDow Jones Near Record Highs Amid Bullish Momentum and Bearish Long-Term Fears