Business

Corn and wheat markets move lower amid higher supplies

USDA’s report showed higher than expected supplies for both corn and wheat at 8.605 billion bushels and 1.591 billion bushels, respectively.

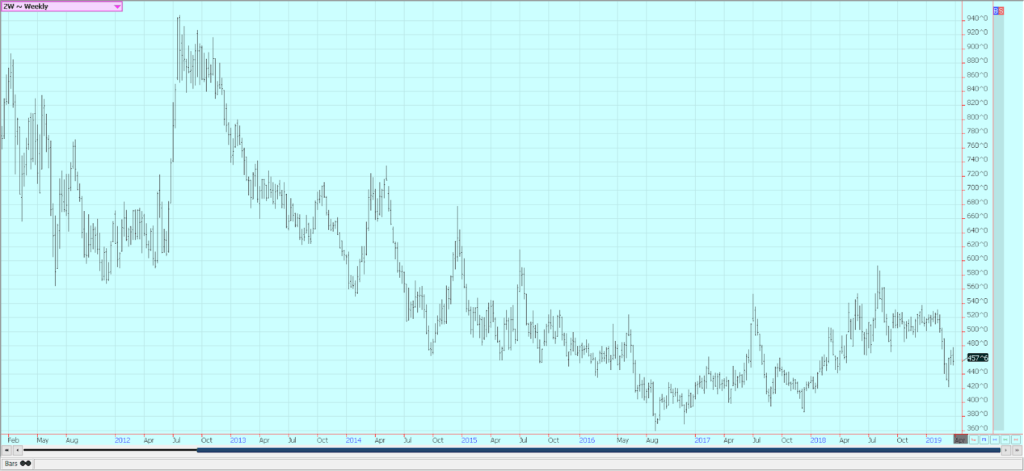

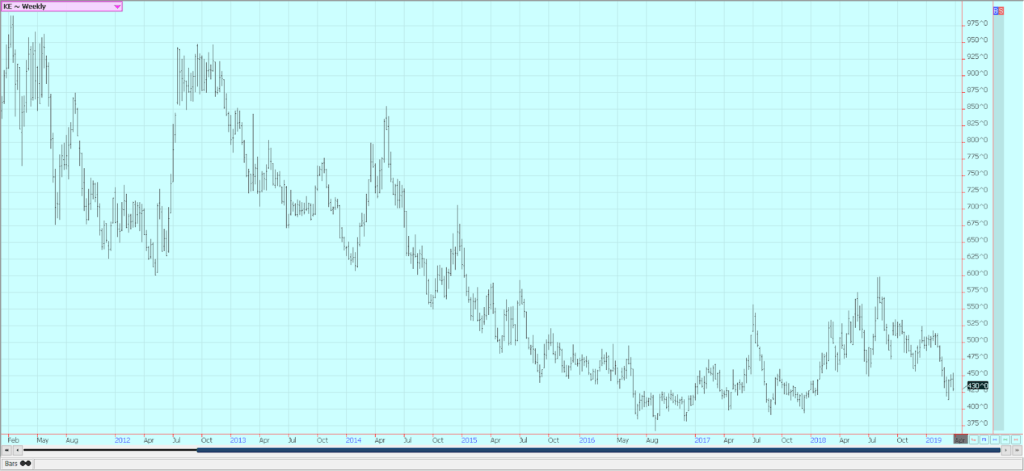

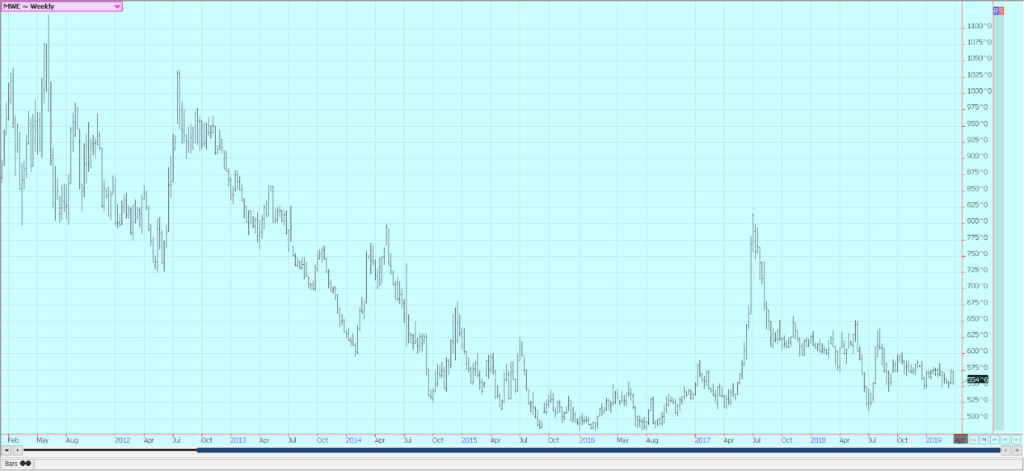

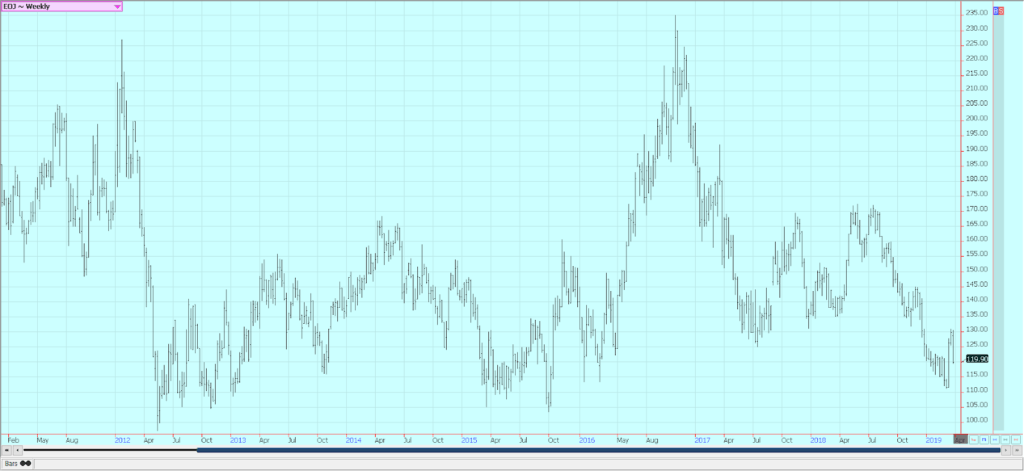

Wheat

Winter wheat markets were lower last week, with much of the selling coming in the last half of the week in anticipation of and then in reaction to the quarterly stocks report and the plantings intentions reports released by USDA on Friday. The market was not moved by news that Iraq bought 300,000 tons of US wheat and Egypt bought 125,000 tons of US wheat or by better weekly export sales than expected. The stronger demand just has not been enough to create new buying. USDA showed higher than expected supplies in the quarterly stocks reports at 1.591 billion bushels.

The trade average guess was 1.543 billion bushels and supplies last year at this time were 1.495 billion bushels. Supplies in December were 2.009 billion bushels. The reports of big supplies along with prices from competitors overseas have been enough to help keep prices mired at lower levels. US producers are responding by planting less wheat. USDA said that intended planted area this year will be only 45.754 million acres, down from 47.800 million last year. The lost area is split between winter and spring crops. Producers that also raise cattle in winter wheat areas have been grazing the wheat as is often done in winter months.

There are reports that producers will continue to use the wheat as pasture instead of trying to farm for cash grain. That talk implies a smaller percentage of harvested area against planted area this year and less production of grain for the market. These ideas do not appear to be pushing market price action very much now, but could become more important as the crops leave dormancy and USDA starts to report on crop condition. The crop condition this year has been uneven due to difficult planting conditions last fall and bouts of extreme cold in the Midwest and Great Plains over the winter. There is plenty of moisture around to help yield potential now, but too much rain will hurt protein levels down the road.

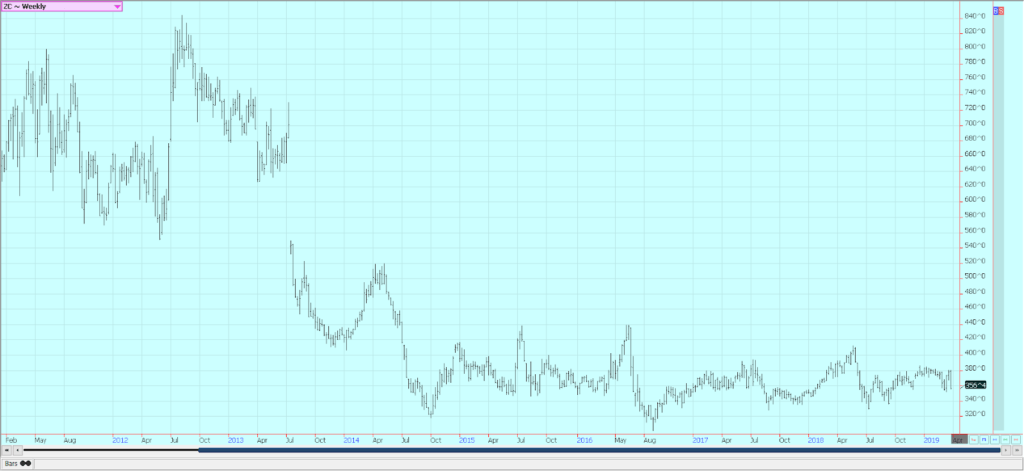

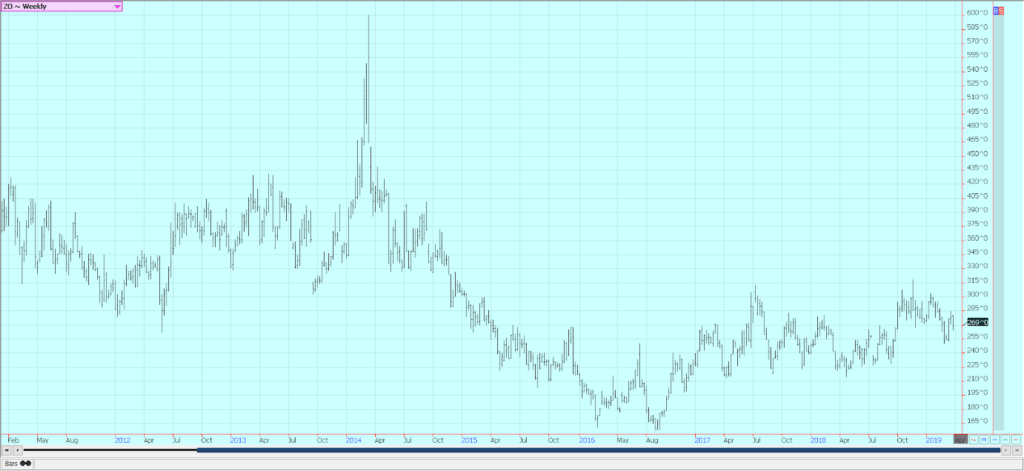

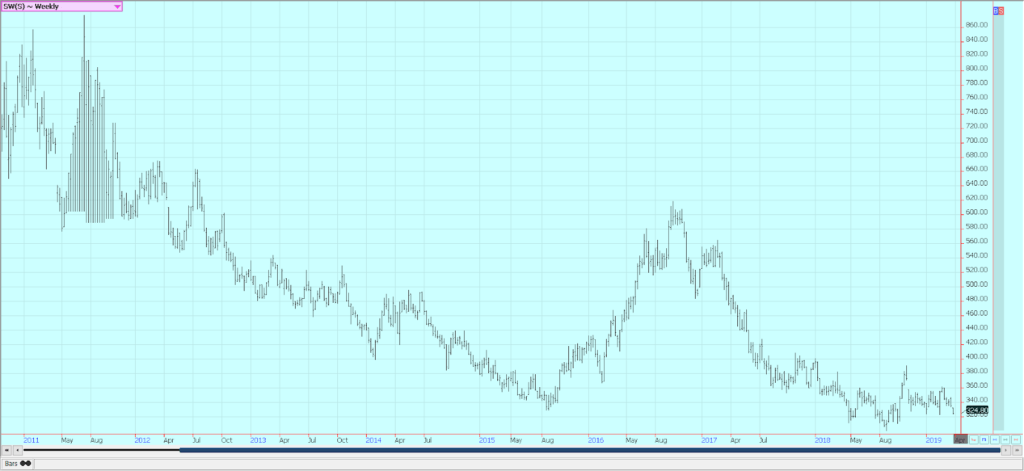

Corn

Corn moved sharply lower last week, with almost all of the selling coming on Friday in reaction to the USDA quarterly stocks reports and planting intentions reports. The weekly export sales report showed solid demand and included the sale announced previously to China. China is rumored to be interested in buying a lot more US corn, in part as a goodwill gesture during the trade talks, and in part to improve supplies in the domestic market. The market was shocked on Friday by the quarterly stocks estimates from USDA. It said supplies were 8.605 billion bushels, well above the average trade guess of 8.336 billion. Supplies were 8.892 billion bushels last year and 11.937 billion in December. The report implies ever diminishing demand for feed and industrial uses in the US. This has been a trend in the last several stocks estimates and no one seems to have a good explanation as to why it is happening.

There is record animal production in the US, so the analysts have tried to increase feed demand estimates in response, but the data has always shown that the reverse is true. Actual supplies now should be less due to reported losses from flooding in the western Corn Belt this year. How much is lost is not yet known, but some estimate that more than 100 million bushels of grains including corn was lost. The intended corn planted area this year was 92.792 million acres, above the average guess of 91.184 million and 89.129 million last year.

The surveys were made before the rains and floods, so the actual area should be adjusted down some time in the future. The long range forecasts call for wetter than normal conditions for the next three months, and that also implies difficult corn planting this year. Producers wanted an early start to fieldwork this year as wet conditions last fall meant little work got done. Ideas are that USDA will in the end find maybe 91 million acres planted, and a continued wet and cold spring could drop the planted area estimate even more.

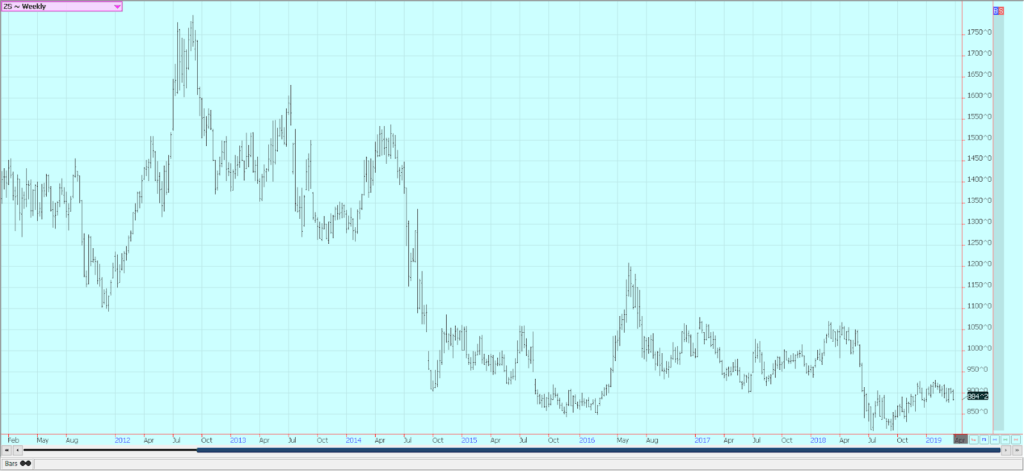

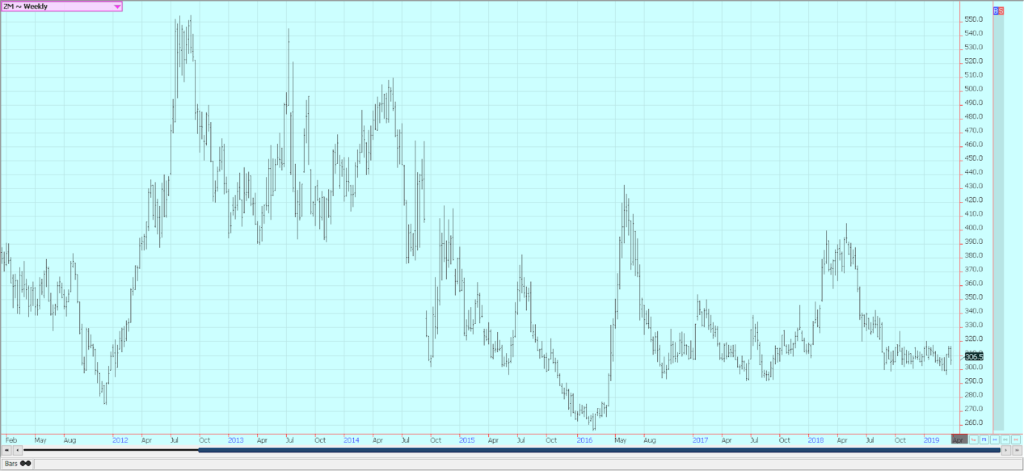

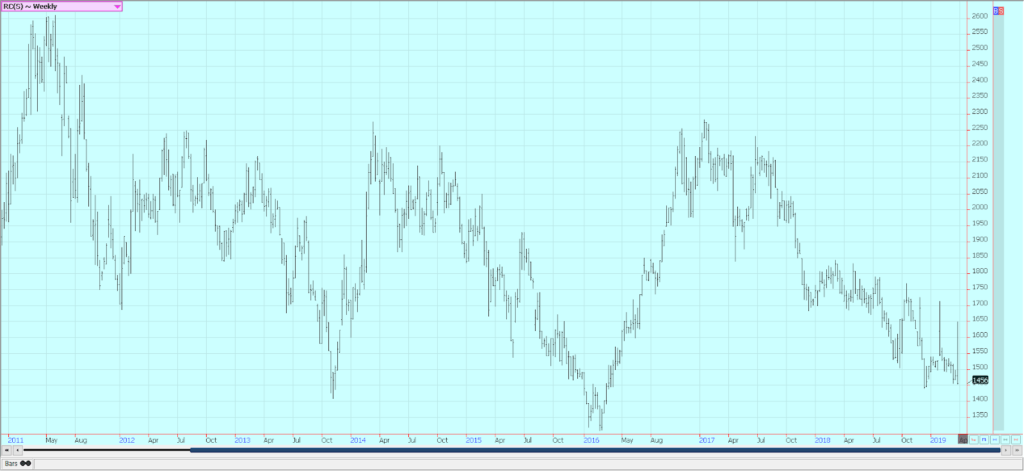

Soybeans and soybean meal

Soybeans were lower and soybean meal was higher last week, but soybean oil was lower. The weekly export sales report was poor, but China came in late in the week and bought about 1.5 million tons of US soybeans, according to wire services. USDS reported new sales of 816,000 tons on Friday and new sales reports are expected this week to make up the balance. US prices remain under pressure due to weakening currencies in Brazil and Argentina at harvest time. The currency action has caused weaker prices for South American supplies at a time when prices there are under pressure due to the harvest. US basis levels at the Gulf of Mexico have been much lower recently than a month ago in response to the pressure from South America and the reduced pace of US export sales in the past few weeks.

The currency pressure is likely to continue as presidential elections are coming to Argentina soon and the new government in Brazil is off to a difficult start. The USDA quarterly stocks reports were very much in line with trade expectations at 2.716 billion bushels and were neutral to prices. Supplies last year were 2.109 billion bushels. The planting intentions reports showed intended Soybeans area at 84.617 million acres, about 1.5 million acres below trade expectations and down from 89.196 million acres last year. This area is likely to increase due to the current poor weather and flooding in the Corn Belt along with hopes for a trade deal with China.

Producers might be forced to plant soybeans as production costs are less and as the outlook for the next three months is for wetter than normal weather, implying less time to prepare fields for planting anything. Demand in the coming year might be less due in large part to the swine fever epidemic in the hog herd in China. The country is already importing less soybeans due to less feed demand, and the trend should continue. The country will need to import pork for sale to the public and also hogs once the epidemic is under control to rebuild herds.

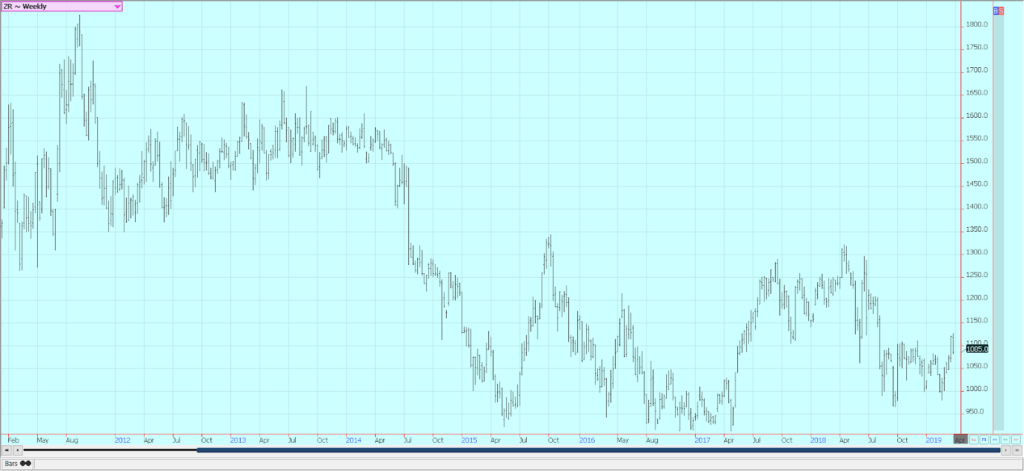

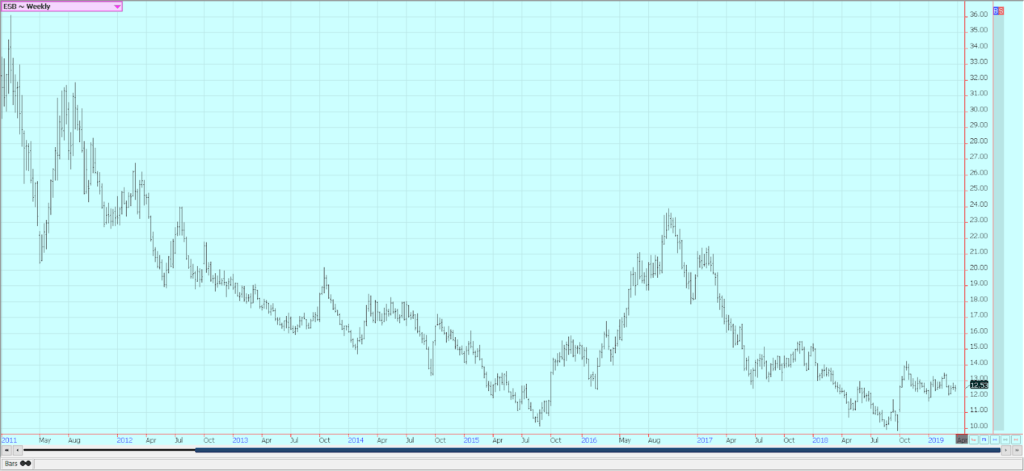

Rice

Rice was lower for the week after making new highs for the move. Planting conditions could stay improved this week near the Gulf Coast and in the Delta. All areas have seen some extreme precipitation and mostly cool to cold temperatures for the last month, and getting much fieldwork done has been all but impossible. However, most areas in Texas and Louisiana have been planted or are getting planted now. It remains colder and wetter to the north, and reports indicate that fieldwork is just beginning in northern areas. USDA released its plantings intentions reports on Friday, and intended area was a little higher than expected at 2.870 million acres. The US planted 2.946 million acres last year. It is very possible that the estimate might be too high given the cold and wet start to the growing season.

Trade estimates had been for rice to be planted on about 2.7 million acres this year, and the trade estimate might be closer to reality by the end of the planting season. USDA showed very strong export sales last week, including a big sale of medium and short grain rice to Mexico. Mexico is normally a big long grain market, so the trade is not sure that the sale is correct. Export demand has been very solid this year, even if the big sales of last week is not correct. The weekly charts appear firm despite the move lower last week, and the charts imply that prices are now close to support areas. The growing weather and demand are the important items to watch now. Asian prices have been firming over the last few weeks, so world prices have some room to move higher in response.

Palm oil and vegetable oils

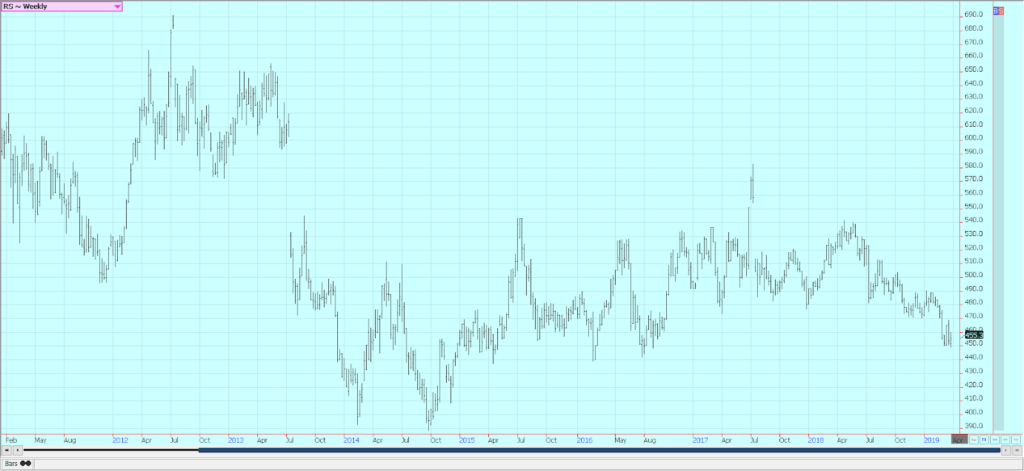

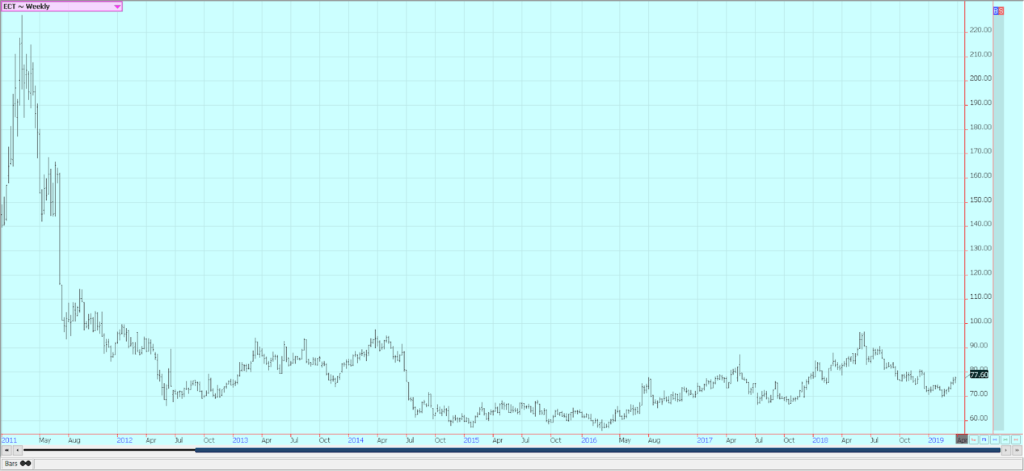

Palm Oil was lower as demand reports from the private surveyors showed that palm oil demand remained weaker. There were some reports that production in Malaysia was holding better than expected. Production usually trends lower at this time of year due to seasonal factors, but reports from the country indicate that production has held closer to unchanged. The market can give back the majority of the gains made in recent weeks before finding much stability as important support is about 1900 basis the nearest futures contract. Canola was slightly higher last week but continues weak overall as supplies in the country remain high and demand has softened.

Compounding the problem for canola is a court case in which a Chinese national could be deported to the US on industrial espionage charges. The hearings on the case are underway in Canada now and the hearings and entire case has caused friction in the relationship between Canada and China. The market has tried to become more stable in recent weeks, but faces strong headwinds in getting demand flowing again and avoiding big ending stocks.

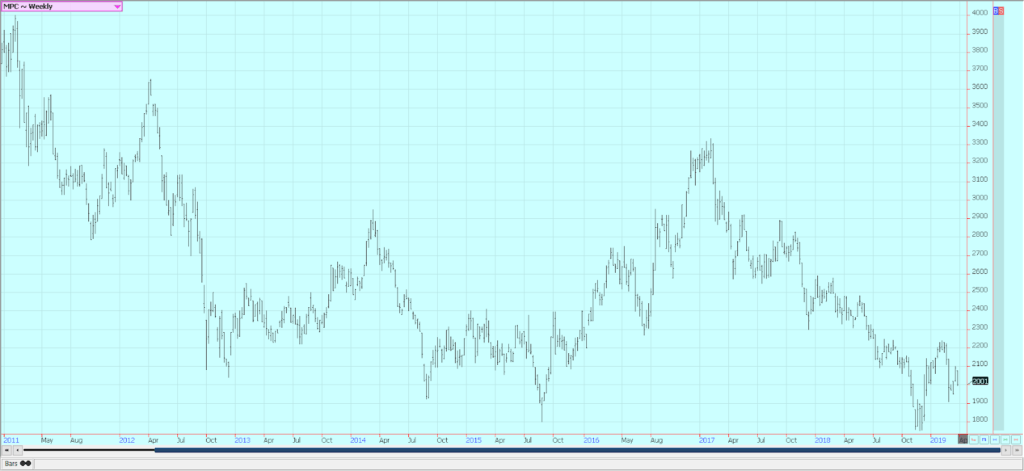

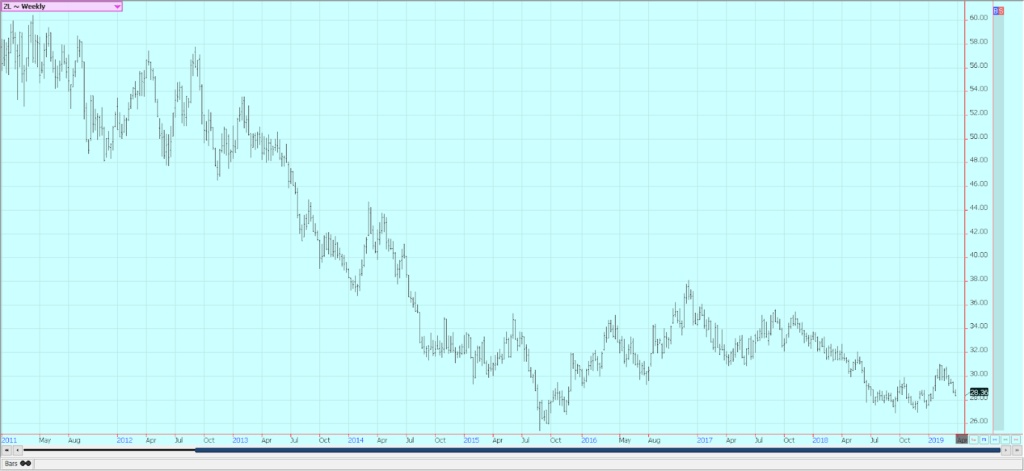

Soybean oil was lower on mostly speculative and chart based selling. It is testing support near 2800 basis the nearest trading month. US soybean oil faces increased competition in world markets from Argentina as its soybeans are harvested and processed. Argentina will look to reclaim its position as the largest exporter of soybean oil in the world.

Cotton

Cotton was higher again last week. Futures barely made new highs for the move, but closed near those highs. The daily and weekly charts show that an up trend has started. The weekly export sales report showed stronger demand for US cotton and there is talk that the US can have strong sales with other major exporters starting to run low on supplies. Everyone is waiting for the resolution of the US-China trade dispute, and the US government is indicating that a deal is going to be more difficult to achieve by the end of the month. The market anticipates that a deal is done in April. Both sides are negotiating the final points.

USDA showed less than expected intended planted area to cotton this year at 13.780 million acres. The market had anticipated a slight increase from the planted area of 14.099 million acres last year. In particular, producers in the southern and western Great Plains might tear out winter wheat and plant cotton. The US weather continues to feature a lot of rain in the south, and fieldwork and initial planting in far southern areas is mostly delayed. However, some cotton is getting planted and cotton acres might be added if the corn can’t get planted on time.

Frozen concentrated orange juice and citrus

FCOJ was lower last week and trends and the recent rally came to an abrupt end. Speculators turned sellers after the recent short covering rally that had found new commercial selling. Ideas continue that production remains strong and demand does not and are backed up by the weekly Florida Movement and Pack report that shows that inventories inside the state are significantly higher than a year ago. The oranges harvest remains active in Florida as the new crop begins to form. The early and mid harvest is over and producers are concentrating on harvesting Valencias. Flowers are starting to drop and some fruit is forming and developing. Mostly good conditions are reported in Brazil.

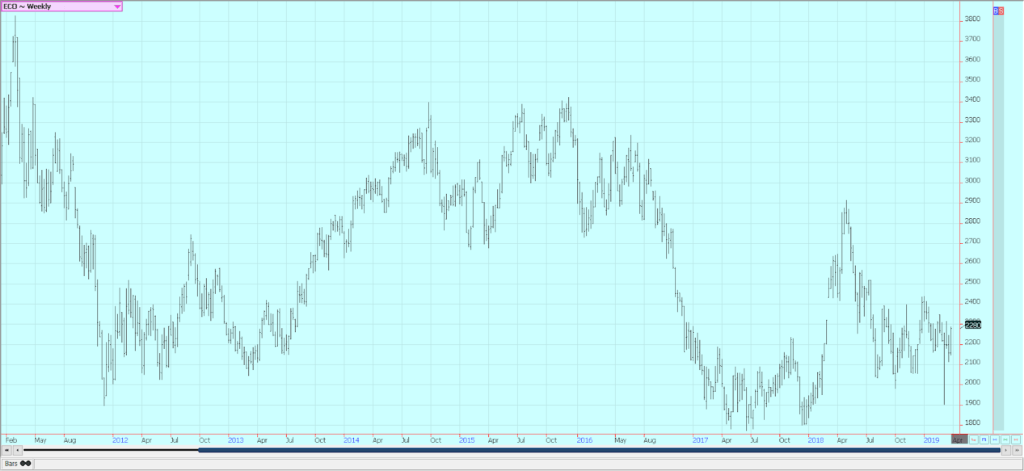

Coffee

Futures were a little higher for the week in New York as weakness in the Brazilian Real that did cause some selling interest. The overall changes were minimal and the market is in a very narrow trading range. Prices closed lower for the week in London and continued to break down from a sideways trading pattern. The trade is still worried about big supplies, especially from Brazil and low demand. Bad US economic data increased fears of a worldwide economic slowdown that could hurt overall demand.

The ICO has forecast a surplus year again this year, and inventory data from ICO and others shows ample supplies. Brazil had a big production year for the current crop, but the next crop should be less as it is the off year for production. Ideas are that the current production of 62 or 63 or more million bags can become about 52 million bags next year. El Nino is fading, but remains in the forecast, and coffee areas in Brazil could be affected by drought that could hurt production even more. Mostly dry conditions are in the forecast for this week. Vietnam is active in its harvest, but producers are not willing to sell at current prices. Production in Vietnam is estimated less than 30 million bags due to uneven weather during the growing season. It is still dry, and production potential for the next crop is getting hurt.

Sugar

Futures closed mixed last week, with New York prices slightly lower and London lower. Chart patterns on the weekly charts are sideways in New York and sideways to down in London. The fundamentals still suggest big supplies, and the weather in Brazil has improved to support big production ideas. Reports that Brazilian mills might pause and give sugarcane production a chance to improve helped support the market. Brazil weather is improving in all areas as there is less rain in southern areas and more to the north.

However, it has turned drier in northern areas and there is concern that the dry season is starting early this year. Brazil has been using a larger part of its sugarcane harvest to produce ethanol this year instead of sugar, but Thailand has shown increased production this year. Ideas that production in India and Pakistan is being hurt by news that Indian mills are asking the government not to force them to sell sugar into a depressed world market in order to try to maintain some control over operating losses. Very good conditions are reported in Thailand.

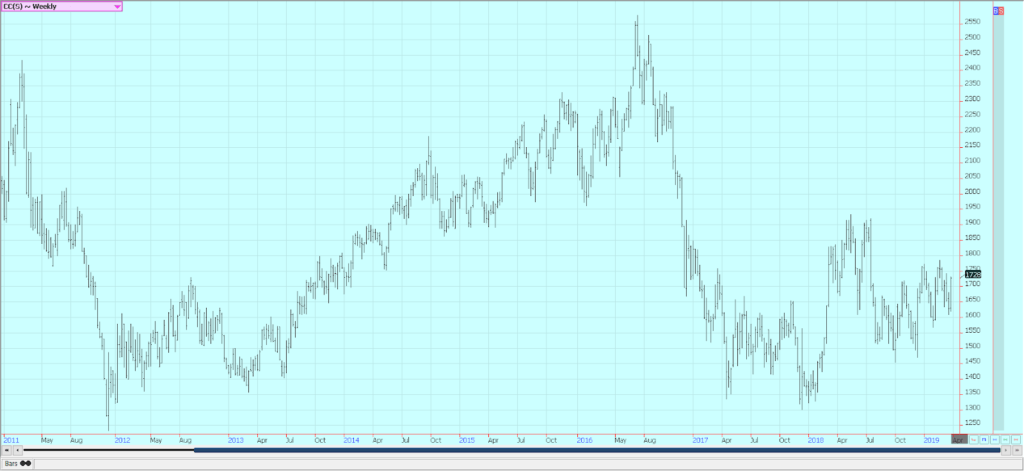

Cocoa

Futures closed higher in both markets. The main crop harvest should be about over and mid crop harvest is still a month or more away. Ivory Coast arrivals are strong as are exports. However, arrivals have started to fade. The weekly pace just a month or two ago was about 15 percent ahead of a year ago and now is under 10 percent of a year ago. Growing conditions are generally good in West Africa. Some early week showers and cooler temperatures were beneficial, and most in West Africa expect a very good mid crop harvest. Cameroon and Nigeria are reporting less production and prices there are reported strong. Conditions appear good in East Africa and Asia, but East Africa has been a little dry as has Malaysia.

(Featured image by Christian Jung via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech2 weeks ago

Biotech2 weeks agoPfizer Spain Highlights Innovation and Impact in 2024 Report Amid Key Anniversaries

-

Business1 day ago

Business1 day agoLegal Process for Dividing Real Estate Inheritance

-

Markets1 week ago

Markets1 week agoStock Markets Surge Amid Global Uncertainty, But Storm Clouds Loom

-

Africa6 days ago

Africa6 days agoMorocco Charts a Citizen-Centered Path for Ethical and Inclusive AI