Featured

Market update for early September

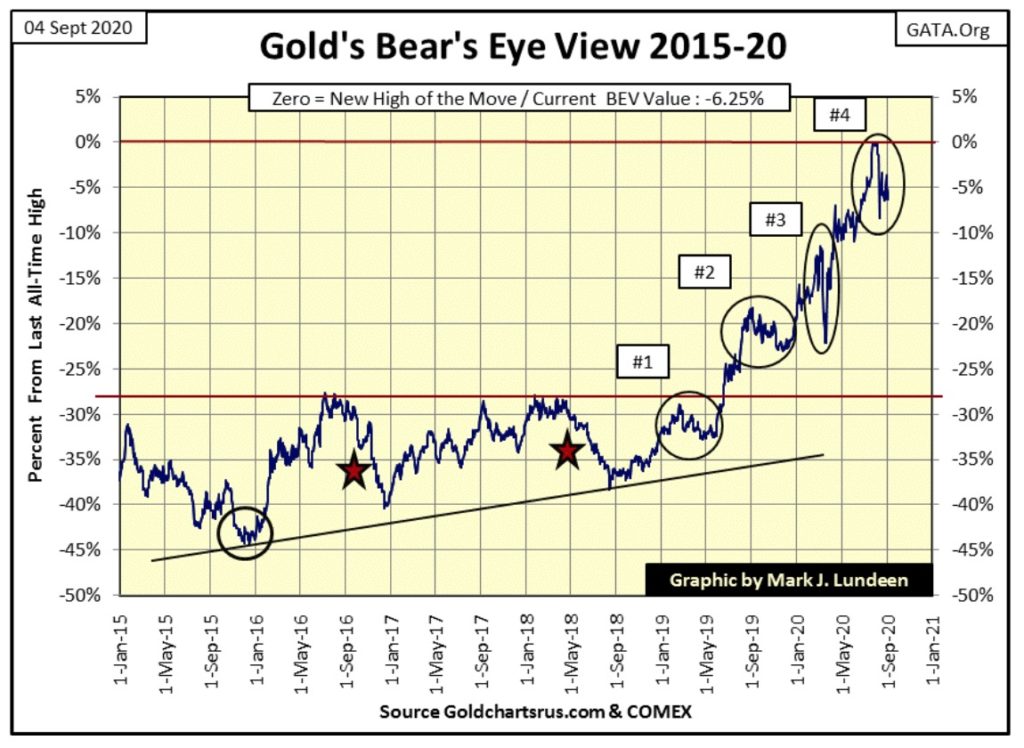

Gold closed down this week, but the bears still haven’t forced it to correct by double-digit percentages. Even should gold correct down to its BEV -15% line below, I’d remain positive on gold and silver, but I believe the bottom is in for this correction. By October we’ll know if I’m right or wrong. However, I’d say gold is ready for its next advance.

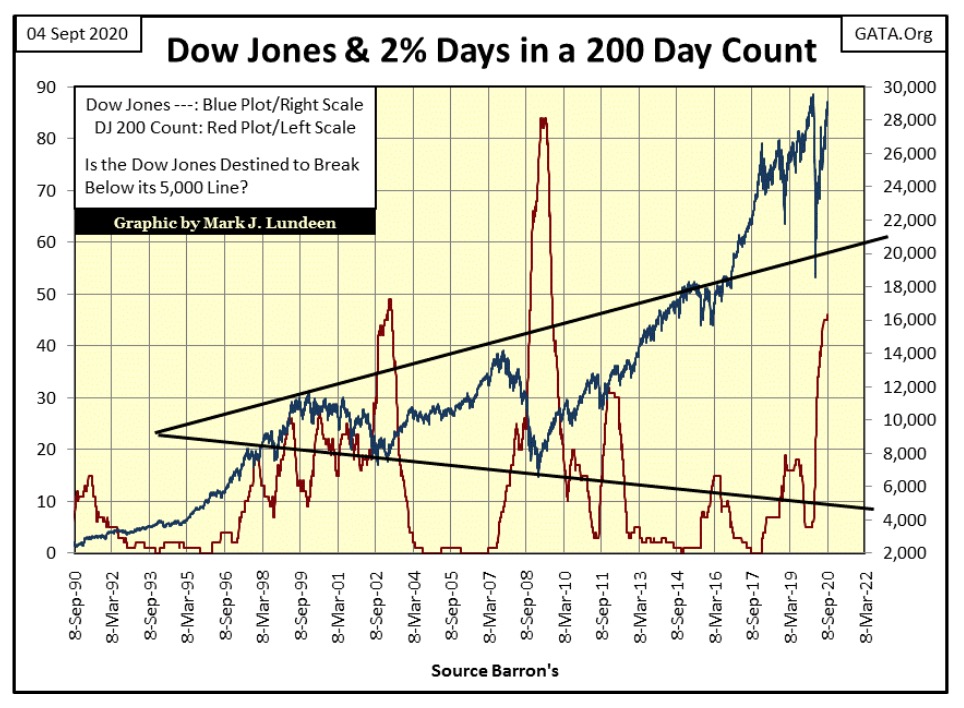

Thursday this week the Dow Jones saw a day of extreme volatility, a -2.78% decline from Wednesday’s close. This was the first 2% day since July 14th when the Dow Jones saw a +2.13% day.

At week’s close the 200 count for the Dow Jones (number of Dow Jones days of extreme volatility within the past 200 NYSE trading sessions) closed up one to forty-six. An extreme day of volatility is a day the Dow Jones moves (+/-) 2%, or more, from a previous day’s closing price. As I use the term, the 2% is a threshold value. So, a daily move of (+/-) 6% or more is also considered a 2% day, and since 21 November 2019 (200 NYSE trading sessions ago), the count has increased to forty-six 2% days.

As seen below, a 200 count of forty-six for the Dow Jones is the third highest count in the past thirty years. But unlike the high counts of 2002 & 2009, which corresponded to deep bear market bottoms, our high count occurred as the Dow Jones was within 1.53% of a new all-time high. What’s with that?

I think the current high count for the Dow Jones, coming so close to a new all-time high, could be best thought of as fingerprints left behind at a crime scene. And what crime would that be?

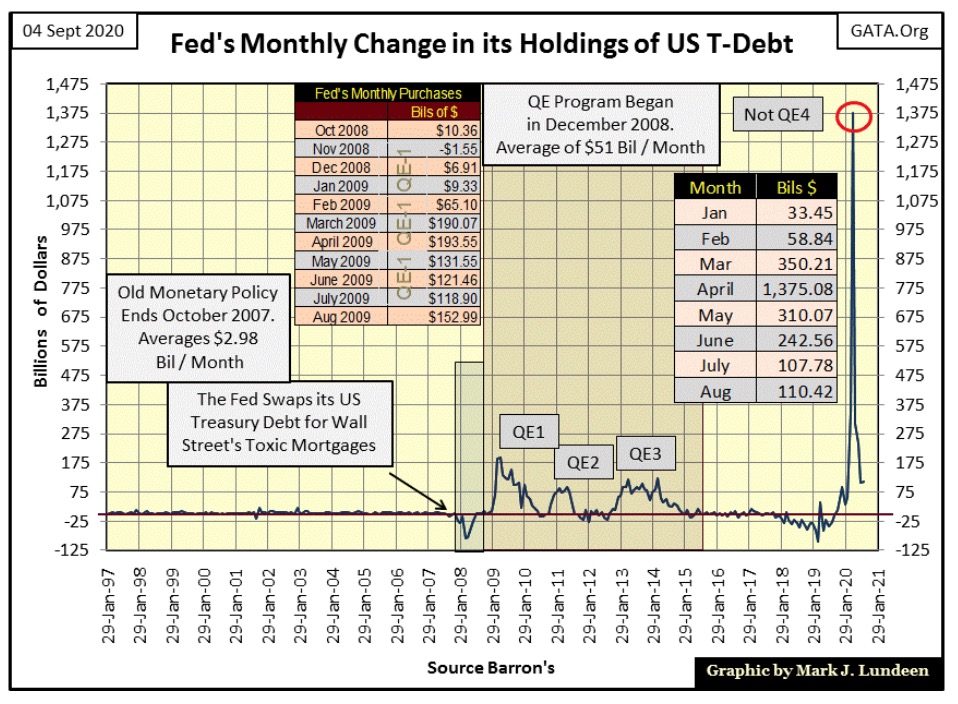

In the chart below I’ve always strongly suggested, if not actually said Doctor Bernanke’s QE1-3 were criminal acts. But Jerome Powell’s “Not QE#4” is a monetary-capital crime that reflated last winter’s Dow Jones -37% market crash (a Big Bear Market bottom) back to only 1.53% from a new all-time high just this week on Wednesday’s close. The crash and recovery happened so quickly (in only 144 NYSE trading sessions from the Dow Jones’ last all-time high of February 12th), its 200 count didn’t have time to clear out the stale 2% days.

This has never happened before. So too is seeing the Federal Reserve “injecting” $1.38 TRILLION DOLLARS into the financial system in a single month as it did last April (chart below). Quite a difference from the $2.98 BILLION A MONTH the Federal Reserve typically “injected” into the financial system before Doctor Bernanke’s QE#1.

Question: how long will last April’s “injection” of $1.38 trillion remain a market record? At least for as long as the Dow Jones remains above the lows of last March: 18.592. But don’t quote me on that. Should (when?) the Dow Jones break below the lows of last March, just you watch what the FOMC does to once again “stabilize market valuations” in the chart below!

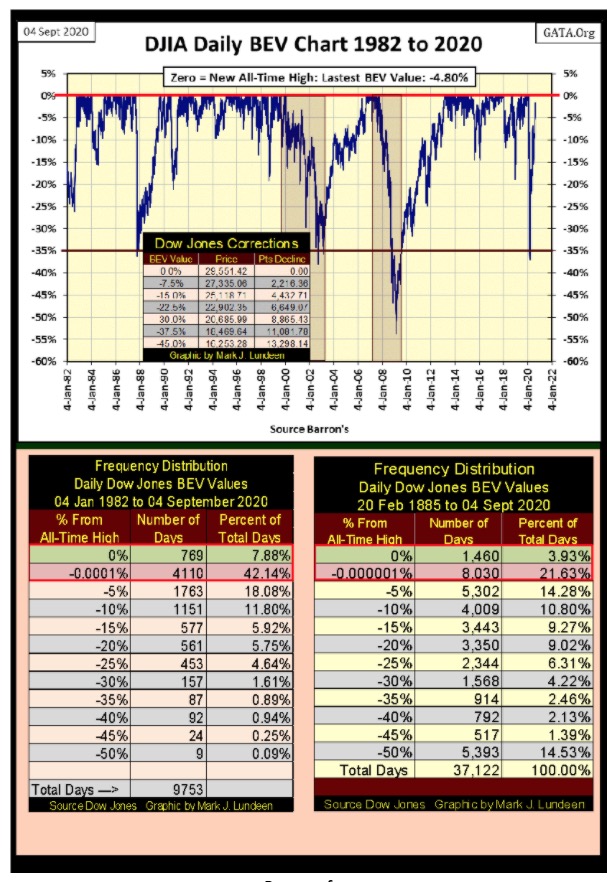

That’s something to watch for in the months to come. But returning to this week, here’s the Dow Jones BEV chart with its corresponding frequency table for the BEV data seen plotted below.

The Dow Jones began its current bull market on 12 August 1982 as it bottomed at 776.92. Two days later it broke above 800 and never looked back. Last February 12th the Dow Jones saw its last BEV Zero (last all-time high), or 29,551.42 in dollars. That’s an increase by a factor of 38 over the past thirty-eight years.

Since January 1982 the Dow Jones has seen four episodes of deflating market valuations greater than -35% in the BEV chart below. Two were actual bear markets; the 2000-02 NASDAQ High-Tech 38% bear, and the 2007-09 sub-prime mortgage 54% bear market. Then there are the October 1987 & and our Feb-March 2020 market panics, where out of nowhere the Dow Jones deflated by over 35%.

Still, for the past thirty-eight years, the Dow Jones has seen lots of BEV Zeros in the chart below. And how many BEV Zeros are seen in the BEV chart below? Moving on to this chart’s BEV frequency distribution table (left side) below, the Dow Jones has seen 769 new daily all-time highs since January 1982, or 7.88% of all daily closes.

Daily closes just short a new BEV Zero down to -4.99% from one are found in the -0.0001% row. I call daily closes in this row in scoring position, of which 4110 daily closes since January 1982 or 42.14% of all daily closings since January 1982 have been in scoring position. Together, these two rows contain 50.02% of all Dow Jones daily closings since January 1982.

To understand the significance of this, I’ve placed another frequency table on the right containing every Dow Jones daily close since 20 February 1885 for a comparison. For the past 135 years, Dow Jones closings at new daily all-time highs and within 5% of one in only 25.56% of all daily closings, half of that since January 1982. I believe I’ve made my case that since January 1982, market performance for the Dow Jones has been anomalous, a performance not likely to be repeated in the years and decades to come.

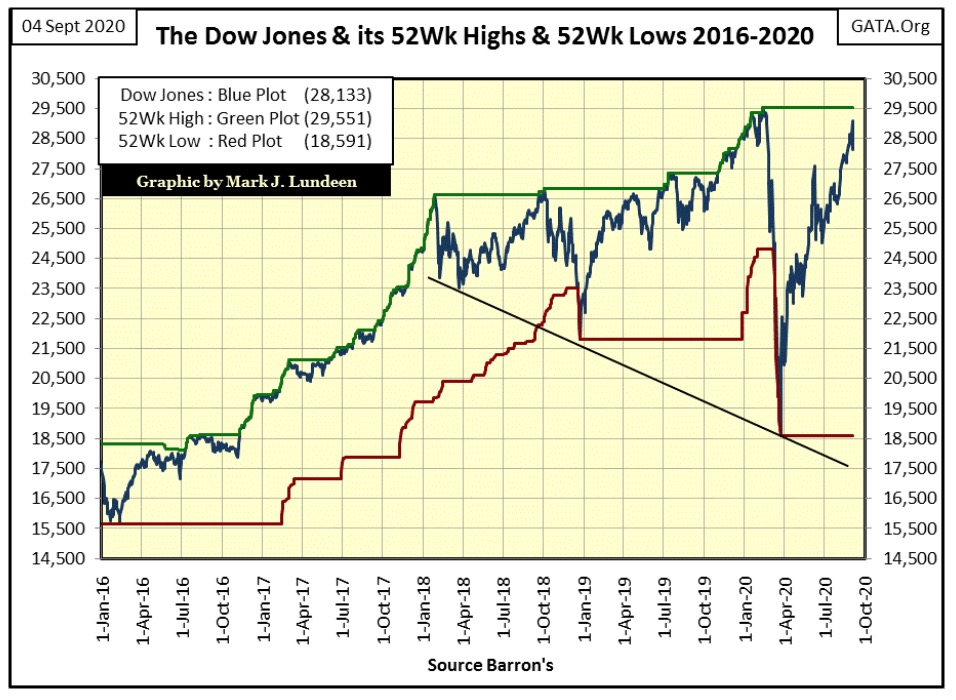

Below the Dow Jones is plotted with its 52Wk High & Low lines. The rebound off the Dow Jones’ March lows is impressive. But after this week’s Thursday and Friday’s market action, wherein two days the Dow Jones dropped just short 1000 points, its fair to wonder what it will do next; push up its 52Wk High or push down it 52Wk Low line in the chart below.

Personally, I’m still expecting the Dow Jones to break above 30,000 in the months to come. But who knows what is to happen? It would be real market history should Wednesday’s close, just 1.53% from a new all-time high proved to be this advance’s high before it turned down again to test the lows of last March.

President Trump has made some powerful people very angry at him. If they can, they’d love to see the Dow Jones crashing before the November elections. So, I can’t rule this out either.

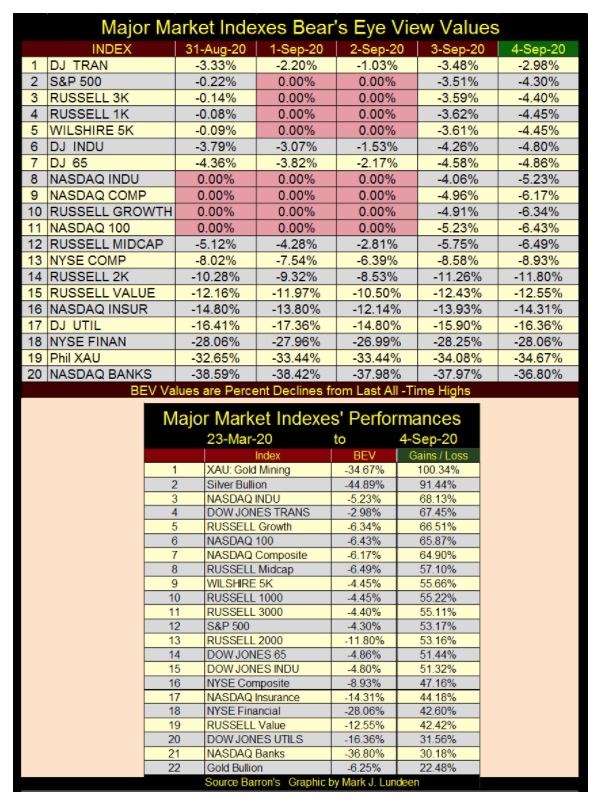

Next is my table listing this week’s BEV values for the major market indexes I follow. In last week’s first three trading sessions, the market saw some new all-time highs, then came Thursday and Friday where Mr Bear crashed the party.

These end of the week losses are significant. The NASDAQ 100 (#11) lost 6.43% in just two days. The S&P 500 (#2) lost 4.30%. The only index up last week was the Dow Jones Transports (#1).

I note the XAU (#19) has remained above the NASDAQ Banks (#20) this week. We’ll know when the advance in gold, silver and the precious metals miner resume when the XAU advances above the NYSE Financial index (#18). Hopefully we’ll see this by the end of September.

Next is gold’s Bear’s Eye View. Gold closed down this week, but the bears still haven’t forced it to correct by double-digit percentages. Even should gold correct down to its BEV -15% line below, I’d remain positive on gold and silver, but I believe the bottom is in for this correction. By October we’ll know if I’m right or wrong.

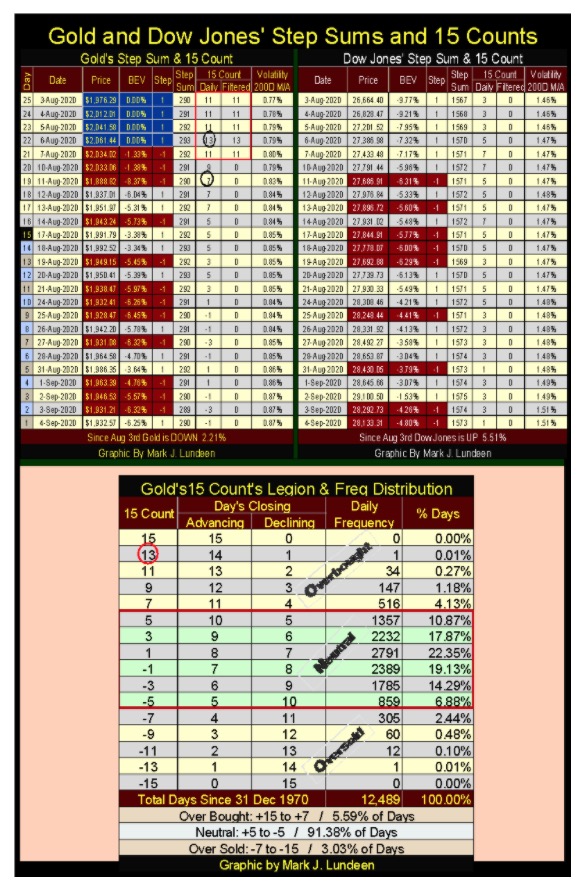

Gold in its step sum table below closed the week with its 15 count at a negative value, so is no longer overbought. Since August 6th when gold’s 15 count was a historic +13, it has seen only nine daily advances out of the past twenty-one trading sessions. And after all those down days the bears could force gold down by only 6.25% from its last all-time high at the close of the week.

I’d say gold is ready for its next advance. What it actually does in the weeks to come we’ll just have to wait to see, but seeing gold no longer overbought is a very positive development in the market.

Science is typically described as the search for truth. Today a more accurate description of “science” would be the search for government funding by academics willing to prostitute themselves to get it.

But there are still good scientists out there, such as Dr. Harvey Risch of Yale University below.

Amid the ongoing coronavirus pandemic Yale School of Public Health epidemiology professor Harvey Risch is asserting that the drug hydroxychloroquine, in conjunction with zinc and appropriate antibiotics, can help high-risk patients recover from COVID-19. ---"At the first stage, it is a flu-like illness. That illness will not kill you. If you are a high-risk patient and begin treatment immediately, you will almost certainly be done with it in a few days. When not treated, high-risk patients may progress. The virus then causes severe pneumonia and attacks many organs, including the heart. In this second stage, hydroxychloroquine is not effective," he explains in a Washington Examiner opinion piece.

In past months there have been many doctors, in many counties who have gone public with their treatment of patients with hydroxychloroquine (HCQ) and zinc supplements who have confirmed Doctor Risch’s findings above. This is good news; that an affordable treatment with a generic drug that has decades of use is almost 100% effective against the CCP virus.

Or should be – but it’s not to the establishment that is intent on interrupting the daily life of billions of people with isolation via lockdowns, and forcing a questionable, and very expensive vaccine on the global population.

If I came down with the CCP virus, given a choice I’d chose the HCQ and feel safe about doing so. But it’s very obvious our political class and their “scientists” don’t want us to have a choice, and this decision by them to favor a new, largely untested vaccine contains an element of malice towards us, “the little people” that is never addressed by the mainstream media.

I really appreciate science and its practical application; technology. But I have real issues with what passes for “science” today.

Science began long before the distractions we now are surrounded with existed. Thomas Jefferson when serving as America’s ambassador to France, purchased scores (sheet music) in Paris to take back to Virginia. Later in life, when he wanted to enjoy music, he would read the notes from his paper scores, playing the music in his mind as he was surrounded by total silence in his study.

In a world with no TV/radio, internet, or electronically reproduced music instantly available at the touch of a finger; what did wealthy individuals do to fill their considerable free time? Before the 20th century, the answer to that question was usually gambling. During the 17th and 18th centuries, Europe’s aristocracy went bankrupt filling their empty hours by staking their inheritance in games of risk. But for a few, they spent their spare time with science. Ben Franklin (1706-1790), the son of a son of a candle maker in colonial America is a perfect example of an early scientist.

But Franklin’s inventions for the most part were practical improvements to daily life for people. However, some early scientist studied astounding boring subjects, such as gasses that all of us today should be greatly appreciative of:

Robert Boyle (1627-1691) discovered what we today call Boyle’s Law: or the absolute pressure exerted by a given mass of an ideal gas is inversely proportional to the volume it occupies if the temperature and mass of gas remain unchanged within a closed system.

Jacques Charles (1746-1823) discovered what today we call Charles’s Law; or that the volume of a gas at constant pressure increases linearly with the absolute temperature of the gas.

But what would have been these men-of-science’s legacy to the world have been if they could have, with the touch of a finger listen to music we all love today?

Gas laws; this is the painful stuff. Today’s instructors of mechanical refrigeration inflict them on their students, but only because they get paid for it! But why do this to yourself, as Mr Charles did in the in the 19th and Mr Boyle in 17th centuries with no possibility of financial reward?

So, the old concept that science is the search of truth; which for Charles and Boyle was the truth of a gas’s temperature and pressure with a change of volume, are as valid today as they were in the 17th and 19th centuries. But these laws have no moral component to them; how could they?

However, “science” today does have a moral component to it. How could it not when human activity “places at risk life on the planet Earth.” In this sad state of affairs, what else but “science” can save us? Good grief that so many today believe this baloney!

I understand the over development and exploration of nature presents hazards to us all. People need to be good stewards of the land. But “science” today actually views humanity as a “human resource” to be exploited, managed, and contained to save the Earth from the unrestricted expansion of the human population. Today, “science” knows that people are problems to be solved. But before it comes to that, why not first make a few bucks off the “human resource”?

For example, the problems with cholesterol and saturated fats in the “human resource’s” diet, problems that “science” has solved with statin drugs developed by Big Pharma.

The following article is by Paul Ebeling, a really sharp guy who nicely points out that “science” today really isn’t searching for the truth of cardiovascular disease, as much as it’s searching for a source of funding by Big Pharma.

It’s no different with the CCP virus; in fact it’s worse. Proponents for political totalitarianism; such as Karl Marx, VI Lenin and who can forget Adolf Hitler all had little difficulty in finding “scientists” to validate their murderous political theories as “scientific.”

Our political class has taken advantage of this CCP virus pandemic. The masks and social distancing (mandates they themselves frequently disregard on TV in front of everyone) are but the first steps of what they intend on doing, such as forcing us all to be vaccinated with Bill Gates’ vaccine. Gates is a software engineer. What’s he doing promoting a vaccine? I’m beginning to smell a big fat commie rat.

So, beware of politicians justifying their proposals by a “scientific consensus”, as one day you may discover the world you live in has changed. This is exactly what happened to this woman in Australia (link below) for posting something on Facebook that was contrary to the CCP virus lockdown guidelines the “authorities” imposed on their “human resource” in the Land Down Under.

Yakety yak, don’t talk back.

—

(Featured image by M. B. M. via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa6 days ago

Africa6 days agoMorocco’s Industrial Activity Stalls in January 2026

-

Crypto2 weeks ago

Crypto2 weeks agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Crypto4 days ago

Crypto4 days agoBitcoin Surges Past $72K as Crypto Market Rallies and Kraken Secures US Banking License

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi